NEW YORK – Luxury marketing's shift toward millennials, as well as ethical and sustainable living, is creating a space for high-end wellness brands and experiences to flourish.

Speaking at Luxury FirstLook 2018: Exclusivity Redefined on Jan. 17, an analyst from Euromonitor spoke about the ways that the luxury industry has sought to monetize health and fitness as well as the factors that have shaped the market’s reception to those efforts. A common theme was that experiential luxury has led more consumers to value luxury brands that can make them healthier and happier.

"Understanding what makes a product premium is more important than ever before," said Fflur Roberts, head of luxury goods research at Euromonitor International. "Spending on things that make us feel better is soaring."

Luxury Daily produced Luxury FirstLook 2018: Exclusivity Redefined on Jan. 17.

Health and wellness

Over the past few years, consumers in general have gravitated toward products that are more ethical and sustainably produced.

This can be observed in the rise of organic and natural foods, the rejection of leather and fur and other trends in the luxury business.

Euromonitor's Ms. Roberts cites research that shows that “natural and organic” and “ environmentally friendly” are two of the top qualities that luxury consumers look for in beauty products.

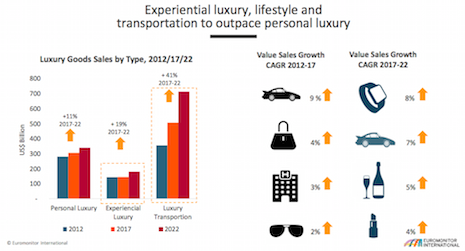

Experiential luxury is up. Image credit: Euromonitor

"Consumers are more often choosing organic and natural foods above all other types," Ms. Roberts said. "At a time when the political world is in turmoil, luxury is less about showing off wealth and more about what we find meaningful."

At its core, luxury is a way for consumers to be able to express themselves by highlighting aspects that they would like to emphasize. Buying an ethically sourced, organic product is not necessary, but many consumers choose to do so anyway for personal and moral reasons.

Changing trends

A quick observation of the luxury market shows that brands from across sectors have all begun integrating health and wellness-related ideas into their campaigns.

For example, Condé Nast-owned Vogue magazine is helping readers with their “new year, new you” efforts by partnering with a health beverage.

Vogue’s partnership with Dirty Lemon, a lemon-based functional beverage, began Jan. 8, just as many consumers were likely to fall off the new year resolution bandwagon. The partnership between the fashion title and health drink brand includes branded Vogue x Dirty Lemon bottles and a subscription offer, promotions that may sway consumers to try an unfamiliar magazine or product (see story).

Also, private aviator Sentient Jet is making it easier for its members with health concerns to travel courtesy of a partnership with a medical concierge.

Consumers want ethical, sustainable products. Image credit: Euromonitor

Sentient has renewed its relationship with PinnacleCare for a second year, offering clients access to medical evacuation and health advisory services. For travelers with chronic illnesses, travel can be a stressful undertaking, leading to a number of healthcare-focused hospitality alliances (see story).

The majority of health and wellness spending has come from millennials. Millennials are “WELLth investors,” as research firm Cassandra put it, who would rather spend their income on personal and societal wellness.

Cassandra’s research found that 73 percent of millennials would rather be healthy than wealthy, and 68 percent would rather splurge on healthy eating than junk food (see story).

This demographic trend will be important in luxury’s interest in emerging markets as developing countries tend to have the greatest number of millennials.

"By 2030, developing countries will account for 60 percent of global GDP," Euromonitor's Ms. Roberts said. "Ultimately as populations grow, we may need to look further afield to meet the growing demand for wellness."

