By Rachel Zheng

Millennials are a more diverse group than they are often given credit for. While they were raised with the Internet and have a global identity, their attitudes towards luxury differ widely from country to country.

The latest report issued by international audit firm Deloitte aims to nail down those differences. Surveying more than 1,000 consumers ages 20-30, the report uncovers the distinct luxury spending habits of the young Chinese.

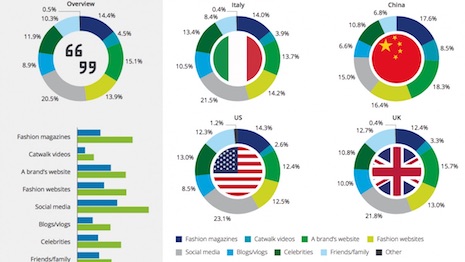

1. Chinese millennials discover trends from brand Web sites, not social media

Surprisingly, when millennials look for the latest trends, social media is the most cited channel in all countries except China.

For Chinese millennials, fashion magazines and a brand’s own Web site are the most important. It shows that even though Chinese millennials live and breathe social media, when it comes to the authority of fashion, brands and publications still hold sway.

Industry observation:

Eyeing the same crowd, ELLE China launched the print version of Super ELLE in August, after a year of experimenting with an early version in digital.

It may seem odd for a fashion magazine to go digital before print, but the CEO of ELLE China, Xiao Xue, said that the print version is essential for their strategy working with brands, which is consistent with the report conclusion.

“The value brought from social media can’t build trust and authority for brands,” she reasoned.

Even so, the social media channel cannot be negated.

“Brands now like to combine the power of both social and print instead of choosing one or another,” Ms. Xiao said in an interview with local Chinese media.

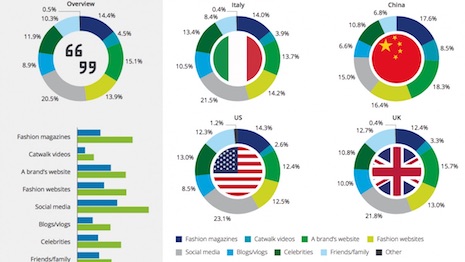

2. Chinese millennials are much more cautious, less impulsive

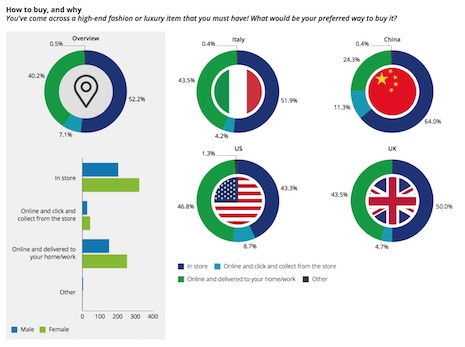

Image credit: Deloitte Bling report

Image credit: Deloitte Bling report

Many assume that fueled by the mobile shopping frenzy, the young Chinese have increasingly become more impulsive as shoppers. According to the report, the opposite is true.

When it comes to a “must-have” item, their approach is much more cautious.

Two-thirds of Chinese millennials prefer to buy in-store, which is different from their Western counterparts, who opt to make purchases online and have them delivered to their home.

It is worth noting that the “click and collect” model is only preferred by a minority of millennials, which raises the question: How economically valuable is a click-and-collect model for luxury retail?

When asked, Chinese millennials said they preferred to visit a physical store. Some of their top reasons were because it’s “an opportunity to feel/touch the product” and “to try the product.” Also noted was “the experience,” though that was one of the reasons listed last.

Industry observation:

When the young Chinese have a favorite item in mind, their experience transforms from discovery-based online searching with a final stop at the physical store to finally examine the item before making a purchase. This finding speaks to the irreplaceable status of the bricks-and-mortar store, which banks on the five-sense experience.

What brands can do here is take advantage of the first stage of a young consumer’s online exploration, investing in advertising and in communicating the availability of items in the store.

For example, to celebrate the grand opening of a new store in Hangzhou, Berluti rolled out three unique bags that were only made available for sale there, and used its online channels, namely WeChat, to build excitement and provide information.

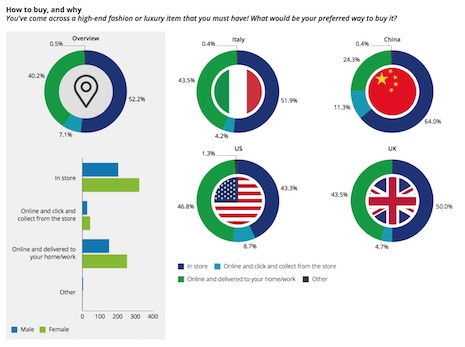

3. Chinese millennials are less likely to pay more for personalized goods and services than their Western counterparts

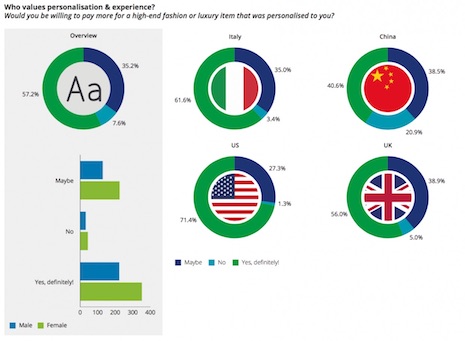

Image credit: Deloitte Bling report

Image credit: Deloitte Bling report

“Experiential luxury” and “personalization” have become recent buzzwords for luxury marketers, but the Deloitte report shows that both services are something Chinese millennials have yet to cotton to.

The young Chinese are the least likely to pay a premium price for personalized goods compared to millennials from the West. When it comes to gifting options, they are also the least likely group to favor experience-based luxury.

The report attributed this geographical difference to the maturity of the market.

Compared to the young in the United States and Europe, Chinese consumers have yet to develop a taste for paying a “premium price for goods and services that go beyond luxury products.”

Industry observation:

But this data has not stopped brands from trying. A few brands have already scratched the surface of personalization, experimenting with this concept by allowing consumers to make personalized changes to the design, features and materials on an item.

