By Ben Pask

Consumers treat luxury labels as a state of mind, not just in terms of price tag or exclusivity. For that reason, luxury brands need to build strong relationships with people based on product quality and dazzling experiences. Get it right and one-off customers could soon become loyal buyers.

We recently polled almost 300 United Kingdom-based high-income consumers ages 16-65 to discover what they value most from luxury brands. We also interviewed designers from Vivienne Westwood, as well as former Diageo CEO Paul Walsh, for their views.

The backdrop to our report, “Luxury, Loyalty & Experience,” is a market that is growing fast, reaching $1.38 trillion in 2017 – a 5 percent increase on the previous year, according to Bain & Co. This is leading to a proliferation of luxury manufacturers selling their items both online and in-store. It is increasingly difficult for brands to balance exclusivity and accessibility of their products.

We discovered that consumers have high expectations of luxury, and attitudes differ hugely across demographics. These can be examined in three ways:

- Quality: How important are these characteristics of luxury products in shaping purchase behavior?

- Accessibility: Can brands widen their market without eroding exclusivity?

- Loyalty: What does this term really mean to luxury consumers?

Smooth sailing ahead?

Smooth sailing ahead?

Why quality must match price

Traditionally, consumers buy based on convenience, status and contemporary taste. But as purchase drivers evolve to mirror changes in society, consumers now also consider factors such as brands’ ethical concerns – for example, the environment and fair trade – and the opinions of influencers.

Product exclusivity is particularly valued among younger consumers: 10 percent of U.K. millennials compared to 4 percent of Gen X. This has major implications for luxury retailing.

Younger consumers like to make personal fashion statements. While they might not be the most affluent generation, they are vital luxury buyers both now and in the future. Understanding what makes them tick and drives their purchasing behavior is key.

Quality is an even more important purchase driver than exclusivity.

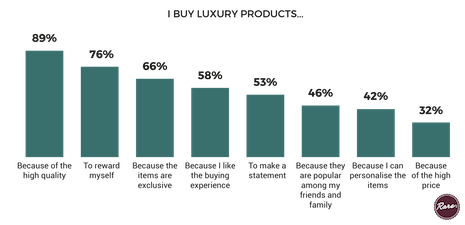

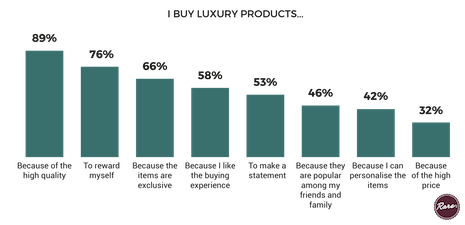

I buy luxury products because ... Source: Rare

I buy luxury products because ... Source: Rare

Some 89 percent of U.K. consumers chose this as the main reason for buying, well ahead of second choice “to reward myself” (76 percent) and exclusivity (66 percent).

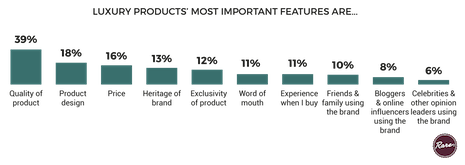

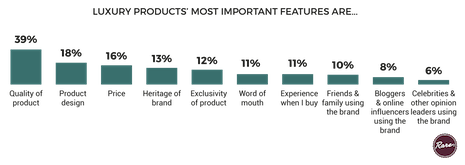

Furthermore, product design was named the most important feature of luxury brands by a fifth of respondents.

This tells us that product quality must be superior, not just to everyday purchases as expected, but also eclipsing rivals’ quality and design.

Consumers are paying good money for brands and rightly expect the cachet that comes with being able to show off an exclusive object of outstanding quality in terms of material and design, as well as accuracy in the manufacturing process.

Luxury products' most important features are ... Source: Rare

Luxury products' most important features are ... Source: Rare

Deliver a diamond experience

Design and quality aside, luxury consumers desire a different and top-notch experience. Even this catch-all term has different connotations for our respondents.

For instance, millennials are interested in uniqueness: they want to experience new things and attend events they can tell others about. Store openings, outdoor activities and on-street promotions are of particular interest.

We believe the way to drive positive experience is to first build a strong relationship with these customers. A sense of being rewarded also drives interest and engagement – it is a value exchange.

Consumers give their time to engage in branded experiences, so must be able to take something tangible away with them.

This is a big opportunity for brands, but they need to carefully consider the key drivers and make sure they are offering customer experiences that are fun, memorable and something people can share, whether in the moment or later by word of mouth and social media.

The experience needs to be reflective of the brand to drive its messages home.

Do not devalue with digital

Ethnographical research by Alina T. Nevins in “Snob Value, an Anthropological Investigation on Motives for Luxury Consumption,” reveals that luxury and exclusivity are intertwined.

Moreover, many customers criticise widespread availability of the brand and its stores. In Ms. Nevins’ study, Tiffany & Co was the offender.

In summary, luxury brands can erode their cachet of exclusivity through the simple act of becoming more available.

Former Diageo CEO Paul Walsh told us: “The point is where you strike the balance between having enough of the audience, but also having the aura of exclusivity.

“If you pursue exclusivity at the ultimate level, there is only one brand. Clearly, that is not going to be economic and it won’t be an enduring relationship with your consumers.

“Equally, if everybody can access the product, because the distribution is so easily accessible, you will erode the degree of luxury attached to a product.

“If we move to more accessible luxury, for instance, craft beers in the U.S., they are clearly at a premium price in the beer category. Whether you attach the luxury tag is a different matter. But at what point does the scale of the brand argue against it being craft?

“There is a point in the eye of the consumer whereby ’Hang on, I can get it anywhere …’ and the brand becomes mainstream. And when it does, your pricing power and your margins will contract.”

This is something luxury brands would do well to consider as we appear to be at a tipping point for their sales strategies.

Luxury Daily and Unity Marketing’s study titled “State of Luxury 2018: The Insider View Report,” showed 68 percent of luxury brands now sell online, up 6 percent from 2016.

Despite this, our research found that luxury goods are still mainly purchased in-store.

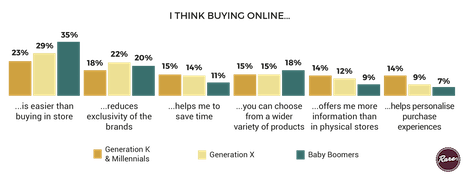

Physical retail is also linked to the positive experience of buying a luxury product by consumers, although three-quarters of respondents believe it is quicker to purchase online, and from a wider product range.

