In the last two years, France’s luxury real estate market has seen a noticeable turnaround, with prime real estate prices going up by 12 percent in 2017.

Much of this can be attributed to “L’effet Macron,” the feeling of optimism among the wealthy elite in the country after the election of President Emmanuel Macron, as reported in Knight Frank’s new France Insight 2018 report. The report found that France’s turnaround is driven largely by international buyers from around the E.U.

“France and its rich cultural tapestry remains an attractive and compelling investment and lifestyle choice,” said Mark Harvey, head of European sales at Knight Frank, London.

Banner year

France has always been one of the biggest luxury real estate markets. Locales from the bustling urban center of Paris to the scenic countryside of the south of France have made it a popular destination for the wealthy both in France and from outside of it.

But after a period of slow growth, the country’s prime real estate market looked to be in a slump. However, since the election of Mr. Macron, Knight Frank has observed a noticeable upswing in French luxury real estate.

Paris' wealth concentration. Image credit: Knight Frank

Buyers from outside of France continue to be a major source of revenue for luxury real estate in the nation. One in every four prime real estate sales over the last two years has been from British buyers.

Paris had the largest growth of any area in France, with an influx of new luxury home buyers during the past 24 months. Outside of Paris, the Côte d’Azur and the Alps have both seen a major increase in purchases of luxury homes.

2017 was a record year for France with more than 1 million properties changing hands in the course of the year. Thanks to low interest rates, high prices for luxury homes and political stability, Knight Frank expects France to have a prosperous 2018 as well.

European competition

British interest in luxury homes in France comes as no surprise. While France may be enjoying a time of political stability, Brexit has left the U.K. a much more complicated market.

Prices for prime country houses in the U.K. rose by almost half a percent in the first quarter of 2018, reversing a drop that occurred at the end of last year, according to a report from Knight Frank.

The overall market for country houses in the U.K. has been affected by supply and demand issues, Knight Frank says. Much of this can be attributed to uncertainty over Brexit, which has made estimating the supply of luxury houses in the British country difficult (see story).

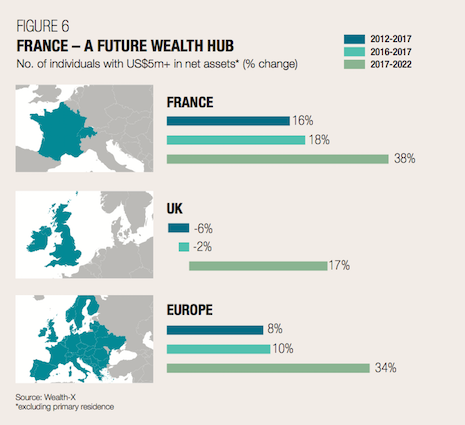

Tips from Knight Frank. Image credit: Knight Frank

With so many luxury apartments sitting vacant, another report from Knight Frank showed that there is a continual increase in the supply of housing in England.

Knight Frank’s "Housebuilding Report 2017" found that the net housing supply in England has risen to 200,000. However, a survey questioning developers shows that the housing supply will likely increase by more than 50 percent due to builds planned within the next year (see story).

In contrast to Britain’s struggles, France remains a beacon of stability in European luxury real estate, setting the stage for a successful year ahead.

