Now that retail is so heavily integrated with data, the fraud opportunities are vast and most consumers are concerned with falling victim to an attack.

More than 87 percent of consumers are worried about credit card security when it comes to shopping, according to a new survey from Radial. Retailers need to be sure to ease consumers’ fears by providing the utmost security.

"The key take away from this report is that consumers expect Amazon-like experiences each time they shop," said Stefan Weitz, executive vice president of Technology Services at Radial. "They want limitless selection, quick, flexible, and reasonably priced delivery options, speedy response times, and frictionless payments.

"Retailers need to recognize that consumers have the ability to balance cost, timing, and convenience – and if they don’t meet customer’s wants – they’ll shop somewhere else," he said. "To meet these growing expectations, retailers need a full-stack partner that can simplify their post-click commerce and improve their customer experience."

Digital retail

The digital retail age has also made shopping easier than ever with features such as in-store shopping becoming more prevalent and popular with consumers. For instance, 78 percent of consumers hope to see in-store pickup from a retailer.

Reasons for the interest in in-store pickup vary as well. Forty-five percent of consumers are interested in picking up their products from a store to receive their merchandise faster, however, 42 percent were interested just to avoid shipping costs.

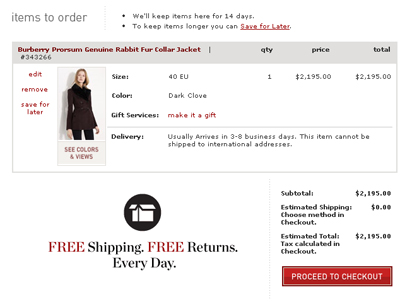

Many retailers entice shoppers with free shipping

Customer service is becoming more sophisticated and timelier as well, with 74 percent of consumers expecting a response within one to two days.

Major online retailers such as Amazon have pushed online delivery further as well. Only 10 percent of respondents believe that seven to 10 days for delivery is acceptable, compared to 54 percent who believe it should be within four to six days and 36 percent who expect three days or less.

However, consumers are still willing to wait for their products for a cheaper shipping rate, with 44 percent saying they would wait for economy shipping prices. But 47 percent explained that it would depend on how long the extended time frame became.

There are only a small percentage of those willing to pay more to receive their items faster, at 9 percent.

It is imperative that retailers are transparent with their estimated shipping dates, as one out of three consumers are willing to find another retailer if a delivery date or window is not provided at checkout.

It is customary for retailers to provide a shipping date window.

All aspects of the purchasing experience are extremely vital, as consumers now have a multitude of platforms to express their negative experiences. About 75 percent of social media users who have posted in regards to negative retail experiences expect acknowledgement from the brand.

Additional insight

As digital continues to drive forward within retail, ecommerce spend is likely to reach $23 trillion this year.

Another report from Zmags has detailed that rich content on retailers' digital properties can help consumers make informed decisions on their purchases, acting as an in-store associate. It is important for ecommerce platforms to create an interactive and immersive experience for online shoppers (see more).

In their efforts to make ecommerce as feature-packed as possible, retailers may be sacrificing a key statistic of the shopping experience: load times.

A report from Yottaa and Retail Systems Research (RSR) took a look at the top performing retailers in ecommerce and ranked them based on factors such as loading time, features and other criteria. What they found was that by cramming their online stores with features, many retailers are sacrificing loading speed, which can be a key metric in keeping customers engaged all the way through to completing a transaction (see more).

"One statistic that stood out for me was that 42 percent of respondents said their primary reason for choosing in-store pick up was to avoid shipping costs, as opposed to getting the item quickly," Mr. Weitz said. "As consumer who is constantly on the lookout for quick delivery times, I was surprised that almost half of the respondents are still considering price over convenience.

"One statistic that didn’t surprise me – one third of shoppers say they would shop with a competitor if a delivery window isn’t provided during checkout."

