Switzerland’s Patek Philippe, Vacheron Constantin and Audemars Piguet were among the watchmakers to claim the highest consumer interest on a global scale, according to according to a preview of Digital Luxury Group’s World Watch Report 2015.

Published annually, the World Watch Report’s Haute Horlogerie preview was released to coincide with the Salon International de la Haute Horlogerie fair, held each year in Geneva. The insights presented in the report preview will likely spur interest in the watchmakers mentioned as they jockey for attention from international watch collectors during SIHH.

"The findings are positive as for the fifth year in a row worldwide consumer interest for Haute Horlogerie brands continues to surge," said David Sadigh, founder/CEO of Digital Luxury Group, Geneva.

"People love exclusive timepieces and this segment has still room to grow without being really threatened by the launch of the Apple Watch," he said.

Digital Luxury Group analyzed more than 600,000 online researched made daily for 18 Haute Horlogerie brands in 20 markets. The Haute Horlogerie category includes A. Lange & Söhne, Audemars Piguet, Blancpain, Bovet, Breguet, De Bethune, Franck Muller, Girard-Perregaux, Glashütte Original, Greubel Forsey, Jaeger-LeCoultre, Jaquet Droz, Parmigiani, Patek Philippe, Richard Mille, Roger Dubuis, Ulysse Nardin and Vacheron Constantin.

Digital Luxury Group’s full World Watch Report will focus on more than 60 brands such as Cartier, IWC and Piaget, not included in the Haute Horlogerie category, in 20 international marketplaces including China and the United States. The full findings will be revealed in March at Baselworld.

This time around

Overall, Digital Luxury Group found that the Haute Horlogerie category has over performed the global luxury watch market, with interest increasing 23 percent. Of the five categories track in the full World Watch Report, which includes Watches & Jewelry, Couture, Prestige and High Range, interest in Haute Horlogerie remains high.

The other four categories only saw an average 10 percent growth in comparison.

Within the Haute Horlogerie category of watchmaking, Patek Philippe, Vacheron Constantin and Audemars Piguet saw the most interest among consumers in the 20 markets analyzed.

Vacheron Constantin benefitted from the largest increase in consumer interest at plus 41 percent and is currently the most sought-after timepiece brand in China where interest has grown by 57 percent from the year-ago.

Patek Philippe and Jaeger-LeCoultre have fared well regarding Chinese interest also, with increases of 46 percent and 32 percent, respectively.

Interest in Patek Philippe likely resulted from the watchmaker’s efforts promoting its 175th anniversary. Efforts included print and mobile advertisements as well as social mentions and a digital timeline sharing its heritage and accomplishments with consumers (see story).

Patek Philippe's 175th anniversary timeline

Also, Mr. Sadigh noted that “Interest in Patek Philippe comes as no surprise. The brand, which celebrated its 175th anniversary in 2014, has been able to keep consumers excited thanks to a combination of both new models and record-breaking sales at auction.”

As for the most sought-after timepieces, Audemars Piguet’s Royal Oak and Royal Oak Offshore collections remained popular. Interest in these pieces hailed from the U.S. where 29 percent of consumers sought the watches, an uptick of 14 percent, whereas the United Kingdom accounted for 14 percent of interest which equals the highest growth rate with an increase 20 percent from the year-ago.

Indeed, preferences are dependent on country. In France the most sought of timepiece was Jaeger-LeCoultre’s Reverso, in Russia Patek Philippe’s Sky moon Tourbillon and in China A. Lange & Söhne’s 1815.

As in year’s past, China is the number one country and leads interest in Haute Horlogerie surging by 41 percent. It is important to note that the surge occurred in a country already number one in Haute Horlogerie searches, meaning that Chinese consumers account for 41 percent of total global interest in the category.

Vacheron Constantin's Year of the Goat timepieces

The most sought-after watch brands in China included Patek Philippe, Vacheron Constantin and Jaeger-LeCoultre.

But, Digital Luxury Group notes that interest is “decelerating” as 2014’s 41 percent growth is lower than China’s growth record of 58 percent, recorded for the World Watch Report between 2012 and 2013.

Deceleration is likely due to the protests in Hong Kong (see story), but demand is still strong and growing, especially among consumers of mainland China.

