Hotel brands are increasingly squeezed by the metasearch dominance of online travel agencies and Google, according to a new report by L2.

The Metasearch Insight Report argues that hotel brands must invest heavily in the big metasearch players, TripAdvisor, Kayak and Google, in order to stay relevant. Brands that gain top placement within these search engines see dramatic increases in Web site traffic.

"Hotels, especially luxury hotels, are highly incented to invest in metasearch marketing because the margin for business booked directly is much higher than for business booked through OTAs," said Eleanor Powers, lead researcher of the report, New York.

"We are definitely seeing prestige brands increasing their focus and spend on metasearch," she said.

L2's "Metasearch Insight Report: Prestige Hotels" illuminates the metasearch landscape to help hotel brands understand the challenges they face and the opportunities available.

Met-alert

A metasearch engine aggregates results from other search engines and prioritizes the results. Brands that pay for placement will be highly visible, while brands that ignore the engines will be hard to find.

Although consumers still visit OTAs and brand travel service Web sites more frequently, metasearch engines are gaining ground.

According to PhoCusWright, more than a third of United States consumers and more than half of Chinese consumers likely to book online use metasearch engines. Younger consumers are also more likely to use metasearch sites.

PhoCusWright also determined that OTAs are winning the visibility battle on metasearch engines.

In the coming years, it is likely that consumers will flock to metasearch sites for the breadth and ease of use they offer. If this happens, brands that are not "paying to play" will cede substantial revenue to OTAs that, for survival's sake, seize upon trends when they emerge.

The rulers

On TripAdvisor, brands are falling behind when it comes to booking options on property pages. Although 42 percent of indexed brands appear as the featured provider on property pages, they control just 6 percent of the total booking options, opening up a lot of space for OTAs.

Mandarin Oriental and St. Regis both have more than double the top three booking slots than the index average.

Mandarin Oriental Munich

Tripadvisor recently enabled mobile-direct booking on its app and mobile sites.

On Expedia-owned Kayak, a metasearch site that clocked 1.6 billion searches in 2013, OTAs control 96.4 percent of booking listings, compared to 1.3 percent from hotel brands. Four Seasons and Waldorf Astoria are among the least prominent brands on Kayak.

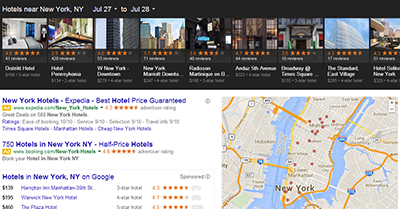

Google has been making serious moves in the metasearch arena, especially with its carousel feature. Now, when a consumer inputs a generic search such as "Hotels in New York," they will be greeted with a carousel banner at the top of the page.

Google search results for "Hotels in New York"

Once again, the implications here are obvious. If brands want to capitalize on the evolving consumer preference to book online, then metasearch investments must be made.

L2's broader hotel report depicts the increasingly complex digital landscape that hotel brands must navigate and argues that digital proficiency is a major differentiating factor. As travel firms, search engines and marketplaces pursue larger shares of the travel market, hotels will be pressed to keep guests from defecting (see story).

"The general trend is for major OTA players to position themselves further down the funnel," Ms. Powers said. "This presents both increased competition as well as opportunities for prestige hotels.

"Prestige hotel brands can leverage their scale and brand to drive travelers directly to brand sites for bookings at higher margins," she said. "The W Hotels which ranked #1 in our Digital IQ for Prestige Hotels, is a great example of a brand which has a rich desktop site.

"The Raffles Hotels and Resorts is an example of a brand whose ratings and reviews have translated into high search visibility on TripAdvisor. Hotel Indigo and MGM Resorts International, have had success in maintaining high booking positions relative to other brands for their properties on TripAdvisor."

