Multi-brand retailers lead the luxury ecommerce market, representing four of the top five vendors in the space, according to a new report by Technavio.

When shopping online, the luxury consumer prefers to shop in a multi-brand environment, and this inclination is expected to drive growth of luxury ecommerce through 2019, according to "Global Luxury Etailing Market 2015-2019." Online department stores have frequently been faster than single brands at adopting services such as free shipping and easy return policies, simplifying the ecommerce experience and making consumers more comfortable buying online.

"The global luxury etailing market is witnessing intense competition among the existing vendors and the new entrants," said Vijay Sirathi, a lead analyst for retail goods and services at Technavio.

"The intense competition constitutes significant risk factors in vendors' operations," he said. "Problems in transportation and logistics pose a barrier for foreign players to enter the market. Customs clearance is another challenge faced by foreign players.

"The vendors compete on the basis of customer service and experiences online, which includes compelling price and value, fashion newness, quality of products, unique content, selection, convenience, technology, order fulfillment and personalization. The vendors are trying to capitalize on the inclination of shoppers to socialize on social media while they exchange product-related information.

"Therefore, to survive and succeed in the intensely competitive environment, it becomes imperative for the vendors in the market to distinguish their products and service offerings through a clear and unique value proposition."

Heating up

According to Technavio, in 2014, global luxury ecommerce was valued at $21.43 billion. The market is expanding at a compound annual growth rate of 14.28 percent, and Technavio projects it will reach $41.76 billion by 2019.

There is high competition between established vendors and newer entrants, all of whom are selling similar merchandise. To differentiate themselves, retailers are rolling out services and experiences online, including content, product selection and personalization.

Those with a specific, defined value proposition for consumers will be the ones who succeed in the increasingly crowded space.

Technavio identified the top five vendors in luxury personal goods ecommerce, ranking them based on their contribution to the total revenue in the market.

At the top of the list is Nordstrom, which operates ecommerce for its namesake store chain, as well as its off-price outlet Nordstrom Rack, flash sale site HauteLook and menswear service Trunk Club. The retail group has an 11.67 percent market share.

Nordstrom social post

In 2015, Nordstrom expanded the mobile commerce capabilities for its flagship with a new feature that enables shopping via text message. TextStyle allows consumers to communicate via text with a trusted sales associate, making a secure purchase in a conversational way (see story).

Next is Neiman Marcus Group, which sells apparel, shoes, accessories and housewares through Neiman Marcus, Bergdorf Goodman and Horchow ecommerce sites.

Neiman Marcus has made a number of investments in the ecommerce experience, helping it reach 5.36 percent market share.

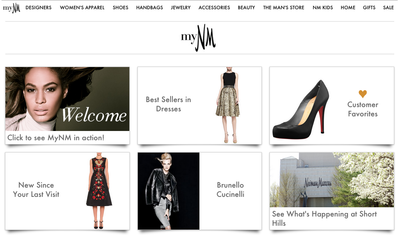

MyNM

The retailer launched MyNM, a feature that personalizes the shopping experience based on consumer preferences (see story). It also monetized social media with the launch of Pinterest commerce and has linked its Instagram to the Like2Buy platform (see story).

This content approach is strategic, as 40 percent of purchases are driven by online interactions. Even if a consumer does not convert directly through social media, they may be inspired to shop a product in-store based on a social post.

Adding an additional incentive to shop with Neiman Marcus is a new partnership with consignment marketplace The RealReal. Through the initiative, consignors can receive payment for their luxury goods in the form of Neiman Marcus gift cards, with the added bonus of an additional 10 percent of the value (see story).

Saks Fifth Avenue, in third place, has a 4.2 percent market share. Now part of the Canadian Hudson’s Bay Company, Saks’ ecommerce and digital marketing is overseen by a central team, HBC Digital (see story).

Part of HBC Digital’s focus is mobile optimization.

Promotional image for SaksStyle social hub

A Hudson’s Bay Company digital executive at the Mobile Shopping Summit 2015 underscored the importance of the mass exodus to mobile Web in recent years and the need for retailers targeting affluent shoppers to provide optimized checkout experiences on mobile sites. The Hudson’s Bay executive, who primarily oversees the Saks Fifth Avenue and Saks Off 5th brands, highlighted how retailers must keep in mind their target audience’s mobile usage when thinking about how best to fuel sales (see story).

Ralph Lauren, placing fourth, is the only single brand retailer to make the top five.

Ralph Lauren, compared to a number of other labels, offers a wide selection of products available online. In a recent report from ContactLab and BNP Paribas, Ralph Lauren offered the largest number of SKUs via ecommerce of any of the luxury brands studied (see story).

Leveraging its in-store experience to drive online sales, Ralph Lauren installed the Oak Fitting room at its Polo flagship on New York’s Fifth Avenue.

When a consumer enters the room with her RFID-enabled merchandise, sensors detect what products she is trying on. She can change the lighting and language, request different colors or sizes or save the session for later by entering a mobile phone number.

The Oak Interactive Fitting Room

The shopper can then buy her chosen items online at her leisure via a provided link.

Rounding out the list is Net-A-Porter, which focuses on integrating editorial content into the ecommerce experience.

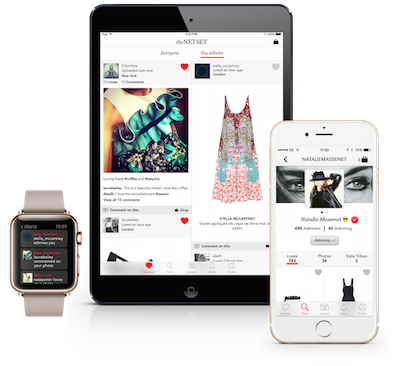

Last year, Net-A-Porter's dedicated app for its online magazine The Edit got a shoppable upgrade. Meanwhile, its newly launched social shopping network The Net Set built a community around its ecommerce platform (see story).

The Net Set is accessible across mobile devices

Net-A-Porter boasts same-day delivery in select markets, and also has extensive next-day delivery options.

While some luxury brands are still hesitant about selling online, redefining the ecommerce site as a digital flagship can help to assuage concerns of brand dilution, letting consumers know that they are buying the same experience online as they would have in-store. Incentivizing online shopping, some retailers make certain merchandise available exclusively online.