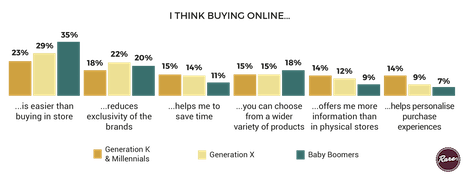

I think buying online ... Source: Rare

I think buying online ... Source: Rare

Luxury consumers like to shop according to their schedule and on their terms.

Online, personalized experiences were less of a consideration for our respondents than when shopping in-store.

Remember, though, that experience is vital. It is not enough to offer better and quicker deals alongside bigger ranges online. It is all too easy to eschew exclusivity in favor of convenience and be penalized by consumers who like to feel special.

Luxury and long-term loyalty

Research we conducted previously titled, “Redefining Loyalty,” revealed 65 percent of loyalty scheme members in the U.K. would continue buying a brand if the loyalty program no longer existed. This reveals an important distinction: for the majority, a loyalty proposition would not affect their intention to purchase, but for one in three it is a vital ingredient for their relationship with the brand.

The common purpose of a brand’s loyalty mechanic is to collect information about customers and to stimulate behavior that encourages retention.

However, loyalty programs do not drive true loyalty. They offer transactional benefits that might influence behavior, but cannot encourage positive attitudes, long-lasting relationships or ongoing loyalty without brand love, trust and perceived quality.

Building on this, when it comes to luxury brands, consumers have a particular definition of how and why they are, or are not, loyal to their chosen brands.

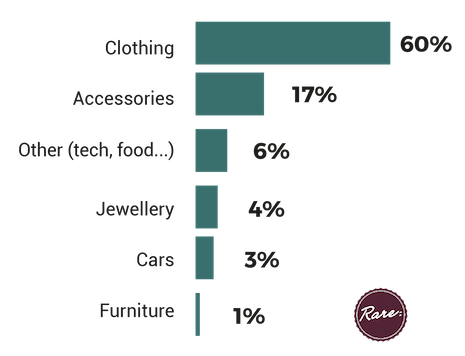

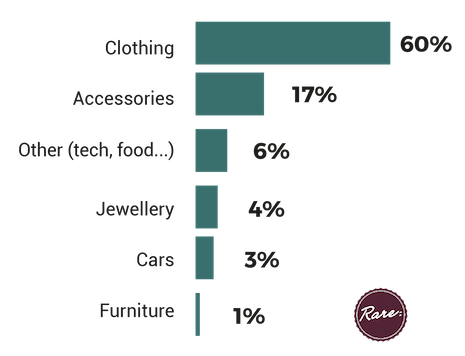

Category of luxury brand respondents would always buy from if it was available. Source: Rare

Category of luxury brand respondents would always buy from if it was available. Source: Rare

When asked to name a category of luxury brand they would always buy from if it was available, clothing was the most popular, chosen by 60 percent of our U.K.-based respondents. Accessories were a distant second (17 percent), well ahead of “other” (tech, food, for example – 6 percent), jewelry (4 percent) and cars (3 percent).

Clothing is likely the highest-scoring category because apparel makes luxury more accessible and easier to show off.

Clothing items are symbolic capital that can be used to affirm a social position according to the environment and the occasion.

Meanwhile, loyalty is intrinsically linked to trust.

Our research shows that across sectors, what makes consumers lose trust in brands – and, therefore, become less loyal – is poor product quality, followed by price increases and poor customer service.

Quality is the most important feature for customers when considering how they will lose trust in their favorite brands, especially in restaurants and fashion.

LUXURY GOODS manufacturers are facing several critical challenges.

The most difficult ones will be striking a balance between exclusivity and reach, and establishing loyalty through first-class quality and customer service.

Brands wishing to create luxury products that both retain exclusive status and maintain customers’ trust must understand the new consumer forces shaping their market to avoid being labelled out of touch.

Please click here to read the report

Ben Pask is managing director of Rare

Ben Pask is managing director of Rare

Ben Pask is managing director of Rare, London. Reach him at [email protected].

