Commerce is in a continual state of upheaval with shifting consumer behavior and values paired with rapidly evolving technology keeping luxury retailers on their toes.

Younger affluent consumers, who are coming of age, are now valuing experiences over luxury goods and caring greatly about sustainability. Luxury retailers are learning how to tie these themes into a market that is also being highly disrupted with digital commerce, social influence and mobile payments.

"One major theme we are seeing today and will continue to see is intensifying volatility, which has become the new normal, as seen in recent retailer earnings reports," said Farla Efros, president of HRC Retail Advisory, Chicago. "Another critical theme is the changing role of the store – given the overall decline in traffic, the store must change in order to become more experiential or more service-oriented to redirect shoppers into the store.

"The savvy shopper is also much harder today to outwit as they are the always-on consumer, who is more sophisticated, more technology driven and harder to predict and is becoming younger," she said. "Technology and speed becoming more agile is also the new normal in order to improve innovation and responsiveness, quality of delivery, as well as speed to market in regards to the fashion cycle and the pick up or delivery of items.

"Lastly, competition from online and pure-play players is a major theme, as online players will continue to push on bricks-and-mortar stores, hence the need for them to evolve."

Avenues to purchase

The methods in which shoppers can now pay for and purchase items have changed drastically, trickling upwards to the luxury sector.

Luxury brands and retailers previously maintained their status with exclusivity and quality, keeping separate from the trends that shifted standard commerce.

However, the pervasiveness of digital and mobile made its way up to luxury retail and has forced these retailers to adapt while also maintaining an experience that feels exclusive.

One of the most pervasive forms of digital commerce that is currently disrupting retail is conversational commerce.

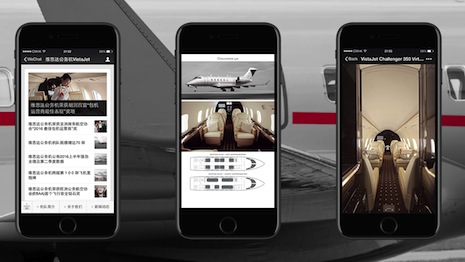

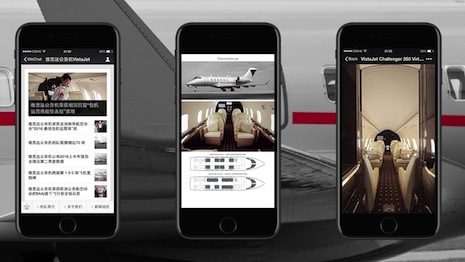

Chinese social messaging application WeChat and Facebook Messenger are just a few of the channels in which conversational commerce has flourished.

While China is miles ahead of the Western world with conversational commerce through WeChat, some of its innovativeness has made its way to the United States.

Negotiations are underway to make mobile payment solutions WeChat Pay and Alipay acceptable in North America, which would make it easier for Chinese travelers to purchase overseas (see story).

Retailers are also leveraging messaging systems such as WeChat to make an omnichannel experience more reachable and seamless.

Swarovski's Mother's Day WeChat campaign. Image credit: Luxury Society

For instance, LVMH-owned travel retailer DFS teamed with beauty marketer Estée Lauder to transform fans into influencers with an omnichannel initiative.

The #BeautyAllNight campaign May 1-31 brought together in-store activations with digital touchpoints via WeChat (see story).

An omnichannel customer experience is more important now than ever. Consumers are interacting with brands and retailers through a multitude of different touch points at various stages in the purchases process.

Retailers need to anticipate that to better serve the shopper. Consumers do not think in terms of different channels, they only think of the retail experience as a whole.

Luxury retailers need to make sure their digital channels exude a high-end image, while also assisting customers with completing the task they have set out to accomplish.

These retailers are looking to recreate the high-end shopping experience in stores online, with many going above and beyond just the Web site look.

For instance, JD.com trained a special team of employees for its JD Luxury Express, which will shuttle luxury purchases to consumers’ doors in style.

Designed to more closely replicate the individualized experience expected from bricks-and-mortar stores, JD’s service aims to ensure that luxury products are handled in a manner that reflects the brand (see story).

JD.com's white glove service. Image credit: JD.com

“Mobile has become the linchpin of a retailer’s omnichannel strategy,” said Raymond Pucci, associate director

of research services

at Mercator Advisory Group, Maynard, MA. “Smartphones are ubiquitous and consumers expect their favorite retail brands to provide shopping benefits via apps on their mobile devices, such as seamlessly browsing and buying on store Web sites.

“Examples are ordering on-demand services for ride sharing, short-term lodging and online marketplaces,” he said. “Contactless point-of-sale payments, mobile order-and-pay, and mobile self-checkout are also retail features that are gaining increased adoption by consumers who often look for fast and easy ways to buy.”

A report from Forrester Research shows that mobile will be the hub that ties together the customer experience with a variety of devices. However, only 43 percent of brands believe that mobile is an enabler of experience transformation, and the same percentage are willing to spend to make mobile worthwhile (see story).

Online vs. mobile vs. in-store

The shift to digital has substantially affected bricks-and-mortar retail and has forced many to shut down physical stores. But this does not mean bricks-and-mortar is irrelevant.

Digital has merely reshaped its purpose.

With online shopping becoming so convenient and having numerous devices to do so, luxury retailers need to work to be sure the in-store shopping experience is a luxury experience in itself.

For example, London department store Harrods launched a series of in-store events this spring and summer geared toward socialites entitled "Social Butterflies."

The series celebrates the British summer social season. Events include talks and parties inspired and hosted by different personalities from the world of fashion and luxury, enticing affluents to come to its store (see story).

For a more luxurious experience, Swiss skincare brand La Prairie reimagined the counter experience with a store redesign.

Consumers visiting the La Prairie counter at Galeries Lafayette will enjoy an intimate consultation space and can interact with a digital product experience table. For added privacy during transactions, La Prairie has added a Mondrian-inspired divider (see story).

La Prairie has debuted a new selling concept at Paris' Galeries Lafayette. Image courtesy of La Prairie

Many consumers are also using bricks-and-mortar stores as a showroom, testing the product in person before purchasing online.

It is no secret that luxury retailers and brands were late to the ecommerce game and many have not updated the in-store experience.

U.S. fashion brand Michael Kors is one example of having to close down many bricks-and-mortar locations because it made itself too available and lessened the exclusivity of its brand.

“Luxury brands that have sat out online have started to take steps toward ecommerce,” said Bob Phibbs, CEO of the Retail Doctor, a New York retail consultancy. “Traffic numbers are down, but many haven’t changed their store experience in years.

“Polo and Michael Kors store closings show scarcity is still a huge component of luxury and once you’re too available, you’re on the discount bin,” he said.

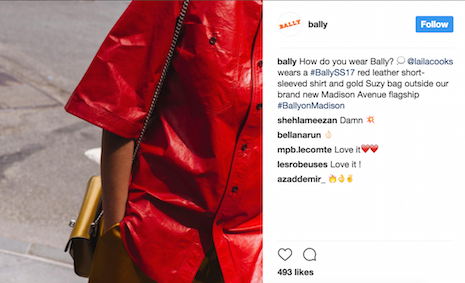

Influence of Instagram

According to a report from HelloSociety, luxury campaigns perform much better than mass brands' efforts on Instagram, with a 30 percent higher performance rate (see story).

It is no surprise that social media is a major driver in terms of purchase inspiration. But many retailers may not understand its full potential.

For instance, Lord & Taylor partnered with 50 fashion influencers on Instagram for a dress promotion. Each influencer shared a picture of her own interpretation of styling the dress at the same time.

Beyond getting more than 1,000 likes per post, Lord & Taylor was able to sell out of the dress in a very short amount of time.

Luxury brands now have the opportunity to reach a massive receptive audience through more convenient experiences with Instagram's latest updates to its shopping feature.

Luxury branded Instagram post

Instagram rolled out a full version of its shopping feature, in which brands and retailers can allow users to purchase multiple items featured in an image through product tags. Luxury brands and retailers now have the opportunity to reach a substantial audience made of affluent and everyday consumers, which is vital to these brands.

Direct purchasing through social media is becoming more prevalent, but consumers have not adapted fully to shopping on social media just yet.

Last year Twitter scaled back its buy button, alluding to a stalemate for retail on social media as consumers fail to adopt native shopping experiences, although Facebook, Instagram and Pinterest could still prevail.

While Twitter is trying to establish itself more as an image-enabled social media platform, its consumer behavior is rooted heavily in text-based posts where direct purchasing ability is less likely to flourish. Other social platforms with heavier focuses on images may be more successful with buy buttons, but dynamic product ads offer the most potential when it comes to retail-enabled social pushes (see story).

Social media and the rise of startups such as Rent the Runway have spurred a lean toward a see-now, buy-now experience.

For instance, British apparel and accessories maker Mulberry is the latest brand to consider a see-now, buy-now format.

Mulberry announced that rather than have a runway presentation during London Fashion Week this coming September it will instead hold private press and buyer appointments. Collectively, the fashion industry has grappled with the see-now, buy-now behavior of consumers who want immediate access to the latest collections rather than waiting for the traditional retail roll-out months later (see more).

“New digital retailers have had a tremendous impact on luxury retail given their array and breadth of selection, and they will continue to do so unless brick-and-mortar retailers can evolve at a fast pace and push traffic into their stores," HRC Retail Advisory's Ms. Efros said.

"Consumers are driven by the need to touch, feel, try and build an outfit, and that is the edge that bricks-and-mortar has today over ecommerce," she said. "It’s about the experience, the outfitting, the ability to be altered on the spot and see and feel the product in a good light, as well as satisfying the need for instant gratification.

“New retailers today are creating noise for the traditional bricks-and-mortars given their ability to be agile. Bricks-and-mortar stores need to garner learnings in order to reposition the role the store and the experiences that customers are looking for."

Going green

Another major theme pushing through in commerce coming from millennials and younger consumers is not in terms of purchasing but in business practices of the retailers themselves.

Consumers are becoming increasingly interested in sustainability in regards to their purchases. Many want to know that they are either making a positive impact on the world, or at the very least, want to make sure they are not damaging the world with their purchases.

Retailers that have embraced this are much more likely to appeal to consumers and to create brand loyalty.

For instance, French luxury conglomerate LVMH finished off Green Week by sharing the details of its environmental efforts as it strives for sustainability at all stages of the supply chain.

Green Week is organized by the European Commission and ran from May 29 to June 2. LVMH was one of many companies participating, and the group posted several explanations of what it does to help push toward sustainable goals (see story).

