NEW YORK – As the luxury industry looks to recover from the coronavirus pandemic, it will rely on Asian markets beyond mainland China.

In a keynote presentation at the Future of Luxury eConference, a director from Agility Research & Strategy spoke about the attitudes of Asian affluents as they enter a post-COVID era ahead of the rest of the world. While optimism and luxury spending have seen declines, affluent consumers are still interested in traveling and spending as restrictions lift.

“The high-net-worth-individuals have really been more resilient — a lot of them have gotten richer,” said Amrita Banta, managing director at Agility Research & Strategy. “They're also able to spend, and are really the people who have gone back to buying things that they love.”

Ms. Banta’s presentation was based on a survey Agility conducted in June 2020.

Future of Luxury eConference was produced by Luxury Daily

Luxury rebound?

Asian affluents skew younger, with an average of age 38.4 years across eight markets. Thirty percent of affluents in Asia have net worths of at least $1 million, qualifying them as HNWI.

Ms. Banta described this group of younger luxury buyers as the “triple A consumer:” ambitious, affluent and aspirational.

Although these consumers are not as optimistic as they were in January, prior to the pandemic, they are feeling positive about returns in real estate and other investments (see story). Now affluents’ mindsets are shifting towards what Ms. Banta described as “revenge spending,” particularly in China, Japan and South Korea (see story).

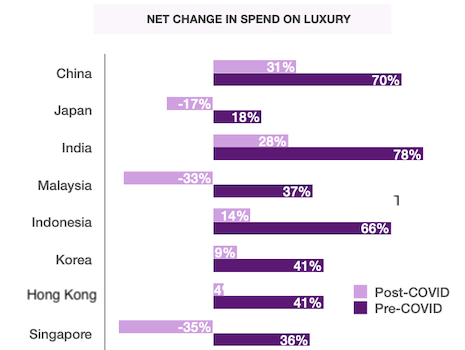

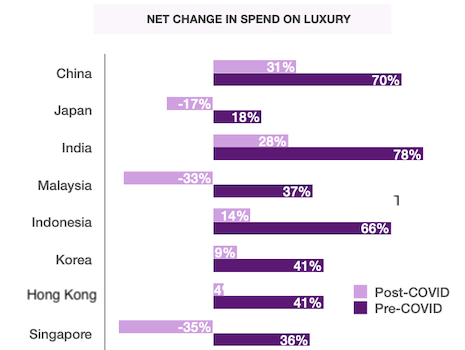

Luxury spending among Asian affluents, pre- and post-COVID. Image credit: Agility Research

Luxury spending among Asian affluents, pre- and post-COVID. Image credit: Agility Research

“People are coming out of the crisis,” Ms. Banta said. “They really need relief, they're going back to the stores, they're shopping.”

Luxury spending has not returned to pre-pandemic levels, but China, India and to lesser extents, Korea and Indonesia, are still showing positive spending levels after COVID-19.

Among luxury sectors, travel has been the hardest hit. This has had a trickle-down effect on retail, since Asian travelers have been an important demographic for Western luxury brands.

With travel restrictions still in place internationally, Asian affluents are opting for “staycations” or domestic travel. Lacking the ability to travel to Europe for luxury purchases, they have also become more accustomed to online shopping.

Lockdowns have shifted consumer preferences, as affluents have been choosing to spend more on cars, art and electronics, in addition to wellness offerings. Interest has rebounded in goods that are high-quality and improve quality of life.

“What’s happened post-COVID is that a lot of people think that they've gone through quite an ordeal and they want to pamper themselves,” Ms. Banta said. “They've been indoors, they haven't been able to go out.”