{"ct":"nR\/a9wghAG5v+\/Tkw54SpifA0opHsh9Lrk4KJ+QD4gnc1qJuAgQKmnUxczzJbtvI8j\/snTMD7pIOSRgY6VfJ2e+DgJToNZXDbOu\/fbEyLgQn+zOiPmPbgWq2eR5Dkgl4pYcL+0iRTrnlX1GxbhV7F2Xn\/VjN3KGH8tSFLLtQvfkl8cRQwq+I4afDKNKqLmooDY8L9b2x+HYJvfZCcYo8jJNX4sRU1yKICpncsWWWrxzG7P0YWhVp5XMZoyt+2XbIHVPVaqt4xjWFbQglVkCbaOyF\/Sv09dfBIljxJ5LUy0rPtRzrgD+x260bsqyn3ZlHdMW\/kh71n5Q8ahhRKIaxsWju6BT8+87dWrdjMkBbWsG3FsS0tDhYgBVmj09ZcJO1bNclZn5IYnMY32deuHaLir0pDzNBZhBFnOWTamoo81zb7yHC6J\/taivX1Id9WGo\/TDKbn3xGL4FcFKJ\/KcqsTM\/5M8JEneRh9E+wZNvhsTlGq1Cf6pu7R3hBkoYI0T4ptccG\/KQUH914oq\/RPq4dBGB3Rou35nkhl0xPsduS39I6TKyvCjD4hD4N0mQz7ldAnGAvtZPdn6rkeB8ztcuK6HotzDjaki\/kJT3y97jVl0V1MFaRPtTdk0rO71GrOcK86STKkbSQ8UYc+X33pr2RfGk9qQq3cI\/P4FCLTBsPdNmz9Pju1qD6SNF\/gTWxdyHbh0emYiRuajp\/RDOwTIdkfUUXKk3RymVwp0+PhqorceT1Qq0sLgIGG+7Elr+1jOHzvdbGHncDyZNWyd\/lXYbKRKRWChyhnbxqIExsL5FxmMRE18W0p5hyMFEFHN2QdirG0o5gs8XuVw4F+IskHmz5LbgUYQgUJD4z6cTeRJ02d+ls5sL0bPAssdmL+16MJdsZqeLTgGXMxQ0HhqrumlIn3x8pwj\/Aee80FIDQP2XG2Rx5jvHJ8QpPl5OxOrwmAe7GdA2O2au7KICbyI8YTdYVxqrzi0Q2zJXBJ3YwMp65SQbQcZ6ecByP6MrfRc\/doK2KJHK+lCs8UoHO7nb9JjapNEkD5GBGg5fkSJ0C6CDO3pA9QwdIe\/eeP36DxUaNmqG2FmXTX5mNgXlBZLoJJyrdWvGx2DS+LsxFyK1FXDtGpKqoexiTTZT4spk5bqCkZsJttWZpC5kj0Yx69v\/F\/\/TWS+wGTNMqqbMiadGPUtWMMnnaH4OZHcHrPcLUPb1Xf0X3sn6JceUD4cJMcbrNvt84gL4uOLdBBLPadZ0YcVXix23Oxo259Vdc3VxdZ5zK5XjZxjbLulE+ENxxz7WabEpR6jYasB36jf0XrS5vUU4UpUbn5jT\/HcCXTqLmxPCoSUt7PMVdpoWXjE8i\/tuyGKtKvWDyYag18p9p6q5f7mBvLYlWxZ28sFP5OBpKsb6siHROVB1hJc1b28sY1TYDx7pM5nNenkY+9jNBH2mwFSRh7O3W9JvvLSfvYBct5Q9fZnlZ1pacBYfut\/0UUGANgdHYYU5wiRASN7avXgCJbnEmPLiALOTbje+b8aoY7Gb\/fXCetF14R6TTtB96s7S6ggUNRQ5a5ero0a9J5OKzG71bceyCI2D2kWFiLkuZcHz3JHNDd\/FCB4kPLH0Se8yYUXqsYnKpSpBDGq0y9q1rwhRZ3h8m7kpDN6pFyFecPPXdYetPvh0kU\/Gj7W0o8lGi+bk0cieDXQ2LzWy9Qg9ZYha0GXOqoUgw1dQYm2NjLMRJmlCujfspz2tLLRC\/CQaH+jlZ9KOzJYO754TZ3Un6Ba8CG6QTq3SVGo8w5oNGHFWrn3sDDrb1pKskSxLV9\/Kxop59RbZrpJ5VgSvakD8IghduISp6kcLS0H2pd1EX2qhGbr12l+0o\/rDAsR6aEMzvq260pX51tUdy5vGvA9Q8B\/a0+NW6lWT