Brands of today need to focus on tapping digital resources at the core of their strategies to devise a global plan, while also catering to consumers on a local level.

Consumers in Eastern and Western culture vary greatly in terms of behavior and interaction with brands. In the East consumers are more distrustful of media than compared to those in the West, allowing influencer campaigns to flourish, according to a new report from Launchmetrics.

"What brands and the industry can learn from this report is that in this ever changing world, there are still many differences in the East and West when it comes to reaching the digital savvy customer," said Alison Bringè, chief marketing officer of Launchmetrics, London. "To be successful brands must understand the local market and adapt their global strategies to speak to those regional specificities, be it the strength of traditional media in the West or the trust KOLs/influencers hold in the East to inspire shoppers."

East meets West

While influencer campaigns are popular all over the world, in Asia these campaigns carry much more weight.

Influencers in the East make up 53.4 percent of share of value by voice, while celebrities only make up 7.8 percent and media 38.8 percent.

Brands are tapping influencers for more sales-related purposes in the East, while in the West, marketers are focusing on building brand equity.

In Europe and North America, owned media enters the scene with 23 percent and 8 percent share of value in terms of voice, respectively.

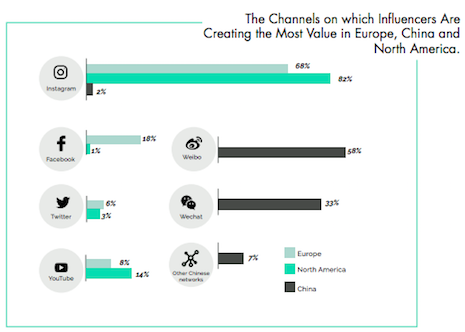

Instagram is the most popular influencer in North America and Europe, at 82 percent and 68 percent, respectively.

Chart from Launchmetrics. Image credit: Launchmetrics

Platform behavior is also greatly different between the two cultures. While the United States and Europe exhibit fairly similar trends as well as brands focused on global value, Chinese markets are extremely local as well as international.

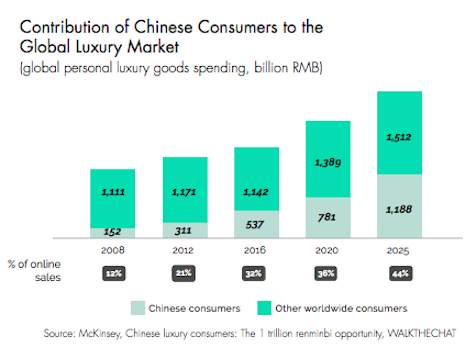

To cater to these consumers, brands need to be both hyper local and global. Chinese consumers make up more of the luxury consumer market than the rest of the world, and this will continue to grow.

Launchmetrics quotes McKinsey data, which found that Chinese consumers made up 32 percent of all luxury online sales in 2016. By 2025, this share is expected to be 44 percent.

Chart from Launchmetrics. Image credit: Launchmetrics

Influencer and engagement measurements differ between the East and West as well.

In Asian markets, 100,000 followers would still be considered micro-influencers, while in the United States this would be valued on a much higher tier.

Social influencers

While many may associate luxury items with a particular price point, a new group of up-and-coming affluents cite quality and reputation over price in terms of declaring what is luxury.

In a survey by Engel & Völkers, the real estate firm focused on the group of consumers who are not yet rich but are high earners, nicknamed HENRYs. Eighty percent of this group associates quality with luxury, followed by excellent reputation at 64 percent, with price point coming in last with 47 percent (see story).

Social influencer marketing has grown in popularity and this year has become an established tactic, but now brands need to fine-tune their practices.

According to a survey and report from Influencer Intelligence, social media influencers have impacted 61 percent of those aged 18 to 34 in regards to purchasing decisions. These marketers believe that relevance is the most important aspect of influencer marketing, with 100 percent agreeing (see story).

"An important finding to note is that the Media Impact Value generated by influencer marketing campaigns in China is triple that of influencer collaborations in Europe or North America," Launchmetrics' Ms. Bringè said. "This demonstrates the value of the Key Opinion Leaders in the eyes of the Chinese consumer, as they trust the voice of these digital talents over that of brands and many media outlets.

"With the Chinese customer needing eight touch points before purchasing, it’s not surprising these content creators are an essential asset in the marketing mix," she said.

