As people have grown more accustomed to living amid the coronavirus pandemic, marketers still face challenges in effectively communicating with consumers who continue to crave a return to “normalcy” while navigating persistent health risks.

According to Forrester’s report “What Consumers Will Do Next and Why,” brands must stay in tune with consumers’ mindsets and motivations, even as both groups are quickly adapting to a changing climate. Better understanding their audiences and consumers will help brands make more effect investments in customer experience as consumers’ priorities, preferences and behavioral patterns shift.

“Business leaders should think about consumers through the lens of risk perception — as it’s one of the most effective ways to get predictive about consumer behavior and receptivity to brand/experience during this period,” said Anjali Lai, senior analyst at Forrester. “Marketers often default to looking at consumers through the lens of demographics (age, income, location) or previous behavior (transactional data) which will not sufficiently indicate what consumers will do next as social and economic conditions continue to change.”

Forrester’s study is based on online surveys of more than 6,000 adult consumers from the United States, Canada, China, the United Kingdom, France and Italy. The first wave of surveys was conducted in mid-April and the second way was conducted in mid-May.

New consumer personas

Globally, consumers are perceiving different levels of health and financial risks.

Those risk perceptions, however, are not stagnant and will change as conditions related to the pandemic evolve. According to Forrester’s Consumer Energy Index, as coronavirus cases increase in certain regions, so do consumers’ fear levels, desire to protect against health and financial risk, and fatigue around engaging with new brands and products.

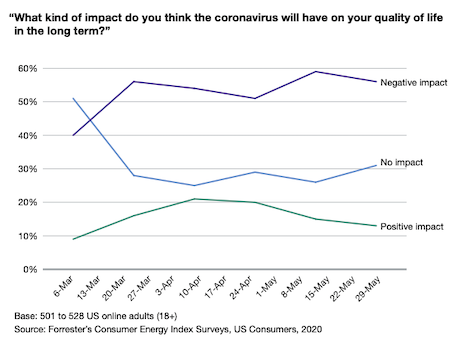

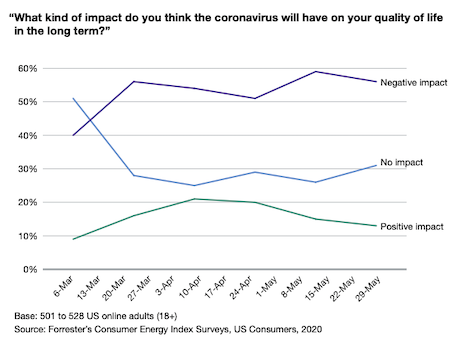

In March, half of U.S. consumers believed COVID-19 would not impact their quality life. A month later, only a quarter believed the pandemic would have no long-term effect.

Consumer perceptions about the pandemic have changed over time. Image credit: Forrester

Consumer perceptions about the pandemic have changed over time. Image credit: Forrester

Mindsets also diverge based on personal experiences — such as whether an individual contracted COVID or cared for a loved one with the virus — as well as demographics and regional and cultural differences.

“One of the common refrains during the crisis has been that ‘we’re all in this together’ – although this is nice to hear, it’s not true,” Ms. Lai said. “Each consumer has had a vastly different pandemic management experience, and this personal experience will directly shape how consumers rebuild their lives post-pandemic.”

Forrester has identified four consumer profiles summarizing the different approaches to risks: strained, thrifty, poised and cocooned.

Strained consumers have the most health and financial fears, leading to risk avoidance and distrust about how businesses approach reopenings. Thrifty consumers are more considered about their financial well-being, opting for the most affordable products and experiences.

Poised consumers feel the least threatened by health and financials concerns. They remain optimistic and willing to spend on their favorite experiences and brands.

Finally, cocooned consumers are relying on their financial well-being to ensure their health risks are reduced. For instance, these consumers are spending on online shopping while avoiding for physical stores.

Forty percent of Chinese consumers fit the “cocoon” profile, while almost a quarter of Chinese and U.S. consumers are in the “poised” category — a promising sign from the world’s two largest luxury markets.

Consumer risk profiles are based on perceptions of health and financial risks. Image credit: Forrester

Consumer risk profiles are based on perceptions of health and financial risks. Image credit: Forrester

Although the majority of consumers are reporting cutting back to “essential” spending, different groups of consumers have their own definitions of “necessary” purchases.

While poised consumers continue to prioritize their long-term saving goals, they are also spending on products that enhance their comfort as they stay at home more. These purchases include home fitness products, beauty products and electronics, as well as home improvement projects.

