If marketers have learned anything from the development of emerging markets, compared to that of the United States, it is that understanding consumers' psyches and how luxury goods are approached is essential to success, according to a new survey from Agility Research & Strategy.

Whereas consumers in the U.S. view luxury as an overall lifestyle their Chinese counterparts use high-end goods as a marker of status. Now that luxury consumption is slowing and the amount of attention placed on China is waning, the U.S. is returning to post-recession trends of luxury purchases.

“Affluent consumers in the two markets define luxury very differently, and when it comes to buying luxury, price is not as big of a consideration in China as one would expect,” said Amrita Banta, managing director of Agility Research & Strategy, Singapore.

“China is also leapfrogging into the digital age, much like many other developing markets, and heading to the internet for their shopping,” she said. “What is interesting, is that this also applies to luxury goods, while many had believed that consumer are cautious to purchase expensive good online and want to experience the in-store experience offered by luxury brands.”

Agility Research & Strategy’s “Luxury Consumption Survey -- China slows but US booms” looks at the psyche of consumers and luxury consumption patterns of the top 25 percent, based on household income, of the two populations in the Chinese and U.S. markets. More than 3,000 consumers took the survey in October across the U.S., China, Hong Kong and Singapore.

The meaning of luxury

Overall, consumers in the U.S. interact with luxury brands on a more daily basis that consumers in China. But, U.S. consumers do not view luxury on a brand by brand basis but rather as a wider scope that extends to products and services with high prices.

Instead of associating luxury with certain brands, such as German automaker BMW, respondents’ associations reflected categories such as jewelry, homes, vacations and automotives. Respondents also stressed the expectation of quality, comfort and a degree of pampering in terms of luxury products and services.

In China, if a product is expensive it does not equal luxury unless it meets a standard of quality. For the rising middle class and younger generation of Chinese luxury products are used to express personal style while recognition of a worn or used brand is seen as a reflection of status.

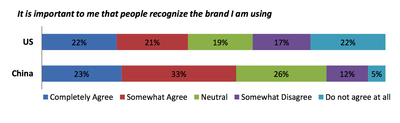

With that, 56 percent of Chinese consumers surveyed said that they agree completely or somewhat that it is important that other recognize the brand they are wearing or using. Only 42 percent of U.S. consumers felt the same.

Brand recgonition graph from Agility Research survey

Also, quality is a driver in terms of luxury consumption with only 4 percent of Chinese consumers responding that quality is not considered when making a high-priced purchase. As for the exclusiveness of a product, 86 percent of Chinese consumers buying products due to exclusively, but only 51 percent of U.S. consumers felt the same.

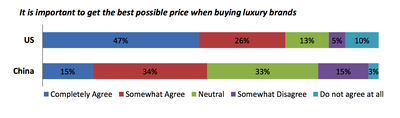

Given the quality and exclusivity of a product, only 1 in 2 Chinese consumers say that it is important to get the best possible price when buying a luxury brand. This ratio shifts upward to 3 out of 4 in the U.S., with affluent respondent completely or somewhat agreeing with going after the best price for an item.

Possible price response breakdown from Agility Research survey

Brands purchased on a regular basis also vary between Chinese and U.S. consumers. For Chinese affluents, the more upscale the brand the better where as the consumers in the U.S. more commonly purchase affordable luxury items.

For example, the top three brands owned by Chinese respondents were Chanel, Gucci and Burberry while in the U.S. consumers surveyed favored Coach, Ralph Lauren and Calvin Klein. Responses were similar when jewelry and personal care was considered with Chinese consumers selecting more up-market brands due to exclusiveness and quality than those in the U.S.

Burberry's boutique in Shanghai

“The environment of consumerism in the U.S. has evolved the competitive landscape in the country to a point where non-branded or lower quality products no longer have a space to exist,” Ms. Banta said. “On the other hand, in China, luxury goods are perceived as having superior quality and individual brands often stand for luxury.”

Different strokes

Beyond the mental approach behind the differences of Chinese and U.S. consumers, is how purchases are made.

