How do people think and feel about gold, and why?

What motivates them to buy it and what are the obstacles they may need to overcome?

All these questions are answered in new research from the World Gold Council encompassing consumers in India, China, United States, Germany, Russia and Canada.

This gold market survey uncovered insights into what, how, why and where people buy gold. It put these findings into the wider context of retail investment and luxury goods, in general.

So, what is the state of the gold market?

Globally, there are clear perceptions of gold as a safe, durable, traditional store of value, the research found.

As an investment, it plays to these strengths – retail investors buy it to protect wealth and create long-term returns. Jewelry buyers treasure it for sentimental reasons and as a reward for success.

Gold is mainstream, according to the research.

The precious metal has a strong global presence. This is true for both retail investment and jewelry. Worldwide, almost half of retail investors and fashion and lifestyle consumers have bought gold at one time or another.

Gold is trusted, as the research showed.

Gold creates a feeling of safety and security, many survey respondents said.

The majority of retail investors and fashion and lifestyle consumers trust gold more than the currencies of countries.

In India, 75 percent of investors trust gold more than currencies. The comparable numbers for China, U.S. and Germany are 69 percent, 60 percent and 57 percent, respectively.

Gold has an emotional connection, as the survey confirmed. It is prized for more than just its inherent value.

Retail investors and jewelry buyers alike feel that gold recalls happy memories and can bring good luck.

Per the study, 51 percent of retail investors globally agreed that gold got them luck.

Attitudes towards gold are also – mostly – stable across generations.

Consumers often ask whether the younger generations feel the same way about gold. Survey data suggests that, for retail investment, they mostly do.

Per the research, 61 percent of retail investors said they trust gold more than currencies of countries.

This, of course, translates into their buying decisions.

Thirty-four percent of consumers ages 18 to 38 worldwide had invested in gold in the past year.

Almost half -- 46 percent – of that age group stated that they would definitely invest in gold in the future.

Interestingly, younger investors tend to be less risk-averse and less likely to adopt a long-term approach to investing, the council’s research found.

The situation changes for Gen Z consumers falling between 18 and 24 years.

Gold jewelry resonates less well with younger consumers, most notably in the 18-22 band.

Worldwide, 26 percent of Gen Z consumers bought gold jewelry in the last year, with only 18 percent in China.

The connection to gold’s emotional heritage is weaker among this group, the council research found. They tend to approach luxury buying with a view to meeting functional, ethical and experiential needs.

This is particularly true of young Chinese jewelry buyers. Not only did they buy less gold jewelry than their Gen Z counterparts elsewhere, only 31 percent of them agree that wearing gold helps them to fit in with their friends, compared with 46 percent at a global level.

What, then, are the drivers of demand for gold?

Why do consumers buy gold? The answer is that it depends on a whole host of different factors, including people’s attitudes and their motives at the time of purchases, according to the council.

But, at a high level, a few factors stand out.

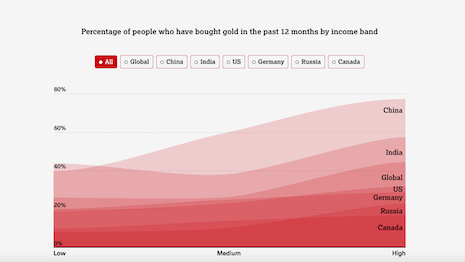

It may seem obvious, but consumers’ demand for gold increases with their income, the survey confirmed. This is true of retail investors and fashion and lifestyle consumers across all markets.

Also, macro risks and price trends are triggers for gold investment.

Three factors typically prompt retail investors to buy gold.

Forty-four percent bought gold to manage risk, either to diversify their risk or move from high- to low-risk investments.

Thirty-one percent bought gold either on the recommendation of a financial advisor or a friend, highlighting the importance of marketing and communications.

Twenty-nine percent bought gold because the price was low or on an upwards trend.

Jewelry purchases are firmly embedded in emotional moments, the survey found.

The emotional moments include personal celebrations of life’s key milestones such as anniversaries, Valentine’s Day and religious festivals – all occasions where gold jewelry has a strong foothold.