{"ct":"6pVoxEnqjVnf+PWpgvoWNO2bP1xaFRpVOX0F8yotofwUn9FsWggY7zoZYLFlup9+jA1hqUvOyQ5mLUjSIOX4b+w7\/sP\/lHIvdAmoxHRGvvcpO3IEU4awg62bEOcrelBepoaujqSQ1enKEboG\/lu6EVMJvvE1bQQXKY5mYsI7fakXlF6zBpwfiEcyr2syE9mpyzGwOVxZ1cEAqzji4DqzqMa9G3zlcL8BbwuUR1x0Y5cLD0VsgfF5OM5u1nrYP0lS9L4vPfBlxF3tJE\/ZUVvr1d39YlkRp9baYWWDaurJQ2uEcDPaY7nc\/b9dUPz6+HdeuJomM1IwIv3Vk602wHpmbBUROLXSiRqiRyY\/Mg2of4LrukUL8oC3HBM0JGjVzBB+JFAvWeovsrQ5s97yaIR6H0LMgFzoyjV5PWF63k\/ZEIFYYCTFSWiL0i7cCsDu+KzFgNpf4DwhvQm+Ljy5HEYc9A0ezjjnSck\/QvxNbOHRdUJOUOIZd0UbpK7TK+8qNNnlGW56H+RWOJckbAP\/NOv7cODzCj0z4St3NfiYQolm5+MtbvgNqgdw+uoAoJVl+2SgwJWobrW9RG6maVa+3e9yBn2zCCCpnhpvZ6nwculPtfLnJNzxvI\/uAu2vjbimk633z0wbgBV\/McHOxttaASlJvJX2iXrAR0hD2X4Uf17MeeQnR4khoPSx\/yhMG7qKDn4iZHqQNY\/+yfgmEV7NpPLQ8gpVy6IVMgqXLMuCNbzafDG2bxete\/m7lGYZ\/cohvmSjZOTdQj+gP1x7vUc\/uHla1YUz3W+nno3AvsBBSheAaNlD0c3wvmItlvV\/d4GLYU1sXZefw50q8Uik5IJ0ZUbz7pzX5sx9i9aKPAFyQBd2qjrMivKkldJSsVdzp\/zZTDspDMLZlD2jxdTRNRBBC68xFfB2wMctCSkk+aoe5X4nSOG3\/3XAR+U1P8y84qt1qwYP\/+02zwigaKd27nOZNu2mgehlZCnbFuUJGjalFyYqGrZVD5mfyPYeLrDkHfP3+6EF4YrHP\/vamUZPX3rM6OvXugnNXVFaqhtJkZk8t18Q3v4aaJRNMqsG\/O9A8BvIbJZumR4x9Dfib58WYPkdEtCHk2N41ybwoGZSlOae8MlZCWfnt2qrjkAcqUPjZvvhCCtyoAF6yw86CYe+QSXLlzLup3JIJ4Mmd++plktqTU0p3k7yYn4CcraNs3T2uTidEN6gD9h5zzbFXdtBTUSdWVtxjSDd9VMnE0zw0jVoX0EBQFYkI2bYo46q\/6uT07q\/NADedPDhVCC47zYszOdJHfPmvgXAe4Tj\/pRo3\/8nLo9OrK2j4mIHIsQG7dibyCPAlO+bO5Ed5GZ3TugCgCcHrMsqL9dx7cc+R821h7\/AbYwlFZlBQ3hH3oZn7JmJSEHFSkzQ2yjInoSLW23Ie5ypTm4F1THOHRcJv2PPkHbCuATrmPMksZ49ZzEKe6FNQV86qH9EcIQBxNmnXcoPg13VulnTSUu8h08vD8m3MAmfVT+czn+GsYNFpB2oQ9CxIX5w3dGbj8sqcjIeaXgy8iYN++922hQDbktgW5\/aW\/pXs7pLjLqq8Ll\/6ISdrcSAvr3FVLU9BaIMZg4Sd1B\/\/yD2IEb0ia\/