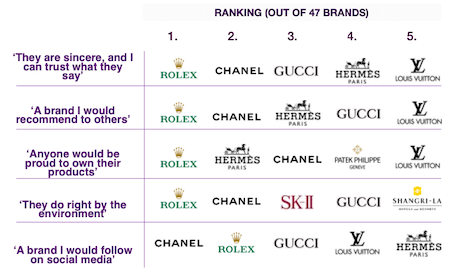

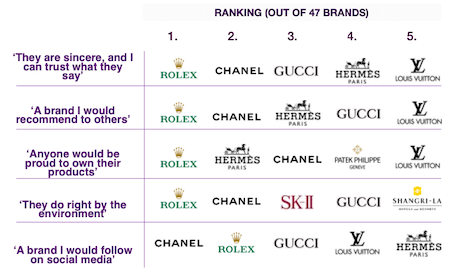

Luxury brand perceptions after the pandemic. Image credit: Agility Research

Luxury brand perceptions after the pandemic. Image credit: Agility Research

Asian affluents’ perceptions of specific luxury brands have not shifted dramatically as a result of the pandemic.

“The bigger brands have really been in the center of consumers’ minds,” Ms. Banta said. “Niche brands, smaller brands that do pretty interesting stuff are also quite popular in Asia, especially amongst the Gen Z consumers.”

Tracking travel

As affluent Asians resume international travel, their leisure trips will not necessarily resemble those pre-COVID.

Shopping is less of a motivation to travel abroad, as luxury brands have invested in physical retail in Asia (see story) and consumers have embraced ecommerce. Now many are looking to enjoy nature or visit loved ones after long periods inside.

Travel within Asia or to nearby Australia will be the first to return, with fewer consumers showing interest in visiting the U.S. Longer trips and more exotic locations will also grow in popularity.

Similarly to ecommerce, this is another way the pandemic has accelerated already existing trends.

According to a 2019 report from Resonance Consultancy, as mainland China has changed from an agrarian society to a more modern and urban culture, travelers have found themselves drawn to destinations that highlight unique natural environments. After safety, quality of natural scenery was listed as the second most important consideration when making travel plans.

The same report showed that One country that has benefitted from these changing travel attitudes is Australia, which is relatively close to Asia and home to diverse environments, had already seen growing interest due to changing travel attitudes (see story).

“Travel always has a large impact on luxury,” Ms. Banta said. “There’s a pent-up demand for travel.”

