As retailers strive to fill out their omnichannel capabilities, they may be investing in more than consumers expect, want or need, according to a new report from A.T. Kearney.

From lightning fast fulfillment to in-store technology, certain additions may be unnecessary for retailers to win consumers’ loyalty and dollars. At the same time, one resource that has the power to drastically impact a retailer’s bottom line is largely ignored: its store associates.

"Store associates can make the greatest impact for luxury retailers versus other sectors," said Ryan Fisher, co-author of the study and a principal in A.T. Kearney's consumer and retail practice. "Luxury clients expect a differentiated experience, that in many times is delivered through personal interaction.

"Luxury retailers rely on store associates to be the front line with customers, driving the brand, driving the purchase and creating what may be described as 'irrational loyalty'–the client will choose the retail brand first, regardless of price, location, etc.," he said.

"Technology can help to deliver this experience, but it cannot replace the impact of a highly skilled store associate who forms a real connection with the luxury client. If luxury retailers are focusing investments that exclude their store associates, they are forgetting about their most important asset."

A.T. Kearney’s 2016 Achieving Excellence in Retail Operations study, titled “Retail Operations: People Are Still the Best Investment,” is based on the responses of more than 100 retail executives from the Americas, Europe and Asia Pacific. The researchers also surveyed more than 800 North American consumers.

Delivering on expectations

Omnichannel retailing presents traditional stores with growth opportunities, since their profitability is no longer tied exclusively to their in-store environments.

Retailers are taking action to adapt, as 86 percent have shifted their in-store strategies and measurements to accommodate cross-channel commerce. For instance, store associates may be trained to make online orders for customers in-store, with companies offering incentives to motivate sales staff to sell via ecommerce and fulfill ecommerce orders with in-store merchandise.

In the same survey from 2013, only 19 percent of retailers had a pilot program, whereas today more than 30 percent said the same, showing their growing sophistication in testing new concepts.

Neiman Marcus' smart mirrors

Retailer’s bounds in omnichannel may be getting ahead of consumers’ pace, causing a disconnect between efforts to innovate and sales results.

For instance, while retailers take on the costs of rapid shipping times that have sped from two-day to overnight or even same-day, 75 percent of consumers expect shipping to take two days. Consumers were also more likely to say that getting their product within the timeframe promised by a retailer was more important than fast delivery.

Technology is the most widespread area of concern for retailers, with almost all respondents saying they will invest in technology this year. While retailers are spending money, almost 60 percent say they face challenges when trying to execute or measure the efficacy of a particular investment.

Some of the most popular areas of technological investment within the in-store environment are inventory management, the development of a mobile application, customer checkout and staff scheduling. Most of these upgrades focus on consumer-facing technology, which 80 percent of shoppers say provide bad customer service.

One oversight that A.T. Kearney points out is investing in sales staff, since about 90 percent of sales still happen in-store. The retailers that are most effectively leveraging technology are using it to develop digital tools to facilitate associates’ interactions with customers.

Image courtesy of Westfield London

Consumers also say that their likelihood of buying rests most on their experience and the service they receive. There is definite room for improvement, as almost 50 percent of respondents say their training programs could use “significant” work, and almost all say they are concerned about their staff’s ability to adapt to omnichannel selling.

Around 75 percent of retailers say they plan to invest in training and additional staff, but A.T. Kearney suggests a focus on resources to help them deliver customer service.

"Our study found 60 percent of retailers struggle executing and measuring ROI on technology investments with investments not always aligned to consumer expectations," Mr. Fisher said. "It is important to remember the consumer and the store associate when making investments, aligning the focus of investments to what consumers expect and how to better enable store associates to meet consumer expectations.

"For example, consumers consistently told us they are far more interested in receiving shipments within the promised delivery window, even if it is two to three days away, than getting it faster but being less reliable," he said. "Many retailers have aspirations that outpace their internal capability to deliver, resulting in customer disappointment. It is essential that investments balance internal capabilities with the technology or infrastructure investments that promise a better experience for consumers.

"In addition, the retailers that are investing in technology successfully are using it to help store associates to serve customers better. It helps ease the burden of execution also, as associates are incentivized to learn, adopt and implement new technology solutions to boost productivity, sales and potentially their own commissions. With those tasks being more effective and efficient, the store associates will then have more time to directly interact with customers."

Despite the rise in digital and mobile marketing in recent years, consumers still rely heavily on in-store sales associates to assist them in making purchases, according to a recent report by the Luxury Institute.

The majority of consumers surveyed reported making most of their purchasing decisions in-store without researching online beforehand. Luxury brands looking to improve consumer relations should focus more attention on improving the in-store retail experience and providing consumers with ready assistance (see story).

Making a connection

Social media is frequently looked at by retailers as means to drive engagement and spur in-store visits, but only 5 percent of consumers say that digital media has inspired them to go to a physical store.

Part of the lack of efficacy is seen in that two-thirds of consumers who say they do not connect with retailers at all on social platforms. If consumers do engage with brands, they are most likely following to get access to discount information, with supporting a favorite brand and keeping in the loop lagging behind.

When asked to rank retailers’ touchpoints, including their store locations, product selection and loyalty programs, social media was deemed the least valuable. However, A.T. Kearney says that retailers should not abandon their efforts, but rather refocus their social strategies to be about creating a community online.

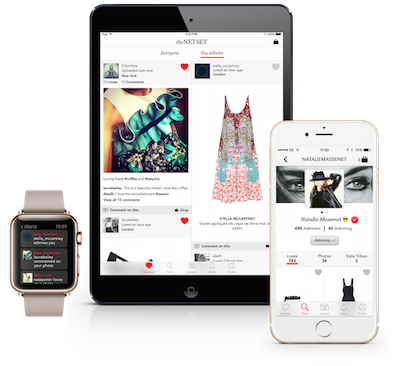

One retailer that has leveraged social media to connect its consumers is Net-A-Porter, which launched its social shopping network The Net Set a year ago.

