Despite demographic similarities regarding age, geography and wealth, Asian affluents have varying interests and cannot be treated as a monolith.

According to Agility Research & Strategy, affluents in Asia can be segmented in several categories that encompass different consumption and shopping habits. Understanding the range of consumers is crucial for luxury brands and marketers looking to reach the right audiences.

“This busts the myth that rich Asians are impulsive spenders when it comes luxury,” said Ali Mirza, CEO of Agility's Affluential, Hong Kong. “There's a sizable proportion of pragmatic consumers who tend to be more rational in their purchases.”

Affluential is Agility’s sister company. Agility’s report is based on its 2019 Affluent Insights study, which included a survey of more than 3,000 affluent consumers from China, Hong Kong, Singapore and South Korea.

Affluent segments

Segments of affluents in Asia include pragmatists, connoisseurs, trailblazers and “experentialists.”

Practicality drives pragmatist consumers, and these consumers prefer luxury goods that are stylish but durable. Price is another important consideration for the pragmatist affluent.

Some affluents are drawn to high-end service, such as this photography butler service at a luxury hotel. Image courtesy of Regent Taipei

These consumers also prefer shopping in physical stores so they can examine products before purchasing. Brands looking to attract these shoppers should emphasize the in-store experience and high-quality service.

Affluents who identify as connoisseurs are also guided by rationality when making luxury purchases.

However, connoisseurs are differentiated from other consumers because of their levels of sophistication. These are the affluents who are knowledgable about a brand's history and craftsmanship tradition, which contributes to their high levels of brand loyalty.

Connoisseurs are most receptive to marketing that makes them feel appreciated and unique, such as private events or specialized magazines.

Trailblazers look to luxury products to serve as status symbols and prefer to spend on high-end skincare, fashion and accessories. They are less brand loyal than connoisseurs and prefer to follow designers rather than labels.

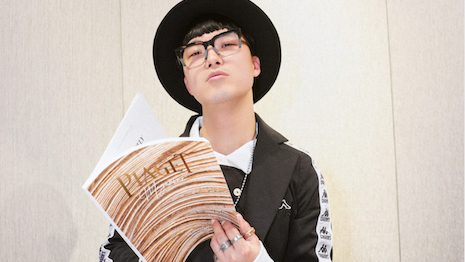

Chinese KOL Peter Xu at SIHH. Image credit: DLG

Social media, KOLs and other digital tactics are the best way to attract trailblazer consumers.

“Experentialist” affluents are those who prefer to spend on experiences rather than high-end goods. Travel is their largest spending category, and this is expected to continue to grow.

Video storytelling is one of the primary marketing methods that will resonate with experiential-minded consumers.

Marketing in Asia

Luxury marketers have tried a range of strategies to connect with Asian affluents as their purchasing power builds.

In a move that is likely to attract trailblazing consumers, Italian fashion label Giorgio Armani is becoming the first luxury brand to incorporate 3D augmented reality makeup try-ons into its WeChat mini program.

Beauty group L’Oréal’s AR makeup platform ModiFace will be supporting Armani Beauty’s virtual makeup application on WeChat, one of the leading social media platforms in China. More than a quarter of beauty buys in China are made online, underscoring the importance of prestige cosmetics brands investing in ecommerce tools (see story).

Pop-ups can appeal to a range of Asian consumers as these temporary outposts often blend brand heritage with exclusive experiences.

Through an exhibit in Tokyo, French fashion house Christian Dior’s Parfums division is focusing on its iconic Miss Dior scent, which was created by the brand’s eponymous founder.

Leaning into the growing beauty trend in Asia, Dior Parfums is exciting Miss Dior fans in Toyko with an art exhibit dedicated to the flagship scent. The perfume is said to have been created by designer Christian Dior himself at the label’s first home on 30th Avenue Montaigne in France (see story).

“Brands need to understand that consumers have unique characteristics and needs and how their brand positioning fits into each of the profiles and in which space they play in,” Mr. Mirza said. “This will then enable them to create messages that resonate with their intended audience.”