Cocooned consumers are also saving more because of persistent economic uncertainty, but many are spending on enhanced safety precautions. An extreme example would be affluents who opt for private airline travel to avoid commercial flights where it is harder to socially distance.

“I think that cocooned customers specifically will forge a new definition of ‘luxury’ experience,” Forrester’s Ms. Lai said. “Already, these are the customers that are opening their wallets for the fastest and highest quality digital solutions; they are the customers opting for private appointments when they do venture in store.

“Their emphasis on physical distancing and physical safety will yield a renewed exclusivity around the luxury experience.”

Post-pandemic priorites

During the duration of the pandemic, growth in ecommerce sales has been a lifeline for brands and retailers. As brands continue to invest in digital infrastructure to connect with consumers, they must remain aware that each risk profile perceives technology differently.

“Emotions and attitudes towards technology will vary greatly depending on the consumer’s pandemic recovery outlook,” Ms. Lai said. “For example, strained consumers who are highly fearful for their physical health and their financial health feel the pain of the pandemic most acutely, and will use digital as a lifeline – they will rely on digital tools to help them find deals and discounts, and transact from safe distances.

“On the other hand, poised consumers who feel buffered from threats to their physical or financial health are eager to move from ‘crisis’ phase into ‘rebound’ phase,” she said. “As a result, they will experiment wildly with digital solutions that deliver uplifting and energizing experiences.”

Many consumers may be reprioritizing and changing their lifestyles based on their outlooks during the pandemic and recovery.

Poised consumers are likely to embrace digital innovations brought on by the crisis, and cocooned consumers will maintain digital behaviors that improve their overall experiences. Cocooned consumers are also willing to pay a premium to shop at retailers that redesign spaces with safety in mind and are visibly enforcing safety precautions.

“First, business leaders should determine what their consumer risk profile looks like,” Ms. Lai said. “Depending on consumer risk profile, business leaders can start making strategic decisions.

“How urgently do they need to invest in digital transformation initiatives – and which elements of the digital experience will be most important to consumers?” she said. “Which kind of digital consumer behaviors will persist over the next 1-2 years, and which offline behaviors will revert back to what we saw pre-pandemic?

“Every company wants to be ‘empathetic’ during this time – but the way to show empathy will differ by consumer risk profiles. Leaders should tune messaging content, tone, channel to match the consumer’s distinct mindset.”