The Net Set

The Net Set was launched in May 2015 for Apple devices, including Apple Watch, giving users a platform that merges social media, fashion and shopping in a single app. Through the Net Set app, Net-A-Porter’s consumers are linked to fashion personalities, curators, designers and brands in real-time while labels can actively manage a social dialogue and relationship with users (see story).

Consumers who are engaged with a brand across multiple platforms are the highest spenders, said a Barneys New York executive at Luxury FirstLook: Strategy 2014.

The traditional consumer path to purchase needs to be amended to get results, and brands should instead focus on creating exclusive content that is of value to consumers. This strategy skews content more toward CRM than media to genuinely engage consumers (see story).

"Luxury retailers should engage with customers in similar ways they have been, but through even more effective methods and channels," Mr. Fisher said. "Store associates remain a critical interaction point with consumers. With the vast availability of consumer preference and behavior data, retailers can now equip their store associates with consumer information like they never have before, making the experience even better for the customer and driving more value for the retailer.

"Social media is presenting an opportunity to not just directly interact with consumers, but drive loyalty even further with awareness and draw to the retailer," he said. "Currently, two thirds of retailers are not engaging with retailers on social media and those that do, it’s mainly for discounts. There is a unique opportunity for luxury retailers to apply social media capabilities to further curate new brands and collections.

"Emerging cross-channel capabilities also offer the opportunity to delight consumers through unexpected service and engagement. For example, using customer specific information gained in-store to provide targeted promotions online, and using online behavior to inform in-store associates to engage in more meaningful ways. The myriad of delivery options are also highly valued in the luxury segment.

"For example, the ability to have an item from a favorite designer delivered to a client’s door in another city or at a hotel will delight the client, however, it may take a well-informed and capable associate to be able to make these opportunities a reality."