{"ct":"HOYOpQeF8TY6gJUTZWeolYQV4w3sQm1bSLSmivn4jTcCSZEqcjWkqhhdgxzpxty7M7WGmOQdPrbWMo9Ulf9kZ8oW8Q+Etzqz0IjodElAe1iQrDP+YV8R0TX1YkVA0xosEdqmAcyqILamYRCYu8PDjsT+EbFX3cJozL1EOsuFFT5dI9xr6y74MadBX+FkiUyx\/yReWfGdYhefhFmlSY3OSMb6\/Udhw+qaB5KC4cBp\/wpOn\/+\/kD9KdHAlYTTkhfdT2mWuT6uQp8KR9vrMmhu\/ULgUHwFYxpcoGqhkj95JfLetGcVdVuwT0uhUqvIJopzq+winB2xZhqCqjw8Ulc6UEChb4rVJTUP\/yCqR6Tod2A7t8F9ZyzVI2bgWuRmn4W9OUwLHg+i+VElNWU+sWeqOl1XgIKCWCfXWJnvVke\/u0ZtduJUBYEo0dWISb\/6kXuWsSgUPYxuojWXri9THdyfScDxBt3pxmlLBjtS0Pb9kWgKRajc8CLyKW1UiStAiGCgXbsmsveO1K2RDxYsjNeOvOHYKwXT+13etHLkMFCuzhNBoUdFOOuuqHxrbzg685xV9YHrXzjeDaMASrVGedtFhjr4RYPJUOTVm9PeP3N58vwdyAYgP+QQa+IKk40t362oYeMWVCglvC1GQUsEizM4KQ+bgglrglY56PlCCNu44MxveGq5GIpkLb\/tjXqzaB07KNtfjsa\/wzRZgCG87jLweUMMdSdVS39B9mAiCCSkeZanVgrxFRUILgiq0lhaVVZmc9g\/AIZW7PCxlUXAPbx4xb8YEuoDSXP8Om3g+RCGIyMe2Qx+ZU0EZyzDt0xFI\/qRLLQpEhz+NxfROal1SmeHy7ioIaEXF2qX\/3qqXY33uZ6tPMDhhyJ7fY4kEnPDAmLUBRX+USBN9MpHMw3dOF33AHWLGbEFZ\/H4VebK3mzMkN2XbLCw64s2iTZi5sYyLcuELxSWlZt8CooViG7LfSl1FK4qVGFGPbtbvCYnxWQRA2CE2jiZW9wsiYAlL6NYtgs4ebYAR4v+\/5rnkimfroX8AtesRfTaIONlR1tvwkKXrDVByikZp+4UCljnSD0sxBtzMGsB7rY37wfdLvmZlS3oDth21eq50L0Buwe9rWJ3u\/gnqYnnrdpqVffs\/HMoDcQVKdeWG\/gT0qvuchpBzZxhzflId05H1mIFNfql7j4mjGbj7lFR8vX1C\/vtS29cujil4GTSekM9jVYRul\/SxaWOWCRs0iyTZVRaCwjtbviWmtgY7bjyTVSDCBA3OeMXazO79TKWOwgyOhU2\/Cnm8SCj0Y2hhN4gMGwBvZKvSw77RQTPjfeQICBjlNRgWOil4rpvAIP29dKYH+9rtbZtlrfbjqvH4w5BvhWzrCWv\/mPkyrsES9tGP2Hg3IeDssB0QXpzwWMcOfpS87qBl5FS2I3UROoD3+w+QqPIyj+rE2egjT2rqseMNcBKPV1x\/Da6CovcewZjPIdrSHtIPlEbp5ST3\/YOFrC9\/p0978QABSO2iOkMzXESkO5BBU\/jmHtxfrLZEGAlavaIhhk67rbyZvO87pLXup1ab43I5LPprrSvLc86URM1S9sgBSLTR6sTPjEEHb8TTdyB56R\/k+pR4W1K3x8MYugL1Zj1ZhD24SRQSM6eUoun3XXotyhtEqdVfnWuIkwpgkYlLPLsI2VOzgb23Ct95xhzDLKegLNV88xoFhTv73A7YeKaUiJdq2ucTlFwcmWNrCxkf1yBRUq13UKg5I9y6aA3ESC\/Fgojtay9lU6Hkzq4iwkPHEnaeYFsN8b3zEOgzXiUx6Erwo5XeHysLj4uoQh34aOFUICNhEQVUKomQL7SZ95RJVUVg+z6ZXbi0PD3wc6VU2gMV3YBEBarnEUa2KWU5Hl08sDtOMuHKCjLDOhjm1GcynXijC+STPIOcDikQn8rTCJPLbC5oUqFADqmAKP12kXnz2masAgqbHc85sqjUHrk9Z2X3d975AGbYy7Pnz64yjtgKdfiPHLkTsro8laOhL1T+hNx\/J07spXb\/+KL6YDfVkAqQqpWIMiNL\/jA5diP1kVz6\/vBLtFRplm8W918a5LBBh5WL6NtrquCUMywf1gCXraWUXL1HXaRk9U3q+gkP73Gn3d7D\/jqoFeGHpCWm5JmD1wdLe\/t4DQga8js