{"ct":"FDW4UOQpNXmrlkqFD0jMGEzNKcsxv893Inff6TDK2C61ukZf6E0tYU40XC0Z7y9hLHIdu6CydSzvHD7IoclrKZjC8Ynks4zi53rQJu5ww2S4HZgmjBiMOZhzj+mDdJlRJWPk6Xu5BH828lx9rKYac2MiZ3G8PLYzl5zpoxcAPQ+7KtidPfrRXhDebj3Rg\/Jj2CW+pu1Cu\/3IIGr3kqV51+vuBY8IQECkv1EXFdQxVxNodt3oUOkvUcR1eh+wvto81KpdWpK\/ese4H1L5+rV1jiIrcKmK+CShF9PjodZSbvoZ+1Fw8wffGoUp3MJMTqffTYjxbhaDyEkW6NpxqxHkmfE5IX2AyXP0m8S4F4QVMe69JjcmG9TfEC8IM2fB6UtNtTg0AZI\/t8vsuTSwcobhNT4hfbp5xyQGSKpxkryspx4FtIHNqS7guRsp7zS9ym+yKiFxkp4fWFXJn7GMEPcG1f6rqpoIKpUP82glIM52AOmpIlAqC3QtadcTMpv\/QA6ct9V9cv3MZaD4wyMtpliYZ3Gz\/\/4d3Z30RUXnZb0ZwFja6g2B3kEKaK5v5ok54zzflluSJPR\/49mzn6oMZ0o7s5ZgwO4KdWx4gsVVuXMsogiJQq9KftkQoqxUloMzwYMkaMUrMErkUgIU7o33AmuKMgxzRTbWa9Lq38K5tl3nuwJHZe36uEDRseu2zTSoEFmMT8cO1j6SnGmuJyrQTafQWuo6kIiW3W2SbNbGS\/TGoz0Y3hFPrZeBxKvemCwkbUtgtwHhdGPeURfRu+awqwrMgREAa1w0sTbvKsrAOlpa4mYyd8+WxUl1gtWeCkhfGg9J5Qv4L1zRiODQQnLJnpj+Fn+GNcktXsF3khLU+oJG0JCMxpS6gducHQsRf6LWm8M6wo4vXVDHLEu3A6CamPzNK7MPHyFnuXifCosuQ0dhsHGXI6TjE4u0I7Ytc0ziYr87XoOR0X5m4fPHdA04K800h6ievhlf3wwl1gp6StcUOgjj2+E+FjFVp62imynYM8DErBNHGUOXhPvcK4CWZYG84Wx5B\/EoUgVOkydRgTtFVOmfSvYpqh61ZrHoJ9Z3keeWHeYDZ0HPELxvsdHNeL2DWHPdM1KBnKEq04ekWKp9t683VGaxOWkmCFiQ3dBTQysTQpmcSyjEpNQ49wVJeJ2VNHXYNNjn0Kw5M42TEPeAXNKVZ4Zoys8+JzdYzLM9iBbOfICQEW2jNrEDhFoEq3dFBktvLi5qwjbxf2Cxh7SZ7h4tjlLZ2mabrpWBjRAZ4bf7hQdxdxGAv\/q\/VpuDAISLKt2aIPtUqO4Rhb5iNBmoy6fLWfrvp\/UuOpEGnl2H\/H6Z4NlCHupFTcWRyRB083rErgpq91e9BE\/LuGv1\/zosyCN77\/feOeN5qfgLMhSrXyR9cTkmaBSVZpMUz\/NLZbvp9BzJpGV7ERn0TJMfwkWauX7Z2emTUMhNRvDUZ7hcdahHY4l5T361MAbw4OK2zsn5tvqd1cEAkXnBXyXwoBYr\/W2LariePO6uTHWaYXhkI2fdLMvVutTZ8lTRjA7wfqum4cFpzfjjs4bf5f4o2voCfweAYCBnE\/Osg2oJ9zlDflva705vdBAxovDf4NooIEnaBoasF\/4S32aapU4wDxIeqNHc777pOLDcj8QAhHNfU4kWIMhw6T0InCWFH6NHbVvIAt\/88KeF4MBZ08UXyjaEYEhpZPqc\/4cAnuIezxgz9dPBWE9YkSWvKi\/1W4\/PTOL1vjKZaqPudcB82O0Yp3m8zJBuvS7KGvi1os2Xdv0az\/Lh5fUaDAzpXZVfRQN+zyfeT5yUgx8WciOVFw4gTfzsVrmEW\/CwACypLgfY7IkiE01K1r8HgHFOOcw+D\/FTQLFEBzhuEkzbkYiisF3o2hUH5ztHYg\/2ABvI08pQekKrz8Z971KiLSaVDbBA4+mXiMJ17tR2UgcmyQwLrpD7\/FdZjOS7vE4mnAMEZrHQaQcK6ikpQ3UlyGJQ63CmxCRh3qEdk5IrWTCPD47ufsnR4vws6YpHpKCFsPvtMN4RyXMY4r5wUV2wWRbpkh5WqM+H1SsN69