A Google study from 2013 found that 98 percent of affluent consumers use the Internet daily, connecting on an average of three devices. Selling online offers retailers the chance to be where there audience is, meeting them with shopping convenience.

Also, for the aspirational audience that looks at luxury as an investment, the access to a wider product selection and the ability to research to plan a purchase attract them to online shopping.

Online to omnichannel

Having a physical presence can be a major boon to retailers.

As department stores find themselves facing increasing pressure from ecommerce-only players, a seamless omnichannel approach will enable them to remain competitive, according to a recent report from L2.

With declining traffic and loss of market share in a more crowded space filled with mono brand boutiques and large ecommerce players, department stores have to leverage their in-store capabilities with their online channels to capture sales from consumers seeking a seamless, hassle-free shopping experience. From opportunities to upsell at point of return to allowing for varied purchase paths, bricks-and-mortar retailers can use their physical locations to their advantage (see story).

Currently, ecommerce accounts for a small percentage of luxury sales, but that amount is growing.

Only the United States and China will account for more sales in the luxury industry than collective ecommerce by 2025, according to a McKinsey analyst at the Financial Times’ Business of Luxury Summit in 2015.

Back in 2009, McKinsey had capped its ecommerce prediction at 2 percent of sales, or $4 billion, for 2015. The actual figure is around 6 percent, or $14 billion, and the research firm has accordingly reassessed its view of digital channels, anticipating robust growth for the next decade and beyond (see story).

Apparel and accessories are the biggest contributors to luxury ecommerce growth, with strong demand from newly affluent consumers in emerging markets such as China and Brazil.

"The growth of online luxury goods sales is rapid across the forecast period," Mr. Sirathi said. "Chinese consumers are the largest and fastest growing nationality for luxury with their spending amount abroad being more than three times their local spending in 2013.

"The demand from Chinese customers and mature customers in the U.S. has helped to build up growth," he said. "With a cross-pollination of luxury spending, there is a shift of focus on consumers from the earlier focus on their local tastes and trends that have taken a backseat."

