The ongoing increase in travel will be led by even higher growth rates in the luxury price tier, according to a new report from Amadeus.

The luxury economy’s shift from material goods to experiences has been heavily remarked upon, but within the travel space, the 6.2 percent luxury travel growth rate through 2025 outpaces the 4.2 percent increase for overall travel during the same time period. Segmenting these emerging travelers into categories can help hotels better cater to the growing audience.

"First and foremost, effective personalization will be the key means by which a luxury travel brand can stand out from its competitors," said Rob Sinclair-Barnes, Strategic Marketing Director at Amadeus IT Group. "How can the brand work with contextual, traveller and third party data to make sure the experience is tailored to the individual? For example, by knowing that the traveller loves orchids and having them in the room upon arrival.

"At the same time, travel brands must bear in mind the broader trend in luxury consumption for exclusive, one-off experiences over expensive material goods," he said. "Brands should explore this through two lenses. First of all, they should think about what can they offer in terms of experiences, to enhance the material comforts of a first-class plane seat, or a penthouse suite?

"Secondly, they should also consider the overall travel experience for the traveller, and work collaboratively with others in the travel chain to ensure that the service experience is smooth and consistent throughout. To really ensure consistency throughout the travel chain and an unrivaled experience for the new luxury traveller, providers should also seek to understand whether the traveller prefers a ‘high touch’, heavily guided and consulted experience, or a ‘low touch’ experience, where the traveller provides parameters and preferences and leaves the rest to the provider to determine.

"Shaping the Future of Luxury Travel" examines the geographical growth trends and types of consumers who will impact luxury travel's future. It includes consumer segmentations, growth statistics, expert testimony and analyses of various touchpoints throughout the purchase journey, analyzing which consumers will best respond to each method.

A changing world

While decreased airline prices and the rise of homesharing services such as Airbnb are commonly cited as instigators for making travel more accessible and more common, the numbers show the high-end is growing even faster. This is particularly true in the Asia-Pacific market, where growth rates are largest and disparities with other price tiers are more pronounced.

Currently, North America and Western Europe, despite comprising just more than a sixth of the population, account for almost two-thirds of global outbound luxury trips. The APAC region, however, has surged past Europe since 2011 and will keep pace over the next decade.

Image courtesy of Mandarin Oriental

India’s luxury market CAGR through 2025 is 12.8 percent, edging out China’s 12.2 percent increase as the highest of the 25 nations Amadeus’ report accounts for. China’s larger base, however, could maintain its status as a high priority target: In 2010, the middle class made up 10 percent of urban Chinese households, but by 2020 it will be more than half.

Russia’s projected 9 percent growth should also be on marketers’ radar, and Lebanon, Iran, Jordan and Egypt will grow at 8.9 percent to become more viable marketplaces.

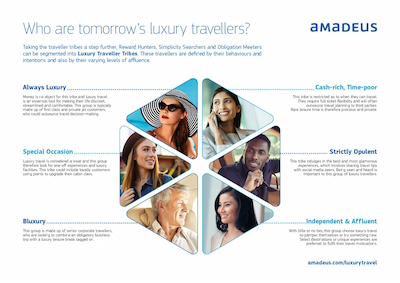

Shaping the Future of Luxury Travel breaks down luxury travelers into six categories: “Always Luxury,” approximately 4 percent of consumers, for whom luxury is a necessity; “Special Occasion,” the 20 percent who spend more for an anniversary or other occurrence; “Bluxury,” or those who will extend a business trip for leisure; at 31 percent, this is the largest category.

Rounding it out are “Cash-Rich, Time-Poor” consumers, likely to rely on third-party planners, at 24 percent; the 18 percent “Strictly Opulent” travelers looking for glamor to share on social media and 3 percent “Independent Affluents” looking to pamper themselves or provide something new.

Tomorrow's luxury travelers

Differentiating each of these categories can help marketers target the clients. Those looking for a special occasion are likely of lower income and should be reached through different channels, and the amenities and services that impress them may diverge from what the Always Luxury traveler seeks.

