Even though marriage and commitment customs are facing disruption, consumers are still turning to diamonds to commemorate their love, pointing to the potential for jewelry marketers to modernize their advertising efforts to appeal to a broader range of romantic experiences.

According to a new report from De Beers Group, global demand for polished diamond jewelry grew 2 percent last year to $76 billion, with more than half of sales attributed to gifts given to significant others. In addition to receiving jewelry, women are increasingly the purchasers of engagement rings, and are often spending more than men.

"Millennials are the biggest diamond buying cohort in the global diamond jewelry market and continue to express high levels of desire for diamonds to mark the key moments and emotions in their lives, even if those moments and emotions may be celebrated in a wider range of ways and not always in line with the traditions adopted by their parents and grandparents," said David Johnson, head of strategic communications at De Beers Group. "On average, millennials also spend more on engagement rings than the average for the market as a whole, highlighting their desire for diamonds as symbols of their love.

"The millennial generation’s desire for diamonds, coupled with the growing purchasing power of women in the global economy and the increasing number of middle class households around the world indicates a bright outlook for diamond demand," he said.

Diamond demand

The U.S. represents about half of all diamond jewelry sales, with China the second largest market at 14 percent. Both of these countries saw demand rise 5 percent, ahead of the global average.

In the U.S., China and Japan, jewelry purchased for engagements and weddings still represents a significant quarter share of the diamond market, with 72 percent of U.S. brides still acquiring an engagement ring. However, sales of gifts given before or during marriage, such as commemorating anniversaries, have surpassed those of bridal diamond jewelry and represent 36 percent of the total market.

Married men also spend twice as much on diamond gifts than their non-married counterparts.

The broadening of commitment beyond traditional marriage also represents an opportunity for the diamond jewelry category.

About 10 percent of diamond jewelry sales are attributed to cohabitating couples, as they mark their love their own way. Cohabitation outside of marriage grew by 29 percent between 2007 and 2016.

Almost three-quarters of same-sex couples see diamonds as an important in celebrating life events. These couples tend to have higher average incomes than their heterosexual counterparts, and they show a high preference for branded jewelry and pieces that do not seem too traditional.

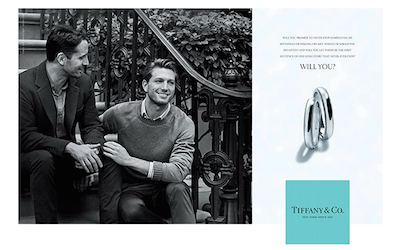

Some jewelry marketers including Tiffany have taken this to mind with campaigns featuring same-sex couples (see story).

Tiffany campaign. Image credit: Tiffany & Co.

Traditional gender roles are also changing, opening up possibilities for modernized marketing.

Since 2013, self purchasing among female consumers under the age of 35 has grown from 21 percent to 30 percent. As part of this shift, women are buying their own engagement rings at a higher rate.

Between 2013 and 2017, the number of bridges contributing to or paying for their own rings doubled to 14 percent. At the same time, the average carat size grew from 1.0 carats to 1.3 carats.

With women’s purchasing power growing, brides who report buying their own rings spent more than men buying for their fiancées.

"This trend is influenced by the increased purchasing power of women, as well as evolutions in relationship roles and the marriage tradition," Mr. Johnson said. "Over a quarter of U.S. households already have women as the main financial provider and this share is continuing to grow. As such, more women are financing jewelry purchases of all types.

"Meanwhile, relationships have become a much more equal partnership than in the past," he said. "Previously it was more common for men to be financial decision makers, but modern relationships are much more balanced.

"In addition, traditions around engagement and marriage are evolving, with engagement rings less likely to be purchased in advance of a surprise proposal, and more women are getting involved in the process of choosing their own engagement ring. Together, these factors are leading to more women buying their own engagement rings."

Women are often involved in picking out and paying for their own engagement rings. Image credit: Chaumet

In recent years, the amount spent on an engagement ring has fallen slightly, as millennial couples look to spend more on the experience of their wedding.

The way that couples buy commitment jewelry is also digitizing, with 22 percent of sales happening via ecommerce as of 2017, compared to just 17 percent in 2013.

Symbolism shift

Eighty-six percent of U.S. women see diamonds as something that will last forever. An engagement ring or wedding band with diamonds is therefore more about the symbolism of the relationship’s endurance as couples enter into a relationship with a realistic view on love.

De Beers Group’s Forevermark recently extended beyond its role as a diamond purveyor with a new branded bridal jewelry collection and coordinating campaign.

Forevermark has typically worked with partners to produce collections with its stones, but the miner is turning jewelry maker with a series of engagement rings and wedding bands that were fully developed by the brand. To introduce Forevermark's first foray as a jeweler, the company is launching a campaign centered on moments of realistic love, focusing on the symbolic meaning that bridal rings hold for couples (see story).

