Switzerland is becoming an asylum for wealthy consumers looking for not just financial security, but personal safety as well.

According to a report from real estate brokerage Knight Frank, over the last five years, the affluent have been flocking to Switzerland more so than before as their interests now stem beyond tax relief. Privacy, safety and education are now driving factors that are drawing in many consumers from overseas.

“Where its favorable tax environment was once the main draw for wealthy overseas investors, in the last five years we have seen Switzerland start to appeal far more as a safe haven for personal and economic security,” said Alexander Koch de Gooreynd, partner at Knight Frank, London.

“Tax still matters, but there are now factors of equal importance involved in buyers’ decisions,” he said.

Safe in Switzerland

Mercer has categorized Switzerland as one of the safest countries in the world. Switzerland made the biggest impact in the 2017 Quality of Living rankings with three of its cities ranking at the top, more so than any other country.

Due to these increasingly favorable qualities, consumers are looking to the country beyond just its tax reliefs, what it was previously known for.

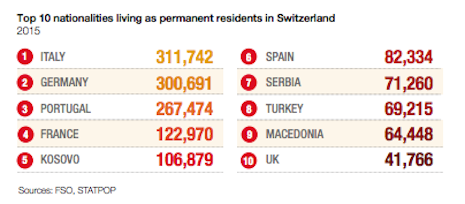

Graphic courtesy of Knight Frank

However, residential prices in Geneva and Zurich decreased by 2 and 7 percent, respectively. But buyers in Switzerland are more interested in wealth preservation than appreciation.

Consumers are still interested in keeping their finances safe, with 26 percent claiming that it is the most important factors when managing wealth.

Prices for second homes in vacation areas in Switzerland are seeing strong numbers due to low interest rates, quality and limited availability.

Knight Frank also found that the opulence of ski resorts does not protect the sector from customers’ hunting for a deal, with buyers appreciating a good value.

Affluent customers who enjoy homes in the mountains and ski resorts as second residences still want to be sure that they are getting a good deal, with interest in locations that offer great values such as Chamonix and Saint Gervais, France, both near the base of Mont Blanc in the Swiss Alps, strengthening.

Customers want worth and appeal for their purchases and investments, making villages such as Val d'Isere Verbier, Switzerland and Chamonix best-in-class considerations (see more).

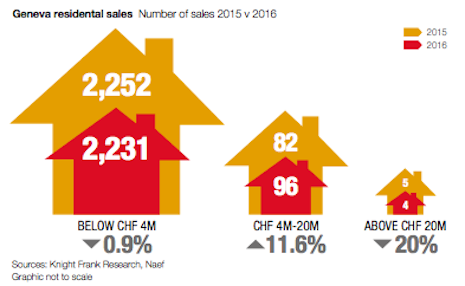

Graphic courtesy of Knight Frank

Geneva is also seeing an increase of 17 percent year-over-year for the market for homes priced at 4 million to 20 million Swiss francs, which is an equal exchange to U.S. dollars. But prices above 5 million Swiss francs saw the strongest increase in sales the past year.

Brexit and Switzerland

Relations between British and Swiss are growing stronger, with many seeking haven from Brexit.

While originally guidelines were on the way to be implemented in regards to regulations on non-EU consumers buying in Switzerland, they are on hold due to Brexit.

The United Kingdom is just beginning its negotiations to leave the European Union, but a new report from Walpole finds that about half of the luxury organization’s members are already experiencing some negative effects from the split.

Now that the U.K. has triggered article 50, Walpole is making policy recommendations that will support the luxury industry’s needs, including trade, talent and tourism. A valuable part of Britain’s economy, the luxury sector represents 2.2 percent of the nation’s total GDP (see more).

“We may also see a greater affinity between the British and Swiss,” Knight Frank's Mr. Koch de Gooreynd said. “As the U.K. navigates its way through Brexit, it could find a kindred spirit in Switzerland, which has its own unique relationship with the E.U.

"Similarly, Switzerland is working closely with Britain as it scrutinizes how our Brexit negotiations could benefit their own arrangements with the E.U.,” he said.