Social time telling

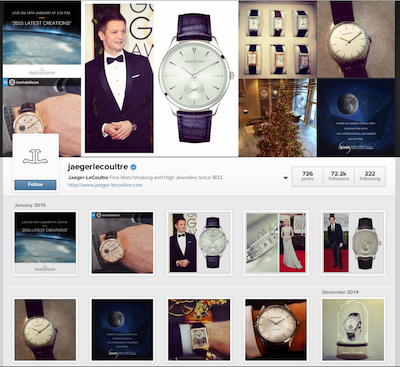

While watchmakers have made good use of Facebook, Instagram strategies offer a higher rate of engagement.

The average engagement rate on the social image sharing platform among Haute Horlogerie brands is 3.76 percent, six times as high as on Facebook.

Of the Haute Horlogerie watchmakers surveyed, Audemars Piguet performed the best with a follower community of 181,846, as of press time, and an above average engagement rate of 4.15 percent.

But, Jaeger-LeCoultre and Roger Dubuis underperform on the platform with only 3.18 percent and 2.55 percent, respectively.

Jaeger-LeCoultre's Instagram account

Like in other industries, engagement on Facebook has dropped as other platforms become more engaging in the minds of consumers. This shift in consumer behavior has resulted in a number of brands seeing community numbers fall.

For example, Jaeger-LeCoultre saw the largest drop in engagement of 70 percent, followed by Breguet with 66 percent. But, Ulysse Nardin saw an increased rate of 36 percent and Greubel Forsey grew by 32 percent from the year-ago.

“This could be due to the decision of many brands to prioritize reach over engagement rate on Facebook. Instagram acts as complement

to Facebook, as the user experience the platform gives is both simple in features and has an optimized layout for mobile. This makes

Instagram the ideal platform for brands to engage with digitally savvy customers.” said Kimberly de Geer, digital marketing

specialist at Digital Luxury Group, Geneva.

