- About

- Subscribe Now

- New York,

April 12, 2018

Brands and retailers such as Chanel try to cater to Gen Z. Image credit: Chanel

Brands and retailers such as Chanel try to cater to Gen Z. Image credit: Chanel

While Generation Z may be the most digitally native group of consumers, their shopping habits do not necessarily rely on ecommerce.

According to a study by the National Retail Federation and IBM, 67 percent of Gen Z consumers do most of their shopping in stores as opposed to online. However, mobile devices are an integral part of the shopping experience for these consumers.

"Despite their youth, Gen Zers are an economic force to be reckoned with value," said Jane Cheung, global leader for consumer products at IBM Institute for Business. "Born in 1995 or later, they are projected to be 2.56 billion strong by 2020.

"They have grown up in a fluid digital world in which the boundaries between their physical and online lives have converged," she said. "Having 24/7 access to information and digital resources has made them more educated, knowledgeable and self-reliant in deciding which products and services to choose or brands to support."

For its report, the NRF worked with IBM and surveyed 15,600 Gen Zers between the ages of 13 and 21 on their expectations within retail.

Catering to a new generation

Gen Z shoppers are leveraging their smartphones for a variety of tasks related to retail.

About 55 percent of survey takers use their phones to look up price comparisons, and 51 percent look for discounts and promotions.

Marc Jacobs Daisy campaign featured Gen Z ambassadors

Marc Jacobs Daisy campaign featured Gen Z ambassadors

These young consumers are also using their smartphones to look up items that are not in featured in a store, for product comparisons and communication in regards to shopping.

However, Gen Z’s responses reveal the world is not ready to completely adapt to mobile pay. Only 27 percent of these consumers are consistently using mobile payment solutions.

About 49 percent of these shoppers believe that technology should quickly help them find what they want.

More than half of these customers are looking for technology tools that would allow them to try on products in stores, and 48 percent want to use tools to customize products.

When it comes to where to shop, technology is not the first factor these shoppers consider. Sixty-eight percent of respondents said that the most important factor was a wide assortment of products available.

Uniqueness in product is valuable to these consumers, with 55 percent wanting products they can design that no one else owns.

Proximity or location and product availability are still important elements for this young generation, at 67 percent and 66 percent, respectively.

Augmented reality beauty experiences can also drive sales for brands, according to another study on application YouCam Makeup finding that try-on features double conversions.

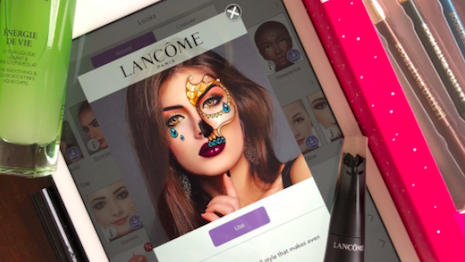

Most consumers are not averse to ads in general, only obnoxious and irrelevant ones. Image credit: Lancome

Most consumers are not averse to ads in general, only obnoxious and irrelevant ones. Image credit: Lancome

While the use of augmented reality apps drives purchase intent across younger age groups, the benefit drops off at age 30. Augmented reality is becoming more popular in the beauty retail space, as brands try to replicate the counter experience outside of physical stores (see more).

Additional insight

Surprisingly, Generation Z is more likely to be interested in and buy luxury goods than their older millennial counterparts, suggesting that luxury brands should readjust how they view the strategic value of the two demographics.

This data comes from InMarket, which published a report called “From Gen Z to Boomers:Ranking Businesses Based on Generational Foot Traffic” seeking to lay out the different shopping habits of each generation. The data showed that Gen Z customers frequent luxury retailers more often than millennials, who prefer discount brands (see more).

"To understand more about what Gen Zers really want when shopping and what brands can do to deliver it, the IBM Institute for Business Value conducted a survey of 15,600 Gen Zers from 16 countries," Ms. Cheung said. "In collaboration with the National Retail Federation (NRF), we created a three-part report series.

"In the first two reports, we examined distinctive traits of Gen Zers and what matters to them in their relationships with brands."

Share your thoughts. Click here