{"ct":"fspVxqCk5L6QyO\/Pio\/6sXyX\/CcSVVCHXyEy1PoOWekUv1Ks7nXNdiuR2SGhnIbA4d9hNZCaVco4SwcLcW4502YIAwPDYT93pDYeVB8ml1VwUOvN2By+iXfEgSvJ\/zqtwre341ZOonAfL5Pz7AwPsnzokvuMiNQ0ltRR2SOVkTrcVDcRM\/M4KvnZneInaBmyvisUdN\/fyTOJ34vUIgIfd44Q0o+WSpoG4i8YvbwUF5lhZT8P3Cb4sgKEwcFYEtua+VYr9r0NKgEqrKr9FyknVF0vRgCxBsRYbliSCl0tBUfO6LsPQJajR5Z0is7\/9UVeSDOJl36nvyVPhBASeWFcMrYF3o+hQHwj+hAIP6r\/U2\/8YOCedOR3\/UQJ1O6CA56GQ9wGHrVkgywsCtdtnfrb3+8PTvAfpFY9CWeotaAwBPSxA9nR5XdoOV4ZTHNA+iyLx+0HmsemdQGCUXvwKh85DaKGjBYDRoTOVksMzH5cDJReDQogvtGY2OfGhU71Ojg5KbUSzLHGsXjCUUuXqE431jLQ6\/9K4WMwePGCCgdVKKYuaqhAA5AUOL9EcNNp2+z0qfBtRH0TaDaqjKW6Hg92xgLNemvf+rgPWrWM2kHM9VDvyrIDxxoeur7Kwdyny8l8cY+QQbdZCVQnRPg6BRGHc0DT8mLrE8XDGA+bDcUhpUG9KAG1h5Uhh0WHScuZTUPzK\/PEAJGsJUHq41ceHHGLXuVEtP8CStgNsNAGigoTfkGj3PW21n0lkXbXuN5yodz0fwNYtTReRCzAagJKlgVo9cWM192kfr\/Q\/ksJdFSUUG7qguq10\/7F+AXQFEFzxEtbEJm0hkUzfDuUIVh8zb5l+w+arUyS6ydxKdaSPdvf1lDCrSOmcdp3orx88muxXilD\/ents3SE17Hm+8R85ByXoATETobXS7T\/m5b83vhw\/R5ssNbm\/nHC008LPcMrdEQgaohDN020SvlaP\/jwxRQ+68nV4k4U49\/GIZNc3xV4uJSYuyXDlmLAlvdGirWZsibVTZKla\/zwqTlo16CB8T48vhRCrt0j9YsRvEQbQLn9jGUh6DHzia1W3xlI3L3nfbMFM3VYKPaFUbyw1WP\/onFDcIsBCcW9GjYaGJ+l3Pf+od5fZcWaASeBM007NITAbs7wEfbvwDgnyu\/jxvsWo\/XoEsJ1BMw27sze+mvrsV\/t\/eBc2z26cxKNqtnBM7vcn8\/CbDvloO9BQzYjXfaigyrniT3a9Q+ahDnvQ9xOAFZY33x+sKyg93gvjygnr6RMYIJcd7Tmkcsl3c+iXKQscCc9tObXXjdvr0KtWfgc56K3QG6c1bckUKsprS\/6D18XDneWEkKGlUG8A1lGRQCa1j2dxaOZ2htDQrD7htDksov\/won\/gdNY+pWJWjZmgD+3S+amMM4rwQoize6avG8eSNgZYKEGY83nHCamaO6mrw7Qqpiss3lzjfgxvrM5fGc\/qYvhHnyd0C1woVc7Xw5uhKEs6gISOb77C5gzYD79tkhylkCxOJYybqqLU4dUwFBL8JcloJbL\/Y1QTIR65v148aZ194gY3IxBAtlavL7NKEzbmRiV7pU2YDTvqhd9fCZNyScOCwJLnuqT1zvqgbakvYD\/Y7mdHAcgQP8jrUweExhFXEG1hl1s0PcMHZjN1uErIR7Pk\/QYswGuuUrydRAWS+7kqbXF+Q9VAcUkUW9v67INxUnDxwhZP+lDrN4JfnPOoOJ5VyXf1ReofUMt1YjgRi1KKJm21TMVbe9dLrkq72CDbfR1wcxpsBX6o9FByu8EKWKBJQMmNy4iU+P\/8vfzhHbAiYaZloyhjNUzqiORTO6QEUUgtEEsUcmDcQKGWnQEK4liVqw+QA3Nclgsw0cmEVvH7\/OyVOHl+G17AP0g8p4EzkOQ0a0+NPyMf55ljJtP0nMsND4iP1eNVtunIPUTPqMXaka2Mak38wrD6c6YgBE6EiiG2ZuBCRIm0J\/Wo4qmoCCscv7lFvHd9wY8b+ylmp7KNDMSimKsJrNAqLkKQwf9hu+4IQzY2cQrwi9aBv5pwyNFsrXUEJQ5DP3mV3pMn592xjHawmqfGCQasMME\/+k9pZcGhAlAJhKi05vB0nP86tUpsFDYXi1MgkJVw3g+6Ll+PAOvB1HiHa7lc4BnAXtmsBA1vZ3OHk2eG2nywmV23nV6GL7haU4rKkgiwFtzvWapUM0gjIcKIrO5EgS7TRVGE9fHj0JsqbaHX9S2YabrctBaTijjVXUhqXxyPa5aBXB4EYVct55YBVXCN4ZadRYh6aqbjoyNi9PmJrs0BHw7AIYq5DIVaQQfWW7wxe6X3VjzeF0GnjBysOncUObGPXkUxnXi8AYs2X3jBZHjPM\/clZOTZWLAxn3NOs5O5pEwAcOQHhQ0HpFSraZJd3NHPuVf4r1SpVPuYPurl\/gA220f1d9QvUQQl0v1xSF8fU73pCE3sZI+UFxd3X\/tKIhewMrcvhVbDzFbkSyh09bW1Ypdlh8si1apf220Pe+0vCU\/M6DlojlvpDgaZPM1gYYJkr\/q1O9zjGhIwRxQvg4fwG3UBIJ6MvaldIY66GQKW+UuLWGJQ1spUyaCeRf\/EUNUn7\/PnJ\/0NRtaI7kVxeFJ0VtfillCUSdASaEduSUlb4DGNPy15Q6BgQbzORr\/F2+x629Tvvav\/Tof3+wK3bKPsw9IfIRRv6m19lTu7B+JWuATofXnQ8Q1MstX0WKtxgGUdXupttkCbcVfK56D7vP5tW7NgOBQJBuZoZ\/dknub44a5VRXYJZt5UGbT9ShnzU1ZsNj2C+10So2UUhu5PZnx9YymK+qgf9JeF\/ix8fhVjqJHxWV3EKwajUCBg\/OehOflYNMBWX3OX0Aj7PBHAHH8gDjXb50m\/XjQRxEqNsyQevzPORM\/V55qFbyV1K5uLTKhxHB6T9FUOZZb5bDGIiU4QK8ff6KwhKf6YiBBYGCpy7KufkCClLue2uFO9JqXc72BFRtXY45Vz6Z0lS9\/RVZhAP52d0gUNPMK7lJMbnOgOQ2upV32DXSMWyYtia4gEWS0g2Oc4zfmmGAvW2qXPIb1jC6r\/rPGoo2sYzTxbP2h9QWLwtcwoUyHucMuhMIa7AE0TLDD9RIuuFwT6eJV\/DNrGEFO4t9cA3Hr4l90lQD6sOf618p1bkgK7p3xg1Ta5ffWV7eS5Ku9QvSa2IdSf0K00wPd8Q4GhWKQSIPyYTxNBMcev+EqjACc3uOKo+mgqurxlvl7l8+oachkZB5g7SJnDWnaLtAh8eCpKwEqPPcMqBNcZsQvuYuH4ba0UGHxKEHMTrhxSWjpg\/0D6\/ZV\/PGQtxYG\/IYY2+TgDvnXgQ6u8iObyn2ayI2rC6Dz09q\/5SPvqMGXLiF65q5E+cN9gfwL4MwnT5ta0HMG81DOJByR2IfinWj9cWo4gIwt1Nv\/9PKSM7rq2upq0WVubz7\/rGcQOemAQ8SvqX10YfejU559WjNyWzp2nzKh\/WEdetwBTJ0XiKwnDlzwzhtGZAHuuiiw2UuOLThPTRwLuNtK7OWS0PgULu3DXM0CrGcPwbYhrwV8ZvzPL0z1uzv\/M98RZxBfEU+4z3B380IjNsA+85Mdz8EpKsDabwoMaWZCtqkCOLD+oAizUPTvR\/B0QNHblTK1zzXQ4zJkxG6UYoPZJeX3KsX0hl4jhevP+d+PuUaR2JHfZ63pcHr8HHrmVbqOuxXhyK69s96p12sIJNTmKOBIJaD0ZxRjZ0WZQX65cMy1owr8x5Ew9fW\/mqWRBiM05gz\/KlAtC5vtXaf+PcIa3AfY+KMOsBVYISljXycsXs1amf2jLhI8v6RVSqc8hNWxsR9rruXEYzYbfjtGrW0LfPWLqzbiFeNdJDl0rbUsI8bEDbZxPzgN0rZoKGl4HM\/41Bz1BAh6E72Q1AUIhekkTfjX\/n2h8kbpBYghrutmC6T30LcuzPalo7quex3luEBiiWkooZRDTwyyFC2Vmil+yYARu\/fae2qbwz7qS9D0SJD6Enz\/bCr5Gfk\/RONPOB9bhoyreMcVo3QKXoLx1hQt05Kcslz3G2ujWukEQQ\/FFClmiJS5o0FEqrJ3uNFEvIAQyONMaKLPNH5Ud4nUSdRADz4o1M+A2q+MtNu\/Z576Tgv\/iwAvK7BPdUZGCytOKUow\/JojGsTq8voVwuH4JuVpNCj4\/7UWuTsZc5GoAUmrZcXeBrouqfgbIQWrfDvgplP3u+jTsxEajS8jivGfrTnnYTe8c9yXVv5w2hSnEZ5ydu0ms2VAnS19ZLDHso4itcXhFE1tj+jqCQO+1psNuaXeWoKuRbm6y7BoehTOVnGMrZVszB85Lc+jzHnMBUlYhCwWUjjihd8Pa45ptO4JjJFviUUD9Mka9u\/heYZYXhenTOuh8YBJap59LxKM8pnHd1iZ+moaZrnX7KC7NpQELPNp0hoxFFJxU9jGWB0Io2l5EFfV3\/RwCh+zZX7HWN7UfvOtI3eDLc1KiF\/CceVxD19fpunNTF3TUfUe7cGqx\/Snp05yhXk4JiyEQT9BsRC+ReqBkiCdA8VakcxeQVJcWUJBmBIHZskGWTjuXck2xU5QZ\/KFK8CBIa9sPt5KDnK1UQ0mJgoj5C44ZWQ6V7gD586FYtkG46eVUlWJt8b2OuEoX2FHQiwuQiyAv8cKv0Tvgel+IkuFTuC2HbUSkzsCXk6caLlUAp9B8rXwSJQtCMl\/oaAXZcJkkJJ2bdqXPL8Q0y2ORIMeJYjERzoZ3N9RFrDKrHNpki015ox3EYrLpiZbYqs8gPs2N6Bw8UItNzkBluOjZ22HM6mp9sOGvVmDjH9CP8ueEIiXVU05hMYpkiTowKpKNnFpLIXffTj4evIisyP2MD\/QLpIfqKJV3MnKJs0meglZiTCk8ujFkBDmyg4eAxihje4L4JSI1SGrveOjiQ2\/4G8jLBopphS8V6exgqgNait2HB9GV0Ft+1w6NvHa\/MfuhfXWsyg2EwlX2Gl5zDGUo5E45uGGYo\/Vqc9xfKkmv8fNdB9jsRcrPT+NHJ\/7+9+SVVV5\/zpWIS6hDlXQ\/G2GrcqlJj69Oj07fjArYFxNkXhH7ttxdnkNHDvr+O+JIXABueSmJ\/GuhgF+3qLCuRoxRPYAeWzq27ZhvsGYUGxNLylbZ\/9Qvc1C\/0wgXcLJt92DEf4uVs3dG8vGFRcoKWrlVCiJ3IIIqJ9ze\/MqOs6\/0HKj6aybkQXp4rvnRNFNPEHZXGgox3DtVqZ9QYlfz3zGeJ+aGet788VoSjYguCiY\/OqrWIFiRnnsCGvt169KlwqDWp2F5sBQCgVW4gf7qROsHZux9M42hqnT0Zs3YJHBTSPko4pRON49htvhUf4LWcKbvtSLNr4Aj23MeFb8Y2Dr4w+av3DN0xnX+Ks6nXV5QDk7US1eVfIT06FKXCK0UlxdrxFWw\/YbH2Bmjxi9MmoE5eqj5iwVD3+l\/eb\/hbWSaSsOblRa6X+dfDZuL4hifmGZIpAKd6r3lySlSMxPJIwTEnv5oXTTeRXfrl8XNThL88Y69mL2mnyR+gVABx7rAlPEdIo5brqYWa1H4pdvXLHqsTwQZ4jKwsZRRn2e4B78teGADV+DYwpMDbMQrGg6niJgP3j5z5lfW9\/t9iKuQTzsEqzxlPTFnLxgeYB9zEGas3p4wJkQ8SSkJ90e+TP5B+jXYLI+l9BSNdZ8vtjcSJdYOVBDA2t4pfyIB\/7KltefoJaHITOM0R5cr\/LzmoCwh9LvNFbE5yrOK2EMnxUUdiirhjGe+oMUFY+F5iu4qytfs5NeUi+tiWkxNArE5rG+Xckq9JTvRypriGSIG4xiqv48B71OQGE\/00y8NzFkra2sQ7v2pms77L8O061SGCT3rZPUNFL0yLCqbLn232f7wDyMZx4\/KGaQmnzfd4APdFwgCFJdC0vvnwxKqLRqEcym0WEK+ho8uQ9LUnl+SJNA4VUsymV36oYUzprykvjG\/wAA8CAKVv5bMd+OebfgFTuImREmimr4DF9fC9zir4RAPbJRpeITu1HqrdXl7bX4X6J08I64UhiY+GJAk3sykXJbNd4FU+Gv\/Bj9Cla3V3Y0dQPH0g\/bsZEjSw+GQbyS1A8fcYR1d39+hK6hoS2Xm6B7yGDaWEdU8KnSsUv0nrH3NJnuwA8QUxkqRyxRZOd9LzSg2F1OLCT6vBcP1D3DPmj1z5cN7YpZjqxAarfFjClX8iTOBP8fCRxKRkYHYNhhn7zjLOmH3iHZSFzYXqDK6h6XplWhmZCRoEsxlPgEkWGP91h1hrZGUp\/JSmYz4NJ7ML\/9EI3lXiAuCObRvw6sjmIsdxx8kxf12qDt6BmXabGfeiRi\/tIEX6PPcDACSqm1SAdakdBKyAZu8khjszGdUEx0TFAWwwW7WSLubL8SXxKZdOp4qqOgT+Y3cCi1oX01asaW+p7yJqfOJi6UmYywJcwsJrPvVgbjiMOygxMoarPuGovwxo9jYnNX76PrTYOx6bP5RwKbpY7IbYRtTPax86uonuWW3qOn4ogQj\/3UzrLWcSAx8\/FaG2Mxxxqnt7GSL6VDIZM13w+Je9sNs\/MFXB\/dxEnmetLGfTi2Z7rx7hhuJUTu0Vm7k51sDbMZbQkEbzefJPCHkxpTk9H9y5N9nog1XPspxv5bnjRbz9dfypObEpTzQhi5C6p52QLWAMTpnNzQCJSr\/cN++q77mb+9e+gMFRW46OswIvv1udDN0nyTRRBGgimw9KSfW9hhOCSRWuHwxOlv1yV6\/NxvFWl59GXVf6DZFe769CkY5JzLPLE7skl3WDvfe76sUGehIBQkqMvBoYxC5YIwQbUYZnOxZEAz\/OcAmNesbf8csc9BmXagbx+z3pEm2\/TzjpH6ws8t16TpE0kBugrS\/R3hgBeAmCjIy+aJ7URVR19Rg6xDQzfeHp82vYhFmitGzTgrRcDhydR1mPXDae5pRT37yWKm\/wfRL3U4SAGimAFdZZRZ9HxMLlyz0ibgFoASLB+40oFg3MjIpcXpK7+DrpLRA6lZQzlq2F\/p6EdAazLtqmkVYWgGI87FqC7y1U0YjzFKvpCjEHPJAVSgv0Gh\/q\/F2J8kRow+X5HTYaffZqpfUGkrQNkJuK0bq7Yvstp6IZgeFePqWwYEmgkyuzZTs1KpFMWuZMAbpXoYD0UfP0VcApcCJGFt4GbAOHDaR6LZ5i0wVFagmte6tu1BHb3CMXtZD80JQWmMfu2vTRsaXfKY9x6qmEBBNZK+A\/TfZd9f2Ay4PflFSMm7z+LkiWP7KG2M59Sxqu\/6X\/la6krh0D3TbOQ1m6KwKpPKDNWRz910Vzpdy7YBmDacINvsaUBkH6k0gqj9mOQaYk8zlaxWidFEthJNX4RQ10YbG9+jNq6edmbSSFZVAHtGFynETO7WZqTpRbGMaV8P9fDeZrhhB\/5suM8DArPxPHjRLOJCZMaWGq0mIA1fWSjkO4pSoXhjxn3nYR\/kDxA\/9lxtpEbeRVec2YeDoUd70QJfsmphO0rogtOVcJHEV0ViGGzMh72+ohQ5LVKNhlTwwUP3NfhtPD3l2VCM6NOIMNVkIuXqKjstonsSxViiqgbqUUraztcItOekGnqJDqs2OD3lfVMEPholgBodmWg+aMnwlRVjRJh25ahaQNr9g8I8KBBelPIe3\/MFnRMovjq8gsetB\/A58lwK8kR\/Bwv6rDDSS3e7fs0sFDbN3EyF5wic4pJNsLLQm5g\/IpBV53EA8IGrWX13JtbZKAGOhNTzgIyhEYlV3WL+tj7WCh64BhgexkamWIHuf5IxOznY5bYuBUNcAGj+RqA4D\/eSsqQbxSwhrg7cofBUU5CdSy4gaC7JCG7ZR2aR87EQl9sTuMcPNH6s4feIUh8EM04h+mMGPzil1bvnh9bQU4X8rFqK8StH3XJkWoGpjrm2rFLfQN1lfubyWF6IrMLVn+O600bYpQi0la5Di\/SWRjElkxUSGUD8B7n71r4kXKRhQFvMbGJCqu1XKD61CM9KrugkKNWuiBZEZDiszn2YOrcrKrT+HD8wxtTCz2XjT8Z9MhQdRE6z8oqmRaKLP1\/m+jr6W2rISI3IXCtHnz2P\/C5Gkjvho66MdSv55nUV3JLje4IMkpUmZZkJdLIhrQC6FASOZXiOellcSAesF7Pd20BAi0CIvqdpMZ2Q5jjUG9EYDi2khE3sdA85a7n8q7YScfMvAV3egzVKguYLAuZikyj2IUTnF0