Instagram adoption rates are nearing 100 percent, but Snapchat penetration lags behind, as brands remain unsure if the platform is right for them, according to a new report from L2.

It is too soon to judge what ROI Snapchat is having for brands since there is a lack of data available, but that has not stopped many brands from turning to the time-sensitive platform to reach audiences in an unfiltered way. Both Instagram and Snapchat present unique organic and paid storytelling opportunities for marketers, as the platforms continue to be hits particularly with a younger audience.

"The biggest opportunity available for luxury brands within Instagram and Snapchat is the 100 percent organic reach both platforms provide," said Garett Levy, research analyst at L2, New York.

"By not participating, brands miss out on free exposure to their target audience who have actively opted-in on these high-engagement platforms," he said. "Additionally, as full organic reach may not be available in the future, non-adopters will not have had the chance to test which content resonates best with its users, resulting in potential costly and ineffective executions."

L2's "Intelligence Report: Instagram vs. Snapchat" looks at brands in nine sectors: beauty, beverages, watches and jewelry, electronics, fashion, retail, travel, auto and activewear.

Engagement rates

Whereas Instagram enables luxury brands to create beautiful content in a way that mirrors classic print advertising, Snapchat requires a different kind of messaging.

Tweets made up more than three quarters of posts by brands in the fourth quarter of 2015, but the platform only received 1 percent of interactions. Twitter’s verbal medium requires less human capital than its more visual peers and makes it easier for brands to pump out a lot of content in the hopes of breaking through crowded feeds.

Despite Instagram posts only making up 10 percent of total posts in the same timeframe, it generated 87 percent of interactions, continuing its reputation as the platform with the most engaged audience.

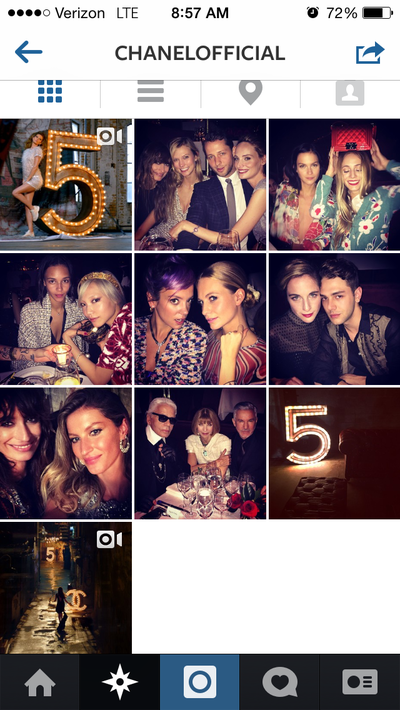

Chanel Instagram at launch

At the end of 2015, Snapchat only made up 2 percent of posts, largely due to the many brands that are avoiding adoption, perhaps due to a fear of being perceived as uncool on the mostly millennial platform. In certain categories, including automotive, watches and jewelry and travel, adoption rates for Snapchat are at 25 percent or less.

Snapchat makes it more difficult for users to find their favorite brands, as it lacks a search function and verified accounts. Consumers therefore have to know the brand’s handle to follow it.

Those brands that are on Snapchat post 26 pieces of content a week on average, but they only post around twice a week, sending out bursts of content surrounding special events. On the other hand, brand Instagram users are active five days a week, posting more regularly to the platform.

Only about 70 percent of Snapchat brand users were found to be active during a one-month period, compared to Instagram's near 100 percent activity rate. This further demonstrates the sporadic strategy and commitment of most brands on the platform.

For instance, Jaeger-LeCoultre, Hublot and IWC Schaffhausen all took to Snapchat to document SIHH in January, resulting in a spike in number of posts, but the brands’ Snapchat accounts were silent immediately after.

For now, Facebook remains the social platform where consumers spend the most time, averaging 25.7 hours a month just on mobile. Instagram’s seven hours per month and Snapchat’s six beat out Twitter and Tumblr for time spent in app.

Bloomingdale's Snapchat filter

While Snapchat’s engagement rates are unknown, consumers watch 8 billion videos on the platform daily, a milestone that its competitor Instagram has not yet reached. Video is only 6 to 14 percent of content on Instagram, depending on the sector, whereas video makes up more than 50 percent of Snapchat posts.

This could be partly due to the budget and human capital needed to produce for Instagram, where there is more of an expectation of polished content. Video is shown to be a bigger priority for Instagram, particularly for advertisements, as it has expanded its maximum footage length from 15 seconds to a minute.

User-generated content, now a staple of many brand’s Instagram strategies, has not yet reached Snapchat. The platform does not offer reposting capabilities, making it more difficult for brands to share fans’ branded content.

Four Seasons' Instagram blends brand and user-generated content

This represents a missed opportunity, as 65 percent of Snapchat’s users post their own content daily, compared to Instagram’s 20 percent of daily posters.

Whereas Instagram is a place for branded posts surrounding products, lifestyle and UGC, Snapchat is used by brands to share a more diverse array of content.

Pay to play

Instagram is rolling out an algorithmic newsfeed, which may make it slightly more difficult to be noticed by their followers. According to the report, those who have been using it as a solely organic marketing tool may want to consider spending some money for increased exposure.

L2 additionally suggests taking advantage of Instagram’s organic reach while it lasts, experimenting with different content formats to see what gets engagement.

Since debuting its ad capabilities in 2013 with a handful of brands, Instagram has been growing the number of ads featured on its platform. Instagram’s targeting capabilities are enhanced with help from parent company Facebook, enabling brands to retarget users across the social media platforms.

Within the Instagram advertisements from brands studied by L2, 59 percent percent used a single photo, while carousel ads made up 22 percent of efforts.