{"ct":"uNBoxmJZKA19sbdaOc0sfgTvzRiteQ7o36AzEnup027QugZu8I\/DdnIRh090odHHW+OFrV\/DNCrtXA8HSHe2zrQtdE2E0yo\/GQ4\/OD58CXqitJzo\/dHf7EUzW1kymNbegmD8Z\/2mrPEQoiFWwWnfSb4SKzsKOKGBvc0IJPUim\/23NkQW+b1Tr9hzj+RQkUBFlDFkfhaKv1YowZ\/huYg5fZd\/CV0b0j2EPaK14Iy5G5YufawPmdgr5Lr1puNew4udDGbF75oMJ+1ZCcXClOvvRH9JNONsTN8wXp+190v\/Rl67OukKwThyw1qZSA5PMdXvrO1i9rZmsyywgD2CxwStVxH5ucM3XxMuqLEk77M3BJSSVJ\/+rwN8n51qhUnosCRMN3ehRgnQ11HLZwwnCg+\/3XzF+7n61eX+DqlHPxB1j6qAE1DVcfFL9fcj3zXhj2NZW3cZ7PiAglW9C8P5hSJB6L5wpb9uDxTUbOn+lnoHLW8yaeaG7epUCE3qTKUj7D23\/mLAu8wZKkF5k+m4EmtnhPSLvjSjUexl\/0V+M5Nn8gUXY4wyVVW1eaIJRgeucMsxZtxK2lKYfjclvBShr6WdveH5PB1F1ELLC7d5z50LWogKe+2eofBTpeXzhvNGyZktI60LyG9ccMg20Md1yyfsVh2Aehz6NqU9xAPe7FB4qa3dQK4LqJoyMGmdFU+CuFMWA\/kqayZjCP2z\/jtsbNnTk+uY8694SaSwVYS1Y0oYEDJme8n2k0C\/aMBLrN5lfnZP1pA81fqmeFt1uMyW\/eiNo4tCZ4K6VXXtudDDSlVb4rtchsRLt6QCQSq+F6qESINkUZTBpU9irQY46JjRWVcvgVmBjKoXA2FnM4D0R8uRoAlRWLk8YKuWFguyEpMPc70OYgXWybYvD4nS0xHT5VAehChKGhpiW+iiXZJ24xNeHHIQOP2bRxtQ\/lIbdyBr2HqTTfNx4qogC0FME5H7kVLmVxxAW7DNK3dema9Efbynqn9jCBGfVgljlfgnRwk4ESYjj1Et9N6JiQbAw9WPw0gEnNIwl\/6b\/2iryKP49HLxz0+szXDf\/9+AYKgpXzdCDzsFdH9TAfwhA94NbIKOkYGWl+vd\/3KCJ9u0tH1a7xbzSj0NDrkFeLj+1jBQVte16AKBRAfvssFSsyhCGdiYVljvEfwBB6y0xb0f7CY6jB\/efGL4hJKAShnK\/o4066pbJgllmdzHzsfUNsEFY58Cssf9qOr2ZKVGcGD6JwVkyeGdXZmF8dLY2x1ktFSxmic9zEv2jbT3o6aegV+BpSCywbsvr9oB5+u\/ijphKV+cqJp6N6C5WFxDYvDgBj0EfkDavMcDeItXJ5IrUt6PI2fPyCW2V48dCDiHHbfoa33BNE5JY55imVi9q80eZ5hEoefkcbkseNmBhz0de7nT\/iDh7Ww1QmGWDt6sDXEJ1VhZ293FUi1u4RZ3Q4yZNApi0na9bpQMfj\/MkbpUTTljVlqt5KbJ05VvFhOkYUVfngcLROE0vL0DdDLtScVwU4a67ft1WL8zc84qRMWXKxUVUlPYdVmAYjhj\/gam+dfl4+lcpGCnKbj3ZsveTNMmU7JY+La\/yuzLYzh++cCKbsxOedSoTs5cIeWmoUMZ9VVAHgqGd+yIkIYdN+sY0\/+2LYtz5DFSwNpdjq0HuFpcDge+shcCXEXwXpjC46e2+YqprBIzWfodiwCQ9f1TP1cs8g2K8x\/DLWyzp5oH3xE8dsOdkfbryOZgevPGxddR2bawlRTRtL6hEszH+AEhLRqiPAEtYAglo9wCx36uvYovpmY9prHSGK9x4YsIJApdcffZf7K7SvV+XzE3KdegSRweFk894JjZVCyBuX6hFYnxdT7J\/uTtApMi+nTsf9n6CxcqMaAGufPuI2+GLQg8hXl337TuZIfEjG4RjBSuCvzuog3hrSaJX12uoB4\/ObHnqhfhQkA8lcx54ZYg715Kd4knFvFuJQEgtc6wyMbH8k1UYUHgS7MO7qQeiYYFFFyNDOGhF6iL5AC386OaFNNKZVd9NlQMHZxzV9+QQj1P2UbnVBxyjPurcLORbLTRnAaKGYZlBburSIY+S71QtjindyhwjZ+\/Ob\/7XH8zZ4z3kJxc8Z6Vj3eH7+6mwSmGgJKRagwyhw+GT3Gf06vZINI2v+q4RqAiQb82vDOfwlQdGt\/YAZ1iwMO7egnEfgaSLLm\/amH8r2E8RmJvc+HhJwtrkm1wubDJneEPNteumgWbVGGk5mGCp8pyXz30+GBsUUZD4CBWolWVbSWWcZsJJguDFOwkzjulqjt\/dtqxWlI0n9h7IwLhWGNo4E5RK0ZoHq3wEA1zDkzAv93ugxv\/vJMbxLI1GZEhOz2KmmbScjfiJ5lp75Hfvl6q1lvzkLqwV0EwM3dkva1fxGS1RxegIAEzBoOrCSGqFbuQyw66dipTPQUGIoE7vfC4RLKBwYKXO9SjSyBNpwg7mduXMvjYZ3wNu3NP2KIV3aylH\/MiQNeB+r65gd1RxNTil8HTkz215C7oVPKSl7rFssXsY7uxKIjsoHTalUWpx6jMO8OCetNMcPhgNZsa93u7SLXXfFxvBForGXMfMqjsHJEzamdPrTOmL0WTs+71D9v5+BhD40hW8iJAlBBjm4t8VspKhXHuaOjUeOVF4HiCGX3wv3N+bukKZCGQDzfr05NlbhFe3fqmN+KwZI22b98fdXP9wZHp9wuu2cCQ3jX7im17LoIxgx5h4CrFrVL7e9JrmY+busYNw7Mlpc4Y\/KrWGALu5qVUCGHvpdY7KLnXqlj3lzQSqEWruMhzAOxSYk9nZoCsVE6GmA0c0hobQfNhhS6fJsf0OvY8hZIJNM70o7SD42PzUyUt+Rf1s\/kY6TJ0tVpLNBlQegfd6kx7dBUxsydqEy4RXWqXDh\/MNatzRP3Er3K3tYME\/s5P2XwT1f8xYgz\/H6ulRKkoHUyY+qNfoqKA+nnBZBPlDb458Rgiqic9vxWu1kS+b74jjls03uc7V5eQS44xp3hsaZyf7RdvfiKB3fWAjv+xhJRY6Nq8FNeyRAzAotgisGcCIudcdgUFtrM3KLRLqf7icNxcWGLPT2N44x5BHSUz0OI3Qr8+JnB6MkCP1WT8G8YPT12Ylc3Mj4aXFSOftr5HlRSu27dsSiDHVacZjER08L+UJ7Tx9R1h5x7+28owdURFjerDRC082ih5SZlqm5d+dbBcLSSlXpk1S8rZA+Wbp8mWCYGdB0H4b10Ee8AUedFYBFo870MJ7NUSZpJ4RbtgO5b6CpQL9hkV38gIptNAcZP7zR6mW5czk0pMdpwUcF4R1teiG6cBbZd8Wmt\/9+XOlEZlvlhi0LWndVTL94HLrFJYaAbGAzUUg2+GHn1NVPWZIy5Us3udZ8p4bnFHhRvc4JCAIG9LaQB6IINPC1Sl79PnZ8C6qPEaYLCtJeMx1NU3uOBjLVCqdbXBgWo541t0ztAQISYmwA1oLByA48e5RxM7S31VMIQYloRgsLBVJrt3IQaT4lSxG3mvk\/quCmC0HxsZsJ0pmMqKKB5BkPzhZjRPLJD46hrx7p4Pr2zMR1\/wToY\/SNH2mdiYfCI6xskXoHM74+xbyB2qouemFYzNeehqNK+LW3hIdaITzJxo8RlC1fZC\/ee1a2muuhIMx\/hmm2OtDNv1MUL9S3Hh7ZMkkm2q2kwzsi6ynVw6DEriWL9NfThoGxdLM4tYzVxYEvSrRiEdlgtCz4uWfyuMc7bH4mRe+UWsCDfZDSjJ6lYsz0i4Sxpd6rk7tWSH8FRf0e423Xl9hRuvxvAw+tO1F0eJl8aHFfCr\/mQVRk4gp+B3\/LLLPyCpeDzMLYa4sQTN+YJckZGmJmZ6VGRU4gkKig9F9Ug2B04q5VHYyekuLA1MGr\/a0Kqe\/mbABpHnnDk1Fer151S8KymmKKHrDOqQxopMo1JU\/hliUgI4CvOFyaNp2jejX7cNgohqp+h3myo7UaUUuiSd4KE\/fmGXum+3eyJzxyU9AJhdGlRyF2MlHuCmWqFH4VKtbL\/e0YiOriA6i2LuyVzlawaKFrwE6Hc33TKVKvahZsi5C8oOyakRE6EnkSn7G8Cr2DpWldiGL5UzIxbH+MDuAR60sAT9JlZNmzlMgZbYH+ycSldzPScFB52McmcsEpZOYVJha+HVqt8mdMLAygT3wyLGvAsx0ALy7o+wBhA4kufN\/vdHZ3JioezZdo1fsw\/40xiWpxzY8l28aRAM43hw0NAp2qlLKqjf5j3Vq4uQUrQGe83gC2fqbBBL\/mRRAqfw6JBgyeAwkvdqjud7C\/NrqLk7xETlvRSE+BFQ2gTbSWyZ3p\/C7FVRV+Z6Bf8QR9bFgr0o11laxk+1K0s0hbpH0RLxTwUkVxZzirM6R3d4fb\/uiwrAuL9yzYgNQjImc4h\/Nq46A0guNZqV+dYKYVxDJRsDhbnFNknkQIEmdzNxxnYZvFhkoyRSR176c\/K6NMO9J3b6qpm96rfzB+KX3WmXnRUUtJKH2ruW4DMV4i6wmQeYodFNLC6QjF0h42kBHdseBZcFqMqrJrMD+7vBE4paqjU\/Fsg412cAbrxXPwMlTc4rM0+62ZnotzBa7odmGBZ1qGp0pRbNwhu2su1IFYWEDNtYLOJQNPpGuk9MXnHjwc7Mpa9KW7mDkl64O5xDZtO\/\/l\/JmHmFQuzsYjQe9peswIi7QkaE8GJE5vbtr2VtGp4RdL3P\/ck1uTDVxzIARQjxzb+267hmLu\/6x0MMP9s4cj3YpjXUlAfXVbV7ChWK+0X1r291czXzdSfqjxStYmbcNSVKvzcs+VrldivPS8qgVEtljseteCoTexM8WLuCu7vEc4Zl2gc5Gnd9pALVxOt3b4LcRqmYHleO37skK1RNYtupuGqhWVkMXLvwkWeUHulGtNES4dLBljvglLRXRcKjHyNBYlu3ge2Fit19Xdo9dOHzS9NEYL0lBRAstezVaFVjkXNkIXerzwmFAffXo2jXrCPJjE3hNfGqcFECK\/D9vJ1OZTkK0rBxaIG9qtTC0Wns86zH7qnUXfbpHuYuZHxr8\/5TLsejqZ51CxKs5qbFLD14D1tmBLWyEGn3b83oDgzB8H1tu2u6JbUB+yGm26TTZFfk6db8zCRAmBqB+1m4R0Ie9I2SQD5BpYCp4KDQXdBguV6bXiKZQI\/Y5k2DVR5In6IoQzhEDzVo8RW\/i53byPsRsFmwNnXr8+Bes5zpTYiqD6bhE\/FZjmOgL3k7J6Uqp40egrCwtHdDrkKeQZOuAQuTMQvy7w42VR4Kv6dm2oV9CHu72q0VZQIcK2HkQE8Cgw+07Q3Gu2Etcd6u5Ik75LRdSUwE1uDc7YUj\/bvGkY3wy3+CqxFTYWFC9wsrskWKQlSuuwaDMALMTEeEyRk\/szrTr9gj0cSFdH2FSIVRETEVznDjv8A68wj0RPSG\/fXKh6sERBISNP8AgbP8y3EGWXLVMeAmJjfFsyM\/w4jVsnJVVYc62yEACxlyphBQd2wVskZRjRIN4U5J3BFnp5GnERxydxh7zs3XjwEU\/\/GdAzbTZeQE5tBtBzO5erY4U9NDb7eAiS2BQfkArjnbvJzPVAHoSYZKFpMiNU4eBKapA2FP7jHyNrAoq9TwziZbFN6OOSOnVT1X0tdlQZM1hWyxDgrUbpzw7lRvQBOiYTLi+EAO3D\/yUzTYgX9hbQ6eQB4vsQgvnZm51C4iOqGkmobmkpZvwIfNM4mVDS1jPkMUUQNSLjAJXPnhwWW41YlBhE+lBm3q1Ijmi9fBVTCpCQWadb2wuDkBGupfpMr383pPdfBWaZFswe57BrhiO9pwuWeI6k0MHsbLmfFwHNIPK5AJtyrgm6sbtwSfflC+H+T7syWHYsCkUFL+12EVNG7V4Ku\/n8lnR2AWf5Fqv12uiMMYcGYBFRisJKZcSJ63HT8xp50pJHHNsKLV7OXBpJLyZpdlLJojzC\/wHmjLFiazc+v7PGJNmtQLyqXAlMf5ZXETEjbFPqMFfhaUD9K9cBzrlr8gI2Bj61l4y\/+KD0\/BWpS6SOKTjqMEFR\/0qxZO3ih9Tm\/D0nowqAhdUKHaQOP18Xn\/5rvgzrqtLbWeAo9381L0wVnhW1i3C2u7YJDOIx+CPngwYlL+JNkpYYf29jdotpML69OyN6Ij2W8FVl4evhN2tA6OZ13auoNgy+Z0jjxyzeIy4lc4hdR3SQaFOAXvwdz1pYHCZC5frObgJzUi\/yrFkLeZy6mFfhPefjLJOd7vMsXNjTRL\/ChzzJrBVpuhcD1DVWACkDYBXuQv1Q2K9LsqmyWQCuJhZadJATBAoFvUSGitTVTt1LCb\/87lUidOZSLQb+HXXn8HG\/uGJVTkHBQWE3RBgCH+4iEwKF0zhWVTpGVBPI1lqUfPy2OB2HVkgwzo2fLWaASzE7yMD4S8xVeVlH1xpKF5Kk0wIh9eje8zQhzJx3Gpr2KJfJRiH4Nz5Z2k+JnQENKlMpDi70XDxpbxpp52qjKZAWfpcFauo14ST0nfmbXtIdEfa6tkhra76E+sRrTLgcEcMY7FvHqVVlOtOf7\/6YvSfQnk1tdPHGphDoclvlovxtiiHHBIFriC+rMHYKbFxMlvCHzIy50aZRULxP2p78kQPtArfFWoNplYAHu4bq+ln2j\/VOqpP4iJ7ePjv3nRVmhgpCpGmi4\/oqowua2U+Tr+XET7K86BEO7hWBEcqg7qzEhZwdyvJMjf4cNHs41LzbcM7X\/LDmBbDFgKApdLerams8CbqwCqHuzbDEPb\/88s3YwQjVcqExdnQXpaI0jaJDg2usnOhGs8rgw8sqSpwB\/Zsk5vg8rUQAbQhj3vsmRptkNqpkvE3JtKJqgnAl3pTRZSJOas4bOUiwCwRc0PKcU+eZFfSh0Zn\/fPgSAbqe+h5gKss4yf38cCWHcK+kK5JK544qrPXOe78FSKYbTjn\/92S4Z8kHA0fYziG1yPFS55q1ujM\/XAKvhzyeM0NOnmmIqED6tUHlXfGcJx\/nJ5HbSpSEOrCdgB4LOpLIG23GUDEuGr7opi0N6rcENumLTMvHVFDFt8C3PEVXXdbeuBmu178NzM6FdQyrKl7n9UJ5Kqoy9zC2KryOZBlly+v9wq6xO9L0MMWuzEi2+ZFZlTOqvhJ2tD5zeG2NgV1wJn0uAGZE6ugEclNpB0oqCMKw88M8YEZNaOXoV4o9H5b\/UeJhOxep2vdbnPcWEs9vx8ut48HMer6VIjZkoXNh+Ci7eZWRYzgoC8CBWdV6gYtZleWVtyX12DA4Vz\/VLfUyz19CB6\/seG4urCor45D2yyQgAY4dvVL5g9zalDWIQ309vSJOhhfZ+PoJsRpvEh7FkGyQPbqMuo8qRyo2xuPN3rq\/lcDeShTGTy6Ix6l8zAmxyi0Q+dlbOsF88OhiWmUyElzaPifE5jxrT2HlSH15PcoaDWV72VIYJrqQmogX0QsCNhcnQjTDUlj\/PzcyftSgfKgy1r4MCSNIvojMFCbwlv6\/5tJn66glmskD4kJiXHpgbkXZUxEGoksz3vbvDG\/lG0LghIzu0xB3brUrEqftWJpngA5xzP\/L7Qyt7FAYd6kUAXBb0RNkbMuaDcSJ+1ll0FcI56QK9BJDU7W9EmAbgpjG+mya2fd9jEqGbmH3VWB2ioX6U\/Eu9\/30FRy6XfQdm99vRHA90dDVyWPm+iq03OEPmvUfdSwpq3EeRkkcAUrGnupycMmm5hAnFj+G7qLOhACK4tOvfW4OVprmSnalGPGYh3MYt25xIGwxXqg0iWwIh9GfODF+IXMuvCcWesbVoe7A5RK6ZcW0IVrLkL15UzLQBs88yuMw1qaZRHkrNnKmRc7dfLv8ntE2qtO+cefhRppcCHdvRKAY0PB6XwMEq\/i\/xdn6vc7o+U9gXv4JdPh+s51aAkjKGUxFXNlprBSkyZaRntc7SUUJ6Aw9IY6OfJLlTL1fklUkvne4bVn7AzAw5HFhpvLwZstOu0JGOL9eY26ImiiEEHsg4tg44RIPYi7Fw+8dwCPsgeV1xpoCO+37p0AEzu\/+jrtTOevmZaKbLxJOgQqbbmumPpiBYn0szcB5bYtgiT+7gHBgmyH7q0PPkCJAnYSKs7wab7XEQnruspqi1sjPKDX2ZeeKXUpBkgM8vymfOLApDoLRW28Ze4JGzKOngfX3P6rygy1nQvQqKz30fDO3G4emYUIY207Kpya6LudcW7iyBbVnZYPpj\/+Vp612d6tWQLcxlI4IKb++IbfTw7PovbEnyyNe057lgchNkjXt+92tdJe2uUxACeoSppaXxTwK8gwA4+iJpjla3g6cG78q9H4zNEzeC74vhf0gtJ3enABdluhBlBzJFjUx9uJCUWx\/l+Kn\/K7SYtOp0Sps8X2WxXHT063DrlGQW2yhX\/UVMGlc1TsvrcRxnpP1WZdgrV8AwR3cvwz7Hn07ULX8kj8e3o9Io7kucgzuksLD2ssQfXcYDJTYtUI92n1CApkeLIstEbCbfn0Pd+QIEAw4k7wlwajmbzVfXNnwCYfbXREYP6kV5EOTMB5+L8d8QPz3CBGK24yDE2d2Y7jJJxkJgJXrdYYkxLKkPDIAWQTECBySUTDdFwnxHeT9W6mkc+SrzaF1GRC6lLal4jDfHOcTu0YaKXfMvWoja5fpmY67CshUrm5qwa7VvXSjF9jigR1WjfU1zUrR9im8o3o2