Ecommerce will drive more than half of global retail sales over the next five years, as the COVID-19 pandemic has speeded up the growing trend towards online shopping.

Online sales are projected to grow faster this year, than they did in 2019, and at the same time in-store sales will shrink by 7.9 percent, a notable decline that will continue to drop, according to a new report from Forrester.

“We forecasted a loss of $1.8 trillion in global offline sales for 2020 and $360 billion for ecommerce,” said Michael O’Grady, principal forecast analyst at Forrester, Cambridge, England.

“Since then, it has become clear that the impact of COVID-19 on the global retail environment has been less severe than expected,” he said.

“As a result of governments’ financial support schemes, most consumers haven’t been financially affected yet, and they continued to shop — although they are moving more of their retail spending online.”

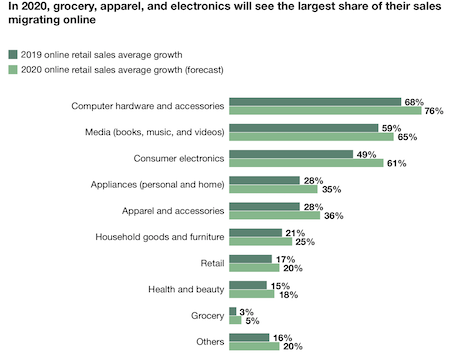

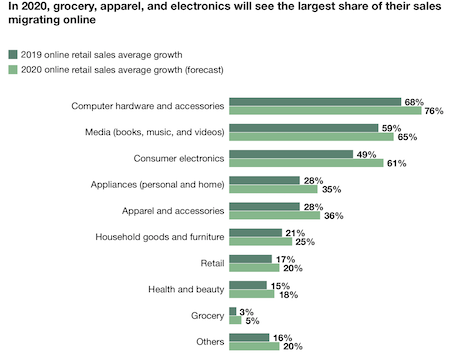

Categories that are migrating online. Image courtesy of Forrester

Categories that are migrating online. Image courtesy of Forrester

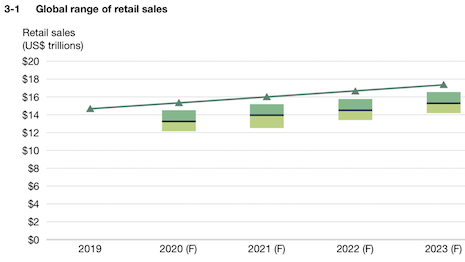

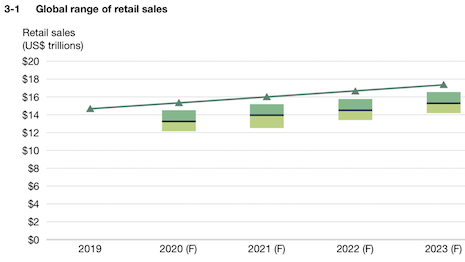

Global commerce

Back in May 2020, Forrester predicted that COVID-19 would make global retail sales drop by 9.6 percent in 2020, representing a 9.6 percent drop and a loss of $2.1 trillion this year. But things are not as bad as they had anticipated when the pandemic still had consumers in most regions of the world in full lockdown.

Now Forrester is predicting global retail sales will only decline by 3.9 percent this year, or by $1.2 trillion, compared to projections that before the pandemic hit.

“The loss will primarily be reflected in physical store sales,” Mr. O’Grady said.

By region, Asia Pacific has emerged as a growing place for retail in the world, as U.S. retail continues to contract, according to Forrester.

By 2022, retail sales in the Asia-Pacific region will be more than double the retail sales of North America.

Grocery, apparel and electronics will see the largest share of their sales migrating online.

Still, retail sales will see only a moderate decline in 2020. In the U.S., grocery sales, which includes fine wines and spirits, are expected to more than double in 2019 numbers as consumers stock up on groceries and delicacies to consume at home.

