As the luxury real estate market begins to recover from a slow run, San Francisco is still struggling with the largest decline of the year.

The last quarter of 2017 saw 7 percent growth in luxury home prices, fueled by an increase in demand, stock market gains and finally a shrink in demand, according to a report from Redfin. While in the recent past the luxury real estate market was plagued by an overabundance of listings, on-the-market properties priced for more than $1 million saw a 23.8 percent drop.

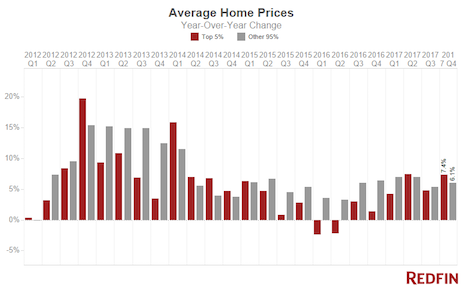

Redfin’s Luxury Report Q4 looked at the top 5 percent of homes in the fourth quarter listed in more than 1,000 cities in the United States.

Luxury growth

Q4 marks the third consecutive quarter in which luxury listings have seen a steady decline, which is giving a must needed boost to the industry. Residences priced more than $5 million also saw a decrease in listings by 23.4 percent with prices rising by 13.7 percent.

Homes valued at $1 million saw a price growth of 15.2 percent from one year ago.

Redfin's average home price chart. Image credit: Redfin.

While most markets are beginning to see success in luxury listings, San Francisco is not fairing so well, as many buyers hold back. This could be foreshadowing a future exodus from tech-focused markets.

As residents and businesses seek refuge from tax hikes, high-priced locations and costly cities in the United States such as New York and San Francisco could possibly see a significant decrease in population.

Glenn Kelman, CEO of Redfin, made headlines when he spoke with CNBC explaining that technology giants such as Google and Amazon will be working to ease away from California's Silicon Valley and coastal cities due to upcoming U.S. tax reform. Cities such as Denver, San Antonio, TX and Houston, TX are likely to thrive as businesses and homeowners flee expensive cities such as San Francisco (see more).

San Francisco saw a 12 percent decrease in price, down to an average of $5.03 million for a luxury home. Redfin also explained that a greater number of public offerings from local companies could mean affluent homebuyers are strapped for cash at the moment.

However, San Francisco is not the only Californian city to see a price drop for luxury homes. Los Angeles and Long Beach have seen declines of 1.2 percent and 5.6 percent, respectively.

While Los Angeles’ average luxury price may be down, the city was still home to the most expensive sale last quarter. Featuring panoramic views of Downtown and once owned by director Michael Bay, the Los Angeles property Bel Air estate sold for $41 million.

Bel Air estate was most expensive home sold. Image credit: MLS.

On average, luxury homes in the U.S. have begun moving off the market much more quickly, with an average time period of 75 days. This is eight days shorter than the same time period a year ago.

Beachfront properties in Florida saw the most success, with seven cities in the state seeing a 25 percent year-over-year increase. Delray Beach and Sarasota saw the biggest growth with respective increases of 41.3 percent and 45.6 percent.

Additional insight

While luxury real estate is seeing a rise, the previously lopsided real estate market, where the availability of homes priced more than $1 million has been more abundant than demand, has raised the limit of what is considered luxury to a much higher level.

Today, $5 million is considered the new $1 million within luxury real estate, as affluent homebuyers seek bigger and better to showcase lavish lifestyles. A report from Tulia shows that the number of homes valued at the $1 million mark has quadrupled in 16 years, but $5 million homes are increasing even faster (see more).