Forevermark's I Take You Until Forever campaign

"For young couples in the U.S. today, marriage is still a highly relevant and aspirational ritual," Mr. Johnson said. "However, its meaning is shifting. Societal norms have evolved, and marriage is now a choice rather than the necessity it was for previous generations.

"Where previously marriage was a symbol of ‘new beginnings,' it is now a more rational decision taken along a journey which is well under way," he said. "As a result, the moment of proposal is no longer the grand gesture of commitment at the beginning of a life together.

"Additionally, couples getting married tend not to race into a lifelong commitment. Instead, there is a desire to embark on marriage only after the couple has already shared many experiences together and really believe the relationship will last. They are conscious that the future is likely to hold highs and lows. They recognize that ‘forever’ does not ‘just happen’ and that it is forged by ongoing moments of active commitment. They approach their marriage determined to embrace this challenge."

Another key trend in commitment jewelry is individuality. Consumers are also turning to luxury and designer brands, with these labels accounting for 41 percent of engagement ring sales in 2017, compared to just 29 percent in 2013.

Tiffany & Co. and Chaumet are among the jewelers who promote wedding bands and engagement rings, looking to be part of consumers’ plans as they prepare to tie the knot.

Reflecting the luxury business' focus on bespoke creations, jewelers are promoting their personalization experiences, hoping to win customers seeking the unique (see story).

"The key is to be inclusive with marketing and recognize that there is now a wider range of consumers looking to buy diamonds as a symbol of their love," Mr. Johnson said.

"One aspect of this is to ensure that marketing of engagement and commitment jewelry is not simply targeted at men in a stereotypical fashion," he said. "Advertising for engagement rings needs to appeal to women as much as it does to men, and it should be representative of the variety of roles people play in modern society.

"There should also be recognition that the process of buying an engagement ring is now more likely to be a collaborative process involving both partners in the relationship, especially as engagement periods are now so much longer than in previous decades. With women playing a greater role in the engagement ring acquisition process, modern consumers are also more likely to want individual designs or customized products that reflect their own unique love story."