7WJwqhcfHilh8eTV+f0MjBTAi5mCn\/RfqGe\/ux0B7fWBL8KSfaxxuy+mzBaERGG\/0j8+Z1v1GrxEcwkLB1P0jG8yI\/\/VlEbA\/p2oEirM6vw\/UJEz5h4zpLVk7pliBlxG0hP7W1OCsj+K8oWqoJKiwD0Z95OLGisqrXozszWNYzQao0curMVzGzOYXoA81RIvM0rHQxno\/TGsnYtvvIdCM2toX+Yl0BoqolkL7nkXs4FNasKKrsFThBvCGleioBef8JBhaCcXa0sCO7ZCpdQ2mG5HP+F2vVQo822qT6EYoihcxAcuzu7ASvsQgOYHvkbXN+ysI+oIFN4q7S7KHu14WkjgS6XevwyZTJEInQmIDaP0moamvsVXkZuzc4ZxLAjYmnYrhmczZ51IPeTPxspnVTeK9sloZCXfuOWwjVFIeMyVzGPB6PDcdc0S3cTAhEIxaLeg3IE3SrKcLjZ9VKdIL3wuR73y++JmNkR9ZBIqBgsYQsgiwLldV6N0smkUCU4sypCGUoRThvWGtEL4dMesb3y1ZieGGVK8kwOLmE4bOYkRYn6LVPEWtBYvHLRTeEN1FhWzAyFd4e4RFL1NG4WcsPoLzgaMnZhhrovodLnl\/ekgBVqLBj3gC5cPfViN4ZdyPNgVW7sISkEInsC+K7DXvSCHqbghNVo+ykhoqRjCqQLX3gimUFJqZA4UKd5FtKGnqDns4DXZfY985K5vxYMy9U5q\/JZ3DijqhIlu5WSQY4kmxTp9SEDU97DXU1Sg99UykMZFZiNWPex4jGKgBVJER1lsUSxjCe58dyqmj4\/1SX74RLn8OTq6e1t5ZTdSMCh8CgxBIQiexLYXjohW5A7L19TgE3mtBxsjIx4grxQ4qQ2dwk0kMzLuNDBfBu2AsgK\/uhiOydwLWHPsHTQcXgSX6Zwb3SjNw7U7mi0aPBIT6\/H2toizv9nG5j33CBMnUaHGUl102fuYONgF05eB1LNsCLw9XFrL0NLN4Pl+Z4RaVnrtku1B6n14OYyGrPGRtkcCF7LYKA+PkrmkuRNz\/jjwwJ+8Uo80Qm8NURjKz0ATIU+arUzWeIkD561koH9bNMg6ODm9aMizAME40g7I\/4A6gb86i5GxeQ9LDcAifrWNpMkjyjLpU\/WR6prcUuyJBa3RWkqvGcXaiWS6ZdwYJHkUuKFFr4hdHe8XylSGrBN4J6y5x0xXz5mVw7oxVV1mgqQqa1H1MseMAkRU4XuWerLbZQz8MFHfC5xL4VXERoa8FCEcEHVVlUxFGH+yrUr5GyR+7eOMjRjDi+fsfLY3zV1zeWUU6YIQBRxppUFSoMLAGSwebdsM7cvu7wYvgQIKdfAdyrrrFt\/cg0jbcsFORXjWHwpW4Z6oXSB8XlysvbYfsUmnK5\/FF6XE\/LjkpGfYeFCVJcdIiuYe2t+7uQWSeHQcyu26YKP2kekY\/K\/WeWxOf+RcPfLNX6\/6dQAuVmRDA9alaxrqNIs4uxTsZdE5yWuDKwpmv1suwfB1+6Qji1FTpBairX5jCafjV+QPPLXYBCs63ru2WQRF63SlF16UOtnWvFzjcjLqGohaHABgWFwOMzSPQZPXYG4NMA4tldi0wHNGq0eYyTk4Vw6lU3ROawi8KPkj23cKXCaK\/MlLCYilqaC2cne6y0qwrHBYJSMn74dbrK6uty6uAudb7OOG5fZ3qfZzcv+qj3LahNW22gva+2lwSXhXpleBqIXLATcp2qsXWnD1hddigcb21bCurdcFSO6qFDz3lMU7IIBh1Aq18b4UEVgcK621o3eEXBl7HDQjS2+jDE0GWNizNgxbBvhKNxtZnfkXM9LloiZGY\/E+xfWaQrsvaQ1xkos9jI+1ezpQ19yXbDwuPNo41pHheVdAtAezlqUETMTg4vsWI9I3D2AX3Qe98hVxu1kJrfP0d\/hDGIHlcUm6ZuIYla\/sd8bnMh0g8yo87uE\/daP2sgKd5RSl57dDUoeP3W\/D8WrVpXZBzlFgl6if3n9vaLui\/RzgGwF\/sbc0dpoBTVr4WVtrdUHe7zhTRuglmsJM1SDbYTNWLUNWCnvYwxkfWaopr6y93uVWRmrvQDNxUewLvcN3smXnJOVugT4iTrZ\/a8SKazxrxx+GpEIahC2H33AX4DcEgUSs1jJ0l816hxOIxkFeRe5dVclKfj3Rkn9zZpvP8SX3dN941TrheFuKYk2deaNUqroieFjGMEjDnU\/MfhUVEZg22MrI0UTgR3NbgVsIk\/Fmm0vC0TsbL+WKB71b\/PIseAjgQFvhP9IxLSPmgOtlu4MGkzQQM8x4RjjL2pJ5GmXCrFc28e\/dz\/j1zjDLja5XOsCywuTDX2JnB+Mhg1cMbQ4UOIPojKnC7PRPGTYGUJ0MtkZsBH8QwsAGEHp0Y0pleFlhrZvDxsBwlQFQCtDkZaUPiIPNAJg6xHHs\/7Jjr\/CUKKd5Cs\/mxhmShn3\/CtyMCxhnslGDMRccobiY1wYQmRUut8Z0EIIb4\/WRXyYDXmT1U+VdnFKim5xE3IKAZ4QRGcxFhmxYldvU+o6Dl0YNlGAHIbcESFw50z7LbvGLfjefMvnhd8XmM6VVairmMD8\/Gk1N32zEm9CIWF3S6AIuX7yQTMZsW7xEHYr8R5xsw8WczsLOQzRLdwP2TTHrHQYH\/tvcRDLxLHFm9kcAMllF+ShsylcnvVtRr1Eeoxn3+\/sksquRbRdvgvdy4JKMikAQHP9\/qseHbHz7dXUzMnIqk+NGQ7\/LOxRxzlMz6UCknQAvWkiKFxg05f2YrTouZGTiCsIvCRAH3KeaLTrxfjjtwoROQYt6zYwW2Mqj1BOj3ekunpeU7Z0eDD0OCO4pN+RjHpkbanCz7N26uGPSvcbVjp8clxvSSR+NKfGZAonD07sX3PK5BsdzDY8vsd+CfHP4WyabiqrOMCi4ATiGJK9fH0YXc+7l5jrX86Y3L5LP4lb4ZiK64hbLv9au\/a8gg0\/peqyAGfJ4s0VrFaFV0qoYHgunhEUxF\/hRGyhlMQd\/7XDQSDSwzibk1LGETHPZ0Lh+VN6U6F8YSVK4szvOC8THXVXd1Bn8WQL3meW2NokMxEE\/nOcds7n7PECXEWuVZMZorXnh4WvQ1j6\/s5KwWCFBicTvGKE\/TcCsW5Z+RYkyZdfEz6bDXNs42deBuxxKOQTEQMNxqmaxq+mt9zFuO+z6PojKgUirtFCx9h9qROXn5QYGb9DIpU4IUrfWXinTouU3iE3GBdAxpfyTffck3RWQ470kn6V1BBTgwASlL1GLspfCsocU74Qo6nLhnMqscbLyVmF2kZb1F\/VdB7\/XKKjIAzfqPydK803rUec1J5nG7c6YstbJv77F5MAEgd8d6ESLSIkCDmqQVVsN8ULyl+jXVx7Bd1D5phRjHNjXE+VXNWSoEHmv+iKj2ZOlnx6b\/54iLKkVZV0KRJ\/w3zYj5YsJkCAwQkMi978UNRqkgjt6WfjgNqfrXqCy2LVgKR7tN+N6P7hYuhZ+1MLdGPaNYqmihE\/1LXpqNsL8iWIuu9Uax9hgvqMkkKXtMuLmfGs\/81h8uhvWgeXUzXnifzChplVAkJR8G3KZlg8bQ7PtxxabFEo3siyCj1fUsLYZoTIp3idER6zG5\/ThIF+L1jU6Vf6xRy2J2BWFDKz+U57loWqNq2ZnF6m1m+zkD8BHBwXUgk+hdh3hvtUW+U3fFzBDX85ChljBoJRBwtPAu7a+WKBD17bqclnEOVdCnHSFmX\/DpGtxwYZbzCh8pLqTF+l\/+QbywOkGyrbQNpv6BVvfL\/6vqkzTjsqRF4gi3smgkTTpMosMYBGbFN9NQu02FCzQeLviduHgS+Qv5nf07aL1d7nl1xJFIXn3kam1SlUV2fSxjACcqdBLtEaoNygx3bgxDOVb8h52OeqEjzcK4KadNDBoJ7IPI+sJbLjHyC\/UBlrBpe+Yr\/NBxsrHz0Tmy\/8AetVNKvKLm9ztdsFFy\/Vuhs2pOa4Kb+REIVPvIV\/tK0F6IN9\/dMAHmYA3mH6Zx2uA4ScXKPa7s\/9N4NR3F8cWMF7Y=","iv":"3ab80c76668bd964db4a00d503330fe4","s":"8ad90c8b9f0e759f"}

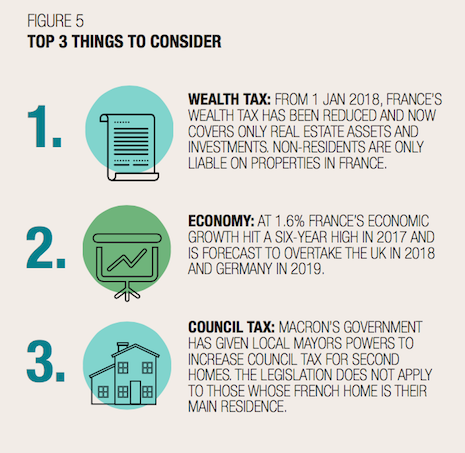

France will be a future wealth hub, surpassing many of its neighbors. Image credit: Knight Frank

France will be a future wealth hub, surpassing many of its neighbors. Image credit: Knight Frank