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York

{"ct":"jxbcZHIp8O8thsEyqpqqH02dzmN4eZaCTn2DZ6E9xtQ7d5wWTBOSaJtSz3lErXowzcwVWV7LvRIYFIcSFSv1TkfwSiXeuKnVhaN4\/8qQeMHul7TT6pLPsfhNx5Fk1irY33+V24MIWETeMHWgWoKcrbI11rJDCoVDKlSpayDvLgg6QCJZfkLaV3RFTpI91poexDVb9mmMEGD0aQCUGiwth6t4Ytvn0ZKcy23ADdJEIiMOZo6MtT\/C5sKfFcj3ifQ29G5rcDbnX0m0sTXTK9lfvZAVEqtnS7qnfN8X6ZMAoXSoZsm7vu9680KKiK7GGDeSDtuyd6uK0K6ZKlIFqoUQe16y1EpWKl5SyalR9F6zUVKmNSL\/Ifk4Bw\/FoMBOWQCL8fz+1e7R7h9c+TiED1Iy7a9uusI2pUBDZimCqIeWhNyVywWdqkqssp\/jmkzhrDLCkJ+sU6gkMmKM5W1FX+6yonjeEW5hoS5EJjo8tqU6OqBUgLnJoDL0FNSL7O5gtinwBr7bb1KysGtnxPKKvcw8tu7vKoGAUGunJrV0fYSkMXYfX8wAUYfvPBKtVi0WaOKnjJ5+4hAXG4MKLf66+1b1IUAei\/WDzRqZMxSy7iGwDUGSZRxVjeidTc9aYhuyQ9tRN78wU+s8toYTiRUxEGihdDLabHabll6f7mz+lt6cbbHcQSglH\/Az8eoxA042iR91jlF7C++At\/sREfD3dy6bv98Qb5ab9q9Wo0Uby5IBdrGi4Rjuh0wRTClPnRi7LwNL\/jltPxlk3e59JtnYEUXs+v0+PTjchmyKF2cIJnFnPYcYQePdS\/4W7gg0liJeFq6+vYsqEM8j43kK7i9MajOoExiVSL\/Fyqb\/KQIPy\/PzDd7qEOVnBxTKL4u4nDTaOlq1blJ9xZUdvG\/BhcfJjK6gy1v3BM0Tjs9XRlLYIICHqhPg9IF+ub3K70RFTlNvXtRBAUR\/rmyY26U6kvifzrE7VxG17Z81UA5D6z15clHQx\/4LbYslp1fiY7TKvMANgWwLtgTjQdTd0xSD+7O2l0j96Oiojwmx7Gm1Z6ZNjWgOgXo4cTViASUwby5jEVQcoI\/hJIdHDjq089H1BlZc7QdHdNT\/HUSMsTP3bP9i\/B2DpQ5akROj719NgfwYquH18UNfQBKFo9mWYZ4Pr3vmXvaA6T\/bgMP5ahuiCUyjCdR5zR15VD0iQ9jpK7NH\/bhjjHbCCDWVrG75yVOo5o8RnCikgbcg0QZuas92ns+kCozpurBAlOqfSEVcCiX0RWXTGZGmzFd2GbLOU2QIbmwb6hSRNg3pUdskTyQcLArk8ofG2VmptYpr60nnsHkufDzfdGdedrbq8\/g4w5UNb4zF\/cFUDOHUq5C9NU1YMNHzAqphKDht6kUegtFbN+Usu1R9Ff2Nc8phPU+YgzUM5G2cyC5U\/wJ8UtSa15Y8kd5f+tWWYlYuOyh+BbQky4ZCFcN65bIWiVdGZzAKp6vC9dQ\/1wNBsC0DVL36\/4LFMsmezYUICQO783rhdxJD5AjPNceARmkOVaRlR1okDdNI9l60nG\/LBiRSt78DQETq\/kMHcVrYcWeYKOlWUhQTllDbelWBrwAJtyGf1vQZQiDpLrH\/0MBXFw+CiC20di3CxIpMqvTcvakMsrU5\/E\/cok2h7TO3SIJcl64T9gwHa9FUzv3D\/sIfjr6RBUW2wfT\/sECHt1GLfcnWcgTJGArIRTGcCYp0BkQlPjgX+ifRPPIKMC49Aygli2\/H9R\/QixqTD641LfgfgtCZZpkxgu\/lv+aImdHCZqByb36q7RspZR7P6KwBqgMKosCN12aFn8SNVM3UDXKbfAB2UQ755vyvlaTgiqWXgPSoG4RHfJskKSqWwDaAvQ7MqdthfSpVG5uotY3l6CKva2bVi8afuzogHvXi9+GU5kWwBGaTGrGXLQYynAnJksKuCPD9dJvHX928gkAFOg7t9yk4omzTG8\/ovVmsFCgBrtjxseODShzv6hPED6Cp446neHV\/3Dic0ATwPtHBvkyanVjm7\/qYpbIJhlYE2uQmFIUl8JRnbsmzTTqE\/IbrW65A9c3GMFFzX54PcOU9i3e3\/Jmb9693xzS7JAsOg03HIvy9oIvvYp9hsNQaCspP9mwEXn\/tL9q+dOjNHMxC+YTalwTHu11Z0oJY3+ubvKVMJZh4GBa8QOSX+Imq87ugk4YUrdnqm\/quu7zfBV86EgbcxgKsht0sXLT4f9qwXCboCMR5mxZLocRUx2oS4Oc+lYuOYMXBVNI2VFyVKYN0nIaIm+DWKVUQ8g7g7VcRECL22MnvDVf0HH4vxbZ2PTRJqUrkeuyA5g0T0QujXqAsqAJ+sWGhwqzdLOlYoFLAAMtya33k413hjm2caAEIjGuwxTtiq1zh3+hYqSN+BbaqHizu6hngbIuZDv93KU\/LKHqEom2tN78MdpAc9WulWJFzZ+603LMvdx6bBhgZMyXC5DAxIb3icXpJShEowNEsMvuznGF9pKW4altiGL4YqiJaCwNqjTmRBBzT8ctbq8CSx7LnqlGKy3QNR2nPlhVWA8ubw3yLZFvC3Yvx3iYA5MAGegW84n+1YhU+BDO2om5T+97dNLWrxP1FYVYgfxkJ0sDQP8xh1pSp+7e6cH+ZF5SmF9VDqj9SadtvB7ogFKBspg4sLXyIgkllhwl2c4NQjselE9nAdxpL\/AnmeZqGQWf32e4eF66\/sBllAdlhSnXPb+yKxKY5RwOZYY3JVhh1gxceQZXB6tx8uoPmYdgopy1t7c8Mzm\/g\/RvvKTMdUC9NS3dBbd7W8wz1a6WEY1fpyHHeia8rN2XX47Wd6j2221ORMAaQ+H3HeQwlwF0nZvVSkPGIQxSaPHCMEB\/SDhp+EUQxjzA0yyk+FtGhkYyMN01dIXw9vjGlwn4IvO70Kr19sjymCWOQJ2ERRoVVQMSsC8vOr2XD49\/WsBtcLnHULq42\/bT2eaViNhB4FvVkusapjniT\/aZWVcYOPdvt4VV\/KKFOgX4Rhwl12VGj34mzTRbUGpX7w5efyKWlaj1X38yRHnuOYnQIH8Lht0L3jeSgU3NsLfNPRNT2SkKktpEdRTrLVN4F3m9wx9NGTSmkdXxG9EzQu0k4HlCE5RUWbNEzEf+2JU5AO+D0N8h1bQ3S9+l9z6w\/pdiARE4vj3S4PyNiIBeIPFRVKW0NDaGH3QWr71Dho0fqZfuru1IJ2kgtdSm3v2ickLQ4G5w56BFWC07pZLrZzBTHikcKRgV3XLIsf4L22pDdxvlTb2xFFsMh+yhZauuu7bRFlZ2ASHTJ5YKDa1Rb3ung3KxFptjfyABvy1BIuLPvTHlprxja466jSlF5t7zoO0hyZdrEz7Bf9HzRwVk+asO649wdpw1iOW05HkdGLBbSDhXfsLVLoh57SSUaLxe+LdObEQBLnhCFEvrwvpJ71fzzRVyJsO3N9B+MazSlazPF8THMntrVWdmHlcZfa+6DDqyob5lpSLZokaZ+BEmsUVDdEC4TPyxhuYhnzzdyXD9qapfZ+jXcYFQuZq3+g0j1oxQf0WJT+9RCGHgyUHutQWHs9UF4pi6uLmJ6Nc2t0NyzWpPUoO0jSZ2RyNLqoS6Hfo\/Lk0skWoAVccxl0+jsmA\/JldIVCl4ZHudTxZF3vgwls9NpQXQtRQy+xpmQ5hlo3w\/a832dVC9W5SwMBOKVNdmzlvK9jQzTUgpF4fg2herRpmpejh3FuacaHGuZ\/\/mOdOAlHZYZ0EDN89548sRDQSKlCFxViIRLKUhjQLFsOfA8ev\/tI8Vl9KZhV19EcXHISXlfh1JSj3s8DN4z5tHI964009DJxix1Oti\/EUtC0T42BhJ8XJCnkxWHuafpIWM