Lagos, Nigeria and Mumbai, India are poised to become major players in the luxury world, according to a new report by commercial real estate services adviser CBRE.

Although nobody should expect another China, the residents of the Nigerian and Indian cities are already beginning to make their presence known to luxury brands. Continuing globalization ensures that the economy will remain a major factor in the luxury market, so brands must be attuned to economic patterns and shifts to stay ahead.

"It is imperative that retailers ensure that the retail experience resonates with consumers and makes them want to continue to engage with the brand,” said Brandon Famous, head of retailer representation for the Americas at CBRE.

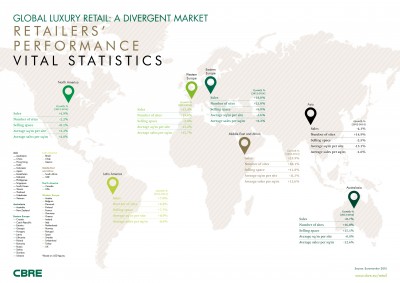

"Global Luxury Retail: A Divergent Market" looks at the impact of Asia's economic downturn and the rise of other nations on luxury sales and tourism around the world.

New frontier

Last year, Nigerian tourists became the fifth biggest spenders in London with a 50 percent increase in spend compared to 2013. The continued growth will put pressure on retailers in London and in other benefitting markets to adapt to the needs of the relatively new consumer.

Just as the Chinese consumer's expectations that overseas boutiques will carry products unavailable in China has influenced retail models, brands will need to dedicate resources to learn how to build trusting, long-lasting relationships with Nigerian consumers.

Retailer performance statistics

Retail space in Lagos is limited: its population of 13 million in its urban area exceeds Paris and its population density of 15,500 people per square kilometer surpass more than doubles that of Shanghai. Most malls cater to mid-low income consumers, leaving entering luxury brands to opt for emerging high streets.

Where Nigeria is still emerging, with many of its wealthy consumers heading to Dubai, United Arab Emirates, Johannesburg and London to quell their thirst for luxury, Mumbai’s presence is more closely felt. Years of growth and an influx of entering brands led to the creation of a luxury retail mall, liberating brands from the less visible space of five-star hotels.

In both cities, as in Nigeria, Mumbai’s younger consumers have demonstrated more willingness to spend income on luxury goods; likewise, space is itself a luxury, with high real estate costs stacking on top of hefty import duties to slow growth. The development of two more luxury malls will provide a medium-term solution, but until then brands should localize touchpoints and prepare for tourists.

As time passes and a brand’s consumer base globalizes, the brand will need to be increasingly aware of how to reach groups of some consumers. Besides talking to consumers in the language they speak, brands will need to tailor marketing efforts based on notions of authenticity and social values and reach out on a combination of physical and digital media in accordance with consumer habits.

For example, Parisian consumers are less inclined to use a personal shopper, feeling that a personal sense of style and self-awareness is part of the French woman’s identity. London consumers are active on Instagram and expect brands to innovate, whereas Milanese shoppers skew younger and care more about ethics and authenticity.

Looking abroad

Despite the growth of Lagos and Mumbai, China continues to be the major driver of luxury sales. The country’s consumers accounted for 30 percent of luxury spend, with 70 percent of that value transacting overseas.

This pattern was most apparent in Western Europe, where sales rose more than 13 percent, but it also contributed to growth in North America and accompanied natural growth in Eastern Europe and Africa.

These changes have been amplified as a result of an economic downturn in China and a strengthening U.S. dollar, two trends whose lifespan is unknown.

For example, high sales in Western Europe and Japan led to decent third quarter results for Kering, suggesting strong business from Chinese tourists.

The Kering Group saw luxury sales increase by 14 percent on a reported basis and slightly more than 3 percent on a comparable basis in the third quarter of 2015 compared to the year-ago. Much of this improvement can be attributed to a variety of economic factors taking Chinese consumers to Western Europe and Japan, where Kering’s presence is relatively strong (see story).

