China has now surpassed the United States as the leading source of watch Web site traffic, but a new study finds that luxury brands have not prepared.

According to Digital Luxury Group’s WorldWatchReport Benchmark, on watch manufacturers’ Web sites, load times in China are up to three times longer than those in the U.S. China is the leading market in digital platforms, making a significant impact in the watch sector as the U.S. sees a dip in site traffic.

“The destiny of the Swiss watch industry is now tied to Asia, and China specifically,” said David Sadigh, CEO and founder of DLG, New York. “Global watch brands that do not manage to generate desirability in China will find it hard to sustain their businesses in the long run.”

The WorldWatchReport Benchmark analyzed more than 120 million site visits on timepiece brands’ digital platforms. The analysis looked at bounce rate, product traffic, organic search, advertising traffic, mobile, time on site sessions and percent of store locators.

Watching China’s growth

Luxury brands need to understand the impact that Chinese consumers have on the watch sector. These marketers must increase their site capabilities and embrace WeChat as the complex and complete ecosystem that it is.

“WeChat is impactful for brands as it educates audiences about a brand’s story and products,” said Pablo Mauron, managing director and partner at DLG China. “It also offers the ability to support customer experiences from an early stage up until the point of online or offline acquisition.

“This makes WeChat an integral part of a brand’s ecosystem,” he said.

Watchmakers' offerings in China are extremely limited with only 44 percent of timepiece marketers including a store locator with map integration, a concept that consumers have come to expect.

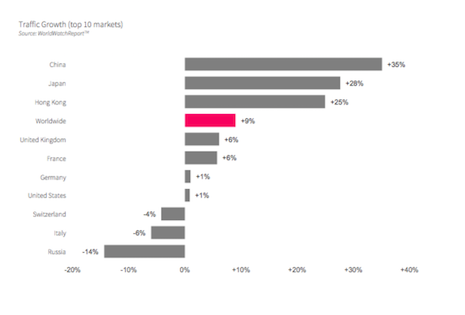

Site traffic chart. Image credit: DLG.

The average load time in the U.S. for these brand’s digital sites is five seconds, whereas in China that load time jumps to 15 seconds.

Traffic on watch brands' sites from China saw a jump of 35 percent within the last year, beating out Japan, Hong Kong and the entire world combined.

Worldwide traffic only saw a 9 percent growth rate, while Japan and Hong Kong grew by 28 and 25 percent, respectively. The U.S. only saw a 1 percent rise in visits.

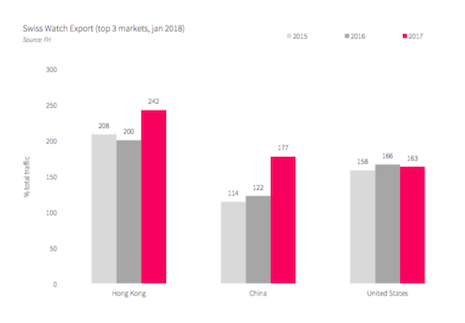

Swiss watch exports. Image credit: DLG.

The primary driver for traffic in China is advertising. The report notes that the country has the highest advertising exposure in the world.

Digital initiatives

Watch brands are embracing digital in a multitude of ways.

For instance, Swiss watchmaker Patek Philippe finally took on a strategy that many luxury brands have been forced to adopt ahead of Baselworld.

Starting on March 18, Patek Philippe debuted its Instagram account, which was a shock to many fans as the brand has largely been absent from social media. The launch is a part of the brand’s digital revitalization, as more luxury marketers are forced to take on the digital and social worlds they previously strived to avoid (see more).

Online fashion retailer Mr Porter worked with French jeweler Cartier to launch a curated collection of watches on Mr Porter’s online shop.

The collection focuses on several versions of the popular Santos de Cartier watch along with an exclusive strap available only through Mr Porter. The collaboration between the two marks Mr Porter’s, and by extension, its parent company Yoox Net-A-Porter’s, further ingratiation into the world of online luxury sales (see more).

“The WorldWatchReport Benchmark confirms China has become the number one battleground with its ever growing digital investments,” DLG's Mr. Mauron said. “However, beyond impressions and clicks, ability to drive user engagement will be key to become the leading brand locally.”