Final Take

Jen King, lead reporter on Luxury Daily, New York

{"ct":"LHc6hInX\/8F7FIDu6mMchrlAS\/YQsPd2UilO6eGX18s5w1\/Y9gw50iLt1kiC6BM6udvcwXaJLSZNrGLxaZ92UYc82STEIYJ\/O\/XhGWa8t8ItluGXOnQU+RqCnAOVJc5ymeirNt+5LR6Je+vuSpLRiadEKCB0df50uLD5HCqBtzK4pHpJqIyJ8IaAPfzf6WDgYGes44LfpMABb3OvKy3VisybTfcGCLB0RC96tH8CpMMXkZM4apqQoMJOEnD2EcMrswMK5lkI68MNCtnBotkQruDOmIGGagAAP41jt0xOw+EulCoIKqHr+iChP6z4wtWM94yvX6qPkDNyPFKFXH\/RBYfyrgsOlmLrTpcK2HUhOAvyB6f9LnQu97n+j7oX3uZCZm+JcA5W24HgaZBpwlaTFVIXdwpMEuoLvNbLJjim9x\/gX0SMFPzfgRgYOvfTsan7lJe0zEl9YNJkM+jxo7qjs38BBFiFSGQzb9vlNOh2dmJ81S6ee+QYbGE2poODCg8wCauHvtgYfyxpBXbS\/VP5RhftbXwdjbJMn830ytkluvtjBy\/rwqLnGrADSBgRnYffhkaunqWIfJexW1gxiSFe0Xoe+6RYcSZZbk+qXve6bT6TZriTJHm8Ey5eLI08RBnPaFbRBfbzGqH15gBEKdwWwivhhI1xzHpVm8zURco8B+Q5cedMNyalIkfun2yQedApJ7R4B+AlKB5\/rp4+89tjZpyKjRp1tcJq0zUexLGss99LbttsUDq\/DcqFDh6qFc59YHUcRJecUUVm4UW76n8Q6ucSBu4ZT399GTSIVVCsePT3TIbkqV6MUs\/cNe4mXMmIxAOZs1DeDPejoG5f0cGrIu\/zhbsEilIC+H69QrGP8PPAKj\/\/0KCVw7fs3Bi\/itdF0jMIjKqRh8eDyMcoqD4QvEOnGp6\/+ftbnYIzy3O7N+PeK0ZdSL3lA5pXwwrXhUyRROSP3STI73aLwIIKoVEr5jF7lmd9cl72PsI3P\/LA1\/MOAgGdqe8qSRwZ0RSqfjFF7X4IHk0GjKgJlJyGek5aKBVoFElCZo8KeAQAo06n4wzTkYnmmSzdsD4j6A65MgekSLrvnROmeFMQBVSg45kiiamylLFKjrHGokupLoDI3kOaGDt7IQVGBWt06fen+S81MegoIEjaNF7GTB9sCJuZyubV9e59euOD8MPHIASFMP\/6JfYwSr+pt2\/5W0GFg34Kc29i84gP\/3ObmrPvifzLUJ6L7moGUbIdwXz+qrQb4zFITRv1\/fS7p4PpVwMx6EMHfPoftA7FN7ivhpamJKHj+sdR7LnWS2opQ6Kn0jfrv5J0X+KrDODx0nNSpqppuFBTyabaZ1sls6pzJihDVpQnRs+BfoCH1Qd5rWzNb66C5PsMWH\/13YzgOFWBcQx8jx3LkJ6pZxJPvV+u4SvNBZgHEb4M1CK8Q4vv5zGvoiHciX8iXZShMVa5r9Y4IIz5dclYplA8HSIgOGkUr766fg3yBAt7NRAwXxRHgRLSHCJbeWVT9mXjDLqMf++VsB8y8BFjVI8heBwJzMyIipSSDY047QbjZI0+KvZR6gy9O6YTUOQI9ovYxp6\/DpBM9NJlXpOEDp2COKRkPEH24pRFEwbQR8ItkikvAnmyGZYSaOR5J0PFs7yZ9alpx0mIMVABINMJFz9ONHXosCsNiCeR+7KT3B4hTPHq\/RW56izCETBPN3eK9BHOi3BVa+KAgdSvm9y2P1kv7bKnYuIKznGKBJFMV\/c73JjIcbN+KHxDWEAMD+bsbHQOg9UzBa4zIljJ8X8NqiLTOPA3dTrvpJiAjiZ4aZmm0nmLNKu4PDo5Z0NNxnCJmbGkjW8ikXT7Mch+4PifULlb304aOQxeWNNnz0VfsuHuBnSHWw4oEdqWU+AhOW5NvixSsqeJ4dXJcvwuDTaHuDymOttXROEHdRSTIPjm7CRiwSwlZVXe\/bO1AAKpdJHX3s1gaCxsxG19mJIgRGU0eaDU4KfX\/fjZ7BWMLk\/qEiOBoUd0uVWMw2zMxo9d7DcdAXqaMzrBim5AV+0QmV7XKcuq7nzvMxd72J6xs75JtVUoh0gq31wnm6p5gyDIWYdCvIrBzXaEWJUPb\/dXIW1V4WbyxdYFIXO3\/gXMurckFKbhCmjuO2sTpkNKP9rjeTr7O0OeoM07089mjao6C2H73lseat+3KpE0uRKjW2qHRUL7w6ohTziIKlxJ5PKGZ6mxtIBY\/nCU70pYbn99EKIpVc7BqqrAofqnrY44Q4Qcsn60fhD4YJ9cQl0fMIKWp5gkt4jLjthTH0VVzFyJOC\/8wx41iuNg+i15SQkH2HDLwLncR4JRcz8Nb+5lm4sBwCt0fOVY0FB4xmJjlyi9tjC8kP6dtha40a3y7gIB1C4osXUWE1KoxOWrqHQjzzNXNCEfXFHcjqUrTJiOng8NweCHir7X2XRc76bf++oA9UDjDO46Qu8weFNotLsMcCWTxZeBvRC\/\/S2wDF912BpLv9QE\/suim4Yb0M8rwLT2oOL6U540CwHNR3CX2eq9jcItzttJwLGTJPXXBkm2Ee6ZswUDBcgKH0Z2HxHBV5tK2dOJUbclChmkG8Y18HtNg+MZLjLSedwrBaxU+HO9FFRg29xd02XaFnLT7dxrqz1khYnbhSJ0oLrZEtO3OvR3QIMyiJrOoVjflSBllnC20\/XJhLady8da5hC7GiXQv5uN46ruXx4\/aA\/sME9+XiafnSzXaR9RIysUj4VEVBaNrF9yi5SSxwUnNFy13UaQtkA7XVl69E6knyLbtGx9Jr5yc2r3ug2eSuVE7TnOHmewsQjoOTcuoUJfZZQFzoaC6YWqSC33XDpCNWmlRoys1K7iYWAtb1MdO8H2Jzr1jIR6x00zq5FW1DOJY2kOdi1Q0otSodeR7ivg9PXEaN0c6NPN4Z7qIZM0ITYcJB+wNJIy5Iu4MaS3QgI1iKGYNdxL4mtyqtT6IWlTODAr006ftqvPTw59I9Lb7pyFY\/HJBToCJI+CrNeaIkVgT1FkoX9iLsMMXUFTb7hxKNRieFfMRD+ggjpW7DDfCrBKSoGY8TSRF6xi+dQscRRBc3OnW2AmyHHY8t9f3QPvoBJ4+AAtrcU8Vwib4J3lwhFTa2Kys2Ael0ee0NAtDBs7i4Su2FaqE\/BiQkorFI9gkJ98su6T6Euk98j5w03zfKGWjPmSPVLPVEB\/EXVjP4OSi\/MDXI\/ss4RrmBx\/k403QBHhj0wg0gkR++AX8BI4P6MJFSq2GNcG95M\/yfDX+0x+NP4KF3NCiZGVBclh2AcpyMvhXPg6+45xXvI+yhZHg9KlDN5aOx+Yvr+6LtLxIXL6UjMPAlWHiWdOu9rNhXvMdSYrJOVHReJqYGSOVuJMFZ8rXerNRs\/9nMsFhxu1L7IhWxQ+VphEwkdmAB6AmY0vx6Xjf\/GX64RJdoFu6uM\/20pJsWZQx\/MI8\/FYhOtW\/8XIUxiSk1JX2IXBgkIA+6+6el\/KLAQjfEhRuJu5N+QeftsshdriQpz6+HNmgSTr4IITi0sSktjaGUUM6E59TGiApDY6N8cJDtgtc4ieO3iKnE8+Wa2rtDVxOnaTNPGUyu2D0X\/lNlIqQSlNJ5WF24ZJ3RwAPDXTY61nKz3C6hqHTdgLK\/qFXYohTNBeBGL0vGJMdByaF0MNi\/H4\/wWF3kyiUxVwPjtbTPHFiOUsnMqxbUbucXy+9qEfVoIwoYyxCfrpz\/7ElCIAgTO083RmDyxmxj2rrC8CsO0IZb7TvDCquzmaCtzaQuET6uFeEqooiFL\/oJyks7hDvQoWIF9S7XIT92PR7t+yhPW3tLiGOGTuk6umh0MtYr6AyhHlmQNN0PzY2gY7OLKyz+BdaFmcaxN+qSJtZGKGODnZkkjCNQTJyR+9OiVOknI3QXpG0P2LH2cIAo\/R0KTGrsbGAYt7fTtKV47gLZRv+PfNHTrVZqINit06SqT3cyQmIhOMT6fSFm8yuXgQ5BxQommKmauCLNRjcGKJbGShdRAnsD0JYQfI4MBhR1WiwCDoBnUItB3wGWMOiAP+a0MvegtiRFxP3Q4JFRHrInuso0kno5M0YYJ\/teDfGUXP7HU\/cQ\/dSTSYXrxWFgBf9gJuodAMgrQwoDQVGfjikOuBq4iRYYPjl1JfmScfo8Pqj+yuZLGysTmvuI7kKBGMNwGdjaEpruSMtmbd1CTS2GjfiX0XBHIdfo47WNpxsdytzFQz+PqZpjdiqdBBbGaMxDVG8O2Z4OVr1m7UzjBp\/wRhP1v360lxS8aHRNwvLuYY04FQb+ms1qnAxQsifVGrSJG4cuz6STvaeZ\/KnxIBOzlALq03W1MblIlRBLcnfSHYF2ybhfkeiV7lsaJUdrFHyYMNTNdpLlOWUQHeG\/hFjN5vnux1r+7UbI5JC0ljJI4+1Q\/6zfLLhZMaOGJuK8UrTHtGv3BcWFKnOgvm1t++IFOqrhR4XPJ+Vv\/aBUKOphSl0QxZNgcWh9Usdfy+6ewPV9Y+O6zEvwHHBtR8FRcvjO+5\/JDLdBO5M6shAqGpID\/CNggIlajq7JyCjwY37ioVsZjwICJjyD+o52YSy9qZqELEVjK\/PsqhdZM2xkgQrf4GWuQux6fkrJ0zzIiAFqN6WDao72ILhsCTx5RMpLBOsUA\/rd36ZADUhoNnP66BHwpBJfnJlWMtpNajxXfGLOroDg+KCtfH9t+iVb3\/43XFafbrZCCczd9UDMDcDWXiN0lAs9T5NF997ce\/j3yplnSMIGdrjwyEUAxlW3cZ0ejOxJYpGhkq540XBjKdAXkdTbfXQKDjdiYxSZxuNHxMvH6MdFNgnEE4lv2lflDTCa8uL6wmrNm6E4lqYcvx1ipB1hK7yzyfv\/AV0IVszxJ\/Jo9d1Exm8DAZJ49IJPmQtyXdAFRSWQpjPUaREr2mLHJJCxeY5o4SyNRrODSaGhu7glz8X1xnkNkSzZZOBW0rlvOsU8pPPtMKewbil0Gr2tgLnD9gce3AKo3rBOTCFn+SztU1kYuEb+AavQHM6dma6c+dR\/k514eDNiRMXjg2V2aSU5Fckqb03fJAxw\/3RmkJhH18hdR+xxXRKQkaND7ioFWuirclRM1\/KeyX2bjidQ43U3OhEK5OKE9UfvuBXT1BiCvvHCEX\/rXZ5eZphmmiY1yyMtzDoh03pICMUqOfL\/+lLrMoKB1kai3GzcNIr9o+rIZh+lW2oymuEzHI1G5eQoZY4MS1HeOXXJJocDU1MLqUeLwGXIUOy31CNVJZbqJfKdcIkpkVdQlX\/jRReJF2vEkdHh7\/6h0AhUBjzT4KipifaEocTIcjbAcVXhLvD2BZh0dQ\/9pNKiNRz44BCN1ozay3tSkdNcGKV2SnuRobw452jC21Sl+xf2mOTLGFTv6P7H2v1szH0yyWH3KrnXBxPbfWqTR1iwh3kds5rHG\/uLfQgDq3s\/uufGWGfwjD4JhevextNdy1KKzc57UHHigs18TlmdYzSMTjIIcsevf7ZP1md2EDQ4qjkKLXsfq8nZSZYbx46Uhu5O618rTFRdue99Snl1Kyl9kotsksiLxTZhiN8zfLJSPeSAS01XD\/m30noGPLL0kLqFJiVM6b6zWN+O2ljJp6ggFWoULJay0ZJKxER5Tt58htPKt5oil2Ri+MOh065sKisDGrNaDNVX9IQzrY9Gexeu