Even though the U.S. respondents to tend to price hunt, presumably online in some cases to source the best deals, the consumers surveyed lag behind the Chinese is terms of online purchases. In the U.S., according to Agility Research’s survey respondents, only half buy luxury goods online while 59 percent of Chinese do.

This may be because affluent Chinese consumers adapted online purchasing much faster than in the U.S. More than 80 percent agree that they research luxury products online while only 65 percent say the same in the U.S.

A report by Borderfree noted that Hong Kong is seeing a rise in ecommerce trends due to low government restrictions and because the city’s consumers are becoming more familiar with Western brands through travel.

The Hong Konger is typically well educated and fluent in both Cantonese and English, and with Google and Facebook as the top search engine and social media platform within the region, luxury brands can easily enter the country through already familiar online tactics (see story).

Although a deep understand of consumer psyche is needed, luxury marketers that have entered China have not had to overtly alter strategy because brand knowledge has already been established.

“Chinese affluent consumers have widely adopted foreign luxury brands into their lives without brands having to rework their strategies too much,” Ms. Banta said.

“What we can see from this survey is that deeper motivations for buying luxury brands are very different in the two markets, and fine tuning brand messaging and the experiences offered through the buying process, to better meet the expectations of the Chinese consumer, offers opportunity for brands to build a better connection with the consumer,” she said.