Jew1wiWgyI3i03C3PTOjKNHNmLU8afcer71Y+7bEu6rfV7UGFcpg0qtKSE5Et23eoy5I4J7MvP5of1OFxUXVhEldOQ\/RFWiwfU8TVeferBmaR8ncMQ4qdEwyUZpC54O4k101dxGgN6oYJurQlLbEdYSYjfHQy1CWAwm4aD8GB8PdrMPr2us8oGwsa3BSOqz+PYNyIoVYqsk95OyaSJsg+l6eH\/gH4N9hq\/6LgdJrTE1GUraHaD1OR5NLNsdEexTyfODRo1vqcGhjRr4n+nlnJ9f85fnSKdNIbcZ7G0olV3w7B1\/YtXItFMMLgSrs8ROiYCCDgWvgiCyOLKvf0K9Wio51pq8eO0eqUfiw6iag76uT0lOCM6VldtPLgGgvAI4uqUYisPDj3PbSQ39XvRepl0aRRmBROl4SeHZRhc1xyFo8PJU88741T8awiNotHvOoadoknSyK\/fK2JzrYL5nbaXqUcMApUS2oQ9Fr1\/q0BpxNJkiMTI4mNPn1pCzWb5yKXYuLb8SKA5FDKQvOQ2+oI85RzsdDuOv1wQ2m1BQRd86cIEVSKQ7eno5OravfXdOvzBaviGT6ys0yBSG618nws5EWUU7sIGlfdJj8b4lhzIOzZaSoIkw5017E+5+4onffcPQ5CBQQC8a3UjzB3R\/DBd83eznTGixxRLV41Q5hg0E2onEFeQXpDCeF4PH+DiHTy7TrT0USvaChIWAsX5F6QY8T++cPwp3sawz55lB+eb1KogLxDJ2\/n9HKrql7PU43uSvfRQq6DpPwJMpPm+eYZFaqIrlzAo0ed+hIYZctsavMnlKkcvoGgRcn0Kyw0NQox\/9jj0MDeds6HFaf\/Bh+xbuufC+FqVc\/2mIMOyLKjPa0WelvdBTcxyjn0c8p\/ujxOGPqMfK7D67+Q\/emvx2zY4D1mQWGb+y74FxQgGATYxa8ULqRIqOK3Z6IwCU9D1YHPrvg\/reXlsXcmmeBLavFut0qc4W91HNlu4xW2IM0Ki2hjvJwwShqXW+ACZL3epppZAwLTV03c3bDZMzJ0daKg+WtSKE8WCzt7LJhC0zIxaqTaO7J2uSqMoAoajaqXTqeYbjtHxUqAzmDPx9aExI5VBckFGaTQS3HhpCSNbjn9zlW3ttPtsMxrtj5nnjw20O4\/\/NF9zxb8UyHKYepWq\/oJPUjNF7cc0lKWjJDMlXpiz\/CwIjnOgs8MlaHJqan2xYjtMS7Min1fSpv6d9R0fgcAX6uFHNuXf1O+b2klkkPYDO87DE9O8087qUPduxeBvRuFVG6A\/JZVJpZM9PQ1RQEfXV5tzSt0gwtKCuw3hjUyWAa6xbnRKCm59qC1wydo8mFNTz\/XT5OQwDd6\/\/CxGc5YCYb4xK9lCSWUbOhVrxA+fbXahUprRSnBy+Fd5E1YaOIBPo20\/CcK6y3mvlr\/OpXPC22A3OnJussVWTgxvbjQf\/ET5kZN5oPKFczFQQ5vjKI9S6a9UA4VgD1eMS+864Gif+icrZ3hvuxioZaBoqGcp6jO\/BtTEILfc7BUTlpJGRIQYnPsbDNzbSV7cUbEpSDsGG3g5UgQhxK8VhrxqLryFU1mBQhN7R8UA3MUErHUwvsEzRsLK3JuIomD5QphIrCL2CXOz1bmO6u3l1eeUG9PK+iuDJIsah4QbT83E87xPDs3qNuuAQbbI9ZDiBYcD8iiWqMmBsIsc44xw+Xx8TdL9dehs2i9TOdaIqvgXpkYruKNNPAA1jbzx+CaNxyMN2Jk4LRVcqce0jqM8jHe\/gVfhlJ0h01\/kHc5b1E11q9QV4mpDx+ajD05bRiTj\/BoaLlob6wPWj22ad7jrEJh0TSoS\/zJ\/WGv02B8d6U0kSKweCmOfMmF1KoiY4e+R0u7ihZz6GdIfxn05pYJE8VSYHSHBIiW9PVt1kNtUQIjIMlfimnX6et9k0mascy1QtHqPEqXun1mv0LLyUQAARWYz27+P4dyLrMxSWHELVRsUIl31V1RHoCl47IuB9kRGBvrq+rhZ0mj\/Bz8QiftxeKcwUCA4\/NcxJ0+nqB3sDXZ9XXgIKGQdpGm2ay9HrTHGCFHL5txYeWyfdw49MHu3mn6I9CdkQwEpnccPbr55VOfPYJ+XNumdHr15Hy+hwI32ezGErH4mXQkxH\/WtdhVERcD2TrrbSKwG2Ax2GXi8Xq8o4rN8VBbGa5GzSq\/Y2Q35RTv+ZlgaFOb42mDzCqdDREDk4hzVG9iT7HuhMtDn99Mys6C+QTvx3Y\/1UyQLXEsTW8VSvThXd1oKFOF\/DxTGektlT2cdPafE\/sJtDnPj5YnBfuBLb9fMiPU3UMyCII37pkSUd4OsqpXSzkJAUozUusLYaR+Ny6PySm6ZVylzlgtFcrbmWQ4stffH2i0HQuBE2CqTkn44xW5HLrn2WmxtKUgzghuNmHlufM3P2a6Ltr8k8Q6VTB9wEjVxzQHSXsjUcij0aTAXkMjfWKrrVk534Qt0uOP6ItdjLLb3Xo6MTCxHRcKqEWErFxTGpsMGxfPZokhfmTeZOtuFgxADcBOBqtzj\/qzPyk5y1LMvkFbYc37UHa7WCUMJABjB3ti8hfL\/xtVFohpCffVvbEQ8wk\/rmj4axgzRkvIxqKmkWrEyKJP2+qklyUhRLlaWApNbBwVzb5T8f2MDnKV3jq1TSjHBZ3daj\/cE7HpKgBlC7ieAtZ6k5g6YaolmOChfjmY8hzA6rBysp019xiRfRZp1gJthPaFbziqCuO5biACvTeBUVhDGPEsLdag8IhSvs8DoZwEAtfCNnWU02+gzmvnENqTpPfm4DhdfVvy4t4RbTg\/0sCMDMrkg0Z7I2261kEKauK5clQ2UcfpRi\/MjzjWVc5ESwIaMaLIhdtz64cewpQ5VphPWgwK4hb35eT\/a0oD5P2oUGPUYAUxlPO7wsI\/f5eBLnPTF2ngKDhPEndpAmQueiO0+aX5AU02d9YazlY5YgUUv56OfAGi63Wv8vyhCP9x5pJKw2FyHZEleKu\/GvMZYdRuQ2uWclVbMSUfuXnqYg+ZzgdfI8seCPV3kcMtgu8iHPPCpIuKRaEOUjeGEAeVI7so0ZvI\/zY9NYEg5D3v+TalclcqfXIV61RGz8K+JZsrvRl17wUxZQmR\/5u8cJiR4cW807APxHz\/DAw4RB8a2PDGvh6JIjncEr5jJ6+Dzl900q1QK7kMHdESRHzNrdaf8pszcH1LI09GA4d8I4u\/\/BShFvunTCKewRGHDW23ZlcmKzxpw1PNxLo34FoIHCrjblJ+ogOpnXHnx1dNgb37O8rP\/dXSbYLoIe\/XfuyeDfb4CN0zWme49stypvsFMYfgkM1ogJHFfhBrcRc278HXPY6RUh1+AoA7n9ChUQG2uBoMvHA0QYFFL8xSNb7vPyH\/PcAvLoZZHp01c36Q3dApZ64XAB2FqSbacqELSrZtWbqnuoGTG\/edI4qtBdzuYh3kzV6C7+JZVU24BlaIaFFhk\/UjzQfrJIrGuNyo6FqX5XjOE0RJAREplQepFl7w\/\/vpD9Co8HUZ+\/elJkAj6P46pDSb31RkJlhYpXgIMgf2xbUTrazyA2Okr5dS9d6pLZ6rQ1KMviGN8w6hPvt6sXJ0+2+H+Lx2rBsZKuEQboQtpDOk6OmuY\/G8KCnEkMO7aj256V39j2x+6jKT+bHShkoh7tiPbhOUXNTSKS1ve23yKFzGgwKnbRQDNZSIzB9r98Km+PUZnDXZw16+76iskvhqYBbxrLzVeQWB7u7+P8VvNm4JKVBvIXPw2Pc+i0QF9h02Rzb4i8YCCvx+eSBx1stZHvzTDwkWkLXwbCS6WIShUrqL4gvC+b18G03bBi3SEdTwoqDPiQBBh1N83dAh5iBDCCsr0X4JRv5BBSfEGlra+27UxMX9XWMEdSZ5pfCRv\/mJqKBFIztBXmu04Lg923AasO4ySRN8n6xIi\/b4jQXuT9d28hhCWQsi7b7\/ymYi6X8xZy\/njk4+H5H9qdIj+Ww7L7fRSeBQ1fibSkjjJadaQTeeIS7KNOXgRRAenTs3+a+vdf1VZ1kUUks41QrUCSW3KjKQbNZj2HHsmgZB82Bw994PG1U6Jvobd+KWtTLW5jVlywetTElrxfhi30QgoZ3TfppJjFQTSqJRNR\/+W4fXIgDcUvZNPCN7gKDjgZlZtP0rHRaPMUF8jCxiEFCdOyWHy0axyFasaqNqRQ8Vf+cKqdfLr59hR6Q3Dv49OLpHfQLFS5OqJwCbR1q1M14m6me5NFLpTtsJradNO28P\/JH9pVnJiJ+hZGmCUE84i4ZTwWI+WkAx+WdtY3wRMziWCIfpzPVYoYgNWgrq8mFUbEHkPgvwZcoi2LKDik9u9UmyM165VUCwLP6EBo169kKBv1tPqSkRAEbG8SJ2lLY85z7HbrH8IzcwMW\/LPg+w7h6qLvNhJKEi56QJ6RbSLwEyOU5eKkBVWZcbkyVxqO1tZv\/tXOcUi1h2u2Xqvx2uuZfScOHKIJERpRaBg5yLgqtX\/zI4Yyxoz0xHWEbXO4KCjgZihkBzIwH9QDcRame9YdGI7Y1\/PmKnH1KG04r4Wr6ckc8lshZ3e8Yg8F+ymTeWgz233SMBZS1CiKN1lFEvBlN2j2OHAib1zoAch73Oj\/h4EDd2Jy4YWwlDB3QULccidSUXhZeYN1tha1jjhyLEGAeLjhilK6UsvbNtWrBsQveP26ITDDKoa5h+y2LE8jeVjckNfiJZd84QwuPcB6CsW9Hv0qzj\/L2CrHKhFatmlvL6Nxqp1ppW9A\/P346dXuKIzwwqJ\/ddCnxg3+Q+VnxUduWzB6n+cQg9zuzpBDvTKukFJVz0\/Dknthg4FNwvaQkEV+X8Mi3lQY20xR8iU4A4ayE91YuiuPOUxsuvoaKbMRYEa6zPPjCsQxeMUJgUCsFQXk01lwtxpr+RSZTSbNo4aP4TOUK5eMY8EqTO+KfVWmznCio9zIvuBci4638EHI4OLA2EmORRzN0zqPeoJk\/xGr2x\/\/Cboor32Og6dTqfRQJBSoIU1mla8yiWcXXysdF\/spdapMAawv8sZyMyMigSi5xORDc+5WfgLzKFvLmpKkg9t\/B9RHJFVS3eAbrGgzF2ilRvuXSbrptofZ37yR5cgrdpv9tZw2F0omDohvqZu1hHtKeZydpPXT8Dlrv+axgxp7VqZ6hhk2Wf4pxUU8e2FBz52nWOqQfU8YjWvEA130IRUjdfc65Tsh\/0GKasxiGVxRqo+bZ9iJTFmuSuww8VNrjgxyVZJ+d7FnpFg4qzIxUFSOgzd+oi9X4U62FFky\/vkPozw4WRhhVV5jfF1aXI6l+dWMphFM81CDnOQ6yArUXKEDFrygR5li2WzU9rjlqKcnW6+WI12XdKYs89S0nUmug8jyX5lJuwOjh9BkTu630EeUcwvz9LDzXRwAKj4UZe02IEHzC69zC8Od3zS2JJpdUgKBF9u6U27gf+NhX8sMQYQQhur5RWEq56K9gjly3h\/tQBK4Zs41Q2E9