{"ct":"RudmWKkSqJGjBXQgyfmnlD7BLP+iHr673QrP0BHV0+hMtD8Q4ai6GduhQy4R4ukF5MuK0fEBY3FTULTYtVjuCEK\/RLZn0FY\/19pB2Eqc6vp2aH1poTD\/RXERCQMDvWop2u3PZJR3udaN5GrVJ5S9a1MIn1HWDeJp8H4I9TrZOuV6vN5zh5lCiWHbASEoowaJbYOuRE\/5ueKSU6P8hGsvWnsknSzGquUmfu3GApU9Ybtr39goDoCyfcKbxlUbEqr6PrAs5rEhYn05BaOrk7zWt7\/vZYKNlvkIIE2lRLpxBQ5ieF5wcosYj2mY3YBUEY+8elgsPmzMMHEvJHZJmkce0YaLWWSRElTNChs2lYYJ1n+0Re5tvDCGXA5JUD3bir9tNOvmE9WKjpwHmbhChG4k\/Q6wFm\/D6cNjlY7JGaqTz3bLYwjx9v5YyfeJONbYlaz6\/ckr4TVUbCpPI0Gu9NxjgmQ7wNtcpAq8tLz0Q26lHTmclb6c34Y4IUmpdkZeXUv3nO63GayuvjgciDPAWIWeRZe+HgKcamNS+XW0tTB1CwnZwIvHergpzVZzgOUWlXFqvlWjY\/JGU1xkUMx6kQRYkKGz2e\/6nkqHtE5B74ZLGX1v75et72EErXuSkJizjeERD\/KaREo\/iSE3VP\/KYKFWAz5HmPEhmqADJpaVdEsBD5+BqaS923MTjSmpHKUtofL1kLUawCuogDS7A28PDQtuPOsSIwMo1nSBfGjCVaWKztm8HsCyYFRY4IGDP6adl8Mbrrfab4iiOtWp+H0f1OhfgpL3dGiXPrsZHd\/zskNHXlp9QpGmlH6YZ3eUmB9o\/4pTjpOeqR4PDIygrd4AmPIL3nqFpLc4rFkEkO0DMD3gF5jikqzqIy2E3bYZOu2AWOtGowICt9yz\/4TIFcXjzGbSJKxEeiNcxj2WdnZ7E9dnttUvEK8\/R9C9DRJ6BlMuUoVpqyK79LGqV8esOjhVQEEDJApJc3Q9o0bWNfibUbJyiFnitsuTMUDZ1txFvysVSacUVBYyW62dOlI5pxPJ64xGffctcy4FwE+7eRJyZ\/lQ409oa7pTiWicQ95k+26FP\/mWDGdCKexbOgTKpRjWtfBz\/WDYK1w7zXIweFsaX2r5UmxatexwxNFnPui+FtSizOb3LRf0mmpFhco4Naq+YaUHldm7di0XueEFZkH8zfU7FLnc7OD5OuxSEKQJrRwYA1St+oU+S4PPRDWUTi7LS4S4O90DGcNu2IctCGfGiV0Za6IgvRXwdr90XhEXO\/b6wWIHfApP7FkWWt+J7preTQcYMz\/kpTDohTLZUetOz4AJH2sZvlRA7KWaShj\/fRwrkYAdm\/xHzpjsYgtPf3AzIFvp6eoL67qXg4PZthqCaY6W1s2JlVdyX23Hwp\/tRekCOgilX61AmfXpG7O7XVXAKFe\/R73QsbgTMssGC+OIbnce6JMpIFadn635wdn5TNa2YJd7HyZYddGgTMp9UqawhIusiubFHIe7pX7FLkHrwO+jmhQjYgzu4An0PsaKaITGux5dPpt+E8GoJLmqkK2YcXw928JXnyQCoAESSVDOS7IqBcGkXjzv62+dkaD4tFkD0R6h56yg7fY32qOIEzeyVFA4dFtCrJiqMn6grADA8JjYAYAS75mlhuSY1UjYRESBMOlLOSJl9tlFlIM8zWNmc6H0jYjKk0BTWMVDBmDDu\/ojgFtoIO5pEIyp5q9GHeyRsSeDzyqCOjCb6UtFC6ab8CqGFnCHPOl2yosKviHzhUhEfmv\/9h4fIdd0zPXyWOF4NmXrPEzYzHPFbx\/nZ2Ldcl5atQTx56plkfPD3Fp2qagGDi+lPvey0ldSeuzsjBpHhoOTRzmmBQ754vqahdZ\/GubINOcwhqkYtCa6liaZXjRLB6o6+ge61fXupEQnkL4CVt+TRRK2r8wNvKmU9mfHjhqcf0EBh6zxSgAcAoi74