{"ct":"MycUaaTu5BuLt5JO85NqQogv5Wjdv4efDFsG20262b057W+uEbWh5eLgolNZwy895f7BHRyMxPbKrNxnRqKkxbGyNeD3VgkPAJoP9kEeW0j+I7fL12w8643tIlsYjmo72gtIO\/WPAHJpxv4c8O+VrxKDAqwlqK4VhqQx5RRA9\/xkulwMxozfSDcgfNJ7ax41bA4ZAqMLrZsscWXoODpmJyt5ibbgYg3jIkNY2h6qbIva\/XdQ7aAvZ4GuPynKprg8ywXc7dqAoTXgYX2Af36SWl\/JFbIGAW44ife7r+OUpGfpCxrKrN9wajW7Fjg\/XQOoQgvrlin5H7lN4k+bN+8YTasRW9fcBEX8K5Tq1Wly0Ht1nXwiq0Cp0ULhVoSHS1wuHoNnoxgiSqSBwSCJH1cL7sdYJDAzKywzMG+ssFIIuDMmz9NToENAEYs6aaLo+VBaXPlqv+KKFnn\/rcjRqEAJTLT18MahwAagbXrrBouetnqhtG1zwzzevA+bEjGMBkVdQkIrMRO1kXitDUGaci8xSEjug0vqO1FUttbfp6HqjP0HxVXkQ+q2P\/tukwAuI7G1GKWv7I7EJ8NFyEf7erHOqUdE166ocV3J36BKfiAiDF5zMtvsX9Wr4LibWzFtVS8pS7YicBGO27bJ7BbX\/i6pCbGfWiC0oRgkqFFMre4f4sTtzlcIlEzAqaoaZSA3YROut8c2RjaE3LKc5zVEFKYYqMq6xIaz5\/qV8\/87L8Q0FgVhi3mMKn0mB6uwD+m5KxOrQYVJODvQH8uD0sM3XvXHsUWtwfKYIJK04zMit\/fjIcrG45zdMWddSFlXEWrwVai9+QLvtVBOko4uJK2Sw0UIAmy1gZvHxbrA71Ihh34bsMi80Vkws+qj\/Y6wid+dJGti\/+O+Ro72THyAUEYhWPeXC87gL8Jzl85xp\/ls7DLQmqN8mmbQ03Wpm7nCJj11WiY5LtVKwSfNfRBUgAgejlaUNPpqh2ecEKEvYzvZy\/mPCaOF8l76pI0XbMY\/2vY0QtO4ySiIdyBOzinFeSCiYXUucnOROW6WSDitX7TavYPND73yAvGujTswY0rZgocoTmc+CSCKtxbijPoSyJ3pCYF6SJ74AkRaB9oFvWtprC7Bie0PfMIYmJCeZuoZ4+REIAn35ybG14krjdAAGDys6nwACz4HdwIs3Q\/icFlzYo2f\/SNRxkdZ1Cxm8tCQTTK\/CQ40SvHDjAGPUYi0OCsHDGeqnt0LqIUo8pfCgm+xzqz\/HmksTfPkkLYa1fHsRDPjCl9Pkq7xIrYFWHg01NzzWATIEYmsM26M8G1vIgVyAEQbcRuSuv6zkCk89oem0vlwLNvIkvNVGVAkOHTjyHZoSzN7bU9lKAlKYi0jG70\/T69e+tSAQ7Svl\/Q9FjUN9ABqLxHVS9KQiB9r0GsNEJKcmqgZvLGABu2kW9o83GGGnO5MMnH3dQ0+m840LEJ4SFzC1dJ+dZpIkuW6hN6hMCFk7iVHhgXWRo3qCdNM3xNgYq85WtBnCWLlkW3zILVg144ye9Yo6SKfNo\/\/lq6CgviHM+Ydo9DUe8aL4DpdqfQI5JJiC4YaX\/DwEpZTS+bdHgpwaPzzvNcRpDhRCjIZMGQ5cwvGJneF35Q+sRhQFndGEKcKYFGylEEQVqmUdT9SA2lXmQ05xq4Z1rstmr6fPiRFpAc3ilQ0yCEKsnX8wcxn0fI8jwp88CDoJfTM+ylR0n7jE09ShD9o+S9fkTkeXki\/BZSdzm8fMILd7UYt+s2T\/zmW1932XyQSlRtg5IUlsXJPeSI6BJaxuNLO6APgImZQnr3kQcHc8LvBURPsEcrG6Qi06zCZvi5fBByilbaGnimtNvnTTsqHhX+hZnZfr1MrgPU83y3Wgab2mE8eZ1I0GYdAS1Q4xpjZtGo60629OvTKsYwA6kJG0jeTmk0sTM5FXd2KlZMcWyzAPLc8+ETIZdoAlfrInbDRWop9B+ZWrjwFBj1+PxDk3Ky76cVE+jA+KNO+8w+sUEnZcoK1ylzEhycbBdC0fhS5mCTa7a7yBqAv4AS6yD0jtR+dsSoKx5YSigrLSpo\/hpXKFk0PFAd9wdOJl2huMRWl4NdRPsYlsU957S5lZpfJF+VuPrjnVTNu0wNP1QTMCiUnw8rPaU1hN2B3ydbsy2OcnAIaDNYqry\/yxekEZGk4NZhB3ImlRb+7nQDWVxt+eq3stll1D+UJzlesnIEDpO6rvkm\/CFUM4\/heyHs9661si8ySPVHswsuL2D+hTTM6\/ZzPpAoFMw2+YNgphZSAG+cLrYYEKZZ6mGwu+cuTGyjltYGWrGCUyOvYPNg6KyLYkKZqY3BauuqnnYtVcmclv3OjtIBcPiK2cW8oqHnFx\/ltfDqiqrFkpQxpBXj7AKsAkboA9Ge+M3QHp+usC8nazS+7Pg3HMPZfhTkV6H2QQKj5ClZJ3wc4zh27iTGFshko6dDGL0ujwMv23Xab4kvtSFH05L\/WDsFYBHdh+JbwvcJOs5Zj2KW\/nMiS36RuARuhQdgZOOVgo7Kx9YCeBconNQ1B2vCkTl693YkUhyr7FLwCRwxkA9k\/q8vIJXOMr9IwQJVHsiLpKOKtKU6Vzc4JmoNHvhfpnqx+8QOPcVibVxXCojMaZ7UNaFBqyx2AeG2JpEn4sfAEaO\/ZKkaB1D+QFIPSfH6jK1hrboeofjZTdC+BxYydgwEJDNdtiXaMvsTwIJ6xgM3mPjx42ipVbHf2S6QIxOduStgmHRlsKA2lwQOBUh8L+2gqLl4L7ybEOMs5BqZ+cxgEzjWmxRpepE9Sq1CWx6v\/x9G7KhuEkE\/3cs+m+47ega4VVnV9HKOoCNcoarLXr7xLSVFK4LTjU3+vjuIM0uMJit\/HZw9PXmPv4kSrObVAACFJBsFCI4q3fbjAx\/c7Y5VQGEg7ErCA56GDRr43oMzxaZDm4acgi7flm80o0OGwZ3g0T+LEUxiC3KfqgilT4RGDbdlds7ubQDZNzKNDea9Jea1UoZJfBvkANJwHFXHnOn\/THj5DnGFjtP406SedIez3vBGwkg49rM35qlCBRXUMLtiWvfFosv3pvUnC1XyobBHA6Vn5EdX9ZvnIC1mgGw9Y\/SP6AQOTtdzaCy\/EDDxEV53Auye1zNjoGNmtGZXxqDkEIQ0sjYx26HBRKvTZZpQ2tKSKaTNBhHAPASO8aKiaQKkHoFvZsMSrzGHVrqAVGiDCy3gHHRnT\/npAK7EQOk4sbBQS4CmETZUtKfGNfnUNK+nrGX24LMuRln6P72JMDXmwJ9sQuHIlo7dSGjY62j4UsJwd7i8WexJioxOxGXW3gWXrzp7OT+sIjsrdKbI6KhhtADSa19lQV7doYFLIw8GkS6Kat\/YFelE0Ci0itrzC2caLp+xF5197jg1TY3oU\/TBkHij78MiCJNvUwqSpzQScihJX8LcgNYmxnizrHR+mNc4uE+QDg1t0\/cb+XRGuhOtwDk1ovUQFa4ChxMn1I0wX\/+\/c1m9wuXwNlz+PRUYr\/B6+lDaoD5iTzFh1ISlWOyuylXl9Q2a8eifEAnKIA3JVntV+XQKZdn9zonLl8FA3XyGhVN127Jx+DFJFtNYlkhHxUHCZwaEO7Zv3QdBRayOEfQoZWXVi7NpLnfvXF8lrh1rt19ydHXH1E2490YGlrdviF8vDmRu3ZC+Gu1SGITmVuwJjqcGiCk36jHeSS6k46WrD+1Cj+4edYvR4M\/URI7sS26sS0yw3Rd2V5DX1\/qz82EwSfU2uZUk3bMb3tVRCQHEl2tP+VDMbTyB1FeqvI7XMqXEsUMKl1IYrJRWrPLCflEMYVhDsX9hiZ6QLNHWr2454T77wRy8VO7ar6HecGZFC3VDWkch9zal6yVEOOwomp2Lp8EOyqAZQWl7hr0shsIMh1cu\/62WmnTUTSy5q8crmPFDLWs9UdkXV1VG784NOD94UFLycf08fzIEcsyXo1zz6JbdOlVKR7w2PAHqFJptK09or48gJhJ6yw\/LGDLBpf4HRhmmF0oXzumN5Ye54Jktkd70m8VAmweq5dURbrbuYV51vpaUZ2KGQx3W0FBPl0twO3Dr9mad6793cX60cKukCAwhao0Q461EDVmr+b7V4Swm6UhjxcQnqx\/ti2UBLn45xAzdgos8jYW+4LZwSFQCfsP\/JlFXjM6h5FN\/wNPq+VHNJsVMPFReoCOERCPJ5VDTZQBwXchMnIKpbhUmPsOJQRukDe1JH82upFFJue0nsSMxiQvA216+WS4Hte4xJiH8JMH1PGoU44M\/A1ilEBK8l90U9ioW\/nhY15jJCAZCSjr7P3W9uiu02widFKbpm87Rk5P6w1FPGN+FyI3j9lEkOO8lkvBPnAaJeva6hTwVeXcTndxtzzO9jS7728mOyWQHaTBfgf5tovc7iwhiDcWoMdAFqjLR0mXHHAx9mtcJxw8\/iHt0zWgW5d9GJs2rNTW+kt4Qsq3LWs6fBeVOp3KwDt3RFdi01SC3ilYEJj1yhRhyqNHcQBXMGDxIknTN0dlvMN+\/SiIi2HAFel5hfZTue39QwWsPbZxqtC3T3oXiadBv8H+Dxp1R8lRQVgO2kgKJycQ\/AlRb21xKPYvXCvIRVgA3cRourQxWv6mrM8XQhCqwZdJdEnIMxnhz38hulfSYi9lT6H\/1IAIj7tis7JiCQPlAgQfA6kD7M6R6Rzfprpz8aACCWEb1WKmTJ+4THLDZd6TY39kSmRBHntD5zUhKFncVrM0dW9SX80O2oVz17HhTB1HMazGjP9d+cZx\/CodQstQ25HoPZoepJ0\/+h3OAIZUms7FZzQ6\/\/d9DFSYf5TcjmvZfee9Bc4m1amz1CgolSB5\/VVFMc20JyGXeh7Xk0E3ZU4CYkpC4koQuCvsByQ2kWObh8q0pT5xW5TliVCBYyrv9z8IKMY9rVbVOFnsRd\/D6a8mL0kVKOFHxv9nwHdRKtml2\/n22KG\/Nsb2A\/AXijbOMjzpJgZacf\/7H5\/50H8VfVSoal90xnCuSyl1PddmXAadng60CORYLnAB90KJqnbos47lDdGs5uAxTPE3IuT7755Vypq28cYG8tc8VgAErynZwnGXSRWK34LbZs75p9Z90QpxO9OXS5JXFUy8IBdvmhMAxhQYR7xFGphxiBSXFBMuel3Xld\/EWa\/jaSfugLSRAHEcn1FdP2aiJllsehCv9AGJHywD\/Rloz1KrDy8ibRnKBQecW0VbavWMQvcb9AJ4muY+MK5Dcmts07Mp8xAAKhnjlv\/4GEMaSQD+vbnEeb5aufpqQ9ff5KV2xu2waBvDc5z1BWsuTapdwrSqxetoVjzzUR1YyzUQsCgRuxeOd0oMD7ApdwfK2\/o4deNf5\