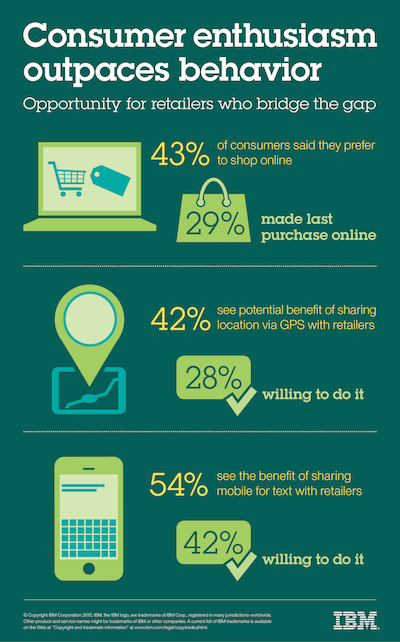

While almost half of consumers show a preference for shopping online, only 29 percent actually made their last purchase via ecommerce, according to a new report by IBM.

There is a growing preference for online shopping, but it has not completely displaced the role of the bricks-and-morter store. Instead, retailers should be thinking of ways to bring aspects of the digital experience in-store to more fully cater to consumer expectations.

"IBM’s research found a few areas where retailers may have some interesting opportunities," said Kali Klena, global retail industry leader for IBM's Institute for Business Value, San Mateo, CA. "First, there is a growing gap between shoppers’ enjoyment of digital shopping -- online and mobile -- and their last purchase behavior.

"Said another way, some retailers are delivering more enjoyable digital shopping experiences than others," she said. "This indicates an opportunity for retailers to look at their digital shopping offerings and be sure they are truly tailored by channel.

"Both online and mobile options need their own important place in the organization and must have their own look and feel. To deliver truly enjoyable digital shopping experiences, retailers need to not only look at other retailers’ offerings but also look beyond retail for inspiration."

For “Shoppers Disrupted: Retailing Through the Noise,” IBM’s Institute for Business Value analyzed more than 110,000 responses from surveys conducted in 19 countries from 2011-2014.

Purchase preferences

Consumers are embracing online shopping, with almost 50 percent saying they would rather go through the browsing and purchasing process via ecommerce. This number still has room to grow, especially within the under-40 set.

Fortnum & Mason ecommerce site

Buying an item at the store and leaving with it immediately is still considered the most convenient fulfillment method, but buying online and having an order delivered is gaining in popularity. Having online purchases delivered is preferable for 36 percent of shoppers in 2014, compared to the 23 percent who said the same in 2011.

Digital is also opening up and increasing communication between retailers and consumers. Targeted, personalized messages are key, and they should go beyond demographics.

SaksStyle promotional image

Through previous interactions, retailers can glean information about consumers’ preferences, location, browsing and purchase behavior to present more relevant communication to individuals.

Gathering this data is becoming easier, as consumers are more willing to share their information with retailers, such as their location, as long as a level of trust has been established. Thirty-eight percent will divulge their social media handle and 42 percent are open to providing their mobile number for SMS messages, while 54 percent can see the benefit of sharing this information.

IBM retail report

While there is a growing comfort level in sharing information, consumers remain nervous, and they want to be given the opportunity to opt-in or opt-out.

Part of opting-in, 48 percent of consumers want on-demand communications geared towards them when they are shopping online with a retailer.

"The survey found that many shoppers are waiting for their trusted retailers to communicate with them in a more personalized way," Ms. Klena said. "For example, 54 percent of shoppers believed that sharing their mobile number for text with a retailer had the potential to provide a personalized benefit.

"But that experience must be truly personalized to the individual or the retailer risks losing that contact option," she said. "IBM has found that retailers who use big data and analytics technologies to better understand their customer will ultimately be in the best position to provide the personalized messaging and shopping experiences shoppers want."

Digital has a place in the in-store environment as well, since it can provide a more seamless, personalized experience.

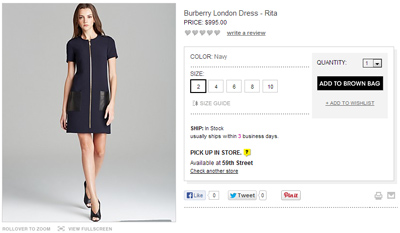

Part of this is sharing inventory across channels. Consumers are becoming less accepting of out-of-stock items, since they are accustomed to the online space, where this information is clear from the start of the shopping journey.

Bloomingdale's click and collect allows for inventory search

Sixty percent of respondents consider whether a retailer offers bricks-and-mortar inventory search to be a deciding factor when choosing where to shop.

A growing percentage of shoppers also consider a sales associate’s ability to solve an inventory issue via mobile device to be a differentiating factor, 46 percent in 2014 compared to 40 percent the previous year.

Beyond using mobile as a training tool for product knowledge, retailers should think of using digital to all associates to actively respond to inventory issues and provide personalized messaging while the consumer is in front of them.

In British fashion house Burberry's newly opened store in the blossoming Miami Design District, sales associates will carry Apple iPads to connect with the brand’s Web site as well as access to worldwide inventory listings. With a 1:2:1 ratio, a sales associate can also use his or her iPad to have a consumer opt-in to access purchase history information, sizing and preferences (see story).