Final Take

Jen King, lead reporter on Luxury Daily, New York

{"ct":"ZKO+wviE\/iYiQV81GytJynf9wkz\/8V+FI3DGfr9GIaJL1YC2ab9trwkhga\/2w4PIqfDlyOupY3oEzRUO+wms8wZ\/P3IeBnPcEBG+L2cVzgqedW4F7iQ25Wn28w531KwGcxDCjMGKLCw6K0eHaX3omVuJj36zPMGh6LS9dMqbioO9an1ADRCZHXcyyRsWlqbmq40Z76c2I\/5Dcc5OenmoVymu6MV1JKtlPSvjorBdqocqx8DXtIQwUq4InLcMmevGwnpp\/gARyWEZqPJK54jtNA4eRKYFqaDP0nU45LNbYRcqG+vyFzQukatJbZHkMvl4S3YahQMir+ljhGLOL6A4b921HP4Iu97HjbK5MDr0Kv3BnIkRif3MDAuT+bBzQSMOCjredz3NIy+lLGpBejXpd31cY\/JrTX+fMEAYgQncb+AK5VcK6gLDJi+G0zs9ekb5hFf32haKJt441M8tf6oT+jYUZ91PCPCWhZgpOjZKEhM5CwVvJIGOLT\/G8ZwJ\/OvbN4oqq2DuICyiWGlEOwDKpmLqMQJhLWSULx6Kf8bJpOQULMCIbBwtofbxhtMeaaPVLmpK5e1JQgXg9y63TBHyfPhnp6geDnqgWsF7Ewz+MlDSAidSE1ZVfiL0GiNdLBaxHuTA\/i5mEJhtw+cYOy\/\/nzKYR9m45glL\/qNxVpCTvqovczs0+nrolR3YokUz3ejWKUTfKM94Y+lzeRM6jogUvZtBrPhO60H5kFR471xdA20uHUGsKKerbwFfM4PqCoSj+0NEqxUGozeXv\/9hBLCb49i3NXg0SuN4VQqpdjZzPOAFFKDul35Nr1oScckVMJwLi8h3WXuR4HlfMIS7tqsX10pt1\/93lGrzQ4ZBEFYUjnmdi4ZBMMyWv74hXIG6WwppcHY3PSTu2aNuVEDgEWheSrq\/gZyUqNeg3y487lyy4J+lQJgPaLiKisFcB+XFOXVPPoKRwm3sKZoA\/qIHn5IXrgT\/aVKdAa+onww67t20AYvhKoOParnz6fOeE79Dz0VkFxOG7unBPXwkxXzM\/P0LDk4pgebXOEOsh35MP3Ezl2LuS07zE4pJ1fzYPzo3ktWJt31MwA5hmn43lBxl2epliJjoTea7u4fJIbi7+b9r1Rr\/jQynZS6kQEpDq8XSYgYpGXA\/hYdkukuMY3TGwJYLSLpYFLFqjKsnG3GP5fsDmrvsxy2RPxXTPvRPxNQgFg+iQ\/JD1qYMFwmIxHQLXlvPPevqpWpbBDuDHH000SCDJmp3DL62lANb1jvEqP3K2TU2KVPgIUL0bxtywXmPkwVyVHb6AksAkrHGGdBJ3FDYK5eY4TVMOYeuDz48m61XTbjmLzoQbbuGwMsHMRKGwpVs6qzf4D8EoGd7uiz58+WmXnGoKhKgeKhp\/b2yAqy55Co8hIEJ6aGnRsXzCQRjceqLqz8uUBcoD3lqDmHxCochWrllNpzah\/oxmbh1hjkhJAabAqe+ZLlHHf51aERo8oKcrNLJlhLIGQqfocShWRkGbAsvCyT3ryFraWzemWC6q3321Y8KihQtLJ2r5FaQEJ0py0AmwztF48Y+tkZumB8jIYgainkeEtIyuQ4X\/yJU3xTfPaohgmhN58DSVFC7QcT7g2y8F1xt7sYHXwtOeHRMmFpxLMLo2l1dHlVrwVOpK7DdObIsDa2da3x5jz+UKYDi0dIoTHa4AR6IFRmaodsQy4in8889tyzX6F8fR\/2QVh8q18ti6t7oF6KmE8ExKdhkyt6uSVQrDvw93NLo2qUBXskj3QUg0YetgViBiD3Cpm6YP\/eg3FjIXve8CkCMW\/9