W3Rd037x2x4Q9ML2gVhw2L1DRyajUWFVF0M3ObXJHC0tvUY59oAqYoUPAvbzlDLb8sCZ4Im7fYFu51uGB3ANCmXkmzm9u\/nDt+s+vMfp0ZnUchXz2oM8xL2yJ9kmOauz7UZ4Db6ql3XKXOn4UEhli4ia0FCjf4Z34AQHAqlS\/LslG6+XsyYtO8Hwd6Vf4rN9h6QG5TgtzBvdCcGEmk3PMh8qSrFPGEz7sTih6im+5bnTHtHm+f3\/4TP3aNmGX1fxBe1VqPFMFgFdK0HOmzJkEYF\/t9Arfn908ieSurY36FoD+wAMDZypx4J7m9iGkodhHjPA4s2104yLxOch4BYuwu3fDVe2QyvvXkIShAeWOyQ0zYMJv1WDRWbqPbG09dEBQZbJua7avK+Apqh2IbXJx8JQPsW\/j8U+G+oXfPYLbvjkXkwytSRQ3ga5snKQbO4Qhv9qduUfTHCMkS4xlIy+a2E8LJTFEYKda7Mf5mgxHybatFXwmOHhJoNgs6fxmGcKA+jU0k5MSixEylZxO8Z1u1OBeTabip9Km1KUsK45GJhUE0KkOFG2nHwF2hqWJW5TQk7DBnRKRlmEpydcMSRhAXK+Ao\/3fXxl3QIjoW4dpNHNd\/QSoBn2YBE8xj7pX3+j444\/yd76U2wKUY3sYDjc1sJc2LBIZp6\/493wTT9yCpmMBY\/tKIYDCkwdO6TD23zwjnIA3wMrsX9kxPdUginxZT3LOeKGkH7t\/IStafLT\/QJ2gNSrRT4wPUCnAL5SQlyETaDAmTpyYC7NswdEwUsDrU9e1qYKfbOv1ok+g3J\/CDJuOfnOTgwyMBpywiSYSEifxG6hypel\/RPdrTCXFb9MHGCGF44iRMxPjIG1QtkZdfD5FPFhayuItKtTtXWa5ztilTAj4LYjgQ93gcOz0EAXjT+0miO8XXZuxv1t07Lmnw71CC6ER85u2erPcisppGCP6JOy6nTxpfbEBnw\/i9ToFGznkOV+ndbvQDW7XAiZc2fi0MvEqosIDex0xNPyfsMG\/4+0RlXDw7V7hqb2DSk\/4kw2jt7tU5\/jvWq+3pTx2sGwdetwpX4dZXtMg8Z225fEEBJjXHu8lYFsqjngKJ9p8nfW3p+u0Rp5lkfw5CI+pNHe0yDIx\/Ssvtj1ZiRcfOz1vee9E4YG42DMGP7+t6aqDHC+oqNDIQc+5gtG5EXLek8BKXC44qNF5nvc++lG1MEecoKZPCtWH5jBxZJIzgUeITtobirKw3PD\/+LBTeCMadAtQ1wjDgI4+HtCxXNlRWdyr8GmLx9P0yH4XcvFpWFPU049yzWrJibO1VYoX7kwhKFYZ1cwu+DhtZ90oYbR3ShKD4pGyrJ0xCy3FwlC4edACIZw9\/T+o5yON3Se7EFnzbmyj8lYGxAkBH7nWN0nAIm41K9tJw7Ct6kDhSAzT\/iOM8XvtzyPfZDyUnPkDGOcrgEnW4WcBPt1vV6TCeNA0R+AgGZOoFuna34iYxVb0l625iOFaxBCSaQg6mDAaybg9RbqTAQybJzlMtTQiieNGmgOu+iEu20uGS+SNG4rLn99\/4Z1yOYZBBt+MIWZ2hhwVDDk9w\/6skuO2Weg\/eIguE2oaVtCUuVaAa+9G0nTE10QxCsQSa11fKdsBAWEE8XwOevOSF\/sCvLwBPuRrF9gUAZ4XSLwJzVr9KCYTrJZXr9LbhG2HrsXAovR5FocEbbbcPNBH7VKxRl8E9Ds1zm67DKkCyNUqJB0AJ2iJAmtq6WxLjpBIwuvlhjEZ4mg7nNGdHzs5PkRX+onHMQSOjqm3xiHKYnDreKzixGGW2evfySunoI9XZ4G+t0VuUG6CNd3dvcW23a4+McSMgqevwsD1E6LPyc8oldmUI4ou8etzyLnfNE8fA8II3KjzsZI7wpyGoak4oAIOw+WHcmrGra+0HNxC2GGHy6hV\/wCKCUhUdwyfkL38svJiUnva3D0YM8+7QRa0