That said, there are nuances, with the relative importance of each occasion varying by market.

The research showed that anniversaries top the list in China, while in India they are matched by weddings. In the U.S., gold jewelry is most often bought for a birthday.

What there is doubt of is the loyalty of gold investors.

Per the survey, gold buyers are more loyal than investors in other asset classes.

Sixty-four percent of consumers who have invested in gold in the past – whether in jewelry, bars and coins, or ETFs – would definitely buy again in the future, they said in the survey.

So, what is the market potential?

The council found there is a significant opportunity to grow the gold market.

“We have identified a group of people who have never bought gold in the past but would consider buying it in the future – we call these people gold considerers,” the council said in its research.

Thirty-eight percent of those surveyed had never bought gold, but were open to doing so in the future, according to the research.

In the retail investment category, the opportunity in mature gold markets such as India and China is smaller than Russia, for example, where retail investment market development has been stymied by a high rate of VAT, the council said.

In the jewelry and luxury goods category, the opportunity in mature gold markets such as India and China is smaller than in the U.S., which does not have as strong a cultural affinity with gold.

The survey found that 45 percent of consumers have invested in the past and would consider investing in the future, while 38 percent have never invested before but would consider investing in the future and 17 percent would not consider investing in gold.

Unlocking the opportunity is key.

Knowing there is a sizable opportunity is just half the battle, the council said. How can the gold industry convert this potential demand?

The council’s survey highlighted two key barriers that must be addressed to unlock market growth.

In the retail investment category, 48 percent of gold considerers cited lack of trust as a barrier to making an investment. Twenty-eight percent were worried about buying fake gold, 21 percent concerned about the purity and 14 percent do not trust the businesses selling gold.

Raising awareness is another issue.

Sixty-six percent of potential new gold investors do not know enough about gold, do not know how to buy it, or think it is not affordable for them, the research showed.

Fifty-two percent of gold jewelry considerers said they could buy cheaper jewelry, it was too difficult to purchase, or that they did not know anyone who wore gold jewelry.

Awareness and education, therefore, were key.

WHAT NEXT for the World Gold Council?

The organization interviewed 18,000 consumers worldwide, from established markets such as India and China, to smaller markets that have potential to grow, such as Russia.

“This report is a thematic analysis at an overarching global level,” the council said in its report.

“In the coming months, we will be delving into more detail to better understand the individual markets, and the mindsets of people who currently buy gold as well as those who could be persuaded to buy gold in the future,” the report concluded.

“We will be crunching the data to understand the threats and opportunities by category and market. And we will engage with the market, with the aim of educating, informing and collaborating to address the barriers we’ve identified and convert opportunities to grow the gold market.”

Please click here to download the World Gold Council's Retail Gold Insights 2019 report

