Although automakers are racing to be the first out of the gate with self-driving vehicles, consumers would prefer their vehicles have diagnostic and preventative capabilities, according to a new report from IBM.

Although consumers express interest in autonomous vehicles, vehicles that assimilate to the driver’s behavior and surrounding environment and the ability to fix themselves on their own, the latter category rated highest at 59 percent of respondents. The "A New Relationship – Peoples and Cars" report provides automakers with a number of segments that could have larger returns than autonomous vehicles and evidences a need to consider and categorize consumers by digital habits.

“Auto companies need to start looking at the digital experience people want to have and treating it the same in segment consumers,” said Ben Stanley, global automotive research lead, Institute for Business Value, IBM.

“The digital experience in the vehicle is becoming just as or more important then the physical experience and as the car takes over more and more of the driving, what people can and want to do while riding in the car will be a key differentiator,” he said.

For “A New Relationship – Peoples and Cars,” IBM surveyed 16,649 consumers in 16 countries about what they want and expect from automobiles over the next 10 years, from mobility services to retail options and self-enabling vehicle groups (SEVs).

A new way forward

As sensors and cognitive computing become less expensive and more powerful tools, manufacturers will have a better understanding of a vehicle’s shortcomings and will be able to develop technology that can recommend solutions without needing the owner to take the vehicle in for servicing.

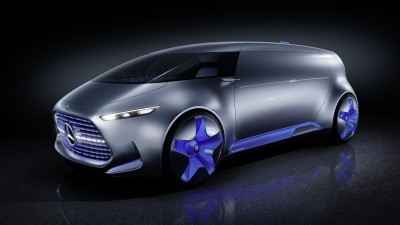

Mercedes Vision Tokyo autonomous concept

The SEVs considered in the report are as follows: “self-healing” vehicles, which can fix themselves without human interaction, such as by repairing paint scratches; “self-socializing” vehicles, which could communicate with traffic lights to attain an optimal speed to reach the light while it is green.

SEVs also include “self-driving” vehicles, “self-learning” vehicles that configure everything from temperature and seat position to driving aspects by the driver and passengers; “self-configuring” vehicles that make use of driver-authorized information to personalize the vehicle and “self-integrating” vehicles that allow the driver to control their home from the car.

The order of preference for the SEVs was the same for "growth markets" and "mature markets," with self-healing being the most popular, followed by self-socializing, self-learning, self-driving, self-configuring and then self-integrating, but growth markets had a 20 to 25 percent higher rate of interest in each category, never dropping below 60 percent. Consumers in mature markets, on the other hand, never accepted a category at more than a 48 percent rate.

Interestingly, consumers in growth markets – South Korea, Russia, China, Indonesia, Thailand, Mexico, Brazil and India – tended to respond to questions about particular innovations with eagerness.

Those in “mature markets” – the United States, Canada, Germany, the United Kingdom, Australia, France and Japan – were more skeptical, wondering why they need a particular technology. Those in mature markets were also less likely to use social media regularly or be early adapters of technology, yet slightly more likely to consider themselves “tech-savvy.”

Audi e-tron quattro autonomous concept

However, preference distinctions ran deeper than merely growth versus mature markets.

“Asian countries rated 'self-driving' capabilities as one or two priority which the western markets rated it lower,” Mr. Stanley said. “On the flip side, Western countries rated self-healing capabilities the highest while it was lower in the Asian markets.

“For mobility services, an interesting difference was with health services, which would be using sensors in the car to monitor health and act in emergencies,” he said. “India and Brazil rated that as their number one priority while the U.S. and Germany rated it much lower.”

As expected, those who are more technologically sophisticated rate as having a higher digital maturity or more willing to take advantage of innovations. Among respondents, “pacesetters” and “fast followers” make up 48 percent of respondents and two thirds are from growth markets.

Thirty-eight percent of consumers are part of “the pack.” While hesitant about new technology, they could be influenced once they understand their value.

Based on this data, the report recommends automakers segment consumers by digital maturity, creating sophisticated digital segmentation models the way physical segmentation models are generally created. Next, win over the pacesetters and fast followers, and then move down the ladder to the pack and even “spectators” content with the status quo.

Aston Martin Rapide S

Also considered in the report are alternative modes of transportation, such as fractional car ownership, car sharing and on-demand taxi services such as Uber. However, these services were of lower priority than SEVs across all 16 countries.

Forty-two percent of those surveyed would consider a subscription pricing model, while one-quarter were “very interested” in fractional ownership. In mobility services, 36 percent would like an on-demand rideshare and slightly more would consider a car sharing service, with options ranging from on-demand ridesharing to peer-to-peer rental.

Younger consumers are particularly concerned with the environment, and ride and car-sharing services appeal especially to the group. A gradual shift toward urban living is also likely contributing to decreased demand for a personal vehicle.

BMW online retail

Between one-third and one-half of consumers are hoping to have a role in the creation or design of new products in services, either through voting, submitting ideas online or participating in design games. Once again, mature markets were more skeptical; “very likely to participate” rates ranged from 26 percent to 39 percent compared to 41 percent to 59 percent in growth markets.

Retail models are changing in other ways, too. Globally, 67 percent of consumers said it is important to be able to buy from a dealership, but 46 percent said the same of online purchase through original equipment manufacturers and 38 percent would buy from online brokers.

Hitch a ride

Recently, emphasis among automakers seems to be on autonomous vehicles.

Technological innovation reigned supreme for automakers participating at the Consumer Electronics Show in Las Vegas Jan. 6-9.