On the other hand, the growth of Africa and India seem more certain.

As the BRIC nations have become increasingly developed, Sub-Saharan Africa has emerged as the “next big thing,” according to a September report by A.T. Kearney.

Research suggests that the countries within the Sub-Saharan region of Africa will likely grow in potential over the next decades due to a young, fast-growing and connected middle class, many of whom are still discovering their next favorite brands. A.T. Kearney’s “Retail in Africa: Still the Next Big Thing” report, part of the “2015 African Retail Development Index,” looks closely at these consumers and the economies of their home countries to determine the opportunity for retail marketers as a shopping culture emerges (see story).

As the marketplace expands to other parts of the world, brands still need to remember that they are competing with one another. Standing out from the competition becomes more important as potential consumers grow in number.

“Brands need to communicate the DNA of their proposition to the consumer," Mr. Famous said. "What is it that makes the brand desirable, why should the consumer buy this brand as opposed to another?”

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York

{"ct":"4ypfUHjByR4XFO8kr7+qTDy+serf2tLR\/XZPIvzNUhZmFnrJJxgLj7L9V6PiJcr8hSRnJ+pR4z4V0lioVfa9oXO1etWqAEwZbUOMFxixRayg0JPFmab+\/\/fxRbmIw5PCO7O9ly+n8boDrmCumETXoTVkdLW7UZCkeBalJvVf03uR\/Q1d\/2ar\/xBxDGCWrqoRFAuE9oa93nIiQvgq94v1wYGY9Pq8KWm9n+Yr4efYX2M2v82C4SR453sY7ot5gUC9oAR+\/mc5SXe6tVg3jHs1t5ldAClc6Nn\/Bsyo4H+6D8exrNZZPLs\/WGeuMuOER6Lx1HNx\/w9xwvjRtSVGMfYZkkSLoQWxRtgI1O9Zk0Bqa4nzETkbjKY69cJ+oLAXWzAMiamGuFurxaXAkunYC35j1t9NaTW6uVyuxNdacJiwb0QV8bMkrC\/MB03prtMv5p+jRyaTcYFUxhbjK+S7lsHm5t3k01Wzz1iYa+5c5+WHo6Ul9DztL255wYuxo7\/r+O9wfhr\/wcvXistvwbAsle+ZGn9EznURqVBuirfL9yy\/u\/xYXepmoPRmTWKTcXpXPSv8GI+DTIQvEjavGpIPWcC9gHSGkwfR1\/49QUxTtY6gpMdrI0GNbA803cw6k9NMRmOrAGuyGsTAG4qC5iOPYILO7yW3S0lnRodWJUUqSvXGSNmNq+zWGkY5DstVoWtloKiwER5hsx6wOeAbDMCPnUhhdol6JwMNm7NHHEOEoVhs38pqPmlBJN7tmZvXCfS0BxldAzJpRbOm+zAC7r3gwj0mHzSwsihkZ\/bfzymCuO7I\/taX62Q\/cCf8G+FpgekQphQ9lT9WO5krbvSB0+wfe7X\/E1eiSbgFjCGrKdV4pwpb0DteD74O4ZdPj7sekof\/X7OQnxigw0hzMWG4\/kdncX8Qoqr+aUIw6l+rEsXuc\/jAnwiwrd2btQBOWwqPaXaClF8Rj07sbFnCpgLPeqjGVVqTJppUPGnquyCy2d+hlJ0S8F5yJPp5\/cDIcPmw0R\/Kki9VZEi07ESR6AZVt0sWvBBeGqzptY0uue2baS42wj6KCU2GDsHSCO1ZmjS7Pzn9XgTQJ9RfzVdrYFnllmLx2qCOUu88C1Sg+O3WuJVJ0CU9IiVvJ6u4ADeTCHECuOb42whzj7JxbdOQFEUuRGmyV\/oLJBtGdOUjCXNqq3I3NdU0Umht2gyrP+BumVQLc6bO6cpYKX10lupwITP2mpxUL6EQV7RwJxfjV6pwcP2izCffno2hDMY8BNeZrl7fW02acDwuH9YrKEtrLJdjxu8UyCadSGI2A2C+LKQUUfNuVmkckdCGFPl0ZvnICQhumiZyI8QbmZNoVCD82\/JaEGega9qgPDXMGrj\/9RGRjh76kNDnLKCyOmp0gLHdBTX9EdFVg7y9+hqPEMvx9fjnD2YdPJakGH+o0QncBaKThQUgYKMo6FiC2Puugt1EuGqzFdYSO+8Y9V8KVoaqjRFg31W1f12vF3d58fHK76vM9QuTBXwT\/TfzkJFTKX\/1le+TrsWtNEOTdmYd26KXQHPgKjedzVfFAFZ1D5bTn5YnIDwTYi8F9E0B0mJ0yufD4PyLLJMuXIeTKSIyPI5rA5SAH0O\/dIewkas12qtNDuwzy+jOE0IbF3uMFbA7c6BAvCYWzVY6+3pHSDxh6nBaBqKDUqtU8+L+JO7XQmO1EYYjYgMO8UDr1k8mBykky9rN7p4gASj7PQYQau8mUscw3IN803BSMzV44R7nYfzLAUnpYcG9Bs1oXSGosl1cKzo\/qjDBbsPK4xmrPiFN7+hnbN3leVMAr6ZMRh5xEXoDUWPr1GrHIkThspBOYEVbBLYLVLmbhhjeVpfysvtFN0As2NnwmqSp86epAvypA7CwZ52OCNCkQEr9MyFr1QhhNWadXu3oDwovo\/PzBvlRhabI8v+FgyV4cQLbxLSB5NHau9eKhnxYMCmpmHvcGWxnvZ5OgezWTCr2IdzQj9gazWvaHhD2ErBHDP3MKJTJU+\/IkhOrsFLxUHF22a6ZyyfPDPAtbCpBJC\/nEvdF3+lzFOjQ7rjNst\/71L9\/q8PcmTtr4MW\/KTVxoxdo9uIJQeITSrYhkd3xSgX3wMEOtbVc3YUOtbWNXnEI6F5Vsj9UDoF8RLavMLD5skK4K0VwR4mEch4XH4WZzHFZd3iprYjzo0GfF57Kg\/uD2HBewQDzKMXHANjj8OP2ZFgqOzXtyfOpod\/WISbbQ6+nXmeMzHttC5iUhqoCA1KCGZLF92PurMJ2KtO53JvWNz1SZv90SwPNkItLyF4o9+GRwI777mZPln5y0kA7WQ6OHzL84c+SaXGkr7O1o7i3Ik8k24td5\/rxHHu7AoazoYyxzMnezhIX3xIgjh3jyRqZ34s1M3LS5XvD2oUlcv1B1OGswoEeyXPYDu92lLd6I3J\/rwx8zXGogpJJOzGBQ0rV\/GawudNta5Hvr0FpOTJdl+0wz2mG1M\/Yf30FHhtdN+sZEUzdFgkDhiQtJGrQaDHw2vefspPDdQB17E+pyomrC8xIiu4+0Zj6tDtsDCgei71Qy531r06ng+AlpHXC\/b32yhTaosl7rEyJnYT5MVMdyLbPJmGKgHKba5t3NUHA4\/8f7q4nU0rHwjkysL0EHQGwFc+icElXDVakDLZLlbl3swHH5dMRg\/EmAaiq9Ia17AXIA8rAiNFV7F+IAiufKa1JZ+Q+U0ahuV8e2GUk+4uMbeTg2Ra0XDQO3AdJ0RZwqe6TwBdSM30vHHlnIxp8aBD6Bc3ZdYiriblZa3t3knlZehe2rZTBHEw4y99KaZu1aha0G+gpWyCNNbTSAD78AxPhQwRDknu2Kd0RgQUbswyt956UpXFu6dgH0EfnK8oFWzSfhuXVODwEOEeZ4WbeK\/2z3hDjRb1VTPTsI8BRmr9V0lllIjMSdGjdGpCqOKiMFjbO+Xz2Qsvne2HRWp7KlKztAX7MfZC8MlZ3tl2iJl0ToJenVQZL6xRTOBTvB5mNB24B5Ja+w7qES2GSUkXUdnx9jEIgCsdvc9as2o+xnicyIKbV0Sgq+Q3TvplVf+GatySduN5Vm32UmC2Y7tHh+l2Tn1ABH3RjFstqJgtPZ5qg1JTZ8GB1nzMWO3DNz5tBgqgVBXdRC02lMrPgLaDEVM2x9lnZ8E9VxP2QGkgOWATXWNSLX15Xntsn4+b4KP4Vc5T8T6vkjHslKhEpFHNMbOxJzr7mTyyg76\/bhwxHhztJwUGS+boYvKaxj+Tw4X7chdyFj1ooI5nxE\/o4OJgYwmBVsa5TEWapH0\/BxYNZqQWK9Fa27h8t3deDtoan1NGoyGFE+AwRsTXjgvp3LOLVx\/fQW\/0PQ1L\/rlr7Y5Jjh5n5UC0S1khCyabRcpELdK0KcjwMQbm+OUNplWm35rYX2uWnhHc4FI+c0H3iN1fMqmFGmx4\/LdGhuMDRHgAID6cRtRCMjNRS4x80e6dLrWdKJNCIqr2V\/eqNHb8z6ONilBX\/k6zNOFJ6Scu5u3klfebeJesaEY+xygowi5h\/+w7w57DZl38EBPvN6RB3ywVNQ4QaVCabi\/glte9Rjt0Lp4O7STP5H9yyJWpV+YVVFmNrv5t8lRWyyZ2bk6kUurqmzo9Acya0wSwoCGePNGV6p11dLRq8+7R1Aq\/V+OtWTnJHMK+plTi1XptKyogS6YV1xWPbkDnYU3CBV4T4gc7G99tDJ6vvoIqODpeaNpSNLarYU83zFo17EiMpgL3VrZr\/eqolsagjrKedAvXNzMsGdlpIWnFhCnipFch80elGwsl2qn8Xw5ap4pFVy8nkUd83YW67INhAD5cUr0GvFoWx2wQTb5vwcEY0RZR62Jih3Re8qDxPAZurQI596jyl0wFF0H2hf+GhmvQBFRhPj20e28H0Cl6wQ06p2ltuT4\/RQexH2GZJtaqQuq7M+8cU7NzeZWIofjngSAV1K3b52b\/k4r1+S1GshxYtQjKlsCBihL3onQ81vMsDS876m4TzP\/kqwolIiEGWXi8FZcDvztCYysMBasgGJWlj47lCeEiZu1Os+RNkITStxiYeCLiNbQFuqWk1DPeV6Z\/izBLFnGOi6VFVP3bF2UqvwlCMhq218A\/Rg9H9a6wZMNIpjpUEpLWzHeCX441v6ug0\/Kkg1z9Y3RRGhwGz5ewsBzfeJX0H77dwRE1t8MdCXwcsgl8LnM4qLAtihnSCAsajzGfaBNP\/7InnxffejOxsoGZeSwTBUkpKkb\/SuabsJPyx\/aAqX8EkxRX\/2fScFRobTDpwAwHHbxlYfID6XfWNIA3uhfOCi0XxkqmVaWWjSCSDm81iZNc+zXkWz2beL1gVlAf5epaY6xr+a\/pW0svfKIG76I6hKoSdTVon7xHL40n8K8yESjSlzIczMxqAER5PMxw46ebIFktnvfYwt4aKizJRhfuPiNKZ942+jwDn4Com1Lbw3CmI3BQygABs9wM1PV6FZHJYf+0KMbrMQpFgDJlKTmPhVr1Dkz5EjHKIfsFc4uYFsoAPOW\/o5oRWZpjVIAFRxdLHqhK+f7xGeN\/h1O5nfGNgwTVIfqG9hsX9EwDKl2TPaFUEiYHcKKTIPiTev6xNZOGOOVqj6USHfv6ywrocd\/AFx5vtmwzuWZbyrDICGAhhGsbe7BLtdiMP60ptZ4VPTiAycZiyJvr5z1OdHOKnkeP4jLbwxVVPGfjzSryzNfPf1ygbWdvrkXYwY29Wxuz6403wyBlBvvoTVyDAyW5PAO7CreebFp2X\/HTWXf7F3zTDcR5\/RMISyqDF36SqUtjA\/6Bb2VVUxL12unpJMoAWB9wmG5Wr\/isrv\/oFMXXy0lEGDwXsbNSeh6bza8wySBKortohkF7DOcRykxXFkV4T8QlDsI5USxW1HnXy4aUfmjQyIuFg4nZJuYuenwkn8Mx1wkn00A68zXE3HqXESMb8OG14qbHcJWfLC4Xa2G6noDtB6mMKVvj1E1Wbf4OmZZgFD\/buDM0yzaH9Mk3CDbDvNkR5ia8x\/RLH2VcHa54u5aeVPj9ZS75uy2uM4iTWJNOr0YbMfjNWVsAHmJLWfHkhmCY4csyKPKPRAFu5DoQ4u5NPZa+9nSXSF+KT+Zwqn\/qzkjFHK60vY1\/uNHLYl8NQq+9WGA9nvoMb1YKeKzVETZncAohwYRPjSvTghmvV1JB27jH\/P1pkRAG+jQLEtB0URUwYBUG8tRjBkakGov7ydNWwHwvgooWBlp5eOt8hL6UGdJZtAUI0r1xDy4cqauitvtW68oeGDFqC9bwO2dI0GEFF9O6q6NS6zV5tbUT\/dhospDSmoSPQ4lJbgTpz0cis5C6SxETHhgMrMwlxKQ1RUF79bNORxfP\/7RC2JGp6+HU\/BE4v6MQ\/mRTNjKLFQTlSGAwF0pmgnVMgKslc\/NjYJ4igt1rF2Ooj3GFa5HUlRLDWWaW\/j571dcASI4WfntKWtCESxF+T7oJpxw517KD3xtEkjx08QzGTAVro62x4cn4aJVGCRnROy+VrsemE766m32Z69EcHLisHxaw4\/rq5C6mNT03gyNo3kwh+UgoZm1Co+ZEh\/xvlghWK7Yo4KUKt45zuqRDw6ss6imIo93UIrGihJ0XC6YcVS2v\/VDe\/YTeEHKHRhO1J3pZDxKVf1Uz3\/82x+1PYDYD2YlH7fV4y2Mb4HWXkogOKzzHwjohEWIhCN8iBOucAk0E6xdhbzdt\/luCVYrngMgOHAlZjPgue1ISG3EPRqY1cv6WqkDaA3e34PrrexcT286ZpeDJ\/On1I33eSQ\/3XSZGfJ3upEWrRij7Dqr+2SoNgHJv8IXJxPmN8MGb2\/lY7fX7Z+L43Cm\/70ZZa0xm6miHDbgZSeB0l5jMgxRshNldxZkif5jUTifXddczY\/VSfyZO5cGIRWeK48OetWf6Tawhr57MSo\/V901VjZqZHXQJL5tX24o4Q7EpIi\/NU37eP+8e77P54n6AKiXY25AxaBzfG5TdMmvzVGHMCt8xpo4rhX3QXj8p8yndD2vxJFzwG4L3b8ofOGAbEz1+q8XlZ3FhQ+Q9wZRbDutuE\/ItUXv2ob7kLOhGDTDf5zOFBv2EgbSS17p1lVwkdXS8mBcDxT\/GvsPbmXkCBIU7vdZztKbH0EanTyqjLXqPuf0JD7SzBzGICrofX9DwL+rtov2qd+WY4fmhfl+dbl\/4+1GSTdS\/Qb+gcTXBxzGVVzJPNx5lQ1Zl5UuAYf8xt14lRnHkyZsU1fWQhtyaA7W9GNUKLXhKfuA\/QVg0CZradn5mjME9Gg5drN9pd9983N98\/uCNK9oHjstfnRgfwFekVzMeU5WmhSi4tYDei\/z1hDni+siCWdXs42qDDRXpnEXyHL6Wxb\/SXmV2QHPfsc3fIOIbpVKsIRQsVPjP95+ew3qp8wt6kxCZrAmsyt4IxsYNykq1gb4Pdzm5utAWTlLkhGv+tlWw0Ga57RSrDBDtTePZB+rojlrT6pDJK3Pr\/IelvjENNrMGBdESByz2B+G9RE06awxPRUFv8mmC26nxWMQDUYGLpQwa067QBXlqCWuSbidBrx8yRPRmd6J1D6owQcqNipltm1CjQTHN7XX7b6zjqjoIVgSWKKE3aTpMHuAqHsPovNp0sFxIAYozzWoIsC\/C97\/qO60iKyCcZaqcIzfqKZVmlkANUh+m7bWiuzfoOpdGrcKJjFSgsiEUxbVqEye\/DOF\/bE1ZAAw6UOrDliYM4Dlq+F9IVzcnvPY80IGoTWOiFA068aVQQmBaZ+VBgtNX0jMHrJ+9YBG8IBTiqvVwWhnKHaBLRy\/KaTBH1Xy0PihYSIViLj\/l4i561iCFF9S1qJiYgVS9mIUjq1pXmS05424GYrsrrn7DRUpYeah4rAnSgerTwi1aEqi+h6OvLvakqRIK\/xB\/hEhj3sXxR70zf0knY6ozqq6nVw7ReEXX9M+QJh7igS9gc3baBE3AEpWJALhQgXxCzFWN+r27dpQbJ6NGhIYBbcuLIAo4uUtZqizCVf1VtXjpnv061zj3G4rNBj0vaPuyXqp0flmvwyEsCRI6jGS\/+ZqHp+Qe9c6AUnq37SgvhgX4tIBrdZulcOndeiIiIRT7w77lxZ\/96IOKaLkF5g6hAV6vVK00A9C6LcI\/ZKprMFKHKkXHXg7u4q59YhuMam+LllOBg668tdVJHE8y4XmIoUbpnjfy4AebSS2DiV\/2AdYo3pKvOLzP1kwQ\/FrZbfpO4FOqif7hJBL1bMvlJBz81Hj7e3dlVH8NhN\/NHHWAOCrViq7hQmEqSfk57LpIQSbDU9SfNo\/ge6hrJIi71UNw0RiiG3bpBZJ8RaTtfYj2M4bmpznd7Jqv0yGRlS4eRXoEpmi3GoGOxplVcWEX0GtAQsPRuaxxq+Bus0ag3pPu4NiS4A2vXiWcidR43mfanvAUh\/UdRZSSI5nXyyDR0BvJCwHNr3E6Y1gHtEhASeW4S8ODxBzZmUW1J9YwA1NruO99eRjG2FAYBkbMIbwUIczdqBwjEqeSc6zXvQLDzxNO+sA6btB5KBnaoDTpO76bDkof5\/ZXwdOcpkjZWhWRqCLrTTpbJIg+9eAZ8HueLvElWBTJOnQovqoA9dzss0g1Hdf1ri95v0DCdW3ZHvaI9zDnuC5FZizdt0PnmZoq7SCeqWeze88yxo5xvh9Bb+\/COXUpTrGP81tNQhe2603SODdKysdQG856