India will become an attractive target market for luxury marketers as the country’s middle class grows and disposable incomes rise among consumers that are ahead of the curve on digital adoption rates.

A new report from market researcher Fashionbi confirms that the number of affluent consumers in India is growing, generating an awareness of trends and a resultant interest in becoming more fashionable. More Indians are becoming brand conscious in big cities and smaller metropolitan areas, courtesy of a big push by social media.

“Rising disposable incomes is leading to an increase in the number of affluent customers in the country,” said Dhara Kapadia, business representative at Fashionbi, New Delhi, India.

“By 2030, high-income earners are estimated to grow by 21 million, which is an increase of 51 percent from 2018,” she said.

Cut from different cloth

Being one of the largest countries in the world with a population of 1.3 billion, India also has a high customer base for retail.

A better Indian economy also means better buying power. International brands have been eyeing this opportunity, and India has come under the spotlight in the last few years.

The Indian market has some peculiar qualities, and there are some key reasons why it is deemed to be the next big market for fashion brands, according to Fashionbi.

The growing economy in the country is the result of a combination of higher employment, better incomes and consequently higher consumption. There is the growth seen at every level in the market, which means that there is room for every type of brand, and varied price points.

India is an extremely diverse nation, which also gives brands an opportunity to satiate the different fashion tastes in the country.

Dhara Kapadia is business representative at Fashionbi, New Delhi, India

Dhara Kapadia is business representative at Fashionbi, New Delhi, India

The rising middle class is creating a huge demand for fast fashion and value brands. Because of this, retail giants such as H&M and Uniqlo are going bullish on their investment in the country, while luxury brands are still taking ginger steps in opening stores.

India's apparel market alone is estimated to be worth $53.7 billion this year, making it the sixth largest worldwide.

Indeed, the numbers are on India’s side.

India’s spending grew from $1.5 trillion in 2005, with projections to reach an estimated $5.7 trillion by 2030.

Middle class households number around 140 million.

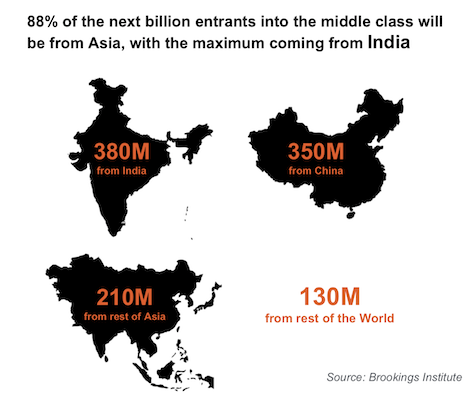

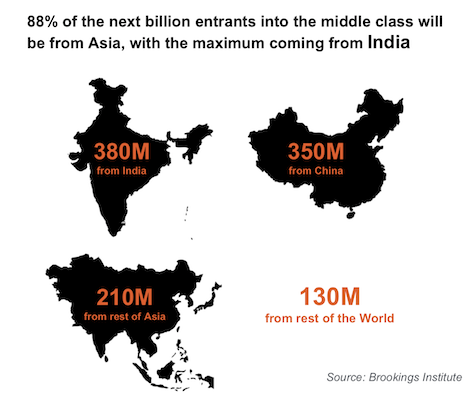

An estimated 88 percent of the next billion middle class people will come from Asia, and the majority will be from India.

The Fashionbi study predicts that 152 million new people will join the workforce from South Asia by 2030, and 130 million of these people will be Indian.

Middle class consumers in Asia. Source: Fashionbi

Middle class consumers in Asia. Source: Fashionbi

Early adopters

There are 192 million internet users in urban India, and almost as many in rural India. India has the second-highest number of Internet users in Asia, with 451 million users and 36 percent Internet penetration, second only to China.

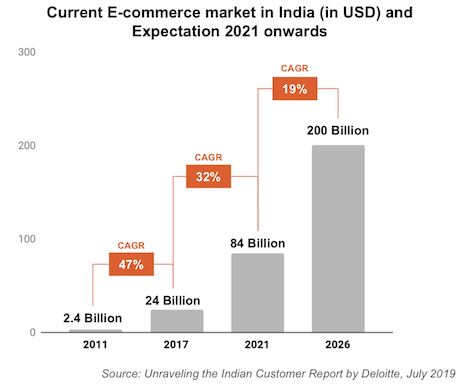

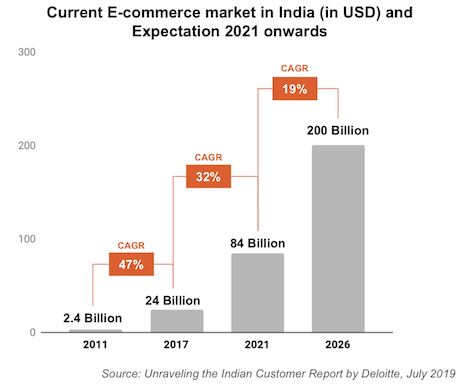

Ecommerce trends in India. Source: Fashionbi

Ecommerce trends in India. Source: Fashionbi

Ecommerce has had a huge impact on Indian retail. The country is expected to surpass the United States to become the second-largest ecommerce market in the world by 2034.