/UnKxeeskjUEebwTIrsKEfQQmg6Go1J6AcwYiIZzx9wK4CxaMhvM\/Dyl6WiukJbgGbidAypZFcE7S+GEa+D978KP8ImzUIf2abT7rx9yM8Jprdto4PkD7PMntmLChwydJ9Qej8GRwOWz9F\/lttSo4\/5Yenr6mvIUmabSDZpaGAl3FzgJ4khjHxAc8IMHaha0SMO1M3deYiNsO0TfwLr9Woj9kp5BuHVzyqArln8Nlqn8Hr6HjiuqLyci4p8bpgzBtNiCjrNdHWtF5EVTz8P3oOwzhuJdsMaMwYjD3ejV4D4XQGVW+6ZmAJ+p6JGJCJKnsb8JSId7tYegd4yI8c8Mp+u40ymJmc8\/WOKHCQz9AahpCFlEc23DL3N6dVqDX3HCayxoGv7OxdEBfeumPxPzmIpUhGKcD6s+KjNMuNe01NmG3egDTJBl6+ER8SdOy\/9vwwBwW2lWeSzhoMhgYV68ImgA6NVFvXkA+4VlMByjYum2ImAevOnRtGwvXBPhuTV1jdCKDcuhmv5aFo135KlNt4oQZoXdCx\/f8GqWZ644TSgCEFYxeXG1QJNLRbbU2p8AlYlkdzzbQA7fxZb+OMsCqzB5NuR3J+t6QOSKrj3zoLruGWZHMT8iu0QxIAgYvP5pOFI6K6466M4+QkwN7q1Hb5smTS+HScKJM1QJqIqqypF386fQiahUBv3YgF0WolMXaqz28pX7oEOoqT4e848IBFhNEECeMtFYhqoSHCeLpe7tZcEXIYNfxbIcRhfHJQ2tzMSibZ1UjNHfXEhSD7LHERTefIo8j9GCF83vn7hOogEsvpGaVvLK845B67VWe0K748z\/TNTCv6sfC91OETCFaD0TX7de0oM6rrT0Eh24OYw\/eknFN1i1gpvumDaGx+vrys+S0olWUMXRHhAXmQLUKBtcOp3fY\/oTEyV7IM8lw\/t0gFaOmjt7xP\/3DEgPbx3SyzysCDTS8Ihz7urMQ5Hj8T5YQLT0uZ0EmvGC56NoJza3ZgaVl76R90+u5NbHFCLqRP5PP0Kzl6EeWzWfO0C\/nz2+2cOK9G2pK5YVRxEiehno3MDzFwHGQis0ulQMRJTM8GuwZwEb8fxfK9sL3sAP2zNfB3di8GClRQHBNuZAL9OJsl0fVJeXGNzQh0uJ3RNM3ZhAMCdmCZgO9IA+GWRmrL4VmAQxqsXXYR3NhWWTdlY00s8EKhN4iMGUJN28IjQvu+gu2QltF2v11zE5PE1Acspwf9rhLTvytk4O1NDB5wjeZbfI6k3R5vV7Iv57ca8zHySwFnOon4miALfPB4amxu5r1NLJzHvXxKihm6KOYgt+gdDdONJLubBCaa20uIMlG3uSc5jCjMUSrcNYaWrUTt9qDvZCGhgBdw\/fMWvdW26888X3jzvmAWxKgSE51dfgy+DWDTxgXmn3vkrCoIaWEiTk2mFOvHDXDprwDo4NF3LmxvSCgNUz0QWNeOiIHaOdC+uSFVSotUzPIgU2M3Tfi6JGye0GRpdmxQRxVLaFnvovmztgOGLUvnlVtL1aCeivwEEHSyxazJhG0QO9kw1pJWEbnw\/xnIpeJEwY\/HWskw4\/KTZKtzleL9prkKk8gjLtvzZqzxuwtxEajgkdaEMYcoefQVvfLz4Kp8IUvh3Tk85jW0HIjwQ==","iv":"394e27be9fa2c84576563fc789ea7123","s":"510cc7d708387332"}

Jaeger LeCoultre's Web site in China.

Jaeger LeCoultre's Web site in China.