- About

- Subscribe Now

- New York,

July 10, 2017

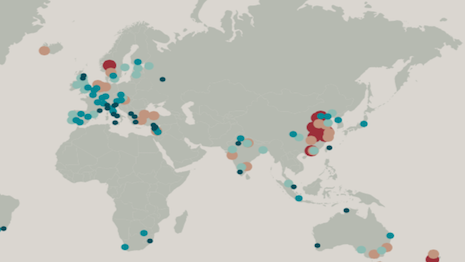

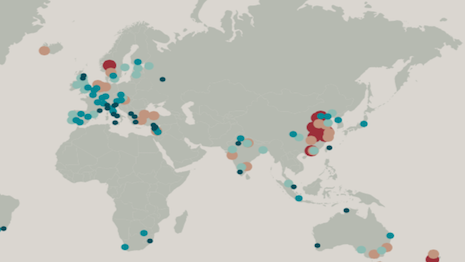

Knight Frank's ranking shows China leading the global urban housing market. Image credit: Knight Frank

Knight Frank's ranking shows China leading the global urban housing market. Image credit: Knight Frank

Urban housing prices in the top 150 international cities have risen to the highest they have been in nearly five years, suggesting that the overall luxury residential market is bouncing back.

This data comes from Knight Frank’s "Global Residential Cities Index Q1 2017," which catalogs housing prices for upscale homes in metropoles around the world. What the report found was the China continues to dominate the top rankings of the global urban housing market, though Shanghai and Beijing have slipped a bit.

“Our top 10 is dominated by Chinese cities, occupying seven places, the remaining three positions are filled by Toronto, Hamilton and Oslo,” said Kate Everett-Allen, international residential researcher at Knight Frank and author of the report, London.

Urban housing

Overall housing prices in urban environments are a great indicator of the health of the luxury real estate industry in a respective city.

For that reason, Knight Frank has been tracking urban housing prices in cities around the world. In the past five years, these prices have fluctuated greatly.

Global urban housing prices were extremely low in 2012, rising to peak levels in 2013 before dropping almost to 2012 levels until 2016. Since then, prices have been on a rapid rise and now equal 2013 levels.

The top 10 cities are dominated by China, with seven spots. The other three are taken up by Toronto, Hamilton, a port city in Ontario, Canada and Oslo, Norway.

Beijing has slipped, but China remains dominant. Image credit: Pixabay

China’s dominance is clear, however, two of China’s most popular cities, Beijing and Shanghai have dropped from third and sixth place respectively to 12th and 13th.

For United States cities, prices have remained relatively low. The first U.S. city does not appear in the top 150 cities index until the 29th spot, Seattle. Seattle’s prominence is attributed to its booming tech scene, which has driven up demand for luxury real estate in the area.

The Netherlands is also an emerging country for luxury real estate, with the country’s four largest cities – Amsterdam, Rotterdam, Utrecht and The Hague – all seeing price growth of more than 10 percent.

Norwegian capital Oslo is the strongest performing city from Europe, though Reykjavik, Iceland is close behind, suggesting that the Scandinavian countries are the ones to beat in the European sphere.

Stiff competition

Other European countries are struggling to match competitors in the supply of upscale luxury housing. England, for example, is trying to catch up now.

Knight Frank’s "Housebuilding Report 2017" found that the net housing supply in England has risen to 200,000. However, a survey questioning developers shows that the housing supply will likely increase by more than 50 percent due to builds planned within the next year (see story).

New York is also growing its housing market.

Seattle is the top US city for upscale housing. Image credit: Wikimedia

Contracts signed on luxury properties in New York saw the largest increase in six months this May with a 41 percent jump in the number signed, according to a report from CityRealty.com.

The boom in signing numbers is being pushed by new and recently developed condominium complexes in New York. However, prices of new condo developments have dropped 15 percent (see story).

While China may continue to dominate upscale real estate for now, strong competition from northern European nations and tech sectors in the U.S. may soon challenge its hold.

"Tighter regulations in the form of higher loan-to-value ratios and limits on second home purchases are now filtering through into China’s house price indicators," Ms. Everett-Allen said. "The average price change across all 20 Chinese cities tracked by our index declined from 19.2 percent last quarter to 15.9 percent this quarter."

Share your thoughts. Click here