F\/Pxo8cFng0at3AUDLC+KaqaJ9qs35gcJagmxro+MLVs8NVvI5fQhDdRVNUydSKM8k4Uv+RvJSqgij9gheZDasYUXHMUVz610RBn1qDNDv8HLGBrdjxdsqwJq89uTEPmFjXcdXgEoQk1tIvlufPaLF5O+SyKPUt5kSn7Xy\/QncYmzun2MxTHWkSCnqKSuBNuNeK4tY830akENhpaXHkOaArZxAuAl2FuD+9j\/YU5P+HVMcd0PHPg5oG+HKzt+QAVFQnCYH\/QEFNjWNyEGPXrUmQjHHUjQ22vMzCCba3KYQ\/Z0TsPUha8q6ePbITi\/S2AFsVaygtW3ykbNFqptJPbToaBnQn1inmcnGzUzJbZ\/2FbNTSObRdUyILfo3yDVLe3pfhMPxU1vY9gUsUQ5G9BBEhlkvh\/DkKRfJCI9aj\/bhSx6IEtRL\/KmMECqKYP\/ZGcrLvNlN2CPafppU1M2bhenpQdq3+9qcEAJoJPXxB\/p3CzCO\/ffnhAgnrSIHOp2YxZzgT1v+s\/\/ycG68UwqKvLDH3kNV2mOR6306g1zR8IYM5doCTvHKnftGon9px4RTu5EIHEtTRoZF5v5pzAuWHDoFoZhvrjtUd20YKlW6n1SCTbsNRsOtnJgudMcKGalOIhbbvkGdCJHIfJNH8fVLU9m5Kx7FEYjZ3RrWyXI2JarYMkegzDP8UHgv48nqBm\/jOy9W8bfu30lROy3J7wdaf4RmY\/n0EU33U23xrHbLWyeW6xwTB6OxvN5lDtwg3uwf\/vBFzdfMyHMbPioD0eg6ycq47ijpR6YUxFRSWXPNRTffpLYtKPA+hnF37TyKwUNFoC2NR6GtJbCmuiAhBxINzDdZIzhXcoT+zuHgw6Tu9QN3eolRRSPKz+vrFIMT\/QJ6aKSH60rqr+g4obByaPHrT83IBg2jfQ8h7Gz2VqY8GPYdCbUgDdmY\/7fOZBLqC7APjoIQH\/n9uNLm09cLctQ7yAxuCCHr23bQHBdaDiEeel16yQoMcrRmjCk5eNcvaaKA\/H6TqcN7Z26dyvnSPdDsxjHBfW\/rQTv+WSnK44R1GAsC6MFXsM4jRnrkhVvYhK0pmZrvzY52CNlnD1xlpdYKtH6bLjOlQ5+Nh8NcTncv9ufNsi\/QfVp+Cd+hYZ9gGZGyETxvCYehxCPO\/AK3hJrlxkOk9snkAM1zSzrwTGDnS6qUqRuRrSw4VmW4MJjGP13Yq\/gJ6tBOlIvK3HIgBIcJm0SLdyd3+ea2rq3Pj7cZEBMf574AoZLtfztV3Ayso82n2T\/MFrNyfecznT4lon0E5K5mpM36syDFqvFAJfmjfD5T1BumnnzWIJrNh\/E7Mq2tl4SS+Yb3Zf+Kyu2GdZKWkfOYHkuI5wOm83cjvASQEMMKIuL1jIM8Dz3RFE1e2yiqEOpNK\/4iB9xPS18P5\/gRV4+bGk983XgQ4NuoFCsnWWFOP9yUkb7kRU+X1ytxPoG9dePjqdCEpiZxQwNOwiWvdqbNbjHeGmWaxdreLPyuQ+4ykKqWqMvSX\/gFKnJ88RMasLiZKhvyRz1XeTPDNFH7kyduOmCuElHG2rR1AkuqK5qVP3kS7n7sDwvQHZ9vagXQK69aysJN7wBdf338DdLk9RaasmVx4rHeDeHx3JBbSRXtUN7E62erk4a\/ZT899qxjaZ9cnihcqutV0LX\/ljKHUTVFajUml9gCb8Ge\/\/YVPSaYRe5X+2UYrSRbGdC7f5kRiGt+AP8UgEnMaNfKIPCZd4IzADoFeNqKu0R3OwMVvrmkkNQ8H2fdFIYNbmA9qCHu+CEg6F5IRQQZ292DqpPzpPJ1MwUwJLW1pIWH925oIU1xpk2jlaOElpWRY6kxJMmEwdxjkzDdF\/vH9WVUqlEZTuwDq4rZ31X2qG4MipcAoGm83ReSRpedvqZ4OtibjRt6BOJEel0QPWu7cs1WUUj\/qjDk1K72RucblNlLtO7gKLB\/6u6kDZb6IG3k78NeLBdNvq2hMxyyDV18YTdb8pVDSHArEkOjJfMfR+eYZLl5F6wBmW0LVEisREM+zsYxXP\/i3GvyewB1+JxM07Nh2NCkphZQmi5g0SQy3iyES6M42X6WP7FPfZyLQYVBJ5yyAqLkQuvZa89pLdEZo+HFVcBxsTqD5LO2xDKS0yaoG7I7suGlv1yABFSOTEbY0mp4FLtorg\/95wkg\/Hc6ZnPN6juHuqp2jMaGmiOmOWTnqifS5mfcE\/LNqZ4isZfWKOKJS+\/llWwHiBh\/drkNBHCzCA1Dxla8XD+07yPw1qDoC\/HfYgTtYXsy3hVEO0RCwLXh\/zklfG5zo69NgvkxHg+AMqYaPawlsGSiYL9u0a271Htd8WY\/XqWjOt4aNt+VRoJNrfR40t9i9nJKH2gowJfyknEpadURCsCm8PlQrWluHjrovjOChzWPMbvFT59JZkZKQDSKoWQssHbeZbhESOWbLXJQQxL6I9S6Scg4l2\/rawhk0hmFZBZAdJ7tF4a1nOH27DqZZpJRqYWZJjFo5uNZ\/5XUIUUSH4iz2nliMkxPv1VnplY7dYKbYj0uEWWbPy13GkHfGOohhI2r3VrEexH60Ij7wm98cqKIzRTM1rtselxT5TH9orTRT1KW5MZF343OZ8ABLnRCUYL5RjB0isrrF7TVncBjtc1cZAIkAG6HUuSV\/WKsPR+UxbJMgHNyctLEPvzJYnXkqDWdpB6gEkqgXMS+mLyM3jea09j4EFl04uVHHd+i\/F1R78EuRAar5+WO\/NAX5PAaW7AC8BOsyLRXYGItEKRR6A95TbKdYZDbbN9DeSiiv\/0M8GXe08wGLC0hg0qhXal\/R1DQqrF0ccL0myaWj7sYh1tlNW2hwGSsbFH+Lxsg8YNflwT8Xhet28fDBFQT4ouPbCBp+CII6kT6OCDNlhBBmCIpkwQGqFDL0zI5xJ7OMXUVXn7qWOlkO8fG486IXeND\/c0MJ17LytByug2FCuULbhttWSqFmGFqjZ3i3mvYl5S7PGk6bXNyCGe594OmsHniSOpYdVK5emIwnV3TW3QKRHCIoKHX\/PXHmLu7vD\/PA4N7HJD\/xQ4p6DhvV\/+yzUWEYYybnXIEvrhhnHLrZOUkErIMN+1ManglELogkTblm85UfqeA23odwKBXiQy2BE7nnSX53XTDMcTWzvXOjjYP92yuvqyg\/BlEHhPoZxGRPqrym8jPF7S5V8685ZIxI4pG33QB1CNDnNHaCkDpeh842V2xBiS+ZhVSCLXeYsyup2FjPzZOdKKM0RnyJAj+E6GfX1H3brZUXRFqZkYrN4wsNj2naw3FUv1CDwhlQW6o7JQVJ5v6QB\/OtALPQ2aPHDmO5rovSyXnXb89Z\/Kh9Le2srzN8bGnDpvYF8c8koTtz+w6MWv1zWBLEf9KJG+\/71hvRqrk0BxZEzyok34WzjMSozQ0r+I45subkHPHOga0hMb7i0mPO68CZmZ\/frLBY4op61M\/txlDL2M7rPm5gVb68a8GS7DsoTwypIzQr3LsIGW86WOhn1GUtD+yPnRDCUzdZQG1HclSYJ0FYw+rEysoQ386hffGixynImSpDV+XMJmwwq+wLa8YjzHFs8GbB8DOggwOSYljwvu61UYDXdkcINblGsmsk68qQjTnIUTAbmNCicjXyPbD70pa2R4vOWv0dzrQuSIYF9dECjl2OqVaIWGl\/sGimxmmBuNiFO5Uh7X+UMm3IkIdwB05qqa4+syFWIhnSA1kpJqidShl9x6HPpeGO7\/VDAQeZwEynIfjrL9y7eh+juXrrzi66m\/uWY8upMtt+HTx9\/3416smD78aPIH61+JAn9fjgzXJeUmYQKfRG5Yn1EmTBjODG1WHJDV8zzXksD0sli2tlB\/dknTlVI23Gjw04qztnEDAhrwNrEKbItjcESnFTGbCAZGTFj39HBVFy1ytmGwofPi\/IY4lDaSPd82Ca+eVvJClK4OhbJNNrewhY5cfK\/v6FQq0A1KPlrEKAxTKD+nQcYAibKkZUMOKQcWFiPEQdnZVpV8lbesrUm1KACQpmbhg15CX0iru1zx2MeU9Zp7XkEtr3zHk6QpOO9BSGQ+UdWQrhrw\/6Xuthpfg19\/yJbwibSaquLkSlbBZ+1QRipnUinNGIwgXr\/GofEBjJDl+i9oI0jvmRjVQZX\/RC+Dgpy2WY5nA\/wY7vTlYGBsodIh9buVc8A4MSrZlB2zcL1yh7M8H82Qm+vxtbu2d3mCNXMIs2\/SQ7mshiayQ75zpuT4UqO1XXFlBrfAXcC7yE42bFoHZomqFvaXnVAwp7dKD36Q3hLTUjqEmgvC4ihzOoNOAo9YFqXo3DS68qj1EQIHruuh8JClOPx7\/qlRYyYRQWjq51xwcq1AOTt\/xSxDdSMoJqkH7mKmKkYLjQCaVRdnNg2v3gZuQ\/k7ja7+UkXKLy+Wqf0H3QjHnLSwZBSsPbKUXuUcqv0AwFchSCTTdkQvPPmSfkLElJR2e+ZAjCs9Qr\/sRTjKnnvfe\/J1Y\/RGJfTv8gjGhmQ4Y7g+Zyk7UMddwKE1Jx8VD3LikNP9GJasgJEXKaOb5OUTuvsudK9+qcqDDqBuhCH\/fIpi78pT27R2+9R7vWzv3q+uyRcTwJmhxU+s+85DOn2j3e4rWyPpr8OCtuv1gkFqNdJ3qLvfmOsMkOeT19YwJSl4j9PgdO3VPFDg0U\/+x5INNn++u0NZRSv5Vcfm2PrvUoWAoFijEyeR8IVXa+eaSLr0kUKWOoBPgSUbgQ+6ljUZJqZqNA0wgCtcmerfwMA\/DVmyi6PpW2IQJkFfezGQlhOnybqZfQk118A3ckcaQVNbnrjxAbztAWaCCx+s1Ef4IDOrHc+6Qngq0R8fI9YC60MQPVCJVKiJ6OzN7qtJ6KdSI38nure5GpYju82ieGS9oQs19moZF6ek0I1lSNVRTWsRHyrI6dmictVKkN3bt+Oqg0B6nqOown8xtUBR5IYxszMvIByurKpaOzO\/pT5Z3s+UWK3bAfb5Xqx+2DT8RCL9tFp76Cpc46spkJulOepWKJski3VB6RjM6ScD5IZoB1Nr01IcI8vVIEMCGIxln\/3TNIjbakJwA2NAFYA19MrIeKIHg89ltUy4QMpOhdIT5dtl\/s+NG1wpyvBtm00XBL0PiqrNrsVFSI2ClIM+BG0zbVaNr6NLlK7Hbd9fWKUhOzS0iA4St38pgWGjXV0pO41U4xLk8jgpCdSfq2nxDatq2AnRuYRYNqzFVahmw82lcxqWJdQuT9ZO6bkHJkzoxyuaazkYlEgZ6yFRRpP0wb7i4Z5L76hdBkpJqKnTu54GMSMc\/wEsa\/q7+7z9DyY0y+s41tzi+OZ2NVujBd5qOHHiHxokIoDDnnrzovmA3ueftJb9k4E8FnLeFor2zexzalWHeSvyAOFfAqcPS7QXknxcLkhCjgWSwdmQuJ4PO3T+y78mZwiJ8oq9a1PR7CTDHIktFdA0FY+EiuoqIYPUQEC7EjmoEdEiLlCD4uWuCTRgRK3flTV8foKzll8c8rBMfYkJBvZBRI\/QMqSJiImWhuZCIxdWiNDSsnp4+MdSpr6aC0Jgfe9juq\/UdiMwII80L5pJpG2nDkXS3NH55F3QRTm2DtnBCvx+iNm77sS6PMNUwWmT3GKgpm8xWu1UXjuLa1atmBow57066nUQh7M9pzaBkzmqOGv1clw3VBOc8i1p4fW1M85JED8Z5b54vyNWe00Epe7yz7M+7AByUygE+Ksfl7fjuuLokkwDAPn0sYOh+ir5PCtBFIryJEzTRd0IXKMJFqayasL4YZu029lZx+rqAPNJMxEzPPRtnNW0BPIOZmAgL6hJkn3mBcHQme95AU\/GB7zgWFgnE+cqiAT5Mqzyvsb017iGIyFtc\/N4jcqa1QiuWLQxqg+P3IWyZ3g0WVUoguzyN7IeqXf5dI3XiIktZzAW8wsvHCB9KUs42QEyvbRx+XUgOWTi88U+hE0q\/9cYgJpHAFwGPVI5pCCxrt4R+qZFZKadmiJjlgfc0uyTZzbsP8xlUwC1HQOn45fDXrj11OYuWGB0WMGrh3hU6bpKmxpwa6Bpa+JQWohb9UhtsakuWRHIdGwZrxUq2gI9Yc8HyhCwxDsXpttzPuNQ\/JC6QKFnldhNjibnPkhc+890KLM6zjTYlR0+XPEr3E\/4D563gz8mpE2JISSj4Uvx\/8rG59uMudwZJfaPnv9eOoAHRh+mpg3I0\/bQOWbSmqHQFzp7UIMIBKxbAcGvo4FmdpuLHF\/IJUhyvz8EQclKag9PeD1Welhem1TMGTzkSHRFyUfe\/m4lexDz6PgQmmvtc5e\/LLPfDprUkc4vKHDeYp8HoUbzx4BRNRt6IpsKVvcxXogvFDyzKAdhQ5Y85ab1l4tQa25RrLxlBvcb+N2wDfvZf72IMiU\/gSDv2D8MWptPAfHBAST3Z5pVh5nFHEzm1I2Sy1K9sSSrYw\/cWD0o3kOydu7EBScCnG90Vz1nNOiavHF8ffBEroQvUhKjuS3PH9Xqv6O05dxQpZ95Llco1716r5xokGq9i53nD1p7b5aC9Y8jEYyccu60HoyADAH5yDUcB9\/fmzdgsSlwgggQz6YyRX4h6MMKLNsgeMQEgjEkRm3+2PVghec9pGcKsftnqSgTk\/aLVXvzqYav7LgBMOa9Ch5X8nzLdBDL7UE01JI2LqkwG0wU761J9PAxlL3j7dJkSHgWH8L0lf29Pufi6MRVDBZRy17gDu5BZ\/2X\/c0GQfe3jiM512MfVeTjut+2Z5JLwZfM7v0A34EBLwsozfz44P2ialT4fMAkEu2X2yqalgbdWPstJNk296EUX5n44cZ5e\/VIIbwlqNND4OFsrFU5vX7QPV4zUN6LbAa108Irqh1nlr8lWfI83SrzFukBlrvFbTqRAsS1Gy6h9ED0cri1PZnLCFQ1ysuQSK7hHQ8ZnDSnRirMI0ey+ZBsMvhofVGUuubTRvNVII2qWos29A9LWwb6p\/IodSHtK2PxFp5HnuTU8yJDMpeH\/g\/z38HJnxOumLgbaK4Pqqk402VRkQ1etesWrA8nPTq4+p7yQAQGwGtjibrcBNGagSPWYUbNInO8VK134DEipgIzXFhqvIg9ux1FOki9I310dPKW+xsuuUD0oTHgdUgOlivo8XEOvOdQl8JuaE\/Iy4sItKWBlRiox96rjWla0CY2k82H1+HLMBFVdBe8HwI8Tvs7bW7xbLslVWPc\/+nFxEWrBlPcBiiHVrb5ikCuOXd830Keh5Ez9J4GSQum8ahsJUCgtds4be+aSMmx5N+qqcGe9iH8cGHWOpzVUmG04CJf9E0MmkJbzXQCrLwsBIJ\/GUNKfJkEkRzf3KwmlQXY0fq9DXIBKIeJOLuCaeSXQNI4zNVkqvL6RK1CagIh7vQkFu2k+F1bxRTWXYeoXCCKVp8+dlpqQX+k7goP8Al2ASIOUCYhHkDZeNJvrwGx1rmIHXjHujlscn2ZR8NKCoLjIzmnaIIRZWne0Gbet01fYdXGGsZ44A89B+IkmjdWCRJzw6phKRqydWXazHcdLKvY\/55