{"ct":"7iYCqXAV25l185o5lZnvz2DupMNbT06wSB6sgHp9SWZsiKmqTz449cBWHiEvednvhkfz90A7pvwYdNcRl3+Ztji4ZrR0lNBWU0pMwCYBrJkvCp52rln8mk\/r+snjyIvD6vmd64tKmPcsyHLr+D5+0MabjR+u5QxUiMpiDQN23UkueAHWseK4U69dpKvO\/1NDmoOIt8QKm7AdRPgbb8gtum+F8x+AuH5WhDrL6pJO6xHIOvTZSg9iDSrIlZoH4XuWnvne+0YdqpxDc1cSGV1L00Cc10qBHaH3UhYIZkaeO+WlVjkCADr8\/qKBXjtYiSXPeKR1r1con1CzjOYiIhlz28Bx7z8T8alEAgvIFeOztmwPf47Knm4\/CmeB8QbT8pURhCupbqX4NYW+N+ieSlXLzTRepRDgvHRQDte2gkZySKLyBWAA3XwrtRN1ibkpDzJzJ3BKetdEL\/DhmiwmfZ0K0XgtpcsFlYCghu0qcPMw1qFveiPQCu8KKqkwu4QMYjqwAoVXONR7T\/6atgCoxaKCtgSHEsZo4ZLSzcLw+ChoXouu+C\/7853Zop4By3JcQhT2g0YgKKRDbERHtOiP4d7heId3yVf0olKQlhd2eWzjS2qUbbyWOpPIHmZYR9x22wXN715IaRdwlSoGZ3x\/FooNEcPWpCfFN6pLKE0mWldsr6ef5WWB5VDBGBpmw5y+YZWyO7I8JENm+6RjHruG+pMHjtwxAL5Yc0xf2am1WKrJ+mrqYZ9sVjbh3FP+0tX8NXNXX3FwpCNDv2ZyPHANNu7Zn3eaxljLc5sPuK2osh20DPQJS66sVrZxKB\/3U3wTsGV3zhZ7QKnddMyHTwpyBC9+8KIpqLvVjZVkH\/fL5SSDzJTf+6YGuEmiDM\/Ev76N6Q5vX0i7dn7ZOfvu6nyeTp3tsk8tl91vthJutJ\/3NN3YAyZ+DHGzaIBirzo1bzjn3z0ytZp5A0nmsOUQMtRLUe5+vRZQO97\/PLNCj1n8whv74mRyUDN3MEWekDZCCxhF4UX7iyGbaLo7VTfINqES7bCWp5UgSnyy2UvE924YHv0CNc0r4rps3oCcmIeSern\/1W9BNB6D05WFqnqktXOGH3wWrR8MTtJBfQBorZtdUX5FeiRxrK\/V3MEtg41bA0dinmxYM5UkUAUH6yH15hUaOf3cL0pfI8GpCgZ0TbTiCXMkdUDE+FRK0iNWZ8XYu1+P8G6uW4wuFpsQakxNaqHdOJ5xaLDYquUwDn1HaNVftQ+25ikNMfdCTLji+D8q6U6I0dFnRpG8JLbsy9cnQzkxCUZ0BkgmVAijbPet2FJR4+8yF1\/Nzu5g0XiUwUpzmvrxRZ9NncRns+H6PhgKcAXreki1PpphvJxoFHEhLQUTU01FjHd1ODw3E2Y9UkbytA9V+5EkfvDRuXtlDR2eOBv\/+qUim2H6tfPHYFKj+88gZfJ5lTgFe8TFaVJI9X+eH2h1Wd8rQuM25nrWpRKKHUamNdx9UaqeItOqTXeMc3FrWeZWrLSzMGjEiyVOB6ZqGg7XbJDijl4MDSm40RlXBtSV\/LyWyPqJOJknz3VqVjuFfyR34qf4rqhDgncTrW5uIvMe0hSiSRPL0kI2TOZVv+opncW+SqdEU1Cjp40fGpiuWnD+uow6Mx7zOAV6lNGLgWUgVoaL8AtIC+NiiWE424iJRRSQiFo2AOnSXE+XMovKwX8UH8XaDCpkZkXbVLiT9pFh+ngiP1el8G0lSQDf93sB65e0mpjyOmQtL7cNuy7BFr2836uhP1oY\/0m+4\/C1JbnRx8F12bVMzJZpUmiqJ1qjscbPd4sifpOwQ5mKbNumLDxRFWmt3hZhu6YXYLCTfSNWJl+OiIUhosLd93JzcmncmfZtGQmp1QGuh1Ia83orzlICxwMtjUgbon2uSK4KQiveGtMBgh+NQOvs5IBPIuHSyrqc8bLND+LnxF3kVlzNEN7gvl7i9JQlMLVxZbDtMN872aTyoAxbTwghRPCi7opuDKmEdwfrZMbXEaVirKfC1W5fdBAgKRvhn5vKHu9LMJlAx8z5FsQVg46XcEBFbuFGk3Q1CYjYDIEkyEd6oesWgqmc5stYRZxOcwVzsYOnDwaX5ZnKRXJMO0Mhn9oFNsMWSyhaTOylnu0kpZBjX\/KOIdpDeQvMdMwiO+vIPUAjoJx3nYBEuTK5QOlRmxeg33MpV9I2bZaQkz4bBA9K2\/8bLdcP4az6PdOT2kKtqTHnVHh+9Q3RrElDr7ti6cyxw3eSAgBIjboMkDwTk+D5JBDoCwReEkAgdh9vV2nwWu4e3ePscNnyXc3gq45PeIeBX4NDk0U7usUD4s+21j5eZy3ow\/Jh7ZVrKVJPdiEMEIBMhiO8tXiGs5c03m819ur8HzTwL58A4U4yEyldFiDKZTeH5H+g7rxWYvCFQYdxQfre9IdswwQ7PZblBKHy3dAwJrLyXEbu5hHkz2SH6Qi27ldOv9GAKZbVNTdzfNztKXgonpP+wk0DERquYa6w8hYBDgRe\/tAEdMXNaWzbHmoAlf3vVHjOKasJMxeKbyzI1ddMjTGfX0oDyVvpcM7en9\/UqIqtsFTbGHLUqgc+aiAR2RYFbUIVZHwHY6pqfuQeWZRMsoqabp8AFyqiJ7KjcnIIsQkI8UpuP6NvZfYgiymdoMUxViBoxQL0uVlvKKGvcDP496fW16Z1Ssci2HolWfJFHXzGAY1AWyyU4No32gSuseZ69BC5F3eR1nCwiyfUxL\/bVUuP0Ej0wLUCJxgETpD+jXCLZq8QtcOd15I8YJPcL+rqD\/2USXFAL3KmActaq9Z4KXNGwiZE2S1njWimpWX1D63Omlcsn08OsvbIvM5IyQ3IYXWKwxfx4YlDiLQcxdQRNtYyt5dh\/Rj