km0IR03am8OsDAHVTI44EMFftX8M8GF9kcsSAwsjXNKUKF+1nLq5eVvZhp98GIqjVQmseUObAMHS5MITRju2lesiC1vb0TotyiGa8vQwtMFY7e3BwdoCM8wlFvN3zegz4cZ\/5honU0lKcZ65VXrwAtMtXC8uApW4bgkGpdGFh8W3EmIc9dupMnPD2zV2Pqgs3G5QE+hV3VkUu\/qhRDz5s5FymfkwzrgYBkMwUL2eNyt\/lB52vqW9GnorLx4iep+hquGoEsCyekxbg6dNQS2jvTAqk4RcBblIUlQhqs1g9UlxY\/jFipXapWB54dU6z5jd+dpPbPEJWelwgG1SVTU9FhxyzFi5ljH8i8L6X4JaPhAETonqWO6DqJ5Y17dluCtCciQUyfInROEAXc2AHrXHD\/vkxPOrXzWm6zv3ylavkY4J43l\/NfSdTA8CfE5lvqVlwCU08nGnR1TVkEFCj+9QykHjHxb1qQEgY9BJ6IduFrG3ePAAM4oUbwso6TwDqlBwwYCx6XWcVFWBfNeC07vWcP0fGiCM\/memUDFveQrH+OvSOMxzSbGRZmQ6qgUS1UDdYNkKBs7BjOwUUcceTQo9Ozt2XjZOnRXoIkYrJvdcnen6GVRHQpMZl6C16peVnmAJjiLyVbTYpruTsODt6yr8HhozIgwYm8V\/IYsb2iPns\/c1WrsepjMc41GmlMo7NrLb5ZyAGavFWHrq1K\/IUyJ4fEji9LWk5MXHLJO19jvh\/Ydk+uGXWcTwoiUOG7pqQxh7hI960qlD013oUdOFeZwLx8Zom6v6EcvUS4ilKiAMxDUlYReCO5K7ZzObcTGqcKi8JgagUIKWLpIF\/VmBfgIRMwm+6OMAxkgdawn0etZQ\/ODxmnI1ValbGtf1YvJxiXu5dRmUt86SIgyWBjOvNXdcCM7f\/MCDg8OzQiSuokz3fABFwVddJnQuue+MfoEEG+9RdARNmALM\/OgmJHv3zGf+lQoHpPtoscCdGtSbtGqfkbdQCvPJq1CO1CN67l2tomJf3z1YsVlGM35YJTLbNqqtRbO2NvCyJPFzavwCxtVZy0ZADUUZEUcid6EXjIHCBOX+2uVHQjp1ZG1vM11c14XS+kdQVD\/zv7x6LLOe9xoMCE832xdxjZF\/qVXkWRXOUOFt3mG29DJ8ryBdFUAk8yLgmXC\/KttOCYql3AsGfnvpkeTvS\/rqXbJBJ9RLoXJ9nykvExRcBsqUD\/FgkHQ1g3fmOxuj004xuWbWP4LqKe+mATweNCYJm+FOuXzK5lAA30UosBVGBaU7J4mjkDhOddvgEq5Fo7LU0rwVbjGRPprkx13EnLQauc0vShZ8mzPF7WHmAyoT3deD0dYyJvwveihX\/CTiXkDrS6dBx1jz6qH5q0FdDOAz+evjQkiKagnfPwMgoswthxbIo0h\/8rngc8b8hENZr8hpjSON5ZX6kBA303JEF5RBAccyEdcT9kcXME53S2laMZQx5rHBAIbqwej2V5uIjIm+CERumywTCQuOFHqfHe85JU6ltYJrOZB4C5BhSENVLpp1z5wAUmVFnIuPMAtVr4a3UgjKoiLBLfKcHlMm7npeATxl7ZIH72nmIY+\/HUaE9bw+MDTFsfwe5HO+PNGPD0xRTgXdvJ9IhFFRyxYcAVdaUIzu\/mNPDMUDPo2lw3AnQVRqsXaIwiDrjOd0tLTjkOXEfYpyvksZ5n0zk5xvB2Ky7vSTrIsUyoJ4uu6\/\/LWeQMStKg7eW9j1zgp6ifa85X8pyrxCr+LtJFBPThvqFfseItu+YPKYCnKoDsd22LbThA+iclSiqhNHAe3\/g9fBhE+ICpXETEZw1ATdz\/eNcXYNXlsTD3yDUlmsDqUgQo4kezpF4tEfPAN7nUA7KAWGldNAZNrrXLm6m+rNIUfR6cpcCge4WF0wEelyINBvlQL8I3LBAScT522VDWIq\/G8JMAUQZAO69tGLcdZlwWOj