Retailers that invest in advertising their standalone mobile applications continue to find success, with an average of 63 percent of all their transactions coming from mobile shopping.

According to Criteo’s Q3 2018 Global Commerce Review, transactions completed on the mobile Web continue to rise across all regions. While omnichannel shoppers who make purchases in-store and online – including smartphones – are only one in 10 of all customers, they also account for more than a quarter of spending.

“This doesn’t mean brick-and-mortar is dead,” said Jaysen Gillespie, vice president and head of analytics and data science at Criteo, Los Angeles. “Our Q3 Global Commerce Review found that the omnishopper is one of the most valuable audiences, demonstrating the desire from consumers to have both an in-person experience and the convenience of purchasing online.”

Criteo's Global Commerce Review is based on browsing and purchasing data during the third quarter of 2018 from more than 5,000 retailers in more than 80 countries.

Upwards mobility

An increase in sales of smartphones is contributing to the growing popularity of mobile shopping. In the United States, sales of smartphones were up 14 percent in the third quarter of 2018 compared to the third quarter of 2017, while sales of laptops and tablets both fell year-over-year.

Fifty-two percent of all transactions in Asia-Pacific are done with mobile devices, including smartphones and tablets. APAC also continues to report the highest share of app transactions among retailers who promote their shopping apps at 46 percent, followed by Europe and the Americas at 28 and 25 percent, respectively.

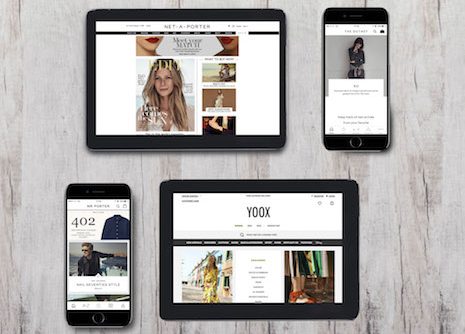

In-app purchases account for almost a third of online-only retailers' transactions. Image credit: Pinterest

Globally, even retailers that see a small share of sales come from mobile devices have seen those transactions increase after advertising shopping apps.

Online-only retailers that promote their apps see 31 percent of their sales come from in-app transactions, compared to omnichannel retailers, for whom 21 percent of sales come through apps.

Shopping applications also have a higher conversion rate than the mobile Web or desktop sites.

In North America, apps have a conversion rate of 20 percent compared to 11 percent on desktop and 6 percent on mobile sites. Shopping apps have a 10 percent conversion rate in Latin American markets, outpacing desktop at 8 percent and mobile at 3 percent.

Purchases made on tablets are on decline. Image credit: Apple

Retailers who have a presence in both bricks-and-mortar and ecommerce also have access to more data to optimize marketing efforts.

While offline only customers account for 49 percent of the client base and transactions, a crucial 7 percent of shoppers are omnichannel consumers and are responsible for 27 percent of spending. Online only shoppers are 44 percent of the shopping base but only make 24 percent of sales, underscoring the reality that retailers need to better capture omnichannel shoppers.

Additional insights

As younger generations become a greater part of the luxury business, luxury brands need to be ready to meet their disparate multichannel shopping habits.

According to a recent report from Criteo, millennials spent 4 percent more on clothing and accessories online last year, showing a greater preference for fashion ecommerce than their younger Gen Z counterparts.

All of the growth in apparel ecommerce in the first three quarters of 2017 came from mobile shopping. While desktop still accounts for a greater portion of online apparel sales, revenues from these devices have recently decreased.

Although Gen Zers spend the most time on their mobile devices, they still show an affection for bricks-and-mortar browsing (see story).

Outside of the retail industries, travel and hospitality companies must also leverage omnichannel capabilities, including mobile apps, to reach millennial travelers.

In a Criteo report on millennial travelers in the Asia-Pacific region, 37 percent of respondents said that they use travel apps to book and manage their trips abroad.

Criteo estimates that by 2020, three out of four households in China and two out of three in Vietnam will be equipped with smartphones, making the countries more connected and susceptible to campaigns involving mobile activation.