For example, Italian luxury group Tod’s initiated a global project called My Gommino, inviting customers to come to the physical store to redesign Tod’s classic Gommino loafer. Fans can choose different colors, kinds of leather and stitching.

Personalization, according to Secoo CEO Eric Chan, has the potential of going beyond “the look of the luxury product” to the full-service scale and “is likely to become a key growth engine for luxury brands this year.”

According to Mr. Chan, what is powering this unknown territory is consumer behavior data, which can help brands target more accurately and personalize their offerings.

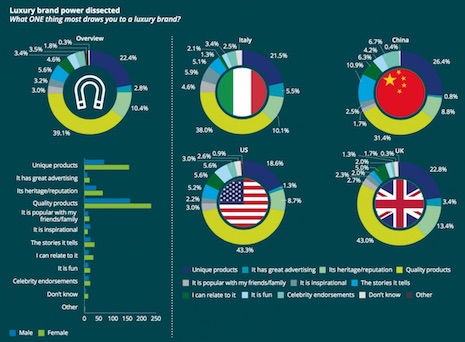

4. Quality and uniqueness are the two biggest factors that draw Chinese millennials to a luxury brand

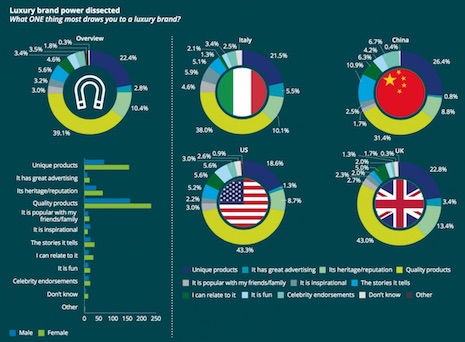

Image credit: Deloitte Bling report

Image credit: Deloitte Bling report

Quality is the No.1 listed factor that draws millennials to luxury brands across the board.

According to Deloitte, quality is the “one attribute likely to push a consumer to buy luxury when they could buy utility,” and “extensive data” from social media empowers them to judge a product’s quality.

Surprisingly, Chinese millennials ranked higher for favoring “uniqueness” when buying an item, compared to millennials in the West. They also like intangible factors such as “the stories it tells.”

Industry observation:

While brands are trying to demystify elements to sell a compelling story, a recent report by RTG consulting group offered an in-depth look.

“The young generation is really moving away from materialism to embrace [values such as] playfulness and mindfulness,” said Marc Arnold, chief strategy officer of RTG and author of the 2017 relevance report.

Mr. Arnold gave the example of Dior being the most relevant brand for Chinese millennials, because “it shifts cultural values that go beyond tradition and norms.”

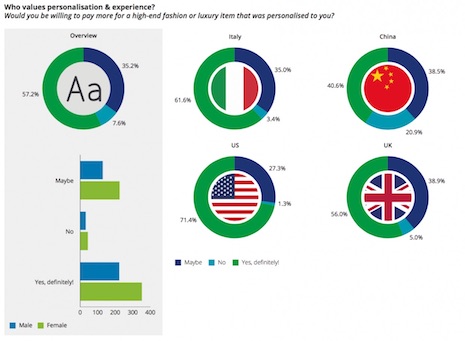

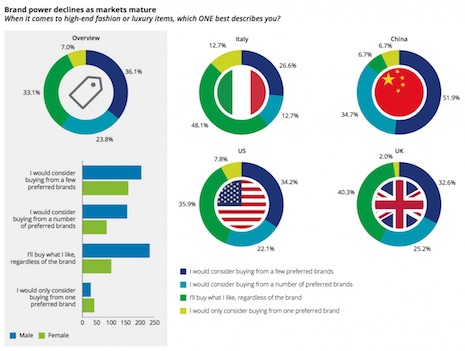

5. The Chinese are more brand loyal than Western shoppers

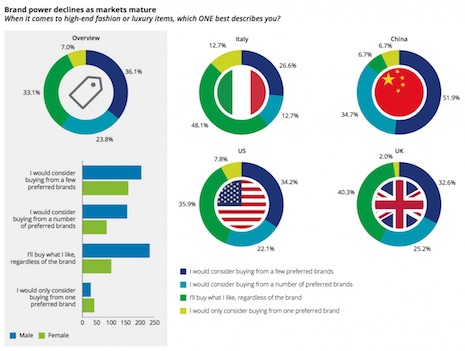

Image credit: Deloitte Bling report

Image credit: Deloitte Bling report

Another difference that arises from market maturity is brand loyalty.

According to the report, millennials in mature markets are much less brand loyal than their equivalents in China.

Somewhere between a quarter and a third of U.S. and European millennials say they buy from a few preferred brands.

In China, more than half of the millennials surveyed revealed brand loyalty.

Even more striking, Chinese millennials are the most brand loyal crowd, significantly more (17.7 percent more) than those in the U.S., which is the second-most brand-loyal country.

Industry observation:

According to the conclusion of the report, the luxury spending level of young Chinese consumers may not be as diverse as expected.

Since their choices and influence are still very authoritative, brands have plenty of room to research how they would like to be recognized, rewarded and engaged. More than 50 percent of those surveyed said they use loyalty program applications, which is an area that merits further research.

One of the brands that made headway in this area is Michael Kors. It launched a mini program recently that focused on membership services, becoming the first luxury brand to do so. Its China staff told local Chinese media that this move completes consumers’ offline journey with online care.

For example, after following the brand’s WeChat account, when consumers are shopping in the Michael Kors store, they can check shopping details in real-time from the mini-program, review the shopping experience and also get after-sale service benefits.

Please click here to download a PDF of Deloitte's report, "Bling it on: What makes a millennial spend more?"

Rachel Zheng writes for Jing Daily, the leading digital publication on luxury consumer trends in China. Reproduced with permission.