RUjITdkGkN8CumetOhKoUYqxOD5QMUmO\/yq\/tiVcHV+RNd8U8+9PW6F\/6ZCBw96fD\/8F5j9fr1XZVu3pMyMHuJGdZVyeuGDQZAudDAlOAVOTT7goYpSbMDZT7pouezWIgeQlkXkWI0mtNk6OoP3VvAWtFlri05OS4CLDvi\/QHMWvJwxbFAojpkkZQys61JaQ+PK0+Glq\/FMtVpR3BU3GK0NadivcQ6vLo0AVmA8323yng7FPZvJALUynwMf0AVXXHwaEOyJ8WA6LisyaOgN2iPHiqlTEggX3u7jVJDkydsGeVi2GY3To4Z\/BadQCCBADtIJAeldM9ODsChmrW73Lr1K8piboyNYxDaucHxKXkSptqyq2BB8RvQyZIQ1Dy4QJ8l7I9gCvWMAyVbgRdpEkhcX8DiztL9n9jD9Rdf\/W06W+V\/4BxIz3ok7GNxmPw8yx3yB2cGdNJXjE1U2x9TUU\/ZvrwsQW78gKfj9BhXxZjrkrnoAkAtZRGmlVWW82bxnkSfIwusdLg6Zra8FNsFS0ITK\/Hk7pBCbvhj\/GfHwqmrO3NaiZdDSkLkJkE+0UsepO5Rg5Y23oHRy+Gp5u58BauiSPm4VoXONaj94\/uLqq+ZgIqhvp0JHsVMtivHys7WRryPCc67M\/aO\/a85wKYXrTod7p2eEAPRGy7wCROw9ntVI230zT4BrR1wGaKC3TmbEEyIiVCO\/p9nrNdSEBlh8nf3cAue+v6TE6mRIl4+2VwkJfwdWHBd6N6+BwK\/PkNUTFWhUMw21xuP56mghxXPUhQ8JDvH4NWth2bN6\/x9ScUhTJGVEwX4Md+ml+p939VlyxSbPY0ZZ0GRRdQOg0hH6B6r\/cNB3hfeccC2VQC+ISTWBSR8VBt9lDERif0HFTgBxy2GDZiooARhUfVp\/DEh8prTxjuEferQrXjCDJ4NR\/OlBRqiK1DDrp0SAsHDJat+fRPKLBas\/fe89QUzTJLu6Wssa+Pb7IjbeqS6SfcinGPvJ73+juBIad\/vc7wMxznINqzTnfiyhwry4DcP5mOXEH4bVz1veH83\/BlxOASiHN9QSo2WOhmxkyeSOExOGBUlphsYtv9HN0o+Jle9gEcIj1QBYcSafLJZKDB37e2RNDQRvGamwqlwalK9xr\/hkXQoGjwlqmJQGkO+N\/eDsQaH6mOHNzTfEHKEknNEY8xQxX1YQDi0yEG2O0LckzoDqH\/8DYZTYZsk2v7WMgd5aTcMkFRkr+xYBLAVGKbyBlGNnLxovvO7Uxx2CaNHHp7trOWNdkrIR8tu5g7p4mdURaNG2R7IK419khgUnvKDV0TfTog\/nXlEUj6laSpPmABnot6YnMkX5mvT0+JkC3UnE3vI4eTeupYwm+lbbZjtW7PLfHriaYd8+TYTjVrR4\/OzH2Mm7sJIRH7jomfE66Yo\/Bsv5OYqgwZr2FQydySETRQG6uK\/R\/fOzN7O8YdfWlIHXtRystVpDs+U0ijsaO0BNrxqJdv0HljotjpSi7faqEmZsAOpRrqxz71F6JdI1\/HHn1H42IxAbco467UA2xWoqn\/8mUaoaNOvAnpK3QysF3JBasIlf4kE9E\/3CA49JyRJJImby2RDzkPTK22LFwdn5do91H+Obc\/ZVJ9x8mIZBPg\/i1Nfyro8rRyzWdEfbZi6D6LVuY4mYNHXgiUjnJdZJP\/LnyzlJcsyx1sEXmbnjG9oEyREvlByMoLL9DtL4kGt+Uln2FFG0USuq7ZrwoM","iv":"d5708fdf37fd3bedc6410126d1c383c8","s":"f5b5054e858b72d2"}

Status is a motivator in China

Status is a motivator in China