British retailer Fortnum & Mason also partnered with artist David Bailey for a window installation that benefits an endangered species.

Each of the 400 bronze tigers represents one of the real 400 Sumatran tigers alive today

Mr. Bailey created 400 small bronze tigers modeled after the real life Sumatran tiger, of which only 400 live in the wild today. Each piece was available for sale with proceeds going to help conservation efforts of the specific subspecies of tiger (see more).

Also, online retail company Yoox Net-A-Porter Group ceased the sale of all merchandise containing animal fur on its multi-brand sites (see story).

Affluent consumers are not only interested in the health of the planet and society, but also in their own health. Wellness is becoming a major theme throughout retail, with many luxury retailers including health initiatives.

London department store Harrods embraced mindful luxury with the opening of The Wellness Clinic.

Harrods’ Wellness Clinic occupies 10,500 square feet on the fourth floor of the famed Knightsbridge retailer and was founded on the principles of integrative beauty that combines aesthetic and holistic treatments designed by medical professionals to promote wellbeing (see story).

Similarly, Saks Fifth Avenue added more than 1,200 fitness classes to the available in-store amenities at its New York flagship as wellness takes hold of luxury retail. Located on the flagship’s second floor, The Wellery concept shop is a first-of-its-kind space that offers Saks consumers immersive experiences dedicated to wellness (see story).

Top luxury retailers by country:

United States:

Barneys New York

Bloomingdale's

Bergdorf Goodman

Neiman Marcus Group

Nordstrom Inc.

Saks Fifth Avenue

United Kingdom:

Harrods

Farfetch

Fortnum & Mason

Selfridges & Co.

France:

Le Bon Marché

Galeries Lafayette

Printemps

Italy

Yoox Net-A-Porter Group

Hong Kong

Lane Crawford

Best practices tips from industry experts

- Farla Efros, president of HRC Retail Advisory

- “I think the top opportunities that exist are the improvement of customer engagement and channel experience, the omnichannel integration, the continued digitalization of the value chain as well as the expansion into new services and experiences to draw a younger customer base. Bricks-and-mortar stores have the opportunity to draw on the fact that the younger generations like to go to the mall and they bring along their parents, therefore it's building on that momentum and investing in the right mechanisms to build a loyal base of fickle customers. They need to use their online capabilities as a way to draw customers into their stores.”

- Raymond Pucci, associate director

of research services

at Mercator Advisory Group

- “Mobile has become the linchpin of a retailer’s omnichannel strategy. Smartphones are ubiquitous and consumers expect their favorite retail brands to provide shopping benefits via apps on their mobile devices, such as seamlessly browsing and buying on store Web sites. Examples are ordering on-demand services for ride sharing, short-term lodging, and online marketplaces. Contactless point-of-sale payments, mobile order and pay and mobile self-checkout are also retail features that are gaining increased adoption by consumers who often look for fast and easy ways to buy.”

- Bob Phibbs, CEO of the Retail Doctor

- “Too many have sat on their butts and allowed sales staff to literally ‘wait’ for shoppers. The passive, ‘let me know if you need anything’ or generic ‘Can I help you?’ are still too prevalent in brick-and-mortar boutiques around the world. Online is about product, bricks-and-mortar is about customer experience. Don’t confuse the two. The luxury boutique retailer who crafts an exceptional experience that is personal and different for every customer is still the goal.

- Fred Reffsin, president of Brand Growth Strategies

- “Brands need an omnichannel approach. It is necessary and essential for survival. Consumers do not care about the where as long as they get the experience they are looking for and feel they deserve. You could argue that these experiences and ease of doing business is better online. Bricks-and-mortar has to return to the adage that retail is entertainment.”

