With new releases launched throughout the year, the fragrance market offers consumers an enormous selection, but there has been little change among the top perfumes.

According to a new report by A.T. Kearney, four of the top five fragrances for women have held the same market position since 2010 despite the introduction of more than 100 new releases. While these new scents have been brought to market with strong media and promotions, consumers are seemingly uninterested in purchasing anything but their personal favorites, leaving marketers questioning methods and brands grappling with ROI measurements.

“Consumers have strong brand loyalty – but the in-store experience can get more than 40 percent of shoppers to buy a different brand,” said Nemanja Babic, study co-author and a principal in the strategy and marketing practice of A.T. Kearney.

“Brands are investing in one type of experience, however a lot of the marketing spend seems to be inefficient, as consumers seek different types of experiences," he said. "[For example,] more/better customer service and fewer ads/spritzers etc.

“Frequent new launches require significant investment in advertising and promotion, typically above what supporting an existing brand would require, to ensure retailers’ support and placement on shelf, as well as to establish initial consumer awareness in the cluttered space.”

A.T. Kearney’s “Dollars and Scents: Winning in Fragrances” report focused on prestige fragrances and was based on an online survey of 844 shoppers, 18 years or older. The respondents were 72 percent female and 28 percent male. Questions concentrated on purchase motivators.

Scents and success

The report found that despite fragrance brands and retailers' best efforts, consumers are not interested in the sector’s advertising. With such large marketing investments put into place to cultivate interest, A.T. Kearney’s report offers advice to fragrance marketers on how to push fragrances more economically and effectively in-stores and online.

When asked what influences a fragrance purchase, 32 percent of respondents said that their decisions are swayed by promotional offers and discounts. This is followed by service and free gifts at 25 percent and 20 percent, respectively.

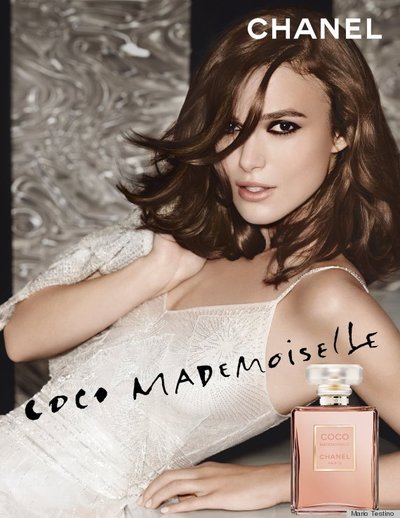

Coco Mademoiselle print ad by Chanel

Other efforts that fall short include in-store samples and spritzers at 22 percent and 12 percent. Point of sale ads and materials also do not make an impact with only 12 percent of respondents being influenced by such.

In the physical retail space, A.T. Kearney found that 33 percent of fragrance shoppers do not even notice point-of-sale advertising. Of those who do notice the POP ads, many find them to be irritating, distracting and taking away from the overall fragrance counter experience.

While in theory a sample of a fragrance should work as a primer for purchase, in-store samples are wasteful and not cost effective in terms of production and training and managing sales associates for distribution.

Only 45 percent of samples, or one in every two samples given, results in a purchase. Likewise, spritzers, the practice of offering a sample spritz to passersby in a retail setting, is considered a drain marketing resources and ROI.

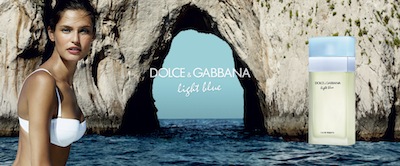

Dolce & Gabbana ad for Light Blue

When shopping online for a fragrance, respondents were similarly motivated by promotional offers and previous trials at 29 percent and 20 percent, respectively. Twenty percent of consumers bought a fragrance online when the physical point of sale did not have the scent in stock.

Most importantly, marketers must be aware that fragrance consumers are creatures of habit. For in-store shoppers, 34 percent made their last purchase to replenish a favorite and 42 percent of online shoppers claimed the same.

But, loyalty does have its limits. If brand or retail marketing spurs an interest in a different scent, with promotional offer being the leading cause, nearly 50 percent of consumers will purchase a fragrance other than or in addition to their favorite.

A particular purchase

Keeping this consumer behavior in mind, it becomes clear why four out of the top five women’s perfumes have remained in the same spot since 2010.

In the report, A.T. Kearney found that the four leading women’s fragrances between 2010 and 2015 are Chanel’s Coco Mademoiselle, N°5, Chance Eau Tendre and Dolce & Gabbana’s Light Blue. Estee Lauder’s Beautiful was among the top five between 2010 and 2013, but was replaced by Viktor & Rolf’s Flowerbomb and Marc Jacobs’ Daisy in 2014 and 2015, respectively.