By the same token, concierge, city guides and packages focusing on particular cultural hotspots might appeal more to Cash-Rich, Time-Poor consumers.

Image courtesy of Ritz-Carlton

Marketers must understand how the preferences of each type of consumer shift throughout the purchase journey. More detailed breakdowns are included in Amadeus’ report.

The new consumers

To reach these new luxury consumers, hotels must first take back search visibility from competitors and focus their efforts regionally.

Affiliate sites and online travel agencies have kicked brands out of first-page search results, according to a recent report by L2.

Across 452 non-branded keywords, TripAdvisor had the highest first-page display rate by a significant portion, and similar sites and online travel agencies (OTAs) dominated the top 10. To make themselves visible to prospective travelers researching online, brands must make themselves visible on these sites and target consumers by region (see story).

Hospitality brands will also need to adapt to the changing habits of categories of travelers that could once be taken for granted.

For example, newlyweds are no longer traveling with the idea of staying in bed, according to a study conducted by StudyLogic.

While a lazy vacation at a relaxing resort on a sunny beach is the stereotypical idea of a honeymoon, it is no longer rooted in reality for North Americans. Changes in marriage habits and increased access to travel have led to honeymooners seeking more adventurous affairs (see story).

{"ct":"yJ4F6qog9Ah5XBmb4LzBQj+4BFdg0cV+Gg9oQbbQm\/fPA\/7vXqwv8+Xgpyg\/N+Syurzj0s35djr9oZJzFIkFnkjAfMK+YMj9HytMfme9mbHsuQP1VolAPTRWklOgRROFdeyUeP664PmErggIfTQHJZ+YRjoTh7sHy+EtSWhVtZ5Ano5F7JeDNvwPIt3Y10pTVJwgBwiBSzjtkMtNHJ+9UfVvwLyVq2E4veBK5qiQgsWQS928n4mm4KFB6MPeOwnhy0rZ4yOxjiLmOcGOfiK8jnKQ9GFCwDYdEg2OUnr74jaRbUdd2Q6uTHDkFm89h9xWgIJeVx4I6umh\/u2FiH1uW2ddRB7tjeGL9WKSjgkp2SOCoXkCjtMqXkN1JA9RezjSI5\/3Ve\/1zdElqZtjBXtW3BezACmX7w\/XShJq5De9oR9Fdk+VG6c69DPdhbIWqmc8y9SA3r4Kv30RqG6a6w4XgAMGrFJiK78PJecQRE8tpp1bsjuagNE\/m\/B+4bjVnh5\/FmZ9\/Wb+BHfCC5fORHAJ6Ad41bor5zriXQopQ1D9grz1\/HNoCfIhydCFEMr5Sc4Pt8dW867pHPXsrhI5TqwVcOFizukL43fz6yafKvew\/cUdmacqffyiYIIaqts3XENyU9EQEyozWe31A\/Q8yUbJZqbrQ2sQbsBO6dNMosQm3cVW1MoDYRYi57o2dEnyn8hMnn7JEr6XDm+SNxOpUYosbMnocZMYNzv6mEBVmJe53RamQjZ5BCqZ\/tFcrVuq1B4Qk7ekMTzteg3cQaIM7Z56UUQ923\/bW8xeC46wZK9Fv4RE6dS+fCpaz3WV88ue\/hpJ0KhEKQbeBEmfgKGJaJE\/B1W4CtufV0KNXKaxk3hpJGP1mvLneG6OQAsH0b32Rgd4jES40T5LRLIV+GfFEvmSvoyXXrDRSo8ZZIK80Rj4QtEnPn35dlafKF6IuLW\/IVm595FlvUY\/4r9yW7HTsfdI0mAlYDwIOQAUSBWIt1hoA2tDup2kCcfTYvC0L7Z3hr33EFyI86ikHp\/Qb1xZTwTTpqeh9N9VGMuhEQcmgEUSEbI9D8uG+9hjhI6N4l+hk7Ui4YSf2LT0MlwaqAEOxyznOjiBSAS96DU7EHBscJKEwXX7i57CP4kG46IDOQIrI1MAUgQbuulMlvIwq2gapX67uFq\/beWTp3QUpXMBRjTrkJFJMkZuJdzA4Omr914JOIOo1I\/VQs8iTPZZULCbOhKc2hcrz+\/8paLwgerVqPmCeHmfapyyAvJYE4lGTug3sOjBUV8sZ09kjBPbu\/FLYqHJPItMOTUC4IDALxxITfFbt\/DFfVc0uBlokR8vCJUodrtytUpaL0Rivb8iE+B9V6XiwTF79AgSBSpTkTO\/+ggYSd0l+cbJY6V\/C+8ls+kXnbUX6DarnMpWQh2skaoFBZjFOPn3dvaWSLUTS6U1YRPqpjyhhb+XhsFgEHGenUVTCKf8KkfLhHjXtAPuSlxIo8OI8YwE0leehj6KRUMGkV8WBR7KwVfWPTGETQhlmVbij+hgwD5dssxbSmPuzXt7eUisSZ6oj5JVAM9V1oLd1QFIMjKPuZ2Ek0fPY7jqYKlX7fTiNB9C\/ttBzIdS28YjONlBbermUurK7Vpz\/drQuuJ0xQcXACEQYXLcY3IENgQ8Ds+j5U1oh4WyQHWZSkfWuwVum6CV\/7FLOlR7dWHM1NEPm3Eko1DtsYZ0bXB9Y3\/GxhYI9H4QcFY94kxD5BfodVr+o1uBAsvFMsHilwD1jgqijpi1X8yefDpVIMHS27p+WCSNT4Mv+tuiOTcq\/nXQ7tkgfJH7bhpk9Am137vn5M1mYZWxG7DEPOEg2SlMR2AK48tYEjdHAjQZM\/Hrkx\/HYJFcnCxmG1yZTVXeve0H2Y3mtgvkZhe5UIGePKsutGToUxz5AM\/vPSTpsKTiYUZ7L9QT+mUnmTbOmQAHY0CKMHLi3IaULp1eMZw24BRpgUUv2DP1ZQA5u8Ckug6W3+bpeNAJJ2LU7oSTcmTfPoR5ooUwxjenWdrguugg2K9NqqUlnG8h\/aJorYCs5UY6bBP8ibCijSG6vuH5RjtzIm0q8Oe76bPUQ6pR9wy\/k+bjU8ozCyHfisRdNcwBA9Ygj34yc9WxPw0wLBJ8LB\/H2FtOGG1G+H6rN5BOpG\/KFyUbJnwhDgB1+uJZGPeIaT4fysF3y3iuOe1JiXokXfxqrlCO4vLKgZ3YS3R90CSue51MHGcb6rGaHQwK7nABfJDr2tR5\/krnq8GNcjMOclkGPLUVLbUnqJbJodaXZziBIAPNWUNEk7lQIn6IC9mOitR\/eXC\/9mSW71xpWnJNo6huIbUzb8roMI6xXrfpxwObXXgJa84DqarQaBJPm70y11RQbrZL22TvdMuAq\/AkD3QOPapWYivFgqN0nBT9Nt6edA2ZhZdwScFjv2ALbpwr466IzaxyXkOCZdakJWbB9xW15hGJthM6ew7UZAq3cxB1v7yitfCDKrRbCSZag29uyAH\/OieVkJONHnLZ4uN97Ib4airID4Ccfsr8bGYFuCp3wS7lto0BdWk5Ir1spJkv8guk7LVjXFrVs3sGDPz00dbiKPuvmTHLl3SSGdoJ80BuALkrfDltjKvk3AMKI2YNOi3UyjlimHNIo1cny9aZWeLOxVNcOtLoEuUXhd1iLi\/hW3qqTm\/nCc8ar7vAQjUDF2NMswWovIU51DZsbhXBrVpex7beZX8wtcd06s+4FNX1fbRreQLXSvB8sAQS4+xMYRfu3GuwxFSiH+3qsQEDxhzQ3\/buDGa090FGn8LN8CGVgICtP8GBbjx\/jhzwKBLkT9EiqA0T74Th\/Z3cR+oVni2II0fJYgZZsBIc4k\/u6WRZdsCDG\/EqQ62pji\/BgrMX41vfponikKIZprh96OH0w4nURYhtz24v7kQoFLhsYJdcdNBf0oaTC+L3IklVKnLRgkH7ro3q4uorFDMfPEZzgSHiR24dzYappQP7mvJpQJh5PSmWQpVi0r85IHn1KBSW5IRUrghQA\/J8qs8QTwDREdf80Jcvvb6CeE7Sp1weu8gvBKYI4YqkR6QRGl3namjJEn0quwCrqTU\/Twee6oO3vHB2Knx9ptkx0GsWR+3Jy4sQB\/uOb2Y4tR4dS+SwyqJBNJ1NFCvtDUWRGDqB44yNbrSkaKsCgDOng51rPMLtbnURVBQKoWvRpPR3huVdHKtoRkk6+WVhlWLC8rhs72WyrAbUNNE8tRzo1tNYcSbv8aNxNMVY9CDR+EK+yqf+vwFMFe5PDIeeGW\/sI\/OV+n4Cui2ct0139PWPaF843qOmahHOGauQPdtKJkFZgefC50MS2X6vln+ykqGXRWyQ7u28T+V11rRADiAScZkQ\/HQ0rcTibIflkrUkX3TVL5Z1lh7GLkYKkrjiU+23LHNxOoV4zf4c+SzxQISPPCDDtCsyMhLYtVLY4zamj6ye9S2XxIGwVUJYjMFC6\/7B73QKXCZnfUKLbTkCv8NhjP2V5jFKnsxAob8OQvMw17E+YnRxKT8sLLPdPY62uJgQmTD21mxzjeua9+6LZ52makGHNtBQaviGnaKiz8HFASob2B4Dko1tDnr3\/MlXurouI6u+gUWBnpqgk1WN9pq+tt4UUBMb0xjwvF6\/4qq0LwhkwDrzH2CAtDvSaBW1LdWaAhl9zUeljxYQzRAXWhlAxTJ62s0gWCt9mbp4+DRyw3aB5ZC5Pt3AWXky7ir+uGMozUeAEfXZJldGOmraZBXkZz32O751CCHp3CPxWF8VdgIRSZWZBRD5giSvKKYwQJEbOdEvdaUcS0yKIYlvkxwD6yuxV0gWuD6X6XiGsaL7Hipc0vcizxm8ACd6qLv6MLyrNg9H4YNUg917+MxwZxMzeP76aUhQbYP8MdPpqaAbZJ6Y8IKqlzELRO09y9w9Xtx+O+0hwAOUtEi0YbEv+Vpjm\/Cu+VsPyXu5LGgJapRsHHtav5TD1Fvtk\/Y+E4drCQ7ikSI3+zmTHYL0pLPEdg6\/AqeRH39hpWmtyUPCCsL10vKFgZ1zhPQULOlgJW7li4O82\/gvxBJj09fvtRRJDCMzbnKdv4652vc\/i2OxNZmT73kvFGIQSQfhozLId\/Ciri0qvMPyKXUYdd6JlLDAgnWnc7sH3zeZ+SFqAahkLQYeEbqcg7mMZl4p7lninT7INfs\/9YJkjsOcQXk2YMBz9qMXl\/7spk\/BMp2yFGUIUtmy6+AGqeNYBXiGbRTdYpysTjbHONwE0Z1awY9HbeaKOcQLrFILJdwBmM64\/sDIFsNdt5cmMW\/RnOZrrSnQPmty8v5daFDvvSWDePVE8kFXLQy06\/pamlPC5593kALKQ\/DXPesrxPvwIW+JEN4oKP+pvNiEAkXpqUJ57vVgtRjhqqSHeB4D7A847lkeHwy+gpEEVQL1DTe4E8GJweJQQOMKrPfPqHJqTs\/\/Asacw\/eWo\/GMg5xeO+856NG4ZeZ+SsHngIlgJqFGWv8OLVNX5sAr3EWXdyAoVzNknqkWKsRYFY2auxHYllh2yxkMDHm6jQBvPALn0OQMoUGHoEw+XEums+ega6xCRCcq+pfOgeGKv+n6CY6NyL7ktbPIu5xkEr7AdDrVmZb0fQi5AWlSB8QNQVTN9xpWwiVOeScJ3G4iNkU7+zeYey345sCvuaL144CjfynjvQYTQnhij8990R+Yy+Iik5xCs\/xChLo4WDu4jfF6BwEMlDI2vau42hJRzgTeDnzVKafe6Y7x\/lQW1kWl\/EDyiPW8dlufMxqOxHdawFZak4pWMJwpvF2bBNH+xvkxJMYbD3A\/ef\/clL08dbibKFeJyFAQhkR6ddDE\/QHs2\/uvOmNGQuYn7PQZJVt3Um4SUhbhCusI7araL9oWvBAmzPa0E\/yB8+rU7pCPDJVU5ChGlcLwtHdlDSkVFjamm8z2f3qmV216kXligTdY6ODAgYD2s9F+inm+juGT0ZxCgonZjtCo5HdJYZw\/Rnj\/fmj9W\/I\/sA3HgEWZcO8yQ81Ijfn6TZvnTF9XEnSv7LzZzpKKO+S9X+A5epnjHdqimgDGW81jADoXoD5\/btg9uralccRr7ZLCUlGgKY4343OHAR1cUArlIiWgEXtDO0oLWH9gromUPtzkSwcHHRio2JXtBPtJz5O7yTd73M0PlGyyHCbLtzvnkKYaR7T34qC9q2lhMwDEEgTIuWxkVOyGcqMYI95laVbGnT2scA+UoarigwLHi31DhP1iWx5Y3TaZ0oFSeNIkB4FeEpeJs5fwKN4HSjsH8ZPVSxSXEjBozinHHTVvw\/btgVQEAo2thc+UISA65zIPGwVn3AfTXH7a1T6Bs16vWSUQB3rvhPNJCfWZ1hrjZ31UV\/FinikPJ2nO0vcVxHs+jCDnFB2eKpdSAYE8KfoGA0fBuroyWVOTcT1pNsGy5Ahhv5vp\/FkcfDYyh0XYT3NvJ1HBrXitvWnc6h8W7JpwMgROmv54Io\/Rpgh1YLq4\/SatATXLIwvn8xQA3bhGxXrZZrXYnBKOJm2auijjlwv\/GHjBTjFWqZ55sOgM2SUnWH4nYxuXHxApwF24Zz3hwqh+ye+QRnjMV7jW+t7Cpkj0YDS5WkHf\/HXYI\/8MVDowiPbeio940Mp+iOOgipkG9LLsghqPAqSAM50e4smWWzTQWi\/OXqvINdbDkKrN6zDqnswgVTmds0fzpy1zQjxheicls569rNOKBDP\/rUMcweRdQyK36MZ42woGN4K5JuvL\/AZ0b