"Shoppers notice retailers who have associates that can save the sale or personalize an in-store interaction via mobile devices," Ms. Klena said. "Mobile technology combined with insights from the enterprise allows store associates to have the information shoppers want at their fingertips.

"With consumer expectations being shaped by digital shopping, it's more important than ever for retailers to create the experience in-store that consumers want and this all starts at the enterprise level."

Omnichannel access

Mobile may help retailers build a deeper level of trust with consumers.

In response to how smartphones have altered the way consumers shop, a report by Forrester Research indicates that 66 percent of luxury consumers are more willing to interact with a sales associate equipped with a mobile device.

The “A New Generation of Clienteling” report discovered that some consumers do not feel that sales associates are the best source of product information. With the role of sales associates changing, bringing mobile technology into stores may help re-establish trust while creating an enhanced experience for consumers (see story).

Seamless integration across channels is key to eliminating the conflict between digital and physical interactions, according to panelists at Luxury Interactive 2014.

During the “Eliminating Channel Conflicts Between In-store and Online” panel discussion, the participating executives discussed how their brands have been affected by the divide, the challenges presented and possible solutions for creating a better consumer experience. All were in agreement that the role of the sales associate needs to be updated to amend the conflict and build more concrete relationships driven by consumer data (see story).

Consumers will be judging and comparing retailers based on both their in-store experience and online channels, making the entire omnichannel presence a priority.

"Many signs in the survey show that digital shopping is likely to keep growing as digital channels are gaining in preference across most age groups, especially with younger shoppers," Ms. Klena said. "Yet, consumers are still shopping in the store, with more than 70 percent of consumers making their last purchase in the store.

"The data shows that shoppers really notice when a retailer’s in-store experience is personalized," she said. "At IBM we believe that a shopper’s last, best experience anywhere becomes their new expectation everywhere.

"That being said, the retailers who can execute with great personalization will be noticed and rewarded by shoppers. Shoppers will grow to expect personalization everywhere, which raises the bar for all retailers."