For men’s cologne, Giorgio Armani's Acqua di Gio and Bleu de Chanel have the most consistency being preferred by consumers in the five year period. Other colognes to place include Armani Code, L’homme YSL, Calvin Klein's The One, Polo Red, Gucci Guilty and Dolce & Gabbana Light Blue.

“Perfume is a personal form of self-expression,” Mr. Babic said. “Through the combination of product and astute marketing, those top selling products are a proxy for what the wearer wants to say about her- or himself.

“I’d say that lasting success in the market comes from establishing a strong emotional connection with the user,” he said.

For example, Chanel personalized its fragrance marketing with a video featuring model and brand ambassador Gisele Bündchen.

Ms. Bündchen is the current face of Chanel’s iconic N°5 fragrance marketing, and this particular effort departed from the French label’s typical campaigning for this segment of its brand. Instead of focusing heavily on product and glamour, Chanel concentrated on what its fragrances may mean for the wearer and those around them.

In the video, Ms. Bündche explains that if you smell a fragrance worn by someone, it may remind you of that someone, even if it was from 20 years before. Ms. Bündchen links this sentiment to the scent and perfume of her mother and hopes that her children remember the same (see story).

//

"Smell is a very powerful thing…" - Gisele Bündchen #ChanelFragrancePosted by CHANEL on Wednesday, December 16, 2015

Overall, Chanel Beauty leads its industry in establishing a strong emotional connection with consumers through a foundation of intimacy, according to a report from MBLM.

Chanel Beauty’s marketing is proficient in embracing the six markers needed for a strong relationship with consumers, including indulgence due to its price and status as a luxury brand. Also, Chanel Beauty commonly references its identity and includes nods to nostalgia to connect with consumers and push its products, both of which are MBLM markers (see story).

Indeed, fragrance brands and retailers must evolve marketing efforts to be more efficient and effective. While the tactics currently in use have their place, they must be reevaluated to reflect consumer behavior.

“There is an opportunity to both evolve the current tactics,” Mr. Babic said.

“[Including] tailoring the shopping experience and moving away from ‘mass’ sampling effort[s] and to re-evaluate the overall mix of marketing investment between the tactics such as customer service, POST etc. to better meet the customer needs and reduce waste,” he said.