j41Z5XUfFqVnldMsajf+Hd3AwVYsr8Xt0eZ+1QxG+Tllw4smHGtIKA7147QvnSa52dqZkfyw6O2SP03it1CJWotfXXppuXLqs6oogWKYK5r48a+CHdq4hYPQTkVpNjFCMUKGcRMQIu58T13uMRcLNRMiiI+zg3dD7Z4BieYAKX2Em74WVunVggpsF\/dcB6EOxdP3o7+kGXYVBg9Lp\/GhagcRV5Yvxz\/zVACl4cPl5aU+7RtLlPm23GZJvIVXsHwjXnXO5Fe+PrpSLUad+3uOHDgbRRWhu\/xlL0sTw76h3iSAxtmWctoo2r\/Auay3vyjpLLbRjB6QmilTbAb9WFYex4cKv43voXg940k9MotMUNPnV6spvLgrP4OL02wj5JqAaisK2m\/0AL1aRcIIsv4SIPl8TGyDrwyluklwWrSslx5HomcgPGqSvZPcasf44rsmqxEjliIMHf\/pxwXC7CEewI\/gbD2B+NytS2bnw3m\/My+tSGbnOrRTsOK41ORsVvG6NQQUmrkuPOK4xR9U3pJcLsCEG+sq1kk+SZm06YXnVgP061UA+0CO19aFWh7WBtjD0O3eYY0\/M+0YrNRbN6R5VLFQ3QW4Z76h05xYISbn1xJ5Wn+mSSbvaVVQnrwcMm0KUw+nIicBTVgUg8dfJP5ECsOXbu+r1NGShsyZ5jfez45v8Z9+IJpbmyuDQ2pz\/8WRsjHV21glueyXEBlDeY1qizDmT74nheSZZmMXVa\/CA9+5QBxvea5e0f2I5jl1jf90gM5Y0\/hAz4fu79Y1NaRQcOmdzp\/pK1bSuAz5Uefihjbgqf7cTOshjDsQHbvKM\/F8bwzinjXGkbloBmaxNQsDAUfj1feDSh5EdECmq\/o98G6Rz+wVyEWAgTCUPbD5VvqfcqinOPPQ41ce3uvAMQj0\/g4pOEMZZ9v+WbDHYsptU9BWq9Kcux69fjqyk+Dz4mpZXFA\/5dzdBpuNP5wEcFNcDFSbJuxttW9Fwj9Awe6BgV4\/lyPx5606OuPBRM6JbwYQE9H38WtuFESvoMV7svAWwGfiw63oZXm4L77oLw5WhwT4ajvBBz85T2RBnkT68ZRwRX1jSLT6pMF9psiywen\/gUEHJI91dxJ\/CRhjQMsIgOXMgrHDFDVmXOcHBDZoC66W5dPib4CLHug54fc82fE58NNld8Ch6YyIesUsGs4yPkKead\/Ngt6\/2\/o2bBqwtlhLUz0ZH\/f1br5LrAhDXNclBuO+Wbd7VQb+3EcmERUw\/I2dllnMSDH3YhGKceHSln5Fe9S67lYefL7RkzN+I0ksWd0c8j1fiUi86TMRgxLLynQ7jMKkVrJOo6R+M48UlGf4fXG7TPzZV0qNGu9pJ+1+EiZoajB5PILTv7f6D7UlZOXErLWA2DsY8rFQ+trNd6Um9bUknQvYAJjmW8KSUI29ZekKcrMxuQ1J9GIxCkzkEq\/49LytoXk2lZ02J+s8ToDnIZTsKx6aQ7XXPnbb35SMTXMPZQlIfmS2Lhh9W5o3WVuLbLS4qp9Stgk7goo0cFbTdlklXy00tI0aPVWBNSBpRN4wqeiiRZesRxOKm1M9G+9AIfwL92ShGXOxCMdEARQTC2aRFxhv8fnN6MkyK\/g==","iv":"0043511f7eda66354dd880807788aeac","s":"a54c052e894399cc"}

"Global Luxury Retail: A Divergent Market" image

"Global Luxury Retail: A Divergent Market" image