{"ct":"A0jSNRVBdDoAc0ZOMBhKRqXUOWaEVbezHb5mF0Ju+dOT2MFPa17K3mAlhUjqQWKnZAujt\/1nvAAco8a6s4lLOu9i6ja7XG3Gfv+BgQVrhFutJq0vOckBssrMmuqF6QJf+aMCnPle\/NUDiO9qSRGjtR06NX1ck2LubzyYJ64yiiHNoTLN3vQFLcLuORJShNZO1FTAsb15IVqxd9hvnOY9+QEYKEMFBPgQ2ha2ZoHdRZHHrhiG4Uwawolzny+yU29nRZZstb+1ftv1Ts2TzfSRu414MJ4HxbbOlsH03jWepLYoSe3Zb4tSy6hXTE2vLMxLrw+9fnKavPCaNESMMOf0Td79U27epItI8hIddPoiNcC7necQVRkoj9cOVlQvyspM8eokAp35xxPeo+U+W4+Heh9gGsTPTRw7bQDEop0Hx5NHILcRXsMtnJaFgspPYyUVa0Rs\/i3HpwNSrxWQnvyr2\/eL6w2R87fwdJGh5IovSd2HNfI7TsO9zc97qd6P\/oP7JqCwzU6qRU76CfdkNiBOsh2R+5wnNFgkz0AScZtR3lgUdfJZfcM205cDK0Pe3L6CffVVnyO8No2gryKt+K2CHDLFrzAeLsdcttp3R9cl\/GlHePjKdzJVw7V7ClqP\/0w+Fk2cbz9uivL\/E07hOvbtPKxwrgt6wQOjSQ3Old4vXKDjuUGPd977zq+e9g2A1IFm1yBPTPoUsyUZtT42cFtb+eEhpJevNGyanR9Ich7hGjcMAYRGcH9pEr3y1esOPgHxKQFos2r2RKxrVzmVl9U4cu4bml4eNh6j1KFk\/dGOm9A4MRPPSZ8S+UQMcMhMAz3H2RVHWsFviWP5H\/v7nWSnEFCQjOhM+\/HCNauOxztSHphg10OphoAAcJitEbyBVqEDy3Tc7qYLonREIBVGNGhWGNfJpOanjSyYQJ8cNDQOH62jW1U6oLxKoINjV\/S\/haibwsUuOc7kKbbU586sLMgWEAxXYPIrtqV+0LYfJ3D2SUmfom01QezpEbfiV5z4XzV4vsGyjzqkT1W5v6FT1ljZdNoxAcP9+9jOAeuBeS5+9Wlm5mJF3vrkdsStyOhLD1vpMgBGaTSJ6juN5gRrMZF6M1+\/FtAe\/NSLriAFTfjIiF8uUEr73umBY5hgqx4g5TKoHicc+2SlHTUtzD7CzlnQ2AXUuzo12CoDBPkwIs18j1k4tEvD8FA8RGPhlSbzX96koX+4NX8flxpSGF1TPQCBmy6xmY0jdy3VPtx5\/98\/cgkVn9x3RAcuv1RGes1eVSP3akIpxNgeISfKDQzPboqH+LvRvsGq7EbqeL11IusXElT8BpH\/\/dYkDm+q7apnQcIGHKcQvvHiFRdGAkbWwNRmq0tihtxAvf2ouSKj9J+0benek34TQr01DiK7CP6HHzgrSZc5JycFM\/6wbG7OvbZZn6uy42yVrxl7Tzd4g8SG3rOe+HYhWpcIBIpm5nnSlkDdKrqRqdTkgXh83BvGWkyz48W7tKjFouZYevdfIPRgc8GysitAqzFB5XZ3YjBnKQqP0Y0sbzQBI95jbqoDzBvQg\/gIiGla\/NJctkO9FHhBdLhCNsMuXQ1qN7cFZ0ahrVyrR1s9+COLmJIOshH+LZMIo0XjuuM8glBL6AKjBb2jj1NZuzqWiHjs5v5iaWNB+InnM2ll8oA1LjTbUr91cicn+p6DPaoMK8uMhuW4\/HGhRhf5ZV74rEeZ5vD01RWeIaxMfJWw8\/xQW42J7D4REbTT3p6oyLMQKGxfY7a2fP35XHRhSrEnORE0+q2tvWlkoogw4Yc5xoND4k5qU4L8rSxjk2g8pPSJQVBM0ZQja4F3eTsEpK92dtPHABQavNu9sDqF6BuKk3Q0YbOLFO0GUQYPsGqeF\/rHjBrwzcJx\/YNLf+OGuufbUyDLKYx21uexK8fIUg2sUzEo1DsvLoGoXLkGOD7KkKYtSSDyisvBCQs1sqWbYti\/gSkVYwFQqGQZOEilEbzrQuIWeWsJmLvSHlyE28C7Vjso9eD7VUvsf4GSsmcvfjFH7VTvO1kHQbmxw9syIAISKI3yw3syWFOu+rgKGC\/r42sknXcdlNUEFI3qjKSDaRjsNeYEeg7eT1Ag6oiphvoJ4T6fLzsd58baPq95S6dwirV2gWxZRhWo7Q1NJiCPZDAmH8MRWF4i5sLDz5LLUVVkRij0yNcOF9Bv3m0HCUSLOjbKEPzSx9tcUB5UvK7lhBjB+AovN6Rdc0dci6SqHYbqnGN1TfHNuUIXFjcjBSx6XQUFik6cahNcN4FPsUZNL89UwOwKDHlvLoh0JxBOaruTcdozX977Kacn\/PrDjJ3TImkbV2eFl7\/ru0dFbyXo7p5kh8iNYFHHJ22oZumiH1IEjgqzzDh2euUv6wReYuoo7lgUcWFZ2gfiYC9Z74rd8DzsB5LRTuV5JqOEvLLoVqwemXtWvIGxMojRNVzBb2cY8Iy81Fl3NtTshRQsn85fZu9Epo\/Q0jmY889ZUBeE7pJP6mXMU\/65tjoKJ6UND\/3Zg3BYMHdTKPt3izd6Slu4Vv+aCDqyet7pQVtyDgtoGL6gcRGKzHGQtvkyUN5wp\/43wbdwBvzvFMGIaQSeSdCS308XY