By Rania V. Sedhom

Alibaba is a complex entity. It is one of the largest – if not the largest – ecommerce platform in China and it is an ecommerce platform that sells counterfeit and authentic products alongside one another, leaving it to consumers to determine what they are buying.

Alibaba represents a dichotomy to luxury brands. The company has problems with counterfeit goods and is featured on the United States government’s list of notorious markets for piracy, while also being the single largest player for brands wanting to capitalize on Chinese consumers and their corresponding wealth. What is a brand to do?

Mall …

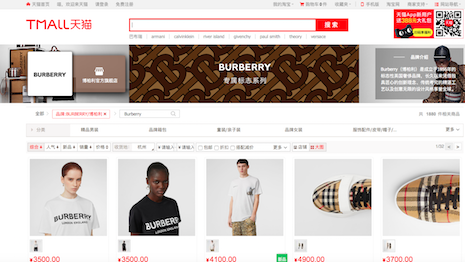

More than 30 luxury brands, including Valentino, Bottega Veneta and Burberry are now selling their products on the Luxury Pavilion, a dedicated space for luxury on Tmall, which is a platform owned by Alibaba.

Luxury brands that want to capture the Chinese market have only three options: (1) Tmall, (2) JD.com, and (3) build their own ecommerce service in China.

Brands such as LVMH and Hermès decided to go third route, as the counterfeiting and piracy accusations surpassed the convenience of a turnkey marketplace for those brands to use. Companies with budgets the size of LVMH and Hermès have the option of creating their own Chinese ecommerce site.

Interestingly, Farfetch merged its China business with JD.com’s luxury platform and Yoox Net-A-Porter agreed to a joint venture with Alibaba, essentially using the two largest Chinese ecommerce sites.

It is difficult to ignore the revenue generation and product loyalty that can be spawned in China.

However, it is equally problematic to turn a blind eye to piracy and counterfeiting.

… not mauled

Prior to collaborating with Alibaba, luxury brands should carefully study logistics and fulfillment. At a minimum, brands should consider the following:

- Who will have access to the products?

- Will the products be delivered to the warehouse directly by a courier?

- How many personnel work in the warehouse?

- How effective is the inventory system?

- When will you know there was a shortage or other mistake when products are delivered?

- How difficult is it for products to leave the warehouse and be returned days or weeks later?

- How is inventory managed?

- Who owns the attendant software?

- How quickly will items be received by consumers once ordered?

- Who controls the logistics and fulfillment personnel?

- How often will the brand send an employee to China or will it relocate personnel to China?

Sure, Alibaba, unlike Amazon, has taken tremendous strides to welcome luxury brands.

For example, luxury goods are sold in the Luxury Pavilion and not alongside cleaning supplies and toilet paper such as on Amazon.

Also, unlike Amazon, Alibaba also has enticed luxury brands with low commission charges. But whatever happened to the Alibaba Anti-Counterfeiting Alliance? It is growing in membership and is taking some action against counterfeiting, but the truth remains unchanged.

BRANDS SHOULD certainly sell to Chinese consumers, but need to conduct a cost-benefit analysis to determine the true risk-reward for selling to Chinese consumers using Alibaba and other turnkey marketplaces.

Rania Sedhom is managing partner of the Sedhom Law Group

Rania Sedhom is managing partner of the Sedhom Law Group

Rania V. Sedhom is founding member and managing partner of the Sedhom Law Group, New York. Reach her at [email protected].