wIORimr4GYX6jinKOnTNr0yU9nuYO0fDrFP9cxQvqNn4RRx7rhk5+Edx5WmPy5Psi26dK4yuvwjSuBnctc2P1I9CO9mT2XwhiJAOGfh9X3HccYwurL7lr7WRTSmfDbLGjZInNHKZp6LydyW29NIcN\/ih5RX9NvUuOOss\/3kLHMdhkQkhB0AgKVn2\/SLzJQvwmBzHN0unkbe6VwPrxwkuQjWeW\/wjJkQrPNAofrmPGE0HjjJTD07O5aj418CIxw0UNBSqlwY0q3CFU8XO3RbfeKRYm9vFgG+ya+doDrK9ay+LNCLW+U640svk\/Y22KGSjNSGTTte9MTQZaKDapRePqEbAwPUA7HMK6QbRy8yC858LnIS2rK8jA+JYH09PKKiCGdCA8PVtVwjNguV11gevib1IBqnQgyUIAgmeqAhU8D+2y6+lM0p86sDN80CdwW+SvNiENH2+HNx76Pr3j6mW51qpDvZaibIg6CwPUF1GsIvWpzQFFgxqGOQcA7Zph\/FruFpHBXrhRQXqkNi2oreXYsqKYoFhhiFdcyBnGKkmSOhh28FkRjVKWcWmwztLpTOAy6ypn1A21J8UpawGYRUVo3jCsAhZMPalgcbH3izg0uPAjlwJJhdaWXzgrcRzCt+F4TLy4l8B5Lh+zRJGEGiyzSIO8ZwMoVrlVwahvyqMJjGlLN4yKF1MG8nrIsXK\/bZ7yqh+94IHCfV1PRia2+wLeua9HDxuo8prlIgwK2mzYqzeEECgl7jcU5ClDFMut47cpG+gq1HENjb3KSd\/FiYTePL08Xf9wcHDnUriMnEYYABKnAOEZcFmUOjA6S9SfP8ghC980r6VMb4+kOflPkJ\/bVIcEDJ2C55IkcAdNLbyj5zr3+0+xcBWOkiI4lDp9qbzeE3cMZgRkbmRjKcBzx2B9lqlNxyDQ3TCP\/BVT5h6guIuHPKm9uky7CAITUwtVqpOjxO64PVHOPJ3G\/fRdBa8wkfv2sgDKZcYP5x1PQplAj78Re4XF7vBfla7ltgSGWiLG6YIrpFn+3n0usuT0X+ZDLGj1paMd3HvCgJ\/0thcUinYeq7bIE7LDaW5+0hdjoKdy2BS4t+20ZoeW1ctVwodiZlP0dgoK9VaKfUNEay9qPc6c7tG6qwWsmc89mfwNlhSpoedowN7WK0Aj6v30DPu0x7fBpCeLC2BUaV8V3vJ6\/qWLRnaa1Q92QHCJgfvimLF0A3JP\/Nc5b6h7t6+4dJpJnQ5BRsUuKbbnzqfyCvgrTZyvywLkJtvF4VZYqk6f0hZgNxB8Hq+WiKdYia\/Pqd2lzGPj4KsDoLfKA1cL9TI4jCBsMDAlxM8Xi5KXCVjFy5eued3FmRfA5fWt+olnXh4aqppIYw+M3i9Bw82M6qVHuP4iFUWNDkiZeQA0ylmVMz3g6w6cQL9Exm0h8RxZDV4rER\/x9IFWP\/j9LFtxrQJmUEzw18\/qnuLGdNjj+l+7WetRRTlBwjbWOcGuy1HGIxjj5xx6e+W0ntluLQRxRGnIcBQ2KL4+opTbIWOHE1e9\/T4Fg9WQMoElhiG\/hViHLUAk7WicGtv3WumGMKfHrtaZIGEF1tXyaozroejVBtefB9EkC8a9Wwk3jQyx5YshW1z59VBdkXm\/pDN4VbntJVsrLb\/fM+5vWcYqayS6yNRWhSKBNZa+kptwgKJIskMd3TCj8gO4jsV7PEq+jv72h9qTBkz+CyOX+IcBEC9CQCjtqrjX7ieC6oIMgt5+CjvjO0MzWx2cwgm1lW1YuK6U8DDFTRdzzp21\/uBLKeQ0mbVaeUvw5vomdHsUsxa0Mw+KPZGzY9zH9ZR0iyyXJ4pmZWr8LWgtxTaUXUCVYx0dFkhp4ZpEjTpXeJ5WijirI1grDxaO1\/HXqETGWj9FXCfJcX29K1Rdk8kjsznsuxQzUDJ\/V5ecT\/F8oRXXkBEEbS4TdHwn2sEsTntEUBLCe7Xh+m4vwhHhqCfo\/C6\/5Z34\/qvZnhIGqt+CzuKM0KreANqyVWaqB7GmySy01wmfrbtJwcFrZ8sfCUWsme1XtOkDGL3L5t6AYeGqoNXMbcoF79Ib4T73ANLEKNK5bYg0iSQHptlK8uk9KIQS0tmcO4qQ64DXxlaLwDtYBRdjVx\/U+Uf7CZeul\/qXgnF+6iESQW+ivEe+vS4YxDVRe1UBl1WOoKwLtYvouSJJuACWchXPgFGbvNUZ57Lm5Ectg3CQWWda5ttU3cE6nN5xex9NyjY3Fy47WXcqy\/nX5RRGRyl29\/gHGQH3s2Z1bwJhjqmsVhK9nepSAwDXN1ICS3edG8ZzHoNXAjD0LrSy6mFhcCaajqxTbz+2awc2Jfl6oLjfZwQQJPh4MfkUaerVSh\/DZ0Su0pkKl0H8uu4VYWKzuYLSW+Y159JRgHIYcXRpjYerfC9SJg+XA0YUf45Ehce\/WU8VF01\/YAFA9kE1aGKQmJqwXVEuWjXIFN9+QpmrXJj+9z8jGkQlMmCgwLjSpQt+soiRC6c16yRXj1CZWqzJY25EIKDgSOQT9wEj3X9YgofFMh+k07FIzQv9A6\/wsv0TYADEbY5hYYRh3GiS9MrLEUH4JFBW\/w6\/3RfcQ+8GzlRfClFNekPMm7DRJBpWu4uSgqUHPv5Uh9LmEkGsQTAeDSRrDW0g6u7Mh4iOR9Ds2YaOTWf9F1zLqsXslYHpbsIJ4FrVqJRwJiyMGk11qMtVy1oAQHSdHMBElwa4xFCMUg698casFCHiEa3tSifam07c89F7Y7+sOFR4BO5xRZFJyOwZ\/t8yu4\/1l8+ZKRSR\/8XXCSUvs3AZ1VOdN2jWGvYneBOaCv299Yj\/WZfHJPETsOJeRM1VwDgHJZTc4EebtYCFJb8iHnA8mIqVP\/lKmsXLhW+Ip3d3oiYk0W1nA2X0os5EJO88sQefMf0hA7tpb3lk\/2xITp1p5F1lE9UmHGMRuyDCn8yr+QAaoN0\/3CwILM\/7T+ury7zJgf5ybfRlOq4pyQg\/j3+XwtpVcVzFl\/aKt1vc2pSNzTZGCz12oezEPfn04yOGkChxN7yrBEKSYPEGIIuHMNJaeI4p38S+A7aG+tehPACxsUdouHseTYr8FVZsB5bCN1F+9ue8lL+7hrRqsoU5pNu7BGzN6YytCj93Qmv1ttuBa8wt3cwnGPcBRoXPDYbyfh6YwgMlkS6pqHlcIy20iAMJLZRwhLpQr5g4trUF6f3\/icQJtLcZZ27ndhGeqKDw4we5Mm45Akmx5hQAAbqjw9RpzsIdZCnjjIXseyKvKrov5vcl4KtIjr9xPLhN76dlR4fIe5KXmBV7Eb3MaOrG71BcJIL65W16ZI8+U2gyeulg+1k2LkF1WwJpwwaY4L8IDdPXdlAj+5mgg+01t4WFz6WaL8\/MO2+nv227KjUGKKRZuW2ucfue0zoh4vswTV9FpCi1C+lRi8f4P4MNclvs3bNbZ8DbFAwS6\/71b7K9BlaE0C4IlWLDFmIQKlb6ZX5bEUzOVBlS8L5t6xqcZ9ie3Y5gNqF0\/JxNuhfiJaiT1vVJYHY2gxu51QVWeQ3tp9P\/SZjqS76ZxGhS32wQBZVWCYPD+8hrFTZMrJbGjKHMCqVQ\/2zYS4bUozNANdo4piBBPE39NUFQCROiFlKbPx6hEZ8T6ir4eUDSJaPj2BnTZt7KhyPo0uuS3ZIAcE4aPhq2rBmC\/rf87avyv+9zAKxEsLF8\/QY9RIOb36nZDOhPBwbpaP4Fc7RJ1pScPlpfRCAyuOxppic0IcuX54ZyCmPGKqo6Ja4YeKvEjJil3NObdldQDf1Jrw0fVy9tFNXeHMh4wGlk6NiZ4aTwjNysMErQDmiBUeGic6bZqmSPuGxz1TekkspM7yq5yYMet0jcHwh7svIpUMipvLAglxTY7s0JsQrnpclTb\/Z1svCdL961AxhfPvyVpvExnKk61+pXQ9xJm0Gfj6Rhn8twqtxhAw+jsSTDjBbk36BXT+Laxz7J2hOv39ZHZLr8a3UL8hMP1PEKhC9kx+rv\/4gIK6p+IUwb2GgSrFO6nRqnzxH\/F8nFvahOMt4q+AhnHCb9p9GZ0sG1+PyIsoylxB6pTjLBM+AwcyOxLiO8QqxbWuWwUq67Ds0qmPhsJ\/j0tX4SMSgyVubhvUnO1aGwJsmzFckOPPgqv8aMY1OYabgryYX65