{"ct":"0W7j64OQ8shH4ht0ZVYqZzX0WkmK4zg8xR4JVGWBd\/bviLBN+nezyLLUoqh\/4NKf\/fhzcAwpoZHwkWvtPv3A0W8XSkVcbQvB9dOXiKplf66cwIw5ahunKrgP+OVsTnq74srEKUBgnghjLXcIi1kVUloHIdvfiXDsdBtpeIvFp15csdPx4zMr4kggyGMSlcTrDmr9fTchLiZicFxGfpltYrJHO0pvtQOfGOwAvPkaG\/Zu1\/UAvuhBr+zQRbq8DDWvOdEEYIlYPEmc6tIrNXQEE5meXAFPtEJpwc365GugevknVLDhzuJHNIe74lEosgM\/X7PTpnDECl+\/M+mJ\/1JZjpe3M8YiimaMFmsLdxbCgJl4etmhXag+s0pzradP9WWw8hgQNjFUwCf56FUmSGNwJlW9K6P\/yzzuZDGc4iEUsBPj+BQZOaVEjimenRITg0SGNEBb0vJcztsC1DfUfAan+ZYXwtTZRThY4riT78MLUebIGoWf5TWhqGrnbyw+J9IFZAH\/uubZqZUgbaavAOp6b9wYpy68KHFppSnxnJBg3ItvCKHwPRzvfyTMEEtKMHiQ7ADZGUAz1thcFnHpJehNGxlBDuRK41kfVIpFTxsrNqJZi8YPHzmfdTGWhvA4peGbMwRbMOr7CvpBgVhujlxKs907Zruv8pARgDVzxDh5CxT4bJzZhygBVT2ulMmOvNjj5cfqmMt0IMxGEkN6kbtUonqWamv+M53j5f40TKs2kgd1FoH+yXcHXskHXhygLf+fCewPRGdFporey6cc8thFNo\/BCoDm3ta41eTrwWVrA1uPdVbFqUb1QXGYxOj5si+WIMglTURz0SepiB4Z44d4iPa8uhVektN+dIbYnPhGUBe0eiCyiDO3UssGdiy77FK1WOV\/K99ysWyAktHMV18rT37qV+xK3Y1f6aMBMW7Yd5My3QxPDlD\/K9WXu\/jhHKWgnXeQuL1uTUfnJcTwHLEwFpGhyeRcOPJBF1ei2RPwDu\/VVO+A9Gaa15ebjaXcDzMh6jb4VLtIWX\/j8IFpYgrUDV1yg3g9l7Ajs4ETyP4EsOQVidshRW\/9Aw1O8NmbNl4YZrt5xokgr2I5mG\/AZLxZfmX8X0EyDrnfyORmK0uhMQoRRRlb7sZzwx6jGWscSoiACJ6obhqCdDohuTGtfeTIfR0l1MTbIKFYgbrNlPFyQR8iKx3iw8TcwTWjvdDgYfyT1eStt0QtDSbcLe7X2u5jvSC6PkP0t12HPsLQWjX+jpPKBp0VFAanTn+OD3Grbm+lz75tDGz2gRv\/jM2T4HgB05RPLQSB8Irt0QduOxAOXHjW7FPbR8kcY51G3LwvbMxk6z5\/nARtXAX8zm2lqkyfdk8mErnJ+B4hEWM0yFZs5E2hZlqQND5CD6gu+awgozcrMGprkv20lUU\/evDm7Hhn5hibHUG+nceqGr8CO9VgyZig39DajfDjCeCQXlN6jZliBfI+bgSsxnfIho4j9dEvKfVn0\/AuqfJZaZvTvfL9tK4jW0UONplGjsL7KS7aozQSW+EyDija3lD+6OvAAyTWMUF\/gftjzAzNJRyN2Gr3MwyoeYteGK2F9duXYRStWkffQTuek+xeUu7k\/jxxTG+Qi7RWuOzDqqPXXqQT+bOoBRygTBTjG1Rorm25SC4huckhNRWuMuM5bq\/FuH8pXAh0I4mbBKM1PCQf2zJi10UTvwxJdUL2umpDhSQkHsUM1IDYrnynrlAp+\/ozdlQ7ozgxrTb2IfNP7wyg7\/orZS0ZSJ4a7tUSEbQMhwakF8Zu+0BsZAGjYcO3HDXVncQ5WkC34wSXHGv8VF0H0LXSi5abpYrhLfLWX18fEW1iB66hgqjrinGhaUbhB4uk91p8SIEwp\/PbCcj8jsGF99SpgGASpM5LfkUTA5I1boXHPoQMwCEplu7ExsejiRiYL+WczhjVAWQJuVRtJszJPnzoG7xlUGVbiScEnOCZLyILuR6MXpAJSmp1loV1rCLVgdJ6BmFel5TGsXFbz\/vpUxr7up8InazKJGqz02XRwakE2SRNTYUuIejq42qykLtQG1XNzn1dN9W+B42tmkw07FzU\/N9SqK5+pIqYy+4