{"ct":"s09NLy8IpUlEnKxRC6Du6rqKz\/0LsVpWZpH+i2ZrLTH3V6z\/w10nagmrp8UwNt4qRpXiMJynboVKIBSF2AWLsj24ujE79fTF+DR5hva1m0UwpDl6hccB6TKrpfnpLq9FMRtPMMaAVRqhfus0MH2PrCi17PhaBlSMVfFFOpuP0oluawO\/iB2QcG6UMSc3E6Z2H5n4PSjM9SvJViacMperdeTiyx8A5a93LISVz4dCHiRPBNaQ7eYXNjZCHTohTPtl+rgz5n3MYrz9IvUiZSyul3NxSzE9GBjNG1ToDgMrkrsJcO0Sg8autvfpkbeAUWqNnXLOgctl6MCNBBYs8KzBfLuwD33xnLiPXGFKjg+TrPhAHLKJ39idNzJm4b9QaOqRSkNrMfpkqeq19tCp7DzH6dOe2A6\/Sg6HUXa22M4eBJ\/aH8t0QjoSggdn\/gF6q7YbGDTDvKBZEwEFg\/Ar3o2xE8dIhIR+9++NDpWyFh5UZXHDjiX\/uK4+QPnmi9qQiNdMTXu5+eE\/Z0q6aVkQ9fpknzul9sYLmsMX0iaaKb\/woL9Nd0QLFhMMikFtsf2yTcAiZr9sFIX6HcoTnAfY7phfCh4tLq9mrxBW3uIOgEJnYF66CLrxMdAWcZwgeKQI7xJGzfygq8+HStf2Y6Lj311\/8VZmRSp5Y8Fi\/owQ8RDwjI73FJS2kimZhbhxervlcjOqzLW8s6WmmvLH788bFc+O1Ls1kY9K\/vMd8olVLaR2VRC7rMjBHGb9d3jUFOBNaoaLg4F6UwxYcLIuEduVIGzNUl7yAxQI0n9dE5\/T5yQO99J75yl2cpHuUye0WjW2zWCQmbhMz+6H3NPdJmv2arOJHQdw\/IsXRJ0i0syKkDeFWEMFQNBgYLNu0gjb7\/8IlfirATz86pMULN\/Jr26m\/gnHh\/S5HPI+32H7PUSJeu3T5fYLOGrFjqxZSSfmexPPeYp+wYI4Bvcp0rXIBgw6toGBXtsgLeizm0XpVJvCigEZHENRVNVLoUlAdhnCIijBmcDGOc\/jwTjUHzDU1E2DKIErnAwCisRjpm4UOZMQQXVnWk76c4qm7LGIM56FdLcWBwCcm9SL0Jbxx1ppswlisEmJKxipr9ipqHymEiyyrH2p2dBlWySb\/paUrY18l7FWxk+jXPcBvGphArBZ8nOjJi\/TJ\/bo\/Y+gFzTVkFffEZdOCSlY5ijZDdGfc7IKZFaVLdC\/xYdyIP3Qg4KIDbJugDC7OjR\/comkR9AiwnxkQVVraGtX0cWtclPyr6EXnL2QxM4JsE9yjONJOIor431sz3R3LlRGu9tG3j3jO9ZaIvQRPYU2Gg0Dko+9qMUodiW3lQgxg5z6R6QCC1QTyerUiGR71n2Bc9lRhsBrtUCTf1sXtBIOTvZeVSBkRnDUWs8zHZ2idKiPeWY4g5d4+NFvMrumc01AOfC0RBemIIgpInffbfzcBMQT7a0Nu5p1MQRyRzdh871VrpOMD+DQETB\/MDVh8okB5Lmbw+fPMTg6Nu++h\/My0RfnK5\/i\/CTbvRFbO\/Av8LpfhSrOATtzfbAaeptT3PiwcpsdlwYkO0rhFTrRbnl9zmcWmBoq0g0B1P5RUuLdhBRrcpDFSfmRsxtLs6THwjbeSKSpcsu6GBcuYuNZefIMRbQPvQ19x54zUBoO5r8ZExsmI9hRaYjkBsUrM5zgtQeMyFsB8DIKSmVjC7EAV1A29JMWcIpMpTpkA5Gllf5lmGj35IoQJ+vNvwsRjPkg5yH20O8sLYdT1FdX1ViuNoEcmuItF4aL0ny6sH04ItYnY1XoMP+7aWa\/Sxg7475ZGcIHFMpKd1x133a4BYdrEdMMrxqenWHiMKLsItKtouua+99bpp4lpYT9SjI9eVS9I8Jtok82ntsSdS38lUFKE1Dc5D2zXjqATIo10NOWJXqsp8IX1f6SfjrnnezINTeXAhLRHCUBWnhd0xhIO\/UFxLWotHQrfib\/8\/niuTHs9SVLrt3lNx3M2muCQiErfPv7ceWsRGcXlCVnlTXyoNMFiqZB7UNV\/Qgm7oIAuWksFHMNGTaT0QzumtKqvlipTVutMvACJEFn0dEtgLSgTygPiy4vjTYYzjWYBCaDbjuQTtSyuQcUXfphVqfY9nUMYa2lchn9B99564BE0wREFxhpktrdeGzFaujdL8PvdXgyVPT7iFK0Q4xvTAvVelYupX14+zTGQhyyWZfscM8aTruJ6axvyyw7wQUfwfvayMyw\/u7ZPVw+ShOCDDjT9Z5BfSogDap8JQ2w0DbJV6uHrDMqSxV2LLj1PJ7fq+ZKoVEEdD\/764vMSzaY6fQdX8d6a3v09mudmblic+DDaQwhRwWp3vOOkJsf0JCi5153DQ6h9Ta1SqTxpxIOSanR42leV7u4RNZ1IgvBQiVFZQ+FaMYKVglId6KVXVtjFYf2AGIbJQvOUHZKVKYdCWOwIgyW9QxsnwkFraO\/5s66HjGtI0FRQqhbQbv\/fcSKRFHVaKiRXGEgI9\/tB7vjHTmdKarYQcQ2wFBHczwmdvwMAeO9eX1Q8byfDYV1291bIMjKQKVLHYF5N1CQe37dHUwR\/FaehcMAMXFSTxSB7AlpB+XBnjMx8rUIySuXcv\/d6tYOXeY2525EflbLPGt\/J4QRqTrBnqBvK7l9VCoXrQfr2t\/SFypbQqrVgSvUL+A2Q\/RWccLTqh2z9rSlnE3nuL+40L8qwo6\/uULUbL0pbXvIhHfyN6Nbi9RUaIWmKmT\/h06aVZHI+1YOTybmUUDoPihsmzTT6TLhAcHmOGolXoxcWbQvWbIL1HPK6enySYEkFYJrRuXX+5wIRdpQARthgc7HtQuEfS8AsR+ZjVuibVJNRg74HpShOlVWP6nLuAZSEZu2BiwelYlMjy5miFh8hvRMzt0PEPQKauqdmt6\/f17XlP9aECOS6w4VRQgl8ZC+dqwtoH1R2U+REtH0Bf\/YHA09awbTJpgJL3KN+16CGxYCw58N7p7jv3CuwQA4SVa3VRGSN4tQbKUNqXfon\/OGuYKZDtgnOtMWW0hmfV95+cxui9JpRBO5xit75hHTp3hQnbqnLQudLDTFjlkB\/4MJj3nHFssPSqjubg6krLy5SMWjIULp4CBgWArEyNFl8OnYOJ6AWoT7EoAiT7lj0sYPVYpgSV9pRANswIM0LXgi2RABYLWk8KAwh93zCmgqHCSv6KfOnZtFHB0XqRAYWESxcZLPoBFa8VvwUuWn5cTbTtdOWgikLgoUcH1S2sifdZ+LnltWcQfp4wKL+L8tnUmAuioiHZrPrUJt4mTv1F7V8McVaGJtGwsv3kcNCO1YMSjhdxbnTpND8US6U+grgaxbl1TgrNcsWX\/NP7cDaac4Mw7OrogA3KaPLbNBZz0cCUUQCIxcFYz3cA\/A3jmKqMrNQIZErGhWosci9xbzk9Kih025cT1Yhf3PjXmsPk3kjvcayiNGMdACxwijZ\/In9MIhHVBnDott5vTTxB\/XJYSenx9AczXks4rWLdtljTnUkciQBKk3NcrhrA29XGkAZkBs\/pBbJe\/qHIs2I1xf7TPMk6XP9NiBVtaMVrPJxpxlh1E2hvp0ANQVeeBUBd4nxLwwIVgWannRcMExZazRWVw4q2GN9Vkrv3tfqaDpighi7S9Vu8ElOTWmda0A8e51fmhHPNcayklQy\/o\/RBbydkebrr5h0uxIpRyifUhqsq17SkNlbqVXKzUs+Yo8Fbtt\/pLaRvsWmkBfCgHfPcqrX4nu01Q3ldXSNHFMG1tBFMGJcGItQ5915bq3f+PYC5SUBf5Q5tbd3aC8\/NXQk1\/MuL9HK\/SO1jahVWtEBI+QPHn9Bf4cw8VfZW5IIc63Ehp4FxqpygxmV7Iz9UQm83SoCAy0IGvG9UDD+fhHRfe3ypqtsvQbClw8pmhm19ucneQDBPZPZ0rKpKYXOEFx4dE+pcfRqE8bSkAywp2OBhxkY4DOauj3J+oXTNpnzzGVZ2U9A5\/+pj6u7rvZNK5wSK0vCaDpkakk4DsEcy0Jfmh96ahVLd8CWsHvAwQCXHXj2HZfdX1nS0to56z5Tb6alJgRHedoTYkR+5RaDwm1FdNq3fQEcabyxAlFvB3uZ97R4AKS\/UYReEr1r5M4BrKn4pkHE0JEv70gtpuEmRDm3U55scN9\/5nG67YCMEjraSxgQacaYu0S0pAdEhx\/aVAgnK0mDoxDZ+mrCkfAySeNuPYOJAG8LAjggnogM3OdOLRxSjobPsq3D4wJZ235AfBWZnjo3L76\/ASIuN3358f6A86FkMWSMx6n57GSOpUULt2VecqVTxt6MWqT0FtreMuGyLvvSy6iCgExRKewvA\/isgxFdnAk8j0R7s86OYUygZQyOchPOCNfd0y2NYzPRibOs\/kLaGvetxovOieZR4qO5z+2vYo2l\/okFx5gpGqIRTrH\/f7AT6n9C+djLe1EdMfcxwh40cwQTixNpfwGZJy++cJkrE3TXcGH+sGwCxYgqKlnuDvWKU592Y44chMP0KtYGuxS4QW+al2BRmtZPjp8TSXxTHB