- About

- Subscribe Now

- New York,

September 8, 2023

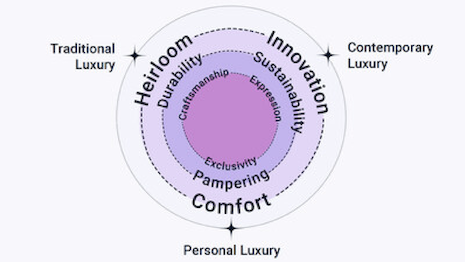

Personal luxury is the third category to emerge – after traditional luxury and contemporary luxury – that resonates highly with stressed younger aspirational consumers. Source: Horizon Media

Personal luxury is the third category to emerge – after traditional luxury and contemporary luxury – that resonates highly with stressed younger aspirational consumers. Source: Horizon Media

Respondents to a new Horizon Media study across the United States and Canada ranked comfort as their top luxury attribute, consistently placing it at No. 1 in all surveyed categories, including travel, dining, fashion, groceries, wellness, automotive and tech.

The findings were part of a “New Codes of Luxury: Aspirational Shifts in North America” study that indicated a significant transformation of the luxury narrative in the U.S. and Canada.

"In a world filled with uncertainty – whether global pandemics, mass shootings, war, climate events, inflation, economic uncertainty and beyond – comfort is now aspirational, and understanding what worries people will help brands lean into how they can help people find comfort in ways big and small," said Maxine Gurevich, senior vice president of cultural intelligence of Horizon Media's WHY Group, New York.

Horizon Media is the leading U.S. media agency.

Resent the ascent

The shop’s latest research comes on the heels of a March Horizon Media report titled “Inflation Nation” that highlighted a key component of the American Dream is no longer attainable for many: the promise that each generation will fare better than their parents.

In “New Codes of Luxury,” Horizon Media explores what a broad cut of the U.S. and Canadian populations consider aspirational in 2023. It also dwells on what luxury means to those who will likely never reach the wealth of today's 1 percent or even 10 percent.

Indeed, the luxury ecosystem has been upended by a growing resentment of not just the wealthy, but also how their wealth is obtained.

Economic challenges, including stark inflation and a widening pay gap, alongside vocal movements from Occupy Wall Street to the more recent strikes in Hollywood, are recalibrating the luxury compass, per the agency.

More than half of people across the U.S. and Canada see necessities such as having no debt, owning a home or having money to retire as luxuries. These numbers rise among younger consumers, with Gen Z-ers over-indexing by 10-plus points.

The rise of personal luxury signifies a shift from exclusive traditional luxury to a more inclusive mindset. Source: Horizon Media

The rise of personal luxury signifies a shift from exclusive traditional luxury to a more inclusive mindset. Source: Horizon Media

Getting personal

The “New Codes of Luxury” study finds that while luxury has long been bimodal, there are now three modes of luxury co-existing, with each characterized by different attributes and appealing to different audiences.

The first, traditional luxury, is rooted in opulence and exclusivity — think tony enclaves, expensive jewelry, golf club memberships and Italian sportscars.

Next is contemporary luxury, reflecting modern values that favor innovation and sustainability — imagine cutting-edge technology, electric vehicles, clean wellness and lifestyle brands.

Finally, there is personal luxury, which is the more recent mode. It is defined by the individual, not brands, in the context of his or her own aspirations, financial circumstances, life-stage and social world.

Of these three, personal luxury is on the rise: 66 percent view luxury as an occasional treat, while 34 percent see it as a daily self-indulgence. This sentiment is stronger among U.S. multicultural audiences, with a 7-point increase, likely due to past feelings of exclusion from traditional luxury.

Per Horizon Media’s study, these "everyday indulgers" seek to transform ordinary moments into special ones. It signifies a shift from exclusive traditional luxury to a more inclusive mindset.

Nearly half of consumers (44 percent) believe that luxury is an intangible and subjective feeling.

FOR LUXURY BRANDS to resonate, understanding individual customer definitions of luxury is crucial.

"This is critically true for luxury brands wanting to market to Gen Z, who are experiencing the most turmoil and therefore are looking for comfort and support in the brands with which they interact," Horizon Media’s Ms. Gurevich said.

Share your thoughts. Click here