{"ct":"9vJPdqgwK0hSactMIQi7r2txEBKJnY1sJeCNtYjL9Hbcq30MgDkZwu909xsQouu6KGu+rCDSAu97bXwG2Pka24V\/nTpuDzeFa97sZpVS+z+spgZR5IYpo1P2B2aY6mY3DI2j01GVS10XQFkuJzb+rm9dVGDdo4mWFBWxlyvNPDqgqHoIZ+f7IyiwwIj9jfdMqxZTZgR\/G6n4bnqsLwWBOx91ShUXAv+xKbCiqf9FX8kkxETLutDXKQUYzphi+4crGnk+lOPKRg0hy3pbDMQJQRy+tuYJfwyQp7iMbJLtv1RhWLJUutumtDskdL4gz6YKq\/dB5eY9QEjNlfebLh4PbTCXcvwwu1gXg8k1e+L2v3yE1uznFfZHlnj5vbSmqxeAzAtDNxIxesLVoySuIu3DpQCI+qHIxblZljL6KNYCRBkYN5pic1QAfzrCJXiz0NcmWThfdYHC0zdtUdfcqVD7ofIz2YwYz5RFe6\/7\/ax9UJWW7AQ8t2\/qnoCrO9jv9EezWJDuIOVPQv51zVEMCYJ5+XF5wZf3avHH7ZvBkYVhKRt0IAnNAMUKk9z0IrsLrfpYjMTe27pj\/FabYxBboflwP1Plh+18Xgiyn\/Nkn6gY78cQOJlIBEmVJcdjRg5RkeaT4Z9GhUTdGrWDgvs1wIWhOtVlRSS\/mDlU1uqp8hSkReGGYJ37HkN0AbS10UbqGJytq4Djygw60+2l5MU+nMXzMVkXR5SA8sxq0mV4QlimzOApvSE8YB\/E8MdcDlmiwSbqnjvD8Jfbl4X0g\/\/\/6NXf\/N\/iHKo\/Tb0oE+twN9HOvCX2ZV3CGznp7TSt+RXVR9R6DUSbap+DlxDOjUnXsTFfoNNLA1ypi3IM9AKZVXSRjqhasUhOUfCpY2wZWgXvQJ5NmnXhOcH7gXiSo0v+8G\/03kxL2\/7grkDi67qG\/DSClj7tqZ4zPAH\/1tU2ziGrWbVPFfLYKt24RMJ\/9Sgvpsg8\/OZH1WOARD505JHWy8mZYqqkpFEDi8OFlB2wbAm2mADuIhZRIEqqeTZLQ2uj6uPaZU9JBRJSK4NjGne8lSxQC4QAzukf8W7cePIXrK1nkU70oCU4u2a32VV8g6O3YM172lU\/rEH+qHTks6F7YWJ6JuRZ+a9bUttc3ukAZ\/kcxvx8ZNkTN2w1t3vQ3VJ0QRb9mDget5xQa1kXA9pFBmwhZ8nZd1J8H6S\/5au5I8yEqzKvP4Zn92LSEvrVVnsC3ajrhTA6ix1kYS0dTAJgLSTlE2d33O0+ffFyikcldTLg8jvCQ0cNmQQbK4Ndj3IeWe+WgKXf\/nOSVuPCwwlBQiiL17rQyhANZQZanJ8oX0XzxtFqYZrbTIBG+3FTOU0mAV1Bk2HaloidOgA46wGXWR6Xmg68NmAXKlCsSB1\/+Cwob6qFZ3IOcZJChfuGbhUDYefX972oKtbj5K+GMq1B7pECmPIGlf5+w9YpV8kEJZ4UBvzj86SOfKV4rhuuV6vbtzsl4Tag5+bJHaX8J4AB7TCx6hWjHCD9YpnMP3811LIfq2fBM\/R3o3AOW3rt+FbCy2NP9RcNPL1iTnDUADzMf7yf4HeuzPVrPZi4UK3OxK0B+b4WmmPNUACGV\/ns2gPIe0VWLFhAl8BYC5CQZAdAMBwke0sblfIlWj3CAWEIyaUsjauQNim8CJquS7ejvijrBcQ20wbrQOTiqJ\/HsyagxhL72ayBvJQehSjrKROxep\/p8GqedF28\/PZH39yeGQtgo8ZuSPS3EryVm0KZsnzTCXTU\/xsFAsuu1RP\/aB9AYR3aO\/hIYYAyw8QAuEs1UHK0Y1FzJRXHs4FQxCX0ZG530hupoWiTgv5rPSPVO4BBiTNjmog33BlevDiHln\/zNvRGvm8s67UA\/\/2VS5aN4DtZ4HanTD9ag92gE1qmvufLlzAUVru6OMw5EzxY+jo6ubRPSjr1mVJ68rKx0fbJYh\/NHbvyKoJkQ2t3DPfYAZonZPLrXgXbTB1c9XdUUAOBxGweZalsEwoIg+wlg3htGIBwaL+8GQ5ZiC811G+lJvnnph89RGA\/o5MYT5weRqSyvGjbC50br4AJd+oCgUfm76zrdiQQQ+qqLTHuz1hAhlNzDyGLCs0YWksBcNe7cuuSf7nhtkuhHO6hINainwFgCiGpC6J2FOFHpyRIOrvoWZLhi5BaVN9goYCAXHJDNqNz3ScPwPkidxXyHD3yEpCM2gLkfaryTB40y8grozjbef1\/xpmfrtL49G5ByPuueexobGi1jlgyI7PkQt2KberfAzCWN3Z0oPTnM9G1v7WfA+7x0DdRsJ7laHzv8yuDVeMHXJYWYU+VabzIQwBZPgmftNAlA3OiQCRZo81k3klqJXHCRyXkfLfHKHo5QEtolsoxuXGWCog3RBJ3gi9Yjp2\/rKnRLpiQdPVyZ7bFSB9u4\/3csBsI5AteWxB7M8b9L+IN4Ngztu5ekwHdwjQ1731u7WnuaB35KK9dUmEhCDJzJILdi9UwU3QVCoOsSbkhDk7wSTRdLh+j8N8371bScXD36\/G+Ef4KE7V6o8KiyrhYEtH5fb4IhU7vThMORc4prLmkPgXs5PJlqmsrLC1TRgvZgy5s6Vp3BUQDNx09tRijbs\/8chrUHhpeb7kKaCn3wGP2SoZI5JlEGpD4PDM5srj9Uf7VFG0e36003m8KfD13k8OwjCqqQAStudnKQwdaJDjPZOuZ1vGHNTO9qGLaoA23HDul6vbIEqRtjZPy8nktE8pKE7VhhdUyKV3ime8d3hXkiOmYEAub7P2IiGOfSeTLBHQqiVXCWc\/JkRQgNar\/ID5vVYDFT\/ukyyHkjITLReHH1fUv4e0mb+imBJUIUN2Js+t3DPCBFSwn\/oPzPzJ6iWR1D5hTWvBREW1vCdVkvuc3s0D63rq84RBj0pOLrVXkshLLgsKi2tOs5o6IpYBRoV1OFKC6OoaVUIAkGjGilHRKBnmXmVgQYwxZ\/xq9YVS40HflBLvZocAotfsdNSBmmhugA5h+X4RWw2PkXkA45q2zjUx+UoZhN5pmbB4TOXGh+u8vL\/oIUpFAh\/v24vTU5mq81UenVI6WAe0\/fVyRtPbGteLpKkVs7Y+OwQo7bEY6q3bzCy9Igd40MKXBnlUi9ETboYeYVhQmGXHIUyjp6wQgm9pd9jxD7Movyb1b\/qy\/yK6jqCvvUsfGAyDJB1t7UiR2ytdUmV23ca1BJv+ZIsS1xuaeGMamIwDTm2QudzOKkSexyQdpl1QQsmbI9sp18aeTiBvKCrvUH5bxIBnYSJgMYqOxtkFe3kVKyk9pNrSxFnCn5rrblH9ZGqathExNs3HWX6cwNUO0oFpwXoWm+Fxl2G\/nrTNYihtisUqf1mXNT\/vmAc7OtQey9JVz4VgDk3Jz4GRs5kK9RgWKbPsQ\/OEakqk\/WyPqmLDMP1N7+SQwHXWOZTT+e+jLk2bjCESLi1KWiB7f\/ZHqs1+fMkva0rYQ\/sx6d3Wkfz+uR9jBkH15h4xO6XjhVou+2Ftr4OhUebet4Th5CmBPgZkX\/T+2Y3XtNptVsjzbBou6jn2UiRWsLXv35mRNxNkq1s9nieuebULxqmJMl4xB+\/rPRxqnZSbac7sBjKjppKfNAApcJe4+zyNGePyq19KCXJKf5\/iCcyKH5kKMQ+rPdVstN+l\/S\/63itCxkjH4KJgR5ITp7Y+tIMpICcUOQX1qiIIBV4oPQbjIQPCuzYfe3s1u9NdWKJTm7Oh8i6HHtvEXJSh+FaCfYTSDCtI1zevoZU1AQlfGPL+No4PX1XXWPpQKqHBh3rvILUHMrF6ukokQPYzEERKQBMohiRT\/rL5g6jOAMP50RWgQvmComidaBQAl50eXQXwtPLRHGhuf6fi+KIQ0F939bF6IJ1gEISvSSKW82w2xtT1VY8kk5itmOq+V\/IZtKOwgsqp3TUOXU25SwC0yWh14kQH6XjHrFJcP0tpEpaw2aWhmWQ1HtuohMdXUbI51CFp25i2V8pdZzz+i42AokBkJIOOplfX3crjXrOmEkOC5KsTaPozqRNj54AEnAzIOahwuKVQYkUP1cb9TiB6EO5exVoRQNpRGFSqQdRdjxGd\/ixyQcGKo9SnNeI9D7gDwK8Pg+4wRWvozz1c4JgHW3KdDx0mpCTJh\/8vcYYwWcqcTViptQ\/8nG+lmuNJEM1RbidGCgrf5mSaeL7e1LfmMOW\/CzxXasBRb4xyPcmy6AHrEjTwhMUGoHs26DTOCaHHw2daOtuuTx82WauDTlMczWfzb6DcqPaAU0UWfl6Omb+7QmcpCcbyS\/ThiioZAEqxsAna+bzyKArnVEpVTutvGJWV\/puXfrlBS4JegksUDq+cyZgkS6OPp6dHh\/V\/ObVhGAZW3u6BPFxTbEqLoWDVpQpDx3ArH1GQHftL9v2uinCFzmDNW9h7AWZEKxUWmKlM51vkyHgpIFnDFtmpN5VYWLTwEIFR8U0CO2AusoKb0K5Z+mMaWsnOEjQP80oH5Of9FY4b3INM+84EJsbAHsoxNSHkV9mpw0q2dE20jzWtlnbFT0rH4IcQMOXTLt1cbTqjsArtS6bio21JJm36XM6TE5IBsYWJEbYh9RmEtyd35IIzlDfwT3PJfxDzjmvezI4HgBvOmmkbpTjGsARe\/kQAUITIvTuiudce2qRUdRTkBcul94wIubsqFv4qz91BHYHqe0IuELTsIdUI82zUu0b86jsi9RX1Ubz6PptW+nu+U3aEADiqyEOFM3hyrqGuEytlEdAD2dCNR0ax7jaxFcGZ7LlHp9QOTgoSOJoHsGlE1qoZvUTx3DOeUMmaJug4IyyxAyetjhGItzUJ0Au1C6hfk6cj2f7+YSwUrfPCA3CTE5Bu7iMkm2Uba7zJX0BHbW3C62hyCWLm