Rg56mtfTD9a9fJhPShKDnaqS4IBcWaDODzSXn6E5DTQmGQjgavaKY7oGddbkBymwShVHGFSglIJrolE1vi0utEMLilO2EOsiV2anFZAd\/2yI4q2GEIvYiHFle5ACt5ur5vrHhTtHtyl7DQJ0Zi+5PaWtaVlAtoCP3XXz91Nl1pBYvOWk8paQXtNB07KNdV+CBXe2urIeIjzPvbC3DvkmuCms1lbAiMdWdkzg+5pKp20PuHGnM7tYg4oGLYNC9DArcRRN2OE0dws7+TSpmGMdF8oUmFAaA3hwQKUojz6uiBTYw55A\/AvmLGmlLqmL6WLRSg0\/MJqSohEw3hWXM24NPQwjwyq2RlWr0ckWZ5gDn\/+7QFQBPYhhbATOFKqTKMor0xXin+sSNqH6\/nIYi6KxgTFV8qdxPOCM0Pm4mrwDC+mnnJm9TsBZuvyRwiwE4Bfo4KWldfGco37NYzI30vb1BhMt0yHmJEJCwDfybPWVtqSwKJDeE3HQnWe74ZuOvzxlRgfCC9Dv1RNqjV+dYqfrTCYFnTIPxC\/rJXsBdz1dEbV3V\/otWbR7U4eIRuiwpG\/3dZkciFJjNntwEXIOkaGycYNYt39C63bxIW2+zI1vkrySobph5HWeYpiiAQJ8\/ogAv\/ELD9GFdObLxo1cnKen5OECyLeueqEvSG2i34QrHGvCh0nU1QttbSeQ3lW7d9nGAkrEfgX2ZiuVNu68xqFYIW9ekk+vz\/t0ya0tFH9hEPRe7Z2glsrZVMDWmrHBsNQSr\/gTFxRPGnp7U8fHlTnOMszjwk7e1QKcyWNOARo8Cm0Jjy3UTPOTVCCISdJj1d+nvXTisfC9KnsBtTdsA2aL\/tYGm6CBgUmV4rmZdu2lPQHmt3wIqEu4v7tomQfcxHA8ifYP5ijhSyGndUSi3kLwAFyI7ofHkFNZDTeyr3qcaSY6KUgOrXgBkjdvJzk8HbWq1aV0k2iVZgJ5d2efyWkmnGHOhOdiBcLFiau2HiLdSqshLAEGSRDO9vuXCF5BBHkawjbAgnAueof5iuUdg3BPoa8uGyx4BOa+dIoxQCyYREeFqE7UyCARGYZXv6Kz4ID5sM6gdT9KVU8Grt7wuTCVCKV5cLHUNAGcAxrGufX0TvmQbhFRD1V2XpAMR07OnGtmRi\/yTahkxzaJDrJt1Ul7Dp7ZKRgKaW7g1sKKeo7qyIcfvgIeuEbuFor853BUiCGvynnLEvhf212BOK\/EJ8+8jqlhbyIYmz8n0ExMQcQyldMa9JZMUFhP6Tu7BrY7Dyj6jzXOO3y5bLo7FcVnAA7vQpGHNcmq6c2wW\/SuDUGNkzMDob4W0xIwp1EkyNmmHP3\/33oBK3vVITMBtRx5f53QJDe1UEmum1i8BhMLBJCc\/h4PjJcUjDXvc+9i5udW8CxITYG9D5gElkfP5yobynzIViFMJJTag3TLU3Rk9hJKmeQ8npLoGSW+wJqyGt3d9uoS2D4MOxvwYIkUT+qM455ULedOeISGYzxyE+AKTYtEqjn6KleR09LaIjWCaPIAnyFf0v2oVG1ai6qKD\/uhnGoxQH1BEd2JfARbe9FcIg4T84prajCrAIu89\/zfdPpUDCmpYUA5Be1s1YWr7O7b51kxeEek20e8yDnnCdQIf9pU1sVl8JEnD+cQXixIEjZQ2eynOhH7RaNSn4EFzacpuUcst5lmWl\/hveYrxFe89msF+jnxsC6HJmSw6XZh27w9EGWOrJh+maT9xLJzs18ZFJbMUtA\/xVBAghRtw\/ZwiHosvE8hxCukc0Gd3CIbkaUwlBr1nfXpWtmgOSc\/gQbSViLZtt3OQusm35JfJUYn67REgQqHFHTHZ0R6SBf3bJ\/2I4bOJzf6yrunjRtqlRDShvnQVHQoT6qUj0+NztVQ\/XsO6vHbtQAefRGNXauJBW3vQQlozOhnRgUmoQaRDrFVXiApWuus\/QkORJnJ+6jez1LIP7vf2X345+NUamtVt0alwMk22XGuOBneHuoAwdIt0jFigPNawhtKsx71iVZUgM\/FQ4Fq2\/r1\/Vnkm\/3okdz+0Q+1qerItP9aI1S283RUhjRVWiXE1BaZTc1v1G5m8eGoDeF0GpEH9VBRaGkkiWFvy8VxrM0ACOLGhG1lYFStuLP8SnNCPHla2FS8u6ZEt4voOaCm1GoqPNGQkbGqqP2ZEaSJ\/T9VKo3cAzZrG420EkvJfWUfwieDQHOqPQr0qoSwYOl09DC5yNfGBm0pzw0Pstjdq8gyqYZZ8VI74MKs58ts2k\/ljAy1u1FodEezAJvLf60HQ4q227C0HBWFL8QeTTuaBRFX+p80Y\/SYJUpHgkFhfk2IH\/kJcJUUBkmzhP3i+sSfN2z9Pq\/q04pBk7IqTB87mY8sYS4626WTYFa7gHHvtgF13l9zyv\/TGBE8nfpu\/LZgUlqt7rHPhLUFCtxZn5EQf6RwTRq4NCxSfVOhydqKG7mDtI112kCg\/duPzkIpSx08VY8SpCbzeY9v5p03D3eBEjk3Upu\/D6hBN+w6xS3tvKQ0WXsdATcanTmjXS+rEN6VkjJnScf2Mtg+vY\/eo0K7NDrOHQYo9BatFG69l1XRSvLWUMEwYh0MFmynnb+\/sJ2CpFFh1+qI\/jOEMk2r4y4gsxkNFBPk8OkvdvgwQXmsfcrCOwIF\/eSBSncWxvrEBj02qa0ITN2pxsyRktYvniT4qmS1Tf2viMv8V5OyY5X4NPpjJvUvEq0ouoMA0IxGclJwlJhg1SvNwoe\/C48JFl6cMyB1COZ4O54+VfmIPG3iObIgeRqCLqiafoRZzaZNbRIiGfLDwO\/Xwi9Sv2rYqeTEpOl5L55uvImIISRruTxbYcVSO9QHdNAdZBQhQ+Cf1Jjx8ghiM12E0B\/Rlt\/nMfAgrReOzU2o+b7+Yt2Iq8PQiFb0cPWGYOB0egucKC8zexj150Eh2r2pVquDEwyBr8r98+RlEwRtyW0ytKrKjyViQGoziw0alHwg8QaFV9nS0LvuJip5VVQXLRTLk0csziZ4ZOJ7AMp5fB2Swso1QwYatJE5HXaRCH0k9SAfj0\/PfqkyaG1fR5YHS27rqWno6pbjneG3oIGLdGgoH+kc2HJndUkTdiehimU\/glq5cYVFG\/ObdQtyLjdJR+36BCh50aYCnenLso6M4ufYW4BXQ5MwIrFQ2NCQlkBc\/wZRyOC5LY1bh92kFFKrh+at1EInsO17w2+jEJN33rr0mKszJItvJtDMt5Jbm+1a9VyZLd32fEjo80R5SuqiZevGUHliFjUXdxnZ853NofxgpgiGjmkJR4Lyemmc84HTNq\/2Nb+\/5A7Lh1ooWVG3ssVTgu0bK11ecHJEpjIzji5GwCs6qwoAD81Sb010R+lUFfTMQI08mlUzGTuIAQJtpt8WP8\/TFJxpyDt\/umLHIPXaf0HWHT1yAiShqN+U4IB0Bd8DcrYme7YGA9TZereDpm1qxauCaXbB3C7rMHWtugEtcTSiAGnOjaBjYmnChaN25o+W6xJ0xk7JyXyq7wuIbyIBPghaGTAF9geypWpsE589C0k8rKEzvltJofw5ZFCKDxqhJUI4EVJzgV1n+AlN\/3dZPnboHSOHLeTN8v9etjgAL9QivlWGm0C7\/jV+J77cI4ifEQjCvo\/O0DlpAba7UyaJ0wVLePvC4MHTCqiV8qxugKFG\/KVlRIwSSCjgsnX0CMyf8RXQ3LxrAxUN9nOmJ7JZSSlHrnc2h0UaaUtyhl83lnwJD63oKNM3SFObYCPfIAEeUaQ02RY\/qjkPBBbGBea7eK9xSe+i5PgssY6KtImvaMf4kzT3TAVHTYHjoDrxQzoz0M053+grrWIH2D3oQf7vMQs8ZHAjSLXlE82QvA2EmxaabONypXbKbC\/xMNO8BCU23HoTd6U1ypxlTna99uxCiefi5CXq\/zt1bqZJMsYRslQz2OonggciVSjotPRx8Wu3hHnxpIg\/l7jQnmsLQz43EgvMOnaJ\/69z979BuLl6NZpsgOrx7uEgJeAtwVs43OQescNOk\/QN+RzBkGqpT1U5EC4JFR8EU5GTkQu6LdquKhjDhs5TWRtc2UVzDgNLzihMJicaWYsSXCKm1QbQOjYB6ouRVq8QzGSAPt3fsM1GYJHb6bGhMOFpm5KhYof0jgeXkDsOvku2q2kmPCkDdftXj1a7PWwpzHeii3\/\/hcLlPnIezjuJ6M63TZbI3zvm+R9hnFMp9kvAs4b2HysKOpkVeyZxztUdfw1yOElrjhhmZu1ExceCXwmz86nKcOsfdcqHS4YQky5VgPKuYl7pm5sv3X7hi0g\/Ld+WEcdDcaFjYNw7RYzEs2wIa40m36OpPhBL4Ts4ndE\/FuOEqsESb47cVm4SXw9smVBLcXNMQcowESAR931vViSsukTxbTx1H2lyX8kxvd1Q80zUTkv63aTTYPoRTjsqy4nzgRMETTqZ9SFywwsuHf9qTr3dw\/0uNyzkwWDWKKk1kaSMENk+yFSLOWFSIohOoezGJdWXlBhhHzKDG0wRIZEJ4Uxd5uB4nlcJ0qsqNG8Vzhn3mz8ZW1Rc1PBBsyptmO\/NcZCijm0ffQ+EhK5v0ZL0e9Gl6FM8IkvkgNoL2DohccRU7+L+7S2rGJhYww5diz\/erYhbpAQzWdXmzI+hiY0E7BMYo7IPxXN3ea84FwwTPQ+EP3uEmCDf9+MT2wB7EYJNQt42zd44UCJMYIUIp1nkse3GeVVGx9\/jn6dFdzbza+ymvbV10b6s9oaRQDrqu3zgpN\/9f9d33RKSnioPz5S3fBmmmmbVY3v\/Tizd4hsh5orXJV1UlI36AObo46pZmpbF9to20+ucdP\/RDJiUwhOgLsn\/MO6W4jSwUfo5aJ4ZoeKCDA41MftQKMGdK7UMagkiuZndzBA9Nou8JsNtUrkacDxLr1QV7NQkzkyMFUkBF4W