mz835LWqLPuEWUQLvzXOK\/K3\/HbXOTmZmLA\/fCOxQb+0B8DXdJ7f4Q9DZdgcHCHdEXu2GzKA0sF9CvRdc4f5W7JGWhYcLW3uODi+QoNXH4NJHNd8gPRPNyz0fQBhhhINkBSp+e4n87lmlE62dMRnG\/24egPGQXndxEXFxWOTM\/mqzMZeDbqKRJeYKcBvHG1Tz+Zdgx5KBDCelmuebvdm1sMOWQEt0mmX24gUaoFHJ+16A7nS9OVqWo\/pwRBIGw2iJR4g76yrO2u6UVqFQR9YbBdqi4f1FCr2fNsCKi8SiU8FqD1pJpvvM40jNkEkwF+fmBUk5N3e96k0CaPrphP9xZ1x26eOfFUimQUR7cRe465Ic6l3Kg1G2ekqDBEx+Wr194f4exOYx61Ziq+YB4YyJnB3VJhESpGPayQKnLOKUc1DykOGnQPsn3IpJ6PjokVS+hE0lBMNd9VRlIBxSQFerT\/rRxXgxfRxJ9bPkcZO\/KsDxL3HAGonA8kMsFPfX1qqPedG8aBpXG7YQaavmTU4RcsN6jprqZUMK0Eiq1lXfEHeTQ6x0C7wud8zTrs4xRDCHExufNg6Gtlt79tW58FY7QhcEwYWpaigl3zMRkp4JD4J1FOT4cSq8ffr0EaVROOg5w3kH0eHd32gHmEKHCkjFU7H70ND6j7sEthQVQieSUSYP\/w+BOi7fYfIOpIAWeNuK3gYlMiiHe1h2R0iF5eVwiwY2L2kT5DX3gmMr8Jzp6zoLCNp4xo6d1NT3o+\/R5LoxEnmYqiUVKZvcdgnwvhzaJD1T+KDLynrcTktU3yjWOtglJBKJw2cRuKcbeBqydxMfbCIVDZ\/mvGzU29Edms+ftk4aTacC5D9lyv3as33HGpxC9wxwhT+fXq8uoFUQgzNCpXxMh60A23Up3ko+uNkM\/kFUy+lgO\/FgkVLtYx19l+LwOgVOYi+HRfJ0J9T1jo\/9UHp4lGpLEE9ibmWsyd5ZFpB3wbq+0hfRDwRLnKoIG9Fv6IUqBdaXkXC51FajgHEa58rvc6JSctYwglsz2\/f6k1wOCp6UBtme6VtiXbigHCCAxSmTw2rzA8eLby+VNRsxv9DmWWmHlkJd2y244\/UHnvPxt4Yj71xjuMN2sKgKiZmVcbUBbZ+3\/XJrgLcB61dpwrAmQ5vlVQN3GBkg9Szqmf5JRKWXG1ZUA3RfgMhw73kcKB7\/WSw86dAVteEpqDWgExkKZmSeMBVR4+Qyuz\/jnmyNl6vXkkrpYa3ftJEP7tw+V+Kz7MZrCBjDdODOjuJ9uautSpK2KyEOVnFd7+nhJLu4tUOL55\/K8Y3fmTo7mky5i56wnRunLDI4\/sW+1rP40Xz6PwpEXyJizb1xdmGBSb5AJiaoyv6fv8zoo20FtL5G8Fb0oEbI9YhQs4NKhKOLEm4gYjkq5rQu+xa359yC4Sp5hYd\/TA86WS7i2W+fLfQNHqUxwr57tv4c3BeG7l5uDck6Wsn9cl4pPtaNQEodHOny5q\/TBgpcstSIpN1UbX88yCDDTjxcdjRXCYRETXoZdawGk2tXCRmzVjLMHcJz43Ks6Va7ZGn+rmluzhWPZxQhYxmEflokhynffaB+P1nRQ3wyApuhlEr7KdoAvGLi5SA1TkPVHpSo2ZrwEChJaTFB3B2xRHPXn7gDG7GM5RVwwuRTjJLuXzE1UA7d+CQyQkyqjVbwS00W6ZgU7JDacuVOO\/VMosZyzaM9s1vOzpx2atn6j95zimGDkQaxBatPTHjX\/GpZwLRW+8nG8CPuw2rJsuAaJ73KviSH8x1nCz2QkaJe32v0WroSc7MqGHhqu2cV1jKzLCexYTD+nBKpy6ArB+ChGy9f3sUZYV7nCYOpR8eArHLzEs+VBD3U\/9GRb0LtHavMzM2UDpJDTbOWX2X1q6D7WKycCgPVjSzg+umRLjaZHnPH6wmZslKyuzdcA\/II63t2vjymrAJEZb9f8oscUOGQxHl4nzBJYu85F0sNwQBkvr8VvHDNfIzYJ7RgD59AQTO318N6lu6HWohQ0bvWcNrVH3pTjLHCVCx3mxLtaSkoX1VVexjqeaNWQvT6eUPMix6LluemKj+sM9GUyh5ydpGLdoCC6hKMs8shfnN3AJ+1JmuhVs\/abKio1fuyM60ToHHupB7mOOJoK50dUVh+0YrhO6YKakrnKexYRyg4boJrNk8HRcxbuKAK99mSNJ0ZulgXs\/UsX6sJfKRFevCLEelj2U4uJ0BJksTN43mTXfRwW55HSsTK3gHvgzb6rqmkm\/yCTM165sbafSqfXKCxd68KSxsRqSO6t03srQciCsoQFBlDWWiHUqoafipe0qfjSrIb7WJbEpSSuN+TtGpuidEkrM75URO8750lL+dv8ZERuiXmD1dceZOxiwQnJS2fTmOeuLEeov4w14tKcUuTUdOlJ+1Fy2jCePd2aLzqaHchKyc9ENmIHt932zdwzLJwkNAVxnLmZzTNkoVBWTnUGBS1sq574M\/TgVWh85QCngMYA0QmBZG3BT4UQUiqndhbM3eZkF8RNcVMVmSDlZD6zbnvi21NwBFVRwfUSlcS69wVYHv3DjM6MDaFnohTCUmyl3aJQp5PbfwPcx7W9auA2VYishTyVhT+x6dnylVHS7q2eAR6ALlJSPXkaDB19jOODG0yy8PngolkZ5gh3MHTpxZMQKCD\/\/iUrCnnaRJkUrba8071u1CX3hbakF2oSpirEqHk6p\/tktnpMN0pWYsYCwUDSCByl\/g5+Jub0vJd6AlgCuxpMa9f1no4+wHIrJltUBjIGBrTFWMwFhV2v0J3aOkWC7FUg1L6oa8M6urXbF2B6shT0uVfES+1JzwH3lLKN0QH+dq1Jthh6RJYTBtmJhilU8QIE5\/j6usOgZFgHN0++Taw8zyP33\/ebY2GgoA8U1kdEyrHYU2R27js\/eu1fjdorM3M5G5c24bG7kBCBdDqjPQ6DbgiL4y8xPNNQrMQpH\/HvXUiHYjI5BK8GVpG3MoOSIEbTjgeKCJhFyl2hJgKN9AX4MbcpID2IGHdJtsIfm2YpubT2OIBqSLX69u+9PYXf+vs6N\/sT5DaRLhq99zeng7gLYipFLlLnDtbekg75HmOuP\/UTzxi\/07DxFuiNqsqNb+l9nKEn0\/14lBWXft8\/asDoMK+xjsNnrr7MczNF1LnilDW9Fef0hrWE4UEi37rIAnWasLrW+XYB9iJv1fxNyOnhxLx5GkVcXhkF\/87eFmoF8iW4iK6+jPpfb\/dYXzWLNmGi2esm\/42AnNM12sGhGIFAph6TikE8VYLV\/H2IZBeyeY7FRiwFKwtL5GXyTwyFqLLVPZqfOr\/b+LflXYS3V6W9RShI7UagzTxSiArPHr6IEAjfDSCIUJ3+zagnYU7iWe5qSD\/2DLlwDMVEM02K4yQonHKr4ARhxxzZLAPVuNRcp1uimbH4Qk+Nh8NL9Iq0fq2salsEKdhN3giem\/sdT4iVAb\/+fvgHZtvXdk1LJ5uu+BLzS6Pe5iq1KMF5IWKXKvJTVLFgFykbKm+gHkO57jhgjynQ8LVUDuvmAxcGlzGanXAEWxcak5Ym4APT6YVfdgF1xDqy57vt9lJ12UXcc32KN4AN1LwQ263I\/obUD1Tk5F\/OjrWhepNY6Bwn6UN1JDOhnZrAgHo7dX1jiW0gNakVe18CVnh4qyfTyxEa2P3ImbkFPbQi8jP+I\/O94cVTdzSeu4UE1q2ufUtBMv5V9Nt4vg0PvjKtcYWQohIoK1G+gE8bQMJch4yXGOOHlpdTzamB9182f3DZX2dEPyMSL4yt0qER6E47CTAz1YC5YcOaZBOm2HlYGrgfaFtkSFnO+EmMj5l9Q3w6YB+\/YJVZK3Ks3ONUoQu2wq4ia9mr39VLSx6D62MWCALuheU9Dx669yclnl4d\/Zj7Svn\/weYDn6prTyOfyJzOGVDaa41LqhDNg3UFYgl5DXBeRuea6mIznclqFejtxhzH7tUfTqjsy1Z++ohCe3AMvJiK5QBH+6Jzm6tjjAHIhTHluLAngOJ+r5c5Td3MpOc5G\/3DZvtkPkLAkpwiG9D8U6\/hpBCr9hLB\/i5gHvM9SXb9j8S0W9W2Ff786G9u2PsQ2jXTBYcooH6+0ReDKUnusQsRj3Vjs+tDSuV3fDAeR+OceBuGrJDaWYLWzfk0L\/uSamJd5rkm0EfJNh7hOQIznxwsTB2TrRP\/Z0ml6IcVPX8NmH4rwAFFnWWS8JN\/OxJ6ezUALjDTz57+BZ+5ust7oSsTj7pH\/1Y9EEEzl2qQzW+T2YZyvmOMIjnRHdbV5Z\/T\/erA4mIyyXLkMvh85ThUNTzJ4KRjsU7Uddh7LjpKg6Z4ZpOX7ZoG7x\/1LDJSFHXUEPFckk8vFDVxenJqwGROsCXIiAhsyBp8zUXR\/HQjL7kyjNBNQn37qUuXLuA++twTmH\/2029oTzygOiiRKW+z3quFOoLkZ\/8LCHIfpkepbbI3pYNa5NRzsGe8\/e19BLueQdh0oUG8c0crDDL5Ar3vZC5nVwiskTgTEd2r3knCAE2P0P\/55s2bSjgUFmRnl5VjAOJDIdqU08HIpCCoy540iBP+Bhxv1p4vrK1\/5+DynAZu3XGxajusrNrje2N0IEEa4T9SIe57hkEggHQkjlMWl6Rod4D0i1WRhnwCHRV1o0Dwqw9c2u2TIrSFNYcGwfUt5R5Iinl1unJC3gG0BLrCbUmMINgwk2WAE9GYo2hYOJLqu+3+2cXKDX0Su52\/UOIf9+gB+Ah\/Z0r1XRRhw34u0fZ6J5RzZF23Nq\/FQJiu548ALdyjr3bW16diJ5kIrmIJ8Y4wtHoj9hpNZ+dOn+qmGGeMiZ51EUKvUrUF\/FIWSS4jK6sIqBfub8uO+p6aEPNWh\/icdtTPPkbaSJ6DmHXiMkMMOvaviasF5jg7GpclM9dffv\/s70R30hN24DUD9Gu8j9ozYx4gnl+1h5BHyxGI\/cxoEn+2YCfSQZTdamBSn\/xTmZ9u\/qDaVCAcJNrkXKdmCGmQtjIIk2IYgf0X77u3h172+NMcAPI8JOJCBvTwdcc4L0GTOB3sZKynjZNFZah68Mhksh8x6\/nAbw3IEkVfZl\/BswmfL0O2VsZ9+GvGbJSJFFWWM0Oj\/FLS1l49ZwJtdhpayqnT2T06NxGra+qpnIE05m7kUOdJwxTDoqkSi1E7XFbeI8lGG+icpWABXbg+MB6sCUcnD0Pm+Er3SNVrgFOIpqwyakVllKYO6NEQI3XCGlTq2m+hCHJkKGorQJkJy6xDoY7ieeu6uC22qgny\/oSwc5DTnDfRJlIteVjGeFsHYaucMnZa8k16qMjJNBdwDspUHtxrPEl0jUHYKqT9o9qByO4dL3Opw6biTZbD26zkrBo1mZea4Z9v4EazRF2XOyg2WZ0nJRno88+oYpZG+Vf6k+umwHJOCsxzoWXQJ2xUyEZB6pn3\/3R+b2tRlwL2R6qAfC465k\/lDc5A+JSw9JqYRvVnDaxApWd\/xfgf5UUb7x9RUCOvA+HIvawT7a3I4OELklGklV3aFZoWvKjlSHNarTTYggsAr2q6M8vuJn87JhmMxoAT6e","iv":"82a7280fee48b6e4a8d6bb46c8622693","s":"aaf1b2c4f5d05ee8"}

Consumers have varying perceptions of health and financial risks during the pandemic. Image credit: Unspalsh

Consumers have varying perceptions of health and financial risks during the pandemic. Image credit: Unspalsh

Consumer perceptions about the pandemic have changed over time. Image credit: Forrester

Consumer perceptions about the pandemic have changed over time. Image credit: Forrester Consumer risk profiles are based on perceptions of health and financial risks. Image credit: Forrester

Consumer risk profiles are based on perceptions of health and financial risks. Image credit: Forrester