KmsBsZPxqso2kGkCuK0Zi0JrKldI\/e2S1o25Uo+1w3c0mDXMa9Z9uPzgKQF52kDPzfqPSmbfhIfDZ01LSZYHmj39VsQtqp1B6rXuPjzf2GdCdxgC4xXlcgOI0Q37LFEo4kO2mJGkvq+e8u2VpCHKRNREbGnw2gxXsOsEOaZi4KKoMT1XflAqHkX0SR4KsJWOZm7fhyNoJ0u\/Ggk\/WBOAJ4hx2TWwJovZlAR7p7SznH20E5gilaaRLpu6s9xgxju3wfQsMxnJNY+RC24ib5Atq2HQfeB9llluxfzGq+U4\/9kZe28ft6xQawUKpwgAyEcIgzV19ToXHtPJKZl0dH1HQBMBr9h7y7AS\/CS2nVPnTJWHRS+46tnjlNgqCWvfITLO\/pavpjDgOomiqUAp8kiGoEppHGlIFtCE\/P29eJF6hNa3h0XOA0XCtaL5URPMMlOH8Vaif4\/071ym3f+YIRDYejYPYlQbca+Rs9n0hUvPWnNfoU3QaKyYmGgOtxjrtnNmaE15bSeTbHYIoJroj9CBr0zHMCECoeECLTJZf0fEC8bgIXI5u0JR3VLe6I8khUYSZ3EYySA4NCG85cJW3qL+SaNzcuQNf\/NKQY2xSzwyZwXTjicjUcgVFQfi47fYgIG0LwgMGEdcwzNLwABmUwY9kuTJZmSYfAK9bGFkusEc\/6\/bYIZlP0JA2lhrr0s\/T2272eXLb7NrwNRMjstZNfS4164bP5pCRBSTKkyt7dP03ui07og9o4GFzGERa4e6TTiNbt5\/mxdXCVlT9vTuUlzA0xrWGjpNHimiA\/vBDQJ3uoxirKLY6lewfcQv+YsmKLWGJaupu49D9e8Rssdr+Slisynja2GnvNODpgsSUR2b55PEydOJpoOuKh84gOgv4kLVycdn3VmdVmJUeYEk7iRu5NASmhL87JGF9WXy4Uo+YuOLoo+VH6CAYN2k6\/UYROq9Ip9Zr6ox9Pk8sAnB14Mzf\/C4Am+Dppp9\/1lLwProNgsE68ObinK2b9YbEnPG4\/IrG4MrhfpUwhoRd7Xrze2+ghTavbfGVnkHcxU2jz\/arozZxPVH90SSTWTrUcgyW1EBgUUDvqaA1BaU6+lS5HTZJvDG7PuQrewJ92aq838HX0rrPv1nTkGKmfUEHjqUu7+w1kRrmTCIX4XmWjeew5NHeqlpYyFf28QUXw6EM59\/\/uLAEvXEVvDoFkDJp2bzpeZG2ikxR6eCFQCfM7KdCtofXQcKedqGQXZ6ewCw3qhQE8FJvpM8BmL\/UvVSmvMaU+0sM950DWl6\/5lm8k9pA8Z8Zb8dtqHPLYs1OnfMBexnEPDa3hIfcrpU1uXHH3JA4wAvAf\/Xl0YMGhJvbB9+DzcApJb\/SRrnMEhnhZMl6mrSjc2p3m3\/4wMr8sEYSsZDG22KE3+RqYWTI2f2SZ3J2jNEbBM5H3\/wLEpSj1LtS4Dy7B1uab238E85pOEOCfdivBLVn7RUPCcb3dgDcr2X57E3kET2aOLR7uBSGMNbmf+QcgoLJYM76ZKe95OQvCmTB7oQBsUlGWgslYljBVbjJ+TOJdHJIpdkPwzn02ETjlGJQVv853mIRDvPunm0hoImzvw8GzMrGdKBGlEzcCrCKxQl0bHOweG3a6JDR5W7zy4vfFGKVGQqgEAIJzJIQZWCeZYGwgPrQyM6jyzNaJL8h8SmO+xtRUQfD1HCcP88KsM6SGm4KuD3FpT3v+6\/1jqQ5gQ5TqkM\/QKf\/FDP2VtditWP8MhMYD70Y3qr\/24lJFwG9co9Su7n+CZSJZHcSnZRdBiPRhvfOqHr\/Z15e3BrvcPJh26wcnVrLxjm1Zjzq3I18N1r3mPe2MmezmRUyVBpnuWUWV6kQXRzGqTFaKZM6A01c95AKI2GMjc0VX68jhF7LIIluejzY11gc+EhKFDXtkXcidphD16GeA9wIUaCsEL5e08JnZaN9LtxGyuOj8HZK93QMGKWFXxgrsqlrhnKsCXN0ScvI8KcHRl+EjYpj9nhEiAHNL\/yLztdtB6T3G+ukFkhVakJj+XX8TdBkknZePmU2gDxTV7ZorRXKj9GmI6k8ieOQigWhNEYyOB5mxwGCN5hgTN6OJVJYPpUcp3tHThP3AYxTeB1WlQf7B05EsX3OVj33Yb+Y0OPoah0KjdkBQovZsw5xMF2U2VhmRsNEqIrHdCX1GMlvMf0YENLOiW4XycSqzY4HNBJT02w3kkBrPmSb2GOhsNtstd\/jTNzIAx4Nkng+mapxT1h9BW41RNZjJGxE0OZW9IOJOgbvurLOg5Vqw0G4Tq6y1FbIFHX+vLUVlRg7+thtNAEKx765bjKcnKPxgMd8P0xoB7mni66Eib+WSOVzcM3FDJQSp2uSnVs9Vij6mFAct6KT\/jOBOTpEk2S2ibHQsPOigw32GQ82srd7DteI9k1M4\/hViO\/cuh2ZTGPCJvW0HcjxFyd2K5dxT6HXCh0y3NhPSpymJ985dSSwtRUZZIrpIag7VGR95eFbH78sqqaGqymiJFp1dEQk5E+TOBAGvUPNJ5T9uIOyaxbirWOy8Keo7829DLCQrPyvCpskgfQt0asovNdxua0ihRaN2fjf4YZxgfRoXO0HFTdyJ1gqsU+7wbsByAlwCxtWoNWPcJSU0\/K5k0FCps+crtyvBjtTdFl4wuL19dU12Hl9kqlu9McBS1WJtTp2lMScD3KnX0Hvg5QgLr\/soxzj010JEfT+djS9i7NFlWLmGbaybkOXEGbDvnduFqqbJNOGJ4QYAu75YsC0ydXG6gIuw5mBW4krT65YiXbi4\/m4OS0Wj0LPW\/6tqRj7HpOy7wZWluSGm\/W7QZY7AdblnUQNOGj+2nfpneJE\/+uG75j0Kn\/Xj\/Xiw\/vvHqzp8IWQgnm7w0RQTYb4