- About

- Subscribe Now

- New York,

August 10, 2020

Sofie Lundberg is senior content marketing and social media executive at GlobalWebIndex

Sofie Lundberg is senior content marketing and social media executive at GlobalWebIndex

In unprecedented times, behaviors fluctuate dramatically – partly because mindsets are changing fast.

Consumers become worried about new things, more risk-averse, more alert. Their aspirations and hopes for the future change, as do the things they value and hold closest to their hearts.

And while most leading businesses have long understood the value of unique insight into their target audiences’ attitudes, interests and thought processes, it has never been more important to look deeper into your consumer’s changing mindset.

Why psychographic needs more focus in advertising

Focusing on consumer opinions, feelings and motivations, psychographic data brings demographic research to life. Without it, you know who your consumers are, but not why they do the things they do.

From a global pandemic to civil upset, the United States is seeing massive change at the moment, and with this comes new and evolving ways of thinking and perceiving.

Our new GWI USA data set offers fresh insight into the modern American consumer, through which we can analyze consumers using more than 600 psychographic data points. Looking under the lens of advertising, some interesting truths come to light.

For instance, only 9 percent of Americans say they feel represented in the advertising they see.

For an industry in which the sole focus is to reach – and resonate with – your audience, this points to a huge disconnect between brands and the consumers that they are trying to reach. Looking closer at U.S. consumers under a multicultural lens, here is what we see:

Insight such as this offers clear direction on the kind of advertising and messaging U.S. consumers want – which is exactly what advertisers need in uncertain and unprecedented times.

Now let us look at what’s on the minds of American consumers more broadly in the midst of major change.

What is on the minds of today’s U.S. consumers?

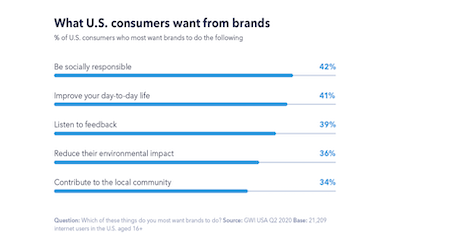

1. Corporate social responsibility is key for engaging them

Consumers in 2020 demand more of their favorite brands than great products or services – their one most important request is that they take social responsibility.

What U.S. consumers want from brands. Source: GlobalWebIndex

What U.S. consumers want from brands. Source: GlobalWebIndex

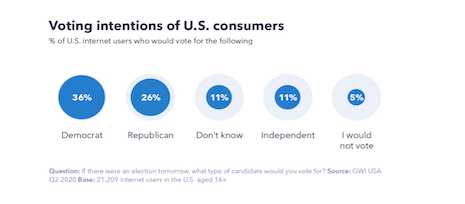

2. The majority would vote Democrat were there an election tomorrow

Ahead of Republican at 26 percent, 36 percent of U.S. consumers would vote Democrat at the moment. But 11 percent are still unsure where their vote would go.

Voting intentions of U.S. consumers. Source: GlobalWebIndex

Voting intentions of U.S. consumers. Source: GlobalWebIndex

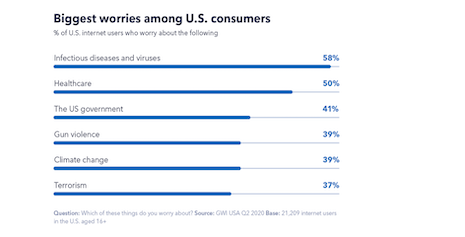

3. Viruses top the list of worries

Ahead of fears such as terrorism, gun violence, and climate change, health is at the forefront of U.S. consumers’ minds.

Biggest worries among U.S. consumers. Source: GlobalWebIndex

Biggest worries among U.S. consumers. Source: GlobalWebIndex

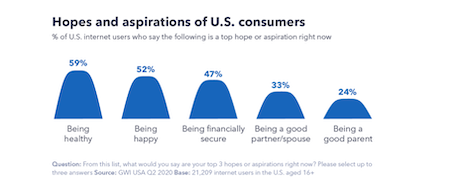

This is also reflected in the question on their current hopes and aspirations, where health comes out top on 59 percent – ahead of being happy (52 percent) and being financially secure (47 percent).

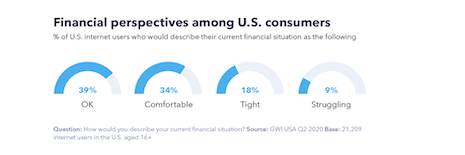

4. More than a quarter see their personal finances negatively

Nine percent of Americans say they are “struggling” with their personal finances. But it is not all bad news – more than a third describe themselves as “comfortable.”

Financial perspectives among U.S. consumers. Source: GlobalWebIndex

Financial perspectives among U.S. consumers. Source: GlobalWebIndex

5. Health is top of mind for the future

Not surprisingly, Americans are focusing on their health in 2020. This comes in ahead of aspects such as happiness and money.

Hopes and aspirations of U.S. consumers. Source: GlobalWebIndex

Hopes and aspirations of U.S. consumers. Source: GlobalWebIndex

Regional spotlight: Californian consumers

By delving deeper into the data, you can get a more targeted view of your consumer. As an example, here is an exploration of Californian consumers compared to the rest of the U.S.

The average Californian is:

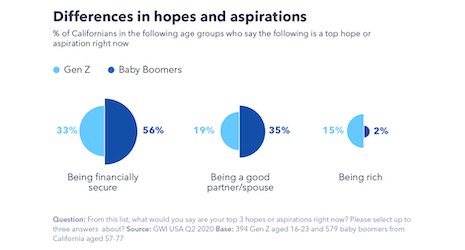

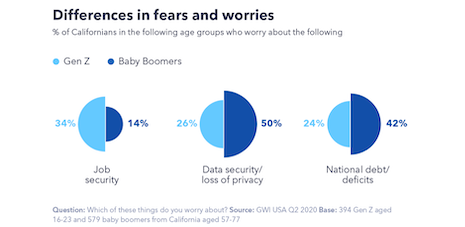

Let us dive even deeper and compare Californian baby boomers and Gen Z.

Differences in hopes and aspirations. Source: GlobalWebIndex

Differences in hopes and aspirations. Source: GlobalWebIndex

Differences in fears and worries. Source: GlobalWebIndex

Differences in fears and worries. Source: GlobalWebIndex

Moving forward with psychographic data

We know as we venture further into the “next normal,” old strategies will no longer resonate with consumers that are facing new challenges.

With less than 10 percent of Americans feeling represented in the advertising they see, there is a clear and problematic divide between how brands and consumers think.

TO MOVE WITH the mindsets of U.S. consumers, the way brands use psychographic must change to match. Here is how to get started.

Sofie Lundberg is senior content marketing and social media executive at GlobalWebIndex.

Share your thoughts. Click here