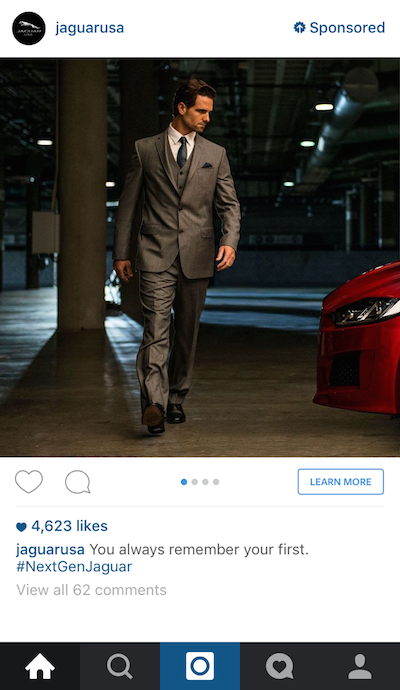

Jaguar ad

In an effort to allow for direct commerce through its ads, Instagram has rolled out buttons, which can include a call to action and a link to a landing page. According to brands that have used a buy button, it has not driven much sales increase, which may point to the platform’s most effective use as an awareness driver.

Snapchat’s advertising options, all of which are pay per view, include live stories, placement within media Discover channels and lenses. Burberry recently became the first luxury label to have a branded channel in Discover, using the placement to promote its Mr. Burberry cologne release.

German automaker BMW joined the instant gratification app world by sponsoring CNN’s daily news updates in the Discover feature on Snapchat.

CNN delivered a new Discover edition which will publish five or more global news stories every 24 hours, and BMW ran video ads between the stories for its i3 vehicle. The stereotypically young audience of Snapchat was likely intrigued to discover more from the advertising presence of the environmentally conscious BMW i3 within the latest feature of the app (see story).

Instagram’s lack of links led to alternatives for commerce, such as Like2Buy. While these involve multiple clicks to get to a product page, they are still less clunky than Snapchat’s solutions, which have involved typing an address in a snap caption, requiring consumers to remember it as they switch to their browser.

Snapchat is trying to increase the targeting opportunities for marketers through an API, which would allow for programmatic buys.

Other changes are in the works for both platforms.

Snapchat’s 2.0 update changes things for marketers, as content can now appear without the need to click, opening opportunities to get in front of users while making it more important than ever that brands not post too much.

Snapchat 2.0 opens the door for marketers to create a very personal connection to consumers as users in the past had to choose to view a brand’s content, something the new autoplay feature update eliminates. Since users now have a streamlined feed of all the stories from others they follow on Snapchat, brands are in danger of coming across as intrusive if they are not meticulous in sharing a smaller amount of content that is more valuable (

see story).

"Brands should consider the platforms’ respective strengths to maximize engagement," Mr. Levy said. "Instagram is an aspirational platform where brands inject much more veneer and artisanship into content, as similarly seen in print and television.

"On the other hand, Snapchat should be seen as a messaging platform that allows brands to be engaged in a causal conversation with their consumers," he said. "However, as Snapchat posts are seen as much more authentic, brands, especially in the luxury space, need to figure out how an unfiltered look should be presented that doesn’t stray too far from their core values."