1EFrVPFHNwGRpO2hF6WNNVmfB2AGGm6qV2W35I0llJUegT\/AS+KUrCXrxVPpZ9pNQdosHFmwhxmQzIfbHiJXnArvRQGRzfpAy31teTdhF3MORBKD2PIEk1gQLJ8V9Z0+iPURhB\/\/BRUqeNotLRMOcM9OH+u6DGZqQQx9epmah6xbVFqMr4fE6esj0xV8zKz3NeO630DYuwE8y\/7\/GDUIqFTkimXE\/q7wuThew6Dc4BjKY6uiTUgRopkp9nfZXdNtVbyBcUNUzNzxFTg19KyYTJAOgSjnOQ5e9YA3\/WoYApovLXcgeIRk0IBDuEn\/L7MALtticRH76KC\/TPHbMffAg1MYg\/wvbCIea6WA0S5OIF4uM\/Q4Q3jR1U3PPtlapr6PSYqOOLIcg3fhc70LehVwPcLbgj\/YtZvuEDfbJV02DOjZEQ3j1pkQ+t03Be7MAlhcP\/t96PsfltQy4S9PHwDA9XxA6Y5KcAZbP3+nabYP7zh\/mQtxSQmA20UhKBlMqxm2rCOmsLMTX0EicGseZkjs+xzDR2byf\/A5zL66HNdvPyCzZrQ7KwBEYQo52Dsq5pSr+pBdEEjLVEW5xTRg4u5IQNSEHc8IFVCB0v4FPCH2rkGPCOnqN2J\/X3gcTXb3GOs1mg9BFvqAsSKC9ialCKyp0QqNrpJ6LBylS4ILWs43ddHRr2tJn5qxyRXoSdcS98WX8iwCXOTh9c6pEGeB1XzaAsSpwD2853FK9rzzfAjUnkc\/Qyh1lh+WPzM4viVL\/HPmBtPXeUidH+iKKd5bl+WmH8yDpsZJEyIgFClHXbs+sFCRJIZLlEigaRFK5EMMIPrQOxclv4hcHXlVqp0W57ZfNyIw2XBfByKJhb+JgEDJ2T\/jE3o5aJONLeu4u68zmvzUxAJ6rqSEx56dggJ5o8n2L6eSezyfjqWqkFsHlWoFLbom0z48KkAIMfKhJ6G2QIacLm8JeT15wLEWarGSoQqje7o\/vHPXgQsxS3A3DFsv6cRdQtLLbxbjro\/rwqxCjz6QKRjvNJXSXZ\/sYu8Vg\/Bt+o5eKrTk7cDGvYG\/4apc3xagfC9VoflpHvxflNxvnPJKUGBhOonBbg0QveulA+Sca7+cmRaZYITzRaPwU76hMHl+m8lMx8mxe639Cnl1i3GAjl20rKzcmOCVfMXZsGd1Yko427kKesgtqfhBfX7RFgl2IR49IQCoLYAS4p5gMQsdyRgpcK6pNNqBjhMjq0uz6HOQP4rrt2nTSJrX0RIkfS7ReqDhCG+6uF0hqnLE9pADlMTyGe+Zo8hr5Q\/5YOTNVmvfuF9BODSqDzlJrPqcgsFtzucWL7Dji+pBR4RY8RI2Q0SGUYgZwgLAfmLtUck6awyx0eLg+lzm7X7QUWzIFtzHDHRivu0y1RGHYYSgQgWeLGz1VOTe9nAZaj+shmVUT5B2AqxwBly0+ugM0fan\/HS\/Ic5x7lDT3ldLTOfGtWG2IdPvgliwJ\/lbUfgJJqEIGxbQqR6Sx+vrCY1TURxTwMoIcZXW7F7vNPimHA8PieXFXgyu\/QcBfVpPY\/fwk+5EVB0vWN6ovA\/a3Ryh2EIR9IOnU6FAhVXzh\/rfiKxnqcFZ5bspJhINKtBD6khmBnGSPNOBONf4gtuLDsScGQNZ1+NVDZ+taLEUsTun52YzaPQFE1YiDC\/paGrBo66gu5HllLjaZ20iXDhnv5zzCyu68zktb5sPoV1\/FRz\/\/VBEnkdHjrwzMuy1V5z+d\/08tlg+Zy8vSt+S5GZWnq\/BlOuYXC2QqRlMuzOnPBLF39\/WLHCHoriZOI8HQ4c\/ZFsovKwSr33CskpFmhuLVQRqxEqEnLoSes\/SvUeD4sCd5kLJ2pMFnD4Hc227Qid5QKe7DygGGVRHFusDMK5zz3MB+QXu+GzbDyUbuefiKMAICNolGbsmvQAEV6m+\/yr7VfPu\/0ZoOQOFtoQoKHWySV6i\/1h3veIyasmLE7LFo6YoPRzd9JlYqDI16ZXWLTdit4DTmhDgUKP3E0iQaRjlY1Cfg9sgdDmgjl71zFCFZbt\/U4p02f3MxDZPHmyblZPOx\/yD+A8D16Q5Z0fdNj30HeGmqnTllV8T0HlpgF4Rj366d5wp8k+whXD\/sBILX3\/oxrFVdWR9xxkyOJaBU7f\/rp7vB0S5jOL4urEd7L7VOGeA5a1RcCF1vL8Ad6oILUVqbLbUhuoQYzQNWK4TLlLm2+lT5R01RvgTBxnX8IaJVxMAqjvx84G98QXiPUEQfy\/4gQX2OEzHa+i4SSQekL75uNfzMRwVbuDf+UdIebEBZXe4k+7VarAWHTDMLfKk9QmaHQon7In3YCQffsi5Z1aPOdmalWRfXDxQrvG6M2dCJCIkY7N+RKCHSlpExyr2yJ9lDuLSBfTYHaSTSNb83pRE0\/CHxXjxFIA20azzmyWiWAXSfknC+7o7YzZ\/MyV0eYL06oNxGiLByLIBfLW6OMgr14NVcJtdWYYB2ZK6i6vkNGnwxxmqiaSYW9PQlNc7JKSQjqhYsTt8u8cHJuKDnak0hiPsm38P5tqp\/uqNWZy1fI9zTSxzGNaNlO0kpIkfOL3SlC7Bxan01aFOOQVnCtwvlHQg0zsSJT6AIQp+2dpi1\/tjBWQkrmXid90sWdy6LAxBR7T5ysQfG42+5MlAV3FR\/a9t5jvh8iF7ses63QDVmyUmsd+SIynlDI5\/VqO\/w62ibEUIsizxQZYXOA5leYKJVnET7gWUzGJNQP7P+CizcyWReXDC8fNtN947No20yapiPMCT7NPXxB1WgnYmPmzLwa78RVv9momh3FuybjViHcFciltZtI7h8PQHJ4aBZqZqbB+BMIL2FYZ2EQiqyjBG7B9SSsENn9tgGj71BWHQzKRED12QE9hxP2yfpzHqS0A\/Ba0dlWTHaDeAe1XqWeaWwSFUGePBYsVjkrgrYQ\/0TAbSxqdKEikPJCbPPfdpFbtoM\/uGLDXY7kN0nOy4\/HIiohNG73NTodQi8Je4g0GYsF6uqJPepugwW1c2t6ijz4QAUrjTOrFev5hpOpknydZvLKkfb+iNz0jIhAznjrdn7BKculMoBOuK0rmXyzNT+klOl22tKjxgim2fCOTT7vrYy6R+LxIMbGwipdmMcmHSZsUcrEzD4ks\/V1kDjKLH2Yu2bysVIY\/BwmIYdbi2L2YZ5YK3IeDx5JmIViFQ2eTEPTPvVNcy+KhnKKAwhY8W4p1RXocTZKeMn4NGaE91aoMXeo6A6bwWZ4QMAEoEE1yYbVdhXNPkApArPR3qexdKhTRMZ0kHSRKZTuxLRsW+Ry4EAeh+JS+Z0Q84jIn3iiUcSZ3D95eu4\/u0XqsMJ09sGljP8fyR27WSazfnQ92JFGVhxsOE4rs551RRlYte+CMniTlCB\/kDPpG4iwDt5pCJ9GAWMkNx\/Aw+j5bXWoN8SvyMX9PjP39KER5JU+4Ahg4t3CUOP7DG43iyDwGxGdhuoqf9PuW5IzMMwZ3mD\/b1zPOcb92m35TzQRlR0bEScAEkcxIvBDXqxkeDrLZj2krTIIYNZfTWgxqQVzHszA75w8DjJj+o590L1iAiJJVmlDCEWQNBVPl6mnHFeJP2uxaH1uOO5XEb+YrvTpsQNIjVEOaTNnqLEVhCIB30RxfR8b8OQyj31iW+\/L4yk42Vsgw9Gb2lrfsVU98sKAir2B7L7FbGJYsT5V58qvNcypSMA\/Ig2+3OdBDvlCd+kv9E3iDRzicYQDA2Q5SLtabuexK7EkqIIANN7cjxwcn3XZjlv0\/6vI6lxmOqDRdkLPCY5eATwrzNVc4FrMx538louv994otmZ3b2Gy