7WMCvtyZ7L2m6ZibpP0\/CAGrCUdA2WEI8ndmDmEmhjFzR6OU+rNo6UDNx97\/x8S5AS2zI19uBdTquLCQTb5iPbvCDLW9DaPPrtfjQXc4IbMkESi\/vq+GDJ4DeQJ+IIOistZcr1kBUXhyQ5T0GeU68+M7Yr1AGPtQHBgbiLlJRA3xIWTEsWGRKqWc94DcwXYAKLtQvFLtB2i4jiarP2rCbWoB3J\/saxeJTGRvwrVLGyQ\/uidPr\/PzrO7+ZDoOZXQgHBNTHNnnxk+sRi4E0onN8Xt0n\/mfXNAhLXaqXJv2+F5MxyRCQHCBrHP4PnBapZRstImnF1R2KHZ0foQePsKUg64wlIOTCgKo1AhsAiI8Ix9Ky4YmvZjyUEsd4gsuB8gvZRB18Lzvr2cKzm\/+Or7jXDVSix2WMDdP81IaeKSHskMWeYOclLRTfl7aMDutI4ZcN\/hRVL0F\/u7HH2N\/Und0ymvqlUTB9PpXna5VYEMr+jNdXlEbQWLbo\/o\/thx5Sz1ri7QrMfeWvwhmdl2MaOkN3Liqy5B4VWdLxW8pb7MH3eehUzquMFd\/S66xsYVbfb2mttQBgbce5kswUXdaoy9\/iN84WKaBTxZDKeB\/jrDYsvD3ckn3vrV8SB0KpUKhjsh7TcK0PWI1xfc6cHy3rs\/b6xO1G4uEHRZNBFLQ6Y6WPLScamZfFDRQbE60gNb6PC011+n3bSga74PrtZFhsv8MmGM\/6bRWOFdsI0CZo2jxSSaGe6ZbLCna4wWSDoE1l3OUHq524k4CyVRV8RiqsPrI7lfiVNHXXu644mSZhmJHeNOVkDI\/26gtZHio42dTbnAfDuQD16XcCiotYCRWP4zHlBUtbIBOIK\/NHV2ab2cmw0T2Ktw35XauO7gAy3MXgQT6yR+sE00qaM8HqgE33ZFQxAGCbKSbTThXSJ7Pru2rQGvvMzCZSHiawifojo2vdWzGsflxJWU7boNyPAogCiAg1NewD9uhl1+5l987Hc218fU0XijncYC1kpc91b\/SXOjFdI6eOrHKlBsUg+CTpvu5g5PrNYyn\/xR7J9hTiqXgggvaOMpJPi1BJowfMhrjF3c5tIG62SnVAZuFrm7y8b2u6tERSmwAw1b+yiSs8OPgFXfTZGZZnyYPX5OHymcX6ul\/Uk0IZrxM3PTcPw3uLh4kBJJGwR6ViJSf5+OGRMAmY2WW783\/PJWIvekPQ2H4IsnxUbNIieFLROyOWKdtSPoAI4U9d\/vlDBSh7XwRgvt2RNI6IEQBaH7S4FY\/wW\/5aMuX\/jmER4gUvTcl0smFgx8zCPGj\/\/rvtqgAJMwiDwxp2WIrBUJUQ0uHnAIu4GGr6i0ttmnlNq7V2MHc5+osIiJDMfHW500xaCkA1vpR7vFdk2GfL+RVpdtCncKCoWXISdAfhBq5DleRPAHq306Nf4OzkJIuIHseW1KYPaCz+jnAI0gO\/+Ah7\/TMxmqAGxbQWEflZeceJeq93m215neRWsZ2WbKCOg+DtNX7IRzfJJIyaTsK8O3KM0ukqUwhIWycG4L4Eip+WfK5VwKp0\/BDLDR87I25te0Odb6UC4OQiaJI0hSrVpiekQAA2+aM\/nkab6Dll5AJAcF5\/0l5Q4gjF\/L+X3SmZizAcr1likvihYYMf5VH5RQa+ApyO6Eap8mwxLltMRnurtGoefkR3iWlkUk9fNtuTXoYcdg\/Oushn9U1gyPp+hfm12CrlmFRpSHhMdsXXdwhg6YBuMkzc7ee5dKoJpnRfFGafjE61g4T\/Z96ugP0LLlCDvJ19dJiG\/OvM1s2yoZwEmocTGaKTvq7hqFCJpoTRLu4Sg5Tbnf88b9aDaMdK\/sGBIPHQsib7GDbC4Gokkk6OmGQEhmZ0OoYppGF1jDMIy0GBhASOaT8Cgkp0HDno2RKpz0a\/jvyDz06YLigtMTCDFLIXK+WrMWLLRMh0mDZ7OKtYRtvoFPBtbbsWSqJ2pZ4fvhJTkMmEky5IZZ+rg9ibUjoEepbqaqPp4rxHSbOeCvIdo34+IZ54PP1klFdi1gbTN5RPgp4qVz7rPoscFY31ZYpyeCuqoX5SFMxHqLNlmsa8r4DRo7\/04UkdQ6Rcm20iVev+aKIXsjNsh12LhEz5CkdC5oBkpxhr0mrDbMRZfCaEinkkeVHn95jhl3a6Jg3UARfcjyhfaq3biNinZlE0XuS6QXjgJpRKYWRM6qtZha3DiMT4ErDnWb3vCjfQZMt7HdmqsdIfri6ro7v0k1yJgZ4\/c7S6d4Lkim3lJpBKPQRLYO849KkPzimzSj9nu04Vku\/RnjrnaQAaVm566LyWv59cHRmRya8zhbZkNs\/Xo49xw968SZJRByFzRzUwX7W\/lYZYrIRVWxMrYoOkbxUpa\/yPtLdtdzwcWDAtVfUPUrHsmyuYthSrSbiC8fg\/9zZuLNE2wYj16vET71Je0sVZQAo0+DymTJrF1rYgf3WNxR\/PPNK5dzh8skud080MvLqhuhC5gzrw1MwzKjAbcs7F+KETkBmGXIF9UD1Nj2KhzfOvsspC5NO4WBu3zv\/XDTkFsFQIXBxG2xuffuG8W8wtkosunGpsWhwbQ8RnG+doJX+Nyjb2A7QHgXiAt\/2HMV64tU8CN454d\/hVxuLoYut9nk52BGQXNN3SyzxiYYLZ30cUBITPfgULRxsKvfZS5cJ+f+sXsYtvZl88kNQif+GE2oDGOuqUvYl2qvQBVl3i2CHXflIAYXZxPUHxG+Iw7l+pj7o9pVcXCPuXYVno\/bVtAqpDljvHAQnuD9LkNnMA3gED3R5F1U5auFnDpMUVaMIvisYRhylWhU2tRoEo+TijEgOd8cy5RxcXapjVjpw78n4dZWu0xA\/ch62nn6YGtfb5DPcCl0uYsaCZ3sY6URjCltW1g7HwvTyrFu3CCDoqxSiY85DTo+U9hdUKIg87zmFZX3+\/KQaSq11dQGd+\/u77t46kB97Px1L5sRk4y+IAzvz5EmROV\/X2nMOwwOOd0RaNpKR0\/xIvslVyCaXk0Rv1sDqX48Swb6vUOmmxuFD4TYSAxe5nNEO6A0beFbuzYA7IZzn6723t6F2eXirSNYum42HoxaQYk8WLPE6CtL8gqfsK7wNpcF2JQhhrBvaZXrGRrM6rCjiZQBLBxvrUsvvQYgvDqlw3AVph1X16sOL3lb6i64bTGpIIVnQROiuS+b7wTWcucWC3cyjfePcHVnjjk+rFRjYY4iOHKuRThjLKyPka+hACQGTzlwYEufB4JzJ6PWPCtYqs4SMti08aPY4wdYpHiPiy6exlNXsA+lcQ981dhKaU4o72OkaFF9lepbZhL75DXV8ZZx7UVB\/klbEqcR2\/1W5q1VSqfJX4M9Ql7RpK7xRc2JGZPCgGkD09dqZTmcl\/zzJemxctfdL+Lw4RyejboBUECvzFaHaIJPqVyXNm7pv20DduVJ0z\/nFLDcr8oZJpdCaAnB1K2Prr72mi1XIR9spBq0lfkhay8wrowWhURcy6k9IpPVutP+HTBSqiamN0BUujBuJ7m7jOBsqYPjvHlczc22X0zVR71p2dHOeGren3kBMkO\/Bk31HGV3324ggKPY3MgnbDpSCPOrzUGUle3KV\/+DTE5BWpbKg+cco7l3il4BsFqIPcsFx1\/jSn9YbxB8WRFzNZzD3jiEOayEOXrBtg2THtuanrudDxHns4y6FDwud\/9dJjBVSreB1HYBC42kgqf5lHaacRvQF7vTPnLiDiwjSe8zwv5e3NBfJMcPeYDH9lOg4Bu93jSCcQdobrfyeEcdF0DEsyLAIm8q+J5NU9UNxrHsTmVzOgQ7pX0hxNzHZZ0zEkf5B3BIAbTFlTHeDaHVF6cuPo6oamv1LLV266ttmXsxeRK0B4IDM+rNzovMf1eueLJRhdgZRaJL7TNOd8MUcUGeZvR9kTt4bGwvxEa8qCOlbUW1qXxIH+KAh3ndH2N4adpCBAdo6gV2gcLpo40uh9zQLjO\/IqCJv72+aMP6eBYN5V64DxUbyBLxC55KuBUw\/XpkTTKQ1Zkf82glVHymlfPPjvQdAfTEzVadllVvUst\/jvS7jmtbecfn5dUgvauma3jeolEkJDS2WBegUjKKyo7TBkRXph1UMuIdlNsXzi2FPtlE9nDo5AMrOFzIeRfvtdM6qJit6D3YJ6mV7EROFFU6R33hCF5bHdUsa3kTKhqhp6nnIy8fXpQpIf7ydfKwF23C\/\/+W4eCdpxs4+P+dF5+eHCaos8kLuWuzUYVtZaJDF8+OPhmjoCL\/bWjX+ED7rivtW1oV2G5xfJ6xyl0l30soHbedR1PIDNlvBosZE7oh006tR2Hz+4Nus9eZ\/4ummZ3w6pBY4OcYeYqA\/S9fm8AoUSpSqW5dPCxP0nkm7xm4egoyXzXEaOGXUxkH7mmgUkLXgI8sdCcqdV22AmQeEKv66CZkFPouXSQusHJ8AGFLy3PB9dTf56T7bQy3tPe1WdfB16S\/EMeFWOY\/x0YUetyOznWgdviC6+P3ClZtjWX8Ffct6\/Tei59rQ7i4hUV2+aGpuJYyo82pfSQtl36VINe5px2vLIYatgFqBaLMGwkuqpPjTpFJgkX7SC05upk6I1NZsLRAomliR9Y6Bp\/MqkEfvaFHJ10\/Z\/8ua07mYSQBsSlDSeIv7HrwigpJlWQItiOuru3EpEneydGH57UQhea79fztwfRLQ5C1XHDM6SEQnrXo7dAqKBnFslEfvqLEUW5yjg32xF84MqvaXrrucnF9qHAMv\/wHW5Dfa\/V2KssoIR3HQDG9VI4vqUNIzbITGgNfhZ2jicS9z1tCycLcJdej4dXHBEknNxIKkpc91GXDEBIBSyBOfeJV8hyVRkOosIbdLwadFoUDk4olI5zwxsjGQjiH67dUc7JG5+aN2IRXRN+D79ggY\/QFQ0xHZZKHkI+D6Z7tcQwT\/w79dRz4VrHdcAS4a8Bi15AOJSO8oXDplkQnDbgiROMNgLyRyIHaiAGPZxZM1C2gm2pX4UEK1nNtZGfuGXvsSDj4k2LG+qvBpVvAk4cT2EXlLICB6OqYFWW9hGnN01zzxjGpbstwRA2C3baRfzyLnloJviXCBQ8Ve55DjfahVC5REtGyoKpoHyDmD6ahmwSu\/EW9pI+n+Vhc1fB0vrMmxBQZ3InXfym\/fFFx7uTdCCchzdqRoU+x5q08r27Nfoc81x4cw0QZlKEMB524hHJy0ZfHRjuCZnIjAhoLmuMbR6MMyJ83JiIYSvg1t03EJAWNLH794a2+j3l0FSYHeR35ml4yX2MXYHmeYTyDAW\/RF1byBnEMfWbcwhKjam0zxpAfx\/zPHt0Y59bKIIRiEQBYko21vdyZhY86uTnbAnZY3VG0SgThCtP5Q10QNMoR+XqKWkBZZaucRnXME6bzDxM7AMzG4aUymXlo+yz9HM14vhlmYIBEZcFAHNvx2tbgfs0Y9tFpfiLFn5sYMHyJgne9QdsZqgnZenPgq9AcdTyC75aLcfHYR44NhEEOMNssAPHL\/ewbijSadZ+OSoqed3\/OYLayE7aiQBxt\/OnOfXY4kjySKklXHnA8OrOPhj\/bfz10pYUBjerPlRIPrheMomt0RuQTk2Th9oBvJfdcKm9iwOSOaO5PLHvZ2T3a2N83StIJk07MpLBKj+QKmSdwzJte1oF469YjxMInkod1nevj9nAWFuCEmPUAXJNoWHrvpB5Oxrh19EH+9LpymuUyz7srPjLRG3GsJEWnFyExWh9dDohOxyLBsIXEEVMGcVj5FxWWOmEgYwnZoYwfaG8e7\/\/3TPuwbVM01Qv21hhj6w58qxlsAsEOy7Aez5CTpglMiRnfHuSt+mPnikMLeugwIA+D05sFmsaI9\/VihiPaK2ALR\/G0AEDfHwbp4r1J6TgII33ko5Z0aAvxBu37BumQeJuDkUBb\/tfRRFZpzOA6xXkIzYdejM+mcjHOILqM6QxTgNjdKUdCFYGogOfEVM4V7Pe8+cWh\/rcHlTfyUL1BjS0h7JY1FODQRaJ31UFGb5IP1gNtYsshs6pNYKXi+NhZKN3XscnIf2isn\/rLossGrQbg5ZXEkHvDDoDpToPsPM1P5wkRmA2nYzpz7DXSXayCiomw2BiIwqCmwFQPoaec32fIBPf0hF6XXrO6Rb8RLPCMG37ldnWMgqxRtusULE+0HG9E1fQfvF8omVcqNcXCbq2I+jjvpMKvyqeSnOwKFF54dJmuALCgkkfiIfdSkm5zZV3EboPPMd8fEuWwoT4OXSv5J6AyKFNUEcnaKkoKKo5+fX1x4lIZ5Dsid\/BN51EdSx8TD\/uFY7c2zdLeR+uOvctQW6zPkKGGwC3o9N3C+Me\/OMOPmCWLjVczHr4Hb3H9HcdKleof5nL0UxE\/rCDNiT3NOKhJAsP3ql97m3Io15Nh7ypnkZ+Q2yK17oHzrLvhrf\/\/wPTei2VmBIQmi6amqPeuK4DW75Q2c6uWtLhe+2RvafmKONwHnMC7rUCWq1Nr+acMOssgPPFX7x3BEIIuGfbagJaMkQKrdbz\/8xtB4BBjGBNmwtUe1\/gM7XhtdlQ75ZG1kjJoB+DIBGKbfs19uJ9yrGqmFqZfbv\/ATUysh\/Ppu8rwfGt7p4lpFfoOlW3JVWONPs5ZuW9Cw6bZty2TYNeRaKahJzSOruf\/+MJQrbC6gPzmkEVRQ3hc20GQdNIuRmHHCe9WrioGACkDZRY4o1wAcmHCRb2QpFnmDJEtl2UiDXWkVMMLAkmpkcel2Gj28aXGtYEEOGicHwBCRHpibOrdG9aHTt5N5dX4aD2ar0UUphmHcRfXmvnkJjKX33xE28Waqo6np3UbPwT7TpP9Dc9gXLxF5asTGWfYAeL3s7D43xBqcF0nxN6S\/gyhdeDle4nCWoa3CoCnVnehn7YT1680lwXBwq83LMYdFOTEyIqmGUKFUcqjfB\/aisfwDNWo0PvIg9WcAn37uaEhqxPSFq+RxszgNMvoqJTj6iKGRylXhUr8mumwT7FALQPXV3DKcVXPIQesQdTqbs3gGmoRkKNWK8JgD07xCk0dGglVhqNyMVT8iHfv3wqvMcAohPWXOlvVSyD3RHsAzzlujra3gWSsh+3uLaOLsHjaX\/JuezBYy9OXpLH\/j7k4h4Myqfw3PuIPUw6ObmVO1wHnegjJgczTHKQxrZZQfxZEhElXJ1HDkS0IgBpIaLjjVLEo6jXOG46LuH7o9UzL4aYaR0eHSsu+ugmbe6WrAer0\/KRc5Y4wJ32174emkMlwB+uNIYWNyEAEKc1JljAyCCaDU148TErykrxmR45KCajTAJlWxzAARgIvtn1VdHtDvr1\/WUcLf5afVQr4aDNCjqKCp+Wd49ESPGmWROSmLwrOZWLdkUAe+jLzKyZxuNldUbwaThcSrqsBvd+mZ3TC3NK\/o1FGNR5fqFwdOL9nySkuJD7Y\/4FjI1idp067csKmC81NLLeECkYKJ77GprzJ5cNGjcJWG+IWGovrQtK2lZFa5Ku1R0t5Bo0nsjXvO5+jtAy07cZd03fJ9Oq7Hkl09+XB\/sOSzW7zy4+h8v6vwonrPyxj8ARkDjGusd5dkZigdgvOPlfqvBuzaAYyPk4Kb9i8uEnw\/C\/ZKDsRE5jm9JH2IZO9NiyNURC6pK7z+Xr4XHxgE6qoHmhfryExQJ04lDm0Yp\/ZM+U1c2F863HadUBwpxvoaJ\/GyhjBDinaUFPF1KgWpYrw71MWoLfzXbkbWJfwegBI8Tn4D35INsSXMJgsB3dmpOgb70KWFoTr6561zjnjSJmUTSGutC1HreMuiuA9PGGY+iss7Q\/sKlgWqg5A2oRn3Ml3haRlCkQezI5qpf9h4UjJKi0MCHJZDHrI1vn3aQ\/3faW+oESN3QB1LMltxoCXdP5tVqTkj8BRbFLoOy5KddeV3YdvNw5EqB5q\/EBSLz0Mh2tHe8xVt8uo\/BXzhXfwBJdlKowPtf8Jo72ehf39xGAQiEtt2jUNPH25wqWZs5SmIT0bfJNIIOCPh9KBuzhrLTwRCH8KjJaBx7llQoogHLE+pdZvwJlDjtZZ6fUBRGMKn1rtWXuDINS9FcCsw09DbdZtmAvX8YnJFUF0RzL\/KarQ3xXGmyvQJU5yF+hAre4CXX85hcIRfM8EBOSovL5N9eVx\/T71wHc+EVVF8yAT6+PZlArh5067x7xsOHimHwvWJ3En5OlaiVqTfO7DBAgkJYqudjeZWj+FP0DgcXmVbEv2sT+bnE5o4I\/1xY\/Ec4KfX\/RnoLl10eewq1klrSxR0JI\/JQ21DSnbg58pZ88Ozl0U0hXavDdOS021d3HE\/LQz2pEdQk4sARmNoR7tseqgmjoW8xeJjCv+wRkNV5NV3o9743F3vGEWMMLmUU0y7ETP\/hpL3tlNSFzFK3TiYYPBSjQG0LUUNGTEb7gPnuAT\/YPnewbWNMgTCZPgpXFKHK0gNukJftVONHlatwSESSKNMeo6iXVDKANPr0Cf5lVPp0O4gUL4qgW6N4VEiMukdQ7uahx7ZrN0vwVVo8VB0QYFhtQhfalzEbHs4Qbjw90RpjlSEK5YOCmqxk2gwR9HPFSMCrsPQjUq7HwpFjWsw4ogD5XNFS6vWe4xDJmKTzAJA1\/Hq00Y5Q7QaYNeVl5yYLigUTMkba0tWaDmQjxKBRZXBIjnO6\/cSICTIXm7PvcrO7wu1Z2LubxaGDsJiN+hMuK2xGtTSB18S15QbOtipBKiQ7t+hhmkdNsiTb49zjqxJlvm9id5AMW8vlE9+Kyo2cMFn7p2F0+oqPRPg10Hug+glSSP7AFiZWEk0f+DtQsxgbZfea0kiecNTNOyE+oXqZNamLBMVs\/2qo5INryzoKwqQcTfmcRAfKe7fij1ybXDmZ+I4BSm9x3EZSuIZ4SNXqmuQOkqHv1V52jxEry7zlP0RUehPDu5sAkwyMj+aYrEwKaOOSE52D600QPpdC5rzXSMLZURJtTJ5r+U1KFl9w2TuQ+lBBuikNcxAxz7BXzgQB61FcWnACEa+5MpxDRARkW0tjPERUP+Od2CBoItxRY1PImiZ\/omR26D7Saw1\/pkzxIaahpzIxOXLfv1RYrEeyVOtt+m5uBEO3BPK5h3x6Jh+F3bs6lh5K0R9vu3lhL0x\/Xv7clHY9ZaS3UDwxysdOvk7f52mDouc+mZukevXARfwlbsCtz7Omh9QOm87WQq1KjNS10bVORuSXYXrSL\/T1RgmagF+BQJWXSuuB7CWOcDLF07O\/vXeHyTYFJLkgR++Jgtqnl2ZLGi5zKdVVf2200LeWSB5PyVneRvEiTmJdfq0lntYassOHXqjgRTsjnNuGCmhb4YoYITtRodHS8ldCZI1ewZBsj04meWUvc23w4M+9NaYH9T7y08LO6YMp5e3NK3w4SxIAnOoQTNmF2Vy7L4GD0KIILBvORfpqzrCoNOopEN3Y+CghaWBvV5LKQohNjU6Laf3\/vFrpH\/h8ZJkeBjIP6j0NKZrP9mtqs6T5TTgaMLTzbgYK1hNBkTVVgz91b7qStz0vcHofHSEk53lFR2xHN17T0XH5ki7vNYt1GitIQTm++Gz+0ILeGJ65ADkCZbkpf6XJKP+wJUJZczQ3OuM1hOaUKCmx1iLK3RScRBpIf\/F8LoAy5WrS7LGG8UHN3l9X\/pc7ZXq1hMyhB\/TfjXZz5dQ7AHcq\/yia0nvfSvuywDl1lM\/jb+122LXay4TP0MY0RPe5bcbNsF4kdtCKc\/J9p1A2MtI+JYd1muS2u1XYRxjbHQXLGjWfKCzXyc+DiF7SgkxzCARLwSueEdBQBFN1Y3R3LQxdOOGab\/STJ81