aubG2GMR8mhxnopbzXS8jnpKkP7IKsEaYjX9\/FIH5ciliDXeFcikurzO02PZeRJ1bSICpALWR2m4SFUnCkXWOv+yp+GN\/qBPtwyC3zEEFuAifRmOdrwAumKDuq11e04pehS2RX+\/qgNii9vqxiUftbf+czRJQsHwoPZsJ1GwR87i1G+16Mh6LNIbjpqjZzTjx2Y02\/EA8BQze00Oiwnov5fqnlNe\/fuRS63LK53ZSKIWGTxJ\/PYXhaABfad1tLqxzIUIMIAfWTpNHnZkFjPUvbPy366Ez4IG8YbaUpjqeJCFWR2EqQMVdsUC0lXkJZR1heVJclVptYmmVgNnu1jpKZG4n9ALWUC7Q4qLT5zmrKWxepwtyjkinJfh49YrJLYx0rciz+pNzLV1Uqd+Rx0\/5uw7eLzj5Qn\/kEzlD5HRsFOE+AhV6DKBC7PbPXbwLLjolbBmPmjicx\/YSzNAhGg5InrSNk4lYDMo57dUPQEQKQo2RQdz5QV83n5phWHp6uSa7JItn8dNgICRiffBiaH9JBfLnyIVMVWl20QDCgFfuGkeUiuw7elbDL6sqhZm616F3NNJ9bhJES+\/qMhOYYtLGcIitlHJOvWIiwo+F+\/L8iBv8Ztinc4m5TySmpMEDsUIQ0eXmo6S\/1fR9pUPF09oImxt3wJ2p3UchlKqsUzrQ7Z0BF98lwI\/hUpTjbcDQkucX+4gLiwOcKjSal7e8GEqclt8I1xg666m6aXwLV6pC22SP3pr+xfgTzvHGWrEm+zEVPvuMVSAqAiPhZusMvYKijolHPPcxw3+YpK0BogkRw7c5yFQ9+JDPvHdhWPmCjPO6KKuPexGWKGEe5rMDH6VLJyYqSYZEGIX3\/d1PSI3a8FxC1JLbpHU4ly\/YNIsKYYz++zHPoHCspqvulaykrPZwSjOIwSezC5CuO5goeuA5yuiUEN9Nyv\/b9h3pqK+3SpabPz8gUEnWT2bla0\/xTFvgRZ\/1S2dYbeN3n2A5PzSjZFn+eV5719m2gWW\/MuHFvcTeD\/09pHJ0KOJAjbCxP5Rn2EAahQVGp00WuosJ7MnhLEpwvOzPKqWw1oExPLF4gphUcq3+8t9vpeXsC08AM9vye\/mrI0HbJ\/q5zn\/AgoLw9AoCnORxNA9DmzjYtoCFYa0SczrTFKZM1UflazAc+tAolCLA7BWCwuJ7P5Gq8nGmJ+N6yCk\/33ofX8TyMLOmqNguENq5e4gvQBMnCmrLJMI+Y9Y4evK36uTtMWPt4vzcG4G6Pg9JBBtI6HTWMjKzfuFE5hbMZevhGNu7rxOcX24bBaoUG3HfyH0REXU\/jzN3BdRsfJlssokYCC8WqWrd9mzamvQamf3I4R\/loRbL2KHpsUg+Mos4O80DVOa0tEu\/sVrp2x\/kCQI++iamof5nD84ZIxFZMX2njRIQPkoOXlKYdzF8nNfA9lM6wdm1kXEY9pZesQsdJUq3vA+4fdmXbPS16SvYt+AVwLCot5jhfeU7KE3MQoO4BAGRKsvwd9Cl+9q5ZVwIOKkTXYyWk6zoCpOouajIjQlG\/pEfVfRL2Xpq0INBy07IwqCsvQ96ZTgzX6qnZ\/0cC3XAQEc\/g0kiD1Nzlaww\/2nYO6pSaSE\/lnOjUsEdHEnlLBmJHFI8D2zYC06V2G3iavJTwqeKChdCg0Vb1xFAuz3g+mURw7IkZ34HPEkRhHaQjxeUDLhwAliByw6ctSWjC\/6jsVSFITNmV+MkZDCd10UJQ41eYUFBGkFoR8uKLsuUC+YEQx\/NgdEDuV4gZccy2vJD8tDlERnsUKP9NEVzczdbrw4PFFseeInplA+Aee++aVRARmYocZ6bU1IagZu6dLBr0QSJRM4iZMn61O0Id\/R\/N2gosBBXvCO3LjaCm2NGSYQhC86R4q6+dD7x0ShUqKcsGGHankeAHpyO+olrn2Puvq+rfQA\/fo6AXrozrZRwFOxCe443+qQt19Yhwc0Ix2VsGW9DSQWCtu+XPo2cWXu3JamConFEFHqWf2x8TVC2Xladr0ItnWbj0vcAzF5Ra7BBLnXeoI7tFLL+Gr8nCE5Nz+F7Q5+7MxFbGguuXTERAGZa21xeVyOMvon7j0pQ7fKQUFh8tdq20wzn0cBuYC4LCj6z65Top0\/Jj9hLHMLjvMjPqP4LrH\/UP9xZqBDis0\/jXDMV2oabP6KqfQrj\/ZOqRdm9POOAIVfQCXMvR\/cOEO2I7QNBF9oGiRp43NN0QUCja5rnLYzY0WHRBcf98iI7odjBwvYmDZXd15ybfTfAfSjg10FgGAPtxZZrc6YjwPFHFjZn8skh4s1qMZb5cVxpQsEXDM+wosbekgqsIXnzV2tKdUXtoh1CGjYtUne\/SEwtjOY5FwBCJbicaJR\/7bGSudFuclsqyNwxDY3eYvG3SF2nQqEQhsCar3QP0ad02WsM90Kzp8LJp8eEsYjI\/gysVQQ92Q\/ByDuDDnP7\/ki85vt82yYBJztD0+Z32gmKc04qorvbowiSLDkegaaPCRpt0atdjCTeBmgoBKrQH6nwRZ2V0SMJGJQNNhs8Eicsb5rbm6XGAmH2AOAECanWRBCvpICp17Z5e7N2FUD49CvQ7EfNXEJqbtYQz5U09fZQLvJO6vk03A4x8jFbgftdwIxnXjjDSsusWDZhp9si7xiw0ZFGtoBvU\/yQ==","iv":"6042e7ed94f0f6ab4803acd44e3058a9","s":"f3c0cd87bbed022b"}