{"ct":"5v4xYrhpc5NbkRyHt5OhsQYfk\/9d868wI22O3h+r8aKOdJL4LEscEA4BI2KKrFzLQBqnHC20pTkHUiIZFdySBK09x38gtJKJ0XPxsrGDpjQebQub1og0Zi0fO82EjjRbP0j1NjygzeHg0sl+G5u8fTPNvk1U30QEZsBIMTiQLbl+PgnowkrF2EJcWmZqplq5EKGU099HgugFspDrRjP8lwO7rWdoDx\/Q81QK78GE\/gZ1f7qzsKiHUZu3BRPpsTRH21xI0JZ8izo8KjuL1iO7Zy431VL8DUzV\/+UatMqZVIH2rUQqzz1VJxcA6I5Zc93FUkwn73FQSnvDmGRMpUQZQ+i8DxCX05Z99TV4z+pBR5UVa99mEW1\/\/dUWBOCUoPaF5r9nZ\/Q8+OMheCs4NsZA9BjNJvNTig1uY5CuekqUQ5eDyerH9zU31wZJKlZPY75Qvuq+YXvpC5SpZf8wFjuppQ+9sYR5n9j1w2Vmn\/1+\/Jhtk3Xb1Zje4\/w\/M\/A\/5\/AtSNFTt+BNfQcX6k6+bFEhSeLmVitNXZxvl\/2JcEakju3FQqCF9c7hrAdCzYWyq9C4SExnopk75nMb2ZG8iE4+MGDhiZ6klpBRcCsV4P0DLF4fPgTKfaS78hhtwnxwSYqiE2A5IhCz1P3BkCa6HN13RAsfxtw5a1cEIFY8o385fciISJ2zmmNr3DbVtuDbHCIB6nzdma5plbKAZCANLVHWTcDs2eXw6Eqiou+L625vP8DzqOfI0JKaJwdI\/\/doJBgtn5dgeo5F9VAaZVfFpnyZENzJZv7\/S+RPIXTVezWM4nzJ4AkWg1ZJC3XvZVO3zUMzggrNWIKZFOMDC1G\/L0Zx0ltBrcIrGS8ed1R10sJZRn\/q0M4twOHQbYojVxQgCD\/RVmTq5nmbVH3chHEFz9Sbs3ivV03ttT5nQqCa\/ml\/FZUzvmQkOPy0RxB1WOCj2hXcXocdZmK0CmZNJwekoiii2A8fOA6feQOs11NVUppzZJCEDW0xcjFyF3t3e\/6dVfpouTJE6obZ6ikO7CtCwbgz1MDYnAGE8qyg1jUroMQ8JDo1X5ozoo8h72YTkaY\/9ZyBWwf8sIUoang4mtSjqE0e+CQTa3irNy\/ETZebPmzfzgsBzzfhVDV+fNk6W6ehjzO0rvWlOoebExvJNY4LlIiNEIWwQwCCpA+HL2VRwtjPLnJk9\/SSSA0Jm4TEex4LENaLi8hquxImfcDSSOxOTxZLGNVX9rDRX2VKKjYFu2\/1dzLjB\/tMCEhmGiqyiguXcQ97laZH8bZSLPcJ1ylCQcJ6xRJOoJsJ2nMchsPEAgjZDG+mXDs4Ki3PmQAEM\/2iHVUmn\/bqkin6Cl6n7YEFsXWMJcqP3Qtur6em6AFelrNQ7wWJx45eQUBCYanVDFXAQAT50dQyaw63d9LgzJykCHarFWE6EjtTpc0KlMgCAMCQ4453Q4Jx45SoKUgIHaMIk6StGM0EBF2XGTIdx43GJgEwq+pATazWJCbHX8JNAJ9yYZ6QGJSHjs8vlcIjFTlL2qKHwUbhG4IAuoO8VxOwnoh8s4Y29EFDGXIJcDQT0hcN4Dzxu1UC7kjwSj0FQb2luBiL8cjSiqmE4EAZR0QE0K6FNWsW8ufrrQxIe\/xD7cbUgujLbKzqWqk7608Q55q774DE8ILjiQWmYWt+ng+7PexDDsMCCOBTah9+bKy8C+0LmKGJWDbTqW\/5O+Dd2ff9Zipb2Oz\/SF3cSdCA5G0qyYdLRI308HJeUeNeZbAnILevCnuB8SgJd5tytIsY9243t+QkK0MBmeZPyNlFfdFOaT\/KoPlIPvq2vr8tgeP7OZ5ACiljfkBzr0KB\/RfLZzE4Izk0\/A1Ed7Z8X6E\/3pYQwEk+7sPmr9bIjSUe4WqaLG8BAjbh3Fau\/66+hHkAoh875K3zMuz0hLdOvoo8d36YqsrHWOrhv6KX7Bc9TRgQt3zJ1k7gi34KM6BD+grqwYUoiJezlGj3R4IH4O2HIHaxr9Tja11b3VFxIfDi2kjVohhP3fi8JBePHyLspYDy55CeF7gc2ARdRpk46+kMuu4\/3vWFCJY\/dj\/34BLZVz4S1sVB0wIJury3ITFGg8GsQKrWaeDAQ0Tsb6\/v0Uc1D1cKA0VIb6yzdc37ip9GyZlHDCO3yHZiOrcXZ7VLWlafjoUy0Jdv\/lcnK4c0TS5hcCPGazdqD+mlqMOpbiYWJA5vsQBeGhfxgr6nFp3WlZ2\/1gPXp1xzKCWkCwI9zAfTjmP\/4OIWlvF4dF5POXSneKCS7AQsivHW9RQ9nG2YudiVEXAxlkEFjr459x6sJxlrTbFM8EiAYPzdH0BUVHfEqpaue5fGbfmlJNJFpOHUROOsJVEivii2qoa3mxfV69CvEF3GX2SSDxabYOLdTQKlN5jZ+Usu0QMlZuhbXylFaJdrGm5b2yO0zcuiBqHuNGMIczVBXvi\/ZdFGkxQBNY1CoNzh+1NbGOZGfmBQB8zARJPGwqcBLWApuAas2DGSyYsUxhW4ADLLrT+SdSIe2coy5ndAfktRbjokGfBP3EYo+Y52jroVyWlmf8KJyHLCtxmWMWEm3PNOYNlxpYjcurPKRfZwYu6udugiDQwwy1m4jg\/CSzNH3UB117baNWerW2HgDB+0GR2u92EdaR+D+iVyPZIMFn2sGnfHKCtYzhnCO1wpCwvLQj99G6mYI8ATF6M7QzjzGHOAyrgWHLlB1+yPUXus9+PopFJrBeSKrteCp0YbvECbm3eGXNHkBlT6Elya1f1SzPUj72qIdmIxEb7YjJabt8ZTtiW97+bZvL4CzBnghe5c\/zcrASg8CsF\/2MAZC6dlRPSqyDiUwwSVwuDLDYdwG1d7bwGLgCEWgeCHjvC8N+v5zNnsfXmpo2w3Y8RPuagZ2kSRK+mpOncCQY+8eIEpIMdRjsNUR6uXCaqXfvKCO8Y5\/p\/4q3t6HiF+ur+fFR+arVp1hOgXl7C9nyLpxU\/4H6o3NifL134g9ecodD7othwlf3msD1M+8enSpjRye0YVeg1f2Wg\/DeGFsDr\/mXgYmtgmFvIh3iDCImLrmYdi6CqxznTFLu81dbdavdTu3SsxGVvAhZj\/Hrbvbojc9Agfy6dx4N5p0Siwyp2hSnSg6f\/fEmhi5M4Rj7j6fLviTErFh11XrCgoPiXYwqhwk1YJEujySaI9r4JZqz0yQ408uMlBkZtz8KH4UoJFDh0ji8AckwgIpF9ORAOFcCcgZYiIP1XiA3rnLusDbpH1qN5yxK7b+BFrXZl6Fjl8CaDS275GLRdAyeDtGCBDkv3sdhHbtCgy9RFC9sSYtlCsEQV5\/c2wIvZYnoOMifov5wfbbIVfxsSbSVqACjvvuvz6zGngsRkVwzKFtgiOMmGxeFK1TI2JaozauTEDBwB4uLc4\/L7kEqkGdFXD7+pHkA0lPr1637RsKMM4g65\/aVyr4GsduK2fOUzpE4IYCEwQgHBgjcgI\/UGcLt6vXQcq3ALKlniQCTbiBrLnIeMvGyr9h1QElfrPW86001iNSalFx4MzTxkrSOg2yRcsgwQfhpCGLuiLirf4Pw5+BbwmmSeaaNKaIv8GmVmpbBUstr9fblZ5qNBZ1ST3txflwGh3dnsJlLu7GWd7pQfiN56BxTPgo9N88VaLlMm9duNIInupDQeh507aQL72jInBlzWXxQC1kSWmvCejMzpQXUB3xdiV8\/ilXJhTreR\/Ej9TOqbbcxurqyFL1Qr7q1I9wDBde2mqR6rceUpk+kN4eRqSkZ7+hJSzRHyJ2jmpy4OrE7QFGzd3o7EnK5Vpc5gy9Ip0WFwfXwtPkgVIODYDPCcnnNrRZpvOzmqRpTYRwnaxgnbKlsFCL90V9kxYzMKj9OEO8RweeNlf7KvnyMZxL0ZacMm3qz4bDj77uJ7oyZyzSkc9gWXmw0Au9\/yTT6q\/YFhAfV\/bwGlRiLx8tNy\/WQI+VW1h6+dM+tVlKVRkwTWt6jIuhTgqtzRog31woaIjNsW9sf1MXFrCdt8j7MLe+TCF47yutJwq+zal\/9ShwKANpY0pUwWjRLUZr0RTyieubo0Oabacw6kLI3ha0lqhiB0QSE7yGydFf6XDU8hd6pjtUcfFtyvMlD7360wqLPWkbQVEcoO4G4ykOH9AvTFjQZTPS8gK3YZFVxS0+qyG4N+a3c9nPLJPD9re51C8kZGPZWBWPllWRK7PGkirahW8ZqNaacsq76iOTcyXfTESXo0axhYHbkubWRYRlQq1w1KoFX2t2rG6cwOPzD1xPN3Q5sh\/OownMBngV+xaV9sDFv5\/YEGPxSCH1q+5OJzP5yLro5C+uflzQ6uDiAKQyVzWFcLpd5CmlfCK92j5ZUSOXq3PbARrk3gq0xHbo\/qcdZpBBE2NVkFGg5f0j3hFJWLe5UVPWhRGlhLE7I7H80DXaB7Ta78Hd6XQLEu2WJKthyUviU+w4VLlUsmuakoL8oSTtwnaerOS9r84Rlid71xbP0IgNmDBew4eYo670ZebB\/Rz5Xr92+5AY+3xIJcjUwkjm+i+bt3JQj6tv0ijsJfNWJDWZynEXkFt8eKAgPErhOce4PQxxNJ0+Ek139rBh0BhJi03A7neS6glx+LMWxdRPEuUF5GPxwmWKxfu3uLwuzZk5RGo6fv+3NL2d9DtI9zgoIOVQbFXANWgZE79XKIYILuk6FT\/doNE+Bv0IgoEDTBLAxZF7uO\/qypWkNZt8KtSm9wgFkxfMCCZkceSMB6dte8eXZNRwfveIikYfRyzA54kgbUTzw0M\/wNQ3Mkx5t9dww3LSjZFnkFFtRBQ8nsOMiirn\/O57UgO506dBZbSAMtWBdGeiWGrCR2IjWgfGCAsOkK5pjywNv7XjPwY\/7mrFqLI0o8BVEL7EekWjrwn9o5H\/4tn2t6lWolyV5WysqCzuGZGQs7RdvI6zSsPqahvxBbHKyVQoE1SIOJeP2Wh70GW0N46NrkNDsOqYo+oU0RmA9iSvN4wkExzOhVQq2SE6lqyqw1hb0QZ8edGpIuzHkbA6Lvc013lIElpAOW60w1V84\/jHqgn1JePM1ha8Kn9p7m1UCNJRvJ4D8KcmQCu399W+SY1XqYWErX3yY8\/rKI5xwlAztIRHEhPDm2fHp831\/zJSw00RKmKYDiijwUjIbg\/Aa9YWcqjO2fu\/wLMjEZf\/BPZaKXOEYDHYiJ\/YZ3C3mWvoOw6nKp8m+6VlQa+zQ3aXy6m0epQCoN+NeIUf8\/Hlcu2J\/z2nnCbCheoUaG9I0hjdxlzp4TzYDuFjdDLs3h+vQnNHgOcN6zsBG8btwRkfRGZSwUvt0raxNTH01IDVQNMwBpxUQIqEjQY8e4bmmLmlK1ZcVfMDrp8LEx0XfFPMqO6s1UjRsnwJQUacnyDux\/rH99GIEemgoGoGxLtGyQo52MBilgTDLiE04JiNQqZ4\/R+NVKpa5NAM7U4Hxmm6BFOSjHIeckfhs\/YppW\/1yU9mq2ycb\/LWfnkGPXLEiGcFNTFTvGVblB7kaWQqqrfJtJPGgA\/lATz32g4713WvmJuO3JNFgmh5uxLSmkrcAQ\/rg2WvA0uydJbsS\/3DXsKf7JsHFGZmrBfh46ySuSDj9+n+ngyx19\/XjZFboQBmnamMav6wVmVYvDnIHW7yqt49\/4560yyIK9mSBslyp79X+KMQo2w5kHrI2pKOFcR0KtE9cAgC1yBORrZUNvcv3kTYhwk3yGQ6vNduzyR6QkZ8KCwHjN2jl8VfjKGNeZNn+eJ882SZLlDiD\/eB6DqKjVFHb9\/P3joAXLlypb2wYfAUi7DKtQ3G3Me3bpV2ERZn9Vf2xb\/uM0E23+wi5Ii9iuCvzcJy8790uW7iC5QIqDM6dLzA6WSK\/2KhUB0P615a6ElWLzkENWIIXgFINaRBXxbxPsRaNjcFCNem\/5UkBmULwdxRyr2865DewIuYzLhQTzdOIZ6rSRbdQ312djc+qGwcqzl2b7mkkkfpYdTidUvayhDd4petTG4zLUHLI\/AZ++V04tUQHX5v7e4om\/H7aQpjRNhIvJkt2s6uUtGzVBlgH7OcjmDhp60DqPHH5bBEY3Cv47wRS2sOA6wmSw2T2Qv","iv":"390566cabbf057882ef26095a9a8a859","s":"414039f7f34ffdc6"}

Burberry's presence on Tmall. Image credit: Tmall

Burberry's presence on Tmall. Image credit: Tmall

Rania Sedhom is managing partner of the Sedhom Law Group

Rania Sedhom is managing partner of the Sedhom Law Group