{"ct":"zchjOfwQjYjHxegn0DNx\/0wSkbvMxjOZxgaiMlD6fd0m6g8tUDvDqs+eIDdk2pL9Yo8UsUblHy4bAbR0X3u4eyeeHYvnv4a+YwLZGI5PhmecaAMgarF4fQGbxzNK0kHxtgrl0Z+dioE0UGWlX93CwFMv6B9crUSVYrV9x7x48cM5RS7n1lyzvFtlpPWjSLUj\/Lu+oWZp5ID25EdT2AjZuQJvow2FaLPzSy8\/vM8AOomCCbeUGs+\/YXWMnJi\/KYSjSGqmQzXEIjaBCECVvQiidQx6zxFSeKb1VV4oaKFgTcrYcKciPvEWmfZrgSz8cpqQwYQQoqAfNnXy8EBvUnBy37Pu3B\/dwKrh+3+jj+YR11X0VK5YpS2oaZwlFniAz3fF06nJOAX8CDzoFFkn\/YTDzkKFwrcDZi8JAdfMZz8y+q2K4\/F25kM1mDZmWGlQBJQSUs0+Up7LrXF3rnHT90HpVMIq+RWbFfUUQ\/Y7hj8wrCeTYFL+VFio\/UHOYaNsSr9yIqAkxCioWg97LvEzf4XSEaVEcg7GJ4iu801L2TuCX3zJHOnKWnVkjVGOBUyPvwpR9IwXOCfpboTe6Fc8YhikZ63V0XnfVmhgXQczF0cB3sO9sx0O0XU+y6aasK3PjvCqDLHFZTMUA0CGBmWhlF2BBfd2J3CsCGVE4y0jColjLM8HW7mPewS4WODfL5fIRYp8Vak\/Rur7oX3abrSyi0gdOePhr+xJSLHSQzpGIc4nHOw4vz9bvYcdCdOaHaLZnT9BSKIdEyL4KccjB465IsRrk296rlMfFBHLTvl37Pw7Sq3j5RYUdMVRnLcNrJqssufxRjyXjhm2VINxG92AYyfBBgP\/aim0WUgUfnLEYrDQG0zRRxbMv8TGYwVZTKfRHKuaXLbJF\/giJoorQU99bdXCSLExvgmOx5vGjsqAc4jVx58PPRxcBaHMW0jy+qvuv8ySPim1ETitmebSTYWNsx5qC2O6oNap3IcOENSb8sRCSvkl22BGMXvNLgJKdfZ2ougysD+Pd\/THbdAvcPZu2FhRGZAidAKgNevJZ+VNOQqF4I58VQZ\/iiNAjFyn3TI5g66tqq\/DoaXYKYq7\/uI4Q9F2jXI+zQCOTmrV0T8HOeMUtl95yGFn48qH0qkcr0NU7Ekgoex+d1+SCM4\/UoTNe74pU3lwO4q7hXnB5VwyM+SHyrkCHYyJ0P6pz23u56e0ikozx5tWLM9IUI8\/0yD4Q33uXvHTjklS0ap+ueavOKnhSdxxA5I\/utNkUEbyY8AcxBJcFmyLWgW2CDxO7YQQIMp7zlmMqKeXvjDwPnTyjeJ2UJfVz8n8HhsLHnS4QI4mWjto2malXV9ALj4w1piY48nA1722kWC3T9esgSX0bjz9kZiHIQUYh3gBCTXZigvxXVPqZXWkxnH5YV7HPg6VTuGsygWVKE5H37CFPT6FSSHjAJuA848ErMgDSAD1w\/9w3bamdoWdWB31\/JSajOx3H51SivLeeDXa7zFW\/bx4mQpZ8RCKZHp0xI6SQjdAIhY5Me6NN339M1gZ4NuyQe+4L0a2wvinuACMMTStXiBVG\/5zJDQFf3IIt52MEKvsGflHmOMlN83UuLS+NZ0pkf80xwUUG8uPJTsHb1l5S\/7vTc7z643ldVBoAIJnytjB+FPA9qlvqP00WamrIEnSVYZeNOjMCI1QeLnbRBxButMaF4vi3YabuUW5cto5EZe3Qn8r1leIdjAN7pLW6Tr5nyqDe4H3jhQNlEVypbRT3YklPC7c6kh2WuNqrWSop7HWG7Bs2tqGwFLqrkLodqrD+wfrQjVaxuepPjWtWtT9Ihs+mSMNGD3gfvOFe5XJcObbxQ5GXnTstTC4Lg8IljZScWvUSNNQReCTUOpIkH9Dew5D3KSDfeuAw5IlE3R0nOp7Ub\/xOFb\/tLan+MJiWyaRw52\/1iLrNkrDClzrHPRyaCnzgQIzhYiCkKbJO5d7GnfpO\/vWOxamJFisNZwj\/ZCSHFX6YCWLO6AHUrkvoPPR+Tpm1f9wwpRE+Xg3ld17BC0RDloZ4RCytQAb9rfzTf0C+u\/guxlnF4guhgu5\/hGts6pxrbiA6GWZ3+hvGKmcM7TrmuQekyoniL8Cn3vojkvwGGPWBSAdVZVAECGE0Iuwe6XxOc2aFcNhaTk+CVcElqOZLMqD6xfoZNXm8qTE9rLBsyTgr18W7FX+YVoSiCXnINfKq6W1f72Dfi0TBdZDFqd5\/yvnjiwzXjLbGUEWvGeeHvkaPvnrRiIrqG2R8bqfQfpFAl3zywZkd++rFcZMDC2jWi5pLohHy1zI3UU1SV55Oj8dyIUt1j547JiwPRkX9Pl6ob\/H4b6XMg82zJ0SEstShHEsK873nzlTnKLJ9JE+NUOjGnx9i8vf+4Z1aCF2coZEhvUQU0quRWNkc8XYn1t7kcf1D4ppA1aJF5Y7+kZWaSP8MO4n7aq03Yr1JVG4+wme8FzufsjjWRpyqNKAhSVnITeWkVZbRHBCXdYXOduVkQFr37n+aUrjs3lNH7CCqfzMOeFp90iGRe4RO4FD9vMyLIkpNQn8DmQYi5Dbd2N8rQDiKvW8JGZww4QIgFTwkfJAKgw2\/e8zAf6muJmm7PvCLEriGN0zUmDH13qRfz1\/C0bONpf1dtNzB\/oLdc9Nk86IrIiNijZY91cx5TtVRv3USb8tgE8bl02he8BRWbpsMSWltleRm8dpLgGTwDbEi8Age7GZSlEy1\/MiCa0PT14+ZJyknhrQofzaOxS+kBNo80SEur6dCoQ23K8kaE4jY2\/OsXIG0orKFuK9YoOamdO9T0nh7uSRg6g6HmhC2jy7wX1+bY6lepPzpMtAWsDSU3XkrbfkI40OD5BeycR8HokX0vbNje8czexBlX4uXaTZyHwstENmR0kt6vl02jfw8QBKT22gwEN\/XHvXEM4lsKg8MolrBfwNnXK\/Ey51x7TjnBZbD0qHy\/EGLI+ybIDdQw3iExi1Bn3yH5yygb2CMidVMHJHJ3lcpQZHbxGhpfX8AWp\/Wn5mqJyuxkmyM0Fbe21vNNbfT\/St9sA6AwJ8eaDJk0ocJ9rPqZz56LexzEpC7jjMzGGeuZfL92CgxtycFfK1mmu9FaLspN2FOb3iUhPXJrBzcNd0eMn8ggAOtp9jig2YF+iSTVczbsaiNEe3aqhQgfO\/5JpRo3pVtq2Jk+rWxf2lxnWUug4XKPKQ6aisUKUu0T40tpIPTA6xVm0mSLXND3bVzmf5cgKv6F4yVB8xATMJITtWu8RAnDXH0OkfDe20ra\/XtfLO2lPd7AC9G7c8zlXsEOJm0fqH4DaytDanx2stTCaIeExqoAv7RKisUN+0NoDSqnCF5GdCHqH3gOVFpxYQEGtyEnGznwfiHC7yrVjHoEO6j1NAEC25kRXszoqg0L9NO5VHv\/QIgE\/j56foxXYScF04o20vkOhf4A0LRRiIePIEZevG3GyBvUi0clAA6TfvBxoeQlAebeAjBIVoatN3Hb+qSl9YaI7+MID1UJ1JDHdY00s3pB0Ly2TRujOpo36ZyAxgjVV8fg3z80TLKT4YeyncUh90PSodXl+EVNCO3vkAfxgR\/HDTAu5SGZ6y2Q1ImzMO8mWbNRc\/VJ5hHPQZaKQmNiamMvWNVoh2hG9lLREtqNmeRYMBPEP+HXEJLVqaeDPRZC0CRw6oHHG0SIY62F9+RtcB9xQkzO8F+g8pPEzVRj5TIxvQGMAUcfRYD+CuRVAovjw+P2mj1d\/UIKGOQdshO3f1DxNnSTvHqXHCoAdesCVazWcv8BzE5rUcuHzlCVt4RyhQtZyOlBXMqkyqj4acihTzGZKw30ookY4C+tFPi4MGMy\/VMrYNVm+8GKaxNv2+lgXtXyyXndjyM+VINe9yttOiMUlJESy+eSOEUPat+LBxCUH3W1XTuNqhiQBhtAbbbRYxgn2xPHuqSRkLI8HFWPnqqC3EnAyNZLlXC\/7Kv05qK1gF8c9HMCH+iNB7qeEc2jpGxb6MeBxdwrI4enKmd20sBOo\/mRy76bYO6w78MZ4NhozwhHypoQU\/7ZyZCGDZAYzrrEi0X13WUMAjNwB+dqf1Q28P8OWDJbeTyJCxaxA6WeCtqf5Tn0nrAcCwUWr7OZOmK16PqMaDm1JTXjLCdBO0EY9OW\/mNonIcdX2gUepy0qiVRiDMTmVI5ajW3h2K2o8eCQmBL34HU8CwF+0Nq0wX4DTXNtjUCM2vrKaZtnw0p7W+jjEhiARNqTbIfeLpegfNOHw3AeLx1VekfX4m5RjRMLoVfLRI8RIJxOkDLt6v6YHkRMjGve8b969iPpIJ0ayW1RZlg+eHHJw7yui6nwUTvQq9X9k\/c\/hRj6+Zs9SUko8CFKW\/zjlsStZ67\/zIg7V2OWhQkxbJbA12Et4tcKD62ZbpHrNTivn553EfVXJlbanUHUM+1NRUwNLpSVd+tdhu95icRHvqiIUJUVORzjV1Cb\/DlwzftJtOmYPaKogAKJVgVJgsCr\/WFJiZuuNosxZB38jsBmE1EfJG9tSv6E1ZhGTxI\/m1PQKUtZbQ9Fmo023J44tI59OFt07UMumc24AJYoUsB5qKIT6qQOD5VHRY37qBgGuxhDNSHJ9hVWofofJZw49poZdr84KxbVLQA1i0nEPiHE27B5R5A3jyQeyeOwIZ4sOelGIumNwts0S3fc1xov8w3S\/JCocf7N5sBwZWXCxZbmAHS7q6unBdAuGjFPlZek4kavZ7rvZ3ewrEysqvaa7K9A12zQMu\/DsDUtZEqhUSdmls4lAD672VYijTJeqLyr1qN\/eVam+GzwU7bEH+ywRROTjvmr47W\/\/k2s3WmlpZxsHG\/ZNJDmrbu9E9yGzW5xV2piuvipTwJmUzRjwEFd6t84CwN3WGCupZOynMalZwNOQQeeHnBFHla3ohhLSmlG3udvBL\/b73+vUVuRikZRcZ5jqehy+0cGe4rSbN3tHrIaiDj\/S9SYNZ1AHlWQ\/weWkGpd6pkjZVJDZhzjKlGrnZk5O\/nOBLl8M5a8ytAZZ6zzqiNMV0KIUzlrPiRyN4X1VrIRcFX0Y5XIDXE9lN4NzOjXBMFd0RKXe2G\/jKNrUUiS8lrY5gxDQ3q4CQWhZa1l7moJsChfkaeeGIO\/G7hPDAfkU1TKQ+2jXV2af17wNjlKagu1QX7hX4sXP8pMl\/CXTez+vQrj3mfwKsLbpog+argl7eCJDuMlFfZE50VIQz1bn42crqEGz2NLr4bFR4fLoZ7PH6+Ucp1uDOrPz9GTnddIUWTjugINtKhhd67PjSZVd\/UaX7qUUl2PCRl3zBKSkAD6fCt3PCbcxwB63LecDb66cKelHe6QQaT\/PgnwwFKIUCgmzaR+rtdDXWTjK+4DVRGSkll9b4MIMC8CCMV6fzdHhjC6oawnu\/VIiCY5MFN0qNZbaeq3R1MkLIuK5qcpBkMSYTz3yyFmY3nHQygN1YLzFXrg\/cq47lqdpMNjkjQ8scevwnonVpNRLd33v2GJW+I6x5AM8hms7SzSpPm5Ce04sTshx3DcFp5BLSffbr\/csCB9+Tbq9MBtSkQUAtaQ3feKg9dtOra8nHsrtTLcBVcfCmGQ9\/0rlKe3uKfTH3FaIX960NUJomFJutf25IRQ3F0\/I\/1RI55vW71\/Fxbk0rpZE5BJfRd7w4JG\/OVDRXzBKRSoFM9DDMnkNYJNuZvnJddAUitMmbbVrCDpZH4fmfCrpuwSax5Ox9F\/W4C9KqRgD4LjkS6Z4IIzX7wImZhUVH1xN3wr0lIGBKvY4hf77BjvqzVGZEmP3M9t\/vDGmqDqESc\/Q7vSGlUuY4+SQPkveMIW6BJD\/NVY9\/W1aKc7mLKuN4Y+cnBltTVmpmuIs1ervJNT9bziy2SZPjvB4UDXW1y6J\/c+3FqqeNB1pGTpxHfX3UOBE0C8H4ZlFeNEESoEG2iy\/Rijp4F7kp\/Golcp8UpuJ53uWkJUQ7qfeuQxXU0Uf4xy0MLbtjeWfYBDghA\/XB1raxEXFYC5uSQG5EkCX6CvkM3iH82S9DrEgxiPCaHb8RJQWJFHTzfSvD10Pn5QOr8gJzwfjBuUBzcrDQwluPtVvCu3\/yh+yyk60VeAXb8YowJ\/WjZPdsV625AVkRM4KeKRe60ekozmJus8ruRdF8tGPwcQTnE6QHKvUhk9CYZbIPpgFvAugXzNTDLxbAhiI0CgxDCZgwfZaJLrsbYxUbg4h8bVg5M7ZNO7\/l+i7SlUv5zHBXIalivTvjqRdSUJK9G4h8txEzgcsKmPjrmFXw1vS1ujB4d6wD3RxkWz\/OtmDnZpsQeQvQD0Q6awVhpL1IP4iYjDEw5\/x1I0EmOaDZW9tJ9cRufBc\/z9E5obb6mIZXPz2AEX+DjlY3odUq6feeaFuEd1GmL\/8oMmR+R8m3TvEbl4N\/URWDN+kv6MQLU84Wg6OWVh0rOEmosKbDD5dqhV8+K9KGiO7vwcAUeEhgLryWYqB7lXF\/Z+9IHt2VAEJqmeo9JI8og0CNAxNV4H2MSxWYF\/\/3+xvV4HO0s69rukkNDIDr8UrYP+jJamOMfCLVMkZQD2WG478yK\/AdJ0ijrruJwh86aHRUzzozat\/7DOY4RFEPkeP4lOb6Ild0NHeNrAtQNn7+6ERkyyvpPLh23rnrh6goHihU9iNTHw2PGMQZlVi3Zkvg9NgJKMHzMKooFBh\/PDTka+t5SEfckYSP3RtJK8NEffvhwNYtexexDDUFWQUajfKHJIPhCyrB7HAL8dMeEXa2XgcORA0RKv4F5EGuuUsZV5gF6Nu\/bZrUma70tYd67JErBrTWq2uAUFeRaQRl8ugHCupAIW7MznxI6OcGXwm8YH09lt9CmZv9BWRfJvjJl7oDJEEXN2ugSeQ+a09NbmqgCEB7J3joJSx0tHysB26bzVAn\/g6uD0jpUc9uCFIqWIsgvFsOHA4R5c\/EIB+LBR2kwSsJfE2pD2wsvKXZ3YYJ18mHKQo73uMNGeS4lIOSNljHhbj0ouRPPAZde9WZ0Kw6GmGIymWDlu2zvwL+njaeuRHtcM1aLEfS027qZCWmUBXH6xC\/2\/A8Gi7qd9C9wbe7EfKUS8sKYlddXOuZpJFje8qqoHbBCblORwvmWM1RRj\/PvyjnB8LPBZgaTlRrQcBfFkBEbeWN1VBb3FJJV7Mwim5PbkkP1av\/chvxmbrGqcrbHszyI8PgNL6JemXON8V+\/0ZDv1N+MnsVfPwTv01lVlnozDa5KuOloT7QgCCIeGDb2QrLTlbKGJ9QtFGbm6CDoN2VFx2v9a06CIJeC655TMsdyq\/XmB5tPP0GR4g06sQqKSjiQsc8UKFj+iTsvHqEuqWjMXbsrBVoeC8h+T7d8xKaj2EhEOYvr4s6s0Y1kFX58IwJp9JiJU+xnT8T+wECcowWCGjOivtHSVKkJ1gySHOv5R0J2f7egoUd8gUnOHM8TsLH1hTVG4On7sVM3HtKtvJdUthm1zDllwkNNTqftWHcJzEZvVzQwJHtrWpfmIhqmrZT9EvMZkMxKyFvoCUhmmrszXKJaDsuTzFUpu8tPB7UBtndW8bgDPNsrTiX3QEtzhk0Y88Rj\/1w7qJtfp2ePptRTHjfAxaPtFTq7YYoCsgSQIceYtGTKL7Hr4XZEzlm9bnQ5tN5Sf9\/rK3Se3\/QDyOMnEhwlZm0inx8GytyD7YWXDSJ1Iwewm26tKZ4FhnAfz5zzGTi4+vYKC\/1DO2hXpK6L8\/Un3kwsivEm1BezrTELurcV1jAoUVw5qpditAjwS8pheespJU7fkqQOi2KWhM2mFgO2\/8OsO9hqgvI16ogzvccuqgkn+fOAQIL0R9Ycv56Kntkj9roaLD5+aCOgCc9IV6Zejw3dyxid3h+eQbceeI0KOeAyjM5Gr2mXWWVy1aHDL7AuqLg\/0mgEhKKprUMJ\/NBHyMQtpU7Fg7s5B2llUCDer57X12q2tAlEDp85UmM3elweLO1r2n\/mm+thoyuTRrLHtWAWCptWu\/D0UZvYmtaABg4ZTRiDeM5vOaF8\/vyW9lDKoS59rmbgB2TkwDVGEGfBWz1GhhjdyzoIHWAeTdMLANS1CC5ZI68hDANzo5JkWBGsb+Ak9vSR8sa4dCN5zIz95LPfSJ2y7H5z0dwV2LnMHZFIx1muh55VdidGMxgZ0G8rDxVbAYHVnFqfkiYxFqUPZVLeb0XD1UchAG+x2j5t4J4Noeg3byGayO4+mQOOgkOAgP+seHvjhXsJkAVM0hiuSKtRALUd4azOJrI1yLsmrpATAS+ndyNszfxwhwaT4bb29mZ\/S2mECkk+WZxRzbC5Cv70XMlwDHIu5IYWxk6cVEKA6dbqwQA4mugZ0X6Bri+g44c9EXfPYAsOja7eht+aGKmPHU+LuijOrxJJ+Jp1Cw8L\/TSXAOLAQMiFiOBqzjoEpaW1wHtBkJaNizXf+OXMRf0cgmTKZUzba8KxBkocnlkNsmhdZdlwIqqZova0Brb03gqKekdMBoidZGc6ZzknS3eunDWuGidkWoOquHbivgLby62DPJS5YEqfFupC2wEkdOh2NtOtV6Lzb2aXCfQw\/9hinNatUODXqEkl4oSJlDzAIWTw8zSd9T3st6Ti6UUcokmjJn41OBxBlJhoUujN4E8lQg4uFKMLqr5BnEsq6izCbpNb2oTyveb\/1zjxJNBQgnfFx34gtpa9ZYrgA+qpq6dc6K3u1pmWRExL08IwJhGfXTth2\/As1p2QAdly+5yLLb5qv+oTFz68Ani0TnZnznPEEsVdzkYUYlBm36ud4FarytsJDL8ZJf\/FzL7bivJ1ySu+g41bauGSK6rWNT4r0sgZqrBxmWe0OUV8XXBwbX5Sbp+QXccxv17Ll2X36AE4pMXgzCPgvOQVO3STuQiCxBjxofSHK7qUxDGzGJgvlNCpO8FgzKQWKxgXn\/YxvypwGk9ux7vNFH\/kIcnPLC\/odrkT23BXHehkskGqDxkzJYBDRcZPx6Ir+EmxW9EPCPkfZqYr+RxEbGbW+PUD13lXUtCHBfcFtUKXebALhFd\/QU7OyorZoLgxrIN+HaKzdX\/S+Zj7HeliM+9js9XTT\/HZo+yJtdL\/rQ\/\/S5U69XYDKemtc9fofTa86rtjwpbJLu\/bgx4V0gb8BdcInPJgsb3R57yjXfqY+zozfFoEZQYYdXYiXcqEhd2706lpysrwmwiY4UXEYrsHidAgAtehmel+bg2tWx9ycgJ85189v4VT4yNM\/JjgPBiiL0KRXpLlHhHtzuWeYuhUqGIl+OMOB3h8Gq\/YWogoTafGn3j1LcK8arn4qGklYsoBbbfD3LuCiSYLmzuA4kur6pwGQ3tLk0vV+7I8ODkk8jrqSkn0cuV4LdUqUZ\/4IOOTZWnsivCfGAT3XNID9K9KltKANjG39+wrhplc9cAbFcmMTfbJJGGmsBQF4CZzgyS86CPjLLOYSkVNIFFbla2mRjRHnN2r5jqT6B3ZGJMc88345wkL2+g269+ZLYsZqxGUZsuL8wnyQN8LxmvppGC1rfu1YWX4MIJLIQD6gut6lXqRviJeE73u8FkSA3Zti6MO66SkvZ4JNcU5jVxBQFrfRoVvDVBk4kbZN0a4uA4NoSup16Oi8U+LIYHyRGaljCqwghJFic195fBVRBKDihL8gjsraEduwTct3aQUiTF91nnMeQV+PtDuqMr7g6UYZrcwY29kxqBmTgw\/y5j6oioKLxFcepfQ6yavRvfr2p03iFarss3vuXDYqmF5ISGA+VmQWGcsRpNZ+aI8mpPux857WUNRm9t\/YPhve3855WglQQOvQU6g1duLuJKyUlm2GkrEVqOT4g7DMZO\/SN8bzFSuAnVfyoMQxPnLpuVZKoSveeXbnPn67W\/qruygf+PdY5EJOC\/I+zVyzcRNhCR79a+iFJgQDe9bUtodGBDvwN9\/SGvJyV1yOxOb60yfbki8Otb3PUO4UpGiUVxOYKZGiVa6shUkqbFklGlwt8xI2pmOjRcVfoQ5BByE5pcmq10pc1t\/ItSXifJoStRUpCM+Pch0edQddYEFtEDsAxT2qkTtMco2ADc1Yj\/P3Pi\/fRxfAQWnZntWefsehIFQfJ\/quUR7W9mMw98DCasnN4kFpq\/EvgKPmSnQ97SVasKp7+l\/Zn2iIvEiKb7FCS8mAk+UTm5hT7l+F\/0cWQBss7kj2Vuhm42SMuUK5AWFxnPB40s8To1IIAUErnQk7dkZ3Ee4yTjNcfkQydy+IyulcoNV2+9n92eZw9mgWPshedEp2TNYm8HCs3Ak2RknV43jwRGHhNgMNXDs3fV36MV5tFERnmljWoWVWuAjh+sno4CRpbfQV\/vQbC3IIv5qkag5m3xTVg0re2kswDccWs+BLAVI0OQdGBMI4GoJ+Ne6HBlUnjm1xqWWoCPOLiyJoXHTql6B0k0SDqJyxmWpsQHMpzNWSQHLJITgmDDrzdMq6E+nc3ErDu4RmmC7MYQC+nXJgr9EYsFHJ0yfgd\/dBrbf1Y5vlh1C2p7ce8yWsQ8oZp+p95FIGClJym62P\/+uUun4Gf3jHlSz02ARXDxsXFau\/w7fl87C30P+3iB3tyv9fmaFQhgPXTANEQqyA+9hXDTfXwz8bP89K0K0ZxKEFAHKZvVNml+jq1zlU1+kY7pE\/97Aq6BsNr5MY0V6RJAP3HS14qyzytenbSadVzFjiJi\/C\/QyERA\/rBEf9mIpft6398OS0PjeaaoepFI7w3Kes\/B3qlx3DgEP40\/5ZEWOwpFqQUdju+uQTCNBsN5bVZahModauQVTeoDsqNXtSh8WsKRFylguNoBlPYu\/CclnWqxhDrJCB9xjyDjnXlMQip33Azfvus9wpd9qi9bW7znpzDqWVpNdb8NCUhgsxxhd8x1ehaQG0GGnkfN7R2t2jRN340SKaq8zRbo\/LgVL1KpX03Wv2cKSdkNeqtYW+we7yjFXnwblx0YIZk3Wg7cadMinZN+bcNR2c04gDZj5mTFNv6cWwjcbdT6Ng0C7K6M5BBc2N3P4yAB732tccY3oBW+xL9stBWMLT2YgN2DraOjciC3BST6XA9rrfb2Vq2VzDIRV\/T8XyFru\/54vg4r5EwLhiyJ6eid8GtbHssJZifE3iO4aFlzO0nb4f4WymsqAd\/ApTlfyG5rLAUcOm99ntdDja+NKQ9jR9zEmtz7Klig+NEB0pdSKRLBINzBq2xMN2VYme9yQnXdrp+OSzBixlR1hR1Ny2IQIPkMu4TLlRLI2rLdX1xZSfFv3RkfAZPff+rwZgF7pld7U1++2lb1IoOMyoVJVuhl1pZoCAXPwypblTJWB8mP7PYT71Yxf7DI9ZHeUTnew0o\/wMGqyF9226QVwxvUFnShIgjwAipQ5HD\/smUBXPZ9lp6EH\/ZR0wcrABLtFuzhn0y8lT4cYCkDAOXRu9XO3zYrpfN8owDg2Pui+ucaIhD3VOevopDU56AgqD0lxV3JlVBpw4fuQfWM9fBQH9qgHH+eC8GZmyL9mvVLFV00tGYQHo\/8Q2i7X3NrVzR\/IHfyHntTcfpUlPWkVRsJ4A6YpTEZ7xviuU63apn6vTFFc9Qx5dkbN\/OHwXJnq54TIKvfqNv7Fe9PvzR9XP18CvqTsSKjY54L3wXDmSEmgtbeWz3\/UqepOUkTHXpEN+qi8cj3Z55qGDOL9q3aZy84vR29bSmfSTXA3cswhujFUe82WZr4pAYDO+fNphE8DKBbtKUYcVgew4uI\/fTkySEciiwLsTl9NxCfUh7F5Bv9PJJEf4M+GeqQJzPILt59l+oeM45+qh77ESIHksKE6Qd9kAuKio89N1KdJjh\/T8lse6vsW0+NYC92YYIDRuLwFfjZeOexWPqmRARyrzR3nVR+spTZJKAKYzJ06JKS+dsYKKD8mBrPevMzSqa9fZnP6Q5ra1JEE+ttjM6t9AdsjHDmlAyQSmnfBwJkO+wmmoTC3pxpNig+rnQOEaZPoGa977JX+akp8VFVhl0gALvAWYAXYmIW4nWAR54DK\/M29KCtng3RX6XZDos92nAYzMrPrIBylJfhsz3HDaVp4SuxOXjdXC\/X66GQg9soW4zfEDvdlXS\/v+FWUldTMb+N0OLLGjytFnA00soGARhB9Z2URnbGv3B0lFHesbIUizpbIgsy5Imq1C7um5iQSHK+idCI1WF5dKt0Mjd19YR9R8fD33Vd9ovwPEKz\/K1EzmxpNi9dlSstCfGEcWxiG+rhkcHRXNaH5+nhRI8qNz4y+BROv3xYQti019u+qPjup4h2Ax\/9t6xfye8sxjZKibG0PhK7GR1E4lfz\/Q4cB69WzsbgIDDxcax5U3Ud1o70WZpBedqDb9LH\/pyrzG\/hbm1FD7qA+jSLviWU4TZj10Jr8Mp+u\/X5XpvorPfajUu6qwUIUxZYC2wZzj3jA6n9c8jQdDHWzdue5agZYvLroqt7CaB2v7hhK2sKRk+kJAW3afmJNq47by\/obf489bgj0BayZeY9TAAUCkHUxnkoS7+n2uugv5mlizs+0nlqsW9mHNHPkxpthtOP0nAHvWkPIAbX6oMGIXB1M8SlRx98id6ank9r1diO3QJukT\/2GyvFdymHQOXma0oO5SJcg+PTr74hLRJr3NH++CP1fEB57JoZWNMspvYquNjvN0iDMWvDwBUZLhVNgIcPCFbki4pl8a9MsZEZCKXvq1WK58xKeeEZRz0Ryqib3Hiqpn7NxaFSOh2avcMETGTC4t8lo4Uc14o9Mx2snhEA2llo0c49mfjSpHbUY0z3VoqtG\/BjUVe0BJrckXkXMddiQYLO\/iatEtOmfFNsm\/Sg0P0NRz0H8NuJL+TeNfhnEpxz\/08qrpqeRdmPVhYaYmtrnRpJ+HQ14wvvLGmbpFQB3J1VsDe\/ZbqsFTl78UiVjuJ4V3kMbj0d6xFhKS9xHn7ZXUpBkezg3pu77tDBv8T6jtrGfk9zAFf9leaGk0HI9tv5q20cBWsadWqxiO6PAcpRHcZ8gwumwud0joBEMr6Um7wTU1\/VleuVIJx9beh2\/8IYECwhIz\/\/ejLfdh8dv0vhnNCjO6OGpbywTL66T1eyJ5p6hH\/phtr4tf3C2aHClk4O1tBxCR\/0GwwgYgTW4qZkT\/nj+Zv1f+9pM9Y66\/F6geW+aRYdTZf\/C4JxuC9RVr6Rrrz4\/wg0jviCAsKGCosO9GtgaQ4DkWAM4v1Dtsifann5+0H3BuANqiIEdlwfOfyMz2hl\/dkDcrS8F8\/j02txtV0ME3YnKkMBfvzW+Gxug+j7B3aF\/dDZcVwSqqX63IoAdwtZzTLh1nDHNehScmGvFjZIhpLqnFXPKpinr383icftmd6IUwpG3YccF\/VMVXVl3y8CV4Zx5rL6P0SY0okkYlFiUNBpb4nU0+ecuOg6UZZYsx15wXKx9tMNCnRzjPuUTM9vqqKiSneZoSygCrh4d\/xiGVdBfYOWmp5LGvoUyv096OCG7FcHciIp6LJidQKw0gHcWq030gb7Np72mmaYHiuqTkuXF3GN3jzLsEReSyGmvGX4fOo2vT0f3c7TUEufqMM3mRYTsibmh3VS2BcB6YRKfvr5GCHNSiscu9na0Z5nzNd2Jt3txq3zvaY3MdxAoPGebj7nBrAWnGia+po9C\/BSms5mlR4CmZFkHdNsdPSXhkJsh39HNHhGX+kxQWdheAkPB17HHlGCGyzhPvTcyaxDIjsW3gkYLqoC94HPFRIPGHT6qmb7ShVcqSWO\/SwYxerGJpKXCE3Q2msq9y\/NYQLVt3K\/7nYAfY7P+v95Sp2lXjcykk9bty9bYT88Q+x6gatyfhABjdHLJCaNCA0LY\/ZmUI2AlI5lvfj3w9XG1+HrQ3JptHTlRPALIhQQ1\/Ef6eLhwQbgZM\/MxlICvPBUgMP+uXdQOSDV1IyhkaYzznds97fr5gjny+e1kKvYfE11hPmOhDPIOJaEkHX38rUfV3rcF9Ezros1uIzO3HoHOepnTz2oOxbfOVHtGYAAxpqrR1AA\/w57yuaRQq1IqsWG5dKSGl5ecr1qws1z8fmG4HLMTBUDaTEX\/1OHKBznkpwdPPj4AlQLZF92Ll5I\/ok89IxXeaNz6T7cJhtm4U22u1xHcXMkRv\/UHqHZym5tGMLFNzOZg+rJfB7XEPqeQ0vV7wX8D61J0dy1BgnbssBxd23MpksSJitVbvkxRb\/+zUY\/5LdOd9CsMSfYtrF3VmuaAm0tLdPW\/2rMan9bFiIwcPU8T2m9sKVxKftGJLVYDp2YGWuf4hJJxpYhpi9OXpuZ19akIYD7ZlM0DdeBBihWr7UfHoZykQ37G4X2AvL1HyCVz0HA7RcU\/PE17TvgVpSiHXkEkkR3ltK5vs80\/n7YK\/z6iGg1txGtgVNfj+LwRrTkKzrZ0hIUQnAesvoQM6jQHpza5dKpnWErKJJTmfGtSi+Q+Z\/X1eRiYTLmLYkwX5Vwn0M2xFymyYUnXGZup7BYz16KPeVdeT90dLGqwn+91tnKCT5O+TULWJ+xFmki4QNNHtIDGPeO+gW5u3Ysy3DJmCdXBbWq\/bm23YG4k43WmZHI80EombjVlNRmPIx2I1LhwhbBllTccU9KQ2XxW3nRwi7KjpG37Opr8wjaLMWWGI8ZxC5kjU+KQBwb799MU\/GwyFb6ki7XPuHhsezp8GlcWrUL5aY61yAqDfJXThbZzL8OfmflsAPNLLblBnbD2wRXCrvs6I37svzlFeCeM84yOlJ0mqoaNHz2iMgur6PUTyOlrUmTE2yZeQ63Fbsjg6qha3sp\/3huZDaCMfs7KK9H5MfFLhGKjhBnT7wCNlcacuRD7mAJPE9tnvNRlNyEs8Z0uYVvwu46qHj3on3djvR42c9WLVymDB3VExty+8WeIQAoYRUEPsQf32hWg0Nztye4ktSjJvAx8bliKLNlL\/URMDt5egj\/ncs4unlPSPJOwy\/mkm9rlwdhOE0WVfhtuRRHmhWLVP6K8xgIhjoxFPiSqsOUjqugg+xeuA4U2tCC1UvXhyFbW9mBhcg9Ae1JLGEcFYSf5QWYA884iFB4mhacTdtQYnRyiNDZyktGF8E\/sr5du2ibyr0lNXDNQiQWigblx71FPirXYzPlIT+nnL2LlBsnkxASFYvDIMBOWECllE+AY0c2zYXsT7+NIT\/UcjQXmaWAaQ3czLerSI8MbIy\/kDW1NAIO4bj\/L73JwyL7a2uo7JWwJhAn5NussMjxV1iF4MF2F+5S","iv":"2c8c0379d4b5a3c58484e6277b3da9af","s":"81b75ac110a9e562"}

Burberry Snapchat campaign in progress

Burberry Snapchat campaign in progress