After the surprise election results in the United Kingdom that saw the Labour Party win far more seats than any anticipated and a hung Parliament, British luxury is now trying to frantically decide how this new paradigm will affect the industry.

The primary issue of a hung parliament is the uncertainty and difficulty in making strong decisions. With Brexit on the horizon poised to have a major effect on every aspect of the British economy, especially the luxury industry, a hung parliament could make negotiating a favorable deal difficult.

"Hung parliaments make passing legislation extremely difficult for the party in power, as all the other parties can team up and prevent any laws it wants to pass," said James Trescothick, senior global strategist at easyMarkets, Majuro, Marshall Islands. "The sterling is likely to crash on this outcome."

Hung parliament

Before the U.K. general election June 8, many had predicted a blowout for Theresa May and the Conservative Party.

In fact, Ms. May was among them, calling the election herself with the anticipation that they could ride the Brexit wave and increase their majority in Parliament. Instead, the Conservatives took a crushing blow, losing their majority and giving up many major seats to Labour, resulting in a hung Parliament.

While few expected Jeremy Corbyn to completely sweep the election, the extent of his party’s victories severely unsettled the political climate of the U.K.

After the election, the pound sterling saw its biggest one-day drop in eight months after the surprise showing from Labour. While young voters and working class people were ecstatic, the market itself was less than jubilant.

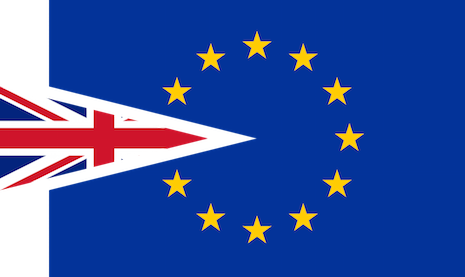

Brexit negotiations with Brussels are looming. Image credit: Wikimedia

Overall, the sterling dropped .66 percent to the dollar and stabilized around that area.

Additionally, business confidence in the U.K. dropped massively. A BBC poll found that many business owners displayed a “dramatic drop” in confidence.

As far as luxury goes, the primary concern now is how negotiations over Brexit will be handled given that a hung Parliament will be less equipped to negotiate terms.

Negotiations are coming up soon, and without unified leadership, the U.K.’s break with the European Union could result unfavorably.

Ms. May backed a “hard Brexit” in which all official ties were cut with the EU, but now a softer Brexit may be on the horizon with more links maintained between the two.

Economic uncertainty

As far as how this will affect the luxury world, the consequences are still unclear.

A weaker pound usually means an upsurge in tourism, as the U.K. saw after the initial Brexit referendum sent the sterling plummeting.

This will be good in the short-term, but over time, the lack of smooth relations with the EU could hamper luxury travel and production, as trade tariffs will be enacted and free movement restricted.

Some areas have seen success since the Brexit vote, including the share of luxury spend in the U.K. coming from Chinese travelers.

Another Scotland referendum seems unlikely with SNP's losses. Image credit: SNP

Chinese travelers' spending on luxury goods in the U.K. rose significantly after the country voted to leave the European Union, according to a report from Fung Global (see story).

Another area that has been affected by the results of this election is Scotland. A few weeks ago, Scottish resistance to Brexit made another referendum on independence from the U.K. seem likely, but after steep losses for the Scottish National Party, another referendum is unlikely.

The U.K. election may have singlehandedly kept the kingdom together when its dissolution seemed more likely every day.

With the Ms. May and the Conservatives suffering a serious defeat and uncertainty facing Parliament, negotiations for Brexit and its accompanying effect on luxury just got a bit more complicated.

"With this result securing any deal with the EU will prove to be very difficult as any set direction for negotiations will be lost amongst all the bickering that will very likely occur between all the parties in the commons," easyMarkets' Mr. Trescothick said. "The GBP/USD rate could once again fall as low as $1.20."