Notably, retail sales in Germany grew 3.8 percent in May 2020 as compared to the same time period in 2019, after a 6.5 percent drop in retail sales in April and only a 2.8 percent drop in sales in March.

In the United Kingdom, retailers paid only 14 percent of the £2.5 billion quarterly rent due in June, negotiating lower rents as the channel continues to suffer.

In China, retail sales dropped 20 percent in February in the midst of the country’s lockdown, but have been recovering since they began to reopen in March. In May 2020, for instance, retail only saw a 2 percent decline from the same time period in 2019.

Even as China sees its retail environment remain stable, digital will still be a key channel in the country.

In fact, the rest of the world will look to China for new innovations in commerce.

“In China, luxury retailers are experimenting with livestreaming commerce, with brands like Lanvin and Louis Vuitton launching livestreaming promotions,” Mr. O’Grady said.

“We expect livestreaming commerce to reach $100 billion in China by 2023, up from $34 billion in 2019, and other Asia-Pacific markets will follow.”

Global retail sales growth post-Covid-19 based on mid-July 2020 scenarios. Image courtesy of Forrester

Global retail sales growth post-Covid-19 based on mid-July 2020 scenarios. Image courtesy of Forrester

Retail roadmap

Ecommerce sales will grow faster in 2020 than in 2019. In fact, the quantity of retail sales that is migrating from physical stores to online will grow 2-3x faster than in a normal year.

And even if the world recovers next year, this momentum is expected to continue.

From 2021 to 2024, online shopping will drive more than half of retail sales growth despite capturing less than 17 percent of retail sales in 2019.

By 2024, more than one-quarter of retail sales and more than one-third of non-grocery retail sales will stem from ecommerce, according to Forrester’s report.

Offline sales, those in physical stores, may have peaked in 2019.

Forrester does not anticipate these stores will reach 2019 levels again in the next five years, as consumers will likely continue to be uncertain about their health and safety by going into stores.

“[Forrester's] Technographics data shows that many shoppers are more reluctant to return to stores,” Mr. O’Grady said.

“The way stores handle the COVID-19 guidelines will have a huge impact on consumers’ willingness to shop offline," he said.

"If the store experiences give less incentive to return to stores because consumers can’t touch the goods they are likely to buy or they have to queue before entering a store, ecommerce continues to be a compelling alternative.”