A number of brands, including Audi, Mercedes-Benz and Aston Martin, have detailed new initiatives focusing on the technological breakthroughs of upcoming vehicles. With autonomous vehicles visible on the horizon, the intersection between automobiles and technology will become increasingly obvious (see story).

Nevertheless, the report shows that other advances are also important to consumers. Providing ride-sharing possibilities could allow an automaker to tap into a significant portion of the market that does not want to own a car, while the brand with the first self-healing car could find itself with a new wave of loyal customers before autonomous vehicles hit the market.

Some automotive brands are already beginning to venture into the rideshare market.

German automaker Audi is expanding its boundaries with a new mobility service.

“Audi At Home” allows a resident of LUMINA condominiums in San Francisco and Four Seasons Residences in Miami reserve and drive a vehicle from Audi’s line at her convenience. The initiative shows that Audi is a mobility service brand in addition to an automaker (see story).

“Even though people still desire the convenience of the personal car, they are changing their priority in when they use it,” Mr. Stanley said. “From our survey, we found that there will be a decline of 24 percent of people 35 and over who will use the car as their primary mode of transportation.

"They still may use as a secondary option if they own it but they will not want to have a traditional ownership with the car sitting idle much of the time, especially with options like Uber," he said. "And once people go to a car sharing or on-demand ride-sharing model, the loyalty to the brand gets diluted. So automotive brands need to find ways to keep people tied to their brand.

“One way is to provide flexible ownership models where people have an ownership stake in a car but the cost of ownership can decrease (fractional ownership) or the value they get increase with access to other cars in the same brand (subscription pricing)."