aIPOU4fAB\/pVi17elcZ4mdj0S\/qaCW39w9DU76XuG2fY+fXiOFHeEYvavkpJnO1odj7dnA+fWznKrSTT3IPQeWKVWLgxBqot3I8EQGI9c7qNd2zfDw\/+WXNQBe1kXIuxajBkDQkZjSdP7B3s0s1z1Vs6jFcOCV5YrPsHWk5Lq9NaTb8S5bHez70GoaRPkJwCeMGMSsUmNna0p0XktCyXkxEgT9B4AbXcFATUk2q\/39dg4ejMaymkaw7779HF2LWqsp+Gsv9Mf70hgHSP4NwGRFcZfK\/PFVfsOvK5buK5RWWoHPBh6cCfVeXwnzIETV6UEluje\/UX7ZVbHRSxig8hy\/1+JcwnQpCzJMDwaoyrtcOzz+7FmMNOa1d1Rfl7arnqf36pNHQHe80rMQqoUj7fDyaEE55oM0nYaHsjgBi86\/Ch7m2swqA7JBTsab4CR7bRZx5ajvwh56fPyGmOi8wj1fUkAYj+SMFA+lll+DKjXZCmpauqNdN5hYghW4wANBtEPtSwb+7igLZjNeu9WS8uck2x0KeusOJHMrMK2NONaXJQBIma830\/V+vITmg3k4sr66EPz2trS7gUUT96bF7udwmESKUbt4hs2FAWBKpjghW\/BPHRy\/4Ixp+Kc70kqdMr0PKwL8QMa2B\/0yJTYjKLrnbfOHBBEweYDtlYvtqj6q9WR2qcDiY\/x8IQCWSbW3dzuAamAWrDG3\/alk+Adkxgk6l5xyPvfq5nMwyZbgOTAup1BX3H0bJcqD2m+XGykXzYzPD67lb7twZu27ltAm6utI1OumwcZwy3zGD4jDdUV9KJ91929DN\/9kUkUrVt+Oqsqy5fZ+upHG6VulqCNRTrqkPrLyzLvd2kNcinp1CMYd6ATJzTlBZxxfLSi\/dnSN+dsUbUAQl2CEEvWhSASm3f6bKNdiejWaLcPqoE36FTHbY75DzrmD1sA5l4hpLCzpNiKBSRJPPTDYnNf2yGKRCJaLb7+9DKstec1qAT6qa9zaLYK6LvboloxMTC825c8z5qXJH+mwgTfJoYcpBhCMiUbJdgnCMPsBbsy8neyunmk1sTb0eQsFLMf0nU7JG4pT6gSOoXykA2FXUgDooIgsB5dFiiT5PrFF93wrs3LELcjTGx7d8LCm5zDIn3cPEScH59XEsuKgbZY9x2FTLxTWNPKDvsYTME7AEcf7F2psOdqxam8GQ9kBYtzpOMngo3OHfEkv4pmT8ZovEwspsE8apn3fGfdgnPbU1HsTDf6h\/CInPMD2bNRPJ0Xh\/rnxleaZw9gE9G+5vMlW19cecTuC1obzNIkNORl\/7Iv8HTnjfgXTLTuuDE9owqF5Ddo5Lj1eXvRbpTJPTR1qNQ8L4a0zLDA\/hfDxgGBgExnMj2pxpRkGwOS1p0+SWgWWJNKhhsQsNbOUe3VnRdMsTuIOV\/ARpX74ajLHeq2ByUh21ldmRb7FzBc\/UrIMqZU4LlakW4A3hwWHjIls5l8jFKZsXdzfMpIAVJCaZEXi+oHcSKuO\/9a+b+S3JG3cB0gICuLBbHlr6AfsgSSSDdU9GfZKkDPzWCoTU1Vqot9RxkZpK8uKlVs2vsy4RkNFFToVVfdL9Q7+BVnr8zVqhtqmZpZCPoRRbUQU1Jg4oDyq4zPSPhHvQMGeIV2n+NgcqAUQQTtg8sqbUbnaMWoWrdX+fE7tIUXatQL\/JKZ6s+z7Q2DIji9ZRmmJseGdwYZSmK6PHQ8ELT1w+4Oba5Vr+x4tPVUxrOFO3kk1tnBc+85sxtivW37YVWjbAcf4jz6Y3DJTXQXqHUeZFf2kASGInYpnY9h\/\/XW\/hrqADK3xqyVYbW\/7Xs8lPb\/9KdeiJvfLf6eZHaTSSZ2GfgNc6So4WxXSCjQPax6e49XGiW81HwudigIIS2092W1ZGsPCNWYTHTvS5JJCS9iJ\/uCqC5p3wWdHzlb2yM5+yDEGoSn9OL1jPFNDRs6hZYsbqty\/t9xPo83c9kvQOQ5VhcsOZE9+cnO6vQ\/hc7bWdZ5naPowWrbB1ksoCmFbS0dy+FeBoo82ExBibtZQlXTH9wdTVQpMZhXD2oOsMCQcmlOaSzhfefQJXgIUwkxToMKz8XPP6\/2dM8XYfB5DB9E8iqBjTLGwbKT3DCC8FBsrHUJHgcI2b55Kp\/fNlCq2tWDzJD8xsixjLXiaXcYNlHl1MkLcJIDoPEVDp4mib\/KT1HK23m52t\/oRVnySN\/YuOlh0vAAGhzejTFiOefBOT56+R\/W\/hG0UzPnT7Z4zAcV7sE67hZy\/E7XTmL7kaz+jptHX9gw2Ou8SwZfeaVwph8rh2BJA5KabH2hT6uvjIyVBMlCDwt0KVZC78QCFG60kYF2ELiLx9T6nK60l9Lt4GaRxo9nMPjPTTX2w9xhjQ4DzfVddJPG8WsN2Yvo26PguKWu6KSJYwXMBU4RyO25eNHJbzfYfcsJqzNuhscWzEPiwDDOR6zZ87hqbKK+6NjXXSBiYKglHsaHHHxBmdbvpuQSb3haM0ulDyb0puaQrpBHJiWKUPbSFJJ1xJCqBBehxQ2\/VstS4XFLC8hM+cZ4F9RL\/gRg0lRmwj5JgNTD+2BpGCOILUJ2QpKFDzAI\/BKrzm0hhVgIooY\/2q9WQz2U47UEnL6Slx3oO+vmbz+sIu6tB+MhqEO7B4at6gpSNFfErw9GTBsdTJgCBp8nUsMGnFlPw9rLIJOW0wt7XggrSHsnQnwiNQJdeGgstJh501cjhEoktKLqFZSVC3ipBnLx+2EBuzw+6PEmT2ue0I6+fw6H2Z+6FhfuR1xYRQBFLbGtb8ua2qacjB\/wQvlaELok30NRMuTs7hmXMbeKRfflXQef5l2HANiq2lph3NfzxgY4\/UrMvuYw58Vf0CWP9GzLPoL78PJxggxPgTCQOcE\/Y6jne1jza8bnol7o0iZRKdH32j5yqRd35FDcKiWMrJifOgzB2MWANuf6CoCG0OUEdoMA\/o2LOk\/LLTvpk72KjosGVOUS6qSliHA\/O0TRPBCaWtyn2stJM5HChsBhx9Gn1gtnTpK\/aqGCpS6R\/IsW2Y7XoWgM9hoOoAibOWassmRVKCF+70dsma7pOgiy6xqjjNPTANu3nyabFUg5ghfx\/v7ZCzy4RynLPuVUUwdiLXvGk7G\/MFHRLFXfhGtk5eRw49k3uTiBUMWF+gwqnio+NCPqPmjm3gj1K7TGOH9kMWKj5ZzplXqzzntC7ntfSFcURlpOWTELDuFDl6xbsQyZopq0\/5n9tCDkvR6oQUeS\/yLoXRO\/7w7hKf9gluo6pp8e9gMMaBN35QXRphzTfs1uImH7B9\/nMSYBBT2aZ84lb62HJLZGvJF3cOLK2jtopAQWGZHRXbRjGYAPG+LMp5rRmiUlSDUYZWfuU3PVsvuiubNkg5d\/9mJ42wo5MGO3BEl3vrSNlv6MTviJhPc2E8fd2lXH8TjU8vDLjYrtPPk+285YewyzCYNKJar3OD9uvHT7tdam3R7td3nrJnXghCsz3y0s9XxkDkmGliig3B5BePl5OWw0vpi4N\/ZBhxETHiPpPf\/7kUI8qtteD+eEO2ZFYBp7cOU\/4gVDn48crZgsJkKlH71uZD+38dqSRuU+BWsytAj2+uyRAuqBgwpXeb8n3tjUeh0D688vC+Fi749r\/Q2eGTozo5iSwZBy0VMyjHKOd2TVoyVJAwmo4JURWDv9R7y4Ef9yI0yOFqYFkVLjkBuY2t1RWkfALsSYVAmzLewgZ\/rVxKPjYIZMIKagy4YeF7ow60pdGJc8Zon2V1Skkc6kBdURIAotdzX0rQ0o4uqoBcI1UKJCDJnD5zozUYWDNGDpGIu7AxTjlxKCjcsxqpSfhVkt+1GIV4B\/siy2rDRoIbiKVWot7F0FIG8wcyl7OaK7tL\/BvbskrvsiylvEuCfZodsOipgmekKQHGSYYhitOF+7u6D5OQB9R26RGToyGCcom93OGtbeDDvUWYbscRcDDYHS6YAl\/Ug7AfeN7XdhPBj62ud6uq4EATCTcPCP6cLwlAD41WxM9fDvuMcdJSmtYuQOCfv6NrXxalN\/ujEwka6wJZ6BS+6sn5beprSFUlGJre5kA0hx4Th3ZXJQOIOqbNDWRU2z27rGgI2obvnOMD7T8A0d7V8kPBn30xozd2NmD91c8zGuPnTg0Ozg4b\/hMlWgUoNI6lP\/ykcSw58Fl+sJvD9e6lgg3NqLeip02eEi+6IlCsJjPSyIp3vPA+9jsrFJA8d09efn4uNR9Gy800r8qKazS068AVjH6REAvkXOYpJFf6SVfeyH1TKYjr1e+KhsTPOhSU5auUBLrlMYUMzJHm0C\/A1tthUzrj7wTzk4EdsE0ARo\/RaicyfoTwnL938xAIgPf3pJFPPuGgj1mt+FIST6D74hxbC\/htd32dLEO3gIBLeO8FxxOlYb0TIly2AfWmHJrsWK6FXRZxR+Qwy7KKFrEyNrTfCOiRq\/DnskHm+jG\/RZIa4tcQ0L+4deIEgWVFjaDEjRwd02UseEk6uawboSEjgXOjqTEnw2Lbx40WrcAaMpPzsYbE+9+k4\/z4C5R+PlzVJ1ULO2HaYkTvY3Xg7swn82BVMFNjbC8mclOQo1XQXeNQx8O9L+oaNcZ\/FbGSLB2V4uAT4U3CaCDeADxQMVs8IT9WXL33c52YtWBH5\/KPTsHRaTOpc4CvQWINEJqt9Jp\/+KgCewrfcOot\/No0tbUi5nR7vWCWw7z27sD\/GxseT107eJV\/5Ikfw6\/Ns64OIu2Ax5OsO10\/v2UReOnk+Xhy7STwWAP4wTYTgzWaRrAn5tdQnc1fU95cQxtX1DGtBELkfAyEf53nnf\/\/TJtOqQh6AAC6+\/5C9k16sK75KElRUQB1q5xiq6ww1+6jgsP4X6St0HLHI8iWGJSZMmJyqlxRmLTzx\/cdKMEVrp7oX6Jo60qID5l5CvHSg0UQ4nUKbUIeKEkQoYExvwM1kB37fanAIx8EW4rWC5RMpyVv9XXpvj+cexDCPAnU9wvLUFMPkQpe7d2dBI7kN1n4Qn9IsjwxR\/d2wsxr5Qwc7f7OxLo\/1W01wvBCGgh+R9Gd9qN\/NKVZuLqyVQSSm7gAowfpuYALUUNX+YWfmNYBqe0+P2cMHAuQGvFlYgbCDpuSu97DGm7MtQsianebz3o15DZip56OqgQLMe3O\/s0tCJFfei2EXJ8TCNsph1aY8agr9QoTAY0bDS4DYKubC0Bqpn1PzfkKodCLxijXQNvcr5fOyiN5xQuP0if6gxa+tnWoP7IjoeLWbG39jXK4gqhSRxWEv6JEj9zvx+7pXusar9K+cliTka8plPaXAktDitedHoIl288Qle6mo1cs4ZmADuVKcDyLvLOZoawrRK6JAZHZ75LhXYF1SttQ18SOBF4aKjSnSJagRQapFXsxy2wqQCA\/MqzNcnatXx8u\/CS0T4bSSnbne4loDkM1Z8VcdrdEH9WvpolPD7NCSIuHzQjmSTna0Wppbc+k75\/+Ie4Y5+HY7U\/cy39Vv2ZYbCpC30DJQH\/4pnt1epdl5Kmni0153icbR98npG9E7Q3afcvk\/OwPoPMQVp001mCSMjdwjAiWH\/+eP\/H5oO2F73giVJnE6Y+Y5FBmkyZcJwNkd71m+h5uCoBSP5BQCIVa\/ZEgDqLqzw7kxrpCiDsUOvUUmHmGJpNEcTpB\/X0ypxlgLD8OjGv+97Ek63nMijBUI\/FByi4OxgwmCrUnSPDRlDo7yEDZfIbuVekjGieqJ5evQI+VGrj23azJZnBOzRSS75mlaeKYewufvk5PUcrbWZ89wH8DBsf4TRuVuT\/IbCfLWjaaqov7d2XSlB9rjR668rriqrFm0fKfN\/oO3Ey63nwPep3o90krxQHTix2YL4iQARzdsfLjKmb6GGv1W11NYKUj1BFUMe5vdspZMFYUV9a2oChg\/OibmmCjXF113V24SCyQ7gK0BH\/s\/cMQmNAj3O9D\/8X1xMvY9T5hLEcW+mLjDr3p4D3152gfk2PFmrXfrbfngHVZtT6WE8++NpcT8+1plrfj61GxyAiA4xStN\/PPBrdgOeOjb8KvQWrYLp+v51lPDPLiNZkUhnvZ35VmL0xi17MIYc9pht5R\/A+f5Qa7nsP0kibYHAvfHAhS+OWTD0mub1xRfb7Dv6Bs9aOxOLbZ7Lp2ENkbIorLdYygvLaCrHxiJUTzVmD4KjMdj1A4\/f08Oq1Y48BKywEQ5+T5jV2+gLEPvH44MArPgTUolx4BGh77V1S1SyVE0bwdQmjk6\/Hqf0M06nNLabVCtbGDQ9jzIh8lPUXv6wEFjyEZxdRCTX0bRRiU7CT5lC9nguIqRvRi+M4O3Nc6iuezMveoIz7VY5TznVB5zE1NIMB+8TxCDudhCCRNc89UoQIchauuKixTz\/vRcWSQGOBp1\/RGDHDtHJeCOZbPpN6Bi\/TtQSh1L1i01vPP3sYzYa0hm7LoHWIcqjNAne2LoCT4CSq8axDr\/7lYmMK7UF7BPS9ZycFmcmhAD+78yzk2gEm+Au9siYnnwMlPuNiJdnO2tDksqzwdxvOrfVI6jd0pUR\/xTLNbzPzXXZxj+i5RF4QVFfosehQ6eW+SzK6jbqMVFWeMoKCWJqDjgLQot5f16nPNZzq0xvSiuvlqLAum2vG3Y+LUiLZHJ8t5YOxIGUE1opnLkvHDuPzhmHfJg22dCBdxoZd4aOgNPbWOJ12OfzVb4XdJnHOC+0R\/ToI2rHoTm9rB+MdDsXbQM6uDwmsxka2NlTVO5PVvMxraNofeajFxnVUJ9C8vQdB3JgskSwjrfaM8C7srkwr8ujp7mpWmZfgmpIJwVmMg6pN8IbnqtaQOX0tQNaRIp35\/iqdvL3yRyspbUUJURB8s\/NnZreE2\/\/X8mXweHh2pZwLiZnkaFvqHGsMR1b8vmVFFNlDqPkqFVxyRZ1WGm4uD83iG\/pQcFh+FfHs0RNH4o4qeTYVrJD6V5B4+MdJVygntU+Zje4d1OKoRu0gAERuq\/mujX2CJ3Lbnnrobd7Iv+1s+4r3J9vOpA3ekEl3OjhozkNz07T8utyrBLd8OFe6clqdV9INgTg4Zk6BOmcwIuupHRNZRs7hDdQ4bu8bITG2H\/vgYfUj9k4x\/6OGCikZDCCut2S27hDyqUTNthIrn8+WY7tDMJhaCRTtp\/jfMLJ\/FFS0AQ09mGK1BUvq8TyzGAlmXLXG8SBQRMSDmvrh93AQEMe3xaFLdl2pkWrb8QMhTp+Cksh3EWFb+r6l2TltSPReLPCbYLFRME6XJnrruce9cyxoxl0jzmgnpjaaH124gxLEs73IWbaWxHlUHeXtQd\/HHNl4JRd\/YhyKP0plOhhTfaryIZCeI8V9ceiKF6dxgslTJoZb\/lsuY447nYZ7JAhPEiLbhIPTWfb+tW3wj5cWCSElPHqcue8d2t2OMIlvNCO3XXMhMNqEPd+U6eHUhi4Ua9Hf1aXEwjsbh0KCheqKpYGMgsZbAL6S9NavyEHRN8znUzqvIuEP037qZ8+udM4+bQwODBISrlu10QIgnSeJZWGuv2KUG6uNRHu5yekDPovfBl\/2Aj\/QK\/lzrIODC5N\/mDdHCejjH4hci05pB20WHfu4TqofL8Lc61BgkbFLLpqHwLrFbWrVSaOJrP23Ju0mJtNEOrbAkjt1WTU8JaFwSvB3STCIDGpzPDUIi9t8NVFEqnIcD04Y9Nli\/Kt2GSF61qCekVUsOza7tbWOlh4y4ARoDXnMPcqmBIZzcIeIo8NkLjHmzAmEhx4brSGR0sgxPuOGOxF4mYl2QQza6iqAHmOuONjLMtiJtItZRws9qQGBcSTUn7uIqKUNNc9qQ7gwcimZmQXntqYeb1XqxemJFh147Jj9A6meMwK4iIaGOA76GjD4HRhTuK\/Y1Ez7prol1c06LWcO+S+XPfmNrJLOhWnPP5N\/9SACDQXR4GCibpajr43krxkxbF\/\/xu6jVuiooMrMeotGQpugSNtS4ZQtxcKDddwd3gM6bHx7fDAhIFqpsNH96f40rdfICivBb8EghXtYO0zVW70h8oFlTq2o+P9BmlkoquPS1U9adGB5hctbf78c6qVL\/sn7+JSliRE+9MO5hUFybBf65odvbm4GbPagmnn2B9i3Sxt0pj23SR7pGBrGq6nr2Pyyy7cJAqDRkcIhSxqlccV5SBZGg4frdO+7q36qgvSWJiJzP6t0OcVh2UJhwodeiVzahGkIKeAJ0MqYu81YNKoTxiBAtocBxgDPNQ2HayzPCr7DSvBYCQk2G4SZBNdDEmLDAeCZuic2sEFO+RPcMEYHpxElQmGjGmfz6Qx7Aj21jrmAgGnjqYh6CibkAC1RWpOQlQSFf1om5Vo5NbUuXZuzZaTW332tDn9ny+\/gNxqz6ZtJWNUG\/UcrhUgGJV8YRVH1PDl6+BsmRRGj3Xa8Do7AS7ULMM51