Final Take

Sarah Jones, editorial assistant on Luxury Daily, New York

{"ct":"qTUH1GwnHMJ0S+LIOudvQncajQtvDNbhfFi\/heMrVeB0KIsJ18cqZmgMinc8+BnAvOjbWJG6uKXuhAT9i3RUXnuG+hYoW4Gmw\/hc9g353LH5vdtvtpt7DmCVAZf2C\/SLsUj3I5JitwwE36p0IFajdD5mdt9pS0KSGxurBs0GwveSh3DAxc80Qkt4BBIcSoXhF2XHrn2Se42f5IFetIAVg2cdY8pGz31xw\/SPj1JfKxSqdTCD2o2cD+ovgeuYwXyso84iVh7NIAQd3pucBwcdYiFFEvim4rf7xutc87b6MjbjBxgYGWn2aPNKK1f6KvMGZtubMg7KZinLwlG5B\/FKNksHEf8SzsBuWvIVzvJFMsF6FlZcFf5J8g4PckwYpCn6A1zLNILJezIQGPgNIT0N+Sy1P7kPWWzyEbo+W4+SoP6hpgFm+c6wQH07SmgyIcyPk+Tvg3t7uzlhORBSZI747a5md\/jCupoxRFsJJqtntHBbMqF\/SZIK58+1z8bj4bUdlw97qsqkD8kuMcA7tZSTBY\/vrT6AWJVdOPulDsL8SJ904FRiLUyg8OapaXF0N5\/ezg03YmQb\/S13c9fO5DhAiZFVZ9mofX4KjPPF13n1Aqpy5\/ulgT5yJewgBNWj5EkNyyhxDvjnSjX\/jdvhZC6sx17Q4uK+ir+W77SSbz8De0q7WOvnCXU49NoiW4R8K6989sGG0e7bT66XbLkY0g1RIfVC7yNOLpKGEz4mlkSiblqIybkoliUVLpil7\/+XemrZfsxQvd1J7m5rBVcBEI3vwPsk\/rwTDRd0easitko+6vvYRalrJUAW3Xt+Ke1\/vMwmEzOoOw3cCBHCceL\/sYWOomub9QKODhCXzUyO5joJ2xOU769ItFp4vP8YZD1\/asajBZOfw1gMKRYnyT5r1Fy3BDhqWztd89eDXyeez3fA+b9f\/ekkqUCCzFEkyr7HcqxPXqkRo5OAte7bScMkeIj6bKqcjuJBF2E9Gbkv5nm8yrP3Z4V2p9Ur8SE4Ek9n8zC+QJoqwBOuy7RLMf1syE5k+jAlBjA6WyVL+YLucOpGMjKxLeDXKKxaIe6Rfc23t\/WVGtqnwli+66Oyj8yJrveZMANNy2eH9d1Hb5dhBTXq6kgSlOLoLUw60g6TwmVwP0J\/AD7yD4f9YHqZucaLKwCiL2\/hLynm+4yOLg2WlVIqMkhuEkKEI1dYFkytHwmbnOmXwr7FzojQgq7c1cg8x+DUzRtlAb5MR4n1+7QHQ+paZeiEb7Qr4tJj0NCZxdwHVn0kzZnvRak8aWFut+JSyrpG1LpmuN2oF6RkN4OLAj24Aj9ZfwVQH6YIZpY+IzvFt2pq7bXYryzvWlxi4OO1rTOd9K9DBpiWUATi0LM3IkRiuYHtP6EbdLB7FWiE8GDDRg6c9aJ0ckbRrNTYf5Ux7RvkGmZqOycaGDDU0OxxLt6ITrgjNR+6jQfYT1uk42Nljih6KemLyOKxFpBwzHI+bATfjr0yOC2epV\/sjXJudVIhRROSGky55WAf2U79pCfvCKmIl+ji3ni80PO4EdQLFP4QZ9+KsmzQls0FmE3emU\/BicjyQXAwRtU+t0LqLOVpZl\/\/\/lfmD4jgI4Ubq6qIskTTM+QbcuHJwdfTWGSiKHh5sgn2gKO09nOJMj7KsJPx5HUWZNKpUsOPW8PKF3+sqjdtYHIOOjtZdrIl7cvCrzcC+ihLmvRbrGvRTHQWiJXIRLn+phOuPR4HxVkuPDZwNfT8TOyhrXCKLE2\/oG4kRJkfv+lYZygJo07iOUnVcBJAfxj0SWOprzbCwMNjdhmWs4ML2Qy7pp9ml77nSZ0MYTkRM8+nRhCfKMu60jKAlhhVj+qRcRKpG8A83+AOpcHdiX\/IJeMmjtJvF7a0yz+jGeMhOdTbIA8dhs0BI\/QTpAVV\/N85WSruwH\/3YZrK6YYMTv9FXhEQvBq1DrtRt83RD4\/Ov2VtNMDG\/olpXdlq70v7F3u2gGJlkozNKLPL1Br13gR1evhVD0Mcj2UJVsR1K077yVURFfFUBkLJ9R+5N51vGSz82Gel2ILpL\/qu243YUDx8GzoD21FpxO\/4yErLzZmgrMqAVujLAI485d1no3ddO04otclEYUv8MRa5fk+k3b2Xl8BHfOEWGcNsKDraOjsuwZS+a9t+KwpTHs9vLaGtWJsLDTsXvwep20su1pVqgduxoToyxgp4EUM7H2TIvw4CbVD6OV205KHc1QiGdWX\/wZoLd0Fgir\/R61aIROfeuLrMZI5LM3UzMre3MeKRzMLgc9WLwCuDuf0xT5lQWl\/HzA0LbMnTwJB7FPpi8u+Ka9BsngNcs6mWXQQya1d60q1phNF2+tSeFjog59zQ3LLDoSPb5