{"ct":"DJBGuKFLL3oAQxZ3duP9VXrtqB9cKatGJ\/uAMIhR\/cddFnDPsygvT6jBldBElcqagRnYOe96YjYRl6kqYew3b+6HvVpiccPsBb2QkR5zgMsWzo3bdzbMlOBvsGW5gFDE4j+rhfmYH+SY\/Qf2d0\/YrZkjpLVwcv6yG6WHvSyh1tW1srG5H14XDhcXF6dcPCF\/8sipINVYNQ4LcWHkW7TelLIulMT80GgU1+zImh6T4+hc1AWfJji7035rJek1VOMDVZtJXt89Soxz\/ZPkznr6pYljtaYoiuq\/iMdln30t4Xx93SBVJiq6m1LILn7LtRvzDXqVMayWXIe7QBiwNngKWOmLZrEk5vG6\/HSi077+MAYPWEHev9hb80CUpRo+4\/ctd4mi9WGZh7ysYnWtVB4S4OKmQGKjkr90h5aiWRb\/RFsewnsEFs0xQ7qkPvmOXH7c4YbBSUKa5hRAxOEffj4cZ71vtxudHWxLB655NDHhAA8LJnbgOjv86xefj1sGQvYikX3vMBeu6ThfQLgQZ5tuV2bx2AIS8BhsrLpFfRShnU5mfQr70bRoPQnBqUP4oa1Bt4aLgMCzv0PafxxtTO2TF9ZEGZsG2lZctwjgBk7XPJtSOplHIXCH\/2txHilsp4gP5svKykUmqMcY8d+NPNAAjnNOfHOFXj7wQDWnEaYAvVKSU53O5ftu304ss0kOahIvvEMkLWo5cnGO2Ch7w+c1\/c2KAjn6q3kn9u7Y8QDLs2jtaS8fM1XCEEmnI+QHSFy3A\/hHG2QHX54W\/oh3Y0RygFHz9aAcixnnOPYnMMe7KgKUC1gB8I0HXGmovDnQ5ceMhlkhnAZ3TcQclaxFm4btk12ojgEibzILHCzjULw5G532Z2X2txBg4ypib7YGmftq3QilFaoXcRuoiHNMIVzqzggzVHLe\/l8Qd8LWFprFg4Dw+S09rNc4fumwxU\/ovzfGy9tbCTsZW2FZ\/P9IxGzwqUPl5rpUzGHCOjAw3aBZjcWEir7G6v0rzmE+LSYj9GE6OuM8pL0h2JsUxpBJrLCIi9DZvoXz4K6t5aEwGB\/4aengLlluINIbRmDJKqT2XbQ1PlldEdYARrNjOjuRyNMhIRTI3PmfMuHON6h08TL76VALLQBEEq+fP7+n1TUrbJfOgXoPaCGoBy4dq1qVbQ8UCFLtgrGjaUIdCiIbBHM0Vr67hbdAV3jqNBb4VHI4rMUuI1QIIcjulwUVxFMM4078q0ord+taKInCir8aoUyINx1+gv9KUYbHSQ51Lwten5KdmfgY4hNesCJWT\/sopP+eD4MpjUzBK3VyTCDmQHN9Jqlr\/Z9vMTR28CZS5uP+qBvxB+xzAv4hfA8\/l6oDCtoPLniUP3cRN0aCOjgMRem\/8Igg0ihADhFl6itHFXyTo8HX5d1eJaCR0B7I3y\/BhzUF40zgUwiBlAtED6zYDB\/gSO1h9O\/0Bp1UAk+Aqe1KW9S3HI6OnlKgzN1\/\/8PXw7ja585\/lmEPXIyP8YBkunGrvjzfSjnWLZlDGgV5cXcxu2DyaKvsDgIdutRwgIZR5g4meS8Mw331ZnG5L55iaFoEZW0O05VSvjeIRRGunXY+xWjWx1cGrhF\/1LwEYjTZHhhdlTO35ieBzKz8+5ChjT\/LgANjyBqOIL3qWp+RFKA7yhx3y+R7ZTqR+2teGnHuBrvBPg+oVO5VXz+G6rSNnLXwefcYjbUvvOeYh1WglLzEG\/VrK2YGU3tl6P9QHfzJMzqrJQB1cbnmxSZByouvk4PD8B8jOfm0w9TyLXQ+jtfeGb6VPa6Fv3YyPTH84Y1\/0Wm9jqZF3QgvHP3k6S7JBHJVkcgk8kuLLGumyEQaQM5WdCpbGqJ5tHz9Ryxsr9xlDvdYZcd557XB36Z+HNbH9yD9bNGZd\/JyRGSwJWFuuyYuu0n7nov5t+NxlmAmctj6jGNRBKyFlH8Y2LYb8aaSe2jx8oalRhhW\/jqVV6tV1i4ZJ10F379BBMaCxy6v5mtawKysQWU7PpjNx0LsIkw5+2fEqktTu\/QO3ssQP9rcVolCzDSetd3PTitlo3pVnkLKKtgCKi1Srszkhmm994NbtY0gSz07466qzXBz3sNLDpv7TycfkFtJaFfOECwIsc3VNd437q\/ygLtGBwaUqPBjQ\/0TRYXdgZuXPJZVPWZLsbv+eZlUDa\/djje3v4ufaW7lHDyhGfeP+QtGH+wSyy9TnvY9zhEACmRw7V0Wd9clSZ++PH5Bm8XFIFfeNBAAFd6hDRg1VfAS8uHaF3Fx7uYWROWjg1sjcOcZzvtbln0F03XSFkfuoHr7O9THTET6NVMIgwtCbU5pc9SPv0a7EkTSQVVy4vKThtE55qrghJ\/RQs9GJH0EHOorYN3gLtoTeQzrSOKba\/zpFq2L+vfU0huSIxd0Mf+xaShhvW7N3x7MYeHqBScxQ6tM284TP5LxKrfGBeD8wqeE96WtQfg+vcimLsxSWlKp7hYdxUwp\/M\/EJbM+EZSHAWRku7OrylWyKzSxY6\/ay+jcKBru3vsjbhYLzL+ROfopsnBvO06uwCck9umwoCQWZoyxLoZQGkmEz2QfrwLqJDz1O3X8kQ2MWBM8lFTRu4PeT\/Atb75Xr126XB+hBo4WjwcXZbWLIZKU6BEzbvFLLOZQh2HYI\/tg02tZFVZfJ38DcaqCNunlG7Hlyh7nIto56H9Ybx4ZNj86xSM6TAnPwbBrHBzXfKjtINoduEAH5zdqcWS663eYINg04C93QqCBT8R+V6iDHaZ1ftq1OH1uc86wPkxBizXRzL+wKDxWdpUGt\/6funHkZCI2nGakAuJYgc95Zx3xEq19bQ99fwPXdqrMX8Zgb+3amNdT884E0WwprJa5ML+z2UAdJPVucBpzMzSD+TpwkPJ9NFAp8xWmy7h91nN2RAtmTY9irxXeRqmy8VTK2fg9uhqpqrcGEydjcTi0gTb67Gu\/z5bTFqB2\/HgfeQccxNj8p+xOikd2qgPMlIru8VNZ1jetezqaX423GnrFCmweMYzLahr8xd9f1KDh25c2DVXdvsN9\/+LqMPj2ZJywH\/1dVXci5ijgGDgEmtP7ff5Uy93hRH2J3LUQg9UEGDpVVMWAwBz+fe42te7rK+BX6UF7arAOpe+n4l9M6rOWGZGlvamlJbaOATc41WhKSw0S1TYDfD6MrSnxs7vItnAewxul8uxpqfgAFJxecNZuiHJ3bS\/BfUJL\/klZvWq3XpokYov83A4G8o38pEdvVmEBpG1K2Q6BRa2iNe9HR2p+YRoyhuU3dZ\/QdjZD8pEVELrXZHTfDHvYhGLEX+actm5oUHaJU6wIMz\/GmQER\/2SZrdYnkRUfx5i\/6TEi69hZPZuYF67+P0D3z2QCSMKQ1tT\/3ZqQdzADaJdzE7ZolgT2jnQPEKV8QdOMEvHHHA9CbnQHsLz+Ayf2ojxLlFYumEczEaqaoAcuHytu\/QSG2u3Jpc0ieR1nQ7HWxcMKeIN6ylfg\/sC7Lcv3pkAu+yIJGmOjs7NtF+K0Iuo4v92vYyV9Dj8BbWP1CFJiOoPFU3tlY5NyRYwhFqJlRZbFMC9iQ7jOxFu1VQrw8VNhxvz1dcOYENt4HwZisRjsqY7ZRLSCiL9f7xY\/7hfw6Kt9mKaweQZ6eHtN9\/kexdrW76hjh28hIzPRfLbuOnpsQdPz62xe78x7Q1N3fMSjLyXtWBQAIattqIugPFtqskX1Hs94vvzDsK17MdGbQOoDQ0ZSYTei4mHQ3nhYOw2\/4c2dsyY3R+ZiLCxwqFuEMvESliueHtE3k8maGVNl2ESDX8xY4QDt3LF\/dKnCkP5gyFeeUbk7r2vRf7U9wf6OUqP1JnJhiPqPQ9pd3Nw4P16FzqjE1NIs7qVJ0lJ2Lm1l4rsztu3FQYV9Z5hmlUVmUqsV1mlcCiPMOL2koeG5JA2BDuHAleAWCgcTJRCgBr301ybklzqDDTvG1yloukCjDT1AbX3zsrxPfopF\/+26Zx4s4R\/VKMYlP4unBwuSiWSdR2CW\/2msqmxVK1SfeldR4+Vd9YZhYOCVk3umjBbpLJheln4Akfssh9rrVa+dVdeFCl\/S1JYJCKHqg12D9v9E9B1hh3lts3dTszdNdT\/cNwl4FfefBKUsmnRXj7McxAo8+8CIVuLxvZEsuLEJOPTSfbLF5QAThoZGsD8ONccZsZl1s8V62bnWbvevEwvqc0rTKYLFzxhVDxq4KOuOvxv3D40TESGFAtYATik5rxphK01cmOhCXRPnvbb3kkr+iOI9ZNUBpaf55uXalmbSlY5kI6wyc0s9adWwxN3dyUybMwk38LpNogw+AoGbZ+ANK7SUTcnur4+RJc9VtXjkk3DJu8QaEAlsEMK2PG9iibqbB9zoxlHYLG8bhJLm0vT7Y24jV83NLk8TKqV+oi\/Mz0xS9hsr4wlm5vGb1oJDdCTnlTCQNEW98rNW4h+Za3q01HYYqSCG9fB7a\/6gKWCFWyUhWI1v6tFBmwk8KBq6ApKq838eb4Umfa0SvDG1zgmb0Ax0yryuXb2o19rcEcXHBdbrS3jU1650IyUtfTURoiUKV9\/Lbu0FGqlXbQ1LWRDAfVHdqHSpiPdenFMOQoUvtex3B1WAce33WpoEShA1LcJtgIlh5+G5jP57w7m+FnsBanZsmx3uTJmkJrV8euw\/HJB+wPfzfKLC9mmWXCmSvstzH1dA1AbtNTaFBPqc06HaT0eXXqAKFMf5Kbtku3uOAEOk1H\/H1j9\/ZalxXHH9tpIwBRUC1DY2Ku3R9qFp9szalXisemnfRLWTkrMWr9ACOw+Mti+j2hpTQnIsXrf0oEeo70ezrrjO3nohuZfM10VtWsW4ok5Tyjzxg3TezK3Disx+5zsU86HQYfWQNIf4hWLYVqYiPaK\/wXknPjgp7BXDqq\/tYk88Bd5HlgiHQWS1TVdmOTh+QcLSyDfJBTofqeW3wB3sT8Y2WC2hyqN7itpIOvUX2KxAvpfAiCrCKu7OWmG0PZ+6l\/STg8Ne79IIiMln8u6ZFtI46Ks6esJ7GUP9\/1Z+0HX+gsy9E\/vjry1aEBNP\/y8\/lTL93YybtunyQ2AfdmVlAd1dh1zbSmnk9VrCpRGZ\/rEBQnLcCHiTFHwH8HDdrqw7qWYuZVVK5g2FbLgntmBEVn9dkBtZO3FH0gPG69XzZEvogdz0Yr9ixiuTuX3Oiih0yXOgnTU8d0uW\/RIKqGhRtYWv+STk0