The population of ultra-high-net worth individuals all over the world is growing after a significant decline in 2015, according to new findings from Wealth-X.

Consumers with a net worth of $30 million or more grew by 3.5 percent in 2016, which will likely continue to increase over the next few years. The World Ultra Wealth Report 2017 showed the combined wealth of these individuals has reached $27 trillion, which was also at a decline in 2015.

“The world’s UHNW population is once again on the rise after a decline in 2015,” said Maya Imberg, director of custom research at Wealth-X, London. “While total population and wealth of this demographic are on the rise, we see that average wealth of these individuals is at its lowest from previous years.

“This is a sign that the growth of this demographic is currently outpacing wealth generation,” she said. “This trend is also forecast to continue."

Wealth growth

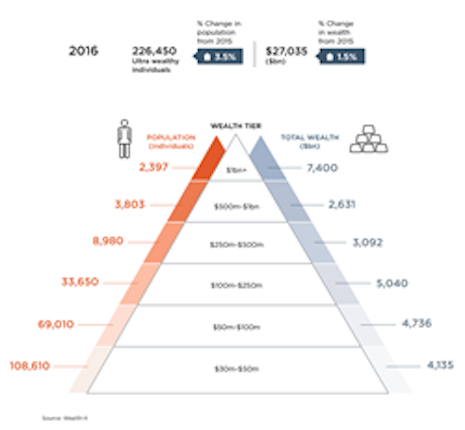

The global population of ultra-high-net worth individuals has risen to 226,450 with an overall combined wealth increase of 1.5 percent.

This increase is projected to just be the start. Wealth-X is predicting the population will increase by 72,550 individuals to 299,000 by 2021.

Chart from Wealth-X detailing wealth growth in 2016. Image credit: Wealth-X

By the next five years, a combined wealth from the ultra-high-net worth population will reach $35.7 trillion.

North America and Asia are leading the way in terms of growth for the wealthy. However, Latin America is falling behind.

“Despite the heightened geopolitical instability, the global ultra wealthy population is forecast to rise to 299,000 people by 2021, an increase of 72,550 compared with 2016 levels,” Ms. Imberg said. “UHNW wealth is projected to rise to $35.7 trillion, which implies an additional $8.7 trillion of newly created wealth over the next five years.

“The trend towards a more balanced global distribution of ultra wealth across the different regions will continue,” she said.

New York continues to be the top city for the ultra-wealthy with significant growth this year, housing 8,350 ultra-high-net worth individuals. The number of wealthy individuals in the city grew by 9 percent.

New York is the most prominent city in terms of UHNWI

Hong Kong and Tokyo follow New York in terms of the most UHNW individuals for the top three. London and Paris are the top two cities in Europe, with London slightly in the lead.

China is the country with the third largest wealth population in the world.

Additional insight

The wealthiest consumers in the United States, those most likely to patronize luxury brands, are just as evenly split in opinion on the divisive new president as the rest of the country.

This data comes from YouGov’s "Affluent Perspective Global Study 2017," which looked at the perspective of affluent consumers around the world and how those perspectives affect their shopping habits. What the research found was that the affluent class in the U.S. is split almost down the middle on President Trump, and each side is firmly entrenched in their feelings (see more).

Private financial wealth rose 5.3 percent in 2016 to $166.5 trillion, according to new research from Boston Consulting Group.

While the recession is behind affluent consumers, wealth managers are still grappling with heightened client expectations developed during the crisis, which force advisors to do more for their investors for less. While strained by the necessity to cut costs, BCG argues that increased digital investment is necessary to propel these firms into the future (see more).

“What’s interesting are the regional changes in wealth growth and declines,” Wealth-X's Ms. Imberg said. “There were sharp regional fluctuations in dollar-denominated wealth creation, with North America and Asia recording the only significant rises in wealth in 2016.