{"ct":"JkdVvN3JGXvF36zW9OJkgDt1n34gTMa\/g7hSkAs6XTnBC+bUJ+\/j7pxitvsbo1p8qqOIL\/CJxjMbynZxUezGsM0O9f5WhZHpdwHGPsXSQX5zLODcwt4AJijMI0R7Mw+FsCup3NGbtrV425Bkrb0uIIZENCnwWwT9B7F3KJXscNPlYeCnL6Isix7U8N5CUNuCBmGbKVK\/CthCD0Qg8XPLP\/Fz5tmAW3mjNfIU6d\/DIEtcKIwnzGLHS\/tlBizoM6y+TlyhTxxDXAyXEmhlsHhv01eTm8lV8ax11iauwyUWkkbMoZTwDz7OD1ToJaFiLzo5TzMllmr0ulwLHICUolm\/oeKU6K9El2UwXSN8WNNGlnc6guy2wkPwTCKyYrm62PI6v1B+yYWzp\/VVelBPjucj1JiQy3I0lRXL7CPMnZwMR0Jv72vBdVcj0ExxKKv9sZwhWhdn\/W\/pvqzEdenZoUP5L7oMtIV1i+yK8TT0AQhSmp4ybpK5EUv2BKGtxhvpsyZICwzeVt5UX7k7xAhjw8g8DXobGZ3pX0p5V0Yw5Q0JLRTecOsHZ5SNaa6Mb9C31t2GKB4D2tBut+vYNwNVEt\/QBrGykYcTVBjACIPF8mDZ2oklXwXDfGLFYlRB3sfHctfqCjipB6Ew0tKvmOTVExg5JXjPy7s71t15z0xVgRdxIcKDc56RPlClWReRt3dlHaNCdvTNA3UyCIKJP7v1kuRKx6f2GxEeMDV+\/b8zYkJbfJIcWBGZXqqeKKLk2SbjiUxXc9zB4Pnth6SjkcnAW3fz0QCGsqRivfuYmbPOh2CYxiOw1\/h8iekJ2FaltOeRx\/MX4nI5hDgA2TlFyzdNJBukRpGsihnligpYjBo2ImfF1ZjRXmkDQ1RYiXtQWFmpEBWeeTC2sYRmMSwmX1gozwyNqiS5juAMOuM\/dq43wa0SfTX78lc4kTaIJPu+VeCiJBtjDZ3nfs4SScqx6q2rZAHbFWlOTRSSA9eaXQ7Y8SVM6we\/SU5p+ty3b9TJwtBOnCWVLHB6kRZZuI3ub75aUTC+bUuWZp0mHKCwOg8tyiYFzApuh\/C5Ul6ymG7LNTp4dQPnTts+ETR7RTCyvL7\/kWKtukNVM+2qhlWPA349zeyrh7TV3Bf5lp78y5GYFmbB3c\/2u8+tjeEtCoUvUvP2+rcyv4CB0cJxrzsl\/MkoZ67HoGz5xPu12g3PbZGeedM2zzKS9Kz0QsErZgKnlcNpDmkGKQwFsn7T8H\/SUJYF8t5JZbFowILaiE7\/qM6OTljL7c5Kmy567Mmh+zhGJu84SZQaDT4XJ0pU++A4mIv9YDSC9d9zUNaz7M8vHlDiqgXUjp1MuA06SeOY+fDy4yZfqcsJNZZfcfp9Ptrieg7xWTz9CSUNze3B6rHemx178zlS52qxdfcl7cOqLuDa7H8\/kzvxmAeMJeUwMfujxOjsWf0rHoQK1enOrmXmArT\/7k7jvz4Q1Wl3oUo2zU1Ba4SRGi3oT6K6L6cYFWX+QoJVqeimQSCadCaPL6hG69AJJ20CatyvUDSNw4+HQ6SOeGvrGkWafT92I5RQd1gjDl2L6XmFwElv293MkP1pQRdsJiGIVruObofJfvbtVOjYJBw6V3Df5OMh4BCIZqWJYvIqLIiL75Ns6StufzNRmoW4ABlMcjVR80h4+Fcxw+r5O5z8f8XUTEnAPcsfkvyLEGIjhua8qJg4vgtVJUowhkkH1kGq72oIODzSRslgSEoDoDbrTeaVgty+uxICyLcxM6Bc2+g13uHuHJAGwoesanObbWc3kbCKYDwg9FzSoFgrRTBLXB\/fVc8vwpCqVlkBsP43x8UsJ0PEeHKKMmzTVoH2fp+lFq4A9+xrMgupAkpEcufwGv9PC8hILTTYjFcBbBTp6vL9i3J6GIuAsIeXcL4FYYqRSRj0oIGlAeY7Z88xsRc3CBszxmd9dhf\/qu3f7eGlqgz+Kpz1CVFhcvdcAXLZt4yc5s6qgB9WEagqZXK\/j5+VOXFTJRjYuZC1u9dLp2nuyXPQALuktxuH2MJ\/QlpjS9m9+nSHHT\/urB5TdOTPeqbdSmzA1RaVMtkA7Nczwy39s40iqCDBS94hbxvMUh9Ov5FTtpiBEejxABHr486fhnQ9xClSmeqjTojBmdPHM5gRYApg\/YazAzufj8YDVHVAKKFbH3zRnFVi6KYIZhcWMcuuzKFVzwc6lKN3kMG2WFQ8IcdN0jJjd9GrWubPe37rhRJDLaE6vn81\/8pWSOzxw2uUByrXp\/0OXxtj698mwAtsJJyjg80yV4LVRtdIvia2irJAkBDCHSKt\/5JRsWx\/WOBP54Hk0qj1CNjja1\/lmOz8YZt1TjOIYK8cs1GWh7DUcYw8ztgu24Gc\/vrApPMQMyjDAanCp6Cnx2Wd4OXFeEv5Zy8Zw6P3uZyENZSAJExlicP34X6Z5aY3jGGt4PGllvPM7emDtPcHrFKKpLHVl3L0OZ\/frKABM0oajLn4hYbmB1e6fNQP1qQn8LMGIfQy4jFd5AFfXqT4K2hFS+nLyvNdWPGnIn17e\/zkLotQdJw9x63d4WQ93kzsRX+e7wD+rewKZ\/NuWhfcFM\/T+ucQRX+dlZHkcjVlXS7Q\/E+h4bKC69LR\/CmLMUjHN+KITrxJFI0JDhbDg\/rANo3d1TTC\/8ALsMlZ1mt3pNd7xCmT65LG\/rVgBNEdYtbS6jNkdICcY++8kLNkPkCZoInlMBnLcnjBTxV+DOAWC1IzlC6w7vt+NP1n0S\/w8f99Duq3Xqw\/y11XDYlS\/RcD4KsHI0vnl6zEUgXQjn08fZ3WIy4qqdJhYgfNGgaghU3Q6kLTLXJ3uS1MuOuY7n0KmoKnkSHsyYWFxOYCq7FrL6x3L5kFgNSt+O8Z2ZDZ9cGLZ9nZA14H7sTwzV+9uuYxkd3eCo5T8jU2PNaXtPvl3wsEx08CQiyNFRpZlQHUf77w7yHNCTEKbUaFqvDe1g4H0a4VuDw7E4Vel7HxuRNAFRbsDp7YIvieURkwFMdrm99sfQt2hug1JA71sUt50RuYkcYC5ts9X72tj7QkMPM1WL\/5UClTis3ydLEo+DYfXL\/qUOIPFE2BBh6j3bM6rjsdRiocaYQcFe2K3y3v1aUjJM6eWa7KhSiukdPPZmyDKQm6dFnSlnUmqYN+L2EjDzAG5+C0mfvfnsbSZ+zzTFzcPnyVeTKRj6+\/ceh+TXNrrZtepEd2GJc94JAo5B2LdVAqqgLGt9MBOnrPSpmASKr7\/u6LSWsXkMNpyM\/ExMxRYUq8D4e1FEwc5LGiPa3lYddRS7p2Z3EMnQAPTL3jptzLtFTM9l5YHD\/xJ7tWx5BERUYS4SL2A3tn+wZJ08jJqr5PMTKsCp8Xy1VXKj5ZRaEyDm+Ku2XCJRGipcZaKDdMt3walT2h6j1y1b3GXfEBoxIzZ1+H6hlkAxBAOFHHkR5ivUFCog6yUvCa9\/8EYTtcmMdlBZ1JOyo2aTljvVkPEwUGcv2F\/IShj0WtcJpoU7v5\/NkeOQJpVNyLRX8QCE6p4hGj7JeVQ25pl+E3kOSzSgLPxhXV5ONxynswWSU30bE+muYt1nQ1ujQddWw7