As innovations such as augmented reality and voice assistants become more mainstream, consumers are expected to move even more of their shopping online.

The majority of consumers who have shopped online using augmented reality would be willing to give up the apparel in-store buying experience entirely, according to a new report from Adtaxi. While the luxury buying process is largely still driven by physical stores, technology could make more consumers willing to forego the bricks-and-mortar experience in the coming years.

"It will become a battle between technology and the creation of the ultimate in-store experience," said Evan Tennant, national director of ecommerce at Adtaxi, Denver, CO.

"Luxury retailers have always had the most polished in-store experience of any retail segment and that won't change," he said. "But consumers are beginning to have that same expectations of luxury brands when shopping online.

"Brands like LVMH have really taken the bull by the horns and continued to offer high value in-store experiences paired with excellent online branded shopping presences. I think both camps will continue to have devout followers but capturing the consumers who are simply looking for the best shopping experience regardless of in-store or online will come down to this battle of offering high-tech, personalized experiences online and high value in-store experiences.

"Whether the brand is luxury or discount, the expectation is now omnichannel: same presence, same feel regardless of where you shop. Where luxury can progress digitally is creating the high level in-store experience their customers expect online, and technology will be the path to succeeding in that space."

For its report, Adtaxi surveyed 1,000 adults across the United States, with a range of demographics and income levels.

Ecommerce adoption

Overall, about two-thirds of shoppers buy online at least once a month. Fifty-two percent spend an equal or greater amount via ecommerce than they do in-store.

Luxury brands have been slower to adopt ecommerce than their mass counterparts, but consumers have shown their interest in buying high-end goods online.

Despite naysayers, retailers that were early ecommerce adopters have seen significant purchases made through ecommerce and mobile. For instance, Moda Operandi sold a pair of $86,000 earrings through its application, while Mr Porter sold a $480,000 Bell & Ross timepiece online.

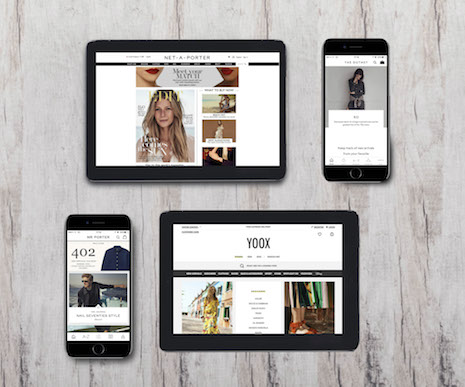

Consumers are making significant purchases online. Image credit: Yoox Net-A-Porter

About half of Yoox Net-A-Porter Group’s sales in 2017 came through mobile, pointing to the importance of the channel for reaching the luxury consumer (see story).

Per Adtaxi, 65 percent of consumers have used a mobile application for online shopping. About half cite the ease of use of apps, while one in five say that buying through applications saves time.

While only 10 percent of respondents have used an AR app to shop, this technology has the potential to move more sales online in the future. Sixty-seven percent of consumers who have used AR to visualize clothing or furniture say that they would completely forego in-store clothing shopping if AR was available.

Another technology that is set to change retail is voice assistants. Around a quarter of those surveyed have a device such as an Amazon Echo or a Google Home, and about the same amount have used it to make a purchase.

Despite privacy concerns, consumers are buying voice assistant devices. Image credit: Coty Inc.

The majority of consumers are concerned about privacy issues related to voice assistant devices, but many say this would not prevent them from getting one.

"Shopper confidence in purchasing larger ticket or highly personal items online shopping has always faced obstacles," Mr. Tennant said. "The main one being the worry that something will not be the right fit, and the higher the price tag the higher the stakes in the mind of many consumers.

"The hassle of returning larger ticket items, or larger items in a physical size also causes hesitation in making an online purchase," he said. "Making this process easier and helping the consumer make the right choice the first time also benefits the merchant. Less returns is more profit and helping customers build trust in your products has many touch points.

"VR and the technology of experiencing something or seeing it from a personalized angle before purchasing helps consumers get over that fear. Seeing a handbag and how it would fit you, seeing if your bedroom is right for that armoire can both be as single as uploading a photo of you or your room and letting AR shopping technology help make consumers more confident in their purchase and in the retailer.

"I also see VR to be one way that online shopping can continue its upward trend despite the in-store purchasing power of millennials and their demands for even faster results and higher service."

Marketing moves

Consumers are primarily coming to retailer’s sites through digital advertisements, with close to two-thirds of shoppers buying after seeing a brand’s marketing. Six in 10 of these ads are seen on social media.

While more shopping is being done on mobile, 82 percent of consumers do not want to receive text messages from brands.