75cW2omxm05nxO5UmZxC2ZBeoz37o1z46Ffwsku9xxcdltot8bYD+DNJ3E\/S5q\/M2XRyWLh+TjepEHWHsFbA4I2rz9pA7fQVJtvaofJc6zHwtXGO5uQvF8ZZHSuUKVW00X6OhxNneEL9T6HBlyq\/HBTttrHryU54jj5IpqaijDU4Ry86\/P5h5CDU\/8mfoGPkwjY8DGnxYQHKWTIBjtHhktz\/EGTza7d+1nEQlI+JGnKM6oBvZkQ1ZGqQzi2hdduGFrPkxDSngey1IjK4R1iAaMg99KUDwZyHhbam2FjP6j0e1bxSi\/1fYasBaSeWzZP7gVyP2rgqAueQ2FNemrxNBSCQ9j\/IjK0ZAPDJUY6by4QjLWDZmC4eBFZvUZ0xvbGcWsg9+mv1AE\/EFEbOe8bQ9\/z\/hM8rw\/a47tiFHxKt4jPMfHQ4tCyCZYBKYmkXmwCOmJeplI43kpIwPpFJAEoF5UHqb6bwDevL2yGHoongtyswjL4ZcapjvTTCXRVgzzrLChWmgrwYVuKuKdhxRC+XNsHR3WwGq9nySjNREZWO2na\/hUPWJO6LFfpeT4rOKzxv91yNd1twQ5HFfWjoBs2UWTAPdic7aVT08OOlVwLUqbGOlNuFTqvlc+aP78BEKNMWzUIt1bNDjzF2ASJog3iKT4Jfq3iUUOLCVecDXFDESk\/omVhPLtC3dAZ5Il7H8Jihf6sWZ2A1kTaOR6dfk7r\/j+Dq2rCu5EIkm252EDoYuFBb555Q5jj0yfGPyGNDdAzAJ3RCAyrBxScBWIvTXf97+3TBAviN9ATCM2nIbvFHWbao73c5Z2MdZVmTqyEVIj6BRoU5YHTQAz6pOqPcJNQNckH1vRfJMlxJWby7sQx44K2kKfUtJpy6SdZXQpgrgnbEMgmGPWQNCI6rHztYUIYN+dVCs45+fvxpU8rnxDf+gVX\/oypqBpeLpTYeCMLHBIP2HinM+okXb5VMmM1z80ZSgnEf5aiUU5YzT1oX1dwRoYNk6D9P2ROqNpFrJLPxCj2P5kZHU9O\/CYskNUhfY9MqfvdLDUyjBE1\/how97GfKXjvEWMHJcqllVbzqlkmZd59PgnVPgIGktB9DF5+7QX1O7QOhu1\/bj8U0LTfVrODVxUujAnz1UiaWUGTtwdwsQggAhiDyt1bEvVNeAc0Bw\/ggKSb8Ph6JOpNn6bGfZedZrZ5JiM1ArGbtDTpgBoycn1VPgBFfLHIE0\/pVTOIkA2ILe3mOgqSFEW9IpHeV9k1MkK3dDb7BdUEgXZgT+xVB3LUvQwCExGRUA2Ete79fwtMOxMfeOIRAZG0feHhiZLqE72imrvQdInazHu4cI6+njoDCAn2aFzKptuwzqyzzwbNG9kKp9m8sP6m3H7omgROCBgPMd2HlAjc\/F\/NalcLMHByUDgioTz5Q\/kU+PYXrMkwQ4i5SWLQEx0QGJOtH4MBTM8ZeCsxrDuhb5LgwLV294bHKcQiC\/91lGGFLQTbSdBDkAqVLo\/dfYORPhcsbM2+gabSAcct2r459UwIspu0pDSZD5EfP41wb0u72SqTEbrUgLX2x0GVEc0f9CafZZvsgQKvIQjAJQ8Y+D2h9ebUPejn2g80I7\/6x8BxJBTev44BJi0r8LPPNHuCkNYQGdmj1ssvKQ2cy\/mspXEeNdV2uIfBFhh\/Oj8UxA1jEfN\/0hkhR+Pa1fnyiLXYRQRhnnV6XshFG1QlTpCHpt4EZ6x69l+l0r4fVhzOJMbaXIdoQt20EfVWyzOyngQDZVVk=","iv":"a88d5201e5a8e3d748db3488904e80a9","s":"123aeae61dc1e332"}

Patek Philippe Ladies' Moon Phase watch

Patek Philippe Ladies' Moon Phase watch