“The picture was subdued in Europe, with the ultra wealthy population and its total wealth edging slightly lower, while fortunes remained largely unchanged in the Middle East,” she said. “Latin America and the Caribbean registered a significant fall and Africa also posted a decline.

“Currency movements were a key driver of UHNW wealth trends in 2016, contributing to solid gains in the U.S., Japan, India and Indonesia, but generating substantial losses in the U.K., Russia, Mexico and Brazil.”

{"ct":"+lvW+MENhTugqVNI2R+P\/TSuEa+g5KOVrOmEpz\/9v51PMN5AUv7Cz3Pc0wUZPofgEHWO4vY\/nNm1yFfdtuyAgRRL0h3j4b76oxxli469yg80D\/dTiTr1Iaxx0U+ChjR7yRlahBHga+8DOoi5FlGQn3bsm3f4s2NBzwlsgHWvTEK9iDlt\/W+5luiTWu7LPogcG33K6rVMu50H9fBFLbuwva4X0I0L9WuyQo1XaW5yc35JPg0CmfTe5CBh7VKHql37V3ttzGwbS4NJk0F+ZdoGFpL6hGuMnrojY9fHhHY\/emhnerWky8n\/2N4raqgwSdZhqBDEp9gqRtSTl6lfpAuozdVqE74se5lHa3KevfQcEug80jce5S3XQy\/QETDOHDlmQ9oGsoiLZvgc6jizq3BXKhI55z\/pIeWUx8M50w+t7QrjwZqBX93y2EQFu8paUCxLhkWYO2NgvdXZmNkJxXMEx4Sy6expVmNDTTtNiHlXzIJzoQ\/SniEnnoMv82rCt7I5qID\/FwsOE4H0nyGu\/ZYNGQNaASgW9Pywx1DWit55OYNUT9P9EEpC+iFzVYkK3yUpJmaErSXGOYTVQ4+xUfi1gkBL8S6Zdhbvklue6zaPLo\/FOF3BNMmrelmfMe7t2U7PbOXB7xfahRnjzF9kiCJyMFAq7an13fPusbWb\/ymtLpMGfv708cWCR+m0W5mTxza6cx+HYDW4BTmFCNY0gL92F7dB7YyI8QxjWj7pwCbgNI92ozW79ZojU6j5XcV26bZ296mbj1WBgV9Dj\/VmnUdikiRRZtUONwQZTQ9+VvYShlzq8KydgbIrMT5HXHuAmBZbajitwQ6O8lQF\/Z6ebnkYa1vEfE6Cgprq+4BO+6mN+jSTvwbxcYfaNo3wyx3BvFEBMdap1Cl\/wpa+xXBuLuB7BaFf78Cd5MfD1WBRTHO1V9dZCseIvrwcV2JkgqvTQ4LFOsZs0c5A6pCXBtmuv9lsmC2VVp\/Vx3xIUa++FZbuZYR40miZDj8qm4Fv6Z0i5sQhPU+gtcV5gTd\/meJ5bVhbKnLw69MHSa6O+SYP0DDKoLnDMrOzBkipWQBDlC4pGHTAZenXNtJuvrym0Culn\/8ezj1bu6wWe+pulkYjRcRWvfQDGpd29flsmcW0aTMHPKds\/fYXQW3ESkYh3VlFhvUQGdq\/K5xl82eg0vmUdaGzO3vaHWRMrj5JltiplZDvCtK8kF\/inlV+KY8dFyuqpv804JWj4eCNR9DHdKaRhQKIQ4t2EIXmNwaJfVpgIYXeMy0rMApSCSawofshni98u7iWxHK2\/rW5QTfJWnXwWnEmygXSaqCRWc6FgcwB7K736EiOAJPPNxrPpb0xW7ycXyBOuWlcFLienyoItGUaFH7WratbdoaCVuLtPPWPHNbX2Z1vOKgrCc8Te8L8WYq4m\/yAY4GgrVfOTumsYCs2xwHpapGU7egUePYA3ty4AzmuaoYfnxIK5IHtNbMgUZZewXKe0UtmyQoUJvAKBAYA2DmqOFDsanGbiL80hJWvf9286CJocNaOuzVWsljVM72NGYZa0TQYsEgop4HTK1FTDg\/hQbuty5q1RB+g1SQ+cEkEEyl2aff8QNOJqs6yjmIX7TOKf4TQ8w8pKqJQli7lY41ZSdlI73\/bXSc8pOg9nVb0gvftySEg9dqXkJt6y08RANAy5GeD4FPqrysimqC+p5C888EdeafftkcccmOE+jpvb0y5w4dQttaeptYwdT1CeT0txg1RWk8+bxN\/apv50Z+uPvPAyxBce3z1Q+bXoHeDw0ukBzr7rNBJ7wTAu5yBVO5siWcKrN960SpICmRJucQrUqEVuGObza5MdrElN3P7o0OhA1HrAoutK2NjDGdtewAPwtaH2Hgg1sLOIXvVBn8EFUnBB3So\/Vd6F0X\/jGpIDJU+q\/0lQ7dNdMuj1yi6xP4tohoXYwmraX7N2O0fspygClg\/3olPsV95G2u3LmPwMMJtcCjJnG6vQncwVfseAkYG2o8B\/UWD9vtLU2\/\/2ZaZ5EcHXmBZLEVPwODiHZy4PoBCQSCJOABpT8gVz112UgpkiHfkT\/Po4G6Y0g+1lgfRwhVL2vOluCapNPBjv2V7V9r8ZM4OKrvlZt5H7IeBopcDDFpp7C6psBYdMdMV2v1e7qtiBgOkWFTZOmvnpDMHe5Ibuu2\/3pxv4\/2OUoPGu3M49E6RP175mP24eJBD2SNTCN33LCDHnwAW5A\/qjYTQl7f3\/bN19DNeK2oraQMwWgBM0M6GU0SNvQFTOYOWF4tvGe3WLAPfog3whQT1ovJljt1E\/8vat6+H5\/ss5DFfTmciUpUTh8jhF6EGdh8cx9zzKcuUps1Xkm9+jILGHbSbSz8qgX8U6DyCra6mN1RjpTJcm9AlUL+Biib5775600GyQevEm5clgN7Fh9w+uR8\/XD4P1z2NF31htqcbe6SDsLSo7gdsPKRaUkPkZ4mPzbwX3ms643+SFQqHc21nyVTvUurJNQ2FEhnmgJQWvn7DhYx+kMcg3S3cTFFm81cbwax3U7oj4sWbDqRUYLx1qD44QIDgpT3NcxqxQM7Li0bwe+34v77dVP+4ZJEjY7MY4KfdCXqgqPtCsweH8cQaRlOL1Ab8HuezYIc+02EC9wU14Zar7zRW7uZTiM4wKavFFMpzgW1BSkvGs5gjJ4uwmDRYXztaxBVaNzuQRZpRbCsqA5LT7c25BiPp7El10GDIFxaphU8KWl02KW5xaNiBsa8gr5E1MrtSJcHDWFyFn1m2aOVW+Wt8jVhFfguq9tmaSfj4Dg\/STVRsybQAJeiy9PczPDfr38yiMNvC4705jd4dyL16ksXQf+ttwW+LjefQXkznrmCrDFoX6aaqFe\/UHjvqrkxcDDs5YGTtOcmHz4KsrQv+qtuv4KSF3Yrf9djreOH0w6ChxClZEeC8ep78Y208NPh1WJRDnfYXw1+rOgnUdiE5Kef6ObcQwemJD2RdntO+adQC7Wjneg3FrwRHGn\/xFlOYI7Fxon5oFpOCNGH+8UiipL4Cc8J7lksYbmHNWUMRwiyjjUYBhIC1PAQtEL\/CjyeEagkPITyyAJTJSaYEP32d57I63Bl\/0XO1bEiXm0NmwCi9MWSQFKJtGcsg1UdITE6qneJolkanNb+1LYACDJexKUhyJ+NqNjWzNb9ccxygqn2GQO\/o0OOT\/9idRDwD3PxDAa9Oe1PPvASoSMMOFMvGOecKiGKF0Jg2z+3x6NWwLeOFpOqpdqhGmqtiP0sIVHG0HQhu+ut\/5McNwk3CupIUQCgliSTACHjTc\/W\/\/bW7xGUWLcclM7my6gtyu9Ub\/xtXcPAOY0wPfy4UFSw2ADVmrLzCL+ysR+R9p8x4OJv0l25gQr2aMyhhuq3l50uWRkFyYFOYZVij3pWH1McahaofJ5C6PbC1Oc9Q3Wh+PwgQQSKcb0Jyt60Qk8s9leUEumHt2eY4EKJ9MKn3sFGxFBvMTmpZi5lBxPquUpSsXr6DNek\/\/jbugxKYA3T8g94Mri3l4zzbhqPOTQPG+YhQyTjUA5jf41elzQ7Wlqxo4mcSXjz8FUbVprE8nBg0+UzWILZcmZH5yRddLvGb6FPAhB3CkXufUxhXX\/IZ6c2lKLay4sWyfVLKBDOiGCxPu1pWfz9DSXQ5KeogxKgBvAve5Atq4dyRk\/2Tgzi9gS+Wpf6jYmW5lRdXtrsweBp3OmsvQ11I6WnL1q+YZ8U5UUbjdp8PvJtuGn3ghu+Kl7hqi1VBbuarry6r8\/NWhfAtRDRKtE3sz86YeWmBpPaN60K358X+66NeSld+HIEXgd3zCECxzDmKPAYwa3LK9BduVAx9hevkMZmzRfLumD3fwo4XM0oXoLeNBj+8w0nF7lvDlz0IV3NEudxKO3FdiJ9TMF7XmPObw9Mjf98M95OdheEwmitM\/DlPQzF03LiM3t2MnyaAkm\/wE36RA0yXcVGaZW8Y1eJVEj0lpmfpx7dtgXRuqmAuTaMXt7s9OsDJkkwC8vZHXDpmelLzZ4\/dLvvigRBhzCW9yldK5dyPtyDk96KeGiwYX73AU2NNaf287iqEfEWC3vHKLehXP6pDawHNfE8iIsS1jzLLm6eDDANLI3h7xzo\/vZodWnotLTxoURbZHjzDpJ04UqRZzo\/9ddZ0anDW8kjrXzu9UpTgiSbbP2ftyrga5V\/AlbtqMRXhxF+eoE\/OurOI3iEQCUlBYburpXFbH2sub95fMTO2icnb1TpYkArS9+eGCTU4X72I52s7z2vh5SiqDLVB4UYifDTsqaLdlJyN9zJvXxIK2cwQ9zMi7wEz6d5YeK0stKWEDrvX20irXSVXL6jKV3QL9scdQrBClTZj+m0pKMBx9SYi2CHEFJgoBAoL7KR+hn8rIKueH1e4swjb1K6D3e+C0YThSwRLyPg897Ibo9WXRPiA6GnZp4IYn39v6XCvrLe4ZNN0kv0ZBHGDe1OQtHS5GEcU7qg0YNWo4Wl5c5DdCQxUUbGgUzND6gERm4ZsezuSqUKLmYp0tMWwa3yKpeNOPutNq5EjGR8a0yY9iWoNhsZbtWD8NVxDKaX9cySK32OoVsg54tGzjMPhuc8EfVZUhadVK1FurOgTaN+m5tdewVdBNK4XJ\/vwUakKiuYqkt54aOHC1EbaAS+wjUV7TpuqYkwDHu9LnTb2njphQZBxnyFKzuz8vl5Pi4Tozki2h\/zKrtv38r5X0Jk7WakIuUeu7a3zDrmM6olypLyGW65SCzMLt1sMlVLylEw+qxXw8Mq+xG4ADbOK5aajBoOKP1qNStJCeRPI31924WDVWsTKKGimgDPf75vq3suQ\/8PnWRv+fuAX9snimZl4V3KWdYmyKaWIywT3yfL8LrwG0vgyir4ip3nfL6yOxnVEp71u7U5rebYsAMieHnUMb\/PvzDZt7xl9ibxQmVBU0C94OwjeBjNFo8I\/WMOouXqZRw8tbQ92VGJBPXI+wvpg0V3MR\/oDp5S\/1v2uDpNJsy1CPTer0mLsowdmOUtyzKPt5p4DEHYrO46wSlk\/E1aiyL5EplQ3yZqGROJpyuslLfBChVv0izRgALT\/f8kO9QUKtPQgvxMqhWM\/c0DPA5EVKrFAM62kIbWZtnRpsIgL6SGozOkK9\/y4YtJsBnlWDL3zouAU2Zkxq5rTWiM50XoxJSEAvgL6st5DwlgYDrCDIADTe35DktFowWiRKPkpeurC3KRZV33ASfvro11KdpOlaVz1vE+7q1V+wGP9vIplqMCH44M80Y9u40YzrwGYWisd\/FDCEXXOELF1JF8EsrAfLUWCypDKZQRxx2whVVDOmV9XbDZipf+5y2AI7MkHcSDpLDQFHYx\/2Ejz1KZqPANPAyLR+XswUQ7hTemcGr6NV4xY5bKblvvfmIx5vLOz4jmeFXZcmRgOETi8zXFZlnLr4vWomnWXAt3CDhHOL2mn5cFE6t+bSZ0JYrce6k14XnP1gUrntdGVHUz86Q6TW+RO4ksDei\/TWq+C8SSbpC02VQHjz0x+GBHtcWbw+e9E8u9D8sKrZwWC6GcxceZtUEKd3uXFRYWtqdAjuDGKAT6WFOnZ5hVD6YUTvJI9QR1kVXRTDwX+yx34ACC+Sz9+v\/fF92FhWTwUpXrMgHAXHhaRH15tmLZYb0LqLa6Iw4EgoqG5Y3Jg6u4qu1n\/h+O3vdpv02YRbf6N1fd5t5JqIwl28vCAW8WXO2CVBNeMcPYUaTf3msS8aNsi\/aKIZb\/elnirUFHUbbJFEqtgC60cjoh+CAsYL5OJUJL2\/6SnEqfDBowunMv8\/fQcSOpN4pE7o03cY69+U3oqenusXtLIxOz8OGjbZ\/WZjMSwWlOigBRR1OekxHX9wEPWsH57cEz3as1PCFlI3p3D\/IDmSOEYfUdiYLEsrIrs5cysOtuLXOWpCpq9q7caSqIQMNW6a2bl3pkoAV\/Utr6DjOGS2A4vGYa+QVzop9dg6S\/llLowHajljJdDiXQJ\/PJ8Zp3SV0qIUF6H0OMIDwvSlhJCZLoh\/n3OW+1IdRhVNyIfUo2UO6zbPc1aD\/fQfS7tZk+81FibIpxXrJDruo5ZzsxKfCrE\/RrhvawZRdDDivrR1NU\/heCrvduMn57jbPD6w1tPaPy0WaUt9kh56lk3AW+iOd5Cvy2buWFYvYdEb\/HsKlwBkdKQI90tKc6ooCnM30Ryl9XhFGGPvtOMk4AP9zPsA2JXtwhWJT7Er6DJOWlwBQVDAe356GRt10zLhcUwn+YUpnaYMtj\/6y0ZVEW5zCnEhXchuHY1N6Qm4qeVwlpzvtDTT1ZFUtoUrcMIb2zC\/ztLtgrI7v9Kv3y\/4lv7kEdZueicEpXXBqFcg9KcfHiCPBUmTS8DknI\/yTZ2nz4G1znNJ+Q0tqAWisegn1U9mBekMkbHHzK2bkKmJ+Dsbl8ImbfpRAFJ0dcZGjf2a\/ZqSUvCDMWabYWtUs19Im3aTfckfyJUE+XgWS3T2teJc1\/Ox6O8bDjF5MhINdqejy109ge2IBgw335adVI62KHiVNvR8pqX8YUfMPrLeukSbGaOTqWkBBgFroF6DOxH3xvxswjgBLxW26KaviQjin0a0Gq197bwHux4MWHTo098FaiDknHnMyCLkLvZUUkMHZqvsuqTnWY7B6moX5X\/a7WeSeGMKaiFCeXy\/p9prgKVJWOhtlQtq9Dv7\/93rOK4CqIfaQr9SmYrBnzgeNFhStj2q9DyFrt94ChgQwJ22zWD+xZzmcsSHKd69\/f8ZOj8jlmy4wsUYUDVy4TdaMAJ4klJb4kx67BwDB9ssviDaTG7eZGgTNa2eo+5dzWSdp+XJHK2+d2xKpqPNta0qutZ23Gg91aHtEFHEWKnBwyk3eEv+d+MmHIPZvNBDmxra0WNp\/GFvlSH1I1R6aConSV\/agu3a60aljU\/YiiMzHPxfRviWFQSHLqRumtdgAJBhnYfRm09aP0G5IU0Yppyq73TLj9oTQr\/\/8EOw6wahrMdwp96VoUOuqdRTfjL23eaj+DF0Y6649wuF\/HL5YXKTjUWKPQvVcsjdaBPQIhV1T1Uq9+zmWjeTggso8Fes1K2REVA+AHrr8znqmK4tqr+zIDpxfHECuvnlJglfUl29l3z3lGcBTGVzfc7VMgS\/GaFOOUF\/1H\/fzXWpfg9zMuyHPkWy1UkphNe0Dxw2ZNmbjj7ZVZy+tmthGiCdzgEAvhhlGqLnYwNmbPSeOLNMxa\/DyBooxhKj3v7\/f+q02TFQKoPF1i4MBCdWRdgkCMycFno67UIogo+AGu6gNZJg9jI+vxh8iTZe8tXC+NUyGt5YUqDQ0p+sAw1jL\/nNsRAARpOubKkBKc2d72fSzYDh+LibzdcIZQHjrv0EDNFSiw5qjMoNLYlQIdm66fo46iTB6CrnG6O1dsFkc5hX9wpDhvJfIvNc\/QxEEWgAwuqqUg8H03c9KN23iwuic2EkmGEeGThZxxZT\/zXMULFi9PItc7LciOJ858seDPRxIwdICo\/tzOrGIed\/Us42HGclAHBGKe8QDBYGq6bq2qID3VKJOJtStSsRWh6MEKkvMmFYE\/ZpMRKScf9IaEHb8QozRosXLDBXVkGYkFIH1t9aejNMurdd4sB9AFPpI6ZsLJJsoiXwssqSJ4hrkw5\/BbH2xrKPymMnrSBOXrrJbffTw8aRCprE+NmIOzRYGX\/RNy4F0jwI9uVbJxhTf8Zdfm8gKJBBQIyFN6H0N9YXkuncpi2PGWdPI9cN20JWaB\/35MmKh2BY4s\/48ZU6HrLdFy2c7C53sgQ0g9KWhjYhqY4DnWw1FI9ekB+PO8c3+RwA0Rnq01592dp0dunexPWH08Zlx0ULuhqW58L6VYRWB\/SwGc5BC+NXM61ady93\/WIgiPLwdpp","iv":"486644d35ba9d57a0c52d92ad3f95c6d","s":"f3a7e8fc92964810"}

Affluent consumers saw their assets grow in 2016. Image credit: Michael Kors

Affluent consumers saw their assets grow in 2016. Image credit: Michael Kors