- About

- Subscribe Now

- New York,

June 14, 2019

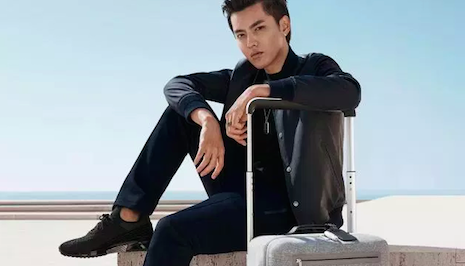

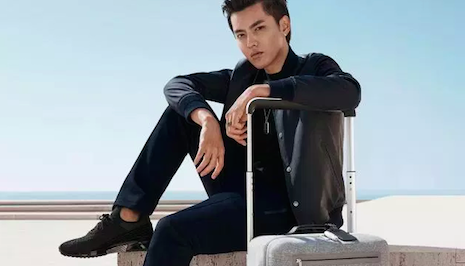

Kris Wu in Louis Vuitton Horizon Soft luggage campaign. Image credit: Louis Vuitton

Kris Wu in Louis Vuitton Horizon Soft luggage campaign. Image credit: Louis Vuitton

The global luxury goods market is expected to reach up to $311 billion in sales this year, buoyed by increased domestic spending by Chinese consumers and growth in European tourism.

According to findings by Bain & Company, in the last year the worldwide personal luxury goods market has grown 6 percent at constant exchange rates, for 260 billion euros in sales, or about $293 billion. Despite political tensions in the U.S. and Western Europe, the global luxury business is expected to see 4 to 6 percent growth in 2019.

“This year looks to be on par with our new normal of growth in the market," said Claudia D’Arpizio, partner at Bain & Company.

“China continues to dominate the luxury scene,” she said. “Elsewhere we are continuing to see geopolitical uncertainty shape and reshape tourism spending patterns, with Chinese consumers choosing to spend domestically with more frequency.”

Bain’s “Luxury Goods Worldwide Market Study, Spring 2019” was presented in collaboration with Fondazione Altagamma.

Luxury forecast

While luxury spending is expected to remain flat or decline in South America, Africa and the Middle East, double-digit increases in mainland China and Asia tip the global scales in favor of growth.

Chinese consumers continue to make domestic luxury purchases, while the government and luxury brands look for other initiatives to drive spending. Bain estimates year-over-year growth between 18 and 20 percent.

Chinese pop culture icon Cai Xu Kun appears in Prada's fall/winter 2019 campaign. Image credit: Prada

In mainland China, luxury brands have reportedly lowered their prices after the government implemented a revised value-added tax in April.

Part of an effort to reinvigorate the world’s second-largest economy, China reduced the VAT by up to 3 percent for import companies, based on industry. Luxury fashion labels Louis Vuitton and Gucci are among those that slashed suggested retail prices (see story).

Ahead of the 2020 Summer Olympics in Tokyo, luxury sales in Japan are forecasted to grow between 2 and 4 percent.

Elsewhere in Asia, a growing middle class in Indonesia, Vietnam and the Philippines is expected to drive an increase of 10 to 12 percent in luxury goods sales.

U.S. luxury brands may see a decrease in Chinese tourist spending. Image credit: Tiffany & Co.

Despite weeks of protests in France and the prolonged Brexit process, Europe attracted inbound tourists who were willing to spend on luxury goods, with a weakened euro as one of the primary factors driving travel spend. Bain expects luxury spend in Europe to increase 1 to 3 percent.

In the United States, the luxury market was lukewarm for most of 2018. Although spending from Chinese tourists is expected to fall in 2019 (see story), domestic spending should push U.S. luxury sales to 2 to 4 percent growth.

Continued trends

To sustain this growth, luxury brands need to be aware of how emerging consumer habits continue to shape the industry.

With global luxury sales on the rise, sustainability is also shaping the business in more meaningful ways.

During a webinar presented by Positive Luxury on April 23, an analyst from Euromonitor urged luxury brands to be sustainable when it comes to unique experiences, not only high-quality goods. Many consumers, particularly millennials, now have a tendency to value both experiences and the environment, and must balance these concerns.

Sixty percent of global consumers are concerned about climate change, according to Euromonitor. More than half find that purchasing eco-friendly or environmentally-conscious products makes them feel positive, indicating there is a financial benefit for luxury brands to promote sustainable practices (see story).

Meanwhile, as luxury brands continue to court Chinese millennials, the nation’s Generation Z population is coming of age with their own set of tastes and priorities that retailers and marketers need to keep in mind.

Despite a reputation of being entitled and self-absorbed, a recent survey from Agility Research found high-spending Chinese youth to be self-aware with a special appreciation for luxury. Additionally, the majority of Chinese Gen Z consumers still do most of their shopping in stores as opposed to online (see story).

“We expect stable growth in 2019,” Ms. D’Arpizio said. “But under the surface of this new normal, the future of luxury is taking shape with a number of key characteristics, including Chinese Generation Z, access, ownership, sustainability and social responsibility, the impact of digital across the entire value chain, preference for luxury experiences over products and consumer networks as a new measure of value.”

Share your thoughts. Click here