0ZLVX\/lX5rlld7NE\/20wEdnIF+WN+k3VBTn4KxdcfjAQLA6afj4cvl5YMhSxeNT\/M5UW7pGqtvEMYXBG2HHQwZG6AMO5\/nz1iePj19HoBeaVMr1a79RPuLcRgH+minb4yNIwrBo21+L6DD3hE06wondCj2XaRg4FnhKSxAUDj6V7z1czwf6LNaL762heNQxrXEfjpV6H4eET1R\/pGs\/9rHygQFk4Hbn3lN5WMsQEMm4cqWCA8HqiwQnWS0suFmg+YMk6PWUQz7PMIZhPlqyrU8sGdesLK3L3R3xFiQ+mbGMAHnsguwbBR8+2urPn7q\/bhIsKm0sdoJ4Tt22b2qn34CMvxxxd6K+UilT0H+CqBU5GP5E\/cddZbMxWRSD\/xwZmMzLRWJtgkE1UUfj4jkS\/dPl+E8TqJytZbDWBFZJ6CfBYCgZ2EWGnqvGzNeAfM2B\/DLKfcHJ\/NrYHTjc9SHgY2E4BiBdGZaz9knOWNNEW++FziQtLS4PZaEgiOCjuWTcL2gukX5SpkeeohdjxC61aDRShghc\/+1uYzasB37A84jYOWQNyRnS2FSI62yLz123tP2U6THinkiaKeKO5RNXTc\/4pcaRpKvN4a40gyPRQNS3zQCaf5Ip46FvXMPmVKFN5iHjdjgX7H8cwqNOa+6BsaADUHLYP9L6srudr8TuQCF8wl7PUHvGUqILtCxX0mVFEJli6XfFAFc9pa5hM7f+fOSusVJabj4D8dvbiPsuX22Zot9+t61JXe+XT89vjzZLfyyQz4Ei5KEqgfaKL4MUWxlBvo8zaNmPKeBS05Y6S2aBQPhBJRC5\/PwSk\/qz9MFgD3prTwn1rtlnDmPfMj8d4Bcwfrry4L6jP5pEOCGSk8W+oS9kyqTmrTxVDWcbtwKuSB9xjKSDCtlyzeK5fnZ1vdBd4FLaDhKLBf\/SsBIGdtsU9zoM\/vBQnyw1vZnCHMRrTvCgvDtgNTb1gO9PmvxqL02+lbMV\/5e+7G85POHP\/5cqJjmPld1pqX8UYxv++wN3PyipCAqFOA0jeOYRO7mmk0+RZ\/DCRHb32d\/AHceNsBGxIT51uaVReHh\/kmWHb92VoFW1RZ23sD+sgfoUcVo+fZViP4725MFjij9QozxJnt9D5yzTiWm6sJZQZWkl3JbPdyZqv8EeyuTdCAaRHF2iZCURo+wCQnX\/5bTjw4PAfsbMne5hbXfo4SqcGdmhyeHVQ+IiNNAUOAqBCCd2t3AMqyNheGyUJgVM3qdI1HKE\/OxMSLNcGKW+WroqSbp8QwG17hkT7RChH0i51hAbFt8tNJ1ZOtseE59O4dgdKUi4rqt69vSbvYSS3zavz8JIXaVJWwT5IyX9NiX0r6rCXSw0zWaD7ycWxiXpNynzQwTk\/k\/qcA2uTzd3O4S93gTI8l6hfwOT9Hqc2q5ij7JDzOqg3UrRPUoBOg5oUR+E3L1kKE5mgtE4o6g4YBmNiIEc+gNj7ZvVEIJfYOiSuc5l7q\/+XvhRKgAhgI9fi0JRhCpZ8NrcCbg9osXFwxS1KUa8TYXc5owmQGhH1fzNCG0Ae10oK8B8fLkcscS8eB3On7x6lwUClu9j3g93buaIWhldJ\/yxOlWTt8YcoBpBTdsXx7QoJbLDpXT+yBIVraU1eLhrfvzwk0MzbT+Pa8DslFL\/fl6wqxNnXhKRGlqnUh6Y0+cWC+KY3YYl5O+bVBAYz1Vv39grqAM2\/jlOnIWkTxtjFX9zC9DVsl32ZdwBGzq+wfurkFS9cQiW3wZ8S5sxlw\/YZDS4elUq4WLTqe9VJEuRtOldBtV9EKfdCMCf33iennNjNyrSfvKbZtPxhF8PJpb1tmQO5PEc\/LhXYUvWdGcQdS0uASR\/mBQkGe6e2D758XZHTzCwsEJWej+DAxa1Tqx+TTYEPwZM\/XlHAPHkKKpYkjmIOF6pzMdWcftAS0E2Q3EcIjolZIfogDnFKJHnR+B5T5WIW+ZkCZi66l+p\/F0930BPnpJSyd85bfJirD7Bschh7hH92z5WFsvWxH1l4h2u94Kx4rnovABmxznr1ZR\/TuNhWaRy\/VA81pynUVI2sGzWL+XRFrFdfYCbzgvjHhKYyzHRFkVqpN44iC\/C46BsOXbV7vvEN3jqE1\/S7XSMU\/DXSAZ1F5qoRRbBGWD3QUo0+OWrUc0DMsEELCDXdmgc47YQo1v0cUiIpHlS+KKIGS6hyY3YAe6puuqkI0NMcO4+M+iNVKOSx79834TptXFJkPALEVP\/\/KWtV8oQreOFZ4Q8BF3XLg3AgYlD\/2PcxB2BJW6hDwMBsjkoemjkHMSaQfKidsdCaqa8uyeg5fZm8kFNFXXP31uvyFSLzS4bd991f603eXRxYZ7yj+5WqGiUIWBfKb8TacYrhMkXHXDuDjq7dfeGyDkcdMZgilfrYWxBqdVYncdLSvm1RoZdT2Lqx0un6ZH6VYuptnH83jK9BwDUB9HIT1djk2htj0vN6oTrrH6xtCtEOapSJ1iL6aI9Ecr8NFYx\/1ogOxvBhiSWnA3CMlXo+YPtJ8A+GvS2S8rE3o2EmdoSsXAQFR7+o1\/VEI0GlkajhqnlNpS0GF4Iq9xe75H5jVxLrBk3\/Q3lVYPJY1vVCn88tRiWhY4lrkhulwNE924Tih9QxLxee\/KkWNIJ\/Cupz3tE\/7x4t7626FTGEQUFocuqFR90YzKOAnFL2f3\/4vZatDFVwYVtAxsX5tGTTKzI1AEW6F6hdoEY6xJ6ePlsKvc3julRq7w0nxYpvDlD+RPlHuaOcL9Sz\/SLiE0EE+\/GywPbTkZoYMze7U8cZSSAsdq6IMP99BvGcKcK6KUlafgHl9XXDYdmxyeQ1jfAekh8WygcTh0FdsxgXH1pQQQutkpjX3