9PKxlocYcIT9C6c+bqDXFBNPsjEhThzg61rpG9m9KxAcw3BjRWz8rtG44HSJKRC+d6usceaxr94SPytRV7xnZXPH7jkW0o8K0146xtgFkQJOJZRGzDkwSpTW4iiialRVGR6Xkhr3cG2J2rk8SlCTHRd\/Bm4THoYiXZuM40RXOq7IWTaK2LeGI+LwtskpSLkGnrjOQYkDDoX\/K0Jn0UdKjGOKGGNGom4HBo1x6GJH2uNE04ACP8zjg0EXJUF9TM5nERncnRsvnZQwHkCGYxWbOvtXX62cEw2DDJMsUBaxFhCBxutG7A2fU6PB5eun7jEynMHr8oWDWoFLmJ6eLeVBkd\/GTWYrBnpxnXDoBYJomPeuTcXzOVLcURBMcREGy5grDbHbxJ0F3US2C78j7Mb9qj9h44hF8RWEGJAsw8JUU6j40FGg0QS+V3LzSkK5dUgz8V8rSz0sjRTkta6swutxx82Rrd6a2VAKqaFWc5Q03LTHm4RiNZynLT1lrBFWnSUN\/IXWkPLrVZiaVyOXLNUIsk8eSvC+x1aZpVYFwOkwMaYJw5b+6Fa\/RUvZ6ZK6kl13QYdekiN4YToWO9ooDMIaoApTGewS72Ob6D7ycso7PN\/QpcDsIandhmMCauX51pxzOV1Qr8U4DFooe6\/UBbV9tdBJlL9CcXhQIhs6dMVfntjUerMn57r+FdQoqT3Kw2IUEg6XC3HkLYYOgcvFCHO\/o1TxCpQZFGXIDHmQxyRN5byeJP2G4A8LFSFORFUdaSu2x0QMEazmrT7zomLB6+Mbs4zAzdKpPw\/t11+mDYbovtPQ8hC3DsPsjDl2rg1wFi+REG+nAOK4g6B5QU+C7d16h5Fg10eX7oFIzkkWSDsoIKLKsa\/AV3EDykB4LHGWYpEoWoN811PCD9mDDE\/RFQzPTgwNzj6eknxry\/Y9VJfR87Gok5KOuw737ftYrjqy5ffYKYp1\/bkVT2lZfZodvvdoZmAOjsSRcFIsvStP0uSPHc8vtaeP8Bo3oAAg7NhjMQWdtceeXbdc8EadZ9AKosHgszLUCNce6cXTf9434z1Ie1gpSmbvoaI5RY3fF7NrER0y7SiC2YoOAp5+aGphopHsAelvXpkju5UT4O4TwnGMpZ5vceAuo+ctdLveLJaA2lxLNHEoWTFyELDRioEjrweh28h+bnaS5M2XCJ71XQqJn4FoVGr8uLFQCM\/8cFMs05y\/HsGxo1dF5av+qd64EufZpHq+bOWJbijlA18JlBBlAyALWGvUgF8+xl2MG9uoIu1DmEyi83V3pv4Avfo+3+XHTmuTYhR7AMNv5hsoN5\/SFMhMpWl+gcTttEArWGQu2gjptYktGIsPhiP48MONdIZ8GSmc\/UTJP7ZRhVioLAZSPDxCXC3kUgx2Tb2SHDHy+4koNTNp8mfXQXx1ZkrqHh7WIzg5JiyIGtuTI9JkA2Wtj\/L7mc+aPDHR\/FWE\/YQf+9aYooZcWooucemmYsZvH1kDLgqX3AWoOFJCxAUuXY\/pZxcLxDeR1zrOksGClMDISkChPuOmFy9hBWhNkN0f7SowqAbw3BIggLZUss+qFlyFq7MEIZLHhvwFcpkz\/raBRpaYf1ezN\/pL\/6AzLPQB15m4\/b2k8ueioUIhJh8SAxLVyVTrdLbReNo6bdRhPM7eruHdXQ5r2K+YVMng+hqFVJkqRZgVQ3dL1bJPYG8URWhQU6x5a69T29SbcQaKMI\/g6ooAVKu9zhawto09Nbjxtgacpdkbls0OA9nPCT41T4UQfKOZDckoB6Z6d1N8mH9VKXyo7x\/z\/pEju3jKVJtRQb1InI\/eDlgd0yfiKimylETRnRFwIAopn2ZutsCJVTcLrgqF8fFwzGnU5VSMVN4EYw7xCr7YJqnddR56+ueFzZxJF+s7edjKP4MXvHos5ARH0nPNOWZHHXaCcVV3+pQhsUeL8\/MfTCb\/\/NYkv1rPG9ADOFQHVdOE+FYA0HePa+UyD3IrxCTdc0VkMSH+ohPbvVkIbkcMkWfACXrzAl3lDW\/HxzETEzr3GEiRy+Le8pKewYVzvGlE7YZ3BCmcrXZoilnj9X\/rSXSCcG3h+41ZTFYyjxo3Wbgd9UM\/KiT5mY87PvxloXj4SqhwKCNcrPSCqkalE\/NKUls1XR7w1g+zKeXKjeLIk8uZDVPhffCy1OvB9fR9fGM\/7tuuNsM\/sVYWJdCyvO+Uz1dLgsCkaoxZac9493otYD12W8r4VIHbskeZCzUphAYmY5E1oruBOev3oA81BHT7IMx4ll2tf+t9HN5OXGEhLtlcGytog65elt23hPqMY9a8a54vny3oPUgOuMscJSWt7wDg4sVU3YpgqmwzHcnCpv34pJ9oc3xczmNkbYWW1nx+7oewCu3iqqd+GjPdPCFzU2WX3sHQ9TF1sGC36ieM844VuSGcHhZ1THjAZfLfmfl6BKRQVKadxqVN1HXihv+1mMYqHQHEbr7caLoRK5222jgysjAr+C85wxT+i00u8qKu0GRB2IFYDCjIxVIgmk1SwNcTyeTI9kkCMf1xNIKuzcNFPMVCsvhW3SyokcXnYJ7ZSPh\/8WCKjGHxhBt7TIXyovBZYcqp9ba\/PQI3AncY08JrKke0+NYch76c46lqbI5UAnJzSSxHArj77LVX9rz2JXdAOI3R7moocOzyLbPrPbjT\/uciJcGoaoG8bsMNQrqjHkXrp1h0p1dUn2kATgNKw1gj4Tk0McjR0Cb2AXJ3R5XCgTncQPJG\/4FllmopkmhJbsZ\/o4bDAMplCw2Be6MYpQT\/VVCZ0jPFru5FolR\/3w93vsD2x9BUeFyZmGg1dUuk\/wG4VxCf6xq8D8D+\/4gLSyzbfNerOZpluovHbliz1lJQZWFpNQ8aLasuXMC+bRAjaP4cKG98Jwk4stZOdB\/25BjJwa0Xjz\/CplxoeBiNDb7j9dYltYljHBBv1sabz4MlG8IlTVYYLLeZN9PAwT3S56KqtI1ECQyTbY2A\/pqlkTiUNPCFO+ngd4Y0AJ9htL0dyp9SVh+sqnA2MuFMEH1KozXPSGzIaD1+XknarCQXVElhoQ\/7IbLrUURLKCNR7q7d4cJcEE8Q3uTIG07oyvjPXNlwSaNplaAEkCNz6uW9ukO6NxcPjr1VFBve\/zmepDJzqXJISiIoiYv0VNU3G5HZxtbYmBZZw\/1H90kWWGroWKXNqnqZJLfyCKDRT1rkNM1bFCGx7LUUZ9nkIG+QOqg6taj0zZ6z+VDJlgfRG4ZBLzBykQwPJ3msuA0ENB1o90Ts\/zaqujkTmSNBHr30kWFnewA+oN64xX6iHDPUWltQVJDws5I+K2WP2TIMgkRs7LfPgaTylnMLqyOibJ5Lb8YngrGxL8f+oeIONm9\/XUhrCrYvd221hlUfsVNOmzJzTOw8MaT3KQu7TMRhgfvg0DyTk6YRwQcccUFXA0qtT+q2PIbGvlNLmE7LYMUOnhCjs3uHJTtkoWyUddDiHA1vZDTJCPKd\/+XPM35Yuug1baeLJeSO9TDNeHqbkrlYtRh9oPnUsCsPl4iHdAjlpseuEFriWDuYFPXOaIHUgWLrRD6mTFaKYI1ogcqPqSm2ns9rd9QRBcFTyJIK7z82I8eCQn\/7s1TfoZNtJ6GaowlXsPTyo2Ei0zOU6eJc5ILxopmb+8Rs104vWQbTze5KA57DT2zuXNGoOzy4YxQYX6ahUjQiB0Xalg65uuaswu\/ChRqAIWCgjLgKoWQhn3jTYWLbgQXIy9DTO6dk57UDxgPILIyyhta4+9LixMnzMBg+sKnV4cbBgVRYK7pJjAUyi4KGIrQ4o7a7GMKbXMygdAK41+czZ3x\/ROTSbzHlMgBCkwXO\/\/onnJM3qwyQ7AauhTRzQSVaxm+ZAQHy2daYdYBFIsxpRA7gu1eefv1mMxCCFTkWQlaQJx7a4gqUcCWfS4df3NSj71bbpn+WryDT61P5qPtJgyC6yM9a0B9\/XBYY2mdZbN+2Pi\/IGX5K3BC1jQRbuYjA6Ow17rSv3v5JoJhknWo+W7CkWP9ZSPEmJXmfjNBUSqgFGnOTceQkpXIBSeKkCN7O7\/Fm53XKolCav6DIDwlPWWmYgqpSB9uU0qXGuT6b0GC4eFwt0Qpdn+pBRonMTEK22QVG3QV\/e5jWQ30VaJ7ZZ2CqSw8grI5UkfjigrYu7Yisa+AB7AMCgA8x+hmUxW2WVugrtj98US2rwfq4ULzUumQLWbL9RWBm3PE8zXpDD0WzmFBQs2tobD58x+hf2k1QCmnQp5qP2WpCm+k0lrI9LAIfZt4KhBHi+R5qyWBe7ahuAdgD6gmGeWVgMEEEMqpCLPftLooDE0P0Q9cQuoHC81yxk1Pxd+O3+FXMtY86VYWVFjLPvY+j5\/RPMoVrejfmzuKmjt9cSc5HxgoS1QzE2ArpQhbG\/hnbfBMQwoROQxvJoVnj2sAe\/AzrjH5nZaGLmVar05jQ03gVUpgoyojrnYllanqX2WP+wLeBbnw+LabbZaxnbPwZ5OwPtqFvq1iQnGnlSvxq27JQwZ88ciSJHpVRsFoF5nhe\/gQ9YuSMz4+0CnM9TLN8wNBj2GXcleKUxWRMRXr85lKgyrBVytoTd4PySYD2c5og7nGFJLRP8FdU+7wrtIoubGr9+\/k6rlkhzIwKq46zxDRqxeeOWZVq\/W6ZVazeL1GaxlK6pSt8+efUlbEkb36hYK9PCzviY\/OImVD97H72mZMjEhea5P2WnC2Wwdmf+CszC1pYK5jgEXBc1k4jsX0aLN5+LIfEkmAhRpe1oDU6Btq+dY3iklWqABSYo6B8jbEJmg\/MWeBKkVKUjoe2Ae07QImNNzf+nAryhT2bSKZxpcCb43PtrLkxUyFlL19Mb1cOC+7RlzkJro7hwDAJ5wrp9bNs0RvWb0uuqNeEd3YTyMP2yg280JVywa52iP9BFvwi3+jESWV+zq5XGe6LLCokZ4buavvdJvzYD77WnD+7KVYSjO\/GlXgbnRodym1P4gqVtVlBv17SylUjAspzxM94XEPZoHnEp3gNfDLpnY\/wqtP2E2mq4WcZyTw7ddhXEMPazWm5N\/ZeJ9hjsIa7prhhGIKWHA2wXr3hm7IKVdEr\/x9w1OA6cMDqIl1J1hZMYQ7QVGN+QMb3KoNHRn6ZATvp36n6gSrY2P8o76ZEvjTsAVeTx+TvU4YcuOG7kACmoPa0oTJX50aaECHI6okfi+12cHpuBJfgrYnd638LkbxvGeu\/okLO5S\/sCeD0mfnagjvrr3NfV8LP3RlYJLqMn3+XMhVozDHOLWnJf08S4E020RTax\/WWSYCY6NzfpAl6j+TH1189hqEwDMcfUQjuznUMHNbYxXZNk6JaRGEqSEE07+Jj9UvBW92CzUPHAEgpPe8mziK0lecWvc2R6P+MdAb7BEqM2yY9heSlLxTfIy6+zQMl1XvPgB\/QbWVKOS4Iszu9yrjhVH07ecNetrvBktvGr+YR0FcEo45JiXGqb2fIjhkzqxZ2cstcicWXmYr0W9UGbLNZ6KzVYHf1gvD2oOfvJtrMhK1U0FeAnPP\/DGMfc39zGfxT6zBIBBRhWGDjBQ7ibYhW7GoK5yK8o\/X1Jxq1wQq9f8pGynXzhpc4DLQOebwu12ahVgQd2DOLdY61gcjycPu0UzttXVdx1da4ZwWX4moO3byTdVnqZAneYm0CcYLvhTa1PT3DgjJKWP6pIZdV53mefZt2ojkNHbyLG5wCzoHXe48ehKSQPjWwdhboYlbKOLKfD\/fKEDPgVhj3zm75LJf+I4pkG9NvbwDKf5PIu7K7pdcFS3IIGecXSbm8CYEyjlxZPt8xCnk08itRZkKMT69FZe7FF+QR8tSbGRuv21\/1nXSuSseY4iBy+ghALBzRVZyELruDM4s5yKPslxjnsymepgFBBGc2mo7mmyCD5E4IBppgfLIOvpGERj1AwTnmStjJfMsuJ5SEn5ro8hGEjIfwdIE\/YGKBjMsno+8QkhmfOOKwyovSeh+bcUi+Dtl0F370DYWcX5I9gj0pANGRcwoQAq9wSDP+Nb0gIk69OdJFSl4wRpM1aLNGeH+Fl26STucQyrhK1hGKxwTpd7Gjz6HGALHBywDgxDD\/hBqWcRgWwFbJ2FLY26SjeIUxQLgX1VpEXZEC3YHr6Hcz2zH95XHGbctB1yXKszwoxhOEehACYDSkJuiNV5d\/FBz3FxDhYvvP9wuXcGRavgaQdtVEnuqwqcjfl8XUeM50TdVt5KnexkJAL+reVST4o+5HxjltY3df\/13w4KFCIZ6NLppqSdmEdht5XR9NqSycU56Yp0JQ\/S+ShODuUCVx3xpDHnvfpAfjdXxTSQUmq4VnhgJNzL\/5CEHrdyuWyqVz6YGGdRSLtW3AzwoRQAw3LDHO3ky471laQpNCgEvORaDigyaBnqTH2fc29\/NYVJQEmWU8n3Y8oL1THy2h+7wYE+BZ817kvUJgJbkhTut9lGHGGupb\/ypYAGJYcTJJA\/ktFma5P\/lRrpdIPWdDp5O8eanQXjRwJwFQ9DjABTVASwROLhhbYJI5VMDem2jXneyqNXfDAIg5SDmgTyRLUSl+F3PlaeO0aBmhl2SK7eOklEnTMzxwKwUvWqDQ2Dcgl8eYJDFGBNdhl1UFTEISXNAbRC3xYKW9lFj92MmaM8LGr+\/\/d\/UWRjLeAzIKgYU\/BP9t620hUDOoBbcICfMWGAHeudtjnHuNDVB3LumkGagfCk97JwbnP7Fd+y1SESJegQulZdQJFFXFItfDiqLjxNEfaTU5aRS1\/ALUB+tYckQCSwLLvac1qembsy8u4g+prVizy8h67+IJn0qV\/524nbdmHkN3iLBxnnZVP91sRoTjK6P8kfPQeqsGzmAUIxlRcPHwrEyzUMfu+jL2enfXscdeANHj\/8OFZPP1fK9fWrko7vNYrDpvnpA7TJAJAs2iy4Xa0QiZBB2e7CgRlP1p17486j\/mPH+E8UxIqTK+tTETjs5jMRe9gFlacwJK\/Pn3ySS1BgWNqMzJN34HqQaodVh\/7IZb3MeoqLkdfA+wJzQO5cDfUkLEwKBoNLz1DTJaILqzXEtUewnSqLgkhBBOtfXMvCJ3g8bMfCPDDWZUqwhIJp+JgCOuzF\/mzyXqvkMjEoL0D20Do4gPTVFfQvlXYbCBa73dtl8ljq1EVR7c5kdpiX39UZiMKsMpGaNRU\/VRJrdl4sSZOvKSji9oOfjOlx9S3uLTWG1ZxEpKlX3dzmQREt1ab8kxXbwzahv1zGL+UZv8CEmVFHJuZTYiW5DDAoRKqG3WY9iMIZM0iytTPaWCEulu\/JTSuB4eNWZPDwXlZBGvTONkitapMYJkH0Cc3fYT5ev6uiVBf8dVyERw6NSB0wtPy2HsvK6mV7EhHPmXAX9WhBYwku6cHE1gGZp4fPruzLnd5B9+S5CdYOVESHdgZb8A1liSB1aRxgQG7BRy4Yl2XtCHMMA3PoHJzQ91yGWwJ4IhW+azDVJjJsawDAxNbL3qDUv14WMc5Y1pBo719a0van9LD5t\/Ou8c26KrpCSgVpncloP4n6i+i9bDUfKjuUEClX2tPvIQqWeVLmG0tesK85xzi9E4yG8sVEuk+f4H0wp2vpylyr4SQbXRmG2lsqZh+XBT3pNvzlD4H5QBq9oXzS2SXpP\/yOvszmuLhTK\/Vi0ec8ikxQnnG3rdFHbUbXR2FXcduNU0TEJwIKLoXrvU5jcx71neWM\/yiZRwHgWmng5pEWbQxEgsWIZFKvZQxtnotEA7Vgdgkx3k\/XXpxucim3F6a\/p0GMy3YGG\/AMvaybUfigGT01G1g\/Kr6ssrV\/ymOOKlnEQXRBgD8liV79Lt5FPozKPDPx94h42GcQmCzMcwR7RANwGpOlb8Q6Dlfh02dJcdU2CTjIXbfe9ZV+XuWFgh1JfgPTxSQuF08R2IIofOVA9MP1ad+LepDV92C8tT4oa2yTlNnotq4uLw7JVumkHv9X+tPkuFAAQfeyBuIoHOBYQ5eX5Q+7cpIBpD3GFnr0TiDTlH\/jZSp5kJQ6zOjbbeHzO8CGAxsMT2gGsHqDhtUuX4MXaRLTY\/D0MbccFBuuH0Pr7fm8lJDVWtKsJfTCsedIDpJqXQzXm5ZwKuQ5c8mZQnNsnBU3psnVLh\/x9e\/um\/YuvF4mP9DTcMYavC7ZCoyq6Z2pIT60Re7sG4Z1jXQl5qQsCSyVgByvwkEqNAuXF0TUuh1EzRXA2zFicDvXp5oOsCR8+AEy2lgbvKt0n12wzty2yTHEHCdr\/4tYhUqSZE6vGI5SSEVdp4Hdp9+5Yb3sJG1Aj6cg1WyqA+V8wfHwAvZGb0fUQaMMgBAjMoMUN\/GiUTG6NvLlJ8fZ9RdY+CYTOzb\/xIVufNJfYB+umc6qZpG9NvSZGRH\/PWbeFmd85k7R4U43irkDWRnAWS\/Y8vR0ehTkp9Ib9H8AVnC4aOOEQ5Ad4QdF5d0Og+aA3nDtLWau9UUerjY0cPUvVIYHuQcyHpm04oygMijjmmwuOAvdD89NRXFXI62oXOS\/R5Dbnjv+S\/RexFWil46vpGmulb3SomfC283zdm4tgsRyzkBKPs8j2qaHSj15z\/yr7mTPtLxXP+Ha5Dt12nR9hMXjZEeuOrP+wuxcwPY7db6q5gDKhwwDIWfsGP95ytCE9GRZewZm0XqqEWsTCFAeWMkn16yD6GrgkgI67+99Qaf\/ro4Y4lzxQ31Zx9b\/cs1q3LVzw1Mnos4dnA1Ui3889WFlZhfGMAziAu9qlff3iB7iIzNLZDUe6BsVfAjJ2NUbmj8Gu9t+Acf7oQg8ownq\/gt\/ANMMzwVVbxWn101kp75ZYWRUYVmG2lHPMVQ45XXqs09BoKDy73P7p\/ektAym\/jiDEV2mYJG","iv":"f756939320f06334d1e916ecd09957ca","s":"62ca42e3663b3a69"}

Forevermark's "I Take You Until Forever" campaign. Image courtesy of Forevermark

Forevermark's "I Take You Until Forever" campaign. Image courtesy of Forevermark