Last year Airbnb disrupted the hospitality industry to the tune of $1 billion, according to an iModerate report.

The report found that Airbnb clients skew young and budget-conscious, with a taste for adventure and a craving for local culture, compared to hotel clients who see the hotel itself as a destination. Boutique labels are an effective way to acquire Airbnb users, but consumers often choose based on what they want from the trip.

"The idea of boutique hotels bridging the gap is an interesting one, and while their existence and rise in popularity can’t be solely attributed to the rise in other lodging options such as Airbnb, it’s certainly a part of it as hotels seek to edge out any competition that can steal market share," said Adam Rossow, chief marketing officer of iModerate.

"These boutique properties often seek to provide a more unique, localized experience (much like an Airbnb) but still give travelers the sense of security and trust they crave," he said. "However, it doesn’t seem as black and white on which consumers will choose – a hotel or an Airbnb.

"Of course, you have some that are absolute in their choice, but it’s situational for many travelers and their choice revolves around what they want and expect from that particular business trip, vacation, etc."

Introvert or extrovert?

While hotels appeal to consumers because they offer familiarity and certainty, Airbnb has attracted frequent visitors for the opposite reason. The thrill of not knowing for sure what one will get and the accompanying possibility of unique experiences interests younger travelers.

Women, iModerate found, especially appreciate being in an environment resembling a home rather than a hotel. The chance to be near and live like locals in neighborhoods removed from commercial hotel properties is another draw for Airbnb lodgers, and is something hotels will have difficulty countering.

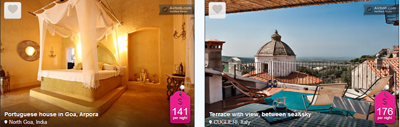

Airbnb listing

Equally troubling, chain hotels are antithetical to what these consumers want. Even by replicating some of the advantages of Airbnb – such as a kitchen – hotels would need to completely reverse the values and attitudes of Airbnb frequenters, a difficult proposition.

The preferred host experiences are also antagonistic: Airbnb users want a host who is present when needed but generally makes the guests feel safe through their absence. Hotel concierge, on the other hand, prides himself or herself on being present to handle even the small things so that guests do not need to worry about it.

In addition to trustworthy hosts, hotels appeal to private, more introverted guests. They want the predictability and the security that Airbnb cannot offer.

Despite the polarity, iModerate found that boutique hotels, such as Starwood’s Aloft, can appeal in the same way that Airbnb can. Smaller properties mean that a presence in residential neighborhoods and a feeling of adventure that large hotels lack and that guests and employees can interact more personably.

Four Seasons Maldives at sunset

Boutiques therefore inhabit a space more adventurous than large hotel brands but more secure than Airbnb. By developing or acquiring more intimate properties, acquiring smaller brands, hotels can look to capitalize on the influx of frequent travelers that Airbnb has played a large role in enabling.

While some brands hope that the latest technological advances endear them to millennials, iModerate found that beyond WiFi, digital was not a top concern. Instead, training employees to naturally offer personal recommendations could create the environment Airbnb clients prefer.

New customers, new competitors

Hotels are paradoxically caught between the promise of increased travel opportunity and desire among worldwide consumers on one hand and more competition than ever on the other.

Online travel agency Priceline and home-sharing service Airbnb have higher valuations than any hotel chain, according to a recent report by L2.

Over the last five years, the market share of the top 10 luxury hoteliers has remained stagnant at 27 percent but home-sharing platforms could offer a future threat to the business. As such services attract tomorrow’s luxury consumer and online travel agencies eat away at margins, hotels must focus on superb digital platforms and unique experiences (see story).

Some hotel brands have already acted on the potential that boutique properties offer.

More than two years ago, Four Seasons Hotels and Resorts expanded upon its first boutique property in the United States after agreeing to brand and manage The Surf Club in Surfside, FL.

When the addition is completed, the property will have approximately 80 rooms and 150 homes and penthouses. The Surf Club was acquired in 2012 and offers a more personable and residential alternative to larger Four Seasons hotels. (see story).

"'Boutique' is synonymous with 'luxury' for many consumers; their expectation of a stay at a boutique hotel included superior service, upscale spa experiences and nicer amenities throughout (including the little things, like soap in the rooms)," Mr. Rossow said. "It’s quirkier – but equally, if not more, luxurious – than the hotel stay that they’re used to.

"These smaller, more personal offshoots of your Hilton’s and Marriott’s won’t render Airbnb obsolete by any means, as the idea of a home, a host and something shared and hyper local is very appealing," he said. "However, they may help shift the perception of hotels from a place of comfort, consistency and amenities to that of something that is a bit more adventurous and exciting while still being trustworthy and reliable."

{"ct":"\/SroKi9qBaWDAL4Dd50CuPYCQLdL889tKGA1zNfrl6JwwL\/ZGM+lBMHOlVd6fvxYMSYqnTYP7yNnkGYIQe+XhDQg5fvr10Zz0pJDmvJM1MPwyvYq5HfFYlCXfwMWiUZHJITAh3\/CBf6g7fy90LdS3HAGYFeFs3lJlY6LwXFlds6F2Ea5LCxrbP0B0eDkhhmF\/e3BjRytVSRK1pQ\/yGBStykRbr5yZ++7pSf\/JX1ub7RNSuVWnqTX\/d3vztFN3sXK9A8etEYc9QY5sytue8nXs9rE59PKRhvhRODHa3sk6S\/PV6Ja7qXyKX0L9EzbGT\/ADsITu4IbxNHIVAWFA3b8\/ItvBGH3mZ\/gJwIRevi5GM0uPg3ocGwIHKLxZ0sAAFO1VqLWl8JFag7K+tLzycnYEgm0IxhTbBqBt+vPTaVoYYyxuC9FF7cw\/SS8iXiFSOYKFxTotQzIU7XmxpwqePACy9O2qI1dhtY46usuVAV9e5G6zdTJJD2\/ZD3nddQz6Hm54GNtqEpe9rK5ayU0p5brXxn5h8XZ0uMbzltIy\/MRjk1efhgL1aGNc+rfUV6XqkBKbqsD4Gpfxv8jPit3Vh8GIDpqwsmCkLZJqO+Z0qi5Dxenma3YPM9gkA9\/rwyiy3K5ze5iR0zaML5nOsEw4NF69Aa6WC4ScmKeGBFfJy08t5Uh5ZdrnAGaVnd+Q0eGIALZ6Pdh804iy5NTcT\/WK+aF4IWjXU\/BTskK7XsJ+7YGyNOZIgpVG64ARmoLVY72+tvpPaYLIU5jF3UO1OlA0Kr\/KJkPy7dd44hYjTNBHbTZOTKtz3nq3T6fhvUjPZfjxDI7y0A4JFbqwGaDwMxYtFmKkQUX8+qYTQkgElWSWu0DC21JuqFTWIf+bNo6qWdqXzjspWYKXq03NxRp2DPhL8oDvFiplzBGMKdZW9Qh1\/t4hMld1rTLWDDG1LqmVvXNA4fm++Slasmp+kAWf381k9ksa20S0PvSoK3Yo19YSKeK3qq+XdRNe5ThwvZeMqzj+dAPGKmX+CG1heF\/hhhy91BlGnJxHa9E4BX4pE0aFPVrCk+geBM6Bw1y8ocvHVYQe1CciuQ9Wrv6xT5TMhgxpr2Mx6buHcaJ6wcKZsMraqQi9vvXzlf4ekdRlNak7IhsRdBxLdbDnOAGO4REvRUb1VPJbgCJKNzCmjZ0SWxj1Pg+tW\/mgVSwd14CtIMHeUmeYAahtNov3EFxNDYn442r0LEaJMLolUxl4YkkLsTGavNf2beux9jrIsXLo8J3DUpifhtao38sZ17t61MF68ieqGBBC7lMm15dShTrp1bGG+EdFMBBVxX75GOHat1U1WuMl2oo65QxPFUoy1eaY3O6o+J+MRe7IAis9bHID50OJ2NRMHWUcMdAZ2UpTTelfGpvzeZODG6LpEHsf7f1bOVEo\/yJtLkFg4FsgZ0IrbbQQlBn\/8LDaLFQNcHlkpU1GYq6EbTIqQdGRcsO8Pg9TnYN5ezUZ\/9RrKbZ+g\/Zp1TAMlTROeeJ4mWMwjUCTWEWqalbhN58jzRkt\/bcKB5Re3I+BXV9rn4D2LUUqUJlV8OrpUT1hUDiaU8oVlHOISRgDHEPc5rI5ZoR9WLXgln17fnSgnqfFyFFIAc1REJ0AUH3Z+P4swzmfgmAW1hxTDtgaNDAVA6NsWD5vrhbMzIb3H5jFi032pHKTc56sPAHuerDNLcI3ERCjOxzdZ248PaQChr51w4FZVIAfEpa5YZItbfB\/rxT0O68QX8Q3ECahoLSwNn54qKOlRS8GzZMuyWcKy\/NdPnlJ8OLFXpXZ6TzX6IAZ\/y20Bh249FYYb65zsTgCwVGFeaImO8x7O2S9cdtbCQ4uCYm9x82Tq\/hgkhiahaD0PZgKTzHjb7stj\/+7MfEB5IOUB7te6hbF\/OxAx1BwV\/iF1pz6jGcMJa5r3uBHiduzP5wFSZwX92XmdW0ZWxO2taOOcxUq\/BVbYT\/J7wHRFjaO1bztRfJyI7wcV0SpOpQ20nTzvcTHXekGt6D0gRqdaLRgiusqAZJcOTK4iqaMsAsWhoTAaG521lV22yrxc2icWUIRW\/1h\/qdU+grP4PAJ0UUF3NgqQcddcvPQiwdww5JEpQhXxphHAhovcZD8C6ZiaBauk+IryiYunzA1MNqxNV7LLRkiABrVLhXBaJQfIifPfizWBCan7K4DpdwMHr73QrhvxZGRWZ45jAmS35Mgx2N3iXqDmWVGnaiJ7Hm7qu85a6bT7tEiIu6WIiq2vtriNis5nm0TDLwLjagvfWIYQoVM0plRQhEl\/hVzKPLcndM3aif6icVUEIC65YCAPftoxYYaraxwNDItgkYqZID+sQCqn65Vezhg7N6R4JHoUSFoWg3S6HP3b0RSLIEiu53WgSokBg6kw\/4AJA5F9TO6f7lLC6WLB+Gr5M8GLKe\/72yLYU1DrY+ODGirgbHvejyN7P\/J9D3ZllNTGn7i4LeEdAMd0tzKQvIIeR9JB9PIkydPRT0759R9OXiskGsqwJ0Re0\/WNn5xk2R7oNYcZhjMEb48ebdrB3W9d6OjtDbZamXUUBc6LFvW5AsWwQk\/XVw6+8uhbH4pYchSvGwHUFkgqlsXvHmswcWjiHEKrGR0wbpS\/isg+jpAFYqiJSogLVh5MJaG2xR0Ud2lYr7V+5U0ojlZNZxy2hlRWGdgEpQoPbGcOQ5QcV3tVXeLxM1w3Ol67Es4k\/VTv\/9YhwveCOOTXfMqeeGusIAXXSyVSHRRRchHYdERNxmpLBFkPiZP08MgmTfE5YTOdMWP3eyIPpFMMpDHakDRY6Us9p42gWaoOZ3Ce+XSahpn6NJ4d84M+DqKyTQ1NI7ZxaAh1R+eBxHXOvtjy5jIKqQAUeNfCKgVw1uiyQ9+V0\/OH\/QvPQcGU17XHUkLh3g20CVkiU\/OzN2PMH7jcSTGtDGytODNJ\/K+9gqJVwC7B4Fgb8KEUWJhMkiJ8UfRemkOBY1ZVpR1T9MR5jCbODqEzvaPxRAiy+2h2cQBrwleZjXd6NY99yZyzn3mwUxRUdmbwnkLZs3\/q0DTuB3\/vgRcKlMe8M2ELDNqKQyNM2opgM3tMWNXpRtL0GovhzBpqwbYoDYMAcKAHgrLYaO5+uv0IW4CQnTQn3UKPp+opWF+myR5Fr9eywzL9ZZlqjtTY93e4dfvwvFxGT5ntRIE05mjwexwpSXpEEYN5zUiba8RbZXcbcCEHCsiN95IcpG5XXelrix6hrp6IXS3Ewht5y5ca5lKXNGQbkUYK\/bVh7ogqP3E9iO9q9L9hEVZcdw+YlcyVRyrESKcPJpNa0pepgDZpZLAvpWeo7BSfud54SA8VqKTtiCaTlnS1hTmmje2a4vQGkT7clF2ef6S6Be7cAe3fGZ\/F+\/HfRaJl0xXmQYWOFsPzLkOwI4bxXqBeh5cq5MCYGOloxpDOvbgx7SzMVF9EKiK2gaajrkf0XeXemO5HfHT6gyR8j7vD5Ed5RO+27D4I7cnUheFMyFFMONKfcmxl0T3s8kCFqpaGq4iuuON6mYG05fVTmKqzlD05lYIsgvExgnoxMJWLXPce\/5Pqc6IBppX1UET+LveykZVlW7hB6dhxpJQpaiUyc1HtvKIfv0QHT7mL0sMczTxHz2Hk88fM0yxpZE4joxeAlOCvrGG1+zWZM9\/ZK3Dx+DrVeEnIt4DxW2bs\/JGmcDukJIZK0EHhgzfBRVwMdpLmuT57kkYp20rSxorj0MdpZZk5asvXo0gx6BbMprMAPAPTUqBQPAR9uNDZWWMIXNpMmZ3q0\/ruIA1ng7l1Sx4qjrPG8Y0w6RFnKe+xIqg63CANlg1oBKokE\/1HzUTvPzxFMBAPTrKG3BoSZDsVfYcCZPLU36y\/pivNuOr7t8wU8Ho5RrVd7cOh62sUdPOVdRz+uFnkpsNdTGYp5YzZO22YVEW\/zesOD0PV8FV7dE\/L7hBbjnzTOlcjCelXIJRH+FAnZtbLhDXQCPS3aLTAU5mQzvo\/slORgoy9XjPBRMi7Ks+Rpcnj27IfyvFKjMoBHrp8\/TR+RuzHNkpYwsAT3XX\/j+qyJzTO\/4VqNe681BoaWLD2gEvsx8d7hJUISnLe80Y8JlF6Ni6S0s0EkSICSzppRCz99mD+7yGEVSxaGFnE+DjN9skvmRl49OmscAbnJPiTzVD6Gx41B3lTtUJ0XymdcHAgNoY4+TeUNyrpM2K4Y5fjR7C9ze1si38mciiqomzKmLvPfcaynlv9QYRupXt60e2rDixHUyLKshQnTeTProukxHY6BXddetVL6OfVBjyi6fBzuvt6wEtcr2m9SC73QRbuCvLH7fDz43ZMZ0GJyI9WFkVbteaxiScyNw4\/hOPmizFkdAOWXDXqZApTB6DCXvD1IeIsdZLzfZtQ8tbuOgBxLwk9hUq71y\/Sc+Y0vcVkN2NbFCWHiIiWqJFYCdLqfVLEiUSeWTFkmCN3wmu5w1FwDHp6mDIxIIFYVGWDPDyK3CVXC6FFOIpvcJCNTT3LcZDTRE9YI89LNLzII0zV\/qRcKhKNDXo9akqoaMrq0gCsxjhvza8zUF32eiScxefJLQyMl+AMSE7IHBI\/r5Kuv4IosmBrpH57yEzoq\/c+EdiwucnoBG8vrJM3Ou\/13uLxczt8MQTxwbkQuWteIafI9IPgSUmoYiLEekGO+xpGks5bGBtEJkrA\/JrdYsthwyXiLSZoS4xRb7O7aVgwiBpSNNLU0HKq5QVXig1l02768rwAFz\/Xbix+mw7WIu6fKk8duG35R6zU+xEq4BuUTBZRZGRgb1l0fLljGonOJ1XrBQv+egusywsDojsYVnIwvQ5FZdU8evuVV9RDgMh5kWPDP9y\/\/G7H4A6JqGxaBJ3gGdla9OsY5BJ5n98zqZwO0SJSK+wJr+DLZWNZLRSHIxz\/v7Zlj0zjAB5qrCWkI4TfSuGyktD8lGriUHhtlHSYkLmBPaO8PC4TBLHIqvf9HLSxJy7CwBhbot6IT1dFoa0QA9w+uz68FvZNaNQ0G2gvckGxF\/lLj0dw812JGsThqAXG7p1AtVc56XsrQraAw0BSqSyGc5hSqloPQX2fLcXmneBpvhYQArmtMdiUzULwisI+ADSk6\/2WX68Nq\/b8cG1FR\/nXaBZMGXJmrqocukD6FSa8GBqTC1jTvPSNy\/Cjvr9qrbGDE\/bGjpvQjAs9LNXRFVzzQ8tQ9v3EzFno7TPR6HeKy5OVTJiqT05gZWyBAiVV4eggKILeeXQIfk3SQ3IkitSlwPmGKWoS7ykpWOjcvsgcdoGMIg7ZRsuKgF2kwvhliPB2HfkwSaOdpelhvuV170UMbl5tPfmtegwo0vPkfvQp13ON4+VuSO98+gY4XPzpS6eS0bLUkYRB\/xFMAC6zI21rmWJheIll1JflTwOK8sNredKTwKeBBQJJ7FC+zzp0v63KNJdmcZN1QLxAgtV3v\/yOGTLIGNdoWJEvWYOidHsC9ndp\/av4eokWGXPnNL0+ILvBbbkra80Tthscam+DdHiPzthYG39diGIngdc0Fp2X84SYQIT6huqdnsYG6489SiE0\/B1iz5Oji8eLFrhPv63gLYrAN6zExDNoryXBdReJa8\/mC\/EDdtCjDswkR0CodpByIbA2squlFmGKI7ABLKq5hENEsKH9\/lDYDINcaFYQcAzdlG1sCjGr+UxJ+jRPlzjxkbxxpYKjge1mCkb3d\/V5\/jj0agYzC6o9f1Vs1FLAcJD4pEWhK1Tc6LRILth3hIPhlhyWjr7hqGu\/qBEIs38CfFypbI9qP1wSBJ9OwywGYoCc+5KldkP8gKUv9SrexpZ8n8bIVEwroe49c1709x6+I1i9akU1FetwogZxVoZh9dLU2uJCcDPhnhZ2\/kfJDJnq+pecdTIYh7fm3S09UL4SZgtO47erO+nZOs02TCP15KD+t4aqunchO9hKnNduS6LlLf9QqQRmxXRqkgYtV9DBhEW7RcvoUVq0xhbklov\/vhHnSXiyRqDbLuJHf4VHApH4XJhm2lkIljmiPvCLUEa9MDIxk\/VDHSRSHxwvETrSf2ncbeaq9sZw37BmaPVgAWk7t\/yNueJGyhJVVJJ3Zl3HbiVC7SBkZlK95SiMRXuWpuDfi17l37MnUmDfTi0TLsWGVqAyMsxGpzB\/IXDB5amF+p+DCoN+VY3LdVlBi4u2QTpO2TqKfNGp67h48Px\/dkXg5euwBgchxi\/jI2FE9U27WSFn35T2Y+pqGHnE9FWeuwWF1N\/e3Q8dc5MN\/NbmQBDXCyeLxYkSVADdp\/lJWmQNZuZu8+2daWjzurn6eRNcbo+pqZZobm9q7k\/PRHArbiI6WuI5sK5NoWuAzA4qxMoGVMS8LmYZXW+fD2TDibKa8mZT\/mctYpHUh6dRSRX3Iv+f+fpRqpNpCCcXOJGBss\/NLS+NTniEkrZ4Ic5BehyDr+JxHiE34JBJwK4qwfw0XKAvU1MBeqdxg+u\/jPaidnIKRsuedOqo5Wn83pZf19Ib4EeN\/HTk\/eZ\/UTXqBlSAjod8DAvN4wdFaJzsXk\/qEG3qUSYIpYafQxNoGV48CLNLTQPHK4tEk6RNQy4FDnrDlhzr7FjO7nVFUuRlMjx8ruxBuzqMfRL0c9\/mKy5DYWB+npW7jH6DlHh0hvXKAgjShc3u6Kk4f7EpmYTPb5UrhDjGWu3u+UE4o\/I1xARznt0Asw5n+jSDyEAwG3nH9oPSZRXPPrNzkSfuTxKcAmK0APf65xt5+yG7sKzcQqdh1oV2BCY50ZFQt7rITCJxxfat8d1Pmlxmgvlt0BmuIyQRND8CALnP1hSUsJ8cOHSP+IxfREuZmKfkKEYBRJcYOQIWXg9OH6QDW9yc1eEXal6UwkG1E1ID\/Y91JorFij8nIV6UKeoUDrsI7x7hSCN46GGnKSHFaPWT2fiQfcpmTPEdUK21aZsoTazi+ZP5fLooBTymmt\/Mvr97kodVumOPCJiC51YpiNnCn6I1Kg89tUhw141HG6r6NM3kxPk9QdYZSSySew7Fi5Fig\/uwsvnfuzhCIcOLeeDrfLzP\/26woSIIsP2B6nYKJJRmOWQ0+kCghH40aX7tlmXknyq78WEN6GIiWxDH1kx1Eg8kn7X+vFJObBOkGAvIhsqFofc0y\/CLBiOu4UiW7xLDrtgPloh+F8K4MYMWEIWJyZ3GWtAqkoXwOBqgOJ3LRgC4YL6Yl0lNj9BePeMA3u26Yaa1J0GJoCzUZBS0MEIB45h4m25gCUAZWC3O8BcyGq99OMA8RMm9EmkPCcMoKZhgR9oP7IM36d5jjNIoTCsVMyXifIhVNmro24B6OODAHCH\/OwE25g9r5Gnp9hc448dQmjFJ2FhoYkDA5TlBrn6fItAeHCDpHIem8KfIWR+4lfCKP+B3paxZCl+IM+FP0EY0B9TpN870qiMyhzQNkXr09WpS6X5Mbq8ePS0e6AJ+GjewyvFZFkFVFffnzuhOnDZAo7YWfnid5JbcnEXorDqyttPodGZUwWRo8I1dxFgR55HtTYtDoes93xb0jArQ2K1BPD69RMhSEH\/NcNXnfkaGX5fxidgbPKxDNJ45dNLtCtI6P3YBALNfsevMLrz9yL3hlmM01257G\/v3s1KlizgNW6JT+262zcRQUUzZAk8EEkYNe0IGN8EFrBDrcEHqLNcmsFIGtrSrlasGWtwAkeBqM1dedWbrN97YRkMvRNM8OQ3MLLzWc\/7FMwwd9rL9vLoi\/hq\/r74FF8dTsz3Kcwbe\/CaReSM2mQ9wKG9Gc\/EAPbTNG3QnrwMTPvR24DdkQipyt+9yDO1OQ8zZGderz0VfuUgTHgoaoOtrFeejmPALN9r0+HWt9aNFpJMwR9JmmU6xa3u3tYTFYzgB0VdacKx7anlgjo6uPQhkMKZSAJtxbtImuz7S9cJ9sukHgsl7VRhA1YsHovDXwu5x\/D7J+yb0x3M6Cm6AcIJ4dSIPk+jAeCyAl2ceTzjA0Sb7kMWupDxq7L84r0vNQW0rDhbmOcv0ck7T00jrDTu8BkHe2Cg\/jFNPT\/hiZgJf0lBb\/Z0VQrW0COmr8MjvkIhvMhtpOmWxnpvdO\/SBKT\/XDiI1x3YEeLI\/mwfK\/st7DNUmMgwMOgwPgO5\/5g+jIQc\/ZqI+rDDLnbmHLx6TW5nNr\/fI6hDu1EamGeABzKDDQORVZHTQWe8p83SYqSdubk8N3d\/m4FP1VkSv55K9qOsDcnkB2x7S82\/0WFxkTchBBxnECWgAm2FhHGjWf+v6BS+c4Uh+BNXIG551+X7wqpN1pqm6R0juYtmCJVyd7F2KM6oPhgFRjCf+EUZQ9FYMbss6JVGN9h6P5oF8IydpPp1Rw2ltAOctreRafeBwWRoI2bQumfz3mP0u6ZPC7KXvV+F\/cCzpuvs0RVsQg7c2P2iwKLe8L\/qyr89WJ1B3Zin4Vp3ZgNx8oC2Uen41E8iozD4GdFY+ineXReNQY39AIMZqLWlP6c41XstaWAcHCz+wHt1sCXC3cH926fQ9X3Gz7Qi+JIIW7DrxMhhbPS5imPsy8vKdZfFHiJKhgkbKlqsS9LTgoW4o2BtLzS7cLaN15z+UmJmTYStOnhnNiTvhzXGAh8hpCpNYv7dkV4CfwXPnzVqmhylOIWZNnqj9KwOq\/fJu4h1\/GMAewwUonBlfmpAAgy\/6ouWXOilcrwUaKMn9CqMwJYfMr5raL+HodTRtgCCc4yBpaEq7LrSgQLJiJKD4R9tAS8zFWoh+CsDw+dxThaV63MkJpuYf2R\/5gWCo\/rOxWb4ZTvRY+2wi2zWOA0tF8ft4eoFt+CiXaxfeRxuyASI1O9KtXiWP7RrJuW9KkBpfRja5pqOG4Iy5kfaUyOiDIxpStd4BIDJUA5q\/+IFe8QO28jjppaBwm2KWWZ3INLP5dYlEaR6WtQYip3SGDKRxhWw1nKga1ejaWacQtj0U5zgTfnL8WEdA7stTzgGWpK7LVhL6cEMSHpk+uLY5yasxXzvAeJzky7G8pq7NHpo8\/aiwJr50RfftsXaBiA++7I5BixTtZiyoG32pDU9L+1K4cq37Wo6hOTifZq+y4r\/uFvQ7d3NbzA7HnV+sGwG2JftG9GXl+b1TWoA+hr+GDKT0dyIHSR2NatXqIq81X41C2BPdjHPXDZjWqBV1wU+UjKH\/gEW4aKZv99blCHCT98O2yyOHaW0zuVGmQrDwp7WGLt5a9cKfAKuqsB0\/APk64IiA20bX7ZcfEq98hURgh6G3Iq5SJZIDCegil1swsuIBKYyTUaU+XlY09oE16CJOM5i+zcNVnIGorSwNBfNVspoaOzk9ZwEWGDSBTa75YMJbOqrg1eccHdpBD070cLGd+hU9rwZBtYukqxXezLDHW5kGGugGClyoyMVdvSQ+QIWP9tjYsfdDdmGvcMZTFuxmUuVtRVHDcAsuFoDHcTG0wzKNgAjY2sPFnsNqdvQFl0X\/HK7775uV3qtAlsGyLla2S5NUQEAQLKY7gKHjvJ3gW\/2ars4vR0uNw+SCQSpsSuRTTYHerAIFYRT9rFReR2EpyUkHwk76PULFiD4d5\/m36vE8TBxl\/k1+Rv+Es3R1WUP+XlDSo+eMBGyCboQoZwqZSiqjKivW6qcFw5rmgN7adV2kERwoMDJcf4+mTX8vyF0\/NnkZCzNB7bDQ==","iv":"64c638939d38b9f27b5bce9a84865799","s":"ada2327a477aea39"}

Waldorf Astoria Rome Cavalieri hotel entrance

Waldorf Astoria Rome Cavalieri hotel entrance