QqI9d9fiIHKsIGgg1r7YYHyfS\/QZDSpm90bFFbUrbfaaKj6BeUvQeyfDulyLx8IOQQTrwXkXyql+N7Y9+yTYMoy0OGa8wLG8p80CvGppkV3HvvEZfNLeTOUDtD6QUYpgYMVqooSzBFecVNOGbYOjKkhLELRFOn3VFjjeQI5etDycZHOnYuxu4KgxNeaU20d+YelFA7O04yRRpTjCUejEXcQ8X\/hBCdA0X9SkOJUBZNWLB7FJr6ztehSOgEqx2vi4708SSf+cXefrRSjcLqsHjLahWc25E9YzRMNxI8O+sCF087ie3bYIkEpe9HhxI4gso2ToI11p61BzY9A6jrELQz9BpexZ9LV1MCSDc+oiErQphhyf3zwv58R1vja9DYQSE+UWOuufyUKTJKHADLdQkcOlLcZk+mdV\/z6XjCN97dPFay9xVuZE7K78+pA\/IzVAF2jB1B4rjpw3KhSUBrBw9S9c54i5DPaf5nQmzTQNXJZ3htEQDMoWo6qEUU0vbrw2tzh8n0hJKKdRsoYm4sCLRH8L2YvUQoE+dIUzxSv73NoHgTSbl0zl2d5HzyqnG3nHC0+4Tpk3E6cwKA0Lus\/8zPkke\/6fnIDkq3syxedm2wwPUkkxU1khiySzvoqsRoNgrQ3SkISW9lwPnr+RvZHZ65I88IwiCY5O6XrOMVFVx9c3+wB1\/nj0qnEIJMz6\/VsyaXcb5HioKJgdcT0HKQhEqLHCGkXHKK+i20HCyr02XO0CfyPNQ\/baiVrW4HwDGwqUHd6DJQK5\/SM02v8jlt40ObYHYq5GksO6VG5YJI\/z7zBgejeH8A0wI3NzfXcfeDeJLSsYnlk1sSlfEcXgDyh2XN3ptO1QuW+i79SG1E2A5jeIhyOVNiFLQRFpnt2CNsCMxCyiJ7r6bWY8NHg4ZffNBDyg4cA3Ql1jUYV1tTymexPvIpKhFXzOmnrcqI7Np3KB8v7tiP3zujiBY57ZxH+MRv2H8vQf95WdqpbLYb3+OOtpLy1a3a0PCLh9oFXpbIJt8B2HpxSjO9grk0ctxviS9NBhfT4toZqqEz+1+VgKsCb\/9SxeyxS9wvV03SQ8BkpK5C\/JXCwxBAHULYRHzZk4qdPYf95CvuL+78\/1rMoEuANMnd09WUxioiQHn2k+bR54kvL0YL4ZgZUa0DzdYWWzGL1n1Bjl078hYtFWeyB7euEjoLWlYANl2dm3a9dETRI9dnWCANlE46zShsPC3s+JK3+3ODLMbvECZu7X4PHiTgF1NdxjBhaL48yhmOwTIlo8i4o1mdk0p\/KqDEHsjM3rU+tudh1g2e3pGc7zbldPwRWfXbLHrXqB4EUZXpCugEM23R7PS1Z0LKnmbuGjnQqMC8UL29Ohi131UH2sL6nenc0paYAq4f\/1EbaEJ9bAnqey6js3zwBkBF5sTkTKLFm7DTDUXNXD8vt3c3nheNT5rKkc9I+50eUAFTMy4FEo+kFbPQD+u0YRnohDnz4oyx1OVqa54bHniLVm6g56AnChXloHvUcl1vWi3GnPDOTXFXsfdZ6jnYwP\/tV5gMwPB0nQYYbjE8rWo+dpHsFpt+Op4v1l0ADDKSa5dT4Ub55\/0iyolqD1SUlhwrCmCXVTtpMSZOyV8K56a0xcXe1MmrD9jGXJf\/Z+4ZRyYXlTchKtdajlZkWxTqnzbLhvDzaoZzUgHcpO3KRovrovnWbKokm9ObIZZctSeOzTHve20iCllkzkFBaS9m5VCsk3gCB+01X2Oq4UMMT9JpBQcoSNilFsEDpW03jzFDejvwU5eKoI\/ibZ0Q4a\/JMxIwuRF7DNQmc5i3mBsoykF7+dVqVkhk0T8UM7mUEG6u1pipB3PEft9a13pVX3+5ygHglDyIyUgoRyhlLsIo\/wCf\/sj\/iKl1vnoSEat7RdIM9mXWPXOpVFhbFr\/DAKelh+EsiH6xSdE+XdeW3mVp2zSPHL\/jiM9PfdTWhhFFs07HRCi\/otKCQwvTubG39f4pnhl3JNj3cRGTFyGZq4m54eppBgYFE852bMBqLgjeXFWJDu8VpLpzKz7H9g8L3JeetnwiYHiFRepZSCDpaq1XtrusApiqJEyHLSRX9WmIi6B1Fjyw7CRfWSPkQ9uRf0H1GhJdgtFwYP3LQgRrjBKWQ6OBit18+CrtUpGjSgqr6UM++qjCjzHrWJvroXHu5UcSeM8gMSrgk54zTTrzAVzv9o7N51g3\/s55OfR\/UsCyjWDLkCWIfmapMQcVIwgTrwQRuOzFhkS74W43Y7\/ED8exLLGhkREqpbSTDdUVgGa3p\/GGzuZqu3y5snckUSD+z\/jgaZoLUy3QLUSKdVavyd8PAlSafFp9jFLLkGZGwPg\/4NujSVkzJZWXz7JJwSmmP67\/ZTvZhB5EVA4yq0k564KsZDdPUDxqDZVgKWas0V6wM6moVMbJ4cbxt3rM3SfgE5sIAguDFgKu9R\/eXHjpVPnVamOvsKLE21CYqgyWzSUDYa1O3w8XkHOFYIqQfXOOddTJAcBFIRTIs4YPUimD5dYgmp5N6NVj+5gkrsTHk0Tqs+0hhLTgfRIOqqS6R6VATFRsMDtJwDoeI2Wi3L80z2AQ\/zuwByOwrYXRJl4d6\/4qBPEd+9UykKPVnoJP0Td5sKuq8Z0Lykjn747WL2cBZmVkrfKkGkMJHg0U4zARA8gkeH5p7CeJjW+s2KbYtWJ\/aB39Lxz9WmHge2f592BO0BCg30ZFXVfuEgsMkK6g+c57NmvlVtpFZhJrbDI8ds9OGOP9Nbkh5QTZXG57CSZNWZyQ+eP9M+V1b9ORVzjywaAdoKnYrBxIxxALQGtcGzJIntiTSPo6T3J5yWWlzb8soXJ7\/4yrOAeg1zJeKh3vkYhLQvqUkVdNLmYfNk5\/