- About

- Subscribe Now

- New York,

January 2, 2015

Promotional image for SaksStyle

Promotional image for SaksStyle

In 2014, luxury brands had a positive year as marketing strategies saw influence from research results, and in 2015 researchers are predicting a forward-looking outcome as new marketing plans are implemented into a more stable economy.

Research upon the ultra-affluent and ultra-high-net-worth individuals has led researchers to understanding the inner-workings of these consumers, and a deeper look into the trends of luxury brands has opened up information about the marketing strategies of the top houses. At the beginning of 2015 several different luxury researchers are predicting a positive year ahead.

Here are the outlook views of some researchers featured in Luxury Daily last year, in alphabetical order.

CityRealty

“Over the last few years, we’ve seen marked growth in real estate, particularly at the high-end. In New York, the number of sales at or above $10 million nearly doubled in the last year, bringing in aggregate sales of $3.4 billion in the first 11 months of the year which has already topped the full year record of $3.3 billion from 2008,” said Gabby Warshawer, the director of communications and research at CityRealty, New York.

“With new developments like One57, One Madison, and 432 Park continuing to go up around the city, the increased supply of luxury real estate will likely restrain price growth at the top of the market, but at the same time, continued sales there and expected closings demonstrate sustained demand for those high-end units that we can expect to continue in 2015,” she said.

Luxury Institute

“I think it will be a challenging year,” said Milton Pedraza, CEO of Luxury Institute, New York. “The United States will be the star of the luxury industry.

“We will always see single digit growth across most categories,” he said. “It will be a year where we differentiate the winners from the losers in a very distinct way. It will be very clear because we will see which luxury brands have extraordinary product, which ones have extraordinary experience.

“The U.S. will be affected by the world economy, the economy in Russia, China and Brazil. All of it will have an affect on the U.S. market. We are the most resilient market in the world, but we will see an effect. There will be a single digit growth, but it may be flat, there is a lot a competition out there.”

Shullman Research Center focuses on affluent consumers

Shullman Research Center focuses on affluent consumers

Shullman Research Center

“A year ago, there was modest enthusiasm that 2014 would be better than 2013 for everyone, and especially for the luxury marketplace in the U.S.,” said Bob Shullman, founder/CEO of the Shullman Research Center, New York. “And now, as 2014 comes to a close and we look towards what most likely will occur during 2015 in the world of luxury, our current point of view is that its performance will be even better yet again.

“Why? At the heart of our confidence are the many improvements to the American economic environment in 2014 (the declining unemployment rate, the large drop in oil and gasoline prices, the highest level of consumer confidence in many years, the higher rate of growth in the GDP), all leading to our economy being on a definite upswing,” he said. “That, in turn, should result in consumers spending more on their families and themselves during 2015 compared to 2014 assuming, of course, that no truly negative and distracting events occur (e.g., a terrorist attack in the U.S., a major financial institution’s failing, a major country’s defaulting on its debts, etc.).

“Where do we envision the potential upside potential for the American providers of luxury products and services during 2015? Based on our recent survey and our ongoing discussions with consumers, it’s among the mass-market adults who live in households with household incomes of less than $75,000 a year who, in most respects, withdrew from the luxury and premium markets since the 2007/2008 economic downturn.

“Big picture: those in the higher income and very wealthy households have, in most respects, continued to buy luxuries during recent years and will continue to buy the luxuries they want during 2015 when they want them. However, if the economy continues to expand and oil/gasoline prices alone stay at or close to their current levels, mass-market adults may again decide they can afford to 'treat' themselves now and then to some 'affordable' luxuries for special occasions--such as a luxury brand of Champagne for a family celebration, a luxury fragrance for a special social event, etc., as they were doing about a decade ago.”

Unity Marketing

"Despite the newly revised and remarkably strong GDP growth of 5 percent in third quarter of 2014 and the stock market topping 18,000 at year end, American affluent consumers will hold tight to their monetary gains in the New Year," said Pam Danziger, president of Unity Marketing, Stevens, PA. "They will choose to save and invest to grow even more wealth, rather than spend it wildly on luxury indulgences. That doesn't mean the affluents have given up shopping, but they will apply more demanding standards to the purchases they make.

"Today's affluent consumer is looking for a more understated, even modest, expression of their lifestyle, that focuses more on substance than style and on quality at a price that respects the customer's intelligence," she said. "Rather than conspicuous consumption and status symbols that proclaim one's wealth, the affluent are embracing brands that tell them new stories about quality and reflect their personal value system, which is egalitarian and anti-elitist.

"The idea of consumer aspiration for luxury brands– that people will see the brand as a realization of a hope or ambition – is dead. The truly affluent don’t need status symbols; quite the contrary, today they are going undercover. They need to be inspired to pay a premium for luxury, especially when so much good quality product at every price point is so widely available. The inspiration must come from a strong value proposition with an equally strong story hook. For 2015 luxury brands will have to learn a whole new way to tell the story of their brand to a new breed of affluent customers."

Wealth-X and UBS's UHNW report

Wealth-X and UBS's UHNW report

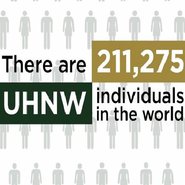

Wealth-X

“Between 2013 and 2014, UHNW purchases as a share of total luxury market increased from 17 percent to 19 percent. We expect this to remain broadly similar in 2015,” said David Friedman, president of Wealth-X, New York. “UHNW individuals’ lifestyle tends to be, for the most part, immune from large macro economic gyrations.

“In 2013, the average UHNW individual spent $1.1 million on luxury goods and services, a total of $234 billion,” he said. “Their consumption of luxury goods, services and experiences is likely to remain stable in 2015, with a continued increase in the respective share spent on experiential luxury.

“Based on this data, luxury brands are re-evaluating how they can better engage the ultra affluent market from a content perspective for mindshare, regionally for marketshare and finally walletshare or 'closetshare' of their total luxury spend.”

Share your thoughts. Click here