- About

- Subscribe Now

- New York,

April 17, 2020

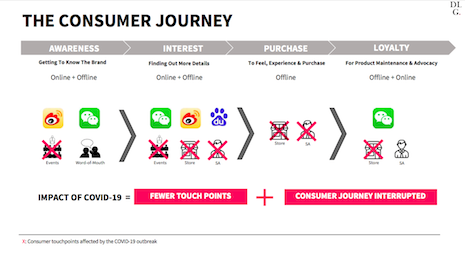

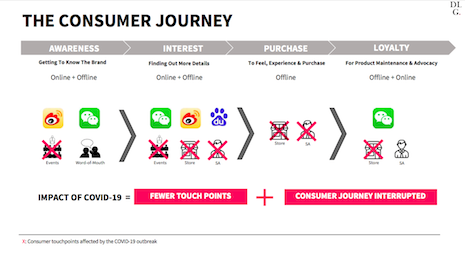

The Chinese consumer journey: Crossed-out signs are consumer touch points affected by the COVID-19 coronavirus outbreak. Source: DLG (Digital Luxury Group)

The Chinese consumer journey: Crossed-out signs are consumer touch points affected by the COVID-19 coronavirus outbreak. Source: DLG (Digital Luxury Group)

By Lydianne Yap

Last weekend, French heritage label Hermès reopened its flagship store in Guangzhou’s upscale Taikoo Hui mall following a period of remodeling.

While figures remain unverified by the brand, sources state that the store raked in more than $2.7 million (19 million RMB) in sales within the day, bolstering hopes that Chinese consumers are, in fact, back to their old spending habits as the COVID-19 situation continues to stabilize in China.

While the health crisis continues to play out in Western markets, signs are pointing to a slow but steady recovery in China where the virus first broke out in late-November last year.

After months of being cooped up, consumers are gradually venturing out of their homes and heading to restaurants and malls – where brands are hoping bouts of “revenge spending” will take place as a result of pent up demand.

That said, fears of contagion continue to linger.

While many Chinese shoppers have stepped outside, a sizeable portion of the population continues to avoid crowds, opting to stay indoors.

How can brands continue reach out to these consumers and capture their interest and purchase intentions during this period?

DLG's (Digital Luxury Group) latest study on the digital strategies that brands can leverage in China as the nation rebounds from COVID-19, offers a few insights on this front.

Diversifying content channels

For consumers choosing to stay home, mobile phones serve as a window to the rest of the world.

Chinese users reportedly spent 20 percent more time on their phones during the extended Lunar New Year holiday period, with usage of social media platforms such as Weibo and Douyin growing by 31 percent and 102 percent, respectively.

Tencent also posted an increase in the download of its apps in February by 32.3 percent month-on-month.

Most international brands are on core social media channels such as WeChat and Weibo in China.

However, given the diverse content ecosystem in the country, alternative platforms such as RED (XiaoHongShu) and Douyin can also be considered for brands looking to grow their exposure.

While the former is a social shopping recommendation platform built around user-generated content – making it appropriate for content seeding purposes – the latter is focused on short videos and highly relevant for those looking to make an impression on younger consumers.

Then there is the all-new WeChat Channels, a strong contender for a share of the short video platform pie.

Likened to Instagram, Channels is designed as a video feed within the WeChat ecosystem and can be integrated with various social components of WeChat – for instance, brands are able to share links to articles on their Official Accounts within a video post.

“Channels follows an active content consumption model rather than a passive one,” said Pablo Mauron, partner and managing director for China at DLG.

“Users have to actively seek out video content they are interested in, unlike under the WeChat Official Account model, where they have content from brands pushed directly to their text message inboxes,” he said.

Mr. Mauron goes on to add that this is why WeChat Channels could potentially be highly complementary to a brand’s Official Account – compared to Official Accounts, the manner in which content is fed to users through Channels is less intrusive.

“As WeChat continues to take on greater role as a CRM and lead generation platform, Channels can potentially play a key role in top of the funnel marketing by helping to generate awareness,” Mr. Mauron said.

From all accounts, it seems the Chinese luxury market is bouncing back, but the roadmap to recovery may not be the same for the West post-COVID-19 given China's inherently digital lifestyle. Image credit: Luxury Society

From all accounts, it seems the Chinese luxury market is bouncing back, but the roadmap to recovery may not be the same for the West post-COVID-19 given China's inherently digital lifestyle. Image credit: Luxury Society

Exploring livestream options

While the West is just beginning to toy with the concept of hosting product launches and events online, the livestream model in China has already reached a significant level of maturity.