VtpCs4bxY6HjLq7+2+Qy872\/kcUD6qjNtNtPM\/jcOsg+4z4Wcsjz3Iq+oW9C+PwDpWuAbYCr1imdy\/vs6ciw6BxSiZSg7jSV8Y3r+YFTJ6VjldN4AmHiyPt2X0gnsvr9hpD0ba+NzrhINtPjLGJj7Dto7Uyf07alfZGyDdzs5mn83ua6VSUrypbIBkXbQ1qmUwnE2YcRMkb3IPTjIwVFtlJVgcvVB9GTsrHNfXHEnjhwXR3GsGJ7HpK6EsIvWFOCf\/Xhn0\/oZSRURiM8IizK2YmNvB9s10ulvYss2YddRpub3wTP9DnYG+ksUa\/QihOMpozutF+P+472ea9qxAmV\/KhMj0CaGQBaWiQMquyzvFQnYtQkL1Aqryd3mPjbq7DIlQnlz6\/Pt30IUyrX+Ml\/B37ftCYZ+iylXId4FMmF9n\/CJJ5YIgVOFo+R2QqSPhbhDMSZ\/whRsyILTGcRHGurNKdYNyH7j1O+LYLG20TiEfWIE1YIolM2IuDAovhAXTojKmBPsLHr\/SSws5+5Be+yDZrfaEJsHwMjSzydOYSveC6serPNGG0heSXWufonMQ7XzkxueLU3Fg90Sp+Yp\/hJj9G9I4sbB47yn9RhLiJcSPZP0SIdNEllk92AnGuJ+Wtq8yXSiuKSyEZ5vuCxNmrS1rKIQ1Fj5Y4nWr84wj7EvU+K+uX6XZr3VZ7KYm0VGVqitfTKCvIjADbNrgfdgamxdq4o8bl4IvHgIBmApDOWx3WEUUcNhqXzgTYiF5uHK9eZss7+noO3bWSiRITtES1g7PUR5l3\/9rWBLXpSkB315RDvz\/B4jbic23WLcK8NevHfb\/Wd411TzZUtjVusZay0raUDJYrZDSIwL43tOHVJdhgwBxOTXpwAjPq8nPpsel5\/8Y0wpdUApxG4Ci6QXU1MaGy7kqh0D9FBPibTrPOweMWptQ07OHCtThGo\/l9L3+jT+R7jZ7RO9HDNwkWeJs5JFOz0dBiuhJuMoBho\/po+ERDkHNGrJngDIeiVzUFFyuA4lU8E1zdtBKJsMYXI3pP+nyBkxUCag1v6\/epjulywMAtr6jlHMdtp7S3G8dNgCTdhh1Rum7OGT3gxodr9Gw\/3k+8mQ8g\/pgX+85SYkrlmtomsK\/NUgt+F\/3Dr3Wkdw\/oU\/48+qoT9xN1Txbe3qiqpmzET5thuF2YCbCZIyzGj73AWHdabVklFsRCQclJykNE0zZ2HmIW5C6MumfVupkwZDlN1uuoNdEkAoo\/BFX0VzXeiJVKU6zRvODc0L2sLfFAD4wKZ0\/4rIcF7AFNg1i2xPKLOvKsvRay5Okf+nkhPzXqX5\/+\/Yq3eG4\/Isp9MQnfKFand4pkse7PKw1WJVG553qim\/R7NyrocSFZgQdGMH76x\/M\/anusUlGD4VD7RRUIPUzY497Nx0U7j5OohXm2GQtAy8gvdtoTm5+whzMhkru4gYZVeP5+pMZt1bzYMjEZVzEF6xhj4pZGV4DtHQ5dz39+YStXqYoFhgJxyzHoPcm1oPr\/QjSs073dUJcakAR0EES5GFEl4rBKdejpW+RyK2iB5LKb2byL\/R8VOu13VaHCiVm9o2teuIRB91jI1kwgrOmSnH2M3ssaOWk7U7e\/KwwZ\/0tJfCPxYvx\/ACvebNKN13Tj3os9YvnBx4Br4eP7RTZpdkSf9oT5fSwH2c\/ntSbrrezPwl+r3BQVprJlQIdV2oTp5v1YamTi1paLvl2FamvP8KJRZg5z7elpiX5zMQjur5WGRcS8rdrp1XUGuhlcAnkYim6BTcw3hUY\/AqO50ui8RKSH4okfHiXOghs83TYqRbtQE5lM\/vN07Q8WUan3mcjOVTuVUAT7pSYk8S0MvAubkGOYHnlDG9n9QPgGJ6vwWHuQFzVGkKbAf0Vnr2uGTgj5JXlNm10ePajrEcFKcii4HnSLMUhUqg8mfRxAVa\/nFPHZ8jmy8psaq0wkdL37cAKUBwvuGeX2dVXVDThVODjhhNXn9XbxeUryQIRwDxrTjvvDr9Gns2TVbp80lnCAhq5PvuG\/NoXByIYRz9o9ByPxDAdAVQiwvI9OLh9TUBEL5UwAVDbHTxEtloJwc3Ai9C71Rw0R5CvVC\/3bo3eERXQsItxXL8E+xz7yShsU1JQUFf+URv6SR+U971Q1uYmqe9t4KmPiURlJNnglBS0cnr7eR0m+l8r+V1KuZ2WsAZYfwYyA9YFNUdj0fcs08ZA1p13+zcrjUJ0lY83rYX2o1GS\/\/bYwRNlH5lVPMnfCMKdEGM04jDDtio67AlowEltkh5KWbAdiZzqD1R6z3tnvFDXDhXcgVfS1EHOJTZH8YcHkcwTJQR5a5DYGj8NcK37CbyzPhASoVj\/4s03TOEzzSsP5dcg651T8fBhMukCGHtm8ELJyhwo2P+hs0w6XcJqc2C5HrNNJqhf2Ywn6AyKKjq\/Urkudry2uy+CtSUv+Ho+2uO\/8\/IeZbLRw4TLM+dtDT1o+8aZtFcFH6QummbS53d\/YrKDoAoxsu2d0EPffLFI4P1F\/2zYaCZB139CemCV8Q2al9OghZhbHiCVPlnsuKZo\/mTUVsdYtDIxxkz2a8mknoAfBBAdeYiCOStX6JuVt2st673sAnpoCtZE7OAfRoNrcLrVlVIRGiTV12p3hY8q2GvdviOFbXxMWbXyGGnIaDHSc8efCx0k6Byickg561bxgulDLRSrhPNRjLNzfpzj8ZPh5NxMfJXinqMweotGrCZhl+mp+CGfGeuM7tH5AhvorZfGfio2p+xX8+oV0f4yNFM34NkN9X6ZrERz7+IS0zEOKwNYdVawSjD6ZVzeBnSfdozpvhky\/3xfdd\/MUJ7t4oTesng078N2Uglqnv3p8tJkV2tIZswOOEAyRhrBI\/gpdu+czOM\/vhqGp9+ArC0vjTfzxZiDMHLWO9QGEscB0ga5Ac5aLRNrCs04cJVzd+RZsaQ80498dPGK3nTuk1G+SJ78AJo2\/0QgSzuTq2xP9EcigRftRyRKfhruwxbSYHWscQ\/UuxCQIBdnadEnQVZS5NsNuqwGRt7vNjwL7z7vi5FEpzRvGeqehQS2dWhXuTjgt5soxPoixWQcdT1DAiPLWyEP4yosg33R9cvymWk\/bXkOppD+hcfO5LTzhJn9k+M2Bs4P0Wi5IiLEImhp5QIVyleE19tkFIUsteekYSV9SiC3DsF5t1PQ5IA7HWKeuWBCoYW2DGwg68ic0w25U9beStYQB0V\/0DIgd1EWlwiUYyQ6uBx6HJkwXQAlwizyZSAmuoMvp0JHYz\/RkAJN4yGEgzIQ4wFCEEJxRWNalwCS2+z5z0kOnmUTortRQuhD82oPGJJfE6SUFN+isq0SaCrmPSdvcqcw7CUut4VtL3tymciqtVSLy7mLNUN+AuCUQi8r58hOf3ML2vD4nyeBHqX0d6uhcc6vPB4OoynITQPhPh8sQeRnbCMGiNPeKzfLPKQw7w6YmEfMCieL2UFQZCijXmS8NzgK4Xbt8wVkF8oLRBQMaapC8Uq\/bjpePn+chVkelGZ5ErIL5kMI+ko3AYktl+434Hv+Rp8CQLnzGzFa7CoumDrXsYbnWVc7gJfYUBozk33jeFG+m061nmoPjzRBcofoNd4V\/JUmkSVuTbABhzv9V56uU54BwdxaDcnHeSfAGaxhcGqmGnc9FxptGE30Gi75CsesfR1\/CCNvO1pXfWenDpjcdUogwxVkl0roaEA+lAndipGT3dm+n8NeiNjGKxls0y0yF1wF\/qXtaI4S1g72Vs+41t7fMfBpwzSxncawR4Q9UjXbeGQ1mSjOHVPyFXk4FlmNKVXNEg9Yve6bKgtqElKv+HLhjetO2YhV\/OXWjwnm7g+mYpT97KfTWe0IA1rKr5WVFwwXPRRn4CBp8PTmGLgy3TaX7dS2cWm3ZdyiyIWDj3eG+7lXPP7UU6fSCvx6BajlbmBY9IsA\/mhcuFvmIuvH4tLox5SDwp8ZcnAEcpWij\/zRc\/uEHKcSCzLtt\/UvpmNnsp6AlhULuV7dVodEuVX6ml4HxbtVq+pJiFxFD3OsMRQ3KLEo9GFpqJF3ik53HOwObXsS3o74W4Ap7qW3pFWSezKYYkstUNAQJvY4mg4B0\/suTkJIRvf4GyiLZcRqL5xBicft3Nxn9oJANZtpUNLSPuei+ly1YmQADl8XNq+H6y71LRuDLGkht2BBuyazMbMaWUemp6JbCra8db9lE0TEm5pkCnNipEi7wzNHSaqojyPxmb+YoIuSxKk1uuR34Dot6jekmFdT9Z7w7bW38RWaHhvuQxXEprQm1liZ9Iq6pwSfVPCaSFIJTpnyQ0A+7PdOGODIi+C6IQL5SrM9gmiWPtFtwtiX1WRoG7dPVONESYbrhDcwrXm11WrK1yWi43qI0wPQfjRibskWPcQPPqh5kmjDQR5ucqsD4p1iJV48EOuAbxZbx2n5Ekv+sPYaAAfEEJrHkCUOCLmcfLn+f0ZtwDhDAn\/q2DhGOyC+7sMlqma0MbBrxMyE3i75m58UKwBZADVd0wYAMgns15IImv7t5i9jyRYB5YeWNT\/8KNISPKD12TJvZlPe0+Uo0So6SjvbENmo5uSHEgsmbd2MNSZNpqv+3lXaT8pGljW2WMPfpV+bIc8hZ0QpoGkmUy5SzuqdsGPVNOoCoQvUXRymVgXdjS5cTBz65pAcFaJwSnGYYfrUmcNO3+xs2sjwRv8ptF4iocFvB6C+Rs3EIKRzGzdJBIuj0nf7CxCY8j3TelyQYTDSBo9y0XXQ4tBE0xC3NHp8KXOaPn\/\/3LNqlE0IZVcPSeifhnEnLK7JYm6KaK\/79\/aGAjlxAZeFtriL\/a76XSrEuLh9ZpcX6GpocsH3+WfaVumurDl+2uhbUrJka2yC7g00Aj5hz0PhkBBOqnCZMk6