- About

- Subscribe Now

- New York,

March 3, 2020

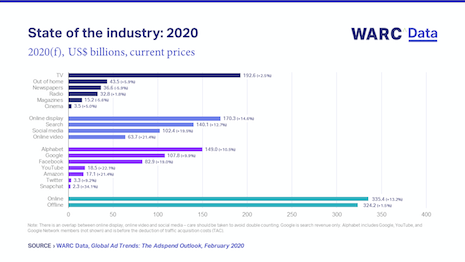

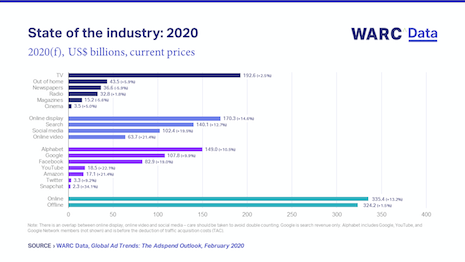

This year marks the turning point as Alphabet and Google cross TV in advertiser spending budgets worldwide. Image credit: WARC

This year marks the turning point as Alphabet and Google cross TV in advertiser spending budgets worldwide. Image credit: WARC

Online advertising will account for more than half of a projected $660 billion in global ad spend for 2020, with Google parent Alphabet and Facebook combined taking 35 cents on the dollar.

Combined traditional media is expected to post 1.5 percent growth to $324.2 billion this year, but Internet investment is growing almost nine times faster, at 13.2 percent, according to a WARC Data forecast. Advertising revenue for the Alphabet-Facebook duopoly is projected to reach $231.9 billion in 2020, having topped television’s total for the first time in 2019.

“Internet ad growth has been far stronger than the state of the global economy would suggest, rising seven times faster on average since 2015,” said James McDonald, managing editor of WARC Data and author of the research, in a statement.

“But, regulation aside, online platforms are bound by the law of large numbers, and revenue growth is easing for key players like Alphabet and Facebook,” he said.

The forecast clearly suggests that the duopoly of Alphabet and Google are worth more to advertisers than television advertising.

Search, display ads reign online

WARC Data forecasts that Alphabet’s ad income will grow 10.5 percent to $149 billion worldwide, equivalent to 23 cents in every ad dollar. Of that, 72.4 percent – $107.8 billion – will come from Alphabet’s core Google search platform, giving Google a 77 percent share of the global search market.

Video platform YouTube is expected this year to earn a further $18.5 billion for Alphabet, a 22.1 percent growth from 2019 and equivalent to 29 percent of all online video ad spend globally.

Facebook’s ad revenue is forecast to grow 19 percent to $82.9 billion, per WARC Data. Much of this growth is organic though the social network will benefit from the US presidential campaigns this year.

Amazon’s ad income is set to rise 21.4 percent to $17.1 billion, Twitter’s 9.2 percent to $3.3 billion and Snap’s 34.1 percent to $2.3 billion.

Per WARC Data, all will contribute to an overall growth of 13.2 percent in Internet ad investment this year to a total of $335.4 billion – more than half (50.9 percent) of the global total for the first time.

The traditional media total is expected to be boosted by a return to growth for TV, according to WARC Data. Spend is set to grow 2.5 percent to $192.6 billion, aided by U.S. presidential election campaigns and the Summer Olympic Games in Tokyo.

Also, losses from print advertising are expected to be half their recent average, while radio (+1.8 percent), out of home (+5.9 percent) and cinema (+5 percent) are all expected to post gains.

That said, traditional media showed the first growth since 2011.

WARC DATA research acknowledges that the projections are subject to the severity of the unfolding coronavirus outbreak.

“We are yet to amend our forecasts in light of the COVID-19 situation, as we would expect – if the crisis is contained – displaced spend to be reallocated later in the year," Mr. McDonald said.

“Advertising’s relationship with GDP is strong, but a slowdown in economic output as a result of the virus will not necessarily translate into reduced advertising investment,” he said.

“If events such as the Tokyo Olympics and UEFA Euro 2020 tournament are postponed or cancelled, however, we would expect a notable impact.”

Share your thoughts. Click here