1D0IIUQ91piJn\/nZVq8FzgOMf2uWOUUWZZhPeTrZzylTFSImBznXuRXRZHXWRDU4FYBcCtbUXMh672kmWk2tXID79d40cOqSg86gawDGtJWwvqExyoxYYyDYkK+2PCzZV\/PY+DMhPBBK+fMHKykQ6+aYnd7b9w8lsSr\/AJAvPEiz7upBUPHpSf04WdRZXcQOCLUEq0IuXdQNYIQoawi1yKGE5KcVNFF9c4X2rlKl2sA4CZ+Gp673WVQl+KjWfjuV60TYnuJAWxmswh9eC67pNugKmiz7G3PxvPW6H+\/yEfHU3C\/ZW95K3NLf2QsadhGbOnss4GwCPmEr28LzJQbbqZwXtjMW4mOU1KFSo63nEReBPB4u\/KI78r3Jfk\/Ez\/sv5wy6SdqKA06J02sArRDtG5iX4lMJydXaj\/Oh\/L++xKmuwaesj2bK3n3JBmTknKR6d8jOfxaZr43xubqqxComen24giz9u7+E71FTzlhqSUXLc4\/cSRXC9TX6kLl0FA5Ss9TebyOSZq0e5T4Ru8zCDdQwbH6ydwOyEwFRGcDY\/+DGBZJEiiPP33Hg7Q7t+wLjEyIFazsIl6fkrvd+9nyjoEOFv6aN1iq3fAyq531vaD\/IEnA+FF2sIJBkUe+iq4o5szis6lGPnut203s4uDW0\/k8K5P2acx5vXpxczyABcyrx+hALa1Ph5XD16aKJGqDKcVjIUbjddQkpHQeU2xN4j0n\/2Pq\/ET8\/QUXESJGOldJ8pz6xqK8iThJlflwl2k\/fjVfAAHu5jKv8bOXa1I4u6FO6CVWiyZPIx1X7oIEJ4Mm40mo1IPMd100vXzdUiLxUcUsb7l48onDB1YZTIhc84CuA4hF5dyBbnswLc3XHSVLbATsKDMdVB3X2AWqezYt6QlfYRkakTQnFflLVE9LPqAq3ptzVPpBzcaiKLDe7VclLYDxfp2x+7pagm0awM2J31vqIJNsZa9nrfxX0R\/kyRZYSDcV5vzK\/DUvOml+OnUPTFpLefbrPEialxpLfKSlgcDGSnAwGXCvbXHE\/mVsIURyO1POc+MO3bhrpS5dY4C6DZc5Sd98LJSyeaBw8L8bUOvlYhNDdgZLbbTek++LDfshza8ce773obYJrDdBiTJ470m6qspbRHdi\/MD9B84lkT4zsrRbSqYaLDZx1u6fVId7L3bP2QZyAcagM+7x+SN7RBCE63waGrk1SXVsi6o3+cDuZQJkIBgMus\/FC1oKMKZBa6WjLj9jePPSwPE0Jf0WUxba295XcSsTmupb6HpN2r\/TIaYTI5fceD7js0JBOyOsB29IDaORlh2LwGBa+cX\/gDSi9MsWZzOvEa4l8mGb3gUm3Wo9DsqspTMHOxLA7b0RD3vITsLzu8UjE+ie1gNMphTJCz0Q1NxP6dD3L7q+yWlJmclYZRCyEIOhzWn6KXwih6KP0MgBYwKfJpoBiVfIGrVrFuDyqZQXQ5vB7IzSlhue4LphOZAD0MKjYod489ptzWntFTbpmGzrUGnMp1keSa21J69Sabgy4eTjLMQsaKZsSrAQRceYeUBixwSRfoqQGoxLIgwQki7YAN13eMekgth4Bdbfv8Z3MEd0DZlwX9\/KhtTfvFgBNfYetdX3p\/U1xvxxGMJhJRQysmZhoTNt1ULs+6b7S5GWovsYG9c77R9A+01EVsIy8V\/J0ldgmeKw3VX65ykm4L12OhZiaqpgH2QGiWGhd86\/9IgPC0ZUUEisZSwVGwYpUYwNHrusK6plfmmiSlGTR3\/ltLB0QfvyU663+9z4ZIriuP5I7b+sAwDai1dJgKBwmYVSsFRCRMevVZgEscbIikKLDmSwg0c88ZbxC4koWQz\/KUkF1+Dnza3nFdpmhTP4DymtzSMe4f9IQzdaQ78ncd4r2rfUMtKt4KoG0eBj\/8oE9ILIU1HDLx58bm1HoORuDrZpR2CfMnv81d8GGr0rGYONxiwAMjp+9ezyw\/hQlg\/0eyTOLFuwmt8Zg92hobdN6RhNPVkeXm\/PpOERK645Npz754Hkg1NYFm4dWGZe5ZpxUEpoX4pjOYyXeqf5i8FyKtZyyuFsKUC5cfNLDP5wWjEa1mPijKtG\/Jwcl3qp\/fSAVb3unMwi9O9Vkw5znUz4f2clgM\/uidxtE1eNCn15d2gkHdcDwdNIf5PkNwB5PbBns\/xbmXJLaIylNekSn8OtUBWzzDUCpO3rH4Lau0hRGgG5xbNAw9KaipGZgjnVJqbFUZAhVJDdYrC6UIdYOcs8wheYak\/jFC7EkP2Oi2nvYV8P2V9IXT2j8+lanXc9Uw5\/DsmNoIwLZFYo6jz6mDT7PDZZl+UuBfsKnbKD2DIvix9RD8gWQmBh0hKXn2DTMcrnHOetgYemfIDX4PiMbxt+Tld8Ue57cuqVeR8tVUsEdXGXBqUv7u1mP3wVcuFxxcxOmqiP8dM7glUy4tQ4SiQcvEvu0QTPImxV8jaknuZsXX\/jJHEjpOg0Te\/bbwEgaIeUoHwO5jbzgqq67I5uEx9ScCHl8K7YNR2O6X0HaWoeLvH79lhncP1WG2eYwWH4wTwRkG9s8UtkZCnHuqVX4Wjkg28AuBvZiiUxYF2kxwAld6hNvx2A3sTxUZp9gHD4WxiJU\/GFhLt1n2fVe2CWM+M+KsEdq\/L94sb4iJiyjv69+JXn5hXekOXQ6eFKSuTbf0IWXzGE072W9AWgCRSu7nILdhw0RSUfvaJjDk5tGnpWAJ10+NAeuSIs+IJD50OBTvuzEGDidiICDHtCXsy7VylgL0gebelCJPQADQ0nHhnPORJ7+4nxfohBwMeaYiFIy99P93S11N4kV6pn51Wpax1GcaowTQArjRs4jRcU9NZ5yOm8F8wnD0cI\/1+I+X\/b8xOHdQXQkgvQYPzoTQxUnbMh9iXQ0\/p\/KeuQrXI9b+lOm9fSsd2d\/YETMIOslB8F2fosx5nYUsPkbd3aX2JJ619112K\/ZMp6AtZTcRQgLse9zaVla3a8QzM3Wd3pXA5aNkgbw6QDgM6QX5IKQZT8KVIoxV\/1g32\/3u6Cy5KP1b4hoPuJ8ldh9AqkL0exQ+5ITuSPFLXJmawmznhR4lnKR8z7IiMqqxEpxBxMQque5pOpDTmGTLU6e6ShcE5Ii5v6yeQxbGY8i5EbqwffKVU0KbvApLaYAG2uzuf+jH\/W5NBy5BM9n+euHnsJvx8Urnm8uqCdvEQxEZ+pKM6MsAUyGzKLI+ecBGiTHfu5U0wPwREciIhlI8xyZA6MqhDdYUcnqNhDEpWVmYtkeK5qN5MpPO82oGCfG7drLUj3vwPnuniqmPp9kI4G1Jw0sMlFyOyInhm6p9V8JNQE9lWyU\/lCrqnpVzTlNjw++7rglyvwowDYkjS8LS+vTyF+7c2VoTv12FskLluEaHdHWNOlbzJBNWblq4IgxSQyLCQsycvjo925pHZ32f\/X\/baRukpGjPqhO9yy8vEd\/Jo617lkjne3ChztCHcrldhqoh31g\/ZV4NVp9Hr6LgOLaLH4oxjbl6xfRzWqZ4g1F\/AohgZzfX8+MkGuHyfOjAE8At6ziRD4XkqvGbLCZmUoBTm\/YEiPjDDmJrLESb30VrXp5L+h2Yr2JazpuACOXAsEOWPADrTEfFkYJEEVZRaF+SdL7Y2jTtIh3UO6e2FotRW\/IzfECGYJ8GlDAD22FtVUvyPi+dIIX5TI2wn4TLY2fx6jdQpb4sB9s9+Yg2iNHf0Ty34ayLVVdOam5heyg0DnO+BcC7t6W3WJkFc8v0hwmD1pgE3jcn0zr37Cm1ohYuWleh++TDYbUoCR7ALdo3Y\/9Og4ambY8n7RHGY08RD8ZZrgZV0rI9inAJxzrK+k5poZBOU4O7VXLg1ioepZZ8e2eJ5bxTxFvAYAogoIcRNwJL5uTtD36MZpvSxKTvK+2xyVMOMBnMU2kDwFJZrYopy35bqHgJKb1YBbDgpL1vVxG1je2IZTzEa0z+66UB02vtFR\/iJ4wOqRyUM8k15Z1k7CyXfaEqfT3QQm7NCYotC7JC8T+2zuEwOQs+JdFdrUgvL3I1doOGp\/tArs8FyS2ZRqh4X8U9thVKl+1LMzs5DwALEQNll81jWeU3PDQD2TTqjOVQnMFfhUj2zu5SRUMb6jh9h4Rco0qI10ZiUm3DTXNAThOj9sju1wJhvjrZ6k8L5IhmE7uo5gpLtp69bgbV4Q6Q22mryUJWFlt8SOJ7R+VqTxxoz0oqpL+0HXOPzWxZ23YQs+ebNP8KzjIl98X2FOJTzUn3Pxr0MYcx4s7kbrO2tK\/pgV\/77KNI19RFRZP8G9k1TxPMIqFFHrTkRsxnjTd6Jb9WJvo91UWOAA+LancOajBS24X4bh7QKNKICheXygN611ZFihzoUM4\/0P\/KAE4JkZysn2+Pw2j1VWCyWwmZKc\/EDf8yiSnCyWpp3U8DyGNBpeRNNRrnapbGth1RTcYc3FK177yrUzofN7jFquxx\/ZpUgtvVH6iVDQ6igU+QoaAtwJy+M1hWaCaiWdDZ88sZiOy9zluiQFMuXVs6K3OfiKjoLlXSubhXaFhY+ogorpNy38c1CqvpZgyRYiULDhR060jahYkIsTdmHM7NubkM6ViNBPPmLdjro22azAZjH+UH+IenPrXs1SjBAEF\/nMsWfeevXkiXzl+WSjO6VHInFQVnkJPe3Z0KET2RtfLSQO1tEADy8\/slaT5gsL3qDas5imbr7lrdPopwurVh5BZOaAVwfLQC5Xb38w1IHNctYB6NBNjzaBa9bTCgllMtABvU02GVBRRAERaPFNN1xAbKqN12Hb\/2ABeCgiZ1w\/qSInE0kk+uLR63ERNgcqfdeDaYkyOA3m6cknYbmTDsF5X2eO\/gggr94vt9O3UOTq836lX4GwjDED+NjlcGCJW1VDqqM8ccoHz9gStf9icsYZel\/OWJN8KzKjtfZWKKazopmA0e\/xQsZnrKHEHZUp5D2EUHU4zldkKJ+bBsUoRh1O30I0QSbPTNoNZtFYH1rGZXYVaYHpc5sTyNMWGdL5E17SzTQcM\/Nuv1gfIt+xdmrbyEJv+wSoUF0wLt21hJykrZP7yqN7tsRjUkWtmhas5IyWZiz1Z6MwDhvLLIxjY5YMaDHxAFLUPe12gk8GOr6jIW8LjrcphUhHumBV3WQ3JF1O3veXGddTBTBS5XVxDx0yQWuB2Azb\/2cAPeM2Gc4ighh3lLY6ES8LfI35YVbxL39lsSFLh2osn\/jqGIOQ0bgZmINZcUS6gTHs7ZngQ0LUcHEBc6l7hMFdLe1aT9jZ9th\/MlToTdjAhqS6cpnvtJ2KYiU7HTKNKvoD4EmM\/lb2KzI4haUpI4hFhipUzM6f+QcBIZV+70qSnvkCMLPy6aneFPQxM5CSUVkQXqmD2Y55tC8MZi\/IyGycy1EYEZf1+R7cH\/q6vgbJAf23B8U+bZlE0AfaZ+es24\/eIVM780CI+VNQWlAS2oZwk2\/ptPcomi4nHFC7QeYt5pzqjKE5gF7Aw8qiGX\/S3TqB2cJUC\/g8m61VsnT3TnHkNbG1Y\/GeYkWxTUzXI2rX433IUPoOnSuULQj6lHShSLaQ9fjlkeN2W9O2zlXZGzJn1IZrWAGLtC\/xsKrUQAirBi4OBiFC9RssoGEGItEUGRS3J8PAnAO10oX8axhxOJqWk4dWYco1Cka+NbIKVmP\/yjsV4QfSd\/EFZRwvqvYdghncW9N3yCfQ3Ahvj0v3aHeWlt9a9T4WFFaBqOegYP1UU5aUtez5+joBy6i6NNZppTOJhyOqlP9Zi5ufdlDBTrhW+wa4LQOWWvlkiYJ\/EeCXDq2FNmj5FduDg04++FLr9Xy1Uyem3zvj8Px0pGqOCPPy8F5oG\/ahbJJMKci3MZaSNuvixzXPAdFtb\/wcApuHofrCXcMml68aCv3NZuPPsa8\/nycWo53hWnOkbFrGdkVkIh+769f3YzThfjnm+VV9S5Yngpb+V1jDmFAYSp+SaxHBw\/h1wBq3cuc3qAWrR9d08SmU1ngVuYL11ry3MhXA8k8mEq90Y6U3UJ8a8HF7j2ekzGTgKq\/p7HyeUwMMiCCu7bYFRQNMti2ynPi6acxdM6exFWLNw6ze2wauhwlUhvVF9b1zzwMPgpymKdJHT8YfL7OHF5XHCTFHV4xjSKwVacaNaYWCS91Dw0jAAYglHfdj3rHkTX8Gss9jfRwIW9zhY2Mo58BXu1jUZlSNTuymLS6xVhuVZDHUuOJn0OsBLbiRkGoilJfw+jYSXpPK41FOluxelzfreVFK0GZLmTTkqWzgRPid51Y16wr9mpo2mrKogqVGP8ZB\/yNMb2ZZ5xUrVCfkiTl5eYpuHCha\/GNAOqc6jgYJvT0xv\/hCYqyqqn6dt3YygJOwF7j1omM8EoUL76FpeuPy22dDxw3Oer+qvgh25W5Rs47RxhoYbnPpjuDynGd+t+alihiVCfM2+EdgMjK1u6DG0Cb9i4tW+\/T0uO4YCsruIjXjMQzOFkL2KxjwK2ZDX1hlmzJ7nvKg5LjovcvZJH6Ajp9GsK3zh5CVBb2dxKCpfaLd6B1O5Gl0WlzgbBHOJFG1Yj6gVO\/v6FYYRhJuGnaldRgPksaUy5MQrswi39QpvIM7KnhNxfKMjxEnzpuCUrJuI4IeFU6J5mHl6BksD+GHgws+AibHNbtY943tSFjDZmWI8WMx2ahZPBgtipKBYhH5fFuR6qmiY1YappIEQb91PjAgCHUE1mAfTty52LFAdWi5VPr1ACyf2EFQN0LV0SBM5vYo8w7lEvk27A3PS21YPmxJxitMrX7xRDIHSzoTwxIFyXUbz1njLrlkwAS24wmyRD0mC7TmDAVNkdTyQj5ILKhOoqcsl4NZZxpf2iPVjuCCPaYWpm\/O4ntvc0JcOW0+WPf8+FpJYk6rOD3zJWPU9tmyfZAcqjc13mis3ppWLDVTV2m6cDXT1QYgOJsq0cYsCtXhZFrXlVzzpjd1WKgKpYMO5XWQVL072BVJD\/+C\/c8ePYzHpwyYCsLLF4jyf8kPPozHF7WHWoYG\/h6zcECwQDxJt5cRD7uZSGkOsr3qLGpndvJmIiFVnxmgXhHNvkOqf63NbQsx7+oces5JzvGSuE2j6UolqJgkV1bfetFjLlK4rBgrUCfXgdcay7IDF3FzhxUcJGeAuL6JhjrjI6kymQMwcW0GET834Yu1Ov3yz3CK10S301OPcojFMtaxm1m8ReXU8Q5G26Eyd5e6AQG8tqj3nSA03\/PgcglqKElZjQZtlTvJiwf78c7L09LPNxnLEnTU06KhrLoGU+LvguGzppdMUPi3mubHRWfBE7O3yKtRUA1bcePbcxD0ms+06O0Fg1h1QFPW9pVwTXYpfehBy\/htsbuojnG+zN16skF4G3g91ZnBx7NqyyT3QqNRDx9pEkUTzz1ugKWa666Ma1fCqXvBAbXp1HVzYfryIQmwssvWn3GEXYnnAP5WRTEH4nER6xEJjn4Qs\/9krmztFzrgB4KSAhWWSsEHv2nuWGvAXbuUp\/YxGwYh88GOuHQpPg7LZ7zeQ5UKfZR7U9R3MWmKEK77XwApFUP4mK+xpzDbeKI09fn9xFv6LvrRd1w9S8Xm131DOCmONPWBZCkAjd3MNM1rsouocHf9cfvtOV4BgiB45917aWWgfOIDGJ16rHeWsoUQ14aE5ZvMwy7oehexRC1fTPa2vCAc2e1tqXlcrrgpV+7fjw4HfhKVaBNGmkSr4kD0KYOgSyF7rBp\/ab+Q8Q4J8dYaPKFrfsAnXR9oSShF\/XCEGTpiXiHkCWd\/9AZzWP4VEwomfML\/2tUWZy94K1zHOMZokPd7Sw6fN8KQdUD66Bw2RikohBWo6pOksg1nrT\/aVTLFRpJ8