YWT3Bj4BLYpbA7Rsbx0RXzO+yGb9KOy5cvjv8nz6kef1mPWsYno5iVCQxpNz1JODuoLiPdB3JJaA2Wr9YAq5snxZKSQ2GbzwyOQeBaKL8V6Mrve\/QpPnGqA8\/IVggeicuVf\/u3o9KZV+ZykmuFILyUthPoc5wm8Juqyv3u29XJFK8\/Gkh\/mwhuFfjNQT9wxLYbs0ec5Dnhl87fBQX1pAxMyOxXYTJYkJeog+EjxWLOWZAV8oNg\/WM6DbfPK3Ys1GSJto5oGryRbnN6rUMZS8r6raPz5bux1ywd6XVs7Wi1GBIyT98Qm1c\/p0UHwi7lqqRYdjPy71KjH7F0bnUMI8XQmvBnvLD3NpIUPOa\/iSeU8obuCPBYncUeIgqNnl4GHDCYclutwk+oBTicSyzDb7znRS+QTtKB38QlmcMik\/d+Z1F2ue\/+o0hazhQ3ZVTnbDgcsxiT91ArfBQrX32RGMl1AVn1gM3fJd4maeaqEQzVgJmAssC10woZQsA8FjOENOrr5VIVcGI3xONRh+rXwyZv53T5bqMhx3pOUgXix0YZOo7YFZpqgKMBnAsrDvCo8L49CdCCMQ4d3++HL\/DqbFI1T8rU3hBas49WfOVNluA+q\/i4PTTx572VFzHkSCPxGVlqbqhxnvu28AjKySBm5npCBSSaq7SyCzqv8G220UiPWiiK3lTzHqMq1ljYf5BTFNPwiydeQQs0vdWRa0yGktC\/9XxjjVdUtL+g+d98nHi6Fs62gEoRZImW2zmNRyZw263\/aOJqIBsMhPxG+hQ7ICqbtfA7qCZpZYyazyIDBAyUs1Pumv3rFpETIB1HAN\/ZuIHSkp2ksdORJXZp\/AFBT3NM\/oyc4fMniDkDDfSTBpC+DskvgWKPdtb9cbsH+C8gOItsOyHk0UR7JwQGuEIEZyDJU3aK1J7OqK3T+TDmG04kDfWwluMwNFTXLZo10+SU9xJcjHpOIkmz7qXNnjZdCkdO7EbrD4XXsKun\/95lYAc3voZO0zFX5cbMI1uQuCOyQNC3CHSU3ps8tIP5YWn\/wC\/blx\/0CwEA+fO7YpQhBdFbTYm2GqNXYOsL1k0r2bHlTHqZdEsdKQg2kaJX3Oc8ppppYJ0RcwYebf+CFPjU+gZc4WwJc5dlRbdJeU\/yi2qCgruUmw\/+UQbPyIlLtRp16UfxealTSbMaMYMW3ViaBUecUmteYphImmRQdbndXboi1AhW2HvbrzdVMRGVJA3lIvOz7L9quxoTtB8vf1\/5zoUJjlLQf9Mind0M0cDIPYpBdj3bg77RQYInarj8r2pcF0mGILe4rC\/xGou1BsSC5Ph6o8lJF5ib\/KZSzrHZbt9OtLv5NjuuHEtIR7tFlVveODCUHV7kbNQ9meScv7lIVfHhYu3oTG1WVWVSkiK1ZifgSNlIyT0YFGF1kFS+4qOTf24t27HdgbRXU616FZ95T4a0lRIPuci208Vqo3CSsT+KaowmlfgKSAsWJYGR\/dlmyZ3B7wmOaGPPtR2pZLkDB6iy39M6SrdxLqEgTga9l8jWf1b5Vq9\/CXS+dVbeMkeL1fHL8Im3YFqtUBeAVB6UxdKxMErKPuqGYw29s4oSp2R6Pn2hnrbhWjpkdJyWzSW1Ndg+Heagkxh6DTkVq4c4H3HDBsj\/V+ZcCIwh2AuRWgBCvP1fsQOSRMgoKuzCZPx756gsoO\/6aWDdIIwmJ1tzFFPpprcvnmrDZcWwjbk3smDbjUqdQdnTcvYrcR5ojbVvFIM1lujeCi6xRTZj64rDO2AKdSAJ15hzaRepRxUOQLd7MeFnkA0jrBwDLF\/9EzVtiy0AOJp+ivB2zUv3+6n+T5JjDww7KDWrGVQ5nsOCNtCdid9UYCNpCu2uFzuZDoqYc2\/4UFKnqPszxElfAVnKPgKqlX3mrZ1DdDLGw0ifx9YCLwg7JneKYrtml0HpsVAKbyIkgpHvg3b9+aWISiSGzLunFqdFHKTq57ITgGj\/Xlh4PmVyIY\/EEv+5MUpkRO3H7jTgdNNYBficI4CT1JwJQLd9LE7AA6huUqNirNHT4l8ADptVv+EbU+\/\/M24AoGcCtnCFUWA0ocqDi7ou7XeutRxJqxjjrF5YSrpG887PyeMaLEcdGVr3jvS+cCuVVkNJGO1J5LM1susSTjWu9TwOTHDGw+tWt6ZHIrlG0pQICyL44bj+skHg9kPVekNeC0OKSMzzPidpRsJ\/bIIhXhDX8Kz43aX1hbjFlVSfJN64+sTYKuNb734sggsireU9dOJIIoA78HWJsYIWa3zhS2zgCzbj+e1IGoVtfbAsmdW+Nl2yX\/vKgGjXbbZH3fc\/tQ0965t3\/WFo5iTJ0ocm9wXb1QLzFVTfOTXGwgr7Q1XKnKe1yf3jlqstT1PokIPzbAczcoD9rJdINxoVjmatDr1ELI69+ZNoaNmhC0QaDNjvkaZ8494REVWa+pvFCnPb4iDsCW6zE00qdIaK6v1jm7UoqHaO3rsovnDmf9ncYzKyoNbKsp9CxkyhHZr5JfjY9ALcDWh1QqIIGOR1CcYx2PjNZF4xS7N6x1df8Uy5uo+z\/7M1h1OaKGBwQw3Gz46ZhecLxx2c0rY8i\/G3YUgJbFhm0Gjj2pzrSOOX53FfPp5wuhbNK3\/B6VRgXh1mnizIk7FCze\/NL3Soz348N58mf1GGWjAk8uDgDJm3E\/9qxzCvxlNSnXJUrEC1G98ICmtXDyvqGHckdsyhCKatbzjZ3GokMuGFo\/DANXnXjmz2TckU4KhutqNCKwgByIGCHGzbb3z+IbshaicCiaVGeuEx9mJ96w2Cu7SiNzFnBGbLfQMx5VQo5CuGFbDt0fFkDqWikJkVz2vxUiZ0Zd6sR+sLeUhobXta9YSxR2Lm3yCmCz+2on9D9WdxmsJxy2Wfv704B3pi9+IE99\/9Z8FqiIoKg6IdwM4ae+lsBaJOnrMS3Ly64xqCFG73VAUyVPlw6f3BnhYep8kcvlBuiFHc+x9Kq3e9ZVwGLzjDjzLyu2CN+zyjX19EA4kflxUK\/JJjvXgTEPBbQCc\/wSmq22BHWd9MgZ+qyuBqDk2czkk2YUe6EPMNocMWiyZu35oPV7pHBlJVMWpvbzk6KW3NxVNM3M+m2B0ROlODMuS9Bto2TrmL1pYZLjdA8prVRbdd\/mge7jcahKuV7MmlZIIGZgQWFYHlJOzCwchTYTmejKrFzkwOIBe+0HlUYHaxkU5vZk5IiQZRaV3UAZuSGx2+dCKg7vjAo2PymbD9mN\/kML\/oTrA8ZrWhu8F\/5OqBrjfs0nBobEiXgHAXYUwq9kgoeirG7fQcEtCS1zbGYzeQVcmf7zZiXVHOFGpXtxmdJtd+KeQtI\/TOjh\/XG4T5elqTf1tyijY6TH8oV+jAzEUeoWmw7t0HW6VzEnFVupLK1TZsfJvLOPBUtJfT0Nj+YY\/PcUjnsNOOcqQ7\/UR2jESR5L8+jF4pXapYiG4CNRp51KLHLXkwL+\/ZLozXAK7faF0kBME2fV0A6dpz6Cy2jycv5iUtDCjkKiNnGOm7slYQle2\/wXQOlu7j7rK7zo8yjogn2GeUmKpwEP2pAm4jYLuqC6a3qR6AdjoL2Ib71FVwFrmPUzXIDA8cLAGRDTZ+nwI3CpYy2or5ZkXwFJsryJgdZtkgLjPd4807nS+rKWfo6ZSxZGejVHOB\/UfRAaXgjRZ9cZL9op8vvqhZnADT9dvQjC2A1B49EuWhlroGXTDkin1\/nkwOa6ZMwSWTMLu0DSdW4qE2mf3bHkKp3dAY2Bom0P7qLD9vPDwJNFai7w+\/Ksx0Z3lh3GK6OxahoLQmPvcVKWWqv5i+KZk1I7B36W7Gjz7jYz5fIAbArgVoFPlQSh7PioqRBqIQWgAnXok7M5Y6ptB+ktp7OO3oI7MyfZefKhcTCuXPvSfIClg2zzuVpw+qV8j+Cksn5wJPQRY+GGdNWuTYS1TZYCtpqti+5vg0izJm79durrwQxgBcqF+MP+ygvHCsCNsVPZ5pVR05b\/wxEn\/yGNdn\/vpzUNH5HyVkUVjM\/OvE0ysGJ+yytmgdIBAv4ZpVs\/VRrPLSJn2DcEGcagjM0j5TC5NR3Pp5z\/NaSiXMXyd69qr0xXA3hlYmVpq0g23TPnHtF+WEQMl49s5ox76ZWgL1aPmUmIv8aG\/akfa3wdp9X1WlFuVH+pEUTy0dJAy+WK98+dR7yCSu0e6Oti1V+0uLjkxp7JMPrunNLespo7mJkyAKSSWHgoWnUhFWzJ9vkSGhOrSOnupsgyaKfFZAhIl9JO17ZQhdoNQuvTBEaTDW0dTHcd8r+8anQXulwdOIrmPOqh8Z3DOlcmqKGiCQo56XaugOOLjti\/BXbJWWSOaFLBKceuPyrLK46mvx\/5z3R9UR1gEdgp3eGop6OnvKme2MLFNxn5PzS7YYwJyhblfJYHYySqZCgJbUeL0nn2WV\/J6agzGkjFpheo\/mU3S1tkvuei5HiN0+KpqN41byKbKx2fUzepI5QvpnIdKxbodwVCwWbDQpnBmY4OR1mn0WZ6sa4u3mH+9uRGHu1cRiYZK88s6IQspafRkcwGIp0k7KD2ydAifN57lc3E87zyXfFGBpQTkcrT6a67w7s75zBWuBlPK8msE2ECU5c4IhhoghGTugsHHYRMVfLhh+sGvwo8JdX5EUz0y9ZtN4ZaNDhvuWxqpguVQXpfQa0EHdvebzezi5OYuKvPSs0mJFNS3c+odMYlZbY8ceJzzsgVkoEF\/evM3E7k6yq9MrrfH6V4\/BL3wEsaTWyL8HPL3mQSYUPV8uTHW20qTg4FFvttCaevtixk\/+lZtxx5sxtH8WBkXD767GQQLVao+jtztNPZo5dtzjcH8y8uaGvlZ+FICuSiwx0Nwms+0yvIY1GL","iv":"6487d07a7e801217a4b2844e05b7ee5c","s":"1a5394fe481d58d4"}

Global range of retail sales. Image courtesy of Forrester

Global range of retail sales. Image courtesy of Forrester

Categories that are migrating online. Image courtesy of Forrester

Categories that are migrating online. Image courtesy of Forrester Global retail sales growth post-Covid-19 based on mid-July 2020 scenarios. Image courtesy of Forrester

Global retail sales growth post-Covid-19 based on mid-July 2020 scenarios. Image courtesy of Forrester