4YgaTr7Sjr\/x8QNjLN5kGhd4cBVqLQ6igtNS\/LhxzUcfH3Wy1H\/vzA9HN5sNL8RgMYCFc43PNCx94iBcreVDM65wYcCIfsa6SK5oZZ+urf5tUwZqollsK0rOIevWBNvdAlNfP2V2Kv+CtD1gz9UZ5yK4PI7CEi3g85MaiETSlKnFAgMhUbNDi2wabdhBlwVOzyk9GIoqyPaYchxU5dQ4bfWOUhDvSfoYFdalvbYWhfTRaC0lL4OEaAzcwJ9M5a+3DNSHSB1Ye5MCtIhqfPoPsTc78LEnoGsGS9u\/m\/DrK3PxOnEkZ+YruIWtA1BTLh4\/Ao0SjAmEpTzL8juHThGbiIyZy9E0JfvR5PznPcBEzuQw1ECgTHln74P8hyMG0+q7WeTq7PIMRukL5GrHBncuaYKAdw7DC6qySGpfsL0bULidAfYqcZi+JjjhiQEN4XiaF4ck7FgGzZDBYqaR7UyOXQP5a5XkO9w3vcvl0XP0jB6tdoHpqQyITeP62eJ+u6O7ctgsDugKY4iPXuYgq2ujPZtaObZh1ZYI3NIfOT70ZiWE+MqgVZWCZSktVpwAEtHD01UN+k8VmWiyEyUtqKI8ovnefGS208yNJck7SUyy5vAzyrJ3mpPMZzWkcatruwi3O2tQVI8k9AWmjIdTob58lhA3w7X0W8B6Ke9f9a\/TIOo15ItBc9CRFdY8cNRSo+UKDkilg3zbhGCMRBHPPTr1qXKCVmUc6NmsXIJ2mgMGa7OqHWS0rIrLO1yK3Bzr578yHSGUsVfQaM\/nVvQXi\/dloKF9ZU0fd4vgjk+wOw8PiZW9h8686HZJjKhIFn81OHJ0FasevE4xLC\/RGKOQLyJk7YQMH64LQcaVYbfVD\/c6\/h25VmCzEZtAVcoH5eGACL\/2SMSdk2v22+g06KDHmqZYIsy32aF1LKc\/oSyZONwatYnH\/hCCLa0Pnz2k5KAj94HGSsxgFPm5CxaoctAsxKp8ijs5E+XFSnEHhYg\/C4z\/DKqseeCSrTvCunmqAYmTW6nzcVUYloMmOC31KVn2WtnaDLkVufnLctpBufQgUKTuCsujXng\/86dLZM6753vHb+2j8Y4vQJ44iQOo6ASVgJluQ9PBeXpSnv8I3evzGV18+g\/my+f94h3Gu4NmtPZ5+dhxNGBJimaCd+aff9KCL5Yj2vhJRMXkgyP5hTZDERRNIBaRS8FHH53nQVzBl0Pxj0MUdbiM8hUm44OtbEPNsHQoNjmAAG4p1MLygKJy9aR+k+CSdmPfjgSmBSkdyly0MLKS00bUuvlA9zeYp65DjrC\/+1w5jP3a\/VEEsV0y07qdFsr1RiXJcoZcU0TE2VwxKapiA63ldsjtHfNr4DxHPOeJPi+WzmrwTaXGRgbvddb47gz2wjlQDuV4fBx0jmNN9ANuPijl\/cnbWGPPC2E6+ErccBl\/B1Vt74751owghyrQQDzGGyb7sVj9z2LOZc1ULnC6cFAJ0bJjlc\/ssJq+IRfQlYtVIJztsQWWkZizgZPkSa\/tzBAiQcxbmGCdfyAXBPDu+1u0oskFsSmKVFDQMUWUkcpdhGCne7\/78CB3Gjntyy3f4QyBY7T7DZtC3bSmxGLbQR8gcPjpk3RgYDHVZRjeylb5RD57q246aU9FA6j+Q\/7O0RlbHYO8k9ecZFM63zVO6Ly\/wCtS\/\/vE8\/zLDV+KYngVBggwk2HX1Dg2R3d+kKNMxBrKFNY7jk8dzKLAqgvD5NJVzVRv5CVwNt\/cf8LpYwhPRb+S5jJIop5TgNf332T7pKNREigEn0CGdPs4XWdxAyB7QfrNFFMwSR\/pLau3AOiqGsp1KhcNebZ6tvCs3ixfJ5EyN6eK0FLSeB+T+fruerxGe8awFUdNAOiG5xyuKoDG+NARKpGhi8bS+E7zqguXRq5YmjmOqaoLA+rL7D0LhGkScp6U9pSI9NE8bYbG67AiVwrxfaul5AMvdP3N45Aoi6aYiqG0Xwu2LzTVJBJoK6V43TLHLkUwISisX2v7\/Bo95sz2fn5DEl3sEp1fe8ZRTxfDB2Gb6Y+\/AoPeZt0NrKh5SSTGFfN+jS3fw+MKiQhp8xLdxydgYwS\/Bi9Ml5ADsOOKW8Oi6L82FXinpiUTLmNV4naRmRc5tVrCf8c1v4lNFzRdlusqDH5mO2ADefFPeTjskGjA6nXP4Aaf5ozi6ZhTGGssG8C2H1LIHcTFUnMFdmtQxBF7kPMMYUCoS+zhS8NSk6+OOsBulJGllAOzXhhyNlanJswiSBG31wbf7kWRbrKo7m0TwDPs72gaSBVyNJEykJUmuReRu7iU1UMlomyfT5pRMZBXpZVV2d93kUdqC2duR0Q2JGAkJv6rFEbvhmuOgTUirQdWrAJUrxGZnFvDghcU0jbmlzxe4SSsZ23vIpPa+iXVQ7nSTavz2L7YIdmeHMZcE5TYYGCisd5897eELch2LBBpOXzzdTSBfij2BwDQ42V2s+sg0Z6gIM1Hs6BHvD8w0ZM5Pmj0ViUaZkbAKVRNR6ggVtrL8OoTRxXfPO+a+W5\/uCgbZPaZhiogOuuMFobxsos3NLtBA69x+wd7FadqiDnbFOfHS\/xpjd\/dB\/j+cq\/zN5Pjkgp9NUL\/0S2+0673j7\/usfH1c9bmyuClFuoO8t8VwnWNLyBZDzrA0ogik3tbJKq5O6oVyMad+CEr7AbgcHAuiVS3jJY444SoTCHf4idiSgFtPHZ6oY1XZ4Sulw2ktVG0CzjbonGvLnEYBKz1D7Gb4r4J2UbtXOQOSkSPHt5WCaSFK77iNwXuBn\/2MX5p1bSMSF\/Tr23qc3bfQBeLcl6wMSwRaqjzW4T7ePbZaw01rsiwKKS7fTZ14pH4TbIv5ZCyT7o\/lOEKEABW+LRm6MERH6bhMcXyJ7k85UFldMzCGsfJdiLECaGWSmlc5MLuifCJN4JD1Yi8P+kNCKiYKBXmJQqSWbfc6aNij4I92kPrTyypAGQRpmBKQTty51Wl3wma4\/dIsFNGlDCEAemEyGHblJl8lNy2e0Amu4\/nuM9sk37KG+y3UmX9XFrLBaCz9q9yQ7WgwwwQanA60Xk4n5Mp0aYlwoeMmvjT7SHqlAB50aJUUpC7qwL0nh1yjNaiLQ\/srtjJf1jNDfyqIbYdlhsSk\/t9WhYqHGMy95aoJQMsWe+itQVQxtpMDMqntfeqUbTxJ609ITobjmEB0NeY951N2aOEH9Wpm15oJMEzH4iv5yinW1TJYuTef0TT+qMItGoSHWbOPGwP7Ybry3ILjHSQUqo59t4TSyg\/g76ZDFNykyUkcpoDEsaAUI5S8YH6vLFTqwWoukhfiSVGlaGaBAj49VDkl2g2CCB0R7RUDkugGvWkTAjbtv4T+SCpukP2jpbWGD7wOS8uMd94aBoGshE0\/wCFOsodXNimN8zIg5QBWr9L9Y3YVI5YWRqiaVCJyZ9tAjq7VtscyEn\/O+opS6nQHZ8Q29j4RhFXLEhQKb0xvoP1CSDYPk2Om9sFskwkyyUwjSEt9o6D7m1QrhPtEfoNKBXL49WGyxN03p+O36gXF1kTvdJbFLcDXJRNiGibpXcrD4Ri0gYfb0iDIQDm44K\/nI16XoYygCdG5e58uz949oMQlFgr80ym9XToROjTlZ94UsWXmN2+JQpK4u\/5FpkLU41KFyxjOGhgt5cjpcC4zZxxpblf8eTwRIonugeLelFzwZ6wZeyja6eIN0sbfVum61FPyuCc9rb0t6TdD19fWIrWcnLUMXZER\/x+gUPOu5mSXYBqGHwUcZDzCWpDLdgNwi1My5Y7lSQZ8sUeiDSBsJyVyI8Io3DgBcKj7nPSv5gpkjmHTg2jvMibGm4dUa35panqnv7Z88hlst66IEuzcu38XShC2GqdH25+vQrZTIoq0fpgLvuuu0cyQTtya+mdzHTFfejriPsG8OAOlGRqJgKNPcAn2yvLhK7mD1a33AXHO1TGug8qQCqfzfFYNhc9B0XOHJRq88BQl1AMq7oOauIC\/pxVYSZ1ydc55FUZxS7H7CZuTdcSYpS5bg\/TzRwrYFIHJiRHOS+Ny\/MQ\/txxzYTB8MJXbNyeOSgQ\/xjRb9eDhzAWLZIudkL\/2rRthY3CxwqSEC6DjLBFiFF\/WVrlRDceBZx2co0le92VYWyKSny6P+LNVqQe8FFS7UFpWjsIz29aSzcwSoaqh2Q0YZWsMM1iQpKlIVM5MVudOY5+X2v46BPeQbSc9WQRKWCI0\/2b2lq22ktdK1OAGUzOegta\/CG+9QKscAS0VHffaRTNbLcatgEyO9XFDoS6IBfHsI2QfGJDvDryNuFRI9Lv3gfQWdL+B5JbdoBOhoX64sREEAt+deaONn3h318hm7HJ6huj+tr\/rp4+0UrhrKL8RuC+BTXjBcpubSqssHoIK+zvwbVu2Y+NNr9vkwmCIC8ykIRMc4MjZ+V2hD6GMT2rzXpPhWk6Y+\/3iPCAFVIilYr3yiUIvL7gA\/4NXKFvcegU21RUECGZsDbGi6axe2T2iyneQ9rdYzUiabvqDHAmIGzbEl1r2BIk2Sv7+wwCQ3E\/JIEqbh4B3TXXV5cgXV812pPABjf9s+3isx4ae9PkBqqNLDsJgWClKw7QncbJnxvHrHshkjRoWzz8+V10XphubwGpV+0SYtAbHEJ+tljFeBJcvhwjm\/O2uIbteVXcOTtD6wHh+VMJAIKUnTWkHqfwuWv9LIkoXGyOdn4fNqWQivLq8NYndnFcZo2N1QEC6T0z6ioJbpGUDuxu90Rv4hQ8i76iFebN5Gauaz207ZHJe2eH+60IezLRxcU1wYP7PTuHsFzO09MAhhFnGO6MlJvNJuECeqvnkp9ztsyXpWHQpWBgkCCsVZqcDfmIUKyEOt0pAzBw9bofsWuZJgeZXpX19nsq3WY8CsVc5A\/YR1zFh0Qsbtzdem9eejTXGteSYpZC2+qs9jueFYv1JJLqSfB35Rfyz4EdNA8\/dR3ZkaS6gAdxMfuLIOPC+\/WiO0OW4RazgVuXNgopwwj5ZoqykSapE6N7tIy2g2qvjC0nuHd2HqGsY8eHvEXtEyJjBcitc2tzYZD3zDcG9um2dl38bovjcynCWF6RLF6OpzQxDprofjFHD+XaqU28Y0pKscj\/QpWNT3plsjWyWyfEMfd71i3nwecAHpjVnDpGop9jB+N2ye7YrgsRTzsqdfTtTzB08kaxi4Kw3gKo26p\/Lh6p9jhEHMR0H72sA1dJ\/EGZPjncDiSDHjh1sSjobpSqPhBn\/AFsPiia95MAM+2QjPfjmvI2IhtaUzdsTN7o65SQshu4ynl0xL1E6XFN4Xes+5ILwkp1fOV7F9xcLhLxntKNyF\/ppYVRQ+aj6x+","iv":"af08f1aea64daae2b54d62e485be371c","s":"e86fdf2ebc0f75e1"}

The Arcade at Peninsula Shanghai

The Arcade at Peninsula Shanghai