2xhlH9sOevQHci9reO3hKRpe+DIyaFdHI6vIX+YT7y8ZEro1alMtD48k5LoOBneM5A1iTfPW+OFyF1pQPPnQAyMCLuMZFCCpTbPtWxUj66AMGALU0qcDyaALC0Oiawvvy5Joo1KKgJHgo2ObzTK50aCKK4lz8p5jQ\/NOmpLYn7rjgz3nZrsuCNelDMMDz12ACjPaDPogvdmVNanLtuR3Il91ogOBFpk0SZ14EaQ37awgEiwoZIvbMeBe8DM59VJ8kmjDY3QJK7bd0pyzlGzeyF0+BC2wBPNDUk+gDEZiNCwIxt31ObSZpOj7uGOtSvDtXFLURKc2LMr6hMolgz2DZu8VqK5bsIYAmxDZoU+Rfbjk2\/UMTmr2Io\/GPl3ZsSTUed8rE\/6w9enpwm\/pNcrPtqkC9GxH\/G5OeiKDKeUGJp76JtEG+RZe\/gX0jjLvfDqxJm4TQ7PDhlrgnl+Hj1\/0EPMdenwKlfyywrNwCfxSn7Q0+YwKFQKS4f7BScWcoUBZ7RVB7VcvLuaxj3\/Lo37PKmb1bHhAzJynmbx8qRLjsGKyTRXqNUvf5GcKE82hUNPNkg2LYGKBudHqSsn7lT5mn+Ot1vOoEgusteWGZlz6vMkANXJdHXIe5zA0Sk8bGvVwutYGJI3W0MPgLY\/XdHqk+xip6BLdk0lemr3u91O8W0YCQKsQm9exOuYt2G1kp54wdoKc9T0TeiWxnQXt\/rXFvmcaT42VV+WxfT70oNtlSK2EhNcx9v2iYNnVdAL8bJyw7qWGtWfaoFxvuVPgiHMxKl\/6zatm3PBVqehq0wKlCWicnTdZ4snKyWQxaT\/vRjUc6Uvtr1c0T5AQveJuptwxBxTAyP5OEDiwlmC58TiBmibeV6354ZudOSU2cCPpL3YoymXkriFu8TgMmshOL4g1P6fhGM2DETMtgbJTMWKQjbHTRQs8kh\/zH6ao2IE\/zFeo1RN2X2Vscl+eveNaIE0FYicMCIQ7WaQmKz\/qVZD85rgSVCMgHnboQ7mMMM1dwJKPePux32Myzb5Xo6L3oXIzbr+6z3Y9KaHJMjU0nMnWk4LOcQfHVs57cq7yctSy+YVQgMjnEZHtoYJUQMJEz0Aadggqlwcirvd43XDnUuwf7Wm4q\/DXkl3kSWVrw8lnXD2aMaQ20\/xd2oCFbldLXQkVuxbSOQ9EovzUopC+kZupeHekNWXKqy13SaYIpU7HytR\/qn+y2nRyFyBLvC2x9978IE2z4+\/46ntb20NYskazADs\/4e+CeDVMPfJkdr17crFo+1ZcR\/kqkm6ReWttaNCInwG85mcMx3xX15lUqUIXP6pq4TKSyXyZrgY5LivH3t0cDyvf1r16foZYEOEUHZdeGNRO0qQI0xkjs3VCQiYSBx9h0s1Gp9IyNMecWvYAM8I+MNKM+WI04vJEjh7g==","iv":"ec101d3654b1204d3509c6e8b2d890f9","s":"cbb250dfb18bc351"}

Online shopping becomes extremely prevalent. Image credit: Bloomingdale's

Online shopping becomes extremely prevalent. Image credit: Bloomingdale's