{"ct":"ozJ97ZMjZjO4zv36WCVHJfI18oA19VgHt8cKF6wGk6TAGNyS\/4yd+vBcZMlUx+zI5x58fg3pyReWie3bCk9zR58J0mqBj6d+FWfZBvwdTp6sOHf+7p74gnbiZ0locsFTc+0vURSLLCbTUDP\/GN1isLa0+STjOYMQrD9JTd5XK0sgxUfP228h9\/DYJL\/LJu25RvfBtwDkmjj72nngI+fS8UCTt1+weC1XdzXEZBB7\/hpcb08n9OXC9U+lGbXoO+KpKQEysLQ+cqFYoFxBPMcFbd2ggGAQ\/buEbe9ToVoBLahjOrpBTxhzMIedItpVrIoOZmLeh2JT6pKM9ocS7VnqT7Bf\/HEGUsmxk3p\/DBqZESbiwHFjRLJW7m7B4VrJtRgAF5PssJmlx2EZGhmz+A+VH9+grnLcN0b6ZKxMehwJCtKRqZdFNdqinsfJ8JyBehpLrkUKGhbtVxA6DwWAZIrzVsjDaOWRkDTAu\/n2kNx8TdpJr5M0UdwOltxWZfcZEk4iu1odc2FHAb04+9DUPDrVPuIDL3+M0+cSzDbiy3l03XQrAJhM\/WChAonm2dqNiptLI9TNCcuUdMnhTFo7OwSOGxbXLeW3AfKvmLLOISdPWz9W+3OSXjtxd71Dky9SIVaqATIKTTEHVlEOlBK0Qqu\/7zrkHmCeWvsC+O6wwdrZ9odN\/8nHXXbEKbV9mhrhKNq\/dT5vUK2CjSBc75Pg0D5LL8nOlBLCAbQ3hS0N8zIiK223MfbPpY1dsLRwH6GeQ153GSwgQjbhmBm18E\/IMkoZU\/bS6oZAnYvyMiNPDs4ERV8UFkuUPybvExidJgfNCW6e8Dz2HflvIE+UT+WYJZjdOHV2jh7AB4GVGwzPkIJRJ8XQzBhQFqOYyagGlA0cklz4p89nOZ60t\/IW55NsuPjgqSCuwvB03yelYu13B\/T+lAfo17peN7KGFN8kYEfJJgaGTJAz9PoG90EerKarZadcKWE22ijBAXAsy9eH44Raf8eUXdy6P\/LRt1dKTAZiqTXh6+EsqpvzoIlvQ9qm8nCkg\/yxg+X1HZx1oPqigElzVpbqqrmYU+HimSAL0lRvMaKpMv63DCIFIJyqb\/2UmwAZxIaijtbIae2rh69Ep7YFkJiTtiVV21Q7VqtN8FUp3zeaIBeQuXvVZeq0eeRw+PNjIp6F8fRyfoW259s3YZdUOJXUBTehb51cUVH0pn1l7ONWJp51RwayP4J7b1NhHmd1ENpoIbXSTCXC4LK8PaYKfe4Ei1wt4XYVKQUuNc2wc0sy7oiM9dtQn\/qobRZjh\/h\/iCU0RcvmsZjIIU7QBZxyUgcCHtopcGTgito+Vpg5wVjlROaDM2zAtRSE70aOprTfAW1R\/qqvNpjR0OhvFjjb2Jr\/yrxaABaEFy71eh6j+xNr9a8jPDIbDJu+eBvi2FGiPxIKCEfDoBjwcrjKls7sqvDEN0yf\/rSMcpgMFPDMUoStk561nQE8x3zUr9ub6QvcCG3FkvNfEst43SdqRsQMPp9UaeWAJeidFqVPpSP686ANXrpCMohm4eG9BpTicLk5n2M\/shhRXR0gW4ChYs3xlal1ZES\/IEX2liDz3a+zdCkFjLR8CWo+cUlMN9QWWd4y7TTQ6gAkudTT5GMo66DX\/t7wVS8n7noJiKlcnb\/pyEr9meQb8uZnX5UqLn3Vw0IOXt6Ad0teGgtK8zXc+IGrCHlAdOFhoSvmaI\/k1soxQmM8lWnKknMzryjdYp7yoG2BIjIvBMLkri+\/ZNrsStlCF2k37Apm5gZmskm1Z02sAaXh1L4sR+MetAYFRtuSy6MPCPn\/5FK42H2KsYIGHRp3bODaRBwHD8iWLjOCyctOpMBJawns6bPEOYF29QE2xO7JWOtGS4wJkh0nkEu4IHsfVp06bUFtcqqaikPbRvM5me\/EmYhMcGGJNuYQnHn0o7KKGrlJ\/7HL11SEAtSAh6T\/nv604IYPWuv\/Q2w6EnUPnYz4AvX6Wy7AnHZfpBQuTXc5N7hIOTXfpQKF9issAOCWg5MbUb\/yuvCalb9swPIgmmkiKPmpwRDEFiV4LHXpdwYKX+eWeDbtsOtM+7ipIQISpKv5ynTIqM3HNYZqbC8mDsDeXw5PrFMsXQ1fdAsvWK1bLL8xb9diFqZI2urCoxVGDJVX91tNsKBJbsTyw8YhQ+1\/ggXyNE5yPGkfFAhI+Q3Ra87P5b\/7nNo2z1w+xkpa\/TUMIMDX0uT9E\/7xXneMVK\/wPS6g70xOZqarhrvFNZZZOTyRY62pryVJP5X9hLQLAa4AA5qVKYu1AnJK3H4fKjlROgQTUEszLpLoZfM6RVUnb5QIkNrPdFh\/2bdNczcTu\/DJFBW2SXAE0odRiOHf4LCEtXLMxDp79IJC3zBHalmWR6gdqp3b+ZvOuyn4qXvCPU7uydhIyHbtTQbUQM3J5txyhw7eWDT7VslEp0yTqQIZiTgjg0SCejsoaOuFecv3KNe7hFHMJKER2VRFU2pSpXa0m\/iYx3vBnI0\/dD39VvuNGoUyedSy96LwUEWgUHhS2Wps454PnXLgvt0ZaeOA6JeJLtvO+a7zvDOH1de8lxOGrDUPfKHDWu4h1E4aaIm8wTQtM77UaOoM9sDwAddlDOxU1aoRbBMvZlcqRErYUWexYrZiZWA496K+lZk4VfG\/iW35\/9js1TAXdXkUuI+eeQLyFBBfUjJNXbMSdpelrem2ZeyF9liKRrN\/5jCE0RnHuAjABGnuk13Hu\/D2V9sWly12\/8mAIlt7kQFL4DkARwVISIw5U0+pIAWpUK6wTK0EQQi1XS7CMvPyVobeSdAi2\/SWMZCfYqOJqhFsp4w5FZGkd+m+zdX+00mNRtllRvm+kcF\/l+DQtEDIhb46XG0eydRnau7Zffk7zHh4l7nkiR+sXd5EEHYxsTOcJ1SPA\/nIuBQt8cNxe2Hg2GhyQZeEzpZ067u7ubzmEx5xBBF7H4QzbLEymKa56YuMvrS6xyFKdL0zmHQrDqmZ+2NvWMRkYNaoxOhbvDQ3ElRwhFsjFcAa++MkwO3ixOH7xhmnKhOFip2XFqGHpD2jaOs2r4OKdiebD5IbsshTDb4e+OrLbHsF2RRa1+hY4olqR2VtI5GteCuiq8+4SOOzRQyZqqTHZMbsSfMeB4xL7ZOYrwhxf1MpxFYkO2rffkbAntn97ZV6Opzz\/kJmAoh7ShEDODdahK1WEHI2bXtSgzwZ5GSFR+nkuROyRv4dq13oNfPs8uSA7c5sUkRye42Mt\/ik0yeQtmhCyNxqjYmlIucx6z22iTJchrfoH36BsA5bdNME\/4agYBJNkL7oQAK4m9Ouy5UrgDrVkx2BmDW5LeIu+Tq0jKFfvY+Qw1jAbI0hiwJBt2VI1pfbZtzLoV+unvVzfa6yL3SERNvDUAserC\/f\/Eh2MAFuhAO1VHLk437goQdWFgBe90NXs2TVO7