In response to COVID-19, Shanghai Fashion Week collaborated with Alibaba and moved its entire event online last month. About 150 brands showcased their fall 2020 collections while selling items from the current season via livestreaming on Tmall.

Long exposed to the model, Chinese consumers were quick to adapt to this new normal, making the process of taking activations online that much easier for brands.

In addition, the livestreaming ecosystem in China is well equipped to support the consumer journey – from awareness to purchase. Most livestreaming platforms offer direct integration with ecommerce.

Coupled with the power of celebrity that has proven to drive sales in China, livestreams helmed by top KOLs typically generate significant returns for brands.

For instance, top beauty livestreamer Li Jiaqi sold 15,000 lipsticks within five minutes, and generated more than $145 million worth of sales on Taobao during his streaming session on Singles Day last year.

Among the more popular livestream platforms in China are ecommerce-driven Taobao (linked to Tmall), short-video favorites Douyin and Kuaishou, as well as games and entertainment-focused Bilibili.

With the exception of Bilibili, which is best known for its anime, comics and games fanbase, all of the aforementioned come with ecommerce functionalities.

Most recently, WeChat also joined in the livestreaming fray with the introduction of Kandian.

Designed as a Mini Program (mini apps within WeChat), Kandian is seamlessly embedded in the WeChat ecosystem and offers ecommerce integration as well.

While livestreaming may not be able to fully replicate the offline experience, it is certainly an effective stopgap measure for brands during this period while the offline consumer journey remains interrupted.

This may prove especially effectual in China, where shoppers are already familiar with the notion of livestreaming and will be more receptive to brand efforts on this front.

DLG China chief Pablo Mauron speaking at Luxury Society's Paris Briefing

DLG China chief Pablo Mauron speaking at Luxury Society's Paris Briefing

Embracing ecommerce platforms

While Chinese consumers were focused largely on procuring daily necessities via ecommerce at the start of the outbreak, sentiment has started to shift and shoppers are now turning their attention to non-essentials as well.

This deviation was especially pronounced in early March over Women’s Day, when many brands tend to run promotions and discounts on items targeted at females on Tmall. A peak in sales on the platform was observed within that week.

“There is a variety of ecommerce platforms and business models to choose from and brands need to assess them based on their brand positioning, equity, target audience, and level of investment,” Mr. Mauron said.

“The ecommerce landscape in China is not an easy one to comprehend or maneuver, but it is important for brands to be where their clients are,” he said, further elaborating that unlike in the West where ecommerce platforms focus solely on the act of transacting, platforms in China also serve as channels for search and discovery – making it that much more important for brands to ensure their visibility and presence on them.

Reactivating existing customers

As disruptions to the consumer journey diminish the prospect of recruiting new customers, it is important for brands to tap on their existing network of clients and followers.

This is especially important as studies have shown that consumer intention to spend on leisure items has been on the rise. The onus is then on brands to capture these purchase intentions and drive conversions.

With the rise of CRM and clienteling solutions on the market, this process has become increasingly streamlined and optimized for brands.

WeChat Work, for instance, allows sales associates (SAs) to connect directly with clients through the country’s most ubiquitous messaging platform while giving brands control and governance over assets shared by their sales force – something that was not possible previously as SAs were connecting with clients directly through their personal WeChat accounts.

This then further empowers brands in managing and regulating the contact made with clients, and also creates the possibility of building richer client profiles through behavioral and transactional data collected.

Loyalty and membership programs are another area that brands should consider investing in, as they not only encourage and inspire return visits from existing clients, but offer brands the opportunity to convert prospects.

However, for that to happen, brands need to make sure that relevant features that support the consumer through various stages of the buyer journey are built in.

“These programs should also focus on offering convenience, exclusivity and recognition to customers instead of relying on discounts and incentives to reactivate consumers,” Mr. Mauron said.

Lydianne Yap is China editor of Luxury Society

Lydianne Yap is China editor of Luxury Society

Published with permission from Luxury Society, a division of DLG (Digital Luxury Group). Adapted for clarity and style.

Share your thoughts. Click here