Of the many disruptions to the overall luxury business, none are more directly important than the changing ways that luxury consumers shop.

At the Financial Times Business of Luxury Summit on May 22, a panel of executives from luxury retailers discussed the consumer behavior of today, particularly among millennials. Overwhelmingly, digital and social media factor heavily into modern consumers' purchasing habits (see story).

Despite the rise of ecommerce, the bricks-and-mortar retail experience remains a key factor in consumers’ purchase decisions.

According to a report from Astound Commerce, 59 percent of consumers consider a brand’s in-store experience before shopping with that retailer, while 78 percent agree that a positive interaction with a sales associate can convince them to buy. Finding ways to fuse the physical and the digital will be key for retailers going forward, as millennials are more likely than the average consumer to take advantage of cross-channel services (see story).

"Ecommerce offers the chance that for brands to offer goods faster, promote their release faster and track demand faster," Adtaxi's Mr. Tennant said. "Offering online exclusives while just holding a production sample in-hand or debuting in-store exclusives online via look books that are released months before items hit shelves allows luxury to keep pace with segments like 'fast fashion' and the 'trend marketplaces.

"Luxury often sets the the fads that allow these segments to blossom, so taking their model is becoming more prevalent. The stigma of selling online is gone for many luxury brands and their power over the consumer is exercised no where better than online.

{"ct":"w6I9IhqXZ1FZUXQdwXrd5gjShzzacxHzSESI3+tn\/aV2ZJTCoOL6UbHVK3ycB5qsZBY5crXJIl7PAyjDWyo7t3Z91ikNRAnxtkjqOzdIetR9+lnj6u6ZzFWJ2+QpilNghvA9Iwj0Ea0k9mSw5kCT5MgIZcLylAdpYnVd5bAkV2DH5RZroiv4S1xux9SrfGHOxbFeGdxO\/rY1fZGciRXUEQWPy3AovTew7j6dAKYmHq2zO0eB4kHArK4axgr9QZVVUsGWjI9CDzJ+gdXPHz+umgN+7yy3GqSCzdO7CRGQneG24fvVFxusfJYYyyJ4ls54kiSUE4oRb4VaU4U6zLfPiKnD6a7b1C82HnMDBG\/pqCxUdlqU+vyTSwrLXPRyxHUQqzYOQKIvqxPZltPM9AQAy07tM+EmyGg\/PGk89wUfZRmAli5ebDoKtAyqjszY9QGj4aMn4mebL6GyDkkzJKxZAup3ZZTpCnpx\/iz8NTR87qsWGkbSvPOavw+BWgH9qqkLZ0bOFqLRB7LlgnOzMg\/ATVrDr6YfwuT2hM5JYNqGSvGT0qVtj0+aKARP8Ouj6hM3KK89x606dPi6sNmh6NuiDjJGg0+OjlBr74HCfPHJvMvm241XeWpLJWI4Q3fOt\/WW2XPB5zkuKAp7B60OLizrBTLdG6a3uSQC5HRlOhHxGjQclTRFH0mbtHdcNOhNLG4hh0F59c\/Cyux43AO2KCr9vJP1yqFJ62l0r+BeThfInDjlEbDrSfr25nndzzu+pTfM43XSdxUkorIv6yxVGX8H7+wS9TBWJUa9nJ6cTrvh7gwX0+7hvxig6TPXF3edvcwN46JuX7qM2O8Rps1jzqhVJcicsmmpKLgy6IWKanFzViMuuqm4CuyAMMkpLzBoB8nUiCPDjCW04bBA\/Ocrv5hCT0L9jp3+C+vfvp6ZENMxOg6TGHo8CEhqs2bnK3\/fxUgRXFox24gv0Cw8WRnvo7yp6KRZPl\/UepOoURLeMXGs1JT6Dw\/OH9Bl7yDTO\/esAdQCY8rqpysL7F8PGB8ENN9X86rfg2JF5n6v8rDRwL6\/7V+Ha9etCy4yNjsRyeqelsnPKUecUWFMuFDi9UnvLLKPNwJ9fkd5nUcKiTKJ6GggBnEPNj4WLR+waSEJdwMuRgwDyAPl7qg0mNsRBd6NlFfg2Hf7DJ6JbS64DZ62UkZA241twPdqqalPW4vZ+lXtJxR35F5XYQMEC93rc0lLo5ftXmwM\/msrpFjoA6K+Y0JRh2YawYsG67PugTXx8omrIRjInQCSyvkI46JGXwjSq6X8GyR06FtCoCrqz5XF3OV\/YMgoynA6aATCLJWD52J2XzN+ryS7YSNgJYuvqcjwfAwiU3zeA8n3pztHh094bOwbvEZ40p37+LBLr\/vJPFhorRch3sODqUsZakyrcYgJf1pG5lCMSc9Et5sSfdEEpERDqzeFzRv4j\/M\/IZE62+D3DaeeoK57lRdzAB0dgvFqgKAjaJozEut6XAh39s4a7iVKJ0j7qfFhphElCosgN9iUTFSonkgURQ45u+CIjD1BN0qzuaHlfS2YbK2JV\/862BYn+rUpn60w2z0i3x2PEq191ee481V8I8bhiO9H8HRfPvqJ0sWHTBO4wBfcPPO0FAw1pXlJI7N6QS4YEsuqHsJRNNhH0VpplE1B9OA8rM573mmHqBL5vU5Z8ncG0nn09coHDgidV1saqUN+cIEQuQOsU\/SOByhrcsdijdYZeENTsCgGIgKn7BsBNHpAnMixqY+f+oUlBiVrMSGAwUBd5D65qFCmlNN4oTE24Lq7fIfXy0lcoTnWEm6+6JHwgYDdco0Rfezv8mm3H7iZ1bjvV\/U+UVFzoRTiUSVL8sWntPH9JKrsETIW\/LhGUFmxtiloo6j3f8p4zvtN69pNYS6X17qSkJRXv2GkuOMghB\/ER56mGeuomVuU7\/uPTvic5vOgTYKrxZ7Fos+TwS5peOGbmTR9IJAqqY4H4A9Yhyg70ucJ7nlZLwj+eHPePsmjLiT7ssYL+liZj7la7IMw6TDwAF0fbjhDLhQsquq+cFQarilJQtsId3k4\/Z9csRz+kEWB+vp4p+NRZ2zJ6FqKS8cGzU2BQ0iSPClrGFw1ehkzexjvE25O0QbWXqyAIqXnQeNkeLfYyD3bGzjztE8Hfbns7dPsaSQN+0VvxTlmcSWkwF6\/5PfEQxzZY7Gsnwr6Qn2m3KhPenjB3K0YaM+DkH4QmoiJaD1VZX7BX04o3YWyFcfy39JyLNsxRprFzx+WOEX4qPNQLWcT+qWhY\/Ut77erOb7kUzarnzL31T8eBRqQIOIWUq09hFDSNygRNoNR6osA2Z50coRBc+dqT1FyyAWOmpTImEpRFxI5YmkrnYvgVsTw8hFDzyUvlPTfoTwIdaj3wt\/5z+K7+aXejxTyU0sd9a8vSNbD1\/\/TT5A+OWSDNaEyI1aR212f2399Iq6Pqt2DDuj\/GJo8atxqqwJS65PRoW1x4RyfIzWLa1WLG3WIWkbbLQkKiA3kDFQNUS8XzKpSPrlI2oUt5IELf5893vxaPxjz32KeswRJ6rQ1NQLFaq1GT7CX7Urd6AuAw+P4t+RAZuXyJQGZxSKKJoGW4dCEy4IjOPG+WrEwcqdzXSj94yQ8THbf9YUpF3XtTRFyW3LXGXj3Ip9y4JAX7VcafgRg8EeoTn0\/Zu9bZUYTFkG9MEG\/HH5nC67p2gZuXauz2VJ3TYtqMSdrWTBjbXWaeMyx1Z53LCz8UtIG23kLDw\/B\/iNxUDrFH\/UdQ16OzEgbkkfVfflZCyyFNpdqfdtTWhm2aee37ttYMIBTH\/CynpciFOzSmhsqi58P+uuzOG0RJHd+6EcBANHOVpehfvwjUjan9ttCXuz9XuRKi+PyDw+GUzIBn6de5E78pPv1Cfb1zq\/tQg2fucoohduV4VgjSyVCgu1\/Nd3VjJONaEkh6iXAePN+A\/FZSdrC2LABA6LoKywK\/FzJG62QN0kHJ4YMw8UoXu2Jc6Y5yO5zkTW+s8nvH75+sX3rbAShDOpBfuIt1rZjuZkCKDTrBOfyZY\/RqlqhURt3iMe1AnfN53+PbS1bhP8oPFdEDR85rZKCcjLRkee28ZC5g+Bh7seMrtSNjTsQrBIb27HpwNBbVE9FGZVuB349jXz4gH0QvsKYcORd\/RskefCoqgW0SUQIGvaxFqsJ7lzU1vFK2R\/Zjn+OUxSq2eriAENxirwyf2404BEPfB1ODsJVMohhLN93\/oQTLHtOVgS\/qdSGc3T+mVp7uf96JAxXRjgU8B65yieEdHMaUTVaNzltgTRvBB\/s+Y\/hPyCE1tLL5mbhJ1z7kYi0wsgn0h6ejwr71gsblRfq9YuwSUWXxe\/PAznhCqTa5Y5KqQrk9s9EKNRDanFr36x5tpj2hMGzr\/3Pq4fE27QuJJdoTWK0MDnObx95ElopXiydgiZHVP4dqPvRBSVhxZwu4fPIw1Zd\/NYuoLVt1jY366oq7xs1o3+OMngp6F1I5EagpwfdZdWLm8Bt\/hn6\/OR4yBa6o8+aBodIGGyed0762ANrsv7UdzyaT3bQFA87PiZvuGzNr3O5BQx6KtfcdXF9COd5CN2Q55eDMI4\/YzgAen9T7i5z+A48rnOESzk4zgs\/IP41YKbbS87iU+sb6lVaa6qXmTHckUqJ\/vKLjckeuE1iMCV37FelQyg2\/B4eUFvndsM\/imEtswNH4r5WHUVtDXUMf30IX2Fug7xRb\/ZK1EuguPHgd24TwYncXKyAzVq+oIVK2aA5Wm8PdELjQXaLX4ZJ0SEMHNxJSNz1tUWJkmy0I9k4qXafmsSco0HNVjOp92ZCPQF1hJCi7xbMgIQi8WLz\/Wm9DbNhASsI1KEB\/N91T4ajcp3Z8ylDU801Sj\/2JCH9lxbXBHAu4wDifAVpEtXZ3jrcg5sULuhgWnPiHu1YHdAbxqWPd0SbWY2y0qYaDnZ2x8S9BPhVtuZ9YOTY+lVyj7bSpkxzRXwI4Yc7QfAG174rMOedNsfa8tUW5p\/eEfs0dpspm2dEWZrdQF2evwkKzt0fOwuKD3K3vj4jervxLwpcZpp\/leWkJijbfeN2T+K2elA09bGuppgA4NL47oG5r2yCB+Zq32qdc0Lcge12T86z2v6N5kqP8eFHfdFXAxgDSqmVo4pUMYXNnKOK8GSgkhYXFlvVZo+EIZ1Kyqb1FZlh8pf5pqCKSh\/PTSZVK0EuVwbBHWbw6NRQe6wqzFcPGIBEnRbWTEQhZtsjevzayDcCsJEHFzbuGlEmEEYBnoyChLOrEG4mQ298O1ztJaiI5T2VFfT6kRu9eSE3Iq12RyiQKTTNqRs5DS\/0c9Gs074AAiS1tLt