tNJSYsKa\/VfDE6IdEXuoxTDFqn5rjHm5eFhIoRDM5WDc3VUZ7fE5ddfxHuLaVWzZkDPNkiza\/RgCMBGkxu9M19gJ9jIHUTAdklXnYXbQdPiKOIPsiXZCuTDmYacqHPJ5ClM58LHA\/4CZvExbAglqbaPas0GOti9H5M2AmdBPnb21q+u4n8IommeDPp+KyNyEMpFgMwFJyMV8c21Ii80NvRp6fd+iYw6JMoClFE2bue+6sL9DUqGUSP\/tPNfGBUwSwpfMSWRRkHAI\/InxgTMUAucUobtZgcD8+VW4zwnCj3XRrw0cBH1SZyVtf0GIFLbCl6HPe\/TLDKnpIajKeZvCT30MnkiZmO2Qd4QUU3pd89aj+5tQ6JXcqToZ6zDbRJl+lGELOUo7XuytRo1PDeVRWkyukSD+88r7G\/C4gqR2ULC91qsO9lBfe1Bl9Fqkn88aZl3EcwxgqYMtAYYVClWKVMktS1EqIRQl4Mdf2fmNoAyU+7dzPpnpex1RPX4Z0Vf5k+5qkUgDQ39R4eVuYrAwmEmd8Mqx\/QeP0aUf8kCRRLcTr7WB4g88QTdhUEA8eeJ\/56LvIAr3BoA0ekH44\/U6RXVhvFrNk7x0NIt\/CuCbZWcZQc+itrCF+mrmSeMXw0HUX\/4TZr6JSdfuAdhxvYDPIV4OvkHKPYkyqkT7wulqGAQDgkRXtgpmEM+SEYmK8EiUGxma0\/MEKknbKFnLsTYpa3iEskvjUJweLGFlMu4RhQyp4d\/TjHnItGpMx\/ACTQ25veHu0OiSMUINVpGBpK15iYri9WtRYrSbdPmwimDm4lNMzBPoWUP9IGOty8lHx6EQdE+sZ5NjE5bL4deQWv5QF3vmPIkHmuUstwvQZoMzhbenzA6fWgO8KbogQIT+J6x2qUw6QU9CG3v+LcmeZNyAg3cQCki5YIwWo+huAEisbRPAxKl4wtHO0edyFqaY+S3XHJKXzv4lWIYzOZk3gV4+Ap8vFe7V03KXnhfTwlIxnC9Ff84lRNSt1vwZmkOJvMFrbeSH4lOPkvny6pO8eKObTH8+XfKLYrNF9KuDuFo+tNjLIwvqyjxWKkOOeMtEXlg4\/b12vgU+GzOkJ0M8\/hsT2Xe4\/1yQK5UYqtcKxPslRbIUmKIyb5tz2lw2APwp4my469u9gzPCz7nyBBClfhLD5gm4Zv4yYwvn9y\/0pM0FXC+x8VzUu2QPAZodz0dxLi8jaOwwcVYFo7XoMApkM5\/xYRxkVBTlaCKHEsqIxJXYEJGqyfgrjR+o9mc0kdSQZpYA\/VpOxb\/4R76pUIFbtR2chFK8bXEHz+ApOiI5KBCKOOkKG7ww1GVZXvBdUIepgQJtWbLLpKbtwCtsjy+GTCuWpjXDAW7EG0WQZbS6cTv2Hz4bS00vFHMtG1+CZhjtYJtfCuC8\/RVQ5o\/a+JjU2CXcdffttO9uXxi1Ae0OMFS5drYLdlSnZS6NE2s3NawfKnPsaJmFxoimCqK2NY4CqqKKSKyDPzhuYd1nxthqf2zkq2aBzVlmRvP3mxrfceoeQvmrInNWsgYyvGJ\/NPoGdQ+T8mozDO0QvM1Y8VGf\/Fh8pH07wB788ww9kzfdZRI5+v3GTCvED3SZpUgsVG2hnaqQpL\/psbLRxGfc0ig5LRjMZy\/LrnlWRY4CQqDz0bXukdVVK0gk7RstklykpoJrC6ZNpdkT2muWacdvkfD53MW2A0WeKHV56C9FhQnsRh1KOM91llkedLn+38H5RrKfx7QJFADEIVO9ONK\/D2w7Y0YPB1piSNOk+2CPsJ2xFNwszLwEB8hCkex5Au8izV7\/v+ykP\/hEPgxo1yS+KRHsA8MkvHyjTaAKrt2KSPg64FK\/qdvoucGbsnSx8RVWo7JB4flsCxXcuMh3bBgl49xfoVsNtGGBDC9ctX4QZmyQdqPHcyqGjEXeXxksUyVHP9BIsqFuxhVzyJC4cm4xNiZco2chtT77WRIQbdzvvnuLxoaiIKSdg9KU9ZpgWk2hAK5NPhxhdLEbm\/yjqS46Pa7cR42iyU7k0xbM9noUT6A+AJ55eY4FIhhoZ5fYuV9n3\/DSSsgGkvkMHeN1hQ0f6Vob5dEisdbNu7MdfTnKeqwWnqstXfMoZmAlm60lNo4l2bBKcV6UZrDaJVJKrQr7EKCBknmNP3ztxceO2pT4m42uHLJI1KvB1ggSnFTySdhv7uTMLedjIT3wfh9Hs2o2NZzTQAhYQmWsV2eeaQT9NZflsTyZGKb+M\/8nvfBkpk6RbW++6Gj7tb80Qu1yNyoSq\/\/hF8P2DYexbyDfvNWUKJTwc3YORvkhpjcbdBz9hHuKaiN3mtMtT9Satmow576qqL\/puStPjwCbiTiugz\/2lp+b6Wp+hV26Zxye3DesUOkHreWJwvaVp0oKYTWs6ebvsrV659iWGI264D3djgytxr\/Iiz2g1p2DFNwwdyuve9JFOw3iRFRCcQopr9KMuGdtiwxdVxkOTgvJMne1X+WdBeGN0+LXv2ekNzGadotPEjhwzwbX4Fuwl\/CywD2hjdczXkzjRb3dFY6styY2CYcwzCLlWS1nPgZcUMMpbLJNmKhOe0+dTJHV0Pg2Rr4qiykD3v\/2ZpmJQczYQEszmDcywUaQuAsMJWzrZ\/6kDsYXAtXEH6TQBwYErOfIlZZyAUhczvXXnynQmKybGGVWYFKTo5OoUiH8\/QQAS3sMTzhmMvNa7UfD2VfNFDAbnC2SYszqi1gnEbhWVfcWfXltXmRzKdoGfHRRRT5tfqcnYBTZ5W6yrW9odf3xr9++0MN8GttgtkKfmGsQ4SPcL7GCvuAnjAslcGLxki4C8K17RFk\/6gQTueDw7Xu7TXshnF0VQpvr\/Hh6ztthZdFrbISDaUHEpr1scXGmjirc3Cjl8mmqzaNLJz3uk\/GJuB423FlZBnHIidp2I78ZFmSuhMktyzYyELEocyDx0QuIayIwBGifgkSQCuP8hXwA6\/zIvOLgx8u4YDIMOoeO5enQsJjKjEGZmEnICatbUAPfpYW3c8MSs+jW7j1i+bdW0GJyyxgLjZTNdClMum4fH1kEuB7ad4AJclgj6BYx+pOUp2BNMUSOeL77N4SIM6bhcPGsMIn10DURckQ\/B0TAByOJhJI\/L\/bGpCybyUYn29r8UTHk4yhSz70eRCVnokIv6OsW5TPSOkQuFuY20iw40yE9mL3toSmwWPGE7h9rn9ICLIX5l4S1YwwHp7yl4065TByhJpz3pxy4OFrRZr5l3PBHRTM1iIDcibE5yQwxWEEs4nejMCGAVvFHvdBZpKtgIeY6Jd4xUv7YbeaYngq4zjGlzXu4\/+e7G4OM3DqJfMK6Y1dFozsKvR5Hgfp3qG0yTKDHp2bknE01ptAXKinWhQHHKIXg9FyU4uc9bL3uOyj5oUGCB8TNdOfUl4p110cLQUzI2UyJX7g37LMCeJXRfb3\/b46u3BYeXhHApW\/Xypmj3fwhdPeTCTfomqKdwmrYK1b5uB6xfqMXp4MK3wBhsu8Xm9lurBojTRjJaQG8FtP7eb9dSppqm+aeYTde6sa7Jl\/pB05eQwKGtp\/V09oQaafatsbuTrGtdQGqL9VqZyCPLImZoLYfoGqTrHUPfzeOdiScjn3gvpMKafT3t44G1KVKzYn4CR4RyKF5LZmaVPp7GfjMI6PDy3HQU0pON3mpRAF6cHivguLGsK\/awYSse7t2HGJLZumciZmEgG1qotOmUEYupvh7CjyvnugM20yChcEt9HbK8jOyNSvaUCcFsbZ5zj0myGTh\/TyPXcIL29bjJlslt\/Q6eglC9cTKt6B\/3W\/uvVzuDdBpZ3ZN2KL4PCO6sC5M\/QmFmC\/o1ZgTaYBy4uhDWQpOP9vTKXNO8IYadWf7BofIGCdoiPAU4eqlIUJRfemMvtzAojRGoOt9JkdQA\/MEC7l2iQC5grCF1DqobdP\/emsWpkrDQxSmwFfhBUbKoZMCWUcVn3TvN5bTpus\/7JvxKhiXwyYmHWuRh+Ry+SCphM1VXw3tGmM3vrigCY9y0M3t7SwpTAbMMTITmHspWULz\/ZLUB3bQuS+YS0YNfyqbaPTT7Q\/eUxOJoqtmQxzWxeQ4nxPX8l67Qu6O+PRaJ9W0ZdvhttcYVQsdk7p+TTBWUPZaB10DkCmUqHnRTjOGZLti06UI4JjlIuapxxY1Dm+RIkwCsfmajk2HSXLGug17TgdJsjJ1rlzst8f6dYWDlnCBxFpIRzWoNH1e49FnoN1UFwgTWcA2kc4JySGnb2P5vuHsDIZDvGMZ6+puOrfoM9mAipMf0Gv\/U0ZMlU46X+5gHck60Rjz4U3t2fDaO0iIEcwsA2p\/Qus+wjnIBD7V+VH8RSUsBKXg4N7IqPfgCW7DTX\/PyypRxl\/kAwI3nejBmEhmZJ63FCi6WIutq2bu9HuYxYLIgT90jEdvSFvjmJpYRhwnyzra6x3QdKBHUElSFHEOLEKugbl6L4Jdcs3rjG59gWd2pqIajyuNnLyxvwgrB2E700vReYm9ub6mO1ZDP58bLY0AFNYRQPVI+RJU2W6mKPsjysNtpsgBbsFKiIWd3mJ94AnHkGgVuSKQiFFv2yoP1+shxhqRmTJw8YrN8IuyeDjmRVa43OgpSi28agKOzdtmfIFUExqSdnNu\/Pw29WZ9IB+2IqneV8pMmwplRBpcOtMxlbnx\/A977Rel6qWDbH4Pm3p\/0snplcUgwYnZBYoxHgL7ZC2BW9gAqEPwb9xhXJL2tEkWBlxr0B19rNX1O4UTygyICMyN20WN6FO6uTgrySb2CF3PLLE56aORTNh1jawNXnENkFG6+2nOoIILy5\/jGVa891j9p1AlL+YQRY7IFrUgodjM\/CNloLExzAT4rHUkXHMuIZP43wvhzEvZJK1MIKxpmH4Kp\/PQWyo7f68mzpGWuGrWZGGnbQIiosJPuwjnG0d4XkPkQ6Cm22N+fKfnJ1U2BicvSNEvN+ft496Jee0c3GK4MC5ZLjsx4VHlK9eA7oA5vl0DAEsOWK02QM7bm+UM+MUKYGcKGBhIETbJY13G6DKP6Cq\/j99R7QyBw2afP+MkNKQb57L+r0jAA\/j0jpJEvOlaaLpqlQ2wAcrGe8Z0bKm4rvL02xJjViQLPKyltWbmksvlExjxZ0GuIImx9F5eeCrIU3JIG2sUUjs\/J64EWorlrfIs7CJ7SlDxEPLq1U8QppL5S0184szz4hKSQ\/JP2yVutZsavK+FK5VwyjjcmTw6NoS04wZd3gcMn1SgQTnmHJ8klcRva4B\/T2SxKpq16h2Lk+4+R4x3ObJrajAqjNpbcKyuYcrMtwXfl2XMAkbce96j1iJBkenztNcFh9PUW6BWoLi\/iyJCZTruIKzo0qtXVwjnpEYu\/GYyecvDnfFO4j4k7i0bjPh0oNE7WJ34lT\/c8v+fyH7yLVK4bE8bDy5Z9kdKTp7Yc9PpECJ0n8yVEXvnp+bwGxsdZPGC37VxU6LO+r1fv\/nAqCrdNtZ3D38e7Y04Fe8hH3u8ng0it4kAJiS8urZz7+YYGe\/heI+tMl+d3tIjRtQeBGFpl94UmXX15Ke5LxDVj\/odhoZbuHUyy9x0vQC0qmKhRwh3UZfaV0tfkH0CSEs7ilOrf1V4sLzo+lIH4nHnXIeH\/OfJ+XMpym7j5P3kyW5fq\/jPlMC70zxqljJ2irZ8R7CtYe4JbnnbIYOELCzBNIN2FOWjsH4KkC04POq4A3mVZ5YrxguoVZyiOmDz7JqiqsbatG1WP\/S5kn0GwIsvtvSJYY0SVQY9+Jme6RnAjTAxHkQqOVkssGWlJOn7btxME7J\/e0AyHRu1DuKzaITDKDZybkMKHF0SSgE7olE1XMa2MT3Ub7RLPluKjlZGVVPzwJKmE6HXfLH6juIBS\/MkDc3neNFJ+jT6IhC6gQwIa4vz1tMusbcnKj1r32ZxucEqOGpXyuxzXeGxm2nWRiciPc6GpQAMEfmBfICd1XqZwmLSuAvIhrQXkERt\/iBm0mq6gErsheHXFbjR6n0Axbr\/J9Ro6k+y6QLcmPbURIaZYGnfgsgc4Z3XHnUehYk5BJe5hM8wQ9xhlo0Q1iSmRhgHCAXeruXsL2LJDBkxVKeiQiChF8xcSZqt\/9kJQSOho+5820GfNKx8CtV6VfZkTaNAE63seWjfMMmRkDxrUL2RDO9otB79zReqCK69wVsic6tJPsxP7tapYvUAWSJbT\/ici2LKDJSLJ99g7mx4EnV87jMPKY10RCrAh52HXfaxKla0H+IugHpNXaQBhS8CvuKhKdLq+3xCqRziBgH8vmCRMNZJK0Sc45JvftGI2EwOR7SmMRM2ITDcZf\/nQ4eprpk+LtiOgZM1CrHvxaVLx7dNAtICcSOaGSXXSgJkF66ixA+PSugiHixMnTVMZNJ6EXDwj0gBIQrYCKI6I8byvGd\/5jAA2vlQ9j2CMPEmU9ILveo4iUE+P8chSQW7peNGacR190KQfCoH20OHiRzNVd\/H95\/qX30\/CS1yUoSo8B0SqZJ+xdWwyS3hqet2WESnBwaVIb3aXi6D5i55jzPRBGV1j\/QRyy609gOGU2M4w6tsC0BLebNHZyH\/cRePZmfIBi6wdvlOvDATtUrWeOF9R\/yBTS1rdKYvmjp3wF\/TMHTyapjZo8hUh6TX8tvx5gByfi3YRsO1L6OvqkY+iBsFbZgF083s4PKI+UNgDVEGorWW1fODttNQZDhJk9KxjL7yZDRahgxNCrlSyHQ\/oYxIbEO95L551O6oAolsqNJ3LSdLyvZ5runke8u7hTKzHcqDXNywV0bDJhk+sk3uiCJs3bRvGPHPPvnExJX+piFSpnDnzHxtGLrqGKSO82P8vVGY4MxjqhGecspzlTArdzwTteU3JF4CtKIfTplPcluQ+V\/NpPP4lHjwG5YDIqsisryKm9npYIWbYd+YB82RRL2KI1qZLPAx6ahlLSJ3gKVDuCcM1eQqAmhoTj2NemRe771OhUHYIjw9mksMv37qkzQsPCO6GJCPeQlD69u\/X6cmZ5vrx3Du7UZHnETHt3JDdQeQ6O8NZrFYf9Umq4iqEuJUHVq8gefrZ540d4MoUbzgIFxaxbaMxbRrmQNO1p7mboS6l98HArd206TubSDbF9IUlRjH1pDJXo2vgN59prhCFByDGgWUv2kGew3eRYecqVRnE5MHKFO15d0cm6+ACK2jVWDfVctXXRySclBoZQBink\/VIKzDaLxItOmm9TxPc1NOLbrKWo0nMFu9wQpEoKwlwT\/nXdyoms2NKZ9yMxbJe9g1WcLtp8DhaTDbfVl7tqdtNzhTUk9lzsfmA\/CfMd7SRTtdbI8fZDu9l8FU50XOaQeUhEApvaHI7qeWMbeypdK5WhRzakD2qLllbDWpyqRemeXlO5O\/JlhU\/4qzecqHklsJac5aAl12tN2cmA2Yv2qyL2hh0uWMMhF0+phebKbmucV1j3gs4i025tPfEuVRysxua\/hAlmGgwC9\/NUbg1DEmJR1X3Jr\/aa2Pf8ieaw4hAmyzETvX96284OeIGiNIPWeeE7R5BXa0CtT3CwtO6tPfzyIKcCSnEEphECJUgcMpyECjpHfKgvLffk5l7BXCXA8QhC0Z+OcvrBec7sMbSGi9kuoaxL5qml6hYW+ERNakvpR4VLT+BBTzsVmuIqCvBQZDeYQ\/Sfck6WFdhmVn2WTe4I2tL0rkN1x+C8OBKrkQcRS7Ix6+EIpGNAEqTwfUEtVCsGe2MbLbiJl4LunV3VLczDMrPrJtCpRZi5pp9DHhdXeVO5KOV8v7hq1F6\/8ZHGb4mRy\/SHWxkVfhU9hPd51OpMmRvM5PY1UAgkEMpkg\/1l7rLrj7EMnj8WdpSixi0NBBpoRLCGJnS9H6BuWKCCK6jaeIBRdMRWP8efoYIKxoF+KComvif\/mJ0B93nXN0I\/74NiowfjgQLzrbmI537psHYy3+Wd6N\/wFZy5Nl1ZozgXJFRaTuV1dRqetsJVcMbKxMZn\/HbClUGDbLResZSwwwrpoAG+JKzcUg9f0WdHDM2Ibl8F8CTQinT3YDslWgVZqY2xKhfyaIADHvwQkYzDkcnpnfP7tRuBArqJZV5JY0Y5YS8jv30xjoTYcYZxcMfZmkVWeGT+AYAjqP\/P4dxIFzkvzyEYtF2I7dg\/jGrS9We4W14nzz6YVfbSWFLEjnfimQjnHcoFBX8UMqUKBwALTj4SqTOBKvYwsUKLeF\/I5P2g9GZASGC7OV0FLdOtW6hhW23ia5PWApkAyCwxb\/8SCTAxPls9sE3Ln6buwG64AqsrAqBKwrC1N2gGLopJmhQhhsCyr0XqtmZ\/KabsfvBW\/7\/djtW6HKMKuK8jnFDHO8E3s5OyGcmEmvWCmgjxb+dEX2uDZEG98TENMZLarVAP+dA0ADkOCce2\/qwaueLh048QLgBK75ycQlkBTmZTTyc0NJ6ewugiDNy1kdTQWN2Cr213lLbPNt\/dOS6VRtRgEzSOVN5Y058RyS1G4DuxUjKnoAlUKgqC2piwERPQl3pphIoKQSDth3rXfrqzjwxTmZDPG1vx851DJWSOQP3jUgRlA6M0KQ2ELPD8T3n2227MtlwPFnL3AjSY1P6FjRtsBHSZtcpfWadTpNhyJgBlhNtHd+p+lUttVLYnKlKD1T04bV6gpCNpbvyLxjuveD5f3U1cozTQyJpjwQg8pDjwGtFu8xwji4h1DNfkRNL91QUOisw5FLNcxXiYk8IzrdFR1ReDKruOJi5b6ND+I63\/BhLLmy+3gwkfqY15qVIAGEILiE7deHc5NaQksJCvgT55qY53\/dBDeILupwLPIA7V3fuUcVd0yEHaLdWx0O8fT0H7QaJOZq6UVf8hVZOGFpbfNAVx2OL98lx\/r0GC+yvhd6DcJJ2pgK\/eE\/oTX8yIQNgw3GVwIVwPvyVZh4l9ntm06YEoBkuTIaplpBFpy6\/IQuZRykO9KvhkghMCNjyrxkl4+JAIEuHZVE5GaLuVgmgs2Q54j2wg9LPG\/GoqxJl3qkt0L2F0utUEv0whqrrbB4rVhHRG\/aPZvep\/2F6VkTGcSB5DtNBhEj2ugiZz6rhO1xCYTaKuSriVHZ6Igso+3f4GDk8jw21dLuS99gNgkLzuTWgG\/qfPJ9tPnRrKT4tKKE9aIbgg\/vfhn\/v14RbxmkbzlMA72x+yplIdR3vtxHl9vzGB5QnmTO3bIhFKsnEnkzubRfb5\/ua\/oCSfhd4ztHQ\/j3RkbcXHhsKBTtHeh5Y3OL5ArM7n1n042J3TWhiDCywHDssW2IxG7bsc9S8NauRhxN6xPZUiKvoA5daieE5rIahnG5D6HDNEOczzxcTl+qBxAB7MldXQJ97RmEMbkrasfbLrJzIwvbc3WshDssfZEr7hwVoqeYqDyXCSn07CuE+7Ht813O3GOmlANs\/v6WZk9ut0j6dfb5hd6apQqCCAod1qxegH6eDjuwj8zo8g1uQ+Z78LzyBGoYsS2ddJ+ghoK4y1MYagqMleA9yk5mwwP83QfmXhPh3Nb7O42jHy6rSadz1GS4vPCy8AvN3c+jM0grX1bAs9xE0wXTZXOat3NjPGQxCv\/2wLvVMCH3L1PI0DVIcmxp1Sld7JjFZIodnIsOUThtK0P1J0vopdf4AAN1k1bdEISeJKPjVAukjxgECxt2VxRJQouYcT1OxUpb25EWNZFVrINi6XqlD7kaC34NWD1iPUK0RhrRzGEfB82c5w+RIVQ1JgNyAnq5x938W\/f934d8N7YeliGOA9ykmOUvNBz2Bba3imCpLUtcrY2KX6IWc3jZfbzSxdU1Pg\/vcAUkDNwmHcjkGia2VTXPPxP\/Mnqo8VaOXplSEbm2g5PCFidLz5JRDWdA6Qchs85yiX7GWK1CLv98uGy6p2HElJYtbCkHn8J1PzAjftybX0xqegqHFI7cpkDXMgR256rB09B3Zh\/HhiEYNzzUlMwl1SDkLzcewuvGqywLSF6q6imu4THtkxGYRPjZV8Vg9zel5ZSeMwQUxxnQzQ177uu2Ewr2WrSSOSWBnx5I0jA5HkITaFHqfCeHhJDLM7SA0KE8+DvR+de0YIOYrLH2Wr5k5GJWulKzdXcMs4ker1sYVurhS9jX6kIB2CDbCi827R0QK25DVUxXQm33lLwiSrxkqfxS1KE+mubsFOeTT42jKOK1B6emclj3sgvtgT1Y68aDGpLE2\/laQG\/z5zPTMaC9NkAITYqvYYgUnyhQnwN1l0qRAPW96g\/4XbRD9\/xh4DkSIauSIdljwHgBjC8gsshIAvV4mJUbmhqH2AKUqLebMPKbWo32tbK1BZakWCGvwtWyF42EKD587YJus3sEUpnYn1hDqH5Bh715jTOvvmtYsrsCyy5BDQPLu9LiIUbyyGGsFvRG1xhfH\/NRCxqDZJZebAsbnQE9GZ4YjNVyCLAveMHNkL0aFAjPHmlVJcH8jy1Z3Z0rhY4agX3\/KFXMBzhFZfyq8hM5BW2v+od9zu1O+tntHPe4Wd4vYK6\/tpG99pr4C+++K50W8TWFne\/FrTOxq74HVGqM5Wvtfr0zzFoMxRhj1Q7TQPP7eN+0zKZhIMwYoln\/YsBidxCG9E9vtSvEB6UMqDeZh05f7Qj4zZJ32lOsW3O27L3AxcBkCMZ\/ftlU4mOiqTxfXmzdCWLGMQIa2UfgqQlgkyHIIMdYGAVF3p6D1ma53acGs01p3P6m2C8EEHnEzgTD3cclXGkjwCIm26wpEMjRMlxkRYFClNUbSV8QqNGhkYPXaku1g1t0uSxlKW9\/hNS6XQs3+UbrBk1kkjmf3TRQVpbLXvv1hmOIgWGJkezgUphzVRmlitELalcwT5amGrvBTGemZ00pN895DwNsD7B3Oy4\/fKOldErz0bqwHz216YvwfjouP31hxWVA8Y5UXlVO9JJly\/NHOIXglKmfXiDZm1xbyjLsWjdq9xtsnxcwfWU1QDzG8DSWQ0x1S6APiOMJGTsHq4Lz96zC2JQJT65gkWa7Puqj\/+m7YKvY5dI2E5Wby7Vvro5YezNoRNz7\/epbXh9lbM1iQcMJddFf57NBazwcCVzv17hR\/gIE2AzwQnIAwBI7xNcz9vWEIp97ZH4iaCcEFupJO2wWPi8F8kXvHAtq8MQpCE\/6zzFZPLn7FxXej4h0Ndtbl\/\/Ml9fSCD9R9mhlIwRjuWomiumjp7UleJq8S6M6C2fIFwkNnQkDtjExrcNwfDxkSEmKcvS8Cs5rfmO9BPIPeT0i3AuIGmurOR\/rq5RdEfA6l+9UIjfUPZMN\/uOmpyh5EdRXq7B4ofIvOE+liHBlUGd+fHK32gdpkRx6FugqkfultCyAz7Oaq01Ijb0BSVXkjlL\/21Gbf7bLWjEy1Iq9H0XDN8tU\/yMcIcn6xaHgrH\/yoEkBF32SkgaWrh6ORmJ8O3fBIlx91c3KNwy+qjFvFFkjTXmflvrRS\/I\/H3W2FHi1\/EjYjstb+D+8bGS9tlE9rA5LwlMLMfmtvGkvqpWyrBakxe+rEbJRqI8jO+vHtJK4FgpJnOGOmdI00bHq9a8wGJDv7j5lXpB7WCu1d0NF9NwkSUetoph5lQaHTgCcn4KihM8rcphBEpUaFarKsIz+XZBWWEMH3Ip3N7OTZZvlaRdpmXS17SaZGD7fRbZZc84n3wkfsKXN++bteYGcaEyiL4fII191rbmkRfFHB9l247pAHjFxioZ8FEfgySN9fvlm3EteZNK1E52Z1dERYe+KQ0tHiwLfR4UdDiarOpcyc1oo4xpwb5Mn4LmBAFr4ETPyn1WIGGS2RnHbRj5JySqz0dGFBjztuQTtJOMhnJ0cj6KBPPGksGcZd8hcphMhPbNKjyi0kjg0Q9O3vdRrvzWD8Y5hSy27XKqmJ0gDZGfJD2spi5y5+Wav0ja5Lpvdded\/PeKFXrakTxxEt2XMqLsk8c16Ynkm49W50EdxrVsLl+LiFfkiVmgFRcXFZXslhAy5h\/32F5aEQ9i2gCB926VRlN0cfpsWHt3Mnvvpq6xQUKQbIUgTO1eYhAvSKD8uvyPNFTZNUGgBdInW7RVodHrXaENjYDfOdUOmBRV3SHzBTFOm\/R1wqUHLlZwwgqikWWTrBcxb8qH4otlguAgk1qZJztu9LzGHdw5DeXTny2d73rlA9RRFHX+3EAHQWt4ExxYs3Z9RhNHONylR4lbzxKMV65Db2JUVqRaaFw88qMGT1X7qZDkZr+VBN1Pze\/shjbQC0wDnidOxFlV3eYtAfwruIHzlCaqFpFbqPEsYLjtAQJdFZdSOk79X0wZIfB42qKBFNg7a5jY11vK0uY5VFgEHYp3W6JCCs6ywpqKLDpsQoRi4f\/kmi7BCUjR941WeP55ZNOhpBDr7lc4yEOdWUZTnAVlpt471ZUm6hl4KyCXxj+jHIvJUgQ7UXHLUlYWMP57CT2AMAymmXOmjb7nHN9WoYYwJ3Kp8BG2XIHAkMMl+MRxhn0PvDZ5fqlTXU907jU3IhSjCiq1ZqapjpkmKcNtD0L1HtA\/uHlXfjUHi0qE9DGf\/d9zeq8D+uJkAkix9Ae0F+UlHsGa\/UCK3RCZnnuxumYDIyHN+b\/rXYf5sLdSRy0J6UBCrFDtnz0ULMlg+wQHLpG27mzuaMfFdBrKprXjvdzrOizxiY\/IH72epU\/TvlWgUAVLdi\/DGTUD4WYBdUSilAHYgVVPCDsKSs8iTyxE4BZHmkMYYbTDgWP2\/bpCR5LN9Pkgzhwfs\/7OtLxAaSs4LXwrJ4NZ8J+TcMNl4QQLJgJzYG95I563wmns70qJSCCRTXIdRcHH58Mwtu\/S6MZIztsMVXptPv8QNVsWxnOJDVOt3oAl1av55w2XWupXun46n9eXIjp0\/T2P3yEO1czIJIdbdRd8xLELIO\/749slQi+ONDr+sGHbxzgBDBswmsU\/zBMxUjeSMr2LMznG9GgoI08yqUTMfqZCcEGgNiXhJPMVGLpGy0W7A4302Sh55ZXNV83SVnlpBHKc+SfyvKuwuu+u6ANGMgyMBSVoPqp\/Gr63JbmOg9yY1GoUN\/KUZvlZkr2iArPznQQbov4ZdYT3PnDj0KaQFoe\/SlH2as2OwSemuBh+icKXpbc5S5TlwTedM0nFoOZnc3iSu1zhtTKmjVvPGveOaqzfhO+NlkmrhqjqMIGTWYFLo2THT5ZCrhHaiBhaKhHforCTMawDq18ERZ78naz2KQ6GX9bAaQn2AQAnAIjLu31ef0Ox6TpdjPJpB9UprQR5o5nNcPL8Dm6lN1e+Ot\/zInd89gBOLZuCAYHmpBLtw5PuAwZkdWA\/d\/gQSazBESFm3YK3aCMnjHjCVBwACj4jpjMbE6Mw8ddtBOH44tDeu6lpsyOgHPEkOVI3pD043kdqhKZBef9aplVCm86AutGgMRuO6p0dK1+EJ8IiPcd03tF3eATNM3y7PX75XbKKqnqChU3cqL7zKlBRTE3GmEcF5giR0ekDFab4uN4ZvRkrL7xSlKQvwp2znP+27dN78rzLAzH1ayfFfPV5zteZW+\/KlAv7W3OzXDv13g2A785Ix892Ln8JlDxMOTOpn0LYbW7hXJfQkNSY3PtDmiaSzyHK0yN4A9+B6kK3zJZnY6EHLJR0yK10SRxAFg5MBuOuvoBSsDW5gCS2FeYMyWAqSyv4kur2y4OPeE1Duahyn5DgivwT2BXBT9\/8M6QenUNROa0Kz3PiMd3ipGuGNHkq0jRNU1Ay64n3pJkL+UgcLqqFK5PkXqPCC5aqgBK9npTe6qd2Xs1Vyl9NtX8pynfC7ALtOrQtieM6tsWtwnfa0rSiaXnTZEGguAIqjmN6SrtaRnJhPVJEZrNhIHezWWLhqg8tj8z6jbVh7OLoIytHWilIPvDchc8+V5LluLFG6najJmM6zwdKCwVb1B4CcKQLkcyyfAdAugm2ehbsUZVGExfMelHHJR56oSV3+us53LqmiDFkwaeYTZLEWs1czk0G6MhXOU8\/ZgxntzEXSmtR2Xy5JKrj3n66TDkd1mGyogKaFwGuPZ0xG4XiO7ldfmYa2acYbgijtQRYk48VWevSirkpkgj+E13Vs0MXdX4cP\/0yfGA18YTg4c5haG4Sre5zf3QTZd0Uplz02BXIGJDvefYwAtWXSMG6U6I48TXpWzUkhEONJHnMJ6uv1u+6R8mbbF+xUooqNYuhRlj7ndsguIuSHkxph2Wt75\/gkOCOJdSSVyWukVSxWmwD89AAMeXNOZ13Z3oipt\/KtPOWY+1uCVPuQpWrVgslU+L4OoaCmQipOj2xYiDZoqZ3XjQhXgTkddtEonUD5gBMZd+j6TQbAW0qhia9n6p2EJnTMbF\/gkJQgfFbLHT0YPuAAPwiD8y2\/OCir1bCiEiGU4h+2FXe4U\/dVJxqw3iJt56Ga3jRb9uzxsCKdIpLyQs5OGeP8\/LtculO79o4KheLIUelHU5Yh1K3iIegDDJdH2xoGw8+\/OzSDwGumd\/im6AnAnMP5WPyL1bHdCNTUU2mqe4AHNmh3EGcV7BPNX9P4=","iv":"2adb99f75362ed081681ca568f5eea1e","s":"f9fff76ebda7a65c"}

VistaJet is one of many retailers leverageing WeChat. Image credit: VistaJet

VistaJet is one of many retailers leverageing WeChat. Image credit: VistaJet