OGohAbeYXsID8fBENJJeEah+FZGtCk6VwLj5C8c3ifq9bYtw8zN3yxpHo71wIUu9bDhDLDTVql3+xf2hlEuWl7Txfk5urX6\/QuB98Yw+VVSAH0UF1S1kvAhKo6xGVVfgbMFiuj\/98Veg0xvxAb5VXDVmKxF2vvBsD2kwc2W41JJrub5xVPlnCwl0GtoDRrDNpyaVVJQn0vuTChEAcOKSS6k0o40mfmMFTwJeJZEKGENa72tqxymq2sj0u2djyRrnweFD1FMnnHDjWMM8CV1brgjK88pVuzv38m3+J\/Ujc2uFn6ldPiPbju5\/CIISkeOOtlorVi3EDuP7Zo\/DWtt\/4DaBL4r9lg52S+Z2SWDqbJ72CMaWFaLus5bVi\/K7lF9KJ2\/aBQrCzPnQRuShXUT1QTYA0ZByyWDER05zhubSBtiucpIcTXuOVBwudjl5YStPYE5UX\/A3niWeHohy1xl510oRolLYOmc2Jf5cIZkaarVjgJprXkDERKkmjSzeIGiqURo2pqh2wNU3U9dZo0yK3nvixEuzLiROn7qBCef1ZbC5zT5FtsdiceeSVLzXWZdYuV0bBzFshTeCraBpbwcHSGUcX47yIyFGnQ3v7A2gFCXczNoGFgbNmQft+UKMiWgNdYY5C26FMeX8igEMvPBvP6TaHlCDAx1OwTnrh1KGgpaY6Ov6fde2vAZqctD9Y3R962zcl5G4AWUy8RWFgg53ysB3HJw\/qoPib4r\/LVvLgDEDP4PojCANJW6hBASaTkx9qHWWn4ykw3iCK5Rzcm6KOoHYRqb5IO58bjk5yF46QCcU+72OMRbtblY\/oORaqRMIwk7i6VY77DmBMAiF2IXxiktq68bME7KjkKV+xCDoWbjOLUuedvJ8VPUys\/BL0Mfalmf7YYh2syAtWf3OMoWA2N1Y3qEuJMWQfcm0n1YZNFdKKJOhEd\/3FAIWGvQ1apFpPnl9qhG4SXPPbWuFFmI5grQqXuCmnkQc4hqveT0sXzZOAibQ37QbHw8SNsb3bs+TfRqhQS7ywV0wknHilLAeknQQ4ranT0i0xdxfdxnbhzFhdZAfCBFZshnzWuQ2B6BOo2QhyUfyMXP4E5DziDwvWzEZGxXApIRPnxVZdxVcuAb3gBDMc4z0qyUC7bjLQzTWrohn5udG6tCuIxvMNjtY1n4ZE3j+Y706hIL7bbnf0k3LXxlEjalwfbvVjVDgRly0jmYMpImyvhG+NabLlZV0KQVW5SFLxXVc7M86Y\/uj1ReJFfscy2j\/LK8uUQ6VAIsU2TjHenwVGYHP\/\/fKuZfQX9GHuhMkuIH4T7L4PgtkelK2Aa\/9vmyDDO8iVxa7ZzYtQj0Gtmo4+owyoMw5g6Q2JqyVGz\/oTmMCJ6L99qTheOKWPjrSNYfXAxNsi0+Ep8VdQduyDA50VJCbwcGAuwogULqUpNGmM3lnvPpreJmoSzJi6inDCT7dIoqI87zFZRm97b3OFN2qtsvLuf144XQgVJ5LN8vxEV\/G3BezTqB1BNPZ6VUdop1gQBtRvTSIlAxaGL6clQzHh1rC3lrF3DraHK0Cnx1R\/Snp43Kyf93CJa9fqM0JPchLLfHBu2XnJxCUP9Uoa8pG28nCFYXROhQ5Dk1dd1eRZKKSmPQNMChztdSX1hyUSUKkHyecGaKds\/QofBhLRKb8hlulK5B0d2G0cK281+PIJHFuWFHDXRXrdNllF7dX5MIRurLGFWKDeGfYGvUhyxVvwlqxnlsAcLi5GN48BSlOxYHJLI4pown0Re2+leO5FMM0HB4ho25c4JP\/OGbAfM+tCneATphtQFfrNQgwU8msXOm8zuK411Vx0TLYz0HIHcQPJcLTuTqqUTtJTW1PaXZgApuFxUKsLULKoDybgdknLZPTXWblSgp4jyg9lx4R3yAKHAXIrq+nXCjptETbrnyPrCQ6xrrOD+aCVglZeVWQLTknwLq\/vykf2Ot1VTzQncuvZxqD7KTADcmNZm5O1EUGHFiMg6pETwxJ1RtYzMibkT4UMcs6WX2UXeAEBTXOdBXNqbNYMPcH1Opvp8egX+Y\/MtjkLz4D0ZwCbr6ivvjzWHJPLfYiyt+c3q6DkA9GMIyvHTLxU0qQHeOcEVFQhT5Kv89JAT0Sc3qpjJAt8Ix9DNFtSldpURgxfIW5grcrSAHj+3OBriPRktMI4UzCGK2kDlx98KbsDwolzDRuxZJpTsNNCTx\/AxOX4aaWMa5y2Ikoh6QTqQjqWRw4D4\/eQzEysvizLb27wfKa3l7uSxTCS\/vtLb3IWOVCABleWxPxKEfRCUjMIjGyr+6hTeOIZiSi0f32m\/sYVLgKKU5FtpygYEmM4Y5BbNtqjmAbL0quvzbC53\/CeFsKIHTGlLs9FaJHUrGeVETHCUfqrTAah3lk0yr2ZNh4UdiVIERkYKqGlzk3SGTyG8AkZYDiqVlkUH757qBgroPMjlpm7+Bs7YmnfQB6vFpIM1PZiZOxE8Rh1adpxNhIj+ydwIB8x5NcxUF2y8SOXfNjhW3bgRkpokWzr+TBnhQWFsVV9rsWLarlCDk9gG3tlcjS3FPbDrzIYdJ750BxYhnp28W8bNjAunPYTWaOo\/qvlPfqD0H0PMp9lSDAe+hJcTil+LG0xY+vtKNf78s0WAIKv\/YaLZ5w7Y4Q74Jop5WQ5qmDwfcZBOZQJmh627rDpCC6RLTEGkYpSSKR5r1wojwQbdNN9vL2gj645VB+meRR7mBclHFJt14lnyseHjXz9muxUrAtOty45RCk9OwP8HzWrWLuEgPQIyHU8eCBw0X92MDcMXy8IiKsI3J0HUcfy9uOY4SVLKUM2Ps2F2X5N04W+mzPHNSIQMKAmcAIwTxZBocclLzg6Co4XZ2C0\/KKSsk9tqsZmNGUG105OYalHMegq0zSzW6qATcUh0aEwt4gr4uWcy6YCPAgVZwt3sunvfMm9lfr7oCcfxS7CNhbOGDLObQg2IGN3VaiLHTa6NuCL9QNkQCy8B5hoA76sEBjGLUW27Ym+OrKwWhyEtVzYsUPDyuLa9CLwkXKdeJD90s7ogyVhsfI1PjGk6euoqN022UCXgoL\/l8CKgGXmar3WOjbGaXJIMbk\/JCKnuMxnnFNs\/Y+gu\/tBT\/3PCbYKzaOMiXonqUrLNwKrbSyo6BXoD5tYHolRykvsLatrMSfADUF\/Yo6Qlc\/jScdIZ4lk7Io+vkXB\/LLYCkPmBwTf1XUBRDmPKaQkfNjqnVZsImEomTkz7OXNhFX2aowx7CGgrcT2mc9UacJmPAy6FyXdrTQ\/z7uGPHpeI5FyG5Ftuymzn4ZvicG9jLgZsk0PWDsfGQN171ib5SRZGhozQ5C5fWg0C0LJaZT9QBmna4Tn5D3zNK9wbAJCmmCA8j\/Mu7JexYMXLSHUcv8MqqJCSCXpuEpp\/yJG6giDfDNMClsp5XLhfqVPdAS7VIEpXB1S6HhC9tDqf96zTE9+e94CKgu\/hGvvbp8TB5+b3N0+aCXUJRoBY9Wf+Ro4ErAdnQ4m4T+IBF8DfQZLc4EwSc\/LaIvt8\/QlKuOQFgIDuBxyzJjwrcavBUD5X2Mq76zRJJ38tPHXTZgfGVO84+EMoc5+ccFKZGmwqMzbV+NZCi0ENKiHveSBztOe+trDPnl2J\/NclToXyubagr6EaWQOiRL3BfNRrpeQA35KTbkPf68qdFibDadKP9+WW3qLM5OgDmBPXIDOYaMBgV72tZ8ELOBrM+HTDAL1yD1aw7ubokQ3gleh5EncD4IS2PWSO\/t3a7AvgZ7wVOEcCxo4LrmuxgK9yq7tKnZ8leasZvfiqO7Vj4teSEkEbg6PwQYAIHi\/0OBGepBwc3SuAzXSaSpcuCOtkjoLcTb03S5a9THkL1raiDR1E3x4C2OsZD3PMniMbbf8UKJJyo7qJfx6E66IE25K\/XhY5jzufo79NXNXQn9GMAdM5UPiX8QDWrcy+jUOi9KNp5vLQHWKsIYo\/B16vg4P9ETUGO58IrS1JbMLREkefZsn6QN1i3kSB\/CLxKHuorv0TDJYiMXjv269HuT8zjozNe56CHfJCqGhDN5mXU\/fUDI6qX5q5h9ifEvtRq8JGG0GgwbSEEaiKrkFtVRmHfCZ8yvPeMct8FejCzoN38luvzfACDHYo45LATLbg9\/hHjnzRYuDBgGmx+tfS43xI30WLNwy+r6fSXb5leyiz2pgIniOlCVAQNrXlSpvFq2pl2tEk0dPrk2GFa+tdNxvzFJfte3rnsEb4EakQY8TETrUeXKhZH0G+eEwiKaPB3bulPWwvuy83e61wQ0t75Vvd+yQUYKMStTXe3E6u+cYi8i\/6ztQPTVpki9zpi19Bs+HMxuiGK\/H8S0F9jnGu\/RAQLUWXyCvvRmCXlTmbRGq7kwo2rJadCbD1+2KV4Tco+OV+fKWR0ktH6ecX30iDlLTD82WzD4RZIDpc51EwYa3oiKZ+En9eGiZBGT6GywJUE89CzHBsXMJznVcAYYi771oQuK7ngI0L3ypcTfNhPYXQSVwWThyDLr3OUhNAkHVStSJ6hwR\/8dB9HfVjLZdfkG1Hcx1fVXiEOrZFY92q74SGX76TMss6B880U3XkYAWc7hmMNYwAB2LhDycqRbQ6LHgIushwSD37lQNtvRaqoQl8d9AGRQ3L2YdFF3ub4sFkoJPdUkVZ9oFrjPDcCWi8IomwkdlE89z9Hqub6Mu5jh14z5up0XlEOFU0LjJuQeDGrOCNKZgjsYuMZoUAlNL0SDC70Uy5NOJBGLJcOeGh2XCndMImOxJZkySiIsW89yVisCvbRUtM4jtRVPOR\/IpCjSmPwZZsSGA5OWfnyR28shar93GkGJYKnb83noffuGeDSSu\/BBFnzrLkzkBE7ETtLFqjXQC6VY6H3OtrTjNmdFCGrTiaevIuWvvRZUgatie+SBbf5yy\/kEmdGp\/s19V6CcS\/lhTNqImfLLW28Fl0KCN9fWEKVJmBZUnTb3D16pryCXz7uMeYc2KtlvIpKUARS2W38+BErW4rSQo5ZRuPqxgpZ22dDkeYb\/aQ4clz9pviFsQhsnrckN5KElWvMyozWfU4cCbqkN728YPeAYYIXy\/","iv":"83116473bb60422f9d836d5ae0c9b81d","s":"e576b08d110b1e6b"}

Mulling with millennials

Mulling with millennials

Smooth sailing ahead?

Smooth sailing ahead? I buy luxury products because ... Source: Rare

I buy luxury products because ... Source: Rare Luxury products' most important features are ... Source: Rare

Luxury products' most important features are ... Source: Rare I think buying online ... Source: Rare

I think buying online ... Source: Rare Category of luxury brand respondents would always buy from if it was available. Source: Rare

Category of luxury brand respondents would always buy from if it was available. Source: Rare Ben Pask is managing director of Rare

Ben Pask is managing director of Rare