{"ct":"bCywH5fIFRar6Flg7f+u6+haHQJKyOlsIxTK6yBZi1i+RL4cI1dT+YbbTl6fZLnMvAysDelNLMJt5HHTxK3EsTJY\/LS\/x\/2Ja5Pfdx5yvVe4iCWHOnxkyS1Qw\/52\/fe+bSoOx7QjfJCk7j0p+2k2fQKplsC9Pu+HCVCjv7EKErNG34jCGe2ZsMmT4ZIL7OIxT2EANmXc9tEA38csdOVsm3MahDUQGoKIPjbuopH+A\/jkAu\/1rOwajHwe1LnMoStgkUA+GMYlJpJEohLCtO6jIc5TUPKV5r69KH0Z3ABqqc6QRoNfbI1YzSlKpBeQBsAtwAjw0IOIEv+geIrE3XocNdCObcZuVUd4ToSfvgIZlhPyZq4SONdmxMFE0HPpduut+0oU6FeMOrpEAAlLOJlSlez\/0PpiOrV5ixPJesMG8FjdsEy2M9Z5JahY2idkw7ffipNFFALibgDbdQE\/UEnpO8B\/86+12XdHofH4RMQwRLyvvfA0I32I6htitf\/wzUoSK4OYKzQVsym+PlsSuJ5Lysz7DGfzfWd4qlKkDCydhlAocqTr7MSfAD2WGjID7dqao4tJhmFIlwKHtSdWtMnkL0TS+Qzp2\/nkhGOKhY7JsJlExc4G2U7WwUbSdn2iRv1ZSGkVs1N5rOipQTbATFRYIdOXVckzmRajDFBrwMAc1YLNu2er1PJRdifPLC+5G9OIfc\/0PHiAGtgCFVXU1FC1lJ3kIFFSILZUafy7OY0yTNCcMTJBQVCpYvOidyNehcsfs4iQDOVjTnIz\/+nzB1LKK36LvbX5VitfSF3pcjqLlngfXl0J+oZpufMJOEiA5rfE1l40ZcLQA9c5hqshhodnv6PQ9dF3\/YM17p1PKI07sWLUDsSZf95zyy3w9Ibe145usYjRMBbJhusoMAsBoaL8kHThKn3lohipazDnsWso9r0jTMv\/jjDpL5fb7LnMre5STR20qbbJ1dmWlkD5XFIcMZRg6GjK3ztjObKOBfTW7Ex9+reS0iENrFUj6Pnl4Yc1YvGdOfjUZbajENTPa9koOcDGYCBtvpIB30L793lxUa6579tEdoUtF1nchY7FJSaQJXvYRMPaJKXtoQ6NsC1\/hyhv0AqzuoxyLVAfMn8\/wFklzW2w97dsVCyj72baXskjGGUxsLc67qFaQ06ZOMZOmWKE7G2ENdOKml9H+tqARz7sLVRNGUWNer6kdgmLadi2hwyU38ULwHu5OK\/dPBWXlnKtj8+2fXitgF7Q2Cb0jrYDkQigUFXYB7tZ79gUguANSQQBQGSUq\/sd4MLT9sywKS8MNTjubu2q6amAqmx3Swizn8uTx9A4fwoy7MndGhjPEc2tWOemT8oduLzhtnYqvTrwUey8WHH92u\/2HpwMx9miSv0TMyVoOr5pATufkH24YdP9x5SNT7sgySMXeNaUKgJcbLQ4NJjCVBCU\/+4hUsHvXM3NaXDGAmfurAi0XMATI1lbViLX57JhZhPsKd+5XlClXVYWVG7+ixV01ZQM8sMGWAGEQCU62GUGzo9lH+kvzuRpcChjS4VjIRUEobKce4N8XfA+YsJ3F58USSWbA2lRSgK8R2xkHNnyeyjIwXYg+scz\/qNdHPksSpgFVgClMGuIDW7G2CkhVbNw+7+5G6KlSzISeoJ+Sb5yB73fUIf6ovLjzi6RFQxW+Z0K1InntGdK1IVH0fec2VwT98wqZZVwJ8ajojCM24CFfVbYDrTzO2Dum9xq1NIzOZoqzAB89cYOQWoEC5aFQFpIl68X5Ryx7BWHoO6W6JNSGG4NOn0hRvj2O+5NrKPk24hXLkTy+JrwHQlwbOTg43g0l+E\/KyvSjQ+Kqz8dnW0mBxZ5pC07mBiCb9DvTgoKPgjM8tcBAGGyWI2git5RK8BdE3wsC8X+RuAOMuxdkozWLUEGSeZNloaJSY+fEuh9Lh3OtdUErw+IFcl46vzUiIwQpu2E+fWYwAgQUvFHkxFU3+frB7Df3hByOr0GdwdDcR5woFOs\/IgjTn+Jr2SFo+kjaAUBEmHvFdb6LG7A71YDN8GNSO98rGWtGo2fagOysQLNyESaRGfKabVBRgqXxmalD7KcgwJMA4AlLIoz+YrcYV2\/bbBC+GHSyTBrKXC+wSyn4ljEFzdHPvJSfk7u4bIEIm01o1wuH2J1E023HeWSeHRtkIw06z5oH3lDhzOJ7UcxZNSapV6J2LS1t1sCTb1OAythNsNixHNu0asX0hTLQEquUGM3Ku1hUgJT+M2rgf58FGIqUHTYd0GsTKxKkVdA2bejYhWbz+ZI13z3wrEzCsweze9iSzlhQkCDz6Pa0GE1EjL6dwG1Rq1synXRTaimvIAf50J34B36uSwM78+XLhGtvPBjSWKa785k\/v5vq975ALL85BG4p\/zBXi2w9rHcZDMpbL8EkZuKZnRmumgHMkM+scW5lCoUOya2evS1hchbo6dX3eV79EsqGCXufbosYqXmZuiR3zNuQ4oP4R4FVV+ITv1U3ukmfxNdvBgcEaw4CnzHR0sHIqXPnc6AQ8NngMocRTuUICnPgYBy9mwkCWnNqkraGElmgxR79tccPtmIhTBiTvegVhbVfgJ5ReJk4K2gH3R77ZSx7Lh+ZKO7rwXVsx7a9hNlda+LSmJ6tsppxYzz0uW+TQW6dhrbvMxzMmE9CjBpqgoYVXLVFvJZSQEIZGyCi2hp4nJ5l50r1wLVWqni+\/ikE2oywXtXGgVAtGIonLbtTu8bUW0y1xfpYQODUFtzZtfVA36kB5DP7gi3axp3Nm0HTixLZrPK\/Oq9C7n8dPRO32RRKpMO9Cu9GHQIyJgnkEqoPrKgcHYBKzQeIN7AXyDh+sDwFZstjFDcoxFoCn3\/c4bgncF5LNBsgClvUYIStqdSSEntfAROgomhxFe4pECD2m5N9yawNz6hs9pRjN83JIcfMKWMfPAdZaNp1CqIG9HSVzQkPHVCvy6g1+Rje3vPMcSapA+bZ58Ay\/MzmUdMmtft08T4IQVqmw3c0fAeabqF8q6JCgvaVcrYRctZv8LTgefPdGhsr9jWBGj70UuzjAGjnzvuIRldg5tdCZq8OXeRoNqoyTrxZmkVJC79kSTDyF0f2OBNKIO4oOhNKc4S1buALj5rMZPnWdKj0+XzdEf1ltoU5KzKL1RoNb\/wwkIhKAQdkUBUyDSjOKJqanfUyC1ykytyBg6VutD8JyshmJPecjUT2ZmfPiWYVLDTKHtz9q0Twc0pXMt83xyH2daNFmYS3RJbhOOSsptp2H8r5rFvQ3lZEyYRoEdSJo7y5sGvXg1C0eILUulJMiAiduGWpWxiXJmd9SDWDKsPZFGbUjjtBmWlpD\/F8tg7XKMd0PSQO5Fa7\/BleUEf9emEKgWK11nhyouHGQy5FHy3BjR4iykT1FTiktvhutwGqfbjtRl7w6lsG1MkQxc\/R5ZKYFqZs0tZE0Hyv1RnoJ\/lX8a4rR6nVDJU5CPEXfbE1ZYVBn8B6qdxJlE89agLLvlgyywwL64JrO8eS0K+k2tiXB7IPKafBy9ey5itZBv4AGDuScswCF3gmC8Qu0E5lQ+kJkzRnwWUwkFyjJ1tX1jAOt1Tpw+IXI2AMQ3sYLWzPI3AZe6nLd9R6P1FJoVTLxs49nLi\/fHh+t0dEfF9MR7xaWpcNLlw7QlU839IyypA2KFNeSszbNEYpay1QZKfR0aWZMmyCLStjj8z5hgiCOnxKS5Jd87EcFnWv1N0iTQ4f5J0FiJfq+1kTfbse+QNHcCdNEqvTBqeL5mFax5ByuD+F1oiRZD07Oo6ibDD3pvF1C0RwZ\/9UlCtdyD6PVuEwzUnfvBRIlVDePQihI1dSO2VYXl6Qo\/xMDsmrRTS4HXVzbBGgTwD\/OWPmJizIt1uM2EvhMVJplzotEFXFPrqdHWNdtaj787pQPyOggkzz7SPdkdSRGXK4Dysqpd6DMM5usZFERxphWfh9o5TRzUYQruMVXCt+fbNEnH4oFWUr7OcsK7kuZkNjkuuQw\/RQAuJfTqdbpasBJFEV7IceKJLXUjGfiHtoqJj5bcTqpcx+5dmpZLwOWD1feMkYnRgj+Eh28bHqpF9kK0vZSK1+pHMKfetwJRZlz8G\/2ut26cq89XRghmBy0zdw3H1TJgvaZ3QssY\/bTneDo+YaIg60cHc1CYEoZFPWUh5va7ZZhxqKAiJP+WPz4UHAcPvEVaz8fwzWHEbTfe5Xz\/mqT2UKK7JtFhL+1Wmn7nc\/+\/HejVsL\/Z825A0aX06tsgV8s9br5p8ipIJRVeq7HzLzY8knEkRFBtIhq0VdT9ZXDWYFjt\/ChIJtqi76DQ7zZalqyAd4\/Mqd5M9F3jPMO4Z3n9jomeJ5TEzJ2nbNfCuXrnusM3pAJJv6IOhVMSxQOFz2m1tR7cU8oy1Wh6DBgsH0ymLqbb+4YsdTrlUuTdEVNE+4rpKWaal5CTyu3NRX0lVFhihNc\/VOlgRDKxw+xvrMPZzz1YbR9V5jvHtyTd2s\/ZQ4dxr94DExiosh37tQ40LhN10DlgfnYfHhMgL6A674mmE2ZQ5HG+ibYYzsor5hbtzA0Syh1swbRZ3WOh0WpgtwB2KsPLMKhUPW7ltonTEn1GT7HlaZwx5HPUtLVCFioiPVvLXon+h30cqNTPKNqNCbiIzN\/+8XZM8a5ihstRIXqpOq0BP7VoA5R8BX7PrbTwZjD+CgUsEYrVNsx1fznR9bK\/f6y4HO9Xy0AaK\/UvhzMsHbid+j1XaPyy+vzUfjRjMuHXcMje+Mc4Voy7ZtH9X6xHCVfsmI42UQqQ3e0lum3Co8CzVlG4hMROkgrtVkp+K7RgiS8XBoo9cDv1prgWMqmA5Tnzna\/KjRFL7XcxPeM7VBhaCZAZSOzhBcsyvAx0BfGGkypElPSCIV7HwLMeiG9srtsojrzemxN2LutN60dIg9Ghqqwa02V8JXI8sxyC+cxJ9qiq7qPkTih8JA09IduwbRBm5tC9ddSWdxaUtLYo1PsgvFPxjySUGpPfpybjFa8QlRjbdR9uKbH\/90KhnKAp0sOj06u890F0o99wK7DpkD4DV51Flhyq5tF+AZdzyyV2jDwxkmkN\/PtmCQ687svqnu8yBE+l0BMKHRML\/OY8QaFOw\/TciJ3I6DkeGtOohOdDeOrBQwnpab+puS+7iHcGx7XfPQiFlMKjRQNfMny5CHu8c0VRB1QqcieD1f48zltaKgCTd4jsEanQiggOGECvQ4R5vj+DXP6MX+5QPItXgCGZ+VEmdJikXZZuS2PxlL7cNmtL+N4lYTWOO\/50ekydDHEabrVVAvwwMOC8MuYuovgpzc++4Ft80B5SN8\/umbN+NyNyJ1y3v5PZgyKxXJAzYNihPuwwJJBRfn9UZDtjdKktzsl7dQ0ZUtSoLRiPOveMuwXJZOLl22P5D1ymbsovNh2su34BF8dXCI3QEgHel08Ys+HmxX9T4P5HES0h770W6RAoHJG74uia3ymSt4qUngtMYpC9bxiYxpJJLCcXc8r9ERDrveXa3tE19x6npPe6zj+Tdyo77obIrpxgFoztjpjbjuYj5EEHlthVHUc6d8M7BQ9mBTXyBL5QL+77Gt0YrbMCj0wn5zU1pdpDk9NMNJV7izKBUkAWgrgyoGwsKTcKifwwJbimqi6ubjnNzbS\/haqsAOBSp3sX376fkAEvmdezP8DRXw8kG\/9gq1PBIXsEvMLE2W6bu\/a382X8QnQTQSLAn1+wxeJGyq4dKB1Q2ofWROmu4gMrYkrULi8629dcOavbDjtljLixrrSxsowyLLZXicBMXdXsmX57atE03G6OpVXHecNnNluhgRlYAsHpN1ULM8HT3Z1WIhzJhMUf5V3\/IJEDOMj4fp6Z9I15RKe1LpqpBoYl\/3pX\/Z1MrN0crNCCFfrrFQqhBPxV8YFcEq+okJrkrV+QwIiUrlO+9gUDI9+Nee\/l9pL1AZVjtu2z0imhU07jT8wRPIZ6bmj3Ev0soWahU8Nf7xgPTSQNqimF+ClbppIhFLO38TEhSpQGgFZkl9UCcLsw2aIuT0sF4NIsMNymIBazHL78otrC8aopnbtdmeE4pGNsYgbK5HQNU7AYKPScGIjHcFoojCFi0G568IpBlFk26mnEdilHVoFpsJl7v0Kn75y9Ytxt1ngmIDm9i3udLmwKx\/E+Jn9fkjHpxO5sEUaWV\/pY1vA5NvIKsyD4QK3v+WwZzFOAgdvQVPR21F6w7Nwx9h8d9MIyOSflCCHxtTVgvhRp6Bl5nx8gdT\/1jE1NV+lGe+quwdi5tuSz1zcZ7CQPggsxrmPXiSuF\/7tiBcqRCikiItVs4QqXdSjpbFrm5ajU+UD9LA3ZERy2hrB9BQkOrjnPKb1ME3lDqRM3I+sqQZC759q8Z7\/pJRE5cdn+d0kOTI8uSlIDReLH08mLw3ZMC2eE70u7ASqtpFCh5Znbm6W53j3uyymQLUPJKBHGRbrx\/6fVik3uxZmQBGP18gEXEm0Lh8KQlw53PwSMH8IYHl7dHQ5J7O7AXQ0voZinBCg6eNMpXJCoCuw662HBgJ\/a5jgrfkaES8mzw7hwNhvKX3fU10Ph7VpLstgr6eIHch7UddHy43Nw6QMaTwdFgYaXzbX+e47sb5v+W+L8DJ1Yf4zwbITZH7SKX4J2Cq9smMp0RjjZtY+icq1XUg+3VPKsiLIVO+WmuYgdoeM8Yr9MfM\/4ylqwUkrkjYjvgdFdf1Cz4Po6xOjCi2UpzvI3F8quboOm6rgUDdj\/PDIIvBBz4IjzZP8EyJZbF6PI6DmeBprsxUZ7DC5Dz8apE9K5qxoRJnjuQW9ZFJR1goUh\/cHB54k34ajSfNcElQwSjsQbKldQU\/4STymI6Y0lfCsUoZC67J0wHjVrc+f\/YO2DuzQ2iBufah56RTjJbVb+pwRItQ8a2\/1cGGqXKDomvzeUixgS6Dr0C7dyAwsw5xFAGOaAE3YQIt678hVi80iWyKWI5CdNNsK4JQRdRVKoFKtwfVn86LXHCYTn8NcVrhPFczECRRcuvZ6MxAFxEuUbXcb4VQD5vuZN5k200Lw6XhQW8+LsWMfbf\/7cveg1wdNa8oCHNOppyywrrNOc4\/pqNGCT0usc88ZcAkFMc3LqdrtwlbRVr5srdjJCtaiyt33PYkG2ZovDV9nIKKdRBEaKN172pdMiOD8Hf4Sz62oDU22iPa9B35l98pTmALdhbEnJyWaTRveWKjJbha5sBNegKaGHLEdyI5x7AXbzxH27LvjloQaTWxKNOScZAmAApHg\/4Ahh+mL+68NetfAStKjQMzZHwJ+Vzs3hp3xJ87vZmYOAjkEf24uB3xp2RQIQ9ffylVxws6Uaw1nvYpHuUhNLKLJJYrrTp5nWU7jEd7BdkGspqk9zoAsQN2MvcMokYmpqMoV\/vzynukvZ2fMltDp5nO41rNpxbo8tnOP4ysRE1dWOt4HVXg0eRmOf+bormSp4IkGtGxFkmf3UxXdBCppU0ZcaJhO91R1j8tlkm57nczwYWDWscRgFRhDuHviQTeWXZynExZHLyw19\/xsAwYBNfAWR6qdVumGq3nKXnijuK3qm1kfY3HKoFAbJaPM3a74rHFvfXajBTyOQMTIgPk3oNQkcd3+iD9Qhggd3D7WDDwYWNdknv7Yoo8wFHgTt2LTa+Z808rNL6OC\/oyuTEbwB9pFgTB9BBXiMSn4VPYFkSUKh4bNNnHSIN\/h5BmpRdlfBKPxD6AB3zSI5J1MlfjJ2I53pQYwxAEAv4425MAjQJfuycLO9bxtI\/CBzimjmw1RIO2oSTCSlbvU56Yf5BeXWNTNHDgsxkcj4pEMP0iMAw04nsayJKO8ds\/Z3lW4yFjiNLZNmI+qyZWsy2MsdBAzdGydZbypET0402NbvFuRWYI\/KMo7n5Qu5ivfo33OnpcYRHXGwe\/Ne2wbiq5b9ZNdE66OzlTaekHo+jQqNiolKW2oqz6+rOgjRIjcIlSihBsLbzeofZPwDt6WU\/ztSHqdAetAMEo\/WsFYr7jsE9R2LXDBOySj1mJyPT\/7XmZjsSNGcv5OYe+ap5nBvsoNe+jA3O5rF5UTLt1ZyCY8Ak3bt4TbeEZOjRjPa5rSN2\/c5vDk1cHKGE8EYP0ODbJ6zcr9RJtTIC1FwzkozmrxuF\/Uwvmcj+MGgvFOyASn7Km0z13cxgNGTVIDmTswI02kdQvH2VMT3PEza+T6IZUOciJ2G5sfHQtKyW3ZAdiI5MKLAMZmxttOnveD1oiWuJ3gflOJ1Y27UKzD72GuT\/QJgPk5FBrU9RPoWkl2FaHp663F9Gf2ajpnL+V+c7jDdcv\/n2t4gER8ysiulmPgIxFYNIoVjhVCJTMPxN1N3epNqD1NN+2xCquwNBus98rXUEqXWhvWSdRMTlRDHA94kKD2TRfJi90LoGLRfHs5QHJOgHIhc+24HtdVC3Ruk+Y4rqyAER86kftwOy+RSG\/KzUtErT9Z8+bSFnik4Ao84SAbC0QchQO\/ZEnCt0C5cwy3cFQAXtY2J0xriu9dYAT+WdRdW4Jgj5VmDdKxUWlhwW3+OnArkDc1LkB7qNmlvGqTiU5y7xca5chECqrIY0KGmJoNdGdD8x2SDGt1iSJL2K93ivyY8ASiJ933WN0b8ovR9MYx5pExFlL5KwqIqaJTgXvbIW8QjraUr8\/cckr6iX2mt6aVQ4BlxU1\/p1FDCzPTls1SUFlBeDDjk+HFfu3O\/NqcP1by1TnkmyqZOqcLAx3bcoPYHFv0R1\/g+1CIDsauxD6\/LOWswv\/MLxEG+eumhuqS+KS0GJV8smHdUyJkR3XcbY+VwqI9Fd8B78COJmOBzEXICzjkOidY2G5rNQhU91I+\/72ph9IQfV9tqObP+Qn9gaTzMwsDUeFMGyV8rRL702JkiUT4m07RjojH0uiSY7bYZju0e1yPDty8UKtQIV67iFx76p0TU9UgzR\/XWnf6zn3C8CaZX2HcVSRlsmsnJIfhciWRQn5drVbveuuW\/AWRBLEveik3vIl\/woJnQBQsKJQSsyTAu4BpUmPxZowYg4tnFyrSU4vPUsa7igFtgRthc+XYlsl4Pkv7svKOJsR4IQKFCJmuzyR9arbEkR1d1bKwd+PbaDRmtfX080jpDX7oYvKYoeB8D98UdzkpQr\/z7X9h3PfeQI8mZEiiJNjkmkU+x5TyoNn8xYWEpCpHFkCMbH0ioXT\/4k2GWP2swfOs7OrZlZ47ac\/dYf5uJ\/mtC2UdKwJZYswAkcjNmq\/6ao3Rm44Cx0TfOrGrtXRj58HJkRShrK2tsztZseqzQt\/rlOwttvzjGUCte\/4YFDoSdOYuILjE58LBKF7mPPJAiFExwnwvx\/YeBXYQA56IbGrYlsk3fWTF28o3O3NDf8GYPRq7OzDkCExXFpbRsB0uwXTfWeg6q8DmtHEl8cA5a+c3ay5fsYlbExN\/zoDD5noIuvIM5MkPs53+gvWvjtDbkdPbr8WrlxvEJHy4pq1v9uPsEAVtrF85s9JyJld8yEx16yuQ648tb0kOLQD2ghHLOX7LM1\/eigPoJnqHrRFDEsNd323zSAYyfrhXvihsqyxqJrN4rYkChdSJAbGoZ9\/nWTP+T4aBLXBhLz3eZLqBzPaXo0ALIISG7Osaa1pMFB7rSuH9adzWl7CXceDf5cn87ZX2JLHJ6undlWHLNN3bB+3ujxsnTTTmXRkxfQqvxRdt3RqA2eoXfgHMoovmNPkKort+m7HWDFgM9jGEAERCHjALuh\/8Wnn1zBjGCRIeL1mYKe2nMfsb5nH2DQfTg0nWHYlSOCNUJq0WY2bmO72vzXDRD1YSEbY04V5WhwYI2Kjlgjf\/4uacJANs+\/jrCGGdtkZNbJGFCOe9qxJGAGPFrO8NrOteP+ihILz6MQzecrP9ElH6qJJdIdNNQGzW6unB12D7KFIHzATp3Ogb9pICJbboktR3etz36fHTAnyIsxNImkOUYecA4srMXol9KL\/q5rtiILNzGD7TE+RGvijPiAisxJVmoWJLFw7fxqH0e\/Mib4NggypiCOl7I0MvHhaXeDqdU9sEyyBF0+rZyOfCvAExhw+wtr8qLtVy1Mi9vtacRFf28+2YWS71UN23iDhAWdyq4NbFekLzLWih\/E4vnAKmpAtLsrNLD219C6FvNh1sPtWciPCdvV6XO+t9xvKHobBue0Q\/\/fJcevk3G9Oo6ejJwBmRdmbSwyR2z7fExpZ\/Mb1zvaHNP68aWk68thvILdTxrM30jZW0Yri6gGpXcM7c5Mv39zYBmGmthqTtYrU+LPll0jQ9Yfw2vE27VnfYq8pBKB\/SCsok9Gbv+xKhbkf6TT7hThmMCzzssDQCXXkJdemYIQw2eVcmMM9FjkzO7P+L764oPC\/V1EqlT+l1S7lQz0os9SJuHHtQea++glluiSbDe+CXIDRsssLjT6AN+ak+qepnbOw8b3Rci++vyZ\/IR9+tQ6X5OpXsV2mLJCXRzJo27MnPYRxr4Kr7F6P5pVauCzL6lmlukgmUhrVLA4C0IlWKGqygeMxnfIvO\/Sr2HMZUseq3gnzJAKhkGSa02rq9MDUQGNYLxhINAkBh2ewhCMq0EMUQFqObPkC5jTg15O18aiW2QWi28RIB3fs8EeoAEