By Deborah Weinswig, Marie Driscoll and Carol Zhang

Along with other nonessential retail sectors, luxury has been hit hard by the global coronavirus pandemic. Luxury brands in the United States were forced to temporarily close stores, and international factories producing luxury goods endured closures as well.

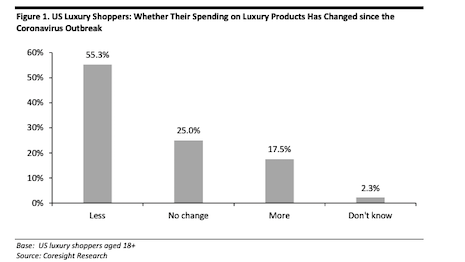

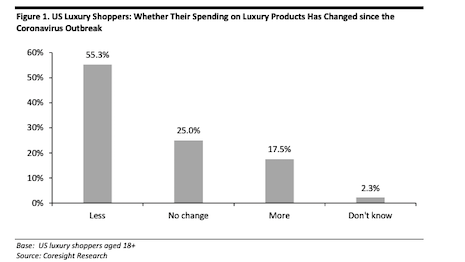

Over half of U.S. consumers had been spending less on luxury products since the coronavirus outbreak began in February, according to a Coresight Research survey conducted on June 12, 2020.

However, the situation is stabilizing, with several “green shoots” pointing to increased spending by U.S. luxury shoppers.

The rapid rebound of the Chinese luxury shopper may well be repeated in the U.S., barring further waves of the virus that force re-closures and the implementation of quarantine measures.

We expect improved sales trends to begin in tandem with store reopenings, but it is unlikely that the luxury market will see a return to pre-coronavirus levels until 2022.

The coronavirus crisis dealt a significant blow to most discretionary retail sectors, including apparel, beauty and luxury.

In this report, we discuss the implications for the US luxury market and how its recovery could play out, incorporating proprietary consumer survey data. We also look at the early rebound of the Chinese luxury consumer post crisis for potential learnings for the U.S. market.

The heavy impacts of the coronavirus pandemic

As in other nonessential retail categories, COVID-19 caused widespread store shutdowns in the luxury sector. Furthermore, major players in the industry announced the temporary closure of production facilities amid the crisis.

French luxury brand Chanel announced on March 19 that it would gradually close its production bases in three countries: France, Italy and Switzerland.

French luxury brand Hermès temporarily closed 42 production bases.

Chinese luxury consumers: Depressed demand and spending opportunity

Chinese consumers accounted for 35 percent of total worldwide sales of personal luxury goods in 2019, up from 33 percent in 2018.

However, China’s luxury spending will have been significantly disrupted in the first quarter of 2020 due to the coronavirus pandemic.

Looking back at the lockdown phase of the crisis, we see that China was hit hardest in the first quarter of 2020, with the luxury industry mostly affected from February to the end of March.

The overwhelming majority of Chinese tourists canceled their international travel and spending plans from Chinese New Year at the end of January, and their desire to shop (especially luxury goods) was significantly depressed.

According to data from Fashion Business News in China, in the five central cities of Beijing, Guangzhou, Shanghai, Shenzhen and Wuhan, foot traffic in luxury shopping malls and flagship stores during the coronavirus outbreak fell by about 80 percent year over year.

Furthermore, flights were temporarily stopped from China to Australia, France, Germany, Italy, the U.K. and the US, among many other countries – eliminating potential international luxury sales during this period.

U.S. luxury consumers: Lower spending, fewer visits to malls and less traveling

According to a Coresight Research proprietary survey of U.S. luxury consumers conducted on June 12, 2020, more than half of respondents reported that they had been spending less on luxury products since the outbreak of the coronavirus in February.

This reduced spending reflects the shifting priorities of shoppers due to the unprecedented crisis – with a focus on health and essential categories over discretionary products.

The retail shutdowns in the U.S. from mid-March also reduced spending opportunity in all discretionary sectors, but with luxury lagging other categories in the adoption of digital retail – having only embarked on an ecommerce/omnichannel strategy in the past five or so years – sales retention by luxury companies was severely inhibited during lockdowns.

The reported decline in consumer spending also reflects economic uncertainty: The performance of the stock market is a factor in driving luxury spending for nearly 20 percent of survey respondents.

Notably, 67 percent of respondents in the $175,000 – $200,000 annual income bracket stated that the stock market affects their luxury spending; the wealth effect exerts more than three times the average impact on this cohort.

Although stores and malls in the U.S. are now gradually reopening (as we discuss later in this report), most of our survey respondents reported that they are visiting shopping malls less often than prior to the crisis, according to our survey – reflecting that health concerns persist.

Actions taken by luxury companies to help fight COVID-19

With luxury shopping on pause during lockdowns, many retailers diverted parts of their operations to assist in battling the coronavirus pandemic.

- LVMH Group (parent company of Dior, Givenchy, Guerlain, Louis Vuitton and other brands) announced on March 15 that its perfume and cosmetics production lines would produce hand sanitizers and disinfectants to help address such product shortages in France.

- Hermès announced on March 30 that is would donate €20 million ($22.5 million) to public hospitals in Paris, France, in addition to its donation of 31,000 masks and 30 tons of hand sanitizer produced by its fragrance manufacturing facility in Vaudreuil

- Masks were donated and/or manufactured by numerous brands to assist in combating the coronavirus, including Guess, J. Crew, Kering, Madewell, Mitchell Gold + Bob Williams, Nordstrom and Off-White

- L’Occitane has donated hand sanitizer and masks

U.S. luxury market: Signs of recovery

Consumer sentiment

Consumer sentiment in the U.S. is stabilizing and showing initial signs of improvement, according to Coresight Research’s weekly surveys of U.S. consumers: We have seen a recent decline in shoppers’ expectations to avoid shopping centers, public places and international travel.

We believe that expectations of avoidance behaviors have hit the nadir, and the optimistic signs of consumers returning to pre-crisis habits bodes well for all retail – and luxury specifically.

Furthermore, our conversations with executives at numerous luxury brands in the U.S. reveal that during lockdowns, consumers had been engaging with brands online and via other touch points – such as through social media, by placing orders over the phone and by making video-call shopping appointments with store associates – and they have expressed eagerness to return to stores when it is safe to do so.

One global luxury brand told Coresight Research, “Our clients have not stopped shopping and are calling regularly to complete a purchase and arrange for its receipt.”

Another luxury executive told us that “the luxury shopper is fine; it’s the stores that are closed. Address their top concerns of safety and health and they will return to stores and spend. Meanwhile, consumers have happily adapted to alternative methods of making purchases.”

Store reopenings

Luxury retailers and department stores have begun to reopen bricks-and-mortar locations as states lift shelter-in-place restrictions.

So far, a number of reopened U.S. apparel and luxury retailers have reported stronger sales than expected at reopened stores, exhibiting pent-up demand for nonessential goods and shopping in physical locations.

After a few months of quarantine and self-imposed isolation, consumers desire social interaction in retail formats if they perceive it to be safe. This bodes well for many monobrand luxury shops that are palatial in size and can easily support appointment selling – two attributes that help mitigate the perceived risk of infection.

- Capri Holdings began reopening its Americas and EMEA [Europe Middle East and Africa] store fleets in May, and has since seen reopened store revenues reach 50–75 percent compared to the year-ago levels. Traffic at reopened stores is trending slightly better than expected, and conversion is meaningfully higher than expected, according to company management. Capri Holdings also reported that ecommerce growth accelerated significantly in the first quarter.

- At LVMH, the COVID-19 crisis impacted the second-quarter results in Europe and the U.S., but management expects to see a gradual recovery in the second half of 2020. Digital sales have increased by as much as 100 percent at some of LVMH’s brands this year, the company reported.

- During its shareholder call on June 2, Urban Outfitters reported that it had reopened two-thirds of its stores, with the remainder set to reopen by the end of June. Foot traffic and sales levels in reopened stores was tepid at first but improved each week. Digital online traffic and conversion has exploded since April, and the company believes that strong double-digit underlying demand could continue throughout the second quarter.

- According to a June 18 Reuters report, Chanel’s CFO said that some 85 percent of the group’s stores had reopened and that it had seen sales rebound in China – by over 100 percent in some weeks. Chanel also reported that shoppers were returning in Berlin, Milan and Paris, too.

- By July 1, Macy’s had opened all but six locations, and initial sales trends as stores reopened were stronger than management expected. The company reported a few encouraging signs, including a steady, modest improvement in sales on a weekly basis at reopened stores as well as strong digital sales in each market.

It should be noted that luxury venues are among the locations best suited for implementing social distancing measures to ease shoppers’ concerns in the wake of COVID-19, given their typically spacious designs and the shallow levels of product on the shopping floors of luxury brands – in both department stores and standalone shops.

In fact, according to WWD, president of Saks Fifth Avenue, Mark Metrick, said on June 22, “Even on our busiest day of the year, we don’t have that many in the store; we were built for social distancing!”

Positive factors for sustained market improvement

The coronavirus crisis has changed consumer behavior in ways that could potentially benefit U.S. luxury spending:

- Less international travel: Our survey of U.S. luxury consumers found that 30 percent of U.S. shopper’s luxury spend is on purchases made while traveling abroad. This spending may be diverted to the domestic luxury sector in 2020 and 2021 if consumers prove reluctant to travel in the wake of the crisis – which would benefit U.S. luxury brands and retailers.

- Preference for product over experience: New products are the most important driver for luxury buying in the U.S., according to our survey of luxury shoppers, with 41 percent of respondents reporting that new products determine their luxury spending. Furthermore, with the coronavirus pandemic having caused many experiential venues – such as theatres, performing arts, museums, sports arenas and restaurants – to temporarily shut down, the secular trend of consumer preferences turning to experiences over product is likely to reverse. Prolonged social distancing restrictions will further fuel this trend, with experiential services typically being allowed to resume at later dates than retail in many U.S. states. Luxury brands should be encouraged by Sotheby’s opening of the art market, with a record $363.2 million modern and contemporary live auction conducted on three continents simultaneously on June 29, 2020. This attests to consumer interest in expensive discretionary items despite the recent lockdown.

- Demand for enduring value: Looking back to the Great Recession of 2007–09, we observe that consumers look for products that hold value following a destabilizing event. For example, fast fashion is superseded by classic silhouettes that are timeless and so hold longer-term value. Luxury brands with long heritage and superior quality build consumer trust and a sense of security – qualities that consumers desire during periods of uncertainty. Post-COVID-19, we could see this trend benefit the luxury sector, and the Sotheby’s art auction mentioned above indicates that wealthy consumers are seeking enduring value.

- Omnichannel shopping: More than 80 percent of luxury shoppers make such purchases online, according to our proprietary survey.

According to Mailonline.com and CNBC, ecommerce drives consumers to make a store visit, if only to avail store and curbside pickup services.

Luxury growth to resume post-COVID-19 overhang

We expect that the post-crisis overhang will affect the luxury sector through 2021, but, as the sector gains momentum, growth should return in 2022.

Our weekly surveys of U.S. shoppers ask respondents who are buying less of any products how long they think it will be until their spending will return to normal (i.e., pre-coronavirus).

As the pandemic progressed, we saw a rising trend in consumers believing that the crisis would impact their spending in the long term:

The “longer than six months” option was selected by about one-quarter of respondents in April, increasing to around one-third in May and early June.

We are likely to see this have the most significant effect on discretionary categories such as luxury, with essential products taking priority for shoppers amid the crisis.

Looking back to the 2008 financial crisis further informs our estimates of the luxury sector’s recovery following COVID-19.

Selected luxury brands experienced only one year of an aggregate sales decline followed by a return to double-digit growth in 2010. Applying this to the current situation, we would see the 2020 crisis impact 2021 luxury growth, before the sector bounces back by 2022.

China luxury market: A rapid return of demand

China experienced a rapid return in luxury demand as the coronavirus quarantine came to an end.

Although the progression and containment of COVID-19 in China and the U.S. have followed different trajectories, we can derive insights from Chinese luxury shopper behavior post-lockdown to inform expectations for the U.S. market.

Luxury companies have also reported physical retail trends steadily improving in China since late February.

Looking ahead

Coresight Research estimates that the global personal luxury goods market will decline 20–25 percent in 2020 to $257–$274 billion, from $343.1 billion in 2019.

Although we do not expect to see a return to 2019’s levels until late 2022, we anticipate a return to year-over-year growth by late 2021.

Luxury, like most nonessential categories, came to a grinding halt due to the COVID-19 pandemic, but it is gradually recovering as stores reopen and retailers adapt to the new normal.

This report was authored by Deborah Weinswig, founder/CEO of Coresight Research, as well as Marie Driscoll, managing director for fashion and luxury, and Coral Zhang, research analyst. Excerpted with permission.

{"ct":"r69YYSTM+TbE+FfWAOVGNbicwlv49vrMz4j7DojDSr\/5h\/6c6mDZn9\/Q4eqAFTbFYj7w4YixqM\/a50c7JKjEEdIZo\/\/FJ1o8gdyJxklr+jDNwvi7jvnHCXAbuBlueaIbiqe1i+GWXi3CA6bZ3GVLEmZmBJe2KFPNKZ9FMrEWY9VnuF+CbJ9ExLZbjvEs73yQbtVJ\/kUkkewcFKXAEXYf2EKKP+IOXyyLBZsVGTL3fbjRkWoN2kcZwV62CuKeuQ9znmA+7Xnrqknphy5Q3smqwshAdOwMQ\/F+6lLTGLUNKsvxnWO0\/9LAm\/qlkD1qEydEKmFJOYApajB+wiEZuNqV8RQiAeTfuMisRozD\/jtv4PRDp8zfneIx\/0Xg4SLk2cvZbYWL7btPJgeNIbF6YoPYjGtSupntqA+DL7cHFQbGszTpkHmk\/u7+P8Ve5f3K1shcf3bM+YwnftmEYB9oDyztr4D34Zp+UDoIjbJdLC+WlHPDRt2UyT8wR4p2bTnT6Dg9672viqx6u3z2OT6gA\/DpFbAMj56+tc09CW6Nx4fTP0Qkh+A+5mbX5SWRZ9fNcdbgeK3u59Pv4MAM4f1PuAbcZAithuwccs4aJ4XOoFTkwIIyaKgW0cULCacA4xhI+qBft2TzvJogXLBM45c4WvhDYvkMYnfws7kFVkqzpryHiIOFOZSDj\/ZOSagbvgjnoeYYVXVJJks3xVXUZWJ0i60HZAUP7Vat71ep1XadIv7hV2h2KOlYau3MUqQzKTD762S\/NR81yqmodfHZZ6v7kZDIiitVlcYBQbGZdCbOG7gv1fgY1Jpek1HG0GAPifmCL+Niy9\/y5xwq8oi8As3WFUVBLsMVX6xMGY9ZtIpQ2CyBWiKYWKmW5WCEqVWt1TkwcuHU+dv4K1qFDPCQrMrfFQ2XHrnTZf5w1zORalLP\/g+SuJxIWNuI2yndjLWTVdDZ0UL1Yizyqq7PS6+xNEG0r0cp2FR4zGD4NcKPJAbWgrlQRaYLvl5Pk\/uZo1qMWZid5XucUTeHxd2Kfox0yjBl0bgEOZ7qXxsff9wjiib2V3k7S9UsFg3e4s0LnY75q\/2jZW+wKKqwq0SPGk4\/rD+Ox4Ej4kV4Qrou\/NdwqMG8\/5KPYCt92cpfi4ra\/RGuehvJ8CaEzvwgOdINzHos19k9JTQ92T8TX+kZ0GhSwPkWGc99QROMp2DqTSRLLzoR62h0x2yqFYdJWVF48kGwxd6lOhXO\/vX6OXZuc1ERiZNHO6G9hkk5INQszXWWuiHe9vS6t+RBECy9yfgqkP29hIoAkaoWBg43\/CCZiRiZ6Jqw80QJ4odh7ZoT7litoXD0NPidAvrCOLEcFPoEotYfrEEATOJXrQeyQNAgapIDSZdjVlWFC2cXUOdQJvIzCSQk1sO4u3wyFTP8\/4TydUgWUzNSA7SxtKj8T0Z12FL2\/lxUDJ92fuIHC61mKDf8LV+z3iZiZRDdsEe\/BjAcf7+Q\/zshnSICPCmxHuqsyJ7vq7wAmLODlhxumUftKJzYcjUAO2Kvxh0wvd\/Hnlpy80XgCIEY6TwnVKEwRFvn9bUoI\/VJWJGkC\/1K815p2ODvlBjAwB873ndKH05ve+k88uwgu8QX7BXTaRQa5\/UJi2X4NxEoKQyNKhHoCD0dHP4za21ZFYJ8DIVMviC5tRkFeXn6\/TYLwNmIprFxysrTx1f1WsqHk44ZBMFQe3xg12qGHnNWbTCDmv4e9spqcCLMuOuaAeeEf1L1uVlr+1nDwetGKRnzVyHjcmm4wN5NpN38nUf2vjsTXNTF\/4RkI4RV2Xl8GB3UasVZDjrozzRi8fTt8E5fV+RltKFPlaYvpMIYofrEfxD5TlEcgjSzh7mLTZ\/ubWhcDoVdQJ\/L036oj4anY1411tbr0HmocYi1kdkua7wLNl993cCRLMtXWXMtsH6Uke6T5a4Qnhfd+XpbbWJOo66J+h9jpUYCxTZ2eLq0v0a8eLfRf1rASSSfKU+eCC9njvc\/XQwIVxWJvvz9lfKrMPCq4IITzTDoWEo3GsgYdnWMVqcyiEEDA2IPcmk6xF8JvRPnuqa6HqrMtmpMEJrRHLdCx4fWrv6laxrVF0XTMS97r45LKTHL+fmdiQhzLX5iu8eZkdhFxr2RoIPeugD7z8\/vE2dYRJSVMS45Yk2Nb3JxgB4de51T3hdSaw\/1qcQE54N1RQ9CuwIhHR7eG7DYRr\/jPclmDTWlmKVkRBog5kCkUtkRI+l3Z4LBIgPLLEWVxGJ5selFdVwV2XGytS\/wKnK0leB2L\/mvVWlZOBQBNrw7D36mRfi13W8qD0I4ONV1Xl4jxBeqKiQJdRNi3Xr5\/+wOE5oX7ehe3i9Ffnndn3ogHBkTh5StScQWrVrnZk\/YnpYWIjCFTRaBdWTez\/WVMbvw9v4VZ5kSOqiezV0AmUSefC5dw3gM73iFJOel+o03yyiUXPPDe5h\/\/plrqVktZCOvee3ZZRwCIGVIWSn+WNqN+QOBxu6O3kkL2Kll03cECXYap8uoVjFWCKB0ZcOEGynw7OlzioYOZZm5omhNktprHV514mSIm98czZVqnQyW2Oudyq+GmwCYvw5yxuG8Fl0wekyT84Dz2K9ayvsXC3f8h5ispKuNZuoNeoat\/zFoP\/rKICB114FlXHoLrO2wJOHPMXc3srdh\/QrWhrOzlLJjt7Mn0dDptAenUTIEBrwnJpxGSu4TIewdZlclziK+40fP6CYRK5XLyusBnR4QOISjVtsW7IrwvgLKUgDilfP2Nti1lLCAMnY\/PQpiV+LM1tQ3Jb\/3cnkpulOrAbTxAkLkJKa39lT00hLnUdifBA+anuap\/vWBjE3d4gjAirsDT1VA6hGqQpGtekXr8QrvWoaNE9EcvqcCbLUZkjkb23yvXEIOLIWcllChciZ0PJNNT6MI6bHboMIMi5\/gNP8dfOS27ODJaK\/pUS3MFeDnzp42wSLH5MO7oo2JOHwHEXHrb12ltn2oAvLWsnvyy4lr8gDkYlt0Na\/UwFYRJ2WUdOUTBcb+x0iHagIxy3qyruDPMwVOd4N97sZUEFJhNVyBJarpfQvG3l0JOZzzoMh+6hQ3maoPeBPMdEwiuIeI3DBBa905LPIzK5S+n2mnB3RgY2KjNgsiJxCUbr41+RKzpJ1J4iqaj1zWZznmWIUHwB7kMHqAyALIAC3yIYFSKxGhbbf1yVfuSzKASIH8HgWbmlAg+omKnJy\/DlW24jGy4xN5wN5EXpDQtSiyNM580ieo\/0FWx+km5FaALAY2ZhxIl5d3Vw8xARC4Np+EWKTt3nxNRp3uVV3RJl3Z4KSWyKFC26enNOm+lr7UmH4WcR\/7BYGF8tJMijfHE09\/g2oR90\/jSN8VL4d+Ji9dRwX9wnulThicWWoMhfS30vYjqtiCGA8iL9aTpX2gidcejNeTYrrq0cYz09h8x3m6AvK6ZW6\/1SrVsq0jVslQNd0Cs1cf6D1m+L\/Ewf6ySK17BgpMOKyjJf\/79pXfXgHj5fiRQLorOTopZl8YrcPtA1hNi2gOgr7mzk6LkSrM0D+l7K+7yt27uohZu37jxsAq+\/Kq95UY6mOz3pZQSasJzJtwdOlwfChp9lhwOlC6\/DMXbpCKkB7aYi+0\/nRP7JgBN\/xCo6mYG+yyK+WvWEct+4xdZiZEXhgNx3RL7E5GKHZpBdkhOH2bDViFsgD67\/oJnOa8D6S1SWBbDSwTGBVvbghyV+Hm1YZX3Qc00fY6nFlen2AQXOD4fyrCXKID4dZT8XEf95\/57A0WGlM6fUmzlRoiV2mr9EXBGqKHw6WFXOcwxkRO4hOl6H3mscuS54UG66buGyHpLoAftYmoKmsGydUIhcSGfexAAC8Ow5QAWMwMJEAUms+2VJG+vpcuUJn7T1jpur6+Cllegugy9hzRccLrbjVEEnef6kplMSQEZxZ6IRlEc0hL+JP+EdB6mOJ9UWJsc42xFli3jsTrCQ1vBRHKE\/qQsgl6X2KcN1mJyjHzHPo+tS\/b8aqdfdJJ\/tt\/EAgi4h3B2qwzbqEkKxwmnsyyqjEeebt1f5NIFzbWkeXWkh7oPanQUzUnFG\/hD0BmbfuD0\/21bHo1hYpLgqx8ztrbDBhXyy8lGOmH4Pkhe8Xlq9ui15s5Lb+vNdCB4whW0b139RCxxW2\/Fl\/BC\/dqS9U+KvxTqAbOgjAVwYnunYA+lj3lY06jFhyS+Gg0JH6F6x9lCmDFlY3zTykOtKuTN4fm4p2kE197ILCcK2bQC6ySyrHuc7dNQ+FqcBl1HGLnxKCjXoFKsS9KdmGUNJuSaZv79Bd7GlFp0qLMFLZ5MmcZg89E3F1MWqj+zlaymCrDzwPFwpln7yIrJ3wsXGUmtjNW9FAvKB8Zhh1yBhM+X+\/QVZn91+xGpc1OMf\/glq5mleh8Fw7u142+8vGDSi2yq6vHZwAHev0fuunv0nWE4ty4d2QPc5R6klk3R9Jp6ZppfY2d0fj6r6YC\/4BTrJcJpnhBPgFSB9EPIKMUA6BywahlBjfqXRgH8i+wBWhe1TWj4lOHs5wx3HnghtZIePUzzWMp09+QqwoOadb68+b9rj2aWuC5pPCEuDhKuuSi29FZWfvWVVXpo0jSSn81eqN8XgQ6OC3ruXxWRpzv96DrIsBegiVAZXGfmDtQJyChe7ybjaqIHFgT8GQcH\/16P8JlgU0JcsOjBIbju3NmYF5lCGVWXY12KqZGMja1u+ykZ\/ykiCBAyF7xUvCq85JxsX1j2Pr1B2cp8QB+HEA+hW3w8ieKxWrRyU1E9Jyjjq3WZoaI+gR3pFI0GlJKOkAVX1Hg133dOv\/b\/DtH97oCly8ic+Rv0K2GSno3CgktBQfuDMTNHfUmnow9WqN2BS\/SS\/YfDTRUo9aKEiciDoLjw8byTTeLzYGGf016Ni+GGYHB7LEFWUmwNxO6wCGtK5IJJkZYvyB6iQGkxZWOTEhgroU82\/D0g6i7VC9eQViKxJ+x1KD8824v1WB93geBQOaUjKgliVEetXyZuWo\/MKyNr2yIkyZ+P2Nh9R0tmdMrhxQi657f7Fd0wYUH3AUATbiR611H2+3gi538Mx4xUfaxveVHw31ezRm0TOW7k6Taqi34Mnf+lxijZqmG9BzKTETuQV8w0tyzNT1Oi\/aDb9OA1gNrm3DJn+tyqs4aOI3nY+SJZS4BuaO8iXTmIvmnc7PMRq6DQlUiD0r9i\/4kmRc5ztDQBYuRjlIQK9urg2oz\/7FU2bvwAhjj0r\/zLXACJ2wjeamKEnjDvB14D+kbLtbff8TaHwLgIpFDP0KA2e1g23ER4IDfksMek0P93be102i2XGGkoYbO1dYY4UlsvqQjmwgtew3XVgCkKxx7UWvVOCPBWgZ7nxWmYVy3fCvxwNTpkgtUSO8GiW03wH1CFpFNy1BTxLAtZb7iwRB7t81dhzlKUgFrPHNqF\/CVtza2p5K409zbDUa6BMJUEsRmn5rmGiNgk0Hw1q6+zNZqPboRvF99NBculfLmjnHDvxg\/aUSG8NTOAqPc27uh3rDXmPJBT\/JSV4jJ5GbKra+qJD2ogrBKAoDyrHxkjZCgp9JJ9enNwqXNGaVX7cd1+lO9iJPnD5+L3bwsXWredG6N8neqhgt5bZrHAIcZPGAxnrs0TwUlngMRBc2oPO2kKKXokIhqo0Vm4qiG2mf1jl91byeyYXkQ1mBquNlSw\/2IlZZCDIdYaEjbVZ8Ru7RZWD+i6wUqN5Nj8U4eQuPYb0cbADfRv6M2hI2eP+RaLlu7VlYnsI1AYgPTbdkK8mh7\/T4B2y0q1oYejLMyZa9MVJdF3D6hhgeMVbvkamKn56jnrfVd9BCgwDX7KxVeCeA5Uly8osNkAAWF7ggh\/9mXy2jxEcUMNH1szk4ae5lKFkQC\/J04qWgM1wB27UEKallr9hwsohz0HuGtUl9jff4acauhupqsXBzjqvP3pnfFkv6xqC4uoWbTLDrmp9TFt+HurMFI7d\/0f0wCQusn4tcPV+s8WEQtMr\/tWFcC2J0CO4HcsRBlv1rLMRZ1fZHfZ5qxXiAb9dVXMxCCPNNa4LKIDvxSGegbl9IVAqncOXaXGR9a2BLJDAqckxcOe+i5PPkF1OT2n03pEmdc3DoGWqNurjUF+zHTUS+lB+4qWbMTLwDxdi732qhOYbEXVyIZ5lVVWgZi2\/pA6jE14Mnv5zeVTikbRtAJi53zkHYiBbcuUhfxBmhOuX8TI3tYMjZLVcb88HU7nCYQECqWUXtd5gUFNc16u8c6\/WZ5WcL7flf7+AJeiExdRo5mt1Ccu+kmWTw\/b+MhZm\/tx3aTb52fABKdIVdP0EqdgMvSVR+OkrLYkgHto6puloKZxwML6YflGIiB4KoW4Yj4h\/MO\/WAXfndE+nsSi4tBczMKh3kByfTvD+cWbEpD1jQeTL03QRIhG7Csf37WLBBdxorq9JZw2kbbcaNDp0riMNVKBLjnDFGEUP2RkakjSICTck8TMsUmzRuMI3g5Qpr8skWB1b8LQByacXW+s2pnyKISohys0sS\/ThWXwAUk7r8vF1AlsIhXcimOurH9zDqWTY\/U\/dFBud07fP+KuI\/XrmFe79S82Etb1Wpg3qgCqxTgjBv2Wosppwxhlu3kYwYdmvDW5jlY9D3eHZWRllvdCxwfWZ973j5jQ73lqVG5hKzDBVhCtHkzSdm34x2TIhhH9HcfK4SVse6oPt1RYCDWhjGYJqVux02eD3MvOhdBiZkbGrXb5Z9ntSkQJp1V4sUYnfUTaWWejVrKeIAdmi5hoQ3fWBmOm7SapT+oWgMBbATu82+LvrCZw3e31sSCcGI72VjCSQxGV4+nKyP2K4liWCc8uBx7HNYnc8A1xyihDFTf0v+64ZlddQgwNrx3ZzwkHqCdAmI3dqclRLjXW1CjwdWWk1xe\/PH4bk4qzjPlQMYVOf+z\/KJwYrrTPG2rXsO011EEAj4whT+coaqrC1r0QMWwTe5pHt5A2aoe4DMIvNyzDziRjSJ9nnP5xOnVy9xc4ug17Plbd2E+7nzN3IbZJGlHrSfqlcSqV9ZXh3dLs5GDDq9mhE3RnFo1BTh1zd3\/DlbCiyDDihDkZ2iWwj7drCAR3Ov3fDzG0FlQ2QWw+JVGa0ovjmnzocE45RHjHLV4NMEuFis2QkVJ4ycGAs+0scNfSVvpQ2SRznMf3dN\/zdoObSo5y4fMuv1r+JCmlc\/Bn+8AGx7zpRU+P2fVPE0+jctR2pR+1JLuK6pCThl6khzXKra4ptzlOmwBtB9IfAk3V3T1oHNVZGikWl7CqchQR0WNDs7p3OQYzCGmte6xGHegMAR2RXwE\/G14uYzxK1lclbIV3Oj4feevKE7MlqvIS3QQbELhSWIlSe7E1hqLu+3ufehzOOm3LDpIi6UkVw9EmEZKF4lcR49VMBj\/06UT8PAnhLDpYdM5LL81UjAPPDdm6FY4rXuW6eRRuGGQjEkXmYc9AduL0f954TuK00Uo6tEKaZkVpvxv\/XwZTtBv3Ah\/u3l1WsYk6bi+6eNXbBiX+bfqbUfeOsuaFgiAIMlRlCYxPeSy9YU\/+Cwiqr6Pw3CK6hDOBm9zCCbtodHBpHdUhV4Ry43EJWRmezQ8t+diHHOCsGjEtfuLqOt6ajmJlu1Zp8mqCaLqzmjcBcwJJf+n9JfvDLSwq8m3SzI1J0NDoBiQBT96IEnM0Zs2mSQ6+Ua4Wm22ZRjk3b0ZOglniTMRoW+NxUOGQ8DuD9Osc\/j2UEGu+id7XPmomwZE1EuBORW\/+EEZKYFPsH0j5zpaUDR8MjgN7nq7cnsa2U2pthVBOfwSc6z3bsSxCk5f4EO9VpcSYWUVvzlnMfVR+PYj+h8bPOUkX\/BsKJmG7P5j2pL5atPJfu5Z5oMC0YOHAvHu0fHLZJ9C+QQwPFiCugdlXKzsZyvF82Le+mzUGaXW7KLKQNCmJtG8oeEG719mfOxeqwy6zbQpLuUXqWxIOO0EjZP7HuGKZldf5fS8nc\/P7P+cgTIyXdnr8Org97uYd4uJ4mNEOLPIlNrNcx93azRoE53Zi0OQ1JSXcez0D7YclJcqIrtWnc4b9lm8WbqmCvpw8ButoJ5xzUoMvYY7\/5Rxbj7lFmUUE9TRTGQG1gnS1T1ax13CjZIIiKYVy39bNt\/53M9Ku8IDWzIG4a\/RqfVi6vwzCC5vUvh2fVJjF+M5AqEFa\/cQ0UewvZ9CcJr6ziDkLc+dqCMfuYxOCDFKpwLW+nGVk6+28I1VplGHB5qinANC9CZXm5o1c6W+r3tPtkG0ln6h6T\/DATibK1HnxkkqZ02uoB2c5f26ZT8kibIm4W2\/T2tonS6d7m79ME7tc\/17ipfGr356p7aaJNOUtD\/9+48+SrecbKnGK\/24lMyrmGlut59FzwJtQDWN695R9gk4yv+\/8LnxqOnfTAoZFusRZ8xDaPKEqk1UwY1Wz0hHgkByAPOGZ2v3\/tAeiLXUvi7psRxEGpZpWjQslUNoTij8iOkgAKYSDbsAj+U5GWKiCfB6DJ09iJiT\/8x59zAiLmVBGv2wK9MGTFMcAvMtiO1SQtojCm+R5pl52Gboh\/Jefi66PjZICZYBV3uoWrQYOuzAU1eO9V+dCTPOWShZEMbeQrhTkqGQ18wBikClf\/xls\/SA7AqbfuSXusQEto\/D\/ag+E5AU3Z1QXWcBYd97322OFiMWbRSgshyUshR5C7C5I2qSDQbHc3arB2x2qbf1rlA4pBOLrfZDPLtfpoOAZGxzXQJsSA6gVgeP8AhBcdA14UOP5ofbK8oOkrON3xvwLk1UH5Ha4Bnfa2hlWE7pODIaNtV6e3VgwHXlMHyGGuaDZsdxNjumKUqrTTQbHWVf0m3HBdzWpeh9u2H2MbGDQwHwc3eTFP2Y3pRGlgbDAdzBY8ZoVAw\/0OsCZYFil\/\/yns0ttaBIKmpfq2xFPvjOJVeKFkgAVC9eJ9b4ebGWJJ7+ULOnKKQ04npQvNW1quGUMM\/ENzatuSfzwV7xA4pl8mjgNK6GEfDUZ6TpeYb\/\/m5sBW7yChpiM8utbkzv+L0+x9UvsegtP2YJvNkp2tYwQgvg7szbRum7RgOMOiVZ66utmAnlc7PRTTblcNMX5iDV7iyOVzO5kaBR0hyPGtysoqxPeUelF4JOnYTKeqzHvFkKmhqeGAuxG9VODLtZZEYvcrXgzkUYk1StXMw+ZBdoFmo0Gk0\/qTgqFfllTXd92x5Q6+cxXEgwwXndVrWFIY9xjsHGxelJNKXbFUA172XWTJ44c9dyjkEhogGxZa6SLxDGizs0RoFmXYWWiJvJ9y00lKueXi9fFjjkUqwOSFJ6Iyhay0DKqsiF1kxVk\/FVTlFkOa7v3qdMYMQnKDCO0Gvs3PfnRr7jnWHv1tlZUbWU6CLHc8Lu3PeuX5itlA26A3I0w\/sRFeccjKwWGqg1AnaYh1BLAfzB+VtslwtyAVmNf2HMZufTGIaYoJhRD8t\/cTqUk38cgl\/sOjN2VIAhSO8M0jIrQMsNIwsKfKPGXAq5+U26ZZnwNZJr4tzfsPfj9bFdHUGHHo9ToNTKoG8glDQS6VmKqOeZ+0shZzOKvSEj4jhM4JN\/mnx31\/E1wsFP0TpqHAMBVl1xiY9BdsmjitpUL4PzWXfQWC+v\/0hy41GVgoFgoebNdyTH6akHmb9dlvQBioFOq\/naIW5mcIgi7LHqsxpUrCmsPHW7CPZaDoHSKsNsPNEfKO0iWfWx0VxxSthfpdprDyZvNnSJuoecStW2vQ2aSUzOOCJW4mO6s+977QeNA3AmSmOiLAecrXyVQJDm8gfXSQWY17mP7Dt7brnvlOhyeiqAkFBvzBbqAGMG6rsfKxoa0TDMF+sb90nAzFrsDU5cYukFxBxDxbaHQE6jZRimVtsq+caX9xwwY2ELgzkneGs2HCdlOh2FwQkpU5TxRptxt08V1z1TwFtdFM5Q1PRRrqOvmgLjdZsHjAaYB3rHxAi6eAHrD4wUKbOdEDZC9O5lC8ao8ytq\/1\/avGo+avHrNSCaCT5Ijkz4LWCvW9pMyBBKbETsEXA2S8rAOQoEqLxw9yScfOjBoPQILbucPh7enim2hJijvFR5zYzo5SZAxL\/\/NIC4RwPNWIcVttV7qiRHFoQDq5nlS2mnD+X8MYEwLzZwRaUH7Ya9h\/2Mr1j1lMCAz\/wwD7hh\/xYnm618OMltFHyUrTwhkkUBMgjqvNBxg1GWh+OW9VL8l2qxftKr90a+RDGLvv4am3zMdd5GfsG+YBIB\/6ifYVZvT+\/WkKVJWkzzGxJdXSVCkaba\/uApNZwRSgJUzUn14NdYGjziODuhpoGoRoESgb6Oha5C6+f2EwuJIMoj\/sL+NmP78zxNSfSzppjy+Hi51GjlBH4oojaay58tX7TOUFPCnmFYu1uku+q4rBuIjyIRTb9RUPE4blAo0qB2do\/dpzFTk5NGH9X7102bvrwXzFHBH5F7JyrMmmjKlgQ31iCMpUVhq7\/eNdCXC2sVf19c+ZSA\/UBWlOt4N7C+5nWwWiXoGkJaZ5Ce2HNHtzbprCZzZ1kGJHMeWWc\/j533PLTmvC6Jd0CEolep9f2T7RexKEGVe55rqCQePUD\/dTULlitQIMNFT6G5kAyW0x2mob\/DhFNzf\/awZIpmo2QxjjjVIzKIZfid3iU1HU8p7XKgG0DNvyqvMaZGDmbQ6\/Z\/QY22zAcdVcIll9r\/sFsOWc+g3d\/yndxmti\/Ui14NBZXspBX1ZuCpdfu9AyoLXycNV1o+00pSaz9bTEevHXToXfVW7NH+prldpPteCD0DbkqrKN7bBgGXpJUjcGQki+yfrA896qYnFPB3CbvfP4szYH69hD6ft0\/augKHc2B6hyO0zxiiTT\/KcF\/1beAz5OCe5oq2QEpo6LtfjzezkW6QFgg3pi5S+xAnSrN0FFMxDPe23PTIpmLuomT6fSs9paVfycSn3MvrKW40imxhyR+7F1ZEASMDiaErZWBwZsdMhN8OtfDlXGeBpAn5lxZgigVCXOnx3Xk4r9YyxbhbMjzSzclHP6BdjCtSCAYDIX1poXdgFAOjeFQoYFHFJZOD8A9M0wxh3a+eBLIoP4ud5z+APKRv\/w30fz3B15nnR11HzRkwxTgTB\/6EwOu9uMxfqHzv0pHqge92jLniFco04\/zts9TLBS\/T5\/8bK6lXS6uF7itVJBgug+t4oJpLz5l2idW48eB\/WXfk1ADnoFSFSRLpPS+whjemI94p3Q18RGs13yZqUOBpcLGXvhBWvEY8bXgC0iIEayJsaunGE8OODgsPLDD6lx6N\/+8MXgkPPX0RCbNTW4OJV2fGChh3VCgKQRpnXE9D4Je0InqF+4MqWNmIIZHm7wjw6ZOJ8c+bqo0eszjkhmX4EnDkbkdLcoR25rMBKGcuzU27+IPX9xnZo+gMUfgVLGB2S8xwGyP7W66VvjULfpr0MdbS9cjzn9qW2mOBWpwk\/\/5cw\/bKTBIlBi+cF2AtVSwk+QXXKQO9vsZQNpQ1P8YIX1GalhVsjHft8opdj\/IH0h3BghFrVYfnw4ScJ2uZUrQZy2u1K1ZRHpfJIiCqIhq+6yyT3e6oVDwi4JlH4TOn6twawKirsP7Th5\/8UfMTXBMpUkjYcF6gIKEQg24HjpnWFRQ3y\/\/J0IljDZ8FiXeNE1pbGIxqKKRGucV5x62DnO1gJppQBjynPtriAWxQt9u5fCYExmiKbL\/HmtqHCT78peolFY10KP0SgFJAI\/tDUrhREguWusgTc\/SHzaAKZMm9zFeOCbDMVa7vo\/bw+5C2ylBIbM6tmmGBDhxQ74UspcUL+RXUx4moueBq0akbuME8ahO\/VNlbrB4A4CqQT1d1t\/A\/memAlHQOlqHdBw7KtpxmWLHo4Dt3sFQjTR\/67gg6f4VDMiB556C8J+QBtvZTVRe23tHy8N61\/J3\/TuM\/h+q5FFctr1OLAbd6Xml1bgZdURbly+PO4Rtqjz75O04lu7\/p8OMO+q3uSW0BJn\/wuRJulJ9wncMn4rVk1bJ+3ONg6FODYTanO0Yaixfb4TyyhnncVDVVAZSOP1EWHYzUct8MX9FchFlCA+BhTzY3Z1iED1WTTA+63CFzhDqBb5np\/W5vWf14Zx3+MKdIDjhcVUz+WkvsYGo9XxyDPgmahw6MBcZG\/T7ApD6Hz4qZj4vXBdbEHUYek\/iDw9h6v753HTiAvryofG8jCOsDyz+JUZQV8Wt9LaSEqFKeve3vz4uMFBj2nVKyHvjpDPfYLoFaTrNP1xMEOnk+nZp\/3pQXh8dbeqbJdEa+LpK7wi6saYhQyqaTeKzrSLIbP2os4WxeLgsz+nKv76tL5A96\/poGWLoRZq3gmdBoeB7e2r+EXYLhiMk3qj7XERJefyreJTKY+jE6T2dI7OmN0LrSWad9JpkmTXc85eRAC6c6mi0S5\/xqruFr\/BQqH\/fbvUuRgjH1rnUNYEPmVRvWf4JUuB4LCL2H9LyUT\/Oq+qOGCB5kXxhSJGv1mORmEfbBe71mrZZizoR1KAzy0jVyVUdOYqF+WgM5HAJYfMJQNCul+9IQQhMkVJMd\/4MQYENkkYR758WC2WA5ZWLUorjmhqFiOcgIUSDg8dj1mjijmllMp1EGYArjwPlNrrqLqGmCpEsw79\/gdqyJhUj3cjURtSgfB4tjpr6HKSDFWfIlVhxCDaA7INVHCrw98PyjlchNnj1Ek9KSXvDg9Oxufl9MTCKW\/elPLXzCnoNRv+j346MBfsQmCIhMK6HjCuw1soWXb1Hl5EHfyJAQr6BacwlJTYVqpLBbO5JjTazlKvIZ8vCJEfWj84RzmXK3NUpx6n4nDdwu2Y6fyJKtLLF3roMZXM6l0sMaa1WvKI7kzwmRKWvx1oJcGkh6PVfu1Of7YorTiqx57UEGpM9PgjYYOSjMspT+ZnXF0+k83z++moUO3ArknIsjdgjSaroScN9LREBHrS7y1DFyD72+GA9LPaaslqkRI3GzQgTxyg8dvYivr8q7psK6x27Zq0fnqDx1aHW+++0kaCnl7eXkW0N3n2jhqld8CDPAVeDi++r4tDiZFzxgJdz4oQV6tbnAU1nMyYAwiK6YUfNpmPMSJORDUvP+MDTIRdu3cyLwqNpYpUd2fUblymLOgJx9ZskSehPLxOLdOIn8vtwcTIVtBBIIVx24FOL0IW3ICkKHV9NFQ6HKBLOdAF+Pcc124FkcLJcpMcBeQQ9u607cl+6xttmH0ony4IGvJ1hYTM7LIeskWJDsHVmDlgtkiJ3EmDcY0AFMJXCCQEWid8O5Nn1lp1WfxYB4L5evjDa8VGRbynKCLir0etIHWFtyEkzPnZ6caEBFs3ikzT+i1mzkvcoffLtUjUF80zBFQFQKFlhzlz9AvuXv51p\/8aFhQXdESq5Vx4ivzxLsrNtK3iBEiJZiWA\/i4LwhgAOaxHsJH3MlcSq9oJo2emhpbQp5sXNPzaTGDO34N2+RHD19b3B1hlUGdlf3mGddijnoSTfX5a84UpT2POnYbKldSCUJIrimNOMFkMT5pbYZKuMGvLJnEdag84RwnNgO6m+\/FfuZhMjbHmwNzONAE4OBOjiK04F9Gsam0IQ12cyF+wmUfpiZaB9p2kZccwhba9AB593YUMBOgXkNO2pOawvb+qFbiMbMHXYMy2M\/TdJ4f6io6DASMW83HgmAJWyXcIbkaEGhs6z6Wk0W+vbGabdo+OpvwXqTa5IUKRnvbOh7sGU2CRW8xkRPDrzimZ0YCzSEAZMshM8SdOkuy6EUyvzEjdOHJcEUCVhJrl0E6FNXO65LoAuGBHhJ8EP1D0XU4ND493XFAHOcdESjMIUoN4DwnL5+sP+UAC\/cUrihADled\/R081q0KyB\/HRaQ7dc7Cm1i5ELpK2ak5uGmGOOAniRaRuZzzfv9RM1l9nVC8ujjI3lL2ekq\/Gr6qAewTiB2H1Iwpd5tK4ET+MjNnE1FHRPxL0suUOMGLkxPbLxYD4fV8WachJLFbO4bYj0K6gAwv66NjIdt8ee04fJjKoosljaW3A4VG6AZWcdJALRCWYI\/hkS0d\/BbwV\/0xankv+yjnZO0BrXYeGfkuite4U1owstJAPzssBXQlxf7KFukXmdoaPiuIW5Zgbj1tlwWL5Og4lUzOwt+\/17Q7wijxvF148ZRCULMlEzaVdoTp05toJ9\/Piy1YYH7eO5XLtamZ1+86zvnFz+lh5TQ5vX+wCc\/Qo\/jl2tV9ZADvDkAOHjSL+JFEWp5UfSpe50HjJRXEZmblbXO3JcYPB4uPsfQbF8NDyS26IGvoa2JG2rBsIwQO3BGQ+mQYg6YRYHqqnrSoy5LhRBxiHLST1naQvmlqu2LeA\/pAOkXK5dvBIogptrGW8g2yXFDc\/DIAt131NgYT6UUUV90hetTUWgRJrKn7GeufEBg1DfrJFpgbJ0WPijRLkZA8sRknQS8Fr3KCAsVNCM0zgo9xJWkQpkAwhoxmIsCUXA9o3wJtTw9rd9OrMK4LoZ9fPPFJZNVEre7ASWGn9WczUQKKJ5AnFi0BjdYybeqzoMbpO9PcCd9M89e2grqdpH9AYblj1PcdJwKYhxBMyN4rcap+7lrt0NS4PA6O6UtQxuJ75+k9z0QnxLMFeRxnpQL+wl+dxv90zZ7saPju\/0T00wV\/uXZj\/qb\/e2eiKIxj1vqVshZdUZBbicPYTRUP4ukmTX\/BESjHFzd6qTP4hLJqzObGPVk8XFbAkOgAtomh5Ld5YV8vplhfJRkCtucry5ahJ0L6wHdUV4Pbj2+H7+nXeXrmZ\/NdhK\/k\/zaWiBzgQiZ3S8QscS13WrbnZZ56TNtQa8zDspqfmsChPc\/5DJFCvWjVevs1LFUe8rTlAYNxg0i9qcaYfQmXgmOdAiL7ZFmh+IKho4KyrWsQXOxgkX9sKZiyK9H0tL9v46YfgAlJWmiatWRv3\/s\/Lj9A+lTXzXMQKr3uvQ0xRROa5tG\/FrYqthE62XVkJoO7qoJc\/r\/KKo5demooYhiJczFO5KNuoaESnuerCJvCC7ysX0gr2Tz3DtooyY4nyDpLBL3TQHe3pBxAjaKy\/onFhmhiP6LadHVh8MsZdOkE8A7wOlerpRKkL5GPClIlFtk3G9EOqBBQNXD6\/5TOVsciumR3psSjC+dxf2rEjUeO4r+44CY8t8hpby4xDY4sRuFNWquAgSmBx3G\/aQuMBileX21aEy3eQbNRTEPQZknlQTqKXFY1HPhw+5QU66XqPrm9bAqEfWlnDb69liB86Z3PfNOu5pmb7O2k\/lGbgL2uPNX\/UyqyuLZNVQUM0K8cizQ47y+Tp7KyfO9IRzPqqq\/4VKdqj4wff4OO1bwQBLApS263konzh7J1i+6nzMqqCtLV0QhweNr\/tIEsorXCWRYRXOo41YIfK6ZNl3lduO479a7QK+vXcwMW9kNOmZmTkIg5wLKG\/ed3ftv1Xf\/t9+EhOWXEb+vbEPH3zjxMmb7AfjbY\/z5xXF4lFE2WpbA5k4jXsfeNMF12LCKiYpbbm4yWpQlh+7jgEIT43IUbSdavfa2Z9\/TfbDB2slZ9+IVS7nOG9GZNelpODYdnpgaCZnx6Xme1bdiUhpnh65cBnywWWe9ycs3Ix6Dkv9icownQWeQBIBVBK6Dn028cZVD\/\/xNukBKqiZCsUHbS\/5dkHfGghXvH74ZXPskH4YmCI8\/64ScAh8dcDqLoj6\/HPy9NQPduZ4A5p86v4yXelgn+Vc0AnfH0bmaOouYMmkucGo3w4Aghwcg1GNHD6YncI904RDcDEiFU8i6Z2Ng6wty1WEERGgIsjxDT1F4AvjCCKRF04\/Tm+BSaFeRdJsJT4nWdzmimI7vkcvF9PKyHzocxH+4eweZmKz65vtCuvNd8JVg6zPSQUsrv89NKo6kZ1XAUDf9VkNa6ZmFm\/CZC0Mxg3Ms98gC9d1NwZ1ooFaLjxrJZXSB5P7M5zVrtGm79fSS36xX2LRW1tzV0iUG8Rt2RehUPT1Mlx9Je9lxEm9s0J9LLr7Ha6dZ+w1fnqP6EeFr+5UohCHdRFcN0HoqlRCL79MWiEgp0+2Q8Hg\/tZCxhR5n8faQaiyqYCsQezcG69RpViE+Kwy2yxBLiwCrpYYtvwCztbcgNP\/XE\/Cb4ItB4BuHlSI6Lmcw5t5jORELrGBxQHiMePv2ZNsNHRf\/MVVsIoab7JwEwm6xrL7CuwA\/yLczOREY0p9TJH9Ot0B2u9XdM5\/RGpDzzF9pso5Yt4jn8MfmfZ4vH94HyWgYC3rRSnvG5jperLvXZ1NnLRgqrhqaOIdZyPS1hw2P9h8\/lV4PLdztQ4yA\/9TMKXUSHiX5aE38gO92f2NoBT6+TiGyZriz9busMrnkZ\/iK8MNsTZEr4pvqqG6VHySr7P3CdpaZtCkoJCKBMpxUs+HtEcdtEkLt52RdQfRn1Ys\/BX1Ix6os6Boe718nwg61iNvrkdJUWHs7rzZ4bzWTuSexTRIVWDkY0OIez4ABF\/7kHbt0dtG4IwNx6d\/06tQE4lJHEzOr5snOerVdct9Jg+89s\/oA01pVVJQeHPtNEaH5RE2CTJhGbNm1STbAm7MJhr6UQbb0YzODvR6RWSW\/TG9xYOVpXc7oOy5k3t6cxmsDPN0stIJ9BendANUNgfZyOmspeDEP3q1dA3InT2L1MrOrPaXZglKAosFxH6Q7PK3h+JIdcsSrca2ZI0WnFq0v6CFx3yfF9pHuZcdJ86hJoqzvaZLM9CgX9i5TqBixRJEZHjx7WzK+qFtQcUCjyIkvCDiQgFiC0Bwm9a3tDjf1Il2nbXKIGG0hiN02UePfqgtOoimFJdR6fVaI04sxaQl0zJfDFfbvg504jP5lIHvsdCh4MCtKbA7Dxd4scdKBRWDsmQseCdD5SKlF6LJIdu+gy4WqoSHvhqDp0a6E3JbiCcSxdSYBlWgcdm3pi6pv46tYvRLlgHsUab\/6GHCWFQaKInCviy2o14+kocXbVj4Mk5mMXAx8aaSpEsjZwORQ1kj7vqB4JpihBQdXBR\/BQ8e2+yv3KLN5GgOoKtS1w55lFxRnjaCBd1dO59CQHugW1h0\/vnsZYLGoRIxM7qgh6UUuGNAZmp7Z5gEDwz0JZUMFc9egIdFGgO4aDu6m9LX5fKcqfP3DSA\/JTb6IFq5qmAc3wvp4Dvy5ju1sJNwFnZFXkMDAgpngLVrokYCjnmnMPokHgBOoFJ\/iL0MWhI59ZnqtvmNbD\/fGIpaaid+3lK\/p9ZA26Ez2YVEnOhRVZ44yZhzSnTQc0Eb+E80GrpVgFzurEtMPk4+LSY7Y6eo8y9Prb4nlTKBKnhRhWkYhyL5CwlIj+7ful0E1fO+g9Q4g+J\/V6IGCazfXI8\/BGlLhhVPOutGy0cGKIWPzmNkYXD1wOGfbxN9m6lYwiGRD5vnYhTuI+zMAdb9PxU0uPSTMhvZWLwDT\/PRMdgJTwY8tnpjpZLTQxZPyTtcCj9ybW1LZu1HqvhLjjTfQX1Dm0yvBbAi6rs3Pjnvm7Z53mkGBAjwxb8jWhpcN+jzZNksS6qp2EU\/IgcfVRB9pPMVdFAi3Zx5+15DddcFB2hkO9f+1XTAWrJdjOPYbBhgQuwsrDjgbnOzUddJdy5KS7rW5YYMHD0zRcG64Ca2swokb1DOWcrP0ecqzmYqJWljmfHkclcDJxn8YY8dJTuxlp60H2HjvPwvytPbYZ1s7FW\/QW2sIyc3jNVvaw5PxbIRdLfoHAxMQYh2yS6ie1G1kOfSJkfDkd8BiIIddP3hhniTGRcFCZDWDfNha\/sD7dBIqRASZWcWT3GS6vbeWPtzZlLPQKWMqf3j4rgD\/7drqZkncIJ6+E\/\/K2KNQ5r7t58547oKzf4OZyBw\/wsAn0MerJzgKyuXJ+Wt73+1DtojQgGpCwZxxCR8bZ\/7Q7xvWOFWPVUqyanixUsOjWo49Tc2AlbSxMyDEg2rtyZyH7tpgnVHXFdAjTVc0i8VHrSi18mx8Jq8NQv5E0MyyD+GYcgdCHlfmtuOOG2WVYow6ZDjH4AusS7XMk5kODhoM5EhU39i0T4Xc5DRn2e6aJdYhmIrPk6BFeYPTRcJY2+7CwNWNeOdPSf5O0AO9D\/3rXfHj\/8VDk7ghSnYzDKMsgmO\/X4i1oJNn4Vgj02Iqn7pI+8DJToMso+6ufjEGXJatDpCZVz97p3JXNK3IXW8N1fR8Q22xNb1frE\/fxDMDNJ2ZPhth3P\/THPImx7yIGEW1PlTdp6eIYSeUmmrYqJy24f3oxnX8wV8ZiSJ3ONMx49eUxgDgTe7Ukex4ADutMd\/Y3UM08j3jQUs6WLVpPUbG1xYvWSxrCiyXhZFGNZUD5rHbTdXUs3EXZ4M0goucvdJy+p4JSpr96qmeStqUgICSK8gYV4IC8rmMciaVdjttnsCW1mVnynaTp+yWb\/bqo7uNB9mj4gJtmXWB4pqinR2JmsxuTdATwSWK7SSbmS\/N79zsUjDCkS0oTG3DYG3gscs4\/UDqUGkktljcqbyiXqqE2HqCObk6A39U41lEpoEn7sdrJnSKNU+xXWdlhvFS3pa6Ck+5p0ZkLJElrgdgnvyR\/53K\/BJtnJqs0A3mj\/DixkfOKBsnkmD20XaiH6ZhuUdRLsbXovkdz9s4LFwhl2tSXStBIsmbiNB3Nmza9c4Cj4Qw1du6cL0AHgrCmlJ2SoF8YliauN8uMWt96soHNPOpIJI\/cSowbOzw4a3JhquERLU7kulj5Ps0S7u+BXYvHStlhxLWrsZWu8rLzVJMfCTHbEqDdlZFaS6E5tZaKu+FvMzsrTCigSij3oxHXFFOaQA0gTV1mX0lc4IiNzw4eWxeVYejFW\/gp8CGWdZ62iuKLyaC1puuQQcuWMw\/cnClFt4BshPggXz7fcde1sKYZGgfaMNdD1xgkf4y2\/NBLks3KfOPNbrkRVxhN1wfnBu6tGefFH+ONhHQ5pAwA2DWU44DuLqJijl+qOmmNkdK4G6SHLNFPklTs+9MK23YHHp7iN6NfLrMQQeCJ6a8q1oriO6X7SB6KY9nlV8T8Q25V2cdUS0KutK7r3B\/wCUh9v5ez5wiO0RuiCe7yT10CYsr1FXcNndvDPpQq72dvihGlYmnQp2jE6qhqR6aiZ0AiHv5Se7U\/LV6kGq518NT5eatNwWIKGCW+Peu9q+eWzAEvhHMQpODDHRyEXzAaJO7eOvqJ0qI3t2EZtjTDCTOokwQKldHEWY1jIs5oZXw6kCgTwwU+9EzU4Pjfv3\/NJ8E6oNYOwIwvkg+hCCHaE5aFlcgXnUiYr1Yki8KUJZGxssJopLVBkCkNmu0zDMxmCyWNALn8rYjgCr7yWI02PZTlMWSmyUpStRt4joBxQIrXnXJ6x4ynut6TYWg6KrN7a+Ee3RKLdzAbCDeSLHnCGx1B8m7iCAIAySVC2iOqJtfi23Bdk575lIUrsj8ItWW1eGuibxWEIa0K5Qx9S+w83WAWzOXE7XPns9UOfaj+DE+bH9rWEOsiOzoLrgpVgWOTqV2IL04\/HxYIIr4KZpcTkfXddmaX0SW0VG7eLs1eLNspjMF+bIsYWIF+FSPon+\/w3QPMFeSwK4cUf31gWoZhUMbW88hwhnWbjgIxb+BXxQ2mObFPRVylCSIny5MHarQwOayXD22dPwM+JVVxQSw8WzPAMyzrZ7P8kE8AckwTofchAkut8addRTYnGhETlDP9oyVX3X9m0Lgp3g6BTgVv+wpqMNIjw\/6LmXjXVP9TMPV8cn0\/RzFFR7nWl3u64gsyB\/GvlMwBh45gv1wir7o\/6NlQAEbUnweV3dySB2VVD06Bq3eXqUVa6JZg6SRDbWjJ09mS927x1r+mxDgnhJ12BxcKHMS9DG32Z1RAwUkpg92NquxClxxUZR4jK71tKuVPRdxDpiSt3lu1mSrhKa0Dp1JBh42W4KxBfqa78cLyTVFbjL9C6WiEPIQA7Sj6EyqFvTYh+v5TPy3Gjp8A2m1I8Ugc6E0iuK\/1rWLEb\/rnA0u0C5k1e8BesIXe87O7FfM8s8ZPzR\/ESxpYJ9uqnLkkoWUleTpAyHzk6J1MA10ZqzvJeRygsWDhxzBA3na8cmwSs2W1W7g5McN3wZNDbNldWfeG4Wr2HfUMqdU+O4eEAphsvYIWLN9RF9ztDu1ElA6iUPIZXy5YHaUMrcgPe2UsLVj9fxL0CN3UqZGb25z5fVUiudls4xjoggPu1jsfJHuFqsmccL+HkDR2gZVlmQhHA5x4OW9t2pEvV2AiC34HrE4dysh1NuFujEwuGLn9wTS8Dwt3gXrF+9mphoKx\/obZ3N2URlZ\/ONZ6bpm8decEYC7qeYa\/Xm+2tlbY3kb+e1sKvDCyc\/zDCe0Lu4rFFnXem5p13KkqAU9kg0T+gaJNJ6HkwOz7\/lNX+d4CNBAxhiBhMd4+WYB2qqXaVImYGnBgXN07UTq87wPzDuk0NreZfdQdwb5CW+PMFqVTfkDW\/0t1GMRDKokkFYEtcdYcq9J1Z8ash5Ghl1udLebcbGFDfjleqWEhVEpKbSx+7RvE0\/x8rSwL5ckHrcw7tPX4ui+hYpTzsMUKWPCQJ6JIa9errQxxHO\/qMiYYsmSEvNtUPEgZ0GrEzQe9GRwxXzIH1nhx6mA9YUWgn7Ty8TuH4olmyD+qxH8UbgvxuaImwPq8Quf5H9znUH+cSPmYZ\/U5A9nnjuWGcdicyvSDxBQ9zHSHPXI+DO4+McjNZFA0nw1a6P418T9a\/bRr70RbKkbO2ji9KfVFn6B2x8tAbohjG39qGKFJnKdbIfrKsBQsnByhj9OjVBkg8v3jvY3ojeoebLv2hr0b4fuiuYg\/BvMxRcSa18ysvPhLUbTcXx4eDcQDnQ1K1cbDCVoRkqvR982mxaaAInyzTaA2uxNkzuU08ePzzBSMp59sRdeILRJujwujBXH6JhNnmHk2aPIqq4fojkhzjJ9StrREsv0onp8jrllDXOY+uCHx1WK9Vq+2NZZNx1f9KvSlQ\/YHFI\/VeSMdJX3a8tRvdoav6igs9EOwaY\/IWsmIIzYFkIy7hbkqv7pPZi6vwtDYWKGckK6YSfZ2b0JtSGr+vt3E4vNAm7eaM3fxEjVjHDd\/E4hv0vxYW+Ro56bq2AEutFGLV\/TIT\/91pmxy7U6+3TGxNcvA3sMn0DRNEmw7rIOcVTlpQQ8EQida5bx07okiuho3M8vX5pZmZHxDcvI55JAWS75K\/NB1P2vsZ5j++Oil8k5yUf6bPx+jkNbHCE4TSmpO6I0f6Q6TKr\/44dplQ\/I5\/vS1J\/Y6m95u7Ja2vD+7CL7tiEUxdlvhspwLN50DRQPrJRYJEZsSXaASP4\/pWKYTB\/hPP9hDXxMn0trQ614P4+u9nwAnfqh43wPxib+H+0sVm4oWi68jaFDtLSdgz1+hy+5M0XU9hj\/qIXEEFg\/NmR4Z+G7STtX0k1zMDF9YrnEB92rlHTokdVXbprMVy5waCAWXXxJs6+10uYcatDkpARUiRwc3YawFnnwRl1c7vbZg4OCS9mFTV\/Bh1mHz\/Ssif9mS2rppQ6nPeh6m6s6IU0FNORLL4umo54aMvHaxY6NUhOiXbqs5HctTUs9yj6HDGPk0g7NIkIzZL7RhuQnlm3Z5keb3VJR4ak2X984GO9ugt8ufOqBPEw+hEIGanP5bkJ2zyIhsrJHxdTyLJaKvmCsPV5XVvH3LgTyjgADXKh7Oh\/P7FuBhuMm47hSR5x6QOM28SNBXHUkwFCkAoQXAsI68Q0OUp\/QXCqG1u6G+7AaRXhlg2ajegE3HjqpZhP4Sa1EEF0BJIbhBApc5HGLBzxOVw6QpWlrsyGe1Ovc\/tOqUEycuKgbMFypIUlkCggjJGBJwBTWFNMBkS2LzXgO84mrwHPIdrnXCjMGQgwbiIHPNEfE8ENEH8RuLrEqsRkfEeYeyjpJW+NhJxEAJsfqXLwlvEAw\/Tne\/T+RrbId2men4FcRcX6\/wUyXcOigQ\/g\/ld+8t\/VQG0eZ3zUOv7bL7gs9FBPaJFCxMDQ92cOYzRWw1yv\/yYYKfs5VYEKgHWu4KgmKHeO\/nBmusBl9QUic\/GRe+RvNa2Wqv8JaYCoaxCaGs0zn6YLgTtFx6+t2Fv4XCc2gYurKo9hOMUA+oh3r1v3aJgwVbrlEnF\/Dm5vuYkqLdQezkFwGuKEZArkzJJAGbr1KIXTYZQzwHpY8jtsyUlvQh+nNBseoX0LIt30\/hk5b9wkEDiQy1ruvJCYeDQX7yW7\/z0yFqc2AGIng3sAOtvNEsjb16YE\/NQK2n4cXt\/kPE8+mMyxXccleoiTzE7+R4fiBmvQRHr0LCnR1af3wsvy8Q\/6a\/CSP8R7Yr3S4o9hxhZQKoV1SJQHgzty9irBXi2fhqz97abzcrYtmh2WesOmXcVqo67pNg3iftji7KJYgPFsIpPoGHGHXL0LZJNP21qEUC8WlppTl05bQ65teHLGgL6ywkuoDBUGRNNePbkJ3O6ykw9SvUcKttRfpfdyZyaWAGyp0bJKTJ8kF6GWpgehFu+ixrnmuRcc0ZbkrRo8Zvs6NLSw7jlY2a6wuC2R2QkBzIO0J6XyXiebxpGI2GspWVqBbDqKjIXV0Zu\/wVnzYm+TM7B\/DxZ0p5VWc9cvzwru66VXAVM27RPtRkjsSWOFOXcAvgqKjtzMGJJXBwpUp4sImdSqgkn4sNJ0HOox3SYiql5pVDM2ovsVSXTe2nxBGL2gA4dd33ULpjw==","iv":"2a5c7c482d8b3b341f5feebb95b6eb45","s":"71dad2006513b68c"}

U.S. luxury shoppers: Whether their spending on luxury products has changed since the coronavirus outbreak. Base: U.S. luxury shoppers ages 18+. Source: Coresight Research

U.S. luxury shoppers: Whether their spending on luxury products has changed since the coronavirus outbreak. Base: U.S. luxury shoppers ages 18+. Source: Coresight Research