4EI946T9TgIeaFASrxOZy+dJ7MJ+aeW6pBlGOH4T1NeEWbE1nkKFjzomT2s3khGLs+sBAhzIX6XM5tvXgoHA4p+22EkYyN\/s48iLuRBoWxETtr\/xNBXu83XXGqi6gEDbp6gafz6ePA9mJTu3n3N6P6YBN0B2+WUry6hFuwVFeRW0jdYjcbUEM30ia+qaJeZTdbHmh75mv1inYaY\/64FJydUCCEpkzgCZ94UAaX3F4KblSoT5zmWYCoU22inGYwTSfzNv3alIXj9i9LZFaj3lu5v3fJJzF+sLwNYWma7WQpFw7OrGFCF9k6MszvkzqlxgayGgpLjokZHso70M2T6VPs0116C1ib7qu5dFQ5GYVRgQERYRuxBMNgpDf8FR3qJe3F6ENSYbNEWfWVecbR8a8Ew9KjJ1dbF90hGOAFCLMnQbP9vS4h111bLFKEKkfiCXoVQ9FzGcXNrBT4a+1JklzE7PGcMfcC8HKledubRW9s9SfCmi13JRkjBpITGoKyyA9iRRuTzU\/gfpd3HFACpguID1\/Ox0J11+1kdxWo1jQUgfEh9XB5NDOUXRVHEvOb1+mTWJ1SzO51dyYz7XzqX8zJWGhp1p2CB2uN5UkAZrDGyhspqmhuLoK\/AD4K0xmWMJTh\/iwfiw7dqnsc3DAKjY3CiNysGWFqQHsshr86XBUA4HbgHC3tKpvnpmYaKflNyP1Yki84QBzNacS931P13IMFajPwpN2F+Jt1L2nP8cuDdz4d7kNT2r1DLY65EtwYVsdriibATjEZc9Q+qw69su7KHzSu9GCm2VCXcWMKWhOyt6GSd4MOr3BVdPXQ5SntIyQQeEoRt2LigzMFrDo+WSfd5h\/+crVoN7HrjdfvRmgkawPjMgYF9DzUttl815OyD5ajok4nTiBsP5Y+BgHvkZLs4cu696oqbzCapBQ9v39hPfpZ\/6jwo24ZoFGvVYR+A2Nj7o3HYyhGhIhFeWp38VvoER\/cu4nH\/F+aSJsYUHBpQFP87vuhBQbOH2DvvyvIilkLsZQhqAS6FQxk+npc\/Kdl1ufTRDa3cXCiVCEaaGnCOIZLA4kv7jr+ETXIPhVlKtLVwnt3kseKfizhjH6+tcRnd8KAp3KRJXyGP5KN4XnSQHfXbnSaiw1oSJfeYoGaCWEcDtbP5rEOSlh2Zi6YBX7IQLjHhuL3RTpo7S6XMADzti7A3alqbotESYoljXsoraoAZM6lnMhiAQgBGbx5u\/ozXyNjYUYeR7VK+QVXIvYYOiiUW087KVFWV7w6n9BdvP0M7qg\/lC6RTNeIdT4P921bDnjGAGjDpsq9SBIgOirrIEGFXSLBTU\/z+IBPum45WlZs5QBRy\/Kz7fqKk5sj8BdKY3IX0CdFiRdLtDRg1av\/L\/TBbdZPRcHmsVJEg76NVCHqdUIY1CgN+hIzkWNBh9eQzpZnBkodg9wYqt9f4O\/j9rCygBrJvg6I95Dj9oGhWuGwcJihEK2cBSKnB\/sqpig\/gyA+IFHD1pr8s4g1vbfdfNauRavAA0i+tUmeERv8D9pMALSYnwQgq1YI0c3b\/GD5ySWyd4sTDje8c2wyFSdrbMvbXch1QO79Ae\/MMyGVJYgRbbiJ5jfi5tn9yi+O50J5ar3Uudv0sydieQIovvdVG8jDtVRR+tzqYJEAUJMUaaL2nCPv+HX3Ynfst8K2MA7SGqjUCKmQLu7K+vSef16EwOpE0AUGsy5OgzrNDQWMWm0AlrLydAUldMuPj4znXrlcsQdNhjFxgEGsTb0BcbNGyvTf5QTTjqO8pRh8FL78hetcvaamkqQyXyDulVk1z\/xB47lmkPBm5SxG005SpuHJW4rRJxKCyOOQaXm4LNmk3UjfkqtlNuy5p4eTbjrtHt4IGF\/yi6P2lBwYhTmJrEy2cjf0clCzqcP0mkyzJKXYkaxvX0C7K2QlWiNDhmPbCe9OJI6k9NaRqUxif2HERubKcZBvKQibw14ovV8xPCLJiSw\/U4bD+nfLOdIkUrXCjYBUdOl7BxQav4lpu1G\/7Le12Vgtp9Pera3z7sobNbt\/EY6pYiCX0U\/32I5lrw\/uxSGlYcjQ\/slLtwJpfxOAk+94VhtLeyupo9IMUcv2FoF64LEwEz1ZOlXlUPWfFd7iw2ZxVLlcWOaD8ADBxHg\/aylmUxxC9COWgZy3YfceUuoqyu6bIW\/ufgRwYI4RhBALhLVljNNgECBV3JWAkZpsk5THNPtTuoGNb3hJwbbZjNe++q6rcvTdICkMJfhjGasQSuCySqZnNDp1HE80XSvtB57FfHWDZnmK4yDrhD2xS9Ba3ls91HG2dinDs102bTMVt1MHfgIxtMk2ehp3EIxJj75EEVxBLnnA46cAlH7lSreNtu0FRtt\/bDt16MhqxGQuPdVJ\/xfEigFL9DOMVR7vPU7G3ly8ATQL7dGXKWB5vB07lT2d09gBKpBExHKWusCBfVHxEScFgzAnZwCIpsaLTKVO8arLRl+csmu4z939ljVGJHHQ0cBxoTCbmhLR0ZDPAfnJkIj7WybdMuKJTg56L70Brjh\/wrMjiIGQp6Ye\/qdlHv6FIhkNqbJsZ49keqMZpy2NDRL4zuZXTEyc4fKnAcqiy+DJgxPzzTIOwk25T9KhavJdP6cVm0ZZf\/MAZyioJ9aAmqz8QrYZDWtkJ8uuUsZMypPnogL15fJ502Kof1C+NkVv0ucxlB6X+Gbk\/OVY8xnDchZlb6PLPUKVJvwyuNfi4uM020VJdVqquT3TPA0IPu\/mZvJUk5B8i\/ewKTLBSorfJt3dlxszR6RGavzgZfapMLUFhQ\/SS2fuZ4t4QHh+y1\/NxUD5GKuwXCEgrUEmxlhifwWznkrXGTP2fWuz6ddd6LbpXkRquQgLKqtP2i2zRnR0KMzohuCTf37DhI7Hi23LlfvLjUHXxkhMbqQgMhOXVj9s4S5E\/ttWme45Uh8pjwYlEchv0v0kKBHXX0mAn4NRP3J6MJefntuKZxrv1N4Ow0wU04mt74uZnTb5G9AhCjucLY6YdDGi2\/vOnVFEiSAg4V+4Gp\/gW0fuT1JftQv5u5IAvDJzoa1fC246b\/5YWLCqDgIdKYQKDOoxy\/wAhcNU38pdm1cck2GanYf2Nq9fzuMZzVmwUA\/YtduA5wAiXN2Y+idQg6eCYZnchPUZKMx16fcymWT26LRr72z2x9+xN5lFrp2HcZzWM6S+V\/kD2wYU1jUUTZd8uWeKMEW3nRjC7cUmXjYnDPZuj1TWq5QTvgyDTc\/ZZt+iWM+FBScNez1KjykKnvpJsL2Ae2ze+Sc75nExIQ4iTXWDSbi5gGtu\/c+pmsdA1ihAInKCi35w5m4V2OK9++SgDYkgqYoaB7IycnE02ZHRbrsu5NHflCA5mOxrWNle3zeSaYNv4pZ4eFcuSktvhFA01L7gfOewiH0Bu\/ZGffmSJZYt+XjAwfL2RwcS4cNCxTX4B+N4c6tmDqiqpB0kKKSZezovrP\/GUrywA9PusxF9atJR10nTswM2yBtld1p2G3ejUVHja9Vxe8HaOvcrdFtiaIcxr0DNH7YdC42o+D3wIEwh8s6YkhAzj9vOEldoAINqgDm\/hwZbTC\/Ymnm43Hg49bS6MvGQl0xH4eXKI1KqvjJWX4d9eP63vPPU2ZQ0VN90WPuHbDKmA54lv0xGnW5CKCUGcnBm1TbSKpv6zSsP\/x\/XbAElYMyeEl0JrckhX9KEYN1hro1izzQx3R73hlBZtMuSRER7Ya8V58S6XNBAZ+9kg4L+u5fjxTrlcdDdZinJ20A6SwWYEk5MTY2HgkG\/+XV\/gzZK\/X2VNmeNTD4nrZgiorReK75QExYIEwNbRyJE1z7PxsPttghugqBjLfIZ46UnvWCpPWA4KIbmMApsiYO\/WO9J+LoUIsZZ4JqTbaBxLv3+tLd2dkKZVXCeUe9N1NE5X8e9\/TAUECRlcuMtNNTJByFlRGEr2NXbW\/L3YMuF\/OiYBG+dYTI1ehZZBJgrTI+s04O3o\/3m9Z8EdTyqT8xw7WXv9UKqjQPFAD+mEfLU3B106PWclzPKbBn+edWv3uu\/tKaPYAAcIpCfgi0i9TebE4jzfzj2ATkvxFAdsvuFQ8ttKzbw+mIWHQDum2+kCFkTXm5TexgMxAOIQvTXRLR5wf\/JgQEi+AheLQc7q6MAJq+xi6IIQOKISrSmGIDL9HN8+V1LiHX+TDvP28w9ZEFXrdWPuhLuIxkCZR5UI8JV3HEwR6WSqa4G+m\/RwIQWtjTXwZ35B94eK0QenTX9z+S5z\/jU+\/zAVM9yOW61XUeeGE0FNIL5EVzwDC1sJT6PjCO7+g9bBqcgIWyc\/hrMxblFLybyFaA8DYaqQYxshdFVNvSyK9jZ9Vz+OLjtE2arsrsW6AnwKchaPh41nMt\/i1VF5mCqj8XJ8ptJaF8VSN2Pd5uAPAyKbIzT9dvTL6NXGKJ9XR83GVCyErSwnPxhqi+VMxH+gVz1kU0zcbltpbyBeqgiGjmMKbl2Q4iLDdf0SAOvU96aTfV450E2oPKWonj2Cg4FSMDkTgA\/nJYE5F+hFhcS8U5MDaC\/05+Hd4ilDfwBfBSxhCW5MJ7Vk6ZzbpB6hkCZUPvfrLLpeUIJswgay+N3h0BeHfghdPaBb24n1ViEtko2pMCkIClJ\/0bmZkcHOtKBbAT0dda3AvOXs1vpC4lNvi3bha+3a22j1oRfYj69rP1uIDLRgVN33GBaK70BtrTpLbp98WjBZ8w3yLgHEcCdyKH\/qSXcOpNkxl5+sG5YhsUDT7PbVyv6h872t7HPMYZ2v\/X1vf5SBhXU80GXKYiGhpO3MfQArn2qKVT\/gWJ2aVB8aOqzI7eS4FtV3ZrEEPtz6VSN0CTTDOHaaFLnPDLSZ77AlsXR4RgeBw4whbbKKXyFT6KoyJS4W32SvGn5VbxSya3eddQRepDjw\/LDOcW+4QrhV394YuVkgUE31BxF5RlStNOD+AxPX\/uQXk5VyFOigAWTJYdw+ymoSIjdJZi4EStL3ymUEBLucj1gocpEI3SXFPYcjfcKj7PW8pRLIlzQ7VUb2BQJtdiUnkfkmLzwPN2JTl\/DcRVfUzjnftiRSi\/SMXli0O8ZF4kV3nTqjO25viepLD8uBjqADpm5ize\/d7auJq7XLA5eAPyN8WAvrglmtrxmm\/yEVBwiFHAzZxl0ftaxzpyNWSH9efJ0OeMYxOnUmS1B29Fi52mAgOSrGOD4Wf0QFFg\/PZyzzyGUGtT6NGcgQu31ThS9W4QBPjEsXDYnO+I4j5DVwNLjbU5rCoDDWl4h149T81WJzjvHJtjiTwWjF28Nr3hbCAyEjV9jtQtJkehgai2ghSO\/jK\/I60W0GeWg\/MuGWebe8E\/szXwu6JPWC9WxmLPqnaJiw+UVcaue5+7QcKLPafhXyoxsh3fVUimJXgXf7VIcCeaK5oY5W+C38ZMDSKgz431PvunjgCn\/FvXRJDvzsNveEGi8Gco","iv":"4438ca09a03430a657007069a2a0a3c5","s":"f6d8df058f531b07"}

Luxury brands are partnering with health companies to attract fit young consumers. Image credit: Dirty Lemon

Luxury brands are partnering with health companies to attract fit young consumers. Image credit: Dirty Lemon