{"ct":"8ekaRgg8JJpV\/ejoAKwer0RSe7xYGi6zdKUajom57fcRvB97sDzwjL6TtnjpHuuP0bodW+xMfNePaunnKEU7D+uwRUy036hAwcP8b6BhfcTfAmIkgvS2EwoqRSJIIRbtCPOjafBmHwJ6imr\/hjnCQmu01zo6e0ZPoZA2BtOBc\/1SDI+5\/AX8YqQpaMrWNEfVPVbv1e+yXFT17+3sZMvgxET56V647+x1kLVMhntjzAQuQPnEKHtVUL6DCpH6b1qv1oCF4kC7QAZwoxPtr0BwVwELkfqYkT7ONG6LedBL7yJnhEBfVPjaHJVETIzUTVhvI0jFH0PVJy4hUStrM0Ufe0urM12zP17TXrfvnGm6oXlUoFE5LScR0ukJkioTJtuByrEnPTK+8WFxkVWQOYV9G3s7jPmKfyI2qD68jn6vnhsWvtbxBuwLbjJh9BM2EfaT+KVUwffX3s\/hbCHg+JjNm1PYM5gcLcs832V5Bfe+znNywPSYbM+J0dLcyqdYYWeQSIsu7qQ5iIRqJECiH9tdtK4U8DYhhLy2EH0z6YgTpaRAOx62ZRrOGHlTZQOI\/5o4PgZcMoau6L3HEquLGBKEDStawwDluFN3U5YerqhOPEtC1hKviavJthqRGPeHNvOY3DFJD5y3lqanGgtPXNYTedL3H2V0u6XFB1+ZuFDk1h1QNsRv9Bz7Z5LlCUHuor968Y5gI3MeoFCMy7rpVsodECPOsVsWd\/vBJlztHeTuH8+JyQn5xJX6NnHrDsUR2zYM0MBNR13q\/lnAbwZLqCobfUme3aI9pY4yghF714hAm38cauZqnH6Ygzq1op1R\/k5sYqnZ\/u8pqfr+IGYqc0VuMCIHLQk07IUuVFt4+iW2iRVZD\/VUVIE0AsrtVBeqb528PZyA2cSZfLyKCmU49N1Kr2BUNNsnjgqkhZRh097XOhv4dGndca1\/AQASyGTpApZDOGBNBnTk5WM9bMclR8EUIl93YfwFLWkKRcN2dvSrPaY\/Rx68vtbaO3MbkKFc7iJkPYS+Elefr5FldwGAFFixA5YEf5B5fy4xiO0vwNXd0SvP6oy0kaWGSXvtuxSMws8TKXuCNWl4yrMpkEbM2L22RkiyEw47zq0zwJeo79JejQUQLoeGbbx7+ZkdSOv6CaKiTW8kA\/n4KjnvFXoCRYUqZkHAmNorEdg+m6GJ3a+k5u\/rr1HmCPpWBRgQAnswI2DckXpho+JU3bywZO55R9pXddqLDsFexc95u\/VSp8ppwfQvEZ2XxS0cFijk4+\/RA3Q0cLkn+dtvh9CVvK43HPd1CS0zyUn+S00gMCt7UqZQbFDobsArc8uHPrUdSs2WPQvHdA7xXNLTYRkBS8nQNIF4wBj0TXveHtBvqsvKKZfz9f6FrwNE8wkv+fR3epwZFe8wjhVxhaf9YHdyfji46cO0NtBDqWxEAccIhD+IThDT95A5KeTRCMdCupQVbsEilWbDo0N82vEoWc53mGm9njJyIzFPdZaRIqoUZ7edr0qbmbCuyGpCaCTPZJkJDJ49I3\/9Xox3gxNs4kPbDccrFuhMaJZ0hWWuIGIL9vVPHmosJ2AEXvpbU0\/XnNyAqmTyauHRVfLo9yqRrsmZklekzFx3JAYqm3inYG+33gnBv4LoATkbt02X\/hI2a6O8mqNXj1LIqlgkh3m\/N+z7AgzvP4LoFjgCVWRdiIwC9XYHunrWamB3kkAW7lz1vSvAuhPrxXWza49C0Y1E5jkPnrkPxXyO+LT770NeC\/oKkVFYY6wl4eR8UleXOp9xH4LWu6s6ocYbJtOYB388b2wTZLTjts9nssoucCobac1kvtGYaoN6T+yDgt2XVDXWqhlx9zRdgIIuYBdLfSsRrobQUR7+8XIJxJU3zmkf2ilDAnEoDZhsbzShcDbd9OL5SgaPzkW8w2UV0OFX21r9WIvHXlJEUqAN0Voq+4a9n\/jOTyDn8+MnhdmiQ9rIhh74I5qTwtDizeuH5Ge4pmAmsLYI\/twB\/Q5Ipfh3cAYDko4jImSPG4GaphS1pc5CuRPaeEKxXrhgvsysVxQlKBNAu8iUoawRwkufqrvjeWBHqcXqOmDy2ThoZ3zdq\/ayBeLYj3ddRYKA\/dUGNv4\/jNnqAID2rvG8MWEK9DelyA0yF2vSIRPfvZdhqsaWCmA+AbtAdcNeemye+rYV2u+tgJLNj\/0jmS256oCP+6vxqf\/P+sx969AFbIMCY7BE6KUf1VlbeJ+olytxkXDO2Qm0Wi6AbJjaJoypNtu+O\/pZjaspu16QKGJGRk3ZlpNniLmDKgmLlxMYRBGuCFvmAyEEB0ryjncNEHvDk33kRRMUDJjTvXL4cXwnDJhT30UeqOyPT11ljkSUjj+CWBxmQqTCFa4CcCO6GJ\/EuQzEShXJxgMA3MCyCt70u8tEmQv4Sh5tGdkNmZLKkaCkxAeikl9r9M+V0VlOZjlzx8UxtIO8PYuZVUBP+frsHXg\/+IH4EHl93+71eh\/Cp+gIAI1P1sq4njA4Nj4fWKWs8zVEAE31M+24aT2aRX8sClQp5kGIFuYawhj\/YjO8f8uiC6QI2RxTf7t1OM7cJl+kCpBV2uUx4Q92h4LWLIsidkjJVO25XcQ8GI+VLVgiNZHpfj1sgwiAgRV8K\/XBEhAfn1dsl5dU2dVvPc66GZUgFZyVd5RgTlnGf+CCAXNwfT3NDM3sj94R9F8FObZQg86K7HH5l\/eLv28LCKRmVQHeJ4AdsWN22hC+YS4wDP9N8muIxN4qDsDGi1cNUCCI3QX62Zv7jVGUmTSjm8sdrtzxpepRVBPsPFP4VrshheJ\/h\/dfHzNNvFvx\/4s8Iu3r4iTbhKqpZZWUC\/e5mQRE4h3CJ+i0ao1Ky12YC+GCyJau+rbQ5oLljVxwv2pKuuNgvT5mT4cEQ0wwXKfVj0vDORy30J7LRqpAJpKUd+3lDSeBLfEyEFZjPV\/Ew76\/\/kcDm1VKzOeEfWXYO1GWf8Fj3\/QwSJb3qaybPH+e4ALNZGAuQ1vRTaLwomtxoKg5Ygc26KAXXnumiXWddDVZvpBhW5DEh1NkFIml4\/pyaYkwnP00JbXut+tbJ72f3gR\/OGbVQyg4K8we4y5br64p6xl1CF49eBl24YkfNtFowYctJDMEolLbnDMYxe9py9sa00CG917BgB9MNiDzP0weFtQyrek4rkCSJWIUcSSefIV+PsZvyJhemIy8mUyD2t+cUxJpaCtRgTaSHBoYwNSx5zRtKjt6QSCdG56aGY+nRfclbTr03tRjxUKnF8SVwd\/QO71\/+GDGoBKK2NkiMuVK5UJYa0i9Bpf7KQsGarwkBA35hEqO5Jp+0G7MrNiOiLdJGcWa+8VRnZx1jepG5DXD6BITkWOGT09ZKhDoGfIH5Y9eZWSo3bptxgyEI2cLpxzzrA7Al6t4gw8ZVAmwZUPoIkucCJMcj7yqVmAYC4+zk2DwU6U55I3+8V2\/lGZBx7zuhxzEazoVcOYBX3d8A0gKNKYL8I6Ego2tSlXumSwA10L6L8o7mtwrFUUY7WoYWsyh6x0PBv9hJ3me7+YkJw\/2hyYkiirA\/\/utjvb0CaPeOwqyv55tXNHXxeWjer\/egodUjZAnKhju2taXBOPIuK2aRe6hcgg1nwbBVl7AiOOcQG47EAUrrqOKsoX37rJ2\/W7Hl0XRfY7yMzyjxmUIXH\/43LQCs2sovYY4cYEl9QVfuffdcEr02fZk1hyb2GNDjtd6ylTZjBOSxPibNkAZXF3b3s\/HVCZs9sPrGWdBGUZqiJJgAIqfyod5VarmhzuSRM0q9BLlgGpyizPP5VvkpV7f+60bdFqPLJUnxYGh750X7BYJSqdZ8\/c+rYYZpBcsOnaFoxvAUXes1LlTAglJQi9p80T78KTrjql0d1oJgVa0+1ke6\/wGxyRhI27lJ9Ya1XEzcyke5PTmTHFR+TZ9wfmU5zxff7qHOLne0O\/JP5tieFV+dMK\/T6j1WGbLvhvksEyH7qhuty4E47U0+\/\/a4I5v9qXr8k4KAriQOhYbwQYp7FI3o0pA4XFc1w5cxLZxlR5p3l83vaqMASBNPQrhjV+7yyVIBTeCVjEmmfHjcjtmYFzGXYL8J3r2QgwdmjJjariOwFQwLVXN4eqoDozHLE6pyHeXCpIJs9aCQDavf1CknLY3cFKZ+kOEEaieVOFZ7BmUOTvVbKPhYCYJFneTW5ZfiiSwSC0N1xVxIQG0v8MLbZSKxX9c0Tr1i+TU+V5UuAgv8IXYDoxDRoZi9CpjDfkP+Zieen+ngOh3GFoQ8mygJrCwxFJXMFGQpqwtWkWr2GZbsp+QNSpXfyyfyGUbHRsWSM832\/C187dByYAzpQDneMktCI4NMGO+Xly51TCeqAbapqZ8sCUq6NgmEsmWkL8uMty+2QSpEBZ0ZhiQCLZ7LBZAEtNnjRcLPgIVSjbyVbO8mTq6715vjBbtk66oYdryo5LjzPsO3Jms9Qa\/8aNeCFISjmiUbMNBCJ8PUsLmvRmdKWC9RvIicvgACiQLFfjRchdt75wqsEcOwjxAJpFOYeQxYI6sGn\/ZIqozA69l5MvD7w5yc65gtVkhYREx0ktlmn5N2eHhW9lw4wabTZEMWkjnoMVQRXYTzhDiJddtz6x15gAz7DpUKEb5v8PeQggRavv2qb0gapJq265l21kpl\/f8h4vFXPRh4q1VvViFOo2DTPypK7BLYnqY7mmYU63HVk7H9n6U7Fpy7V78x7NaLlYG1qkCocgkCTyNCUa+KrZI+OYNOXcGnL99MDruVbCfl+JWi3EXY\/Fn72HZ7aFVxSr2ItZ6Aa5uyYp0xn68NQ8UVfW45ab30RtI+FuRvti1LwGsXYfTypNX3b0ccl2yjAyEXLyrY1rL+D7AqJhQxeFSA2\/XDccbhtySgQizwMgEqeS9ni2ghftrMhwILnX6tO7hk4xw7Hf4lXjJIlZKRF85q9cHjkfBUOBeExZFGUw38b0XZHbEo01NxUoNh+TM3pdF526RieSJmhxL3d8IZj2fFqKGUqNQh55RBU9jNfJ\/jLSrPMjm6QIYBQD5L312ijZa2xxJi\/3lY4wgQBqFlFd6wPCRukhM9dmG2pPNNxspXtxeOB5UbP6NEF6cLtSagcnT1as03ZRT6lM+TheSogRS\/5TAdJtf+\/gLgEZVNb5Uypce5R1UeVB2DU6xdWBzpy3KxoQeHoUuEIwBygRqwPyPvFaQg9kv63utvIHEGW1T\/04U0nxZ5brjoCAYejyttmnfbEH088k4SsWVl09aVij3GqZY2zkcTMwECnF5HP9JG\/PSim5wZ+J\/uHa\/pN1lLObejBeosDuBPQnbH4Ul4GvJ0pGNclLhbhqvqWdooD\/v\/zu3QOZNiYJDGAp\/dr14fid36a65pKF+G6HOsE1tVqKfEuOfL2EiAzORc18\/yATqjLoXsaAC0v057lFMfZwDkoj57+\/Q3AjL2s\/8Qc8vUp3mafeSYiJbKRm1z7eeA681GgD5mFXvXUxcZf9MtY+AWNQZOHelPl4xt5e0DtgarvRMlmKVqyJ2aN6Qb3tQwcLnyl966GiIhN9xuJ5YlTfGy8qSldO37H1qVTbHpFN9zF5bCft+TU93VSBvyBy3l4drlhyNUQwam1Ewdg6BlNZXhYXZrLQvhMHDB20\/pappYorHFM4IVAp6XT69Hc4CKCYHdqj7okLKIUPAWIjDW+ihM0oTcpqH4n0TZL+yDaZyJKjg5C+ssYX5d1UQwI4VbV6alp\/hRzY9J6114zQJan\/O1OLTr3abcQJaYGBcv0V5FsL\/Vlhv6woO1O8V5Fv0u20QwQO9cKLyBvOJfjDzg2BPTi\/ds6+z82DaL88vy21ofAdcfJQhFgTYNV6imBtYkjz7e3u7Uvf7oId3CY5Sv8XKae\/Y8K44H5\/MFEWeyuR6tYYydIpxmZwEhIv2aQoaHOhNgTWoId6wWxTOzEhpFnln8HI7t8+x3MlIlzVHwxOt5Joyw2vUXb05Lf8KIleLSGjh79oI8laWecLoMNsxqOunggLVlrUR7uh8HP3ZUoLLO9Fc5BMqWsEkWyldhT8aSkGs9\/xEqhT4Yd9hJXFMbGl75MS8enuilfmsxPW40OJqm+dE9GL8RVthh1iwvEjF7Sb\/5mhsLUWmxM4zEsHN7AzipT1rcHwnwBEJcwMObb1Zm5PFcL+tuF8qs1+KAxf4ozivHuKFNBH1XLlBeMoeDXddua1xEPE2uYi\/8udO7p3Yawc0xuvYvr7x1eKjaQnM0dlLsa+8F3thCCZrCczVIBfJiq9wDs48H\/DISxNAKKspGa7QtHCBCfyh8g\/CMtr9xBXPP9iO41oifEyuNOXMUpS1q1wdGJ1inS+DRTAgiT2dZnzzABuQTjEwFmTljs4s2eTdneGWXXjy1Wyc0wWqvMszN5YFTIzwiYlOfNNe7BOe9rWzqOrm12dXQK1QtHtq0FjA0vTzM6YvqBDmm9JYfC2P7P9i4t2oOkSk\/8dm9p8h+a5KIGjubtuhSoL2JiBNW4+QeRFs3x0vz8ffH6r\/4dUeuPRtXqnGNQES0mxW3Pqd+DX4PL1xd9dDDOXp9IjR1yIpMb4nmbwSjGqWz4Dqvm22QGVTEYzl\/O4+4T\/eQDwiy5LL\/IoMfgOqZ2fNmww7RuDGHg9xx+oqoR\/I+R9xlnqFikeJdDFlEAMW\/8uASkboJurpiCuNcg2PxiPM0g5T1GPL+3GuXNCEcKX4gYEK5AT0Y5SAJ8dsp6RwsBKd+tUHDWrMRt76DnWk6XsyedDo9nEzLoJ6MnawPPXI2mD+D5pTfhWzk5YeCEhC+hsaRySkFF009MONXpe3dBHQvnCgWoHyn\/u5TSDBn+Jg1J8bap240hwAvhpS2Oujt+kax1E88GJyHV3MGMIN2FtjKNeFuu42GJhb5TA2ztfQwFRr9KsQG2x6nDgchgbRwR2Zv\/IkV73y+eoSPMxWCmsyVvS33gjBCuzZEcndCSIfC5YkVcRn3eXHrzUZZIVQbUCk+ylKXzUpWtDrELS43YgOvsIvZ3oIm0Ebl42BIloXyWeciiW4DijjSJqxHG5Nh4OBGHt3w18cAxmSX9UfzyDsAOd1i9V6uN4aHpq9DhZTncwsitfPzpbV\/9VcFNxOnlKNPf2hwnce7fsEC+gBZnI0qqR8DOCSpkUenGcNcBs8ilGHO6P7lCcnFq4Ssx1olnYHgyUMg8S2U\/z00YCqUn0kfuOb9jUAdV4vjdlG+eVCm4dBZW7QmxR6Wfjtkn5EY4jGwHuHP\/zP75ZUyxXX2oYL38rDKOAxM806SYNKotbl+aVKGqFg1ib6TUIg\/ofQWtbUJlEOMNiTPFsf+fWrtFRsM7B30nAKxmKQshfLTbCKxbHMHZU+PpGCWfIbL+jC5D\/0dRV34imN3SC2KV4XxYsT7y2aZ1Ry6gUlrYfqmseAKUhl88ufW8FRI17njjpbLKYS22vwLQKQFsTiA3lKgvqIm8t4T6D8EBlpYSz50Ik7FcW\/47U4CwdwHX9rfhbfeXXqgjPI\/UpmyWCl+cTtxNJRyXT9mAZAPDOOspMT5r\/+NCsocsViZ44HDLqJNXcbsJV0Hfps1wYtAE1WCRWaJL3ZDjhUOXiNk1YuOZLtAgKSp1ApAZalW8KpR589LuMDhOKx43Syod1iMdh5NQyLex8LE7eZZFzpK5U7XSmZ5VoJ68kF1tz9kcEADHWrmzoUDYyx++Kk7wyIpXp\/+C5GwcXf1fHTNPxtRVrfJkyKCLGuYhg8nK\/pRBoDFW20ScvMwcA\/7T1itBtF+BeATbPNzUeMtnyPwv5WBhPp4\/EnzL0rwYlNZw6DhJKVGmWI79ChZKCi\/yzK4q0EfGLP3ZiGq70Voyend7EA8kadVZ2X6enTkk\/UTQJjvsEHEKqlpStjjVjMXME2ZS5btCz6mPBo5I+sefO7uzVWl+Z1Y\/F52HvZR518J643\/ihekN2Cqn3eI+BVQRxqftlbkn\/x\/xCWRDDeTBmNOHsXVaZCSHWiKwOM78wX9xkktyhuNoUX5naK5fMWj2zviC2cF6mRmiiuJ+8Rbs1tjKFi+WEjptLVE6oqMHPRktC+KkiOIOA7jKB6z7nHjsgtjcasbEbFCcGKQZvXp5P+1jGbUJYc+A67zaGI5HhfHUgqzkU75ODrKNn\/jyQ21BI8uAMxZtux0XtXpz9Q1xrJm6eCJGnAMzOCXPHVVW2zT73QOk2vV7JhQO\/tYnfbr1nnbJvouWbdFmjWLQUdhKfBnrfl+ESdFkkWSlMDNIpppaueFPQLDrm7PtiKOKXi3V9gdvVW42jJN2iklizkYbJtWjKDpsufWV1RNVrG7lGz8iublzoRt3af7fuJ4fZ0JZLS6JPumuHVaC5W4bPxBmubFNeV0FNxZeRQXX+ejuCYYAe1CK4s+dGhODc0WhJoOGaboeF9C3xOZbs8rAMdJf5R2YYL96XfuTlxVcQc7AeWT\/C\/R5l2BkaLbtSf6aOiDlkXuIzrGogys\/LqKl5lBFWpTUsOCurd6SkV05aSgHT9hd\/eTIktsr1gjQbLyZziNgoDzsF7iUtN9jsHqKIm4iB7Wv6isyKN2peIeKszFqWqFYqJPGYpp3RyaKrrDdlGvtxOfhDJ1WMosyrab+BnIdVr8Za4v7bGPGQ53yiYOTPhAvxTuuwjnp5gMhR5zBmpIMNdX5i8bhgDtbZj8WVssv40mELifS4kLXsN2ilI\/BBoa+\/cy7u2go1FPtvcTV0yQmgP2wd4JZrdyHs7T2Zsg6NTdNeS91Oap6Ar8ggRBBNf1jNTahu\/JLMKj1T9vRZfIKpriXpEFLWTy0rSLNFnzg==","iv":"6c6aeb8a966a4e6d3d2c0b678f0e84d1","s":"72f3b9a7a2a98cdd"}

Luxury markets in Asia, including India and Korea, will have an impact on the industry recovery. Image credit: Flipkart

Luxury markets in Asia, including India and Korea, will have an impact on the industry recovery. Image credit: Flipkart

Luxury spending among Asian affluents, pre- and post-COVID. Image credit: Agility Research

Luxury spending among Asian affluents, pre- and post-COVID. Image credit: Agility Research Luxury brand perceptions after the pandemic. Image credit: Agility Research

Luxury brand perceptions after the pandemic. Image credit: Agility Research