{"ct":"Mng44Qt5r7ZtQ74GkBkmB+AZEkqHaTWxTlowWW2Ie0SZr0XviCGhuvV\/bN+d3spMASDtFcQrX7BDOvUzptnVoo+uRMtro2FeGgH5JucGy2H5FeMSnBgYeS24ornjgbXkf10tlKX+k58VAmIpbKwpHDaRKjeKwPJLbi33XrVaD0k3dneMHlCbElsvW9Tm91M4SXWMq9m1nM0tbbvqlM3q1+STNTbgmhaUsUhj6MI6Bc5xZoymQN96E8+ePodbp0fms97RqtNFVxw+kelgtFCtI110pRH2L0n8HndRcw4seNuWMBWmwIJyy+6J7037PVgTmuIgpwE2c9E7fQwsfgv6az5xSgdZGrdj13\/5G6WYztKV25at4849jHTuErOo4G0r79Za8Z7SARDTduieQPKWWl\/8gFmE2hYVFbBl0o3Mxie5As2fraMp+jLAy4lCG8omwmFrDNGO18oUCPb9c\/E7\/1T8lR\/ztyR9CD1tEKQ8\/nY\/tum9VyM1p+2Z4n9LdQ5tDxI027YJ31q8obVb0\/2+whIJkAhc0REt412qpZiLyXNdhgyaohtN7jStBzaK8pnBTg9shINlz9US7JkATSPFsJJA8vsFyIsPCtLr\/TEwRChcGIhfeRmVJSDP8XOYPfD1INtELCd4L5j5z2zxSAJzrc+d9QWbLcBCyK\/zGJ3WOAI33S4q\/Ap5vWEiBC19A7j9AXVJhrVVjDtBlnfl4vwYADlTdiwBLByOJMgIUCznClYy29dtBTSV9sD3Sn749nmzjRFE05p2H8Ck3qMo01R5dk8vYVRP8NGT6\/cbd5SxJTt8m5RRCAy7j2y1u6662DKHNOyh0YGTzGXgaeC+5\/l51oxIQPwi08BDX\/pRRfRO8Vw1s81pjWUexOJwVfdZY7CC1lkQjYAxsa8k\/dgs4RHFxtiV8I+VHwITSk+ycTFA+ksraqKzE1pSBCclwrtuc\/QR\/\/iJgGyDTfZKpg5I6hj4gYL1\/MJazhsiiAXnGP31NELDgFJlchJ1+M9gEdzt+jnHnFvhrNwK0pZ+8bcr5QF4MFbaz3DgVW4sWoWfDiNpmyFLCUP\/wEi3NrPZbdbrhSNBD1ScKrA87K3SwSbU4wXur6yKq2FcaCFjszK94B3seA+An6\/gDwhuMdDyRP56A0fu8\/rVdKcttcticxnnmSD+HA\/w4Sg5aR7sSbgXWrf1faK6FRlhDrX9zRSVVMJPqyIjn+RJzEXgCl4P4MR6j6cZbyxsopBvaixPs3b5xnInIdw7zulqBx4R4exruJO1HvdSr+LvSauMoER873rgscWjGEgVtn2gPMBOARxHsrImF6TrXKdydIO3pyphaLjg2uYRlRcToxDbp\/+G2duX8XgW34tUTklt7VCe++QXNTgVcUEFchQnjRLJ0SZtm1lQClUE7hSihklHOIC5zvDRNzT6sRVSDWU\/F+dSf1jSxBgDZOKptXrHJaCDwHXjia4BfOvg0b3RAG5HFuMjo0m20So04ghGnd1lp83POt89TUdKMi+5ueYgaMKmYdPFKyJJfVABpGshaq0VJfpXXiCIZebIthQJ7\/6bKJJc7YuIz3zpTZp21eYTBgp+6n\/PZRElyLdNRG3yg1S9E2Dy3hcFc2xMsA71IVx0m1E9jqixkT25VLrYvTcGGoAo9nVP3PAUR0GOJx\/8o0GmZtWDFMxX1mGdirSCtDIyycaAUoAwmwp7ile3TJblCAVV8pYUlP08+Ejk8eEMG0ww3Lgyotwymw8FbQ8FiU\/Dr\/URlysDpyhElpxaq6RQkCRK0HuhRWgOGn5K5ytPmaAZl2JL55xUbZr3K73K6q3nNqu9yFWQXXgcn+Uqgu9tdjWP+8a9v+X2riikjD290Jd+HLP\/axiBq2RKg\/j7LZ5Ah0V2\/um54P6