5k8Y82rN+5HqRgIHocB2bcBAUr6D9kCuO0q+k5jfYnS7PQ+NWLJohnYLWTYXVWHMAq1FUgsKHH2jcl9jHztW0NnZJksV6K+PBU8or72kHPvj3eeZa3BwCC1hEkCUil0M2RiwFNVB6zIBS\/nrPoM5haQc+83C8w5SM30TD5Td03twg0KdiPbIDpBQhOaqttcE6qDkGMcl7VIzAPyRybW7WZ7ngj84unaHkQ33+Go0oEt4zGFOxpxZmezIh9oNA3qUYq8V3nk4qz+CF4cwvJ7Wk838Tw70oZ+aNorhR53DDqfSykdIgAui75Est1odIym3sqeRYjzB9XKfq1RiLm+IAVDMH8Qqu2EMqPrfK+YspwI288TCndjPvlmovXHJYGzXjgDwIKeWaexx07uITm\/J8YS2j+h2I2Hv3GUNR+sKOTL46cea05xKxEjwVBtmxZ\/0egVlaVKMlk6ReInaXb+sNflWeqnZpnSqMaAaX8hxBmh7lV+4SvVaZyglqEsqSXjTZS3ite43hT5bmroj+PuH7HI3D5lVExcyGwN3tE519A+rGpW9f\/mBdpmqiAdTx6rJt5guJkZs9CUXMaPkAOyUvYLHQ+5hrLbIICiJjLe4Au65jw6JoxE0cBQocR+WkPisJqf6Y2BzyzHet7PmKuxsX17e4uuFt5w8xeR17Qbvvyl6fCj3hHUU\/VguFeKHa+QBNBQbttRscQg\/gSi65OlXr9r0kd9srvQnLTFEEJ3dWGl8EoWtDN9wxHGRhdAubZfcJ8Hh9MSjI7FOi9xSrHGLoTRfZmFvGZU7O3WsGZ2S2Cno8dwwchoUPpVVkn6KRlSxT1bFCx3bBj2feaosX64sHUXtU3SPoe0v3TEbYPYSQS3CINBmBtm1OsXCIlSe4tTH+HlrK0x11hf7t35RcxTWHU53aXpmebZeD4TAumOO\/c5LscvjQV8CmD+2dHjbHmBEPKOZ9gqhvsJaXalv6BI8TWHwcuIesCsvC+ZJXFfudYwANEWjfF8MkM8hZfvG84EUEdG2LH03pcsYgtP5lNaP7k7V9tSTC5J8FOuia1V6ousK9DuYUDIPUwko5Cob1VJaAhDs9z9TbkjR6UyEinmOqVeztzdqc4Td2pqDfZy8F6ipb0sfQxyIjtMheTl08qYcKi+OJ+AM13qv3DD8J3MbCFXw8QMM12SCwq2WSvwG17JtklGgG19S+4YT+Aq2eYRdIMeOIiILf+v5c+qCJbjOtfAnE1eI0gnivgPvMpRxFV1cQVgJx7\/PeLkG+7JNYGw6ZjXuuTTwd\/f0zInL3S6ApXLV02GhAMGG3RNTCnx5e+j5WMaAWk7AOqmRdSzH7iSEuGVoDNCcRGuYWGQXz6iu35gjWWfLicMhYDX6D\/IPGUDnppjPDXeMB5WCmQu4s4ka+YCRh5annCosRHgxN+qkys2KyWNZxUwsVML+gyLoXf9ZzZR1czWca2CU4d+Lp3NApX6sfFK9YP2Hrdc126oz5mcNF82kGrFX\/ohVgOds2oa1dHdA47zf6Gr3Ud70EW0W\/q5klFNGU+i4b+J8VvL8qsxqGIhpPA8rkW91ycxxsQSUIwyn6ohgnTwHQIMtu+pdOPZXZgz2Vx8ytnnGTeezUNDI0ZoRQOtfh5J\/Yy\/2CdXG49izMpLBYF2IQ+gPu+BeoRBXF8UhEHLvybB4R1TyXYTeuQzp1uh9\/m4pqfIJH1\/2lkwaMDvfFKu\/Q8TSCHGd5b5KlN\/lrVspCuc85KIcl81F6+7f4bYRE7x5nTVtAnJYD4+\/Z6+TgwDAoxr\/IvAJz6WhBDRlmQJYgCYBXOF66OoD\/IhM2ks\/7dBUT1tMH\/lUH++JsspzJU7QsPiHyGgCyvCe+DFaXNJ+RMp0bbzKY8JJ0Je4lcGQ4C2soxtcw1WTe6rW5\/LmuYhxpsgwGoauVxO3s98wFjY1SYwsk6fwm1ET6txeprvab24pIJu3+vVtyqQ62sZF5qhjwEjibslJ+\/5gL2zb8nFLWNZoY+vdwba44hy6tb4wj9ojBnuYZNPL2\/p7yKfdBg8L53CogtEdrW0vEkQMRbvuIY6LVgGpQtSwLmIAlmtrU4oba4gLBk+9EoEARppytJlraJv\/fng3bWUnz62A9fx1DjWY2uhfNef2oscKdYaJecH3AzCVGT3iY6BuwwyI8iKvAl00lOCr5QhG96ocVj45pdnTeYA2nhJFKf3ZkIi8NqiwnrwSg3RiT8P6p4QxjYOIf1hAoECMhMEVINyALYJp4ri2kLg5CO7HDSXW20ZpEmE7P0xMDJDDhdOzInQlh92CIEJTw9mXB+FXAEjmcip8nSwiKrniKW+rOoAIZOpd+hIcSqzjpFOXTM+aBZoiFWiMBK+ilc69\/\/wUzS50eEAeT7jwD9C4ZOry4OyiwdJI40P4E+mlNNzoS505kdEtNwFm+QuTqgERiLDpIpUStxh+DtAcO3Q5LQVofPZiKVasVz0JSt+RZon+jfTjefcolUWN2o\/5mO9qx6+QP1unkJpwgh4O30GSr5f2+hFSECabYNRdSvZg10pswbjO3nD38hlaLMMO9FcoxZCqqfvTSDtoobOJ+yznlb3CQsn56sw57FMthnBl8onlKBrXT8j30tuFnTZzXz3HRMxp0L7nxmlFdix4761ZbYVsgmRs9ztsKSYWlt4L5CJzoHza+HTF27BagQzaxiHVP2vIGYnVS5hyK6EmOZkySe5kxea1ONglGp21EseqPaIsd+YcJGbQ8ugbydCuBT2vLP8lFv24LJMhBrsSnHeCbcvwohl3g5zy1Gz\/dWResTrpKU0sHtv169gL07r2GVa3Cc0omLzkCy1zapBA4BfBmu3LIjN4jF4DbzbnosSE5q+sIdyqcdCuiEil3paT55M7Cd5roMLyNuWdglVYAsk0SwlZwXlABIjjBJTbhZfpZR0GqHFiG03MrPBiREEO2xWkj4QW+bXFigyfygNShnPKJ0ZxAHKxxmlNOzmvfzr1d10zwtr48prZ9QQrojoKkl7MjWUEmGPZuuIVCIYzJxNQ2NtmI1lbkdSPgZ4yqLufAatKAInhZ44suqf4hat+80fqfGTMqPd5lI1CodY2onzMhfs\/TpnFal6E+WD4ol4e0WJFjQoXK8Qj8zq4VzoYF9j00KCDV4viN+OptN8JCiZBVuy44A556x4zeeNwkZVsgHl5v1mf61BJR4+sohZtrtYOxq9NS\/U4\/u1A17XNvc8yJO+hY+\/WS0dCzsSi6HdilXxxKaM0laZyHm2ppeUR9TZPhMnlUm2UBkmQkLzYDAtsYExXnOFDWQi620WH0Pd1nigBqFi\/qSp\/06rgLKBx\/Hg1BmMsIY\/5qSPBnaMTBcKzDzJ0KAQH\/wP3v4IH6BTMiib9GEb5efl0Q9xR9hpieP9\/vfIGlcQ\/aPiypwWwGOEQ7eqDPGQcrk0UhZkn4MprtcOuok5aL5C+sz+XoBgddgiSJJ\/WeqxoSJaS6bmdgiT\/N0BI1DaToW2XVSJPHwPZWfued9+iYobfT84egOMNH4YtyXWxCFgqKEwrQZLUYTe\/H48li6hSRmsSmsP4m5BlHY1mdmi141WbqQAeb\/Z76jpuFnXeUReZIfkhOicZQggsBlM9bY0pkdMwzCV4dqRZms2sTYPUQJgcoPUfa9zXffdVw9\/kC6jVMTC+135QWaCmnhmUXz1mLPdGXUUvn1uIxIHC5q8lbRU9F0yjddq3JMgB7SKgxWaSkBkeZHdQfUHcpnDm33U409ofKU2k+VnoHFxpwfC27tgEU3fbbhPVcrmYg3ONJd8mQ1OqgLpEipcZj\/Dfss7mKoqccgAaYYeU7LBl1cOGtXig0zgdLNFyZQb13w13\/5nHkOynEeAjQQ3PweUoiKq+R4sgRS1fEwarUiNEQrsiaMVGqXrUEzBZytkYheKd9tagNQNWw5hnSkxvLUZKBuvjNJZq0zUOBnsxA1Zvbux0ggc1BGwARZDgy3ySbej7OcMs9+sX+QWmIogQvVgkb4I4cItF9XFOkIuxQgU13WmlsjkbIeF2wbGfZdUNl148CRGt4nrrUvJ0DbMfLKwBNvpWxzHRQx0VAGS9NJiu249LmJbiia04LJMgL5meXfNxuZ6wonutbqbsDAZyS+x\/kzbxnqdiCUH6ZabpIHOdnEupdqDaNjOyryHOKn+3Y80vhT756fBsCE+mrT3IqYG6LmAxYd6PfQkW1UD4u1xb9+IeJC62PvFlCshSB8eGECqu+CYPbHjrcZV7ybtEBJs6QoQN4C+aHHk8LwurBq+TEehH8N7fnamUsWs\/eYRXe99pJEw1m0C8UiVhS7y9HCq0Qwto5YPaJjK5dPSOP29dgzg+UO1swImLkgB\/ekSyjYE7ECbceACkiIR0\/cwc1sY4U7tw7dmS5fzH8CA+s4EHyvA9n7\/JvLpkxiiCm2IjS7FRLohdZ3nSj0JA2E\/WPi4OdLyxxsGFh2yBg5QGG7ulJatOe4JU7KmGlVOfH+diyFffqfb6VJXQWihgMWChvEYteB6kJfztJ4MOhPbAur6E0nBs6JXvz8GT6dQi5J2gwz63xjmkmumCwkbxUq40X\/+DwW2EA5qXNeWVa9AE4fizIJsDXx27s6BSJYvstcdWqK5pPadDr4NAtvjnBlSfXcaxrHDWIMv5DZF10Nvz0tCBtA50geBCVgvkE1TuP6AKK72Ep+sxfg+Jbq8w\/MAOfTZjIszEI3QI8Xex331t6w2aJPySchv4mT\/77iODNjnRxyqzgd7KZbbWzFWJkqVG6OgWEWPfF5sH492+R0jedh5mkjAKa5p+9oQ+Wiw5Xmc+QugyvInRfzjzvK3fO+02R5jE49L3P2sfGkU\/aG5a711odxI5nDCfj3CTVuy+7xiySDmCRAWVN6k7WOx9b83eO9W2cIkMMu743aW28iJqbhpQr4S0Zx6UoBtzpDiQaZmNoAhziKEheILOP2N7ByWN3C6K+LTo\/X\/mU9l4UzmOcDmtc68gzZaLERSC9Coab1YSCQGwhh4nI8CalXX9eigNG3MPqfBmjcX0M2F43R6vDLjtWo\/Xiep2G4jC\/FaytUyFOtlXJWiO+QHM+qVWNfaxt3fUaBI01U7i+QL0aaBZwRgihPr923rPMf437KYNsLZXq7NU5T3h6Kr4Y9YfFwV58+pTo7j4h0zITbebXTebF4PA9cKppOoAqa4M+agoNvlNTh48\/8vf+0FdMqWENWv6BepfsmUlat2i4AdQUK\/W\/yV8nDpXTyQ0\/oXPltEPwAv7jLq1va8L8DDYILlplvajxUx5fieqXGWBtE3S7f1kmn1Z6AktPvq3dSLxvOh+fqxPrseBWyzfHvWhsVmp5x0k6\/hmEK1XGoaPiDxpw3Qfys3WPuRl4NfRRiYwvatvIK0LP4Jh5vLgGkyDMoDsU6v5MdV3dd\/9n3NZdNXnnvN4DAu21fcrS1vfcM9s\/QgSacNaj74e8yy1Z6nHSQadAOnHsZYJn78YACAy8fudZpuwLriMdpnzcIoZbSLJX3ZqsgIXVze7asES0aFGNyY88zitTiSZkTu94JcFtUiQiIuuzHjALQsk2nTN23zREH\/WQGlRMZ\/4WF\/1tVVsuPh1SzbjWyzFWIZgAQ5Zp8oMYSv7KPNnGnq68XHrk+2mH1rsDxh0INT5phqnfDijluUKoE2Wp8mKym\/f3DoUPz9C5F93hyBbtANVWbTD5pZw3H6Vd+NYDZb2e5vDWkeWCYy+Fm1jrs9TOEEDLG\/Ia1rgbRvDrlDWgaaeTPHjkK\/FUo230ZyIvifPPbUhuJVhUsLwt3VKxs3e7GBxVWzPEIZaTwmynD9ShWcpJmidjP5Fm4kx1\/iayJQwsh6XWUDuyfb4MRA4K58xpKPGYAS+stTQgDMoot51hytZj1jPOwOVwZ9PvKcU2DX4H1uWn3VJKO8nciMclN\/EzcQP12s1E9bHilPU2EhTwplZCnUvSrLENpNcrCLjO2vrwlRox89shKZMRxUXxpJsN5EfZZZOKS04Ge31gGu8H4IafaeV6Q5fSg+B1rni65l5YHZZgh7pFfbpKEBlmQh8qxWg1wvfmDGpzKRInqzUDhVkILqaot2W1OyGXzkxoWDs3lsZ+vefFTlgZHJ1EvdiCMqvwucHfbdFh5o+O+KYGg21YZ4MoIjU\/SrrFvhs6X0Nk\/Dd91b24W2JN0y04KiayvrAZLDI6ZZ19PkUGYAt7NsXu4U2Oz6R+T+jDO8uj8E0XytP6RO7fQHmdfR\/htHY6NanO+eWvSjEmddw8VtIUcE6Gnq+M453AEKvZcK6bq07L\/7SN\/WCSIaXaYPf3xWyEmAcapmTRzDs9zPlciIFunOTLG9yKO+XmTd\/hH3LCOFB6jICX1aRpoQfSMhXIpvNx3pWGs++cTTeaLb4Qg8n7xnUJF57tcOMqPDTST1ZZ9oLxnn0nefjrYI0X8XSUlI3TRT8+nnFBTYTCUx87sAg0n3vNn4D6mJiAKe2Po+hVHRdiZWDiGDfyqQsnACqqZ\/6aeQknZaVbC8pkVmTW8Tsp+b03w7FNCiirO1Sao+1I8M\/vMd0OG5H0DAkJAFeMrVs6pat0A\/ndXyhKSJwzQ3leHXi98OfPt5DuSROwUjOgH+nE6WF7pRnb4tnyzsNnhMTgnhMoHwsQeZEcApVVW2Rw9wfIWcfR3u4Rs7i+8irPf\/s\/+Bv3ZV5D5simLEB\/stxMdagJhgg6\/eh+4RALqJ+iv41tmD+Gi6uFYHe4zpGDugg1sppzNmj6Z6DDW0hOEJ3Hlw\/q39LXwpK+\/GyDIDD22iogMpuiZg52i2xMUEuxWDIn+Bz9G4ZTo4kxSksjZhNap3JSRvL6ChTKkaBZRmCaCk3VwIM6k0VMneU2tAQcYNRBQx07YslPzYpVsvNXH+YSCjMR92jOHfDKv3Fb5T0WypKtm\/9sNdnm2fQArZmQXIv+G+CQzYNIt1J4k2jTb7ij4Fy2yoZgFAJ+2Qb2B1Fkozb0ZNA6XvdlbA5HOR+O4B9lZKdvg3UidTLVsnF897cAYdRi8g6Vjgx3frgcBFg+ZNK34vrj+YeC5RCvOCnqOu408Q59By5oSO6hlTs422iXeF43acZkdg+XL3xq7E9jwKrEkganNS5BXQEymkWPuNrBc+X96nKV+2hOL8BpZlyVTtv2MJcPuP5o\/d3kCAPcsYoX524OmIaa9G7QVIDKWyL4FYP0qfgoHTaR+z6+qCnTzwLl4l5Y+WUGQ+fnRx\/cY56Oy4jos4Y2qvrwU2LQxNix6LYzH3uZwJW+W3W\/lEtu2HbzaB7\/bR7NTrxZWO1ORgKZ\/XVrL4H6EjXAs5ESHhSBrtlNXyVG5GN2hdLv0Y7zF0+CNj5qZOrNJwD+d+MLNadpu7Tjw+MxhsuwQGiiUXavvJpHFT7kpmvemF8ZNnjDuCn3u31eyCWr91Kl3N49uP7kTgAE3p+Jkkq1VxfAfPXKIvXFCLtfWxiQ0nerKZY3VEt9NW7Jjm3EGxqlM0aujbbk2lCt6RXgtsbGAvLOxU8PzR3DciYWa2Jv\/d+ZTK6vdL8+WJ0cs4ys3Oduc7LsxTYqWJrnCMLGp4ArtoXU445eVXARMw5ho9JOT5wTCosoKrOYpBo8xRj8MBD7jyfxUm4KjvEmYp6+WLaBAMJMzMUNNJys1LESLi3gxjcgd5sj9H5iWH53ks7bdDcMFza2hXKeDwPWwLHVCFUamv0oDu8N1mkE0BxqSRPEbxQWeRTEiypS6KeZiKgjzl8HCH32LPYhhp9vF1EqZj04AKxdkwZCa8kaVnuepX1Qle7MgwefsK5ICXK4UPbL+QI3AaJC1K\/di\/\/cXbIjxVGTu8twkGwmZ7obI+CQNsm\/FOSGpV1g65hL0XzbfM\/U2Z3KpGIrnPlspKGyjENC0olfP6\/nZiDVYChuCb2KoCLQQM+I4JN8c\/PmrkOI9snH6XpEDKWV3VXxdZDGIMkYpRlXm\/Ckol5KbtKAi9HpdJWkvpGiJSeXWk5h+ZhgwfQw5P7nwSbnJawIfUZM6rYd\/i04vuTD0VRxb8TfLqAtTHXLKLW4HlJA20IVmPvHRh\/yVV4zXB6yx\/WE\/ycNCzRth4EkJLYHbCxPJZns43NeE1qd0o69QYhKI1+O5rRBDJdzHnKbq16GcKNY4021ekIcWFaGym4nQ2qChkKbNbCVY4GvnipwAlFY\/ieMpFumESAME\/m6BywP2szrMyaPP2BeYE9f5jo73N+qPIqbJ\/TsPLhtrlYQ5o9tQpJwQJgGHtzRLGZbBWDJ2RzF+vU45BaYysXrN1hM3UEeUW7J8CedU+V2I080Pv68XVRzEUQOcNBE5XrcwxsAvTGZyYLPX2YtJiJTCVjMhkxoQkeagDZNhxwCPBYx1597ZUFinEC7RF+Haf5qcxg\/MYrlsY1ocpmvZkkyhWHrH4eSnHIy\/zCTIZVB5Zd+JnwTEJw\/lUGUVAZvqa1nqawaEjdJrVSEw5Fhgc6Nrz+1lPSmLCluPcoSYzBpAM42wCbL1pOOdDw18YzRxM3irmgZMPkz+msmPQcY=","iv":"9a60ebacc617a85de8c510c6afa60300","s":"d5d269f353f90ebe"}

Image courtesy of Neiman Marcus

Image courtesy of Neiman Marcus