rCVrfWGhbmnMDQEk31MuZCmfcPDRhEUG7j1fJ+CKfTk9dhnKRdObUQL\/tJXXkq7cCvtjv4HzzGYCz1ON\/gwdCRZsBpzUMbSxpiUfEoHmcAgxePC8bbVkevPoHDGiTsI175Ga6qccYk2VhVLwwoyhNXNRYdG6fw+feQqUGkHic5NmrlXaaamzYVBNVZ+P0p6FsU5LHZRD1ucttfFWX5PCEBd8EQzRFfsojKwawTiL9PIrw\/C3XvsHKsB3VAUXjS82qaD+baJX97ZScvUBbHixe0sxE81\/WyBFA516dhcNRxVkbK+m7H5SDSkVm9mMRc31xzZOFclHRtVzibgDa34Nv06fIivXziJXJfaU04TUYEOXQC3vtunqFq2YXxZla4lMeLY5TvxVjFkmO4SKVMAPYGSqKaAdc1lEvnRhOa+W8DoIm3qIFn\/DIHbv8cDELDtSI\/Gwzgp8FP4Av6CWDsAdW7QlsaY9HwYucNm+rn7YYkzmTOWamInYlbSAVsrYURX6hp0jwzNrZDxpPpdxXJZxNVDYDX4UNWCoyKxhN0GhYlDe+xzk2HHZb6FXKfZuumfE4Jk68q1XodY6D9+mhAJEhGjinkk4Vc0G5NroHlIaztWWm9jsB1nZ6C3b5FyjZBx77TiWJz\/NJP8+VlWCAXmVdS+lkfYVJ1idC1\/aLL2qKnpZJCYp5KnvbaMiMNvpXkF7Z8qgJIwhIsMjRReVu0cVxUlzWddrRkLR6KKyaZDzlzbzdnSuYcQxeb0IIe3caRWVjEx7O5Lmd2eBR\/5mvcwEAT8H44FbSo5h5szHgzxqvcuqAcdxsa2H6hzikYzRYwBEMgFGfsEglaOx1AG6P7F\/wF3VdQug2CBKrsJ\/WEoMrS82swXvEWnQOHBNjtdYpD4vx798W5BsCohJb8U8ZI2q9cm59FONSu59bqeoygrKzDZYp8nn5fwfsGVdZDl+u9Dw3Yx6G6CB3qXnEJ6u+FVTcdMB+lnTaKd8j9oeCJotAl6IiU6zOLZMGQOwliOyIE27BybhC6wpnbtrashdtQQMiL484GxQAcN177jLViTSiTWeSuWs\/9cWwTO2SP5SjkDFEUZ95YjIupV1rr+JGfU72QJq7NpBzOe0WRMU63r88Y5iyQKp71k5SyTV3xxB3Lm0dXt7IB\/wirZASz6kChL+36J6F+A4d8D1Fw1Xz9u6gIogW09UQx34niLNS+8nFFr3o03GvayKWGP0ck\/vMlkN6wDsmrV6OdtvehGQp5FOidU4cwhtgrgtWtSRighCBgLjFM1luTvGpG71ynFa1uQzs\/0TNb4UIM01Bddac3IKDWlnxeKChTfmg3xDS0mRwnHbnG+WGan4PBY70OergDpeHDRdiqFCuwu2alwlzBmtHQQjUu2tZgDa5taZCNwfdpEQLU8B4obyzgtrKmkkXEnRLSc2ioxC5FWe+o9XPfBBw2gRy4JB8rVL+XNKYQifQAt2PIvrqon9a1yPWAE4Wvq14052\/mRmi2VHoK3nRH6YIPZGYBqANTLak4rm0gfD020CE1PV2\/etLdP02X1lZPQWJ6Qb\/rqfFrGZQQ+N\/z7U0KlI64ycK4LFlfumzHOtUavrwk915UbLKNBxa0+uOxdpcO8P8YbhWhtOMAkPpOzco0gcKYp98Bov3VKQoRROsnpDF\/QjPsdHrClnMm0SDPcvIC3qVsvkGU6NsdXXT1LwjSdwaRofTJRGVbFwfVndHwDcR7wzQyrT8PhI5tq2FmjXmH92QnzmPSS3cPLLUI48AejMCSLrl4Vv2UkkqQumueMjlH\/bXXpuXA9MtHJody3I6U+LLwKCglb7Wywk28N29TL1wicJ5JqzcdHnppV9uUSDC+vCFpv9gSL0k4kQDoaV1g1EywQcKKngmK\/sYgOK7I8rEp+I02QvtlKrgNVLb\/p1T7X1QSLEBVlb7EBDUc\/N6vmAnbI1s5q8ROiytfsz4DzMQ\/2O+WrB+E\/MopNN6TUTQJgdQ5vnWEGGjzRa1YywOJEJr9n53MxtSAphJ7WZvZYGhPgJBSuJPxgVLtmj7woUXlfGX7SPHUh5+6yHYXGTMIOqxzpi0bim\/FFgUvOQz8GbpGJEEb69c1\/JDqGi9ew\/rmBOl974ut71HIutcSqlWPyx6ZE4MIZjsjNEsudD0k4uZ6DTNdjBpTSQtSd+gtU1+uOaHQl60MfUPiZ5Ay3QHQIQbBsVcUEaF3KWVN9ZHaTdak16cG5ClQWZzdZUnv0+yDdm\/6xfYQ0s62hGESeXSZrhMHiZYXI4o8ck6no6bgDxeBmSY7Yd60pTlHnN3bEI4p56ThppfIrWHtjP27yr5c2+yZQGL4vEW4HN1fX\/\/NqMdtKpbMIu1uxkpvYfek1BvdKNweK9wwNvDx49cPDU3bNeA2cnqnXDfFR6dWzdCpIlD07m\/Urr+3DTm2bt5x3rOPMw4rtr6d\/pAUUbDp3iCZfxG0efNXyNSw7MJa1RYKEeJbv9sviaitId7ww7xXDbiDuZAgNgV+jisMsbaMdFLRviUwQUBd90m8+hVBv8xJRaSLgdvsGZUh4sA8XYmO0CWxubdeBomNvm0LXDisWyiXII+lICjhMO07YP47naP75QHrNRCyygZmnOOoQEcv0HhqCYjElaaKQyZ83ptg+4pxvlIwNZyRG+2rpdehoOclvcZfqGpyFyGSyR8AJJ3G0gms6HwhGqWSCLXjM9ItEARuCyj741gPPxhQWtEe4hZQjGhYV6+TvCoaeNvf6wPgxyGCe+sVWsXmRnb+lzfzvVNnCJQdx7MKC\/eiqa2pbCF4kvwzYpmM+X7YDZeK5EaX31t\/LE7RUjXWjIw0QqXEfan9lkBCTVonPHKB\/wpDRZGcb7I7vDtq7B8Xcy14xnQaZQL5hmzeh0Gc3zvwXldBTlIIt6s6D4MhSVYuVx0ukpUcPITgY47UqckkqnJnfZ2OWrzU51O+R7cRbFGBVSaS6E2VYMPAl5uT0mztCMyyTNWAWxHGlcF9njcH+K+W++x9F9\/Xl57ZkbczmlBNiq739Spic5FDTDId8bMwBbGUTQgchEID8KBnHP5J806GYCMUvt5yscMG6OCNY2NJ5WJ2C\/eL8Ul0AltFGVrhBOBSZFseLu0A3G3iq7skrBmmun6eKll4jGVitSp\/UNVGKa24dANShzDA0UnKLKXGIKIUeXo1Qi1wxmpvMQz6RlgABObQ8xDOjtbZIsO8ql8X","iv":"9da982416795c75b8afc65aa0ae0a97a","s":"454c4c456364c5cb"}

San Francisco sees decline in luxury properties. Image credit: Sotheby's International Realty

San Francisco sees decline in luxury properties. Image credit: Sotheby's International Realty