- About

- Subscribe Now

- New York,

February 13, 2019

Stitch Fix was one of the top ten online apparel retailers in 2016 and beyond. Image credit: Stitch Fix

Stitch Fix was one of the top ten online apparel retailers in 2016 and beyond. Image credit: Stitch Fix

The ubiquitous nature of technology today has allowed new companies to flourish and greatly disrupt luxury retail, but those who are seeing the most success embody a number of clear characteristics such as focusing on the customer relationship.

A new report from IAB outlines seven attributes of direct-to-consumer companies who are disrupting their respective fields, such as focusing on the customer relationship. Stitch Fix, Tamara Mellon, The RealReal, The Honest Company and Drizly are a few of the companies IAB mentions who are coming to power as business operations fundamentally shift, but no matter what the sector, these companies share a multitude of characteristics.

"This year, as we measured the year-over-year growth of social footprint for these companies, we are able to clearly understand and illustrate the value of their 1:1 consumer/brand relationships, as well as the data collected from their communities for insights into better marketing, product creation, delivery, communication, engagement and targeting," said Sue Hogan, senior vice president of research and measurement at IAB.

Consumer driven market

Instead of focusing on customers as a whole for the shopping experience, these direct-to-consumer brands center on the individual shopper connection. They use individual user data to make a personalized experience for each customer.

One of the reasons why this is possible is due to the fact that these brands and retailers are all Web native, as well as “socially closer to the consumer,” according to the 2019 IAB 250 Direct Brands to Watch report.

Tamara Mellon aligned itself with the Women's March, getting closer to its consumers. Image credit: Tamara Mellon

Tamara Mellon aligned itself with the Women's March, getting closer to its consumers. Image credit: Tamara Mellon

IAB also states that these companies are “maniacally” focused on consumer experience, solving common customer problems, filling needs and catering to their wants.

Many of these companies also use content and an editorial approach to stand out from others, making consumers feel that they can trust these brands.

Content is also defined in a broader sense to the direct-to-consumer brand compared to the established mass brands.

These brands feel as though their mission is central to their brand story and operations.

IAB has found that out of its 250 notable brands, women run almost a quarter of the companies, compared to the firms on the Fortune 500 list, of which only 5 percent have women at the helm. The IAB list is distinctly much more diverse, with companies coming from a range of regions including eight brands from Texas, six from Washington, five from Illinois and four from Chicago.

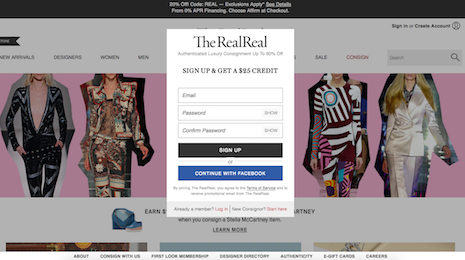

The RealReal asks for opt-in data immediately upon site entrance.

The RealReal asks for opt-in data immediately upon site entrance.

While these companies represent a range of sectors, including alcohol, parenting, beauty, household, lifestyle, home accessories, personal care and wellness, fashion saw the majority of brands. Foot of the Bed Cellars, the Honest Company, BeautyCounter, Freshly, Loot Crate, Grove Collaborative, Dollar Shave Club, GoNoodle and Stitch Fix are ranked at the top of each sector as the companies to watch, respectively.

Direct-to-consumer luxury

In terms of luxury disrupters, The RealReal and Tamara Mellon have been significant players in the high-end fashion world for making quality products more accessible.

Resale in luxury is becoming a significant driver, with consignment shops such as The RealReal pushing secondhand sales in a more high-end manner, while companies such as Tamara Mellon focus on creating a luxury product but cutting out the middle man. The direct-to-consumer process allows them to bring cost down and provide quality products to more consumers.

Tamara Mellon took a big step forward this past August with its first bricks-and-mortar location after its Series B funding.

According to a Business of Fashion report, the footwear brand has opened a 400-square-foot store this fall, after a $24 million Series B funding. The space is located in Palisades Village, Los Angeles, alongside many female-focused labels (see story).

Other luxury brands are finding ways to leverage relationships with disruptors.

Luxury beverage makers such as LVMH-owned cognac maker Hennessy are tapping retailers such as Drizly for unique endeavors.

For instance, the brand used the spirits delivery application to gift bottles to friends far and near over the holidays in 2015.

Since Hennessy does not have physical direct-operated storefronts due to three-tier distribution and has little control over how its brand is presented at licensees, partnering with a service such as Drizly allowed for quality assurance. While Hennessy had been available from Drizly for a period of time, promoting the relationship as the holidays approach was timely, as many consumers purchase spirits as gifts (see story).

Moët Hennessy has since entered the DTC arena with Clos19 (see story), with delivery operated by Thirstie.

"Perhaps not a surprise, but a 'happy finding': the sheer number of women who’ve ideated, brought to life, lead and manage these new brands. 25 percent of the 2019 IAB 250 Direct Brands to watch list are female founders/CEOs," Ms. Hogan said. "Compare that to the mere 5 percent on the last Fortune 500.

"The women leaders of The Direct Brand economy are eliminating the glass ceiling for themselves and providing a roadmap for how to accomplish it," she said. "I hope to collect and discover even greater diversity next year!"

Share your thoughts. Click here