CLAOniZUdFH44p117nEyQABHlVJ8zifJ+sztkZxGcPE2jKtfGfMwoxhSbDGRVvkYkbO5AXThGqEaazkWOuLd1zKX6w4Tj++mQgC7Gy\/wiYcgUtgn+aAmHOOeypU\/fzxxmghDEvkAzrRSk4UGEeSMRCNC7a2CnS6m5iJxU9VWs4I9n8mG8OjfUBfY8qf76ppbO\/HCrQLJiXC1Sif5F4lCxGf5eqVTwWkqo9Ah7MdBVORaLiD9K2MpCpxqOinF1Wznf\/OSoZLK8evB35CuauATrLKEAXExpidtuIfwhOnc8IfqXhJjtZ\/1WCUMDOja5NamcuT+cfZf4ttIyy5STP5C12D3GQ5GmcrowaKKVy4FWPSYPd46UmPJesbefSfCHHL8iIXMK3DXtR3VgmCNOT1+GDlXgXKmlye8FRoS3MklwZ+m9VYfsuUbH8XKfL9s4MLUkQz4L5MtT1Cipi1B8u0Tz202bCi4HAgW+dFc3TYzzQ6Vx+BNQNe6Y9fBk7JdbtgETifubhLJu80iyKWTgbuhsgfg2LXwW1PgrZwjhlF05ck+26cvoc2okHBkpQ+en+ftjkW76IP2FltkeFcr4qw5WtS0DQaKZN5knSZf25vVkT8C4ow3r8Us0rjITTGiMqdbAl8TXdNf6VGF\/lgibaJEURYk4NsUtl0XPvzC4W9xv5CECb0yFXQy1qder4cNVVOBiCbr2RCyfCIj0ilCmpQ7eJ4SZpT2Bf8Fjk54xtSora+8d+1roDKuyyy0Yst6V8Q9WiQZm7Tpq+poaRaEoKgLfG+s6SNRgNJ9zeeR4C7s3i7JhY8p+Q113d1V9N9glL2M5r5UywrH7MnyJPvPQVHREbYBLFC5dV4pHqfW39\/r\/nFnAWLujv7b8JVdqZUfFRVMugmyx+tw8f4iUW1G\/F9cTA+pKNAMpP5+3YlZUcxo2gpQkytY0zWJV6tm+V7z4lXCXEe+pjdNNertlJtLy2Iy0hF7+Uj+KVH8ldj0FSco420lUfNJ2jdVYmbGL4u6G8RHo1EilQdtW8MAGbKHCDHBQ9KrZfdEliPb3VRqSmTvJ6OV+jmqBnYwJ0cqZ\/baxizE4zXN3h9aCaMa0U21j8s8uP57z+t\/5jAFx8YdLr1XBa\/uf4AjMm9CvehP17h2uj9tltEJGGQ4pLD5mUx2RNe3gzCdhaUZBJEKSG1NXsy1dagQk108b8qitO87jkbOggY7l+REwwJfsoQA6+Yj+C1lIh7fbUobn8STrZAcLR7j8bd7uwIzx0BDiYUx\/3VkWafh8nlDo0MxqqiCIIiRyAY+RaILe99dqweOwWj3koD\/l1JI3YcHRv5ODgqJqcwZodiR+Mfm4UF6MpAMer7LTX7u8DErdDb8UpDsXmS1f34PD0LT4o+qFq6CHLljjJS5Y6fEUxa\/sFHscNrOpXiZlUB8tYx2l2FqNEU29dM3\/rVPlNb+72DGPopb2GxUL4RKZkRdaWgIWlz8vpuXAmf\/cA\/i13vURzu4Z1H4+UDbRFfhg7oiO96+kR7RSErLv20X8wMh3Lgh3aTYBll8PG0OZXozJkco+wT1gFdxP4R8Qa2mgYzV62RBIdHX5iqtDbQi4jpc+pbwTMCdhLhcRG5RI1CHKRlhtJ7c9shybZ+GFa2Bv624kyXB2LWlViKF5Cdi\/kh5pOAn5I2wNJ7kmbcb4hnlqTRew4Ia8RygdrzMJ+ZvBy7tO\/X9fPQLIS0Urw8yZDWV4QB5dAmA8ROsqEqTD67UJTcj7e05WCwFK+7gbJ+04wapTPDVhjYv9jpgF\/Yb28dJlp8LTt27SvddiUq6f9CsUw1Yu8nRU+s0\/Nwt36yNjr3KK1BTlg8zopqsohb2L9Ho8xAr+eVyf5ee6KHlTwOfjukRzkV8GzNJOaSHvqHHLeIn74\/xYaugRc5g\/joWY9BZDsQn\/hnm04MCPtOjXQXp2fb+Ti2simRvwxmLk930BosiO5CfLUf8Rx992g\/jRgh13c8dK7BuPjw0uRYUj\/I+LcadKF4uHCkzpXANXdBaIHzTwSWUWIYUToHOOOa","iv":"ad2276a062eb35d597e4c67637003cf8","s":"35e2fce2807986a5"}