SN1RAWd+sXgtKtSIdE2nPeoeN\/m1zk2dSi6E6udoTyjnCNNy0n34Y8aEfkMg75eCF2VMtrpHtTfa4FnQ\/y21zpNH3nTbiGMuMSq\/CueBSBAZX6JaYfDPBaZsIAtA4yZqwMjm5sVsbqmRGS+\/x2LBUwezRu\/RBFN06oH0hHiW1l3XWI30AcroUL+7vejfVFM18mMU2U6P+0YNLH+CoN+Q\/3vvLEASz9Q36PUhrWUq24cg9FuzMjZfjDQD3Zqs9BfvkopaO4L3ox1dmctFIghG0seJVtQSGKCcXuDVNgqw3J0hpdmZXB32QwSbU77cg1FCHJoM1YEDdQW219NKOShwwK54HysXDAPbUgroeCBi4EhuPgJFIgjxc91n3z6lEMt0U8QU73ymsC85SOXvYIhWWgB33QEiAw5pEdROK0nhtoAS3iR\/hhKprnU+qUaJJtA7UTJAYq0tg\/xbTMu\/27ObYiDyWr2aKmG1AgvzfuQvKNPwh8\/LStnXpeWo1ovQ+cIMBOvC6i0+2DWbcTQQsXIKjgmniJKp6Gs\/BOBpRraGhoEX1pZ\/Ai9frlYJ7MZ0oqI+SS7x1EQ4Mh3Q3Mu9nLHyIkiF7XVaxle9QMqZvO0gBOWgyxkTr0cXreIKP+D5a2TYdN41L7jHEQ97ncceXS3+OXAxw6srUv5MFtMz5D3P8iQRwgerXMQ\/bOKfTuSrqH94pO4hg8SSZl5N0zAyn0y5TBUFUOub7k1KEVMz3GtFxeaLH0JAm1klFyOGnf7U14GUzK0Pa5PnO6ADlFwj\/0pqfeDcA3b7XFHAeBc\/5UmLOFspELTwKlGcok7pVWMuJIzjfoFiU0PeeKvoXI4XJzryhaq2E7TGsl+OvRyQRfbDNC7Zf1GW9wd+\/Hnz1398Q36MGdFk\/bmmftTBLjW29AGgQqkJj1ctXWijchK6igABxMPks+4db6jU2gjNR0UPvBJanI2WO6vBYFRd545LmC8d+VdPb8GCQBcW3QnU0NdAPXp2l\/vKHqAGk4xa5Rm8iZonRMyESmeHzNlUXuXb3Y2mVkggtuYYeMseV0gvy\/ftv1DWRDzHH1+Dlhyl1qsKzlNyj\/NRfxBFdYYjzHM4RfK3iHdg732tRsS5J\/qjUbzsk87F\/+DMX0RGtG5qEOUvkt1o9n+ZftH9X9me+5nKhdvXDcGzgeJT8mmRniRBK52WXZmX09yT0SdorNkaPLEyPrrpJVp+aP0tu9ACgLo8ZekIKQkm7xyVAp20pkoOKN\/45wju5ZMr05L9dU8LORV8VTZR53L8IFlwkJrz3+tj6tsgleQ\/rPmQB1w6P5TWes\/Ji6Sx4W0h59zeJX1WaqcOvB8KLkSzutVQ\/FeMb6YazMGvp1f6Pe4YHnmtBByc6EU3MeHNSa+ay7WOgg7n2APStdLo1Jyn66bQhoQEBzlsmFTCowB\/SMk\/CXh1MyPE0\/Nb9qLQoXv2m7zJ+MrzkRv\/uNuZLEiLmMKkX+gQ6PWq1KiDFsB+KVaEVZWNNUD5ZjkUgaOG50eTzmnb5pXeD9ruaWKZ9hJxQt\/ix5ItfDAwEqnCy72sIYs6Sf0QcuCu3d\/qaFHcOkwYgBu6W9ouJfc8DzoBVJiJVIREclMzpJn2lJuCq4Lid3wTRVmwgkbWv0uOevOmm2\/jyzCRrH2YdvfV5BkyZYnZh5cBSy5CZo4ayjrehai0EG1pKdrZMRxMuRCVp+0Uxe5MY2aG8voRaN\/oE8ERunQtXzFX4Y6NsWJcmcrBNpN+ROxCSMlHctvXPjVcxoaH6y01C5S9neulS41ROr81ggBBTCARc7DoWEdSIVfkW8wf0AoXMOmQKDJhTn3buYA0uto\/xyOb+J+EpfbzQTd42CTIVD1lz613Hk6TAqaoAW2BCFM06v\/oduuMhiIB\/5EHJFvMAoHhgL2ziWx1pix8oa\/iOYRoHv5T7ZbW+uk8sRPO6u4vq1q7iXozbTF1age0h34IO1UlFiPPlA3AxqnwMi7ZdJCMfaBAseDPhisYkuHXbQCCSJQWWX\/hIQmkD6H74g5vZ7Cy8EOvtAKl+fVmQAde41bKiOCysBd9wt6GDxB21pD3b6Nbmu7MCpTbHRL9KRydiN0Zmvj0tq3HHKPgdy\/T6DrdxO+9akij6yMx7ckdclYfiIc8S1Y22zy+tP68G4uaH\/Xa5LZfQHptdqjCm4+CcMMP9nUr6SjNMUY3LgbDAw6x9hk+Oufe3jrdRLKUi8Mv1hRm+VwrRnFOj9S6IUhx3xlODhpHxkjfrQPeIAf1u30HFbo5gZRqytbNG+xJ8JhsFmGixfhnmsBT5npRHtCZaiQpfoALA3jynT\/Mk3TM41FrACYYii2EY26p0jDN5+P0+yQQAqs6bXkywhaOpY0FRavEMav9olbt9gYQDvYgYFIl7Jcj5z32\/+9o6bOBKxeOkgH\/UDj93e1CNb\/D4ytnJzdRo7zyGwqYaEv0NCA3oDp9mNIoMN68AxvKP86Ye6Q5UQmm24Y1HZ94n9UVmjIwKoLBkDS9sFAIuCrip5jLlKpQFgXnnk81gKuwNRj5SglxMxUIyfgXpmikZg8H7QBndL684RcfWGHD1\/XZXNzrSEX1ALVivPdI8N6gjAUdw46yQA\/RCWo6P0x+GqNxTHR9wwjOyOAXoYvAjGJhn4XzMZoFW2CUfKrUaRGueGTnx4vORiUFJbP+y8qx5PzE6rOiS2+UZi1\/SI9JXekhLPJArwds5WYhr0l1zUjCYazJthqmC\/NTqJTGmqD8dE+ysXTD+yjE8kyjPIkGehiatSUrL0N6t8+rrnRXLsBSJ6BY4INoA5OG7nAlwk2tJcgOs+kGFJnirPFXwYWULWSh841LbRoM7McmWnQ9Hj78cbZSSry84gppb+lKMxVdTm5agyvYOwXgAmymm9nisZuC7a5SUpzUwOm9dT+sBj8BR5vzXqFeSyUV5uTncXasCbCHjm2zyqjbM\/t0efmTYJgJ0mGpr1TiC9p37TF3CLfK+zYeHa54bgepRdxuvtXO7jtsLC5vB9yelhhj4n8M+4X\/VOIF06U54JjbMIg9Y20Hu+nBnUDjBSbVqQ0LAawskjNHHb\/OYpTdtOIQcuCzK7faEP17T0XmqBdJJtjFhZR7CIBwjismNphdO51oNeCwBfK2w1tHbmsY3cSkGHdJegE26EaM1ge6lYioVVjuMpSXmi8paFWMOc3KDsLjr6v3ktZRiDJcfO8dUTAIfK7Diyq+yMf1p0SI3N8EsnVWC3Lw59kxux1BLi+OmiqWOGKL14nW4MO11y4baQ8EkhrCUDiitOd7bYZKU8s6WhiPaT+zwHnPAZ9cFdgky1RL4rgdfdqlliPMCi5hANzPtyTKXivQ9w7AIAuReZg+5asbCJRixvnUHj75ZoB73YMWgVMZpbxL6sJY4j3z2l4krvdmyBh5fkETj\/b+ehek2I0F+6SQs0D6XZ7Z6tVTPVCSZNWNhtpFDa8PLqPZ2d\/N\/+4PCfJF5TzOgF4MweaqHlYopb6unltTSR97FYBRvuYud\/9Jwv5GES4nybfO1RpsuynkRKmbUqRkP4fZFzyZrU6C+V3TtZzgkfI9uA4BZVINgl33UEuYTMzAmz7OxFITItT3gOI2aBs\/Pm8E9oe6oNvWWo2mOsRVkrb0MLObnsO0p+LsmEvA6FyUb\/czTGercjfojlSSaywjm0VXK6O9K5qCcoERTIbRUtTevYjaWbWiIxGgMGwVEgXgD4qBEzEenE9HIY6jzVFFaEPmU315gZbr0TdAZWuThjXdutDGxUevFFQFXnJhIobbdl5DR5zNYbmfMoQVNNoAiL7qmVkygy7VqUoCsZFXM2sXWMC3tlTxYcD+lOwFOrVe+bTIVBP1BpXyKEjcrYJxkQnzM0QNbkJZqSslaBrM7QYxxC7AZiLJiWQe92\/jRKoQjME1ZhLKyCkUFYvPQ8227uorAlTGZaKlFJm8b3X36x1NGstZsi3he7pIOX\/THUUIQnu4kuQ7NCPMAarZOkKLZ6NLqriDzwPrIhiWED290byN1mPXqb4j7f3FexslbxYTSP981iZEBG+W8UiEMAJANRHs7w77nGJVhu3fLGsVdN73jbYyZvpimBBArW\/MZw7G3GpqYQeHZJJ4NDuy6ZdgzERsBjWTJstWfE3w0y53R\/Eh\/whix7\/JmRNNssOs+JnbfFvfeb\/gVJioSQmH2Eq0vT5H7PyM5xoymfIU\/2wW67Ldez5B2MMnHzDo\/ueSt8RiENjmDTrBX8gqe9iLoZzXA6a2qZEnso5A3qxDVvKGvB2BNFE9BtL2e2KHweEsV305fLUC3EK1ZHcSnN2iBM6x+FfRyqtRTMHOUhK5Hhd0v7\/ejJnk6+DaipiLfoB7kdIrV1YAzN8C7iYqGulAZIfOjfWEU\/YLO9lVxSjatkwO5hK2J2GnLwXKJ0dR9waAU1Rk4iHVM7seFzHnRvR60ig5wistdBab4FztI+zOTZ4NQxHWjTkPLiFUaUWPUAHXLDg+BgoMAhwQHzv0MAe8TxDQ8GTV8PlWsx+2vkMT5ME\/Jmq58zje5lnWet5m9f2GzwXmLyCM90abRXS5M\/rljQA0H+oDwU0=","iv":"d39cd451ecf6c9d51cb9fcc69cdb6977","s":"5a0f6109f982e61e"}

A result on the survey question "How do you find out about the latest high-end fashion or luxury item trends?" Image credit: Deloitte Bling report

A result on the survey question "How do you find out about the latest high-end fashion or luxury item trends?" Image credit: Deloitte Bling report

Image credit: Deloitte Bling report

Image credit: Deloitte Bling report Image credit: Deloitte Bling report

Image credit: Deloitte Bling report Image credit: Deloitte Bling report

Image credit: Deloitte Bling report Image credit: Deloitte Bling report

Image credit: Deloitte Bling report