{"ct":"Gz5FqU2IFNagCSmGP7v2mDylTdGZrE1TvILXRTJRBaTretMvAZI9hJdF7\/3rH5d\/yiPVnMFhe7zoqHN+rDJfXn+vUvyTo14XwiKKyN+ra\/ZlX9CkkCuImiBp4JMuI5M6i1aaNezj5Osa8Gczj0zwVDuYDJXyl6SzARD\/OGyTa7sEDL359onIoZDvvoyfwTKv1i00nwGAxcCJ6iJQby2gs7sLtY3hkIpTNZ5cIlQRwnj44haVyohP3d9DaDvCTNwcfB6H8WnKzuRXQo0NyP9FZ1G70DsDai84Ui75RcX+se\/hWbJmhbC8M2xqOzQjotN0n65pXSoo+DBEA0x5PwR3ryyps2NGSMuas2Cg3+b21Xw+o1KruspEI7plBU5ATutwaEEcV1dr2LYowDLDOnBdJeCUf\/\/9E+\/YCgSg1UaIANpwrWjbamEB8QOCUJE3kPHgb\/tom7Zg9XOUL0yevOWehm14RBK6nUA6K9fncH2KDXbFBi7+giLsagZGCSIGVYKu1rXtaGCnZ\/+lC\/Bbh+srfErNi\/9T1rdSkXX0WNtusHljjHBJJwdHC\/IIV446cW7lCBVZMM56Ar0HZa\/YxB8HuduajosxEQ41BYDW+miXIdrQXEiZUfne78u9cLdM7ZZFUMUCHu74krITlcr\/SkPub15kUbk8aV6Wz887ZjyToiKedTo9i9JiAIXlnxbkbzEBCgVThYJDPlPieBXU7oLnkB5YSsUDG8S\/i3PikvzBMHSg02KIqtNmdPNwTYCOf2DOiF0xEOJchcvP11zYQAiDMsYc0JtOYlpRXYT1KkisISc9BZPXHTztyv+7bIyCjkSWMzFcUHMD269Jfx80HpI\/8+QsnqkaVPf7z5WddJtMMDchVdvdC1FufLfvphHyt26U\/J7aQYl3aDafY4wrwDwrx0+QJKTjtJTDs9FVzNbDQeBrDcbqIgZzZfPMmxFPrUxQ5Msq9UAkTBqGhh9fRkQ4g49vmMAUsxnaRt5PkcmYEbWFj4FrpJtr49NcpCLV0hSY6T1XH4d1SvDt1CbULGXOvZTqvGZO0F0k8HhdwHvJeMW021kdOKeTvicbmp\/n5XBAQqBTA8JRni1Rc2\/R+28NrlF6Oflb3ZslEY+20thZABV1pOc+3pTQN2YcN7p6mykTvV6Uinaej7bBNYatz9K9EyqK3TWelEH5zH\/oMEyo332DSDoMHlBe0nFn0bBAzeGd9o0vw69teCvEnsIewhv0zuKhcFDYuDuax7JZAzq70z2uZHcCRP6H\/7JcBEX3Pv+UzMEQrgmx5vkM\/GF1T9pZzXq\/TIUqYexVulkIfDSfLJJb+HbQLWPcq3sy7ZC9PrXsrLgFXLx5Opoz8q6CmpAplBn390AS7myUxqEwey0McXt7m0IJ1RfBTlWYk7w8UcjK\/Kn78Y\/Rb1q4\/g\/qWRos2k6oWF2Bjnii4uC6UHOc2BL60dqPaE\/4+\/zgecmZCftePEY0a04isNTtV3YG41HrBbmdCuGnYJGtYUZSjM4SxW3umLP3oP0W9pFhskMQSU6sqQ8jEMCkCixAYBbYAbOxE7QgoU27NuiFSBeZH6fyiwWdTRMDH66QEelwcpt\/0XXcgKCsJFXXxJhfRDlrkkC1M\/209pCxgT8yRuSpof8E9gWKPhotmSVbnzVkhyd8f9KZJ\/BovlNerEmXC2IKTM22JzaOtKqnmn8+xzcKgnLz0DjE6qJPwvqiYT8CG6Up52\/XazXjdQstQTtQ25Ay8uHlngeyzBCCPHu2SP5lV8QLZ2sQYjzX2mL0LqH+rQcdZk0\/q1YRQN0VAwIVFjbP\/Y2w3TmUdFq7Qjj9Lf5gLYGPzoOBvwXHrgP