India’s ecommerce market was worth $24 billion in 2017 and is predicted to hit $84 billion by 2021 and $200 billion by 2026.

“Ecommerce is the fastest growing sales channel in India,” Ms. Kapadia said. “Through ecommerce, luxury brands can reach a wider customer base in the country. Brands can also offer shipping beyond bigger metro cities. Indian customers are very open to shopping online, and luxury brands should take advantage of this buying behavior.”

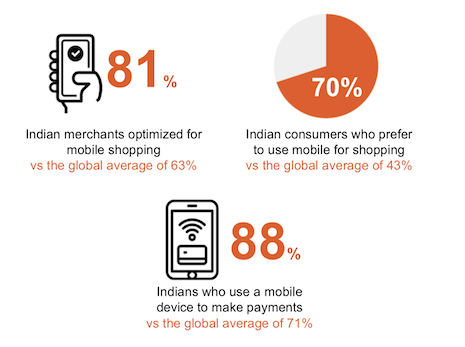

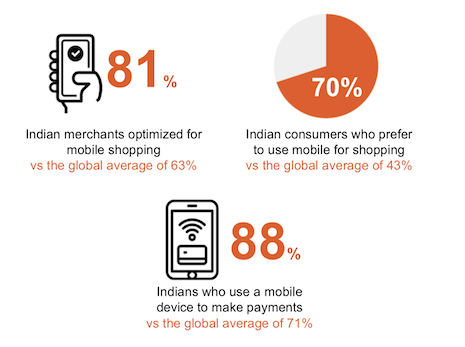

Mobile adoption among Indian consumers. Source: Fashionbi

Mobile adoption among Indian consumers. Source: Fashionbi

Mobile marketing

While only 13 percent of Indian consumers own smartphones, 91 percent of these people use their phones to look up products before they buy it and another 54 percent make purchases on their devices, according to the report.

This behavior, combined with increasing Internet penetration, hints at a big opportunity for luxury marketers looking to reach Indian consumers on mobile phones.

The Fashionbi report points to Future Lifestyle Group research revealing that mobile-enabled purchase journeys of apparel and fashion accessories have increased by 14 percent and 25 percent, respectively. There is a $5 billion opportunity for apparel brands and a $9 billion opportunity for accessory brands that can penetrate mobile.

Additionally, the report found that 81 percent of Indian merchants are optimized for mobile shopping, well above the global average of 63 percent.

Another 88 percent of Indians use a mobile device to make payments compared to 71 percent globally, and 70 percent of Indian consumers prefer to use mobile for shopping as compared to 43 percent globally.

“Cheap Internet data costs is making mcommerce available to customers in smaller cities and towns,” Ms. Kapadia said. “While luxury brand stores are usually found only in metro cities due to poor availability of premium infrastructure, online sales through mobile can help them reach potential customers in tier II and tier III cities.

“Luxury brands can also use social media to create better brand awareness in these cities,” she said.

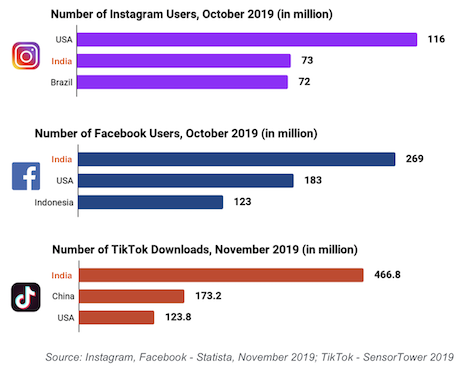

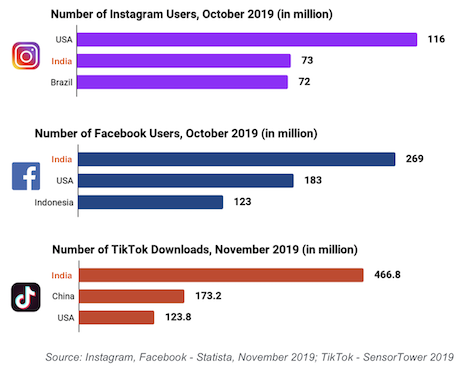

Social media usage among Indian consumers. Source: Fashionbi

Social media usage among Indian consumers. Source: Fashionbi

Social influence

As in other regions of the globe, social media is gaining influence on consumer behavior.

Instagram and TikTok are trending among Indian content creators and advertisers are spending on influencer marketing campaigns.

Facebook is anticipated to influence more than half of mobile purchases by 2022. Mobile platforms are expected to influence more than two- thirds of both apparel and fashion accessories purchases by 2022.

Social commerce is growing in India as well, with 57 percent of consumers reporting having made a purchase using social commerce in the past six months.

THE REPORT also found that regional content is the most influential in India.

“There is a growing number of aspirational luxury customers in India, and luxury marketers can use social media to create a buzz around their brand,” Ms. Kapadia said.

“TikTok is the best channel to create awareness and viral content at the moment," she said. "Facebook is the ideal channel to achieve conversions, followed by Instagram.”