4f100Bm\/s+SPDpCzfuAl7l6458GraeSYCx2iC64tEYPRHGHHlVBxSU\/+feepBdHoEQqHdXNRtaDbrJ2fCEnnxQH5+4EIZ\/x4lCG4IKEr1FKjUZxprG6svM2R2MLB00XwUiGK8WbHmxB1RJ0SBsYQZuk+O11OLjXkvAIJoH2\/ZlyEVE9zTDUdu06rbdZQ09G2KZZJboHD76UOB8YEXg2tbUYbG9a7v\/U68Sn1jVqAFFHlpEv8dHiWz2AVrKeIea+XkEL7zEDqxvysU+6JiKjbp0625\/kkhrp+gMvyvEYmZaDzNHRnFXusQU0CWLXCBMdCFu6mhSpSTfjBk7luda9kqbyBXMmML9w4euuFPaYGRF6F7kjlgZh+\/J+kDPmnE\/i0+ecNxKQjG9bu+rg3Bb+OPL8CCyRerZkG\/vlfV6qKVTcDD4fQw3wnOCpPpoaOWtAtx\/ywULD+xuQNrFPjq3W2IMH75zASLtB\/Szj00ph1FT8jgcEvbZ41fgGceoTFhk3D5lEOn0kFS\/V+oKR\/LzmHpt57cMiAswWLRFgxAa5kOQYuv+bzHkU4ahHA4iOze3E789NrcdtJXN1bGzFIIhAkBzJt1HJ6W4T0\/sQAlX2PIyL3gW2AY6nGcrlEjtojMzl8Uc24qm2nbWibmpFpTzHgM50uyi9J9+9LzPLYhGN89BRRExjMe5mkOXpe9gqArDg7rJNcCqg2OmBj9ukb3ZxtJLuLQVyJidUK+zOMAbS2PdB\/S5RavTA7ld0kX7\/WNErD3oa\/2iBOOWnXSD7oupc8Uh\/ZfIRRuRTpCvlcmmFpTaOKyVXrlfnx\/EKpCngaaHJ5Qpyg1GW22qfQmLAayHGyuC8hXzLUUA7478Xgag8mwyP3pWS9XPXtyjAS7VuElswemWd3\/yghX57s+dqDpBkt02LeX+5Q2+t0kK+IUccUGedY+NqEIUqWkBszcU3puEqPLmlArq1tGgZpJmb48UOC65VGwsNR\/8Ep9+NQkIaBW7guM+j1WDwf9ZHtwFHfO66iI5HbampjY1YJn8uBZumu+nUC3fDrWQTagAGwz04PeXZEPY\/yEXQ9AKIZx01lX6flUUqmebqd0t0Ix7R+dUYfyIbQmVy9wpwGD9eCVBLS5ZNzDfg5od7gtCZLPbiLc+aTUWRNszQESMLviWsExxWvd1Z0RSockIqhyVDvzvp1QEmZzM6Xu97Wh2BPlmqHPhdw6kD0hJqkWdII0Aoi2k\/HAFf9uDqZlRgfkll0RmvDe8Eaigeb\/UWFYvW5ieAX8PfmwOF2WFd8w8dEd7pMHh\/TMrfUJaIX5xDAh5JGPtBeuvMNDvo5j1cay6npeNn\/dwRgigw7b3mkryBDZ2jU1osZ81GwCPgtsWJON2\/U\/cAxT5MlH0snlETgUZPo+Bx8a4ec9VAyxwUgUiUNScX9oFSscM2yHNSOZxQVXBJzhllbsD0usAx1lff8QjkX4ktktKaULXz8g0Kyy\/wrfqHV7PXgcs75f6URYahbhXaLmadm1Q++EEl0AJhCSWoH+AlCCXZlULGEhqN6zbdj5uMkGZSfb\/g1BKu5GeV8A+AiEQ92y7m\/OO9hWBbYWeNZddhOufDqcyGROlzHao6r37lJz5BfRKS3iVbdE5QQ9AgA1UwS5TO0iMyvlRzq9MZZvXme7Xet0M35UhFJJWAeAceV\/wvowi4ts4tUiXeFrKUfCRDg9YwCRrDrb23VKy2BeiTlJthOd8pifQXVyxwYBS\/JoVr9FbevE+eIwIRPvSdGckiF1gXXovZaU1VZQy2SYrPQ1LbRYPpcmgQ\/0+zmhQGrkPv39NHFori3GzzQmuo8Z1zT+gaZjt8ZBYRER+W+DLoeSE7DrRnerqmbXgeHGAHUJFa0AJcJafsOjbBVLSXAbCsCMEM+KxvZN8tRfWTCceDe7JCXF07ldPRuG7+hw\/sbARYXRX27OCfgFxhr76VjZOZxxdQ2pvPxVcbIsPF78HNHXrOKnso\/RxPQnawWEMF\/9\/FzJ+PKGqKopVcwSgPRxU67e0Pwchw3KLeBT5tWl5NxEdaRH2Q09Oo+\/UT7ZEz\/MWwS4Jq36ciQ8Y9b4+gNps2duKjZcTe\/Y9TzSQpVRtOpUjUUOJZDdNCtGIxqT5Vum4T+rHHcLYeGk4BHt8n\/o6\/HrtVgUIE2+nTivvxbgBLUlXOhNR7+Ni1YTpdDnl0acv\/gYUklSOU3SOk4UyHnyc2gZzv5zOoBX5y\/NNKvAE+bxyO44uLvIhDCQMqoHLSidpbrdlXuu25lqcnnTcFVmUx8Ux+I0xrSid+kxsABlkWB1ddI\/\/SZeOUdnyfdVX3YglhvdS9bpRovwjepzhPmjBNGKIpdZI11VDKpi9\/i\/hwDpSi6rr54IynyYMTOA566BmhtKUpySBP8R77SKM4e9CtoyxRIO+liCtmfNQjhEdVLCtW\/4IAsGkGDT76F6So6IjaGUfgbNDsBb2YNum3cOFkXLMdmWLBaRN97VoFMNxuqxmRbHDX0\/hE64Ngrr3BVjIE3w51bPFr0dc2ZyNAmNIuo2cTNOpPhhDdPwV67lNhiBx3nh1b5Whn\/Zapd63wIA\/TenqGg\/I08m8xl232aOCb\/\/vQx396fK7Emuw2CLJHajQE2FqljvwNYvm0sNlEG86lbZbM1gMfpA4A03mMedhYmw17VZY7I8q5ny9wXW\/g+vKkQnFGtfMkFFoGt0XXz27bbAS8fCYbEiM4f8FrVBBbs2wvpYRDLtU1EAdYb40JbtjMQjiGzTFACcgUkdKAEH09cf+Y\/UJZvXT66bdg21E1RaS9D+Gc9r+\/2ydNrNmNMiEpihSm4MYTVg\/Yw3p3x6miPdagrt97QPJ16zNxsrFmbU9Aqzw6pT93uQaDxwBHWcHkKByiqXm6XtwxJ+uNNjtnhP5vnS+l7EHL5dd9v+CvZNhAD1qEuesBu6K6b9+DxLOsYUyPw6k6RMLdP3hYL7mim+wcKPSNcHZtWiYXq1HM8jNJZIox7CFUgmMHYN49vRx6VGciC4KxlgqIO1CJ4KKMGVcQ+cfsbR640JyKl1cX1OpRGIy2xhMHz7qgVT3uChawDu9TNYa+9GKHBudGqlpCAVLkWGnW\/AIsVACcNKbwhiFkUvbxJhAY1jOBzwhgSAwu7FbBSlK2ByE+2sohWCJ2ytlB1tjo5y8pE5FttcjWKTqXTRXDIv84jZpsdxC36MAPGGDecpEsWFlXHeYnEDVtwhra0Ft9vT3HM2vFkHy9bkMu2lJmFG+Xa+RsfL4Jnqz9tL9cCIJybGJrY\/8atlF31g7zzRTVy4ud1\/xsXgWOJLCkJ2JJ7LrmZuxaKrm6IdN4dOzwlM3r\/XNABAyReM1Wr2\/qM\/d+5BotCB3Da9rX0jez5S1v\/tcwfMQSLkmKji+EQ2vsFIt4eyFrPJPOfZGAfzBrC9WUUWMUPYTNJd\/HYKIDBA9tDsgvyjM0PVTN\/XFYm9xp4QKQIkI8AKjrqvrtTFKEJVthnyxo5REV1fanpk3DjhXksaB7pnobUmczJ52B\/vHANpk50kVN6x6e48Qb9XYKRzheet5oaqWoyLUznV5S39EU5N2fDQgh0S1bxE7JMV+0Y5EjS++nB7UzAmAVaopu+6Pd3R+nu\/ErNAqdP2V86VyZchPmYX14qFHdSd5zCcA5Jr6VxDVPeKIWwpDMU8O5D2TTReUKnzwvbzX73MLYaQC4ZcZCscMb0I7kz3EOG0L2A4UYN07yt6w5HYyJuX8JbTTDBqtDEf9AfR7qSPFTvYMhmjNKTmm6mGiQEqqlq\/cr9w\/e2t97eLW2dMau55j4gX4JjB4VTOH8dgbD51qNe6lWnn0k4DNsLMCAFoqeja60FwCCAThgbdh9j1MbT1UXBohslK8eiqVEMjDszzaM5gE3fojpPCEgtCFDA3TAv8BLPsL+rHEWjuaRwddGP9ZlHdW3L+V7P7E2NVGJrYFnWAdMpNLRtBe91n7UN\/kuZlwpH6ZVPVsZjpLjg+RicYvthF3b5cPFTm\/NBPFVHzaxQqUbLZFQG3iSywOpxK8L3WSnWLi8JRWlKewBXVLFRFHlAfyclXcLYtfUjwKTXlFYxNDlaAuoRd64rir1UntW3CiwjqL13ajI3F+aSyx\/2aGC9unGfbo\/DrHYugTDd\/n\/QSokqVaVFNLk126HyF04qredW2Gy+18W9tkpgNddwEDoMLM4xsQ4uFhW1ap7yglLe0LhD5ChDChVkS2AsnHqGeZcFqTFlXEwnprNJCznWgc9x0CgJFVGGWYCB6L8oKzZOy6XUjs8OyOdzg\/FpmeWtyFnKck\/BBtUMGjcLkKoMwPO2lmwmipfIMrIABf5FpHBJUPkoEN1ZYHbxaI6hopuUYBc3Pk+TTexqq8PsffUli1r3gb\/IFZQZmqrSZL4ej5WxUGSO4BOMtW+bKN0nNQTrQWvsPjTOkEsVfF9YvrCXEmgwzjFgkABM4W9PIqGIEpfYk6y9JAHZvYJG+N3KGkJkXpZu+VTk62O8bONWlTLqVaIadhscjJlyBU7ZQclSsFSIt8jUqcloNWXbvPNy5hlOhDZba9WR725i3BJkweKu6Ccyi6P0HrOqxkHzVfNRsM9PvwSSVV6csoNjes8uWjH2trBBA\/ueL1ot3\/GfgsH3pDOXGDym4fW373ozfbVOWkx28wsBk+XK2BwfyQT4blbRMIo8002SWVns81FEFWcLTw2cOCAYkatR8Ib8a1IzzfGs0Sz1aDy0AIWUOQwARBkdTYKvYdna3UtQ+x5Zy\/GYv1PJFD2IzsUr2s3rIOYXvIvTJAqpBcN0PjUHNpIU7jnC8ajyFKrgr7NcBMukWQY10ty8HFjNoYLM1hwwMQrp2v3IyTti\/hfdOM8qTk6KK9mxlU0Z0KNV0irDfDA6Etr7eOvnlkEzaWDt3IF8X20l7xNkM+Tmg7Jvd1+WhPFzUJW4tUtVCUZV+tOb+Xn4HHuO5jshXmy\/HMWQVhqnFmKfnbOXRlLi8QD0jZdmrW3urre20wXW7cZbwiN+iN49iB7GtZc7NluN8JUg+j1pX\/x71rB0wf82MYP9k4bJG+8M9T95MCQfZKsYXB\/hjI2gUyOnx9Na+E9aQFLg7SXHSy3pag71QB3Vo02CHv65uo9QtAqI5JgkKgoAgxXtGLG+cLM5XjU4P567fxmBAmxcId6UT4hLzY3VWpj2MUvd3IZjDlNHVQFof9BGXPffasBsWRDMaMFBLtVi2Vx+Ef8tdIZR\/Z0d+B7pSpizo83cdMP8lqGH2aDJ1wlTRWPDtSr9gjy73CPsHhnOyzNGXYh2mjwjZ5wHp3PxneYKAMATZrWt6KT3uIvjBY+OghETsbfltrOPGdg8D1IIE+ZtLgSGfFVhvvnaTQMk0nex0fexi3A+Z\/NcwMbP1XtKG8cVWmoQoOyEAJbGoEo4uKZXE1A961ehF6BaHiiu6ACmpEtkI6h1OTHsFY0ZSMW6s\/zZTnwZLy7\/XzJd+evKkNhykkzVV\/YNSUplREtznR6FBN+6F5JaeVpZvERacopAoCzE\/2bNRkYwEtac228YZf+UnL9KTSG2VYNYdkBMg75DTT4uCMCOkSUG9k7UkIkABuAJQgsJ9zkU2sXVZRw8TMgmKh\/J052Rh8A0c1i3x6PeeEcKy6\/o+yFv3FOYUDMoKnv3v2lrjAplrG+8oO3p7xFkBxo3js86atWKUb7UR7GFLPlOqQSW4LPYxT7XclkHluVwlvpvDZaZa9AGatipIB0oH8gHFQcfXuwfXQD9ANtgXn9yy\/s1nvDTgPluUQH6huRh1yvpe7T8q6WNdHgWVJIf+qA2V4\/aUgloggZimFkyb6TGzEZgXgOTFm8oFgdxMP6UMnEjQoSoMi29tw27eWNflPzIebxadM\/DrzYyBLLqXxY7\/hFxbxWXQ2wIcauvgTikCGsnRP6DzLVqrsGWaN09XlOo8ryGpafj5GClKQ7TSQ8Iq6SMSPA3K4nueCET7kcDsO5qbdqjI2shb6lrqVgO+ng2Kxk9BAD9fG+uOb1R\/jh\/JCS0+P4heQmlExzp2Vy4Rawvj9ZWIogWHi7V1ylEaSmL4Ati7CWSWAvuut6zmqivEPPk0Wh59egGQluKuNlXKxihFdrzLluQmPbu4mWvTAZWM4lP6NFmWsdU1I7ycm3hbg\/2\/0r5EIxlHlR2Eqn5ZgYU37anLzp7wyJx4\/w57p2PncQsoBD8DMd1XDhZeT8HgPwOrRg5VTIA7+fvIxdXsXkGVod84OU+SEmaAbhsCi13vktQy3QIBkOf5dmXK5arpq4bMpklgg6IipMlLgPNUGHgX4S2fEXsgndPZDU5AvHKZomrJ068lwh37ha3EzunYkRvhq\/EgaiQavMMXvrksdkJwcDJYABhA8MNtVeCqy8UNqB\/CozTqShHW6n0NmwpJMLK8cjItOtz6b7k08O9vg55Y9KmU+haT5RK3nHL8+YAc8cdsJK6CVubpImE2CxriPNr8Xh1NFG82DGbN68MHdHhPA4U0GIw5WVKp9fshxqhaGVKa79YNsRu22DIpysa0WaLn4FoqROK4UeB3sYevN5dUnMXNChZnW3HD5XsI27jn0HlAHI81P5\/AALdZQPr4Ro0dmKHUWR0YVpCehfIa\/X3LDYNcRNNZnluGVD1wLuxdJS1na2b3k5zioSnhtG\/whrSvWgoaEHjC\/VN2n9u3fHPNhbNWqMEpM+J86kJJMQxDX+9sUGrAIAm9mYQh29MKr5BwQetBKS3\/7NC\/fIxBT0fv5BBeN+YswNCQDSPFMYy83kRkSkHPZoOeTFt7UKeKktLhDJp0jAy+CIqXRc2+DGXBcQ7RBfzAxpne94yPvsdjHI8Ko8BgIgZEYH01rPzkwbd7YUOc5gQe+DmGFLVyUVOb6gfV0j+UFTF5KKdW3UMHNxRZ08IABIR5rmPga0rp9lP3Lgz+4n5EmCvHPQCRJ+St+zOPW5gA8x+UcQTKdomi7jKYqHdfMChFQ8zwSkdsE61\/zSR4no4AZUcv6Xjg\/Y9CWIBBKU\/w31RNL4fmoJy5mMwbHJXIZZaXxHBOP2keBq7bWNPBNW2q5va2dFOLcg0BuyYLOx+QuVNs2wNnvIbE05ecrN4Om\/whtRogMXTCHgSgmI2W75hGUUUW8gqXBqYjO1MG4ZY97+tS70Z99j93v5yBqjuLrL84dGnQqFMBJv5t8g+xxxDOzHtTEV7352PncazU1B6DvtGd6b\/FkUHsm6CALoy05eF3pBSDgefnUPoFXkllFYNFTd5Zz2CqeCbsLmpbuxQ\/Q8ge+Z77cE1XrmCLq2V32a7Pw88rjuJwEAwAC3OW3CkVJ6f36Vy10OPAWV6iMz8tqrFhkxdogwtopUN0oHIFYvCdWsVRkDi\/G2tH1ZiWy2ULs8RcuhU99pSpAf2Y7tzs9JS9I7hII7Tvgc3qcBLtL3fE8q9\/\/CM2zongVB9ZlY+e\/9irTjZRR4ygAnVcMaheaBCuGvZHuIba9wz+rxEfvBEO8jCSFPDRiFgUoHH1ZijHYD9s1LgSQYB16fvuOa6\/R+QLQkbZJ219ZlbC9+OBBLyPY2rA49jEv3ZbGNqbolbJW4roQqXWDzCQCwm\/jmZjaCUhznkoSL3rTHLjDmzXKEbcMFiVs0YLIrxhl54oNZ7S7cSDgg\/V+8H6L67W6eQOSgmKi\/xEmT5mQ5adGD9YdwLVv7w8NDaWfp6p7XJI7drqddlJ31HeHn7e4iWrOI+iGTLEFC63O7P4Sp1iZ+akOMhJuBnim074GBuFBsvZLaaIP7t1cYM0ps2fZ8njPP4IXrGanOTw\/5A2\/mNeIm9pbBPGF70k81XGAw0QmxcnLOUE0f5fBXQQ864QEDuQA5pdC+5VqbAzetYYjPMUrJMM+pLv\/utKcYo6trh4zNoAw06jtbmGKY0qKneobnTs1O0iTQqHW+F\/Bk7+Tf4rsnIETejmiH505eZLNTFRcl2irs41+r7toiubAtL1BSs5E9vIIaas134rVhzepqqFGqxHawLPqkmC9V0bgOxpK4u2hGdZ3R8T86XcPdBtji4z9P4oEdcOJmCWIDAu7lj9RrBkGSFy8OOSpzn+rGpzgp2fyRjw7Qr5dZ4hmqVR8k8HlJ8ey6tFI7MvYAHA4iWmA\/tqPpzhy2pm3Vf7th+V+BvyXwgthwh2ZlJO3l3Srda9p59hh56QcjypZ4Iia+ZtaU8rRSUrz8cu38ZyEVLIBs5X5DPu20QransIW\/m7SLsUAxzbrIKEgnM7S7CBgIh9mEAoewm\/Ij+2K7dx9Eal0TQjup+xE0jgnVxd0lSVc1oGYM6OL2xUhv7ROKZ\/RWTVuklIlOumaWkrU0fX5bHZgh\/u9RnCiPcDvfhJX1K37JvVvwMpKC0wqdYx+M7miGNfBnld5R\/9INw5DbdopDxFXc0k6jN6db7v1fSd5w29powzq7QJ1FZ1GGkuFH97hdLEB4BZatYeXuK0PEDGeZRjRsPgzUyV2aCaGiJS2F6PvfQ59Q==","iv":"518f3555625c6e0934be1fc194cab183","s":"a26e1f1a5459dd55"}

Shoppers that use AR are open to ditching in-store shopping. Image credit: Mastercard

Shoppers that use AR are open to ditching in-store shopping. Image credit: Mastercard