2k0UeALNZ05MsnJb6G1TWnbQlO4U0JhVE2U3iQs3uCDbiI6msjQrsOgCNL\/mhfpCfe6uOK8wFKD4662UNZVBAvwoL1wbiJXTP23MwwHmxUBZ3Gyne4JVSVOZRQpbBAbuMjstDXiyt3037A+i7cJF214p1J7PWNgjpktIePQ0rFkFx2axkgziC21uhvPM4Zimr0FMw95KPIQEWVyUBU6Ntfps5YBr\/SrFVWSN4B3eUWupf9oWxx6OjmtOSwYFzvRpwoEv59bH3RBT3m0gHvMhTamunBhr1KehfeH8jweVY43E5y0TmcYPeL\/eCpR9RUVsEKdIUhZwoKdglQulR9bUooJBmvrQidbyTLaw3b3sSpYEDU634rsWtYqQ3S+YpSBCynDTgILN6qtSG9YpKMxNpUMQy3fjYtldOrhAqPfOAqkYH0Flpz1OkqW8lWF7OZbq9hQoZixYJrjYNs7m4ZNnQ2an4BwBsH5vv3NWw0AFyw67keGJyD\/xfED0oAg2aFjja9y\/lgm6s129UtUJW\/lcTurprv7TjJt\/U3xJIpH4WC6c0\/lEaRpWgPXXSSTVuWoGWHtkUDKV4Ha\/f5JZ3+vDLWPFBBsLIwGZXt+EstGTGqZTT\/0U03\/gQAYvlDSGI43Q8yZYp2NzOfRdVoUqyhqt+lCWbC+dM3FLX5LCo64IUPsQCDx0hYeBTMYbdJrc7QaA\/jZDSiPmETxgsTPHWdSc+kcmn0hZwz3FUrHwp5LPvxRF39SAPP3TM4x\/a05jOzmBb712Api+nLJkXn18iohyYulPtMHBzpTPYAvZMK+I0si8QjzH4EeOTV9IMtgQeCjjmMmcOsX4Lb2M25vRKzCEVG\/vwncTAYW3EbNV6HQ+W7oyZjoWyGQsItJoyEnwfQn3ljYmXrdFwG6fmpl6q2pxZ9Y0H4aHx6rED1hiYKGYT1+xq3rit\/xXesKsvT3BdRMLNXUhXFd\/+zr6+mBHWJAsI8YK2E57ey77mYWDYNUaB3KLXgqSuWdhtU7WUms3EEBv\/vCNJn4XEFPjg3pTP2qg1D0hFA+iWPMXFFJOcpyAnAm2acr2kjeha5U0yuoTk4gT4\/SotakTHWtN0HLpI8bjnRZI6CEgDC0qxCVfZkHI1Q4ycLHuPhKA7h+u6+6c+nuWxwT8AsFA6GTIqQijtR9XhnkyE9snbEIxzn+lkNt1e7RuULbWb06Sioc1yQKvV6YOGUog++lvD73okNBTT3MlB3aiWzow3Bgunx+WGp7GxwLQ3Sh6Ril6ZJl99YUq\/1PuX7TQSCkXwcS0QsoqhwFOskdBJMKQFoj9bnTX2wbO2WDFmh\/e3VU+u4ONKQQW0r02Lb1JJ4X2RskmUk91q8uIh8x\/bbMKqbNVjugw\/3oulGQnbO4hQuTR6zwKXJk9WZmuhCn+15hRJ8tUZBubrvd7WCOP1QJgaH6bOwVTnPdz95uJPAJ24Voqgw7zjFQxsb7RxbVLemjrylBpRryZelTKKE4eUgY+nN4jxeetOJxQLheBQ+XhhoIs\/+JF0P7qEK6IHdMT\/okhS4cn+AmLU8ULOX4Cmzzx+bnkv+194fdE+NeTwemwblLNvlQN1NV4QWpWM+CcMdnumXflGfmXRQNr09mIt28MTakLu4UaOICxF2SKrdoS2t23gdsU8gqhXOwtFYTj\/b4I9lALoA4oIbWN89SgqSIKKAAV2+exjpLD2PoWX8EgIWugeMjSsLnK6T\/srNCS5YSAOiLjp147nDPzPMivoJ3ijAap67exrOKItTwNpAGbjZXRjWZQXJqCzjbTZspi0l46Jk7XykAfHFOtdtRoIhRX6PjcUnTa91BvYw2\/Ut+yvld0TwolLmXdGnhcLTtm7w4h+LjuGwGLV1ie2iObCgBvO1jBE9lmG23q6lXvyg63+M2KMTQhe\/XbO03mTy+qlbdwYb8L1FpxkOQGwduAKlsxgvZ8aSyDqOUBJZROclbYu2aoqLlAdCfbk+ONAY3tCWCq69iKrlRdlATYBs7VwK1IAEW+Z0iDhZHct5etQSCgXNdJRr7cpirMs1QC1PbHd\/8s1u8NZOoWtmFKWAkZ7JZOJEeiZYsp9Xfd7xN+mO8sLJrJk7LshOkOQDrNlFJtvpa0PcWCPjJ9ESWjgTGNzP6nc9C8FJi1f\/8NAljC9PmHwyVkgG4dEJjOWYx8QzOpGtxMvgQy4lOnJBsG82dhynvVPGSAPJ425nOXweDHFT8gH02qRg4bP6Z7qaXsd1AeiHopr2tbKRn+EH17epiW54bzAN53X2wbV579BX0Av72qwr2f32p50nYEzEteg9j4Hv9iJjX3Blu9xtiLwTxJLbvhBXPtWaHY0rJHX8+Wvm2DLjX6Nl4nkMBtvhjMhBTFQtVFmJTht8wobk5pVdxu2Ka1yty7+28jRGrVc4ONDxVsHhQDx9lcOa8JKIRfinBqkrZN2Ehks08sZfkjX39hANa3Bf+JKTnye80khz5Cj3bMN5ItXPPMncrRTtLN\/O+9sjdaclRxZuIXgwtr65Y\/nk7JNKoc2jC\/j67qAPbR3tsJkfOat8QltJZdoJVlEDHPTbO2cnlMzj31W8Etl\/KfurITNkcuGqAsjrSw5R8J+8L+T2\/WP6FpxYGhNnAmwyNtN6U7n8d2z2AF3ZGqY3vgfGfDJpSd24x9VzAHrFgYkJDjn8YUSF5wZvfNym0LkeXnuvlQEx67Zz3ytPTqp6MOOqCWdW8xTuVM56WfWv++prCF1nnl+W0gKs2TflB8Uu6QY\/odNHiIzcV3iwcUAxJudKj2JhEeUgmIjVv1pClOEs1wNsDf\/qUpEV4eK4lBytw9dRW8w14WpY6l4wkT5cIXbDbwGADMNYa1pyPkKsWJQXXLq2BdYq3Vq4Jjc7+6nJa3EG8vD1fGqsRASp2GY+\/TyEg4T1ECm5dXJ87dFJN5\/GmU5KM7dCaSif5\/ov4uvbjcVihjkcaXU31aAaUooE24r4O7vHtZT+fuPA18B6sGVXgiT8VT8TbYmVZW5vHXnVQRdxjzCsNjo9hJRODQTWI3TS9x+lKAszvQeqtce6A6uLB0fNNYJvbPAd0bzZODMceuf\/NtfGrPtIwbfdt\/ce0+QQ9Ouy375oS0OTuIOMXExBBdda30yW5pXZhCLRiba51UreHcmP4tAWmpZrIdSzHeFuSiqGnwzlJE4bK8+b7u8IdluBmKU5ZfzTFM7b1GunijYY2cG9z+PMyoOhXLzUSUZzhULn9pzATzswn5AhZH3\/sYNtsmcCOeCCQsjNWZEpL+GXzbUcsT1f6\/JgeWPqj4q5\/qiMomE8iuXu4v18SNUB6grGbjL9DAgS9sgbr9d0eumxpQveg0OfXP5wBL13j93HaHTwGn6R3aNtpfO\/nmAgWFsbc+tuuIrHSYzQqCoIHavDz2LpBzh96rirAW4OKcTHMI+ieqTPl+R4KvDk9AeitTs1hRU0otCJI6xDp4sbHZN4wQVapmvSPRVBFthcaddbt+poJQJwqsblBzexzmeOnb9ljtTvEXR\/UhcYUzFZdYgNkwiLjyCMxlWwKsUD0GUfCJx2gkDNvctnyOUZ5rcAZ50HNTbKM7UByKOJHkmLQWRJoBaUVasS2Hlq9RdM3J37AEwAgGos0cOaDj87dFMwjYW\/fni\/uFojbUwsIay5w6rX1tNYTumM4fMiWFkcSJm55Rrx94Ntmcjz1NAIl+h74JgqEPey5SMzqxyNVO0\/yFOUCcCLttGslnzVTmAoeUfn+zRIiw+ZEZGTr7lG\/T2i4aRT+fd72g7cmgDpuntRg==","iv":"831258d04a2e75c53f27f5df03537278","s":"61311a707568e189"}

Search results for St. Regis on TripAdvisor

Search results for St. Regis on TripAdvisor