{"ct":"D0\/cQ5DZFT1b32CdF+062tVwej87M5cHua8FQx4O3MnQz6uL2GKglWriAmiv6gvyGwtib5FZOQ5H3\/yJJzjSBqun1wFfLIIMTOlk4muj6Tk41ChaBvl2niUz2J\/wGvSWC2h1U5h1CSZ8VOSov2m\/ZLaOm6ko5qyroJWCF3pm4KbEwC\/Dsr0cylnt7djo7xmtCc+77Yawa3h5uPQ4uyC+WVkwBvWZRo5GYsGby0xb8HIKp6FaNad0D\/GkDKzlf3MSIySs+OsqXDXRTuO0Yy9Exy6A0y5zfbVqm695Mdxgxg\/2e+uwvhzZj1CgjgYWU+gZ9bghzimjfVUswm949ApOXtIhXLZh2ZjH7\/EXjfrBhBwzefITQjFBua9JPfzFSO9Mx6nrl3sC0natoLnS5v5trjy\/gOU5j+EOmDISjBjtpgJrtNydkZPhVdFuao5cMMYkwmsR\/UHUzGA4\/G\/J30iXYY\/EpVBVWnjZh2C2+RxzzFZQ0+rogHRcUtqm0rCcwovPPnOo+yKvPm6Sh27YFstehA2VxpdMtZQ1dv\/JmdnslA\/q4XJQCIfhiQBm21aH5JOC3n+3x7u8+rRKPeFJbkt1M9G4XzHVtWQgEcaoev8KuzMpSIJAO7I+tBICKEe6e\/y3RHjVMknX1kcfdeo5gihSiMufisNkFY8Y1I\/xZ5jC\/FF015fmiSpXhgzJzZtVUcZtWLE4OVhiqTgvyUyM\/8JAU3uGk0W+suK++AlwkIXrCACdKUX4RGrwnxdMXjjScZ5IAcpWTsCPFBV0NE4gW10CorHFhh2xKIH2t3379r1o+CUJXtPAH9oZLQ50tQIU2M4pyiSlAQCC5XdFc5eyrNC5weJ523xys1KxOBWzPtQY1t31C+Wr9zBkQx59SupwqtJayTwcrQtUC1yUbAk5q2tZmKhe1kBPCaOyB4edLhgdfB1q\/kyI0peouDBj1Qquan5GCF2IMd0iTIHSPlinakxgN5gEtLS36eEN3\/QmUOwOC3xSZzE+Ogcfcdr+W430\/xvag4TLWXuoODWak1p5D17FfVg1cSuj6o3UV8N87Tx5Sh9z9kz7bmomQP5vi5iddnVIcNvddVvN2A8rlJY9bwXwQcWffyyhOWesV91bh7suVqTaO5VKt69O5yo25\/KkDkG18kGwbZrWmLl\/P+E8Ksdghe0E8MF0RYwtIi7Tkvf25d9BVWqHf4QcEL0CLYCpc4ZtceMlOUva3vLb3Jn5bnKz75ALYb+3tZxoTqr5GjegZ5QGkP\/M5Wx5PsgtvVXlgLLriMjEwljOrpuL+jPK8HHL+MdfUP8NbyqJXBkIj2ZyFxrRk74rxBzSvR2Rb\/Qp6Or\/YRyRBmK1A8marLlY\/XeEoXod8wm1iaZHEfwsubZsRVpvSTxTXD4V5KjXJcIlMjTMymX6D5yzil4gK2hxAa4xqhtds4tWkQR2OpVKe7HWDuQ5+2eFc5A1IfaLE6ddVBmm3bZA5vbDKJsC4pwNCTrbflI0o7zo4ojr2bVunNL9MHbRYrNTQG4\/XNlAWHOu\/0ycd\/cf5LplZdTbGYZUcyyse4pyGBFI7gdwNbKH\/NhSHmQE6SVZbQrZjNkwx7Cy0wRgwjV1mRSd9OF52TvYTP0XjoA3qQeZgM7OTxnEeiqVm7q1XFLtJg7sWBL14R0FVwjn9o+H\/yOfnp5IWGgV0mBNjiV\/5AfIghlgQjozcBDkqVWQA95p6izblVXIO1DVAgQa9WFwWtIVYBIPRt6QmmjUUTHMcEi7OOS5nnM8XHgcf54Q+X0tbUV7aP3lUDrBSYiVgdAhzn1GGHAYpavhtQaERU\/zf219\/4seBY76nkqsGFRl5ecZU11ENk2vY9kPOnsseIxKlyOp8++er2PkScRZzrqYPTID5ApOqb0ht8TscgH7UUfcSOjORbs7gSvjXg+MaOuIjqkwCGXUgwvftiWp1evO8lnJTC70Ah610Wm7sIMNfj5Mjpz9snWcu0wxB1sSMAhOvRM2eMD2xJ2B7F2mjgv4j7g7DuYwIWJ2ZyqfY4XnKyN3mXn4Yi\/mXNjKqjXRoh01UeUT65r3le3m7H\/\/OS2\/cX3YlY0auX3noO8ICVQxx2Cj5TwobzH4ChzdermUoEpWb03ZQlKgieM267ap3TDOve8RzYiucb1zH0tFTzEaMAzEDW6pKYGXmKLAsH2fDUhcgtvIdtwLeqV+WD8Kam0IlJoVoh6TqPAT\/6yQ9oyP\/9CSrzyTafwl8KharKiwqRup8LmLSMupJ+IcG31jMF9c25QDNonEDc6e5xrBhQTZkZzdFAsEwQc3OxNs\/j5UC25hEoWPeiiN36cahE+VRFQLJ8nQZP+TLs9GT3W9\/noRs7cj0hA7RRVguKirkKUQo8e6+jO9DYW\/Y1Njqh4NH1kkuJqfC8PPi6znug1ta6iyZ6KVamxY3hwjb8+n0AT7DRBGhFqyfgKeYCZWrKxsX98h1iVAClnODJd5GPQHge4WIxqWT907z9eI5dWSnDFh9QTP28s1GcDM+vpMq0LLkAkkgcMRT1sUXQeA\/tkKoYycIJRYSuHjzbr1XlcQWliTm4ku2AyrHGrQOAuNZlkvHKNtJw3UctzVd7DqUfEMjfuHnwkkhT5RUfqdtHNgCL2YEj65wFCnrv6FByYJ22yng5VSCXBec6jLuxiElgK6JuILRmR8mbtKqkd2rdlQ8GnwNPXSWwBlcEwXGW60SpD4t2zCJnuccYMDqqCaGT3pEhg0H1Usn5Nxzjlxpta7IG4f6cuuIk\/9rpyJbLsRW9tVG3NN7oc8fLXtDFVEPh83l\/0fp\/lxzj75AJzf8e\/BX702WGnTxKJd6dwtTOlxz1NT03WlYwh1DjzrVagFaeDDiYA9tUtQDbjGphNS5TZ1D+q8fwsnSrsvWTzSD8zF4pn5KFavxV5zlWBYEx5KEydo7qz0E+TcLZpvgEfXgeqPolWlA8eH1NiKmPTmm0cDPWPe7JCwelhBHJmtC7qRznqgpbHZBbN7WgpfQCm9nnzig0CJ3JIg+SPWTEJEjjhR+Qs+SOe0PIutLxfIXDdr7u0ug5mkGf8ufLTpxso+iiOIGMdM9Uukhkb1O0ZjXeZ9txOX7ZDX\/ycUaFcwJUm1Us3JnOdBvsZY1LS5JldtweiJ32Uc5F8O6jx9XUAg\/7wOemtkx2kyP6yXfOgSy6WSTAqx9Aj2\/yMRZT1EQgjaBXwu0mSIenHJzhNVxS8hdWQ5Lu+Dw1tKXDt+15sxyUjnD60zhttm6NGCYLvOV5lC7qsskT4lBdBwP8MhPEBUj7FZbXdv\/MFzlQcZ2kgHq0ruGg2cPZNu9zZs\/t1w3cXW0WJccOWkpGgQqQMyw7T4+LD\/S\/VCaWjjssEyai9nhE3qHKcy+eFjiwmstV9RQfT5LFTAgoVXA70tZ9VM1mlUKrNMSDVFoCFoX1qqzBqXyCc3WyLOj1yi2W\/wHZx0WBYGddYAX+xZgCWnkGAt8qhzqP\/j0ypQebvqLdGQYMmG13Z3Vrtm\/MpwL\/PCpoz5qQu28V1mIjbA+4J2EjF9ywk2wwVyV2+ND0qLDq\/UAmILrrdY\/P12niDiZ4\/xJJJpQPrlOsZZwSS2rybFXFIi2LXmD9DNXvzAh4PtEdQpCiC+vkroYrbt81R5JJABXH8SSKn2dKx\/NG+FO5f6jBPWdkxjFrrndEdjgEWS6vIbhRnGMsJUqi2Gf0ju2OnwcRtjXJSIA1SPM34k3X4Zp\/so0vU0MfL1OD71u2k8FjULXX28+sCjjM3\/lWG4bGsaNbu9HZaKfeOp8f5Q9kkEEId6tVXWVdBdaBUT1Jv7udFhoe2KDNGzw9z0ZFl2JxOBG54q2YV2V37r7xMskK5n6n\/PWQBae76RhgH9GPiDJArTMOYNBUUgZet2lVxLWqsPQt1Su4JibGJwnAMryMf1R2dGrI2f22uC+d8XN+dccVo4CGzNHeOgWxdskn02NZfY2joRHqYulYQ0LXv3SZw8vMRXlEXH1Mr7XATaSNnN1GPhK7C13WqNmpC3XWAz5OWlWUIneZji\/qGpXP3HiFWlaISR1YiDRli3e6W0XYPE3rxThFV4q+8JmE37shEDXADHlHFDuut+x9jBVBNmoeWlc8I5um7RvCqfCTgpEKaPjPCIGER8NWDxtuZhpDcCC0iiMmmsh7\/iUpa\/NlVR3fdjXyraxELpy+q7VD+RnZYTLR7SJataZAgN5Wjl5AKpkzBCAqGPv85F46Uj7BQSv5dBuo7D\/N3vjnKPmimGSQhYnwTZqhyUEa9bY3Yw41gXvfVpATZ\/AvzhktR30QKTfBmQA\/tDuP1SpBeeSkDE53GwdaNJYfgg\/czFuvLqBmwOgt4HFUE60yeslCadhs7x2TPauthmOJW6pskPPX7qhcNpOHwnqAlDJW9qW6fe5lPgVgUqU0k9j1Ly8ho2bHCwafxw7nwcFB1EVfzdTFfRDRthKsCAi5C6oB2J\/7C6iL\/Bao3NetEZNe\/fcIhDT56GRawwhQJYXO1oN7EcyS\/BO14rxyu+ozZ4+Otr+rjK1AGmMMV8wY8PpTgFn0k6o+CidIqi4UE\/lJWiJ4Vu\/GjaFvrGY2XAsxb\/\/TTsu7+dAZUkEILgK4XrBomCRbo\/DKR7hKOcdLPut0YDLO9EkVpJtBs2OdBb\/Kf4oG34KrolZT\/c67zR1wiSRmkZJHYhGuPqaI5wHXgVtw5SLBjmrUXf9rCcY7z02nO9lprpbJ5kQk92cvGj31VcB3fcFlhTs\/e1kRBPGjtFLr0MT+o0XJVVkMAn8wryszn\/O5acauPoCPa8DUSaD8Ln8+LEHJvlOvrbRS3pa9aUT5bEqqdBJRpO9EGClr6h1Idk3QN3VJWfD6uyMaXGdiIy82LxVN2H\/X\/\/11bFSC40bQzPVrhEfF9xDI2zSu2XsFfkZWvwtmHS1Z05alFzTHeZcuZ4AA3rwujrvEil7C4H3+fix9NqEvhVyZgRyQnLrqxBIg8SmWwKMLFS1520NYlumPi+zhlRpQPEY9ky+8JpQpalWcXZaSFp6Lk9CatpSYWSxG0IOcs8e2Z6pYaZQTsj6GMl0HTZi89\/V5BGJ0zQG3skDcRUMVhoSWvN50zzVySyHAetrbA4Y7Js4bKv9HzXWgUdcTDV3g98z2P1ViFwfitVJvYVSFI1nhpPkfISm\/j9XyKFRktMjB+1y2D9TQ3zVuSGfJrqmXL64WI+TEzdTIyl3YHCb1BuZJ0DdcLPhwa8XaeV4Kx1eWNZWV82Tv\/9v\/2W+P9zQLueVpUex9fP+gACdx90DULLfrMat3\/TGRCg7iLWdvkJxNSOyjFA07uSoebyB8T4JPBGNlx6j3OM1Yxyp29J8MwK4nmwHuUh2Vxd8jOPavk1rn4mHzS3fjT6So9t4KC3z0KMfCEGv4xXgwbMFkMvJxEfsfkbLidqwJF55qzWMSv6mBSGsU9v3OplDjiKU69LVZITMaz25UcRhGIwiKmlzMmow0dntZ2oxAcTz54Qgc5a1V8sM5u4bkl6l1\/OVxqpc2tUmc4n2JToBXoktsLr6P9LhxVgPesyI6zYA4IcE180FMPuJ2zSnKvu1ew8dE34Pa9c1B8Tlb3d3BLsDnSDuOL7Vdo0gwfITTDCDbs8wzqMK9GcAMgeqvU4bJpmloA9zhH5BMSSI7qzU3CHyMdxq5UlEf92WbjBDMUdpMR19He1uOVkRvWibdcWoCDxoIH8Tl3R9UGbAf5lOdfz3dxcJ39PWRiSINahBNy\/q2MSbqWCTpxvZU0i2SmC47L8SWopEbzGK2hkwleBpmYh\/3T0IG5CbMQkBJeoLfvAg6sZCXPBk\/gfJ3B5waI+kNFgAUHVdYf+9PVK9WE4Cp\/eO+0EzZT6DvyutgmS4Pcw5M84ALRmQ1UFaTCrSkb1DLEeOv+n7i5wOyj5t4XJMa1pzmLuxclKD5HAbeN6x+A900A09MjjJCuBoSZn4eAPgqtJJsakXLArRIAMduPcj4Kx+0VnBRQU\/WNT7gsu03q6YtjIpb5ah4gG5u6xJQxq9CMv+AcibftLDt465CIV2uFKnbhXIEkmESmu4QgjO8d+uYyE37fIsLc0BwLy8Fi0XgTzNBBEgY6jmlVKEnGa1gpb4vM3nnl7v6jooR8XiC9CzOiJkq8xmdrMMUdgrYoHFwUW3cZwQ4Mq0+NRYG83iqZVQYdtvPwY6gx71EmUmKbePJUD0MpuO8nHMpCoHfbAlem43j\/zQZWW\/vP\/yqi90pkAPGC47DaBysJWjImKZTy1A0H0n22f1B12Q7dieZmvmP30TQ4+uDMvSuLaZ63DEPp29QSLTCkvDJA8TN6cyDrD3J\/F+kszAph+q83dcZ4JINDJyFSX+Zrz65H+KOsTK5Yxt5PYEznxS7S73TEl3ESksuEkEsA2fDcjhSP9PEMh21\/sjuavQshlBh+TNkMwCzZmnuvNAygExwiAevf0wTgXCjFfWdQmKqJwIqkaJyxOFE1FuXYBaU9QvYk\/bVi7wEgr4pR0IdsCEP3RJVbfxpeynfihXaTZG0IoV6M8NvAT0boOJIs3XrTyIspTAquybP9Ty6cMPvihctd3yXr38B0vM7AXN8h6vA2JIkg82xY\/cuwQP8WpjtoiN8mT8JH3BEgJ9vP8OYDw+t83gfskNADhbmE1y7Mmzbxq1YIwC+M7LsEpJBrrOysRtdOAT0ko+o1m6XlUnrXoJaQWN1Cmo\/SsAn2BVbEEft3UIHzP1nIEVIGhfhN+3q2R+NwuiecVavM03f9iGqn2hzswoQuUwDxW5TZGf929kW00fez2PuXLqwkzaTWNGVcSVBHKGlCrZ8\/75fFUD30YyYUDWLoJu7CD+vAAP4xk9SoKO\/a0eS0lyWcKRSwSfDEZJBpHsj\/\/nnGB5toxnTEa\/54hcVQ10b1nq6h+p8gDRs2Rg+kVKkGsxQmAz2vojuYioc9\/2E+\/1yklJlMW841wjwZyMIciHbqlkMyA1U8nRsagaKu0yplZm2lBrb3XcC6XgBKjQ0v7JM8Qo0avsp23tyeGHub2MP+EQXbuj7vFeoqVgqOdcyrXsjcHNO5TdW1M6\/P6oWI1V6Qahr\/dUawnezsNACh\/zbydvBjI8r+PGMplTJ3V1IAx5aIgBkfOM4309wZ382x9CE6L9BcafKHOysxBsr8O2Oq6Gxc\/2cTASA+uyTnvJQq\/WnAAn2omIWdVzAAQti2\/EseIAY5X3ra3my9JTvqexWEjopL3RvYsvQr\/JmG4Ddh5fxCEXxoLdbUiQfhM6Zj\/vjBggUQzvmGdWmir8e2N6wNDRL2teATi42icMsD0kpyN1hS47xr0ZxPknWr8SES3z1xuNkEDSDCqDw8AgjHuIldIqeppVf1pK7OcMffmPXDT7fRagAiy2GOqoUoZDPWN\/bV3dLWfvtVqvFO3yNwfj\/zOJohARKMEPRb81OQISQCz+LIs4YTjm8uwl3QokcrCqIPzwrDg3VZvUM\/BKBrxmv9HRsgwvZp\/LnlBxQhrBv3wftMbZkv2Z3TmPzwUQj3lqun4tXWgINIT5wnHJ020kXUBIzUBpXZdDpbEzvpnQ6XQ2m7F46TdZFyw2xoTS\/hF3NwTfZMiVeD\/uWo+mRSpKBpalnbs4vEXHy0c\/eJlryaZTaES2QcTrjm5KlJYT02AcOou+V1DFgvbM1EGGTzpTQaqtcUZ9XZK9zfxTwJG4WLTHym0X0cdj9BjDMDykDSGPgtE9mlYMm4XJuE4R2UmRM7sHE+gK5kylJkeV3YDAKzooSZv41spiBzD16ZPKiCtvqDlTse3EMCtn04P4VtDVoV0AVGteCmIQL\/p0gvOUxT5L1+nf2+lsTIfWXZLiN+ZUs738qNLpKKTBUh7wD8\/NbX1SQq9ueLxqZEt7yBzkCxl3luzJZVXpqRfJaQ5JJvlXt475DbWRmqrad0Guw4okTzQn5rsQ3Tkh9Wy\/c0Zm5Wm1BUAjL\/5sQHA\/WA4rxB9oP6zQv\/tiPzS\/TnXVJgNNw4CQpzxzY6s\/7gxbfm9iFSJ51xRvFu4CmcAWLm6BxdqHf6ERml32uAqEKxxgpEJwS4SPdXND5POR0UcOUkP\/weNVcVVzvFFlkfwFJGlBySc683oyW1lBh\/grVIGB7NasyKo28UQ2aUpNXr5gmJOKvGA++nJQC\/PE16GocyIorffyK\/LhN+0GYN+TZNudDpB3+Gf\/vd0vYqi0Y1X88pvLnuwakGXofqHjcnmMYztUzeMfiDtezOAWGHhrv2K7mTHzE\/WeLYsmPwvJXxEk0kppIexlvC+PdsW+sfDE+51SsQUw9CE7FNGFv8oktYQneBzu32bYshuQCxZDn928r98CaRkHnlSz20wOnC1+NMQFKXx1mW\/xWpSptaD3EgxT4ZWhKdQHodsUvxDNMhu5KPVouEN04DSBf\/EIf6bH+K4uL1pc4vuX\/VAIEacC4E5yIFnm0LfW8JpuipN+YP1yPvAwJQtWyysSk0w0qXrvTsVBr7E+xNHAA5EOa7KcJgjHOdAuL3KJ8yp+2lpjJe5DSw6L7dI2Kb2oIOxfV7vXazt47B2ELyjfcMb7ePjdxHNSZkb\/k\/wbepMhf4oPbPwj1auXBBwd0eFNRYcNGD7ZYP\/VXg4AGsSm0O8kaxbmlU2eePkiXEEQ+m+AWJH4JaGOGBY1KUgkikhSuOKxmHZCLRv7lMF+pSksm1BeCws1kI6UQXK5PBJiG0U5aD\/ybDR9\/JNT4oiYyPwv0bzBgslRfI4A8BajCCog+xrcSeUWCsFXr7VXKXtpdwGKJdzoVm55V86R\/sKXWqtqShb43aLBgNDPw6y2gkg5xu3\/gvU8KBA6ck4sZXHeoVVL0CjTG8D0F5DQcAVgQKCtthBd9\/0ioR+ASouAR3s5r0ivkXlkwheC6A+KzL3kSwanCHAp0tL+2B5SDhnl4v+trWI\/gbhQ0hub3To9MZnffmBaF5YYQKwgYQSVY4QvmLiToiWaRjB5wg5WnPKIGZ2mkqfk+SlhUs7EjhbuGCPZiOzKwMJHzxkVGSm+bFJ5KTkhsG+dCYV\/xGWvxYLvYtO\/HRrLZA1MzqF3h1XkuTd5V6qa2XN+6XW6SEqqRyxy0bcjj4D8\/\/X7xysCY49EmC9iUIC5ZRbZNbcRYJjZjgWzqh4OHnRc0mxL644eglXX3YxdzN6AjCsoh4pJQP4giQk1+Ji8DSI3m\/swiPmwM4BFrktDXIqMMeXL\/BSJupU+ilCe6AaanmMboZstWXOzzrtXqqRI08bnHcuAzaEk5xNQbmBLq5c+AFO2UciFtb9uOVHFrHA+7w79ZO4s6cHdAF\/knXOzFu5u1lz0xd+M6f+LDI\/4nThmLmC55MJBw0sjnNoDAQOJadydpGYH7lPnKKPLWPT++eJ49RKWWLeH+TykLNNqXC1psyyPsJOEL\/RtaeaiH3tXpSRjrvByu3pVDmAbJldG\/hKEjfj6FDxzFPtNabjj84rftx+VnJbUttDzyzNa5t9IzepNepYY35ABjC\/z+BJPxmegXsfGXEGLk44FWpPqy2edOvon1AlPcx74HsjWEy6g7Amp1RaF1Tv4y064A0bXukA3kFa4wrITKdOjNRuzBXExxDknC2jW8e8AFmfwTwdLv\/OhTP\/EwCOSX7zLMp0ttCsIWke\/nuBQicMhPNT69Kwp9sGkfMKTHjCWHAmxbIEXf80zNPmH32waQhvmbOwUQZ2X7IKGInIIkFj4qaWpSTzLbFWxlG6QndqA8iWCh+8iMkH3qXwXsVEyd6TSsgyr8SbOgOgDnGL6VU3UdCUDi3vO+wuNq\/cBYU\/JUmaZ2gWS2f+YWICgUfxcTn05f4XFr+F72tdTJ6Bkvw6l3EQGxp77BShCP7l+q+hgZwcJDOflIt2kmFZp5gLmrBpKN62VzfRU22t8entd890IvRydROh108ZD3Qy74iNUUOHLPnIu9lAGm+LpB+txXGG+yxReZdPhBDeR0V3kh4CisTL+287L+shcqPfrjIEoTtSxzjPWZOz+IfHPKx4MxnQvgdgw1549TDJaiMp9\/AG1Zo7\/i1uAkNoXw\/Nw3KZt4oWUaex2yGovvMAs\/FOuzehhS+FkIA9G8JDvJa\/rCe2N2aIkUh2UKWGdjt+HbzQVLoTGAnYzuqohVvUfOuKzaHcszhwDZatBJxb7FTuJJX4A7L9N7HYawPtC02ZcBBsqSGCsOG8t\/UwDtbiS8CEVoysFYfA1+mDM0mGsB\/hSMU2UvKOUSdov\/PrW0j8w7L0sr76iSAB65EsWYZKjp2JvZX0jtP0QSMB5hLkTVzSh+Dl10gwOX1yenUHMFFSHrHig1IUqO1dLPL89Sm5SZGWwCiwTdVTpdbJR\/8+mN+z8ACqp2CU+Z0Sy1y62EGNrujbctbPH+OxDS\/3IGVrFRLZnOD7oe1sU6bWxK\/u4asCb69O3KLJoFhBv9CV0m1V+NpIjw1GigyeFsxE8bXJ33jkLeQbLmVerfNFCzZW7LVxU8bA2C1lyAhv20HX9k2TByRG15JjkIKyKgUMiZ5KhUkSDg3v0fV1GmwC9cB0FjZZjHz950O8PsKYdktngGomxyJDEtRmKu8I9m5ImcWSJFk1Thf+9xGNsjdq7gTh9dXvqOyi8c7vjjqZgTjoTBhQI7DipNHlEpP+Qn71srnuqgbgQT6Qneh+shDjwKUGXtmIjM6cWIRNTqe9qAnr96Sik+4aNY0W1ESY3uMx2YScCVwUCxV17ZpKoU76HaHGkOV14oPNZyoGOZUWfRgdhasEVrpS7BYKaDYIWED3\/X1fj79AVMLycndZ2ZdUpMSrbL9Tmg+Kdx\/ZRHqZEyG8\/uMlrAsaK7pd3L8zNYesnmdHjY9Twzp2Hnw53A1ZN69WRU7GVz18fZYY+2LtI9l9fax4Emuk6A2PY+2b8FJhsihqaO0X90i6t6NP2zMH+arbpSckCaaRm5MNsGzzgz6PxMzu\/\/\/eiq6aoVwbv8vEFFWpCitBxYJVWb4mGQWTT1mL9eHTKXNiD0eELJFl7AKl7C6a+UJz1BKHw4JpQsfCOGjMptFj14iKMl2u2Kajeej8szLcSkSkqsHaSUeeN3saUJhSDlIWGwjNlvx0A67PzUg4kZyaGJShoiY6fezwUQw1cTB8FtCBlC78urilxQ9ibad3lmOnv0uoMv1YKwCReEl0inneDKdA+6uR0G63wEK\/8WJTl8p2znhwzSWZjpAQ7gFT9F5RFMjeutcQlIQmFZI4loui302Iq1Xb3DaEuoXIhXXEsnDyEcmMGtIlwjE5AJOgOokDLaZ7co69kNViDpPTSz97nkCoNimMBn1XfbncQ28IaHLe54yE02mT7p7XeN6dxYR\/OajvZnYy5lQCRdIHd5pNYLlphogGYeRZW72\/F5vfWrPSinSI37hJoZSFejUryMTWVskJWd0wEGEvQuKqWxzCOVFua3TuijoUvxX5OHf0j4hyiSa1cJHrtrmsiGQ0RcnXC\/Rb9hDJhQeI5p+6UGJMbZ3ZP1Z87lvIf82em7a4Gmdh6J8Q2XC2n28Xatv1KF75eSlWC8fsV0fT7AyBT\/eW7vzQ5cgTqDedZCe46pYp8C1D8vsBX4XCqOj5GnVAhWtxOVBra5BlSDGx6jTW\/MGnU+FDtVK6kQIN71fRfd7YEJFR63OzLtaIp7dFDbR5hWLNVqa1kWjuZ3oo54tE2S5rpP3Jj2foUoiPbOhU\/QYg2VURc540ea+GdMhUR2CHHnTPrK5QJqOT7D5MVVA6UrUzWB4TrFvbM6e+b0jrHkf2NjgFLVlJSGWEDPYF6KNhgYnUqd3S4O9PCN0u652\/LwaT7WhBFLRELVpUnyIuLyWsuesp\/zhKYHUllAbSQ4ERnp\/fCcXk+ige33XJaNHSoicNNqZtst751pf\/cLgAC4hq8iGnbe70zfeqDozu44SHxb4EdBruhCkzcTjsJx+QeLNH6DtYPETtCxtesJnAQ5k+jHBdioRCJAr2fpwCuDMtm7PORTf7SVRDCVKPf2zYNTun16vgi3q3ap\/1vaU8PDVLRQ7Frb37JnSz32Kja7R7COghKxQ7ViYqJHrbAeGrF3yzT0dWRp+wj4hlTI+S7522X0DAwxz9CigcHQIZulFfX12pNABZW1u\/OpWfw59RgThleKb3G5\/X\/6hN","iv":"e136cc9d9b1a90692aa341de8135c5e1","s":"ee92db4fb2e6b88f"}

India's growing middle class has become more trend and brand conscious with social media influence, thus fueling a desire for fashion apparel and accessories. Image credit: Fashionbi

India's growing middle class has become more trend and brand conscious with social media influence, thus fueling a desire for fashion apparel and accessories. Image credit: Fashionbi

Dhara Kapadia is business representative at Fashionbi, New Delhi, India

Dhara Kapadia is business representative at Fashionbi, New Delhi, India Middle class consumers in Asia. Source: Fashionbi

Middle class consumers in Asia. Source: Fashionbi Ecommerce trends in India. Source: Fashionbi

Ecommerce trends in India. Source: Fashionbi Mobile adoption among Indian consumers. Source: Fashionbi

Mobile adoption among Indian consumers. Source: Fashionbi Social media usage among Indian consumers. Source: Fashionbi

Social media usage among Indian consumers. Source: Fashionbi