TYa2PYw\/Ys5f7K0o0TWs21WzooTc7H+kjBMqOIKI3GlOcb8K+05Y48wvjMiOnQ\/rKQ20\/kVy0s110UAFgOMoKK+eS0EWADbDS9hHvtfvyrvhJID3rg6g5EVX9hIxM0F+KWfm2E8heEgnciMLOPCvT0x4pXEet3D9Hs4MJLCZT9FG7Q\/t8ydTTh9yMB+\/cownhlYxAJBl8wxReANDZGqD1YG0htpJCtagNL0WPOGQLKBd4634DMvcpb4cevqKccUU6vVD6bIUVFNwrecKl385azIg86nF\/5ocxvzZtBRcvTcjlagSr7QqfFKglD+11Gjnyozk3EVtxWKP9RpGanw2GpMW+1Hf1BSa1nri5\/Iaf2fO0CDe9kLzS7HcP+o22XncA5X6hW24\/nHoRzkKRK80B8tVWd6MFa7+D3bQHXIDRZn4ORq6IqqxwgiSgDqGLe1kJvT6+c2tivUcOEudgQa0D2K+SwlVuzuTRTRpU6dXjE1DIhCdI5vNjSwDSbNZ3YIeT4y+3OMcBqj1gTv4l6ob05XgUXQNF2rQJPVlbWyZjm9LuDWHlZEZ\/oO3IJ7jDFLpPpLdTkWlIsP2YcANX4Omssk7IO56txZQ7VljxLLYDmVcGcF+nJXO4G3oNVou5p3JOf9ukU9ohC6FCLw6MHmODTw1UMyoVBp0Ijsmcw6OxE6oXf55uqwm9JQiyfx08sUfdsAbPD1LMttGGbB7WcxIioJN+AJjHY7J9OE4PS1gqHgu+MBWA68RfkNsi4eAwNFKdp\/G3AeqGEOeg\/JuGY3vz+yqotuCrzZsyaZkk4Mudftgh+WcHWbYfkgUSWjF1elSO91Krff4gKvtpyA+BQnx1+EtdSYq9AGI55+YEzk1iH2VebPtZqW0LfJ+Mz\/uO\/1x0l9tuA3NnFYO\/3o+2rFpi\/yyQHDQ16P\/P15LTYn1AIE6XczcqIbTgdibIcMIfpz5yux4rZaYG69yJ9VW2us0uhb0hVqpkASV\/BbV6BngfId\/3zpVYMPxDltxAUE1dCxunnjtY9QdWi9R7vG6st5KilaDM6n1JUdBzGVSz5PTCkFJYXmvKb16EVTPxeUKaXXQej540NnPjdATwhtkJ9Fo294XNbRG9raze2i68SC9XiIki337fDIQ1WJdCMIMtZrV4N7aXLuAHja4VnoUWd+rG+cZXZbhrUaxFNbY7dJpvboLVghbYcJCf3mnRm8q71Ug1+jiDxSdJng8HCcmGI73FfAb\/GPqWU7NRVtXGin9jxiSjfYsswJpDdjS7wvNeifXpaK7+v52WRUVIHCZa9Fun6boBLEHN+Em7MjbvSnQfch2XsoLiZyaRScgXNL9orsMzslVOQiNEHI7n8xAGwuFQHNMInaHah3DL1vzIlXBDW\/nKtGLJ9VnSRs1ykvT+O7w3hEWVZ96NpdetzZXP\/3Fq3sY4FOY1GxaUO+6kN\/y1rvithGBoX4KJKJ3NhFLmQ9mflwa5io6LjZ3C9V+FnTrQqZ4BT0I0WL1Ex5tNg0lC78H+ZUHb2fq4qsgjsrzbDbFDCZ2DgsIPDwpBzgJ9mw1Bau9lwgoIUNQ8bk+wR46sWEvmBywtyMwu7nVOnmDZpanCie+oumuvemrdWKcxv74UExQo9JGjwbTS55qYGWis0MTgUGraQIzSIbnUxVf6V\/UMTzBxn6Wd\/76d4sKRDWN9hAvDv9hqmCqRy141VuXkklXdAkJQq1\/8hVlT7Fzyb3bqd3ktycjVH5Pz5VVpDABXkkoIVNVQ\/jxi3OjxCyFY0J5KE+7v96ja64shRnt8kLfA5u4UvQhzTf3zeQx+SOfb3Pkr5e\/6GIqNUWHrFcHT+VZjHxW\/mbUzWdaLijGB5h9LcfhwO5ekbCBIz42LoNDt4DIY7fqoiudZVWt1sLCGXUbz3qrJ2Fhb9TrlV6SnR5FH1f05ranrYg1MeeCfmKMGylF6uewGDxZ53P9B6uxbFhzJTQlFcThu4ARA+S83mzVDgIyhAvJAdXFIaHaz3T0\/dsPXVh8M7ImKfndOEB1ishyHig5q6JeHZA5Z9va7GU8M7+5klerOwJspsBRrnfX2PXF+sXNbcrhdgx1zX0y2hPpJqXsIop3bOReOxzWC7HUM8Z7VBl9LI3GHZTsVM8FcfVsUYDUnUd8sNhdNeVVd9DsWEDZb1rDUc6ZM4EQ3xRCw1THlwl5zyfci5zzsdcVUMVdpCTn8b\/o2Yu0GcReyyf79krUQVFlzHlVW91PKQH9\/6u8NnuM9BuSUCqHetnpqH6JxnSF0cjBzmtOXWb7lXp2+MYT3L8H7Ub3neWrWx2BF7jYddonpNoIjOaUX7\/3qIV1pJ4RhFwmIIx9dj\/XVng9LJRwkM8YeKwBS76Mx7HYJLaxVLte9YKwLQhzuY0MFH7xVkqMNMDdmdGdqWmnFDawG76XlVVmn1b353Y6ENAH2JOiz3chwBENElkwShqoUGNIe41pLzwBzlSq+yJ7DnLHnRQowPgDJlFo597g0SZiJl8I29EOruALj684\/jtWsz+om41UMrqH6e6Xnzr8g5bTZsQPvkCsBxHsyiJVyvXmTe5tYL+\/CLhHeRWn6QCfjWnpzjBKTTbX\/b9QrvaJw83KJ5GM\/gAxsYKFlK4KXvYnPpVpI4Pu5DJjpe1OjWuRBDtWdZ3Q5LIZKTxkaAM1cyfqupWI15RL2Sum1S+qcX38AAQyFnAsEl3jqoZj51iconWFJ4ZSCjAjP6MvLa3ux6Co4VZhP3kCk3MJqidmSGxwbaqvPRDKl0SXESGT1fslMyQi4C4yEbyIKaIglwHHHgLfePxZQb00dCy8PoxhAMN+walTFNUEOkUUPC6YpYCCDgJ7eJnTcenPDiLFaozx6xfeXXPpYHKxYQ5Ub\/RNir1VAHqtHDuScrNXqoM68Ij6YNPIYnK0TmQ9kiKuqyd2K552BBav0vH25wO4ylpF6+4reidwfS5dJJVrk\/DjJEXW96dYVlydrTm\/m6kAp\/VrtBkF48kBpB4t2Jquzz3MKRLgFmaV5KOxobWfMPUDVDGY\/5qQdWFza7PRa3A16jhVd1GYm8QL5c4LriGt3pIVANVRNudZZ\/BSQHefpVJhqZjcqrf\/SpUkpaIWQlw1TS6l+UFNSsS5sBrwkgwayRboDqoHXBcgzvk+vdhwAUXNFv8Ia8dIL7kmMlnAWU\/j3LAaMoYnIVQa2BoA72AU\/ULRCjiffWOBz1xzKS6edpGA4+ESPkgrINLOlqRZb\/EQM2N3Q1PC0kH2xWKDLPkuo5uBrqtEDgviwjwIce40+mzLUOA+Mnn6HTjWKUfy2Sdz4cc2JIZBVM8tLhuaL4vRxm+5o5xKOIB+DNxJCpafsGmW27xCgCH0A\/I5bZk505n+S\/BhGFf66rtPBpEMh\/HPFZRSucSTQCeO28zTHCq353RLMdoxe49z94w+IxA\/3vdo1u9EP7auyzSy9Hdcq9lLdJuijyoHrI2SdHFyiDdA9eyQUQhvKtVCn863r21t4bFAs+8y81aoKvtTGJKemOKNQtsTC68GUUBqD8F3h6quQJElZj2gpK6f0IbWsAbjJAiH3l67SDgMSYCmEi44oYq58hNkJGKblprOlOhWWI2AHMan1uLBs5s6M94QUVsOLh9\/zu4FhDD0YG\/MHEAI+RhmNU13GhV4ezZXRydDSptnOHf7I0Yue483Pfag0F5hfHEGvxaVVZuIy6DDPaP+tcDjZWlh16ToB7J09CUYNLFH2m0nllrso\/zm97aoK8f8233l\/d8sf8NjywzNsFjlgdGB2iwlcs57AwgTtmYxrst2HdGiL5c21spenq0iSD7ZgPSgt9llrqQXAb1Y8b4SbTQKxPMYvxHXMt\/9TtWNqNS1D37GSEIKgNuJKynzWPoWpJh51wn5lLD\/LdLLpaSW9C0j+cal5aGDALN9uxwzbm483wYmVqobeNakmakKhztU\/W6qNHFaYaPA7jCiUg13oimaFmTdKdkyTM2KuoMAawcFdJKs7Dly8SLpNV8zRmbx6q\/nDnFRlkAf9L4WDZLE4UDNT2LQnlac0Q8+FXMPjnkrIyyhDzOp4nMDH0Xjx9O9kx4Vi02eAp7caE7iTl7GzYV6Xd0aJpB6TJV6i49gm1Udm6HGQ29aCuAPaacKKA1ayWtxj0dPYnqaG4NbRQE1QUpSbGGUxQeKPFA1J9qN9652WelFxCVT8tAdafGsVj0g83bRtw+yezjfsxvhyn+8Y2vpji\/91vVKSt9xYgZlEBoS\/GDn9Bu7r+76\/iBJRryivhjqsDNemSxLPd2Yvuac8efr7ime+wfbEqREWs6WBayh82K\/JdOQCQvceLPteR4eAvctR1ql+BDWlbrUzRRncZha9d9vmNr7pWtAoGgDNjMh0KQmWHc5YgWHpvtkwr7fjtoj+1EPPe8INyQxaJbCrKAY0SE7cWXkvvXCGdKG1wVi1v8Ro68\/KCQ2TqwYa1\/P3sCXtYs9gEcuXYpUi8SvFRzAiZb6WZqpyPz5NljdH2vqGKyZLyLBdZ\/B+JWGGOowuBhBR7yEyLoDjD8NN4frsHhh9XZaBSb5bJ9vNhgkyTI6ab\/xv655NFDYc1gGGu4K0wH3VCR87LxW8TQA0TV81yqsXBOF+TpQU+WZo0zYsimvDlxK+Wv+RmTCqDNfqX3hBafobnLgnZxiHLhVERKbXV9Ic8lmMFf+qfkQM2fInEKEiMrVIG6eSBmaoUo0Qq2Lxm5Lc279ukf4KZxEl\/gVyexeSs0MQKglPazBZSES6Gpnya5LwoCcD4FEs90+YirtZjwuC0vMlFWV2ku0Pt2oN8cGqLu0W6SdO0RgLsoPIq1y2z3v9jMdnss1GeMpof6jAxQJDbttou+JhQc9f\/i1wEiwZm84jdkiQOJZUgJhbMJdsTbq3XeILuwtf3YIFU85UANzN8Mt6XhT7ILBH7Mv9e+WCMQnzY8CxfCTSNyA9798ycS4aDfFY87SDbHmlCmwX0q5ETp5W0hzOg\/hux02BvqSwTflHQCang\/5pNZ7S2ZASHtqsi4TQoyporMqgOQqYnOThebeoyMSuM4myDmE8iTICtJqouekzRQIFbT02yNVE0O1eqiEjzsh2rsUqv3N4V0OIZSn36Zro\/zEIWDUdWZHVygIiTJWTkuENK6oK5tuXuTPJzFCpSRXbefmbJRb0EW9b1jTBYScP6rJ75R1AuR1ZH7ZQZ\/SmTvJcux\/fR03lQQgiE8JNHosCBl82mk89iDU25IItN+f4SZG+ELNn4ReRPVlxaCGgPBMbHBFJIrtV8z6KXR9Fqwb7NBIhPXoab7\/47iFF3P9PXgtI9ZNH+WsbeLXCzjA1cDAh46e02kMOysXRR+Vi4MV5Ux6c01TIzozs5jemjDzSi7H8XYgHQumnEQ5bAnollk2DPz6VNm0zHW7Hgaoc8B1wbJ4N37lxY0W7QPg3SSkSZdQx3lDZgj4fxVZ6aJTudcR288TBqYxBq28ROicuttYEDOBllJHBsUFKf\/4jQThEpXOUcTXk7ct1EVO5qvXVnSiL5EsR9pG3AzEi0jR0bkpEmb+MlvIkYayaspAYrm45V4EKnlRPcsfFt+PTWlszTP31\/6xNHLZfXtJ8+RGOQc5zFP7VZ789SjpTisIiEwYyWJcldBqZziH9OSrAWQBgH0mdsGQ0VaqVm8bMf1IGkldC+0NRUYy0HkOFHXFaXh7iLw8le6GvczBH\/rm3ptdxVsUwRFqf3DQuembFu68i8rHWfjPVifhB7O+R7GTOKpOoBTKSFLVEyNfVnQSEsZ+wct7ZdbC4JD1DUWMYVjA6Lwipg0NhZGvzjdaaaG8SDaIY4lemghqMAtkXHuK0ow\/QOANsYaKQcqU6izUouv3L0NC1vuGThEfbVxRv4OsFmYt\/LR0VfeIkAs7eR72xqg9e+zqCTHUU4Wct8VMxfyA5jEsEueJSWzTJ6k2exw1fMJ3KbKQf+0PZBs5Gw4\/ZAhVRoPKheIZt6zugQ5DZnbrwEYOb7At\/XWXicvlk0w87iijLQ+qnHXmPOYgVoJEkmra5jieuSebCpr0NTKXb8LCyacvrTGRutFbBQvRcJUaK3fLbG6NpvqpGmOfTuu8uZa312noZgowKaeK0k\/fTmwCpjMDblM\/L+twpzHiJ5BRRrEcJz6TpNT0tH53GXq7cmghMwZTAOKdKiEnvdmDvdMYXI2ODBWWmg6K6Q\/2vghdxCJ3tEL9PpKcynLFdALDDER+w4A1ZhBGhQ56AuckWnsvde4KJrY6oUgt1zDm1KNFNp4Q2uSi2qv7e3BQXyOcm9Lt2TV4DphHsfJIXkbq7W8btz0s7pG2AuxDnJRG0\/c4ONTzfNVp2pQ90feqJaiSvSsJgOybZBp47vbm8PWwoko4ObLKjbuhKyIUtCOyICrjnkZf5e4Xm2rMN\/9fC6x3uq95qBISshs2pPfRtVUVAsCsBe1UgEFYIR7sqb4yhw+wfvBVSbzEgTT57zl\/qEgIaj70l71v6X+wCgWtYEhvvixWXKd\/sCCr+kZFQvHUtJLu5uT6\/BBBuTSiZ2WUXkWXOhPQyYXFOUSqC4xsRpNRQqvkcqs6VJVpenNk38lWG6U5ATY5gJGGLM5cc+UqRUOHPQJnGiOAN\/vhvfLoHV4yTtSSEel0OpfpN5cwIWQmUsBlpOiA9Yz8BGM\/YHhd1xOKRnKOtzyPNrgX4Y+8ciBvyeidsS2hsRI4MNLvrS9IVxFeyRy6pE\/1lEpRoNwAa8+EcCA7joYoYh73h6ZBUvSgD12B6l2olD6kFNRE4+R86LG4z7uk\/t2Xy16\/T+yPKG876FQ0OR4D+SPIWO0O1YRk1dLegp6lrbRaP0Lz8JyIF0\/jEHGe4JOpi0TI4iDUrl8gtvyctt9j0oEW6lybQkanQ3yJTYjBbRGZugJN4Je1dDZ5CxzHVHQyVczIE7MvnxbGBagiA7IfRLA+dExjgetL\/sjZ58MUTy2nnIIvIc7bFWwQONeRPInWXGqm2vv\/ogrlvk1YvzgvB5IRgWIwaNOJADk998tgcIJBvC2Q84STBcwctYC9eLQm99uiJ866TPP5ErU6aIinpwjZZUNGNKNcjuVELFBnxSNiHU\/mWs124WmCRawfVd7J56YHG8idtTrs+qUCT1sXdq4yUdKhdxmzQbtZm4K8RDH2YlF0Z0GHXBUJGIBg0tOGBAL0GW4Qb6m2T3HJqLV0fjJKoNbHsvTO+RaqLmNyDeinvnWggrhmv3D4sg6MW8WD1vITNBbrDzillwJYlb47HJTpQXYlVcegQPuCWSPxzP28DMOvJrMt9PidjnAH8XF\/lrhS4RdV92L2i34USw1MawzEdXQmgBOrpSTQn7T369hndM1X6LX+wjV4buvtFCOOABt1WxYGASZAMFKqMyohKTyUjgkUrxpo0jDBO4o+zE+TGXuS3VoZm0XwKdwERO8u+qJW\/xyqDnZM45QoV635E4GJW5cYxfhwp\/J2zJIZVoY3gvAEqRy14OxUeVbHWeMlRHHUaWvszJWejRY8hn2njhoWZ\/0Fi\/uzm6pe\/esqiEyIXM5dgulcr\/vIHO641B0D6742x4G2KaTkZp62QYQ6WXb4Lrqam+TaPqMKZJX5CfvBm4rtsOlQn3Nkf5IreAun8wZ\/UDwAx+wCN1ZWRWA3Edubq0Hm29g23tkuykOZtryP5I9k6FUEGoXRXNlOxgQfwdtSrK87i7VIKvsHjgd0rAn2ML83Van6J6NT6LBnTL022ZWK0q6oC9GbosRTGZ87MTo8YQsDGVl\/kML\/BK0mEEfb1ojGRAknOJYx3eHgcv3sDCt9v2yvtk8AGfEA2iG7JaJ9MJ0gMRlnT1I30UCQttDggZTNeXtS4tGX7GUOQhnXwDLAWmYHbRM9wT5QD\/\/IzF9LkrM1E8Ee+RZnB4OsK+qROC9EqdtCStS7kp\/FNY6WvI9Ph0Oy65f3zTT9UQw5TvOJsiAQV\/9dfvwZAiHfzzoXiut+PhpH\/7y8ZCAh4OF0N7PdrrXWQxmf+EXIGXgeRp+rGsXPJN8UqwVOPrSUSlyy93o1wQL3Wnrip2IMrspg3H2CSjVDLayPo8INkDPzFjobbNYDmX206yBrSc5wO9P\/zxhbl8fprdPhBbh5pmbME0JmwLP3DQPxrGaIMuF3Gj\/lANIi4MV5DH+nboSAMPB\/3gOoDu5qighmb0I0A7ksaoFplkby12Pv7wtiiqx5eHFqIdQstfdRJ6tlXRl6i8JgLENtXqlnZWyFlUbyaB97TSk+arYTDKWDsjvsQej7QzsKnHt\/ZJRjOsagzza1\/zpsNVRUanuLzDiJBrxYeaMyjBzl3arkYtwTGBz4P5X3zEnWYwgmDjflTfY9+ZPJcfW4SR2Cxpx2aTTy93BYji50zauFq+9Mmzq1J2hEl9Z2RljCReYo8WiuunGIu\/3gJx1uso3X5gqdCpZ3Pm0IclpNhyaCmHlDgVgeDgheeEMpvza\/WpiEpQNQgSOcTmCr3l3A4l38I9RDZd6EEnWrMET+O6rkTj5bgoqzfjpLfo9YrjBsscPKkjYISU78wdqfkFMX04vj8T0KDFCDUJFeT6IJA1LL\/1hSzW5vSbbV+\/I8r8xOvxzkCYWyx02DZorE87JwkI3lNhiO4NKN0nzXz+WbOff\/abqFmZy2SrNwReR8RlZ828KpHam+yWTZz88cgxxhGclUOMzUQH4slFoHf2+XWFRq2gCLqZCSYTO67xbe7yg7xrQhwURDkFQxwWxe5WYmoofgicI+neYAOYn4g4HFxecNT7OA42zgRmXx+qXq7ZPTzYBwOaHJ8GUKPk3s4MMpiMWRQt2EA14zSCS112q50Zz6EHazKAlng9lAzEULQyltzbS7vVDw4a0t\/EShPaxkqGZch9qtbvFHP1hHN0Fv67vUElURZt\/5XLiw+ocrkKDwSxKT3dF6W6o0xFblSMi4yrOsu1P4rcOzXYA40OGfwW11eRNHc5ie4dZx\/zGEQnvzOTMUMb2R249NIQ3fInoHOvODYZ0r6n91BJk4Qd0\/SUUiI389U6OBQWPfCKpsQZ2MH\/ZSbS7epNuY8hvZHfpB9ZE3p2qrQtHtD9TiRKalxgL6xH9UzgUsQ6qNBYKgNjhe+WBrtZunfH8Jc3VSXt3rkPLt0ROzFN5qL83X30TaeO1PYE4GZUk5CtGetv69vwgDujjXu65bwDJK3\/G9ytaotIg38LX0Q1XyzDbesDhAW0Dw6p5wkybrtSqGT7uBbOHf+Xaf9t0Rk2HGJksztv7Mz107pp958x5oGQ+gP+gRm5KkXWMb4Rga8vLhP\/8tcCOf\/R1p7mZuXAQIJr9dF5+qvo7aZ5sUqx\/Azqt1EQJwdlXYI8wu0KlrapNL43lvNCJcYBFn0nh0kgqcQ+qoUukTf3sghpBaXLZ6AHNB4cA2Y78mXI8gKA2ZY62\/jViQNlX6A6v01XIud7QfkJFflspvHw3INiehmfQtfe7M9vHTVSffrz3tH3Fze0WdgNhT7XD+YC7I0HsOz16PyyrjSA9o2CXhC71Kwt1+WWeMfoDT4lVm0I+UW+GkAznz5nvcIuCwY2w6g4sH8mbtG4+iWslM4qWYdL4SlgrpdYvNMA\/JDPDuuPqSKZdY2rQdva+tPMf\/NXU5z8Pk7utJV0FFODg3atmcwiTNTyR1c\/BWn6zR54Ik7zK9PqbzvRKwZBD8Fb9Zdg0X\/DtgG2sGdoGYVoQucO3CrPHd5fmP1JqCIEjZ9JCQRtnDCHs0o4NkUZG9gD9MkzGYo4Lk\/jHtW3E4yS+M\/\/aGZ6fH73\/caKgZI+xGZRXmYp3M9RDhSVSXojoH9JZ8NdjV7DpYHy568pX0xi4PA1fSGBUfdWaMohUPdnYCVKH7Y+wvNpuOV5w+WDnsIgrpyA888GUW82J4pLCbed5eCSWiq8mRArbfezpg8hkxOiOQEjOotDV519lJ30DTzm+2wEDttGSkwdamEju8mGopxEp6bZ8V0QpKv5uRwSmmrg3sF6DU2BiHNozYDc1hucVYM+Evl3xTXHwi84To6FqnqcjUOIbHdEjVUQxHyjlf0CeAPep+qhfXBQeuQP7RYon8OJiar0YNtXG5ROeodIumSrvls5DdodYXQWLlWku8fohQ8Rq+CE9k8afpHAVnhdmhj196DMeVtzJLbGK5pBPW4+ebaP5AQL6bxf2uXiUQdHK5UzLd+oYzvbjMxE7blSBJGOElI7WrNYluyOe3DJBG\/buwcZlBCUwsdZee2EpykuwjVZ3Ngh5ODyEKfIXZOns+VGXrFQawy46zTuIxxCVjMK5yOI1k3fVCSnbTMKJGIjh5q3X7K7RSBDCH96K\/L8KnIiQjhipROZ7S\/O7\/xc8YujFUjXwBGl22OEXdZHEdIdVHQxjFdDYyDRsgGHMg6qEPUsknHe2fX8+eBrpZH0FHGV6xWHCWdk=","iv":"4b1c4c44d54ed662e5fad0d846fbac3f","s":"29482ee94960f3d7"}