IIHSu75bwuxcbHj1FqAJieeCdhJXWV61pGoTN\/+CqJXZrREtSFFBzVIe440Jk2zKgWCpSwiLLteu9BCFSAmT2wvRm9LZLNtdPGFAlAZiFb7ITbI0s7cVNalvrNBnl3hGSjoYQ4LKYuabiMGysi5oE2hWZTZig1nOVb5Fk8zey3Dny2WoYKoF3Uj3xc+MXoTKawf78yPEdH7gEHGumMR8x0YI+t9IHGB1yDVWbxgPY3dVnmcemgPjh9DIifhmZe5WHIjge+UUM0c5dRc50L\/BRfoXmzz7Vjg\/\/g096LRuYNVjgr85ff0YHQRuzYEs8dSoi7DqeI33LJdw566FrUhFgObVCVJXf4uteItXzCwV0iYXuwVU8NgeVxExzC5hY94j32Wd3XAzwx42RimBuXpwToHKBWEeIFyw8\/wMSZXjldsv6t8HFcbhIaQPvuD3Ajey7jKH8zrjdv+nrh5a92EjfrlRNL5kdwMGaOq9qgJM0gYz8wJWTNCoDd7cHxWtVDfksBl4B8wp\/GKdSKXs5LFEz\/OzsyxdPpxuBmT8d1D7bxriJUTdNmVkhkQDzKas3sP0FmVgbcuI+gAnRxCHlzxdEEVPcFSAhVfC6XBlZt6s\/xAIZ4nYMgWRRZIPwnErZDvW0ITGyjumdsoRICfGHPYhq53EU44Jou0D5DLBAGi\/PM3gyU5kEFlkpcvRUFaEDEHbeC7RoZjONTOwuZw\/fyxiWRypUB6TCP9yV7NH4bCvjsdJr+JVAaITWymd4asdGX\/MmnFcdJ+ufomerJJdatTDeYvbwP6SE3AapgvCacdE2G2JzmtW\/zKdGmmVhdse1defYVWf\/DQxB2DWJU0cfuUHxf0ttdDZ\/QN9WaYMhHs+wCrs9+Oj9AkL7mJoY6jGXLEesSs2J0uponfGF\/4FlmBxinacUyvmgRfjaQCVljKMa+DgE8loUOskLAxHdSawO5Z0W+cs49fQBDYvJw8iZuxGX4mRcFacB95v4\/q5yrE\/TdEJ7R+M44vJfAGLrtY10PUc9MZ009a9\/VetCUVmtpy9qoSm2vyI4QBDmmGxkMubGc9vdRP5yuV4nf655RQi9vMSDELfWJb9nHVV4zC9jb983\/KzcGl9Wm5041v84Uw8C0GpFY6O4ZTh1514MO2+jr1KNErvB5WdXCOzXZo2jyE3gNdQIm\/YS2xZW\/OhSEoeLwN1XiHgNXbRqgQRZuFi2uzSMjJepYti9UVKa3t\/eHQjxthxkBknHFvzUuRVSwYdV0dAjOYEscN\/\/8eCNI\/m0dQaYE59H+tfQk1BFyU5SWv1wUYed3URDdDn0cikNd0BEWC467lPbAS5ijTfdNB3JWruoBY9\/LGhtpcV5yDbllw+o6tRFqd0sBHv5pHMTE8MU3em2EKGXpFGhyDAwiunnu4MPvf1iHWOso\/hFUg4TJFhcOx6YkUZk9Xnhao4j7Xynr8MS3fwjQCP\/GKXxmLkKNdPO7RGVxipsrp5DEal02D0akNB7HRFJl1Xulbfc9h8Mjhxj2Hy0dGk3z+vij27GwqFTDKgh2f2oI99M3pM0tBTFeKv9XO4PY4MsBDZz8J7xJZ8CpZ6NV\/7Lc9mBXnFxIp9CDH9aP6nuBYGFgVmYKUP3bEXtgxiSX+3bREvDQC5ujlKxyjxHabrn1069nhZ2oRgtCm1cVx6j6P3gJl94wX9AGF5VyWIZnTNszu63NhiDtnEpukXLnUq2mYb\/qJMpd4GwjoSTO+of33AE5tfcFZf\/7f6\/ohm9FCJP3uck1fVOM9jNdzmjlInR5sbpxU3ZkmGxD2rVrhtANhKT8LXNNcyNh3o2FGDlGM+KVBiUCezZHZQdewYNCVFNZffUzUraOfe+0V3HT+Y7ioH8NsIrwDdMA\/UeUqZa7HacuppUjKaMpiT\/EZcBQ9ZuofDtrwVAjMq1\/UXPTqcRZ7MoCUZafSmNDpvOMzKI8zvEzdszj4IF5GY5M1TfK2Wn5NraVK91VkEgHJ9p1Bq5CijTDDo+1t\/HtlSzL6TkBZGjUCjHHAKTYob6M11QPp7Inr877CcddqjABRrjAU32jLK56YQ5QIygOegWcLxIrDAyuNuyZszmBBQxDyhcTz+L1iP\/098tpkwZkdLqHIRT1Lm\/DYDx0H74BSM+GPZzdOoEX18NA+NABVHGrJ1uSgihAnRq9pquHxPL2GK4qbWRFTepHgsGG\/MaRWB+Q48y4mX9HArrEbqLJs2sGPGHarlOt2TBDobE20Mpe0A\/l52aeVAvwQxtLIkIeLl6s1a5KuyqFUYf2Wno+F20k+W1tTllpJAnfclYrk+PEWXO02tkRfXVstiirUhdx0OLjx7SQMOnFhei0r5GXQV7bXF8HT7usWbageD\/P7YP8KMLNOYh8ieOu1hx01EUdtHUR2Mk+QPVSEa6JKqGceQqU5uPgw4i5+R5VbP6VwScYuiFzu7hfcdULFLLffud9co80l7J1ySRa3Pn67RhmjzX4fuw\/Y8Jrbuqnn89YZ+Qp\/gAkSWJhphf6izsFGoomPtCZo5PW5w1Hz46GeTv1a34Hhp8zNk7tdk6IJGoN9CaYUo6aoe8QYCiQLI7Ez5Mv+RB6Jd3GZo0yTa0QDgEdc3BFSaQJhaZin7SgyCj3fRraNRgLViZvzMbTOFNcwCR7ri4Iz2QNiDjIDRKRLvbtSCTB3p45QjqxKI+x\/KwMZ5CaN\/EM2Dvx7keBazXkZ5nvmbrnv7MHLNqu6eXZ1CGOdjckhq0Wdmm+Kf96rPDP0NqB6wnesLrU2CrWXT2Ho\/7OiOqt8uhBMhtBaq7HI5gHqUptIlQLzDf6mf9k9Uw+wMHPegwUM771KBBioW8ANWG3OuWcfLuF1m3Z3iV6R25ZAmncMQd0n9p6419usyP2uEs3UJ\/6dZ6UrY2YMdw0\/xUyblHnpWqxymgTq7VEvDgmO8rJ206msCY4AYLksIBoaCz3OrSCp9yFd3tSo+BuArGPQoluYI+VMVC+IbxiYBzEBBcYQ5gorep5p06CK41ktQ6AGX2N2wi+V7QOfDu3GJ+QLpRFxL+DldAhaaIDOQk+NED7OqYBJRbO1ts+rAAeQO9PBUzgTL7OzlNsSDH\/VIuIEAVpYg5qU26nx4rtbMRF9WQu3lu04DqV6FKsTAM9nPYJOl2pSTlnHChEG2PxlGa5mWnL5LEb56iFzWoEwsuhkZzaISqVI7YjV+6+TS+KEKbrTS5EzUlt9MFAVYO1tHjR+gG4u6l35FxJtEWi\/p3u+Kwyp3n3NCCBwuaMhZFqOpeg6FIBGPea\/A5CS2\/HwR5RrZIXUzDfTgbvphapHIrl6rTmdNl0DluRrb0rlv4y4D4W3ClWW3FJWG59Md8hgZyO374WDXM984Lrq6CYeDhmR3yHs6Pv1o48HsdADV3b0OkgdKJYNJpGaggGqXNiE0yqYDgumochjFtHKFJdXcI2BNp676wMEmCX0D2KSjPY3ngMSXOzkjhvNwQMszJEjvl+sDgSD8AEmo8yajA4xYYCy46dx\/y+XltVNY0VN\/xdHrmwRdgWSGB25YllDO6l3kzkE+X8L834p1zL\/3GFHHUDh9JaxD4ra5yIsVETezVcTnMgHUg4H0UVKfRFGlVnXPsyzIk\/5cZWyt1w34HIlkU3qT9wtKb\/Phg\/V5AZ\/0p6IjXUHexK2XfV\/tHTBx3vxTkRIOIdhXZu13NO7H12YzbNQ65+kmgDj+8c5pe5Ok9zKH9adO+IAFKCby+LD8rKRdiprQ1Vn\/JVsUv3t2n9wjOLRAAf2rCtbVDHeUzIau55qOhatrLLVKFj34Eq7RwyT+znKOUhDcb0mIbE4XDLVNfMS2945PaVq+p19HuzFiQ85MVp5VKKjtoGarvFDKl\/n3IyEcDLeLB47C4UtLVBiwZ6lhiJAyasqcCgas6P+03FNqCY8fPnbeftzWcGqYY6GolPo0OyxwfEe\/ZFiWo+xYWX9FZbnXx6F2d5tyH0RGyfZ6dDGmFW64SPvD0HBaOGQ90+cWROlrGeRJoMVOurkDTKc131MFRQaC0uI7ZiNjf8KfprzSS2r0o2Mxpw2Y9YfGbTEv2qObRomKiIhwY1PpuLVLlZRapVstg+\/N2Q+gJWPJDsTtNcttw1wBXweP\/YTsbuV5UcN5TzeD6oBgw+cS5GXu4+df6VcSyMlTeho8T62d7DNVMGOmlEodrKTHQ01MI3bEEieDrs3Krwm6BkjSpQnNOuKk879F\/iNgsiAPALXbGIk2gaJF67G111r9MBhDHk6NLQ3rZ8D466j7C5wKDbAmq0JqjSAa8Snm6GqxWze\/Lbo84CyM2Jf2NYpe2\/WuAVlXZoIFuDZf4RfvteRlPT0y0gXh5SBbsn2rEm9DKiymtnCDwiBxTVv6jXpC1arBQ4rN35sc8brzOG9YT0tiiUiN07ycw2VD47haeySbqyYwJOwa9lgXwH6oponj3wwpc\/EMqmQ33Ue1LVKuuedYjQqMMGkGp+5mmNCn2n2iXw4ATDZa9sHzLitbLPUP6W09KtcGrtdMi0y9tvVLWVjbARsyvBsgHfqXADMK3ihz48+MRNbuqo4JshwLZJRpgURDmdmRvl6dHJJLX4SUPOoJ2j\/gVNGhLtBMihcWbOf\/jOsfK80R\/8dj5uBFK3UWGWlR8Tq5sXV6rPTkBn4\/zJvSY+LD2TcAIKJMJFxfB3Io7WJ+u09ksMNQx\/kMI7scZOTf93vVukaYsics7mg24eeYp8QXXk6pZMGm+jeecrWi7f4N\/bwTxtVwim0IWFs5Om3s3vdZovog\/ZyfIXlZVt4fd1Q8hrYm5qo87gow5QeF+tHvw+2GO7UKI\/o\/8d\/I0\/10IGBcmXdIcPYZpOcWqJmZXILQr6JcaEO8xmhDsN0c3ez\/LDycLOLvKuGlUnVTAuVRbFv1GqL9o9+HgPtcXb88nvncpktfzj7kJOHcvzi0WrOfp5JNlMvSSirlLWFD\/ZALczf8BZ9kai2E4wr0fe51s9zDMqlwLM8WEQ88oe68RJZ2fjVp1gVP1N3fWEw7e18RmnuY32L\/DcjiM753aPGynO8aa89O2tFB4kxNEGB0kCqkI9rL4hDPddpGhhZcSVByv\/YAo\/AdoG19bsePJjX3GJ5urgVtNb992QP3eBrbVrb7iXcVD0PXELN1bgEzluCoExPgGxj6Q46W0X2O\/fsAdai0xfDYJV8ikXsoxcMwMO9MO2dfIwIAiMHeBEOioAXZVU547ue2wpp8h0TCGrjyx\/C27496qwKZiw86CP60GuF5tb8lSQrJxA58N5h3t7MyQ6CC0DPg6nWEc4\/thX0Enes1lNiG7qzaJUbqEdQCgAWKB4qBCTOsPyPW5ij6WzFedmKSlHUpknwNEKWw6Xsi\/G5hYrSJK9ccxm+bHvgq5ZLbEB5B2\/rFDztY3LYiQDTWWXzMK3tgrez8JBsfEqH9HsR+moFixR0KccwL1uGe9r9EuphAmPD5yimCdDmzUcjODr85w","iv":"e850d778f8eeeb90bcb5340388e3d66e","s":"0929c3f4d586050c"}

Influencer Mr. Bags collaborated with Longchamp for Chinese New Year. Image credit: Mr Bags

Influencer Mr. Bags collaborated with Longchamp for Chinese New Year. Image credit: Mr Bags