In terms of travel, related sales through mobile have surpassed 50 percent in Asia in 2017. By 2020, this will extend to almost three quarters of all online travel bookings (see story).

{"ct":"uDnwZuK\/YiHl\/g2Desr2dVW8yaruobibOuppDTUai95T6aAvjNxsy7y++ve2GRxahu964WbWsI0HHbHp9u6AeaNawzuA53VGiPydBH8oatz2ua0cbxmWeqslDDNtdkndxUhY1\/x+G3felv+WkaMF3GkNxuBsG5NNO4uX688DQetqVq2JokJx9YfU6SBgiJGY\/BxNMD0\/SsApEgbcCY\/+0e1RYXUXayS7jRLBpoDoY6vZtMBsmuNLnE7Wzg9CDErIYr7QoCrMcZb4jELD0aZJMRB6bU40z0\/IwmuKEdGs5EwVNhUlz+2CQOJx9Oh+0KrW6Wv3Fe6psk8so5OMukKl0I9Q3jHqpKzBYEs+KSmhsx4f6PKOCt1L5yPVMhZ7t5+GEvkAgjneEuIUtPIFMwkd\/facwZNh1gfmSfFHA9jqq4XgpwZ+04ysQ6O1vi7FHSO9JWb3OEpNEecKkSo1qIF4IqbdAx+H23vx1r0a5Jsr3lO74SxQ88uK0KtR\/iY8F2qvALt96xuLu09dQguWmVZEiLEmfbBtFi5wN8vMx\/Y8adVF\/jHlW+Gc8WRVHkoTK7g5V9oTgDJC54\/ts\/lV81QtMkGdNbmzLKyAATC4SSlLey51GyXCDto3vOiPzKnJ3ecqqH1oGodVGNL7cq3GKtebA\/rsSRc0WlMgENqLdowDA79rNnQse+x98XzCw635d6JLdr0fJTHDyEsMysyhuk\/sDV5qLpX9HcaHyaHf\/R92ja0JuMz321U\/GmopPJ6ARKJv49UskHcEr2PnEN+vWTnrFwT5G4j\/PUAIptEHodMlVJepMBv5iZsCJjTo2AgQR5iWcs1DYlmx7A9J1rSWnEiOmKdWT6hhLOZpJ5WHEBoyg3rBhPCcmAcilYuVwxypib2dnKCGWrvPVVphvT5oEpmQL0vYpVgc+DhVETQ0Ka2ONgiQBNWGbnjYVSgl8nJqX3IpsqwxU6l5MY1a9zKPAk+KbPqkXDOkm91lYi\/3OtXMvpH5AEN0rZUqONN44xrk6ohaMTz+NC\/eZbeXVIVoMzIckAMQ\/KWkCMQn2m7kKI2\/ruPbjXHBqbxk7WEQ6LRD3F4B+LxSB\/UOttSV6PpySCqKIieeOV55biGVvMRd1oufC2dQqrPaQ9GBKaqpApohVKtGujRTwS5O+PD7Gn7fHrUD7zFlsY0QVK5YBjAnHA4YfUbA37y1t2oIyIdPuT05XgNpSuWxgKwKdUto5OM0nmmtZplTNQzAHoiHVWvTWxTXwNuXf6aOliRgfC8JB9iue44ZdfWOrit3kQbFfX36IlFzwsltIaiWSacjilccXC16akBaUV1NsE9imTuthJAoK2YWQ3PVkJXxoV3sSDTU9NKM0EqIlNoD0H4quK6vlBMmd5xkzuUyKllMcMVE1lRI7BrgVyrcWQ2Tk8VNJxPJ1il1mz45REtWdxlid4\/AG\/JwyM2KK8CbXDb9XemQY9qaO+GpTbW1aS4Ssbobt4pFbq8XdgdQCV8hL1VdEsC\/OugqTS0X+l+xu7q+pMcVMMtG1tNaXXb2HIPEUMnchEfQl\/WUHcLy4eY16PAYF2Aw9hK3D7Ikh4Wxf4RkU1oRKAqSIN3dPuslVnQj7eWSAJRG8eDg6rg4Xg8zpc5zVGfNsTRrKRC6OEs8fixQ0aocGm6YOArqdWAHO14dNzWm+RwUFAEQRI6XiMmrEzh3fQkVYx8RXS+tp5T36G01j\/bS1L\/A+ZT2cJ55F3n31QrScrTNzRD+UNwdA6CR3935GVlIAeK3m+pPKCzv8vRnaLifv9KBSNQ9Jr7WuFHYgn4ZPbZJUW72XbhM8crTHG47JZinOtfzzuaF78wie7\/3ojoOPebI8qeaZYLXkylPP7xWiDNm1cgvoaGgAvQg3PK8j8iIPjrub+q+JCeSsu+3jfgIRvPd3ycMtYT35DxHa3qdA9l+pEufdyFVLJvHfy6oEt6bt+HKJGH9ypVxxXT4u42OwK88gzrEkEzswyBPOj4FRwTATgn+4sjrawUswh3UsY2N\/3DnabidOyzTxtb5dW2wA3Mqt0eSP\/n1mk31zaaR9yD4tO8JSTCnvnuX58zEEuV2nsTSWMu1l1wwhyG1tF+aFvEDgjgnkT2qlmKMMCtoLr7P2x6KTs2XykELO8KJdT5SrLxUj1ni0krLO2JXzb0mXfx7sFLPf0axpEQJR8viuNaVb3BNQByl5uCKT\/eDaQAXaoFXy1+\/I73OJdDdSXP9awftx4yBCRcYAIgnnKmCTxroEQr4GIWp81PFbIWTfJrv0XXxiwYwGJFKIyx53oF1ibOQZjvMPzhzAYfGCfe2M4iV7ltxC2KHJD\/4hGKnRdcL0WpiJDl3GAq2o+is08qw\/ldKeLjm6EH2071L8XobTKs29ZpDZn4r9A3c0a6DkkxGozD4e0adulRa4XWSnmwvgen\/pWIZ6bzyfAYAiQuRcY2cH94AyJWkb5WTD0\/KNwCJJvRefLWSo8OGHzJj99BUk5NRS8kiez5i\/NWsSokebnryIkXn7\/xPfBuiGhlrSCRxWKslZIfZC5jr5GONSceVvJSbSZKPbsNA\/zCpuSBP8SReDdKJsdLZmWkH3JVzx9deAIZY0n08aOvq+rRpr2xqJnQDYQ3aTGhPcMVRO4W\/CByDuW3Pn+DyYeAIEBmE22uMsMB3Wr8H0swwuMTvuuLkdCxhIxF5IhlASq2xUEC5Kul37FEgZezk5MFihws\/5codrtLgSBU\/ZFLzRTd8AEP1Xy4TEd836cVooj1PvrbyAIA52RIZcWqS\/zxs4KXheRo7Wj1SbhLqLn43wpuY\/M8yPSjLoIsUd4haCpyU98kkqtXuFH2iPiUOuocgEQPM8fD5NScryd8t1GLDigEhD7swPXe+q1lv21RuV\/kuMvhQrKanK8E+3UTJAAWqB8KM9UjYaIU7DLSly+NbnzufnI\/JHLGw\/tjV19pS6eRFQ3KxOk2NH55DdLiFpidHsHMbiG+Ys4Zl09XjFed+iXB59rhb7mUCmUr3sy1db9O+6yh\/6XhJHqUL3MAXX9bhPoaptzz4P+OyJH7jDqIhAckg8m1hUBMXFkzM6mkfXlE4Orl0tvQEIbpOEsSigcF9d65eONTID1hTc50NouhW+BJAOaKQRwYJvVpJvTnlhozqXGCy7t\/DvmYdv8eoQ3Nr9MPefWkeYC\/6FBAx\/p0U4Yyt9guY9UcYAEzjf8zNoAixl4VWF2wURpkCok4TN\/3uCWP7pw3zfSpgzdHMGEMKH18ot8UwAFOaFr05fnjVFga+WUurEBtfwBp1ZchXObpD7Zm79EapEGLuNxTbnK5eUYXQyS6j8BRzKIlHHI9Q1Vp0AVIJoTAM76ZYKK+wwxCKNFYQbZzq6b0AteKmdYO9JkxFk+Ru3sfuihYUBEkRq8diLuWZ8oqeCY6NZrmTV+6R9IsegNeDWT7oozXSUw1vQs+Dclk\/5x8x0CfOujgwiw5xS8OOPdy8t8B+pDPQUMwKPiQ5CZwSOO7nRzd+Rv\/GMbX3GeUoYrR3\/ZXB1QFSgP4vgdezno3zLH6Xmtf+9LAq1aSXUJDjXShILrBYXo0iUxlIXFsVJZFIpigHDTHamNll5biP4n4VxIBI5IHum6on+634EbWIAIb\/LDIGATwdJoA4Pgjr\/XFmgH4EP7APEoNBON0rPhFm0QjLAXYjlcNI6ecy0epx2LR3IY6F2uHfZ5DiodWwwYf9YaOJJyydFi+YYNJcwA5ix6lYtTatf1FjPUbgRv0KLysLcZpKfOIZypCF8VS\/xw8fQ5xGdf0ofVTg34f\/HksPwTirYvdVL\/+MhA+SG+Zsx1aJRflN1KisBv7beuZJDg9ra0r1gSbng7ef2BkakG78T4+PubLMUDvcJHjYBeEFCRCnz6QdbTQRbyOXAKUn0QxnPJThVEJJVzpnWgl47Q+E+sEmyeadZ2FekK0Bo2cfoSpNyym0\/ez267wkRoemQIN9M0f\/iAq7kTGZn5rs+6\/1wH1PElOfPvxeaRAZ5cpzk3VPDOn7H2iydJdM7NS0vZ5Nzs+vlnHEdT8uVAQEQ4psQBzWDk0+oavFjI42tKpIt1Fgc5wJadzpYspbP8NbCxdhegId80wTErGcguPhGli3Fb0I\/ytELsUQK06dgRWoSVyrF5vrjwE98fGSZTcL1+0RKMk0PM8LEJuDIROw\/K5Q8OfiRQWzJ2XSH27lNjbPIircB\/p+NA5q8W6N2GmrFYgedRo9rOJOj1c8268DmUxKNOMPT7o5nhR9KELsZ8CkO\/E4Qttd+dawGvyWRoaEOFGwFhXOx6TGZFBw0gKC4sQefvxJW3T3nduEUFSkE4J97W9nL+SshoQVnD7gnTBqhiL3R5jkEhUYzINpEieaEbJ6iqjA2LfPMjgBjAysT0q41ZpGqnmk\/yuB9u6JTMkRkLNUESltP2YqSeBWo2L5uMRrkTeqC+pbNJr84gVnFF2NFLTIcMrEXhXGe21Jj3zGfoZGk917q49vRxWP+hfKm4SfwDfnZHxlELLf+BpIdlIIKET6R6ao1prMhZdg3pWAH7SZkXjcQyTisCzmVbTGA6ZuxTxyHBCVrAnc7oXslGlNkLbP0o88Td79EvGm1pmAFPiW9BfNFHh8zCKKU1QxvVb2rviqrwGJfARdf79gHGwtWZbMTCnvJL\/k35dYj8rTEZB1S8MCJbTfMmSMdoOnUCQA3ByrFjBYTgosphixtor+Cgu8zN0P3pIQVKpyVOZeElGiNyLYhL3UWMuW+4DNFA0LgbglO1XD3ncAxLCIqWNNOJ5ZobwCnBohqEV6NaJDOkOp1Ns6YoZxdvF2reB3rXqgkuirEGs\/qgARYXbRfzonEsDg\/yk4hVi2IpKDH5yfmrYuL2OwGmI3ljWvwN06e8e2Qc4bxG9lLWNRsjCmnQsYKn9QnfvQKle+1kqfVIy9G9Cc\/1dNoAeTw0+9xki3tn8QjgXVO\/FXHvz+kw4suql51DXdm0VJIheox96NdbAUkoCxtkYHs0cBpMZXGTxTja\/54VS5NxgDkT+WOb4haG5xBKvf9X3Z5GXwuHoEbmMiLT1VqIn05bS0nRZaqbGDPPzZj2amPWo1umtzvx+w6018JT8ljeV99B7Y3m0B0\/B7l+9wOatco1rBD+sid6+a9+50pjTZRgvlPvkEpUZeIHfoP73OPL3KHeKFjOHhBmSfWnOTcbVBRrmNjeXueTtqiMwgRc9x4XpltaeEnQ5mETsP+fPoq\/M92h4rmU4DOyUoaBkH7mRj57lwkUjE8gZYc6Eu15xM4q9Sr8u3bMLsDSXJjFTqUzBk1mqTLcQ0fg\/fYrBh\/bLVC8H3CRCDsIk\/qRM3uyAFAkUu9YGtp\/7LtBwt7TB2TE5iJxwxA7PpVVUHluZZqP3OBbMEOL+xTb2zR0VsFPgooBIItuhmNQcNOX9N2VfCLJx1NZsFfqhyzn6RActKyVygkLGhXQZSEEdfhCAOXUNIl9Eha8bwb0yhhq0V8cJXMKtsLcrZfECiTnus8PQqXTava0wCZMqpmzw80SFopl5dewDYj4B3cuqSVyPHEtIJ+AW8Gp2QO6SflYBuqj\/XkmQVBRFKn5a+VIg6XjV64KSwpsVClDtFtVwFWRKCoe\/xgmHV4BYAt\/nQcCMWDrkaeVskWYyyqZ\/TzHdTwLs0YojXYYKEsemQxdA7YdN9XxDZZSKwPKwof9smu8ixstLkp1tOx9Sip0jwr2qfhoiAcTcnDoP+8Nx\/Iak0CHJv2CFH15YdQvSYx70HUYpXfztX0jW65QSZ43IdOuY\/UcAr2\/hJCq+iaPxrQItnlPxax5x+moFJnrtbUeqoky0g9lGrY4deSgTRh3zt00LSTS6nIW3zGAXZDvx4i\/NGvkMM2BO5Pe\/\/Tl460GAbXzR78WH6PZkfgN23El6zN0ly5Vh7PpmCtgyx5F\/OHMQD2LQL2LCruXGYuDEtt17xh5A4nPJh8OXKgwG9\/Qg9UQcDRc8Tk\/5Ou7Gn5o0ejVkNmavDs5N7tKD8jhfeciyaugP0RaBotOIGG513HpARfv592VX9BWS9N7ZP5tzo6a36SSEvm57vG+vTLJ0Y35JzdB9M+kQzo5U5kiaM2qnUE8AD5r+0e6fSQ3uVVIlOzRZsVPhqKpvMBqabkmTyef13A5lEQMXCea2F7TYPVEg9xCn2\/WGG0cC7rxjRUZlD9BZg\/t108ezTJyOmZgCtik5Mu6eKPDZ1Kr9m02jh0fsOUxuuij+0fZ1C3L\/SJoiwI9ELuXCv0+Rh1jxQU0GbCTrAwg1kFgFswkbplggxZD0tgpPJGu7dHFiTtdGwtmpo41Kfy5Pc\/hQ0Xqy1an9cxQnZMtu7L8pjhXsaMPF6gFWwEbxexP4qTFBGu8dFcXX53PzuUS2n7wKWS2XsmCzGMe8B\/KyjAFRadJRV\/7FZSnF+axTd+AMlge48wc9Q5GrqJjgVFXchc21dQSQrWn14\/YnDjKW6uERvcKKe4YQaH0BkTGTxtXKV8xsLf0nKYWuKKBHp0WN0l3f17YTiE1Htsp8MtxI8Wxg4zkyQf5\/VYbCSe\/4WT9Q9gYZeESgfry\/JjyjU2cSXe9BRjSymbtkFbo06wJxugJPb4yRDtz\/nw49Fr9nIO04X6y+laetqwHX4P9Vq9xrDWLcmFQOhbU9FtGm9VPfnMqT3yDj47z5q\/347xgp4Y4ueaHHfnMThGjgJD0a1acDkGFIM0lP2BZtp5x7evneYnbe0GwI2oMLBMoPvOpiipvVwCcS6+x\/vCz3Un7CVQX02V3nSwbFhh\/y0Sjt\/huPja19gqMFSbaCQQqJw5BPoagQ0IHZ9HkrBwv7IRgRq5rpnXXn5P9lhlVraE7HScDGCVrKqkIC4vG+qWSKuMgUiOCuKshY2Ufm5GleS7elLrbE5EGMNJ1RbygK9knw5WJm5Lhfopa82Cj3bBbTO2pX64hAL6rYlo31Ti\/NKIN6s5ASpVJVclVflohn9rSVz3fESTEA\/gZ52GsPMQlaJpWuMJXMqqatMq43YMM\/iru67NWrlPzSMjBN+TJ7dpZBPXR2qHbAsVduLk7pIg5PACtyW\/XLbOAjBU0aeZ\/r0JywHvH0pJa06OHoC6j+REFjHycFVPlEelkhV9fIxpiJQ4PVUNAqGt\/t4640mBmrctnduJ6y8+sEogoYfAbQBxqMfIl8\/vREFa+8jh+buC5beJ2jKN8R0vgkfbQpy\/aowOlAbY+AcleZLozKZhhWb43Zu9B+YCKYJJcLwQXU3eVq3sg5zr92x92\/+5zWxiwUle2Ps9LTS5ky5bxIFbA9F0oA65egQDkwc+D4\/kzHcih8LasdnAxBnOPHnDKtJ68tBfik2Va7D2VuWNonOOPGVfeG\/3dBoFX4mAbaPdB1YeVMSk7UQ42ziWa8CSTbwnigBq1DfMOJlh2KTrv12BZmSSkrQmtvt+trdobHeMyZRDGg5QEy7sRRXM4IE\/cKicvMFsKu4PZGColAOLQJYBq5pkPgIbZvE+wBi3lBjnFkYb6de9P69B4gjsYO5Ta6Y00lVmzIbs6uD\/ELRo+teyxJzv5i0iOlSusObO6hbmQp59oY5xjzkP1R3+idEEfOko9Crb6Cm6iqHnRSKQvB+yAzix4uaBlfJnhxBWuf5a2EWRJArUtTRYRKUBqiPHCqEKANFa8nLSEk8LzW1+TDQmGiFfsWP6hY8\/jdsqX+sRkOmVKsiPDhgUZRMKanwwS5hF0XDpaqvg7zLczu2n\/vVgg2fFX0X1kH0SAv03SmSbbp1iqoLwBCSHq2c6su94PMFEyJkU+DOgRQ9vAdjHoa+L73oZBjAFwUUtXy12Fohan5yUf70W9A4SvgOTW1bQFUchE3IFsPShWyICGUBCTUGINkDI2jzQFc8RPyl5GaeJ+UqajaEZN7SmvDugYZTJ4k2WRFyY8FThngjNEXa\/l0i084jE8TSjWaRmFj4MFXUnTEt+aC0rE3ckVlefDWgM3bbekJvEqu1pKXBgbI02DNM57mCkXpzk9SAzBMt2dkU","iv":"a66ed2a8466c68180818547e85c89066","s":"534adb0b47e24a5e"}

Mobile shopping continues to grow in popularity. Image credit: Estee Lauder

Mobile shopping continues to grow in popularity. Image credit: Estee Lauder