6D3khXaRQzLh8GkUMk0nnauc5DBtH69yqd3GPCKBuaWR\/KTxqdKBJWp1osk4bHqSYO0TKo6poVUNm7EhJw+o+2Ty4RaoAK9QbQkBJfeWGJGEpiS6xW96JI\/jcc7F5nrVobz+KT0FKk9GthiE9+zB3Xy7\/JGzXqUgFLX+lrs41293uio+rjKxLO8PYtcPKnjrS4QQ+BOWsqp8bFC2BeHM2By8OkpfXhhWVVfXtF4r5aqV5iN\/WBO5NQkmHOTy14sYX3um1WARel1\/DE2leNDn5Q5EYNn6Pl2s5D8AhWg0bzRoXUnRHs0jTmk+K8TTi3XWG\/nuNXldvnTzmtYbD2CTzbOHeIRK3hn34CVd+DuhviEVNS9oLpgsJVmDHFxOCu3FUBH1ZSQPdIXShdUh0BC9hr49xRPZjNg7PL3mSdwPn51BdfVhFfC7QaS3WRP9e\/nH4OLwfArCxJ3iMrkU2+dd7W0rF3sBrWlZbGvqrWEULC\/nYw2Uk\/3yE7mOSYqyaaa\/zdHPPUHXzSKM7Zw3\/85gM+6xemWxVSmPHrHv7dAVe5NAeNQm4q8r1y94PNiCUyxTwm1bk59fwZDXZhrBjv9MQzCi7zWsOUGm9bs2MATPhpAvMgdJfHS112W5g2QGGPQgnrFqz9JQXos0RYjDvrEQSFP04\/D8f\/rvJgSWzv55P2uIYFPBSHXwQrI\/FNhUlU96TBbaGIyrGFrBH+0V0mEC0gJcJ3BYI5359r4ZVbUXYfe+XA8LK+GKpmpX1JSPREvVUkJb2Bqsfx5TLSVd+38EM8h3xdcT7PFp1StOozSDlzPFM0jVGWQ0ucUmncye7buP304f9\/0j2EvQ0j3\/NIu\/kPnypJnAt9R3luwyVM0vbYXuycCHcZ61IlUDgKsAd2TfUT2j0+iiL7e7I20zDkVW9yLM4HvSv7\/OvxG1SZivguaiOHsw+jWb5r52lAmBX4aqTTlznMGzS997G26RE7LVgwgSDRVTj7Dq4m23qoNtsdcgZ2uYCrHhVtYa8kQIjlJ++2FAH19vG2KMyGcShbhOvYqYs0p\/iOcigNKeeA8YpRyvEvyK7PhQo294UZLctsxnLoNitEjwlJSVk3NuPWsdRKrUlUwqyLotCGASzzUHtxT9KfeMypv6KwtBlcOOa2t8u\/FagGke5iKItKTWhpy22Kvk8y6ZCoO9bzqmUSHR+HfEslEX96XrlcCnIAEUUEjZRG0GogVzY6E5tT2YUDtG4HENWhrvcAR7vuivDzhgSYb1Dq0NQspeFYLw2pSky884wji1dkG5bIjJNta+XoekszagmILYsrsRF8GQr30m0\/JkSUJ+ctwpNT0gQdCA6cxP6Xlt1e26vPFhwqHTaGK49\/cD9M2f1MK+y4Ndb12cSzixDKO\/muofrpUzHn2IBqk3t9GWuwO\/wFMzIww2U2BmmFPiFwVisXxbWC26vKPex0\/HFsd9YBCQZ7bqbnI62s2U4j8nyJBT0GfKnAnuho4Ekd59wBFU2JA2h4kkE6Nl3dZ+\/JUJ\/2v2mar0\/3679LzPmqTZYFNIUg4OGlabRoBA2\/2QnZjGTkokhJF\/i+0i5UzGNBG3FH9Uu39auIONz\/5hEdcIy9rmcSoM3cLBxYKZhocagdlMiTr1tx\/8vaehz33xpjJYUd00fznmqQQpeGlrKFycDkXar+AjwfKyQqu0g7mlImtRVPgAOoieCYNfX+Ld6yjfJGOfbDwBlEBcLpASWtzlpFKBYmFG60qEZNBfcb+g==","iv":"12ee49126e22257d9b819bf16c78c82a","s":"c3ac6bfe243a6eee"}

Michael Kors is looking to expand in Asia. Image credit: Michael Kors

Michael Kors is looking to expand in Asia. Image credit: Michael Kors