hBu4kdVmqfT3taFUbgPpM1P0jaQl5uUGQh+TQ2hCqY8U7lgjl9FG\/MqFU9eVytaHIvXN33l3EsktidXLN75Fzlto0hvRj43WsQlXsLqnHUvRYlgpFQs7AcZpgtXQqnCv7MjzCRoXtbw+lNY\/zFKfXWjfc0UAZXuOv4rYuq7+TlBrFBzTlHGyoyLbHEjqraj389sVMF0vwvtElMb0NtM4PMCFru1JELZsbCAg4N+lV4wkXlM\/qmntXbrOQ5ZQl2fq82q87XvUcEuEgpTtsRI6BPMgFjUBXpxXNaHgSdLEjH7GZCcjx+g1SE5\/0kDt4RPJrT3a05jVAd0nNb3BSzjZPfBtqBekBbTgPh2tXiDkGacetQ0mdEIbUPaDaAhX6mcaCZj91A11Zp82enKB5VYf3u\/UL4X5EHFfnDfPLnqBb+Gf2Flh52+TkYhl+cHTsEpCsElNNS8WFgEzDftAd0ye5WQB8HwTtwI067Qspu0on4zK43TZzEdESQs7c1Jo2o2ZiOp3N83lfoofLX77nLtNH0CsKGrkuMsSDE2YrYlG1B+zIBafyZBSVodria1w5nQ027iThQ6wTs8kMtfDuq4xfmAF8JhWonY6XOC2SAQoH1CEJ9KPRFWsA2606u9\/d0MECYNwr2Mi4olCqYTuKUSxMZeEjAG3atbd3ngLkujae0WeQnEBdCDvirxVcDPQSzANox8jDZsnhYCoeaA87Cq+8WwhB7hhy5w+ongdFugx1fmR+u2t34GnaH4MSu9mD96HcwewWpF9Ahd7O6AQ4obq0Ux53bvIykBZHZwxrS8ZH4aW6+4Dp6pCbZYS2ZNlKbzR0GqsYTJ3eiCVPzoNGO5SDREDIiTZDeipFDVlLWxZlfgC+ucQzZXUgV+flROiA19LOt7s3g2p6DcK4vgj\/Vysdn\/1RRhDbU9NEbLDTzge3Jx2t4E5iCl+cV+\/9zgMiafv7Is9yRuq7KeI9oHClEW\/3\/hfoCo0mEmkbv+S+yzxNAePIoTX0kgRQ4ugzpWVyMlYvQHDQa5QbeWjF8D+0OWtRFwrFaP58PqXRTQXZXV+Rgo0ibmhbwGqykCqT3UY2frqjB4uLX19jtc3OQj\/xGJZe1UA0iQYD96EN0mth2iMToZ\/nXe6bDu66gVxZfeDyCGvpeL14LB7uq\/kqW2+mG4zeXGJSC58zz3W6mJkTPSHvhhC0E4k31d9UfurmaG9DCpFdu+gA\/j2D4fLXt8V0gmINNwE8DYXupqB8ixy5XOSStuCePxNMcimgrLQAB+bJAGEKuBIRnngwVK3uDPL8SbrQmODDyTSJ1oSUz\/Qu5L3fsGAJbThCAemE3lRDWIi+j57V78liOCZYL2lTkJXO8xgdeH6xDz5upZETMdFa3WuWyf2oDltecXV0yikR76LLjWb1\/\/5lfw48JcWWFaFE+bhSmDYqaULr\/0qPAoSyXYy48ssOBqyPtGHu6uCfAPY3fujlgkifgD14otOeLkpeE4lVWYRUzV7WPcMjdMhmMzBraawKjKLZFaqBdj5CfLzJGppxxJiAavV4UVvj0y3FqOXyvtthz7aL68cyXch+mx+ErGNvbq3ndebP3PkFktKg05maiKtzqN1lHhw3o6HBogZK3iC44iLwXL+mxtn7UDp0pEQRgrDVo3Mm1jH0nUgkS83OUgRdU\/lh6YnpjD3+3jBvOnz+21ALkFTcNfLFOuMtYkcY03JPEcg0ng2S7Sj\/d1D40PtRC3gvjzI6WW9xPBfj15INbdsVINzJyI74AlYLz43SsWImtEsRL2M4YUpPScpiXARcV3vLbu8uQ6gUI1RbYqAv63PAhyufNPVm3m96nnXygqheMxJSKIca1zXWMEfaC61Q70VWdexNgfScVmIGdCcYbRJF8bCXcGRHQX1N7PIahV+xItxeokQD54rg8oCKb4wH7zLkdRPh7S0C1jYvve3e4m0sux4TnzCetdiVFz7a0y6bA17rb2N38U9yBOUSaGBN7U\/q8eQ3RtsUq5aZUoBQyviaqkzrZ1OnFfQW+A6ndXVUDQFEvZH4Uq6elODV5Ja2++cxYPQHbCauVKzEwcZJT\/3e+JdK\/\/Jk0szAP5gMH4AnSvqm+67J4nIOFz9RT\/nweCDiQuNbeJEVAiOHJL9M845PfzRvqAb0QYiUGxBOgx2xxef2FmHtpp+7dG45cyVTEghRMqg8mL0R7AD\/sE0uk5wT3BmXMKRSTKfctE\/p1dWVgsZo9\/Sacfp0R9Zi2Tv8Vxg04Vjkb34TZIzuHzh22VLA+ME\/9Aetl9Vf3l8kf4DGh9XY\/3MGPOpTCRcx1kHEQNDFk3Tu5QPCdMPgJ\/oq5RkPT5V3\/+HdNYsFMLQ7XeShUAfRutDYvqMLAWIUyTF398CIl0GZiOK8EG\/u8jnxgEB\/rH+boaMWYmH5Q8qP1YaqzJQK6N0cgiaPDTLZEFjfkGtMV5GBdeQzVwr6P0B5fJ04xGeGgC92Xa+UONfErzME7LWsyoLjToC4HrCqN5NoQz4qB\/f+U6Yn36pcP\/yIIuh\/Ezryw5YP6ORdDS+1DxxyywjDCq1sM5qVc1BuR7t0WJxZMv0UpLJx+9mI3Um5Szbr\/pGzqWIsP0GodGB0yoWWVWFpC7y6xuQCBT4siKxAlqt9M0CoJGQyId+h8jgvts9SzBNG3cbowlIj2g8jOQg\/8Tjpz2USSMSs\/sm2qbLKEninpn5an3Pma+fh3ncBvai1TIgY5zcUlFNB53bLA5U9XTLC7J0m7\/LHFGp5OGm19s1ocUlnN2VyhHvG7LdfFafxvh5vLKhuGwChz+ELOUElo2W9nnTq2K57rsez\/az6UTGi+p683DMF51dK9kLKvcdV+z\/pLjAmbziVNgUK9rMdeBc3vOCxf+JxJSU1dlMU2FtwLd0L+IqTgySJe+otQ0ZI1VgCrbdAZz94T\/l3IBLHrXUaP12gdYoKhcrVh+UJZcBOdxRHD4xzDfH9JAX0B3zKuLKxMoPlDC57IVuvyDB5Z0ONxDV5SiEujBr8h7jmMusGnWb8LkQKUBejs3ai7ahWfiKKw+kknoRglTjBmK\/RCghhcwoA0wAXWsYeK8xuKVngoYGKnqdWtqE\/kA7gNj6IsjCwlvlyM4gpGmuTRdXwv6NzeHtKdOHpaAkeBdcS6v6rGoNf3086blvwCSVJnCsTJM8AhyCA\/gzl2N8KiQKHVBDrHtq3Zz\/d6Hm6Yl+T8gwgk4Zp43xtjvRTN8SoJZbkixIJsNcbWg5sBdAGklP7b+0zT8Njwm6rqsnwDxFy0n0HkEmhN+s1LlKjO9RmjGuHibVAolRxvPrjuY2OnEPuwjbhm0m5XHW5ByjdM2SQ0AXtBFSShyJ9VGDnA8NKEn65xiAVhbViYDVZJnv9WNmAUwDkcyWe8befctDubAXB5W9G7V0yvOWzDADuDhxaFxaJj7eCSSzDskT64c0ORoRJ41oCiQAgecVs1lH\/w0mcJEmuQFtO+sfTsDsryQXZDQLbpM0kQTrgLKzt0ng3AQjuCsuNnHsp\/teCYz6PIro93fKKHOZP8opxnwrdYeTjD+P\/\/JkR6PuYD6xG13pAGqv9ktnRftLM32Cv1wBIZSmw6mjhprThdkQiu\/YCbS5QJ2cExoO5rvtpcu0A3Ryr1X4pipeRRCb\/ADYQGMXEi8RwW5xOsEHT6\/R6gXezLNHeQyDbVfQGxkcBqftjVyOFVUB\/K0JyvrgTaMiKaY34oB1+bMC4MXXbB79LCuY2uUJyOiTfbU5YWh8Gac3b2Er+7LpInJ8011Dor6Vjkji3IWsjfzBUZf20JW1Bn7moWCgknLEa7J49g6CwZoEz3NYaCGKi51a4gYp5OyIuF0itBfZE5QTHQSwuI+cI6PV1PW5yvs0CHeC2Bgq8Ubg8uAeY\/hMPypk04pdVQu6\/z5yyke1rkDs4gDJ3p1BJODNn8yOzAvyqRzoTAoQfA0wyuVc\/8odimNfncLMxfQ6\/DRIWsadhjMJvLR77g8C6vl0CeY6n2U+wLlb0W4ZpgDg0ROmfatTTC8cKF2euk+eomoSS\/E+4mPo\/CmmithlHchwSwp2fAiLMDblIXGIwh+2Ic8WvSvRK\/B+sPZ1ubKhtvgJ3m4WzpM9Ne0WPh5LsvwqbCYooIiR3iKHXJkI8FcJwwtUr1OWRA9g1N0DUzkywXlGQPifq9\/CMO2KBnW3JHSh3BbjFw2aK3PQdbxfFK56JAp+950FFNmVdwh8FFIywlLPKrKMTdu8RexujJ77AI+5k48P+1GDGNyvw5O7XCl2APNqL2dEQfYaK10RDb0RbbgpcchePdnvr6cYIwsouoreLnGlRCdU5hHi2FGWGQWs7gzn07lR1opHHZxzQezgftnlt4Uby21QPSyAEaZwtCTVVGU\/3Nz8\/489gijg0efQDLW8D4AoB8DVcwMrDWVN82lWZCryAx4q\/5IETIrjhU\/jQRNbvR+dqAvgmLCzav1d+fP4cCl2JBLUdWR1LKtbHWRI45FiAp2o6HpOmSMER4gD1vPaFAGviI+sg3srYrwuFcXymPeqVQUfPuO4Uy40kbepoL7W9d\/T11QGU1rumWI\/5Gw\/g1PpwlxW7q\/rUQi+qnt8F+Qe4LbQQqkj1CpTRZ2SVVUqcIzExywfslcTK9IyzPkcEt7yNnvyOmf4IDLlYs8EOFpQRDx8yiwt1SudQl7SVCdOm6ioRmE\/No4sxHe0qW07KvS0X6UdObMAgck6d+1WiTCYu1+sZxVW2KuDKuisA+AviIcVPARZ1AiPCs5wJWjsdMF\/PcSsNInA3O2FgGbX7ePYyiccr7YZ3YWhuCgm\/auGykM1\/ZbVZDOp+LKTbgI2DvZo+4Qxa68ZLwWvSyhVTMe\/9mZjZslwVypU439Rkk4KitHr5ZZfAFd7F4mACU+U49e5NQLiIpOFMTFGokABch3nstvyLfOFyk8dU6R1lPZwQyvB\/aentgg8Mml6jXXefJIhbZ\/VPZ0NdDgMzMNrxKr7P+jYr6MkjP64s7WMduDa3CICiD\/emG2RHzYasx5FBcwSA8Xqadzq0vkV29BYijt\/\/SMzxl03s\/X6rI+jOrpf3u6z4eNjwZ0FRVdNht96H3dqTdmdHw7kjBhseLE6E4UbP4QWMgNs+q+QhOHMq2v8o\/eMjsNqY8ug9ESPOclAm1wXOySEYSctqWABoW80D9xW6JI+vVLPJaoQfgQa1OhYKOe37t3NVqZm0S4vXPtN9MoSiLPWyuKyY99ZyJWnpN9Ob6JK4kQvEILe8qKLzGspPdP6+OCFy7b5CZ7Ehvh+TT6y3BedPTE1xvOdWC\/0SJZEGeke14PBpqxUV+myohbvb3Julx\/t9bCIBWRXstCc51FpbWe7UEdYKbu2crXEfWFROHxoWpzuzRcfCUOKF1Rwirdsz0uz+g7TjYp3axGv4pz8dEjjv+EE0D\/FYlv8d\/Z8sRe9jiBGKhSRCB7FZGLeGNSke8nTnDNot0v1iUU\/mxpwxJSzAmT5ir\/YPw7nD8EaVdpY\/fpqA8Tm7VwwHxNuaX0zCzvliS2NqzDrsUggmSY42gNnNkv4IQ5GSg9eUHk5+5eHLoDBaotzolJWY23IKyE1VhdcWN2YGOd3uMrAp2NRBU7abDGVg0Iq8wS8Mca\/42O0buvrlRHKt+vhgePslwKtVjrJ\/3FSpNExotR97cL\/F2nWe54M6\/CLz+6im84A7jSkJIZ8pna4hJ6W9eIKnuUvXGHf3dfXzSPtHHingKjya7n9TqpP5TmaGB4B3dkTOMPzGVJSMLEiKoQ06lhoFSzTMe3YessqzKZOUHnEka4Tr+OpERZIJLkasbKIvgll3bt1roHmjQauAqoT0VLvmWzCFHqk+3zqpcMedyPsrdLQU5lrXtFxi4OmwbewKNsfZ9KEe+gEnAwNKB3nylZUuobA473emDz0gJtgqNAXai3VBObkYXXaC9ob1QC90y0xipltvjWnkXUJ7g48fVk4diTc\/\/HnWAvClLi5XcxZP8l615km7pZ1Sl5UxylP5\/89fEZ0Xkz5qTLMfvp1\/F9l\/u4qn\/+h3sVPRal63U9mONssy4RJuepMf5Yz4xHkpw8Tkk7TaB45\/b\/ZD7fgZU2EAi5tLItRdYUgHwYN6myhCBVrb\/BBp9HYLW03WM7OAQt6+sLNFwtalfn7wOX0VfbU34nhQwPKdiUDJzGPV4pDevEAQmJ3H0mOU9i4xjDUufF6epQ2B\/z+pEKbYaEH3wBe97qYrEgTKLwAVNSTcsFjT1+2d\/Dhfum6MZIp0GLEaDmkFmD856O\/rYaeQbCA1QpH26qtZShF4wZc5NszfRdcOO6hco041Mjhmf7rRU7daUnWlvv5edGL08C54EGa6XQekC4jWueJr0LgBmXYMKaA97qOqNJE+UOwxdyiIAsmD0yxFz15Vpj\/0nULQXNYRhLBRFD7yrzoZTxOX+uZa0HFwlmvkoEnxDfsNVv1r9YqeXBZqzT5vspauoxE05\/DxK8tBE1+AnTNZpkisaEThaHZcZfF1J7VCROEvi8mCEdqiaEFofvL\/wCb1MP2B3g0TejFWg6TVF696OTxJ2F2PnqJaJnx8XE6TlHAc\/+pWsEZUnJH9wbKW+lHBwoo+\/DZlV0\/KDMw57NpoIJ46IDs9iS1WMpT4ZnaH9lwLv9KxG8GcLMpfKWgctC9RwzyRoOeZct8Dk31fnPHvsqMc9irUXia26u0jN6K0EQcmoZ72mADQHkg5wKo3tjUF4pnYbsd942kAMxcYNjtCH8N73gSVGvyuNEMTiAfvs0btZBYMDjNx28VNl\/unl2NkkLitlrGwa7Df+cflszc+rkCZQ3DUdE7ZfZ4Gyv7Gq7o82Nid7K21pKBPvM1rRe7\/5f71nPXRH5JCgZwOKXkkGG9E542bfTa\/205VDAJrpqoBp2gnJtn+H8XW\/Vot8HnAOfc5FQ0ueVUKD9as+7jBUOw7zwar4fG\/7YD2YkkjNHuTpXxJRTX\/CXY+1lj\/YzGQzUUqZrVATTjxVY1r9PMhoCdWG9C9EYYs23FgFclDGkPvJTN4cEbEiO\/PX6DrZAk2zOS7UaW0rp8wNsdL\/MFxiTWxdfXZ03xpMdyadp7J2QD4D+FN\/rSmvE3gkeAIS\/IpN4pS5dc\/dLPIsJfDkhM2G0zbaEh6UN4zDlygOftYx3gO3GwBtu54wCvegap2y1icJL64FkA2UydAfSs+2udVznecf1w9faScwOL7v7DGGiw2uLnFruE3rjn\/qXeR6OgYMq3OejnNNNse2d1CJOxVV8\/nwaSk+2MNA3GDUKrJW","iv":"0a1cec359b385867b4bf61eb2a776695","s":"35ef05c6f319387f"}