{"ct":"6PfLsg7wwheg3qblG5b+Rwbd3KF70pRsBuAx6d+NueyLqLPUIMjANANqWbPHr06b\/lCzKb3kPEdJN1+7vtSDCuvN0o5o6LUPu+1yXU6S97N7Rl2+jcJvztP2w0ElRF+vyJCx2dlnTa1N2rl6cLKgo4BMRjjcIJLhh8iAoEc7kJUrsBrwg9oOBpduHIKc9DDh5TaYT0hkekoxa7pNx\/KQzux7OHhf594NvosjExbKTbfv6e8rNlbv4+1fVpAQAnDiq62RzO3HuQlcvmA0oDCosjU5Yl2s\/0g3LPYqWVMve1chaANfNuWChP+sRl2P6evZy2llyGV0LhNiT52opB2ZjG9sac87nIM\/dxLrnCQ1au+aW25nFmp4Fm2uYIdqWKWm+5tOccz6lPnstd6NlXpX9pcTEHsvGG9WUR4Cz+Bjm9f2JtXGpoDKt9bE4rP2hJmqrsG5e37eUyf47Ek61gRvHzWZNCNA4cNsXo5QMQrxCLZeRMXoDlL1XbJ47roBhI4zvjrT2QXPnySmHW44ZiXq1YpE\/3sSblcRzCz1TIWiIIzMbgQeclCAihrXIhr7Ec6LY5OB7Lwq3uUiqheHKlnSUNPyioe6bDKjdoodjJg\/Sv\/DkFktrnvATqL7MLlYZ62lZi3nkx9MS8j4K6XrCVDwVFA+BsLQF69Sv8CulTCD23oZPagJR+8o23zNBLxIvA8ahvDjP0xnJaOAPBZHb9QClHxJpv77KBHeQWE5GCV7aafdbeqpDE0lwGfb+6SZpGs8cbFS3BTgFbOMi086OIGXbq9ynnNyIwU9\/DTJKdmgEerHRI+B45LZxJirGOGto5keeWV9\/nLDt60YRmMgIADI5rX4oq9VBE7vLee\/p6XBnj15meB781\/sVwKRCEhxeN+XLDPQ3OJGjiLzDV6lny86xgCyYGr2hwc4gg7f4BClZmu+kN93ikM0r1zTo5Z+pW6LneWY7P1cQCzw7S7zs0fO+OZVEyebxBXA4wf7cKxivcp8pEDpb9dxYbz+iJ0V+2bib7fMdGYjd7VBNR3s1lnvYxynwbUQCRGFjWp+\/w\/\/V2vLOjFMdOfM9OmVMQ6Ir0rIPojpTnYb820wSOg4gvP8tcP5nIwSpYUEoFDDnUx7dAFeROKYw5I7ZihVWQ1EB8HgxF5em\/1iTjgc6RHLcuGiSEp3DA0Zvxyfj1pVO6MiexkhMkHjzs3HeB+GwyahcoyQXSO6XDfCWzsnB6DyWlcoIbNmO\/pIdiseObeAKx\/vWYBOpzNlLUzkiByy35PkE1qsMF8QftmI9X7tce39pBJUoLAtVEHJTA9HOuIDdouNYvP+CxhoCcVNWfXjAv\/kan5pyxAJQZWV0dkBctFTyq6g5TOH6kPgxB7oMWph98KbfpMqDud1ICyoej4B\/\/hTL5\/a04hPcyDkWe6xylokqP7iO1HWBc7wpU0LQP+8EMr1cKB8I8MtgjzAHVXE9j0Ryj+dNLsYpAiFPjc\/UwvzZdv5mXjBttBEVLokmf15p2za8a39GRrkVzoZZpKu4PtcKmegtCw9dxqfzHQNR52PR5VaOXSPzdOapgwHv+XRKX1w+3rMlnS0UJazkOhnaKuax6mh9736yLSGQWTy3WEXFniIqSxvIRQUDz31GaFHBFOeiHytiDjQaNeAo\/JRNOXGLWQCWmNBNdXxIPUu0NS1TJFWuwB56fSopBih6pA7ztbSa0ufjLFvwSF9YF1tmuQfdV6lfkQGmlSGRqAoPaEIXLmamLbuf4EAW0pVGJ7tQihJqUDxXBHdSvrPV3IGp0imbJhfuHqc\/Oderjpi7E79WzTAMUElNzvNwT\/ugAd7dBTNRgvT4Tv6gLU6gLkcdVCSJ8jO2wQV3LCab4KcInxots7AzyKzqIATMEMQXpLHxEA3FIHOYxk4vHCDYbM2hGlZAYCZDIX8K4XnEgWU0Rtiij1ihm26+gkrFvAVexPyt0DWyftJJTJY5ReCGltCpPs+nAKCg1OJkqGz4d2MXjwJnAGRz7EwmPUekmkrTDpzn7l9HsQC1\/z4VrtbSJxY+ZisztHXQKlv1exy6tZDFGx9zRCRto6K6FcWsCw9A593itma16zGUjayGOJhyv6Pc8ce7wNbMBLtrt+MJBzJMAqs8dX5zLp0Ri83yD1RDPrC9SfFAthkUbQJA0t85vxd+srUqbhLCeipmJazWDr2bTJKZS0iquMIJzLa\/R8nArbl4llV72TMzMrETCF5kFfzXJ3YIIFDWNbzOxAqRlLuPHnJORk2N3JadqHQero5LPgH\/kItzGk5HyF2Sxeq\/OBORrhoI\/453B8PmeKIvqGaCto28PNqU2IUKRqQqu5pq\/J\/rW+UJd6SPthgecgpsHBTdPo7H+SZElXeSsT3hctjNj430UHznplWz8irIg2iFSA7In7xQxjraHDngkWJyNAq268Pz6K0O7no5a9X+12UzqFxPONZkn7d8kUjiqGOSpXWVKMJfRY3nHtSP9hS1GO9dLXpu1aecEGEUlli06Ij9b\/3tkYRe14Zbl7ShZfMUdBLFxooQ0XlK6Rlx\/V\/5wuQLRH\/62rIiLq20cVK17MVGeSEYvhrEyo8Jfjc2wuvHhFMtobZvl+Jp7nvynafMGrfKhjv8KoSkEss8SG+qo6cSpDK2ViH19Sm3YRLtJw2HeoNbmKxzBTnOD7fBVE3gkvDVUFJtOvKoEAfd9yGlhhnkpinciWIJStiog1HEAlUQ7p6oGW30DL7JtxHTGEIM88BdcG+eP7CucdwQrsJEJ3enm9B\/oofFlp9BXtizISFCudfd1ohi1R3lwWUbYrTnpravPInNbFvYr8S4pZ3mtvM9GTjt2yc47ex4ybi+yrIEzeeVpzMLFDIJuB1HcceXcMJBqsXcBCBaE4EqL2h+I4LdoeOCB1qKLyuyvpdNbAjL3rMEPP825FB+u0kV9wbkbzUKhTGWvCIQmwbP9\/E3382EGeJqfmlQD\/ezoB0AbFOpqOnQshYSxHvSmo4plJb+h8kN6inKx0wA7KwJgwkSDVPkLTyV395AdRYsCVsqzfSGbM1lgNzwKse6prh2V8Gq5Wf7UFDDyCwrb0UDt59Ukd+Xxh\/jaGR24x\/Rn9qdQ6vsI5iRp7EPUHTxEQVagg6NXczYFL+LnnLfSoekYUsFvp4iSozv+giCpJLjpT7oxxTuqUtcwS9Q3IWRGQOI9UwZ4yArT78JTWmCA9bxwQvXvXEsUK3GW8pb6d428ah1krstAkO57jOLfEw7tZ5QOOkgW5yQ2ldx\/oyfjKtJFtX70iNsmEmHtmwI6ZgQCFIbrgHZQPs5c4XiaEuJFr0wWT9P+2NvrZOVDMCeSOkZ1qmFtNgAzBNGK\/QKJ3lAwiYEVfwrlF1k4ILkjfPKvMmh\/IGkx\/QVURlyHnQM4vGMxXXrJGRqHjsBZWAEYLPcZqabAqSMSOh8\/rwxk4SAcl9rVMHtR8SCmrBTXyJVP8Cspecv46wCIr65FLrbczgo3M0iF6dk0CxaimoGPwokhWFuvpfKX2h+eCFiKwSm2fLvCrQLKD+xCa3bXPegHlQcGkpejvzh1cqtZzTUXbz10QfoviGt8mQgKKFHFtlXBFQ4JCe7QmhQmO\/C2p6Qf5QAxxvNai3PlcOrYEbaAUJTXvo3cu\/ej69TnedoWuFttyzgchha6a\/SXakAgkDNIXSZWPDx0bl8N6qMTduFoqAQxd+fDH9aQxYvEUIrZ9RBERIQ3GE4k2muMDTO0jal7ewA3lHDhbhcwoASeve8fKcSHLHPEP1ugJuR+igElNGYZLWepVxxruQASIsHSTZE3ySAfCuRfsbR37MT4XRs5Hf1FuZPMzeu5S74R3JMU9pnbKB0rpfLA7jMcsYBtIjJnYT8mYBmWIOxK30\/xFHugRSylF2ZWCbvqu8POmIw55Aee+6k\/9vBVS2CPFWUJYdT6vdhHHq8NpTKqGBEt72MXZsWDZ0fan9SNbRfOE7+jxcGKW9zRifrlWYxAwvUspec4pbIZW8dFw\/IhDUQ2zeLtXJAQK\/doNizPhqLvESPmcGOso5z4N7W9AH1n3wXncBXn8XRlIM2AA\/zSAWH1LbcEm8m51NPsid5rvPZa+KXBf26lUFpLoPs7gIXcMg0HyBUDq2uqR7zjsJK6FBon35vOzT3LVa9tPe8a4liNzNlEPyYmNwKxiCiiVL5TXkdlmYvSlEbeg2cvnYJjhXjtd2lPqLmeZVW\/hy\/31NQQdfccP7OelgxsCBCMIZcRIY33jmt6nZ4D2acYNSr\/YVLMh4i+zpm8RPvXxn+ZdjYDWCfUPUPC1zmhcNC3lTSF9QfXKBw5UdQeJij4cGHVDHhODgrwdoWzk9wxDgdri0FA+AJc9MTBLeYMFD1UIW+Matj0judUEhxxuo8c7Mk018k8gBDySCv255Db+txBeAsfmoi7I3Od+RFyrq6a5aoQoctf7\/jxXpaWmC08h6eL63ReA9QQcrdKfLKgpFXbkqmJ4b6NV\/FmOXLkMAPz5FrTXbQcGR34rrzckQes5xWuwvc08Y8eFNbe9dM\/RS7gVwyC8wMDWXBt9EejcrrEawdjFRtIIICMPizHK7HHCG7ID32JNwaCrqBuv8T+MwQhN8QA2VtLD8KCWT9uqj+AEItBeaRK0QuQDxEDdQ3um+7wORlVZzYskhNQmKZep\/AKlto3hzCaqtgCggKOnhNnFUblmZo6bdbIXqMBV21rC8IePGMpj71LOaVhIGyAin4V2UprK1y45C+0eByIKtA7r7qWPEZNhA9XJIzomM4o8dz7gYMooaVx3VVp0bhVeIthFYQqBfHLhoZ+Zia2lDINXFGIozvhq4caIVLz4kOyJThr87\/Zk8YSeeGi\/LT9jdUApTVyAnC2UN0qS9sGV5ZLyoPl\/E8uC\/wUnHm71YPiAHIJ1L0F0yYxqTn8G5P+OYEwvA1jvHN61YGpa3BAO7IJbpmTtDdBlK4HjeNlb2h3GrIZWO7xcCal5wKaI6DzjAHs0tkfylrH7WRz64WFXbv8WoUsIXcymzu+72tjHhWnXI\/ZbcI88hFXwUdWa8iInZLAEkGfzppUZ3m3aDoCC7RcurSDx3jwzwaFcQ+T6puOG\/tr7cXKRMOfFxJHdgIgk6i8JEHho8U3Jh7gvWhRGrZ3xtPLPNzulL1qxt9YTbLIpHq10iiGg9drI82e77GtMcNZNIbP\/aNSt9u8qtG2CemGLzVIXutrvaqo9z0jrmGVNDmKSYm+bkaReDyr4QTdfKneKbbzN3mE8yzaQku5uOuhAVTnvIN4QwzZvCAWpmtdQXui3MJZ2d79NS8ZWlM49UZyllcqShrzFIvCF2ugNSewU2TrWZC7Cqw\/qEeKHN50xq48UKyRaIY+fHxkGvjUKVUooQ+sYEQt0KRgfpnO4lL\/bJy7MQdhoqroiM1sbOTwn\/qAqg3X+x9WJBrsx4Oa5QLIL\/VS4JfbS4sMk8CYUMjSZsSzvqfd2XfKmLi0bv0IN710W5yqc741nUz9HA+U4XmG1+zAfzG9JhETX8OJFTMZ6IcIoZhZSqCwccrZHdD\/Dsmc+zEIhWJdBB1PVbRtgs+hkM4pu7EMn2Ahl5etpesy6c5s3PKlJ548Ud2EssbHhEzCwQ6ZOuV9\/JNotR4OfIgBBPIf3WOofRdy8XNBEp5fbPVDJ7samGoiuMd3hcSr8KGrWrMMZQRBQYPukey2rzXkaG3mgW2PCUVAQ2QLOnPV+GSK6my9ZJ+km7r5qHINaS3d1VJ9ym3AOWsTqwuS8HHseEbMKzqDUXc8dRA6JejsRs0LEUzZRT7gq43tFxEQiZ+CseRHkqio+JNGkqyzbPmY+DteIGnjBIHAi3vmSjxPj2wziUdyc97+z+eTeb1Wz9OwC8snj6SaxshfqG8IiUNxj3ZMY3JXL2sOL0nF9ZxhTttNaxemIE0BzfM9U9yXCbv7jaCCeZRSQGK3Eo01UT6oe0pBzGeuU8avPqM6hv\/\/AoJVjVF12HEDfwOZs0QWyEh5Wv85vLyzHhq1SZcqQr3NvsZvBNBF+qk4fanFFyjh5mZX1dzzU\/jFDhJgQrcHLxOeBjJW9Umj7BXCMfgWeoreQq\/qQD\/vDLY0WllgHhuwPtVsUHkvpSVPINCTK\/2o2etjneYnKOmMDxgr0e6p7zPbzs3nxmfwT6xlJiKRB9v34tegIGnA2tqprDaGYpkq5G7lLleUnBP6LjPUx\/B+XcBzqCFCf3YgMk2tskFjQ6DXeXCsKcPZzq7MD7yQrfgx9EDPY8C6GdK7N37QCPcBSTtDNqIvChE6+pyMEYRYDqa\/OX+qb\/J6ESNNqCkJOXeZs2pPrLXOXN4+KlfFvLeU+0AusiwF8n+RrW7rMuPXp0ht8bqyM5T8VVt0xgarupAa7zvNpEapFVXj0ohRIM7uZyrvhODzPFTJ3NEuKUuer5\/7F1iY6i2ITeEZYhO7NcrnztGdu2RE6bCId1XtUfWzv\/7GjEhNI7KkP8zcszGcARDWLAR5xs1ayl4g7TcV0XNrk8PoWuYk6y+58Q18xk7UiWfwAMu\/wO0iDqQ7W3O+xADggdMdieCKEI31ZqUJS1QIkoCekQF+OW3mCjDnFP0TsMKMZ3OiOuPTPTensD4cSZoyZmuJG4zEbvzv+LZR9NTwRxo4KyUsnHJrG\/dAp298RfIEMl\/FpkenZybbjBb2RdVGJo4xHJm9QbNdT7rvJrgca2thRKPHIoQt4SiyW\/FegESqfgNCPYsBM49jtjtQ+6uSOHttXuIbIIw8J4vJelVGEhSvOyLQc57TaFq4JQlIrVVyrZQc6+cIRKT6zbz5cE3vS2Vu7VMvJwlbMCAnfJ35rTVN7Ciqz5gNLIKgQcDWp4eVy74gT0enDo+fsvF7IML6Ot0Fc9WFfKVml+hLMEfv4Ecy8+E3AoX3sFq8y8eY+i7ohOU5\/xftDp16ekmTpYXrt9FF5+FmY5Oq11NpCQfkCmRFRkwJxN4QZeDxDdkU58y17X6MldsBCH6BKrX6YcxtmfC2gC\/7cTweSP+9whFVB6\/gSWjgw7CGQv49oBjJNzSoYkItna+LhIwYRnu0y3HFwYerJ8jXC7nCf+FXM+ovYUGYT3Iw+hVweRLhXs9QNJbqLtiWVRoSH5bXG0bAZeiMmPKYGKIcDF0UaK8tek02S8TkKUbR5vv+idwhJm\/EX8xkYMAHneSq3thJQfCNHWmMp1JW\/w6HUeE50Z17w6UPjzIXHJhByMF00EA+xAfNkVNGSltwrBV3MHJmJfbtVkXKhewnFsFPoqBkTV6ago6SD1G\/Q2bsr5xqM=","iv":"ae0b3b806acb95eefd3df63f328e821a","s":"b9aafd8486dfa6f5"}

Jeremy Corbyn's unlikely ascendance poses new questions for British luxury. Image credit: Wikimedia

Jeremy Corbyn's unlikely ascendance poses new questions for British luxury. Image credit: Wikimedia