9KggjDgbnolqc30FfQcUrpcPWj3T3PlwaZ6s9noBkYl+pTZtWT6Di\/+DRZB9Nu4FNj4VuJbwNQFTPv3KMC9OE\/k\/lSiizNY4KtTZLCkJB5yAAYRPe3miJZZKEHQvYP1XI34DQTK8qUzAwnPHhbcT4mCgoP9iSuKt8XTIfddWKEKNFTiVfTMrKiq0ttMDzIt7+6ot9J+5zySsde+MlhQ+W+F8jmDgZnesWrfp5SpLmXPLSmL7WtpZdihhfsA9FIvMGgXxS3HcYVSlUxuNiGq0o9523d6ab9vJnOYHCa3cGnJJCYcntr+SHJxi5JXIyPAV8e8FfF3LylyD04s7fPSDkFPGet9O2qtNT84x4O2Aih7RM1Az5MrjlYF1etQ0oeACe8SfW+OAC4lrp2njcMsLpTMFL3EV6gtpM4\/6yLojhQxjDHvlLuMbjCTN6No0TmWl9bBXMgl4uEDKMN2FOo\/V++0hebyrEqn\/K9mqRPFo33Wwqruq9uVm6nF2797m2pEksH1iUzOkMGyzkpNgZuijzi64Q0AsU2VCMwQcS+Jd7vi\/DWnpQPE93Lci3SSyfbWW1BVR5WtSF9dwPx5WROuxMQMhmWdcoeZJ+BaQIDCMSWVx\/RsmfCNzQHivBA0RzccJku9Ho2re2ei2zCKsi819onlVkfFDu65NFiV8\/qR5mYSYPGLd4AQfGNclGM+njoaRvjZGx8+zt4ch+oDjHPIgSrMJCjOCeFOLF7a+cVLhGc2jtmtyQrrF7ftcMDVcOfJ6FdNu9V9RywsXxy0fZGzLS0jAI5yNaynR98JZ9ngAPZsE4at5GZW2znOe0EH7bdR7gfNLMK2cWL38iHP6M4i4Sp6lrTEGkKG3ppKh5jJvAiWtdgk5A9TybqJLA34bFhptIiXt8FS\/WFnVr1rfcL70NheT7ndp2CFIY1oQwZDHoI0zQOHLAUpuuNNKC1Yk1C6PD8BoVUvkNBgGtC\/zobvfmGgwUCAKuOXc5sAWBJ\/4TaTtOJhZQwXI5w5eU9pBKrwaO4z6vF1jHA+dLnoj9\/8evGRUOMbn2cmp4Wqt1oaHBK1ua+wgeXFs5iVdj3vUR3XZ\/Pn2cfp\/HrpMuHdI3cUxszW\/c81J7K7uamuJdivCR9lD77IXu2q+t2a8bqi6zikQwmbOZGz1Qk7R\/JTCxF8mjpHt0fmuVIS3u3aD97gWcjqGkX4hJ1Le217cpz4mxoR4NkCq8k2Wc07c16ZEdRI49h4ydhaPqOx+4pjYRJbtFvbR1YxzAYVWSn\/9vMN2APJtEKy0IUTslByAbAENIqan+kNViXwy9epnhFFSF7aYTnBlWdZunjSw2\/2B2vKfMJc8aaJ5AziqI0vSFJuaJJQFcrwGkwbpkxlgyPoCcxUyK1jqB6RNsURGJ1DDr2Wd96oGXJSCGUkHqQNzEhyrdstQEFYFF87t6KAoPwNzXiJ5z1ot5\/ep8HYfAGSRjGS92I\/AKDq\/Hwz3hhcisY6OQEp1zBjKeQHuPQjj4xogIseAuOZ8CpLHqYfl25BstzW1tPYe6iBe5iFa322FWxFI8HBptAIkKN70Mx2nx5tEqXk2qWGgEicpekxF+ncgyiBW6PxXOtNEd6sWXrM884nXrRQz8sNYC0J8V7SWuXRUpe+tRdXpAbhf6jfwZPY8QGdw61AoTj67aJnXKs0cquYEqQQul5qGrv1qBwn\/nR7wETThUDi5UmC+rzcC\/G6jt1+a91Xx3oXQxcHYvoWIBfY9SFBSL5Zj6eyo0SdnzxxnVg67p0ugkk9LjESLcbaZShutX9DWQ5GOmGrvQkFBCl5P6+pXHXqPRNGYUFn\/6d4Q3efymop0GN1I1MBcA5mGMYlfs3I75GmxSWQ22GbQLz1E4rKh5BU3DOt6Abhzc4b\/sYnnBOE1ORZHlWcPA+G+l21GBr8MLu4ZNGp4VCHQiNI\/Yq8mynp+On1l2MLCWvFW2CE2MpNUQAupdLT5zql0\/UsbW+vlSsDmurmpS1BFqAb02mAwJtzw4YlJtms9GEtuX15wYubr96sOzLjcRiHJFsThJMMOwwfLtWhTYqMQQ9MXKVzntXLvKVLCFKX5McOe78YdD4ogYlBs7ZearU0CTdtHgV6WjBhUSRilkBge00UB4XQMZeU9b7nOCbGeNTeIejByEAi41pwExhVAzYdKAkgWYTxI2EEa5KFcoL9eLePEMs9vRr8q2SRJ3gRKvN\/xNLVrnvc2FYdCaVs+Xl0MWzjaIMYExXN9dflvW+\/U8t2k11Zm0NMqX6J1ngIcY\/7Q9leB6hE9YC9sq83A+hqyUnj7X2gfuHtjX0JgEPC5O1A1MIKZ07c7pQSTIVnaY1JYM+\/PVaYj2FWQTfcwZlExqIVwySmQrH13NKHCOfF1jah8N6pw1kPeykgoEs1sDIJmrFBMbk9Y0bu9oE\/OYg3vTyqguRWcQH1A1Vl8pwaTjoHQuDBrfApgwXQyVaygjTmog7GQeRIDCByNstAXwOmWz4hDjr6Z8mCDpjrQ67tKKMmpcvN7AB1ivdYgu00+fBlXmBtFjFAP52BYLZYzfMSPsfRqKDc4TZJUXkLtM51kETNURwzaVP1wdbvOlianRJggItphsgKFxduzwjXJpLYdhWsmaSfLWGF4tbKH4mOPnshuHLMZlTA5wTl8gNnhsOSiQ6ZbnGOz\/9KBg3u52NTW75C3efS1FLUzPUbNSJZbQq7oXRV6XIkdf7aw0q3Evp8ROg7FDPFfXBtIXPDgf\/j0e+7jpe9hBSCp8DlUdS+zqpMoUTTeqocgnJ0oJYHYT6JzOxCr1NgNbcMItNHQbBks2RibQZlOMA2SQX1hTNlY1A6zN4CoptpmONDqjbSmOElv5dv0FcZHOduGu5KtNVaD+6Dj5+r6Co\/b+Eijz68asLyAiv\/eXaMHc6U9jh\/f3XpA8WdEg2zcwsNj\/hMjC1nYn9qM5VXKIbAe54soUmo+knNn3FaLF6PId\/4pS+LogOapHB+0jSnQWJw+OfmbJzzE\/sUk5yrkeWlpZp1jFIhGjofN0xnfYX7fkyqcVPhwws\/ROX5aM8zJ3qPyyfx4ymhWk2JzzOmQlU5IH4HDr1\/qdOSuvXTuWiaJr8AMmDrXiu8f+VLK5PUCollPYiLpXjbC39JHwg+m6cKXeJmoY6\/7yWsLiEaGhDfRZkEtX5HnrXm6B2cANFxbmslio79JCZ9YQzHAJABSm6KRNHvILcdQehT+GvOsXHGbX3C5528Jd95TJQyQr7xVh821+X5Q3NKCQpEWTG3iWLHOxCK3xHIbKhN0rh1kq3QMTJVn84VC7XXjPu4YJR1rGWdvUywk6WVn2DVOZa8cDu7qbfvrACTK41ue5s+ylP0Zc7lmDu1\/v60jM40W1LWyiqo7KP2A5lVS78FjXkCjp1EQBUOtZx6byjk5fWtR65BnOA+SW5hkdFP9xKP\/uC07PIOrAHuPsJ+dQnV20dPdjMVt3DdnZx7BU0AadKMkI2h+eXKbNn4Jms3QyzXYUgpEz0epOF\/EJSQ8FSUrto8tW+V6xnRFjzj7XiO+lgYkERhjQDB5iwVGn4RrLlCPtLgr0U7LRNoX1TuPrT\/8BRQw9+ke0wL7quL15dJp1srBSY+iovQvm7zk4BSA\/nxKR61HCoB4QkJUylPuqSSJkgQ\/m+TelxjnUulfPBPD1OemEeRHMbIjA2HMzDI6c4wdef6xIxC5VI1XmKq4tSbYj0W6OKOcqk4uwsiqe9CG6y2OIBbEaXxDSpL1uhUmRitafJtu+oEA9R5r3dizATow2N38F1KC6oynU5+s88hu5YwqN+OIOoE\/rerW9QcdrSbNpsJ\/EP78CCB\/jpTjyVOrvzCl0iKTOH8a8Gtx8pqtDBuvFk0t+Nli37y8KGffTvKUtnDbtxDOIozg4UGT\/LspKAS0puk3xYlVhARvRMvfdjVgnMJazHjgQjXcC46gVYEqs6DV1mgrTC9r5ekgtZLW\/B7qOaI5\/nQnIbl1qSbrqqw7EfKTkzeY854TN7Y\/XXtK5+O3LpNJUmeXzCIyPc+vzmZrXbcGzslX6YsHrbIoyIzQ\/C0K\/cnv9Hxqhc3pIBX50PKXSO+zHA+2C\/KvBPkXavKsnUWSzCqsL98CifR22xvKr98UlWwjBvvVfBsUKipK+0mUf8j1ZD9ZQIYzTXeKGrG1WGKHIUzsuRXpNAGo7KPiVGxAkaKg2k\/o+W3Udp+GZD6J8dmJSQOrwdMAH+pJMjCmIpE0eiXioQxOqV7QselBkPvAb+ZHE+d1rxTmsLGKdZQGrj1XXmOvBvD4dF3\/njF7IyfVZDQuZ4j4R0jAjgZjCgUVsG2dbW53\/Jb7Sd5H3E9L1DEDZojYHWUlIiTKUIaoME2E+S2vzrGF0eZDVXr1aV4FMyzLaz93CMSE1OLQZYUA2f5gs3dqv4PuLYqQicR1XSreqb7b0C58yZHlizCSCvfCoYK3YRFNtf+BOU2tX+i\/W7Q+NHeyqROTNy3g0PCJkaWsSjtgWuPQ7vPQbhKH7RIXTO9jzEsn86Ru+KtEKd0FKVEGqP31jzvQ9jeEUY2x2NEPQElK2wWWzDxPjznyInmtIL2acllv9MHnkO03CEy+BCJm+ML6mxSD6uErAKhiI+h7BfHtFQqbN6ZizFbjMeHWS3rAe3nvTs8ANz4v3hffwzgDrB\/8n9\/+kaUH73rASVzdhnr\/yfPlq\/sD3K4Ca8T88JF74ukcTaFLoH0Hy8MKD5OB1rxiY0L6CHabwdnxn4l6QM7TupEZryQwyI6TwZo4hcwGHuQhmRox8AwezptdaTUO756jNYLyZ0CeS\/wos\/PhAPwRA+ci\/3rpyMroaQ947tBCyJny8E6qbjSXQGjgptr1qo\/Z24FrM\/\/cg7wFX4CbZgDR7\/WrAMOmO8LzmjFCP6SpmOZpG1H0zFkQan0Ly1lj7heBx8VIzlsFe1bPbgOCWKODykkQW9a4RBcGdeeMPF1iNL545G47JKZ5JZ5yaTyf1F+hyYJVqg2nWlj6fVk7t7cvPCJXe38tnIQYlB2Jxr2znUvuZgOYLOwRrVMmBYeWIf9OSweEIX8ld1n7CfykhOH\/DQ2DENTgwelub3Lc4E5mclxyj8vIL0bJpQok364ldJAYeBNcQAdrV9adzZHzI4j0wCWTBWYPHmuz0A+v6BGyK2QULx7SdQXlSCQ51mJZ72FCg1leJK6StovrqtJslQV\/MkldDmaJaJW\/u9sRpfZ0c7rKoZaaZCSF0Voey7kO+LtO2XM6F4Rn3CCCmnllyEIzNIUdXhtFdqbGYqY2EkDci02ikeXWUlUYYU2aSvVUE+tqLwVxwIMZYA+Kpho8QjspscxVaMetzTxUBsGH033c+mGBjKHHg5j8hSPWnXkLAxELVObzmKwTVrtp0n6pDs6YgRLzU+fz5qVowmbN4LMWRED\/4H+CE3JZMjicQ48gO5zx1NAA=","iv":"175a56478a38bea6270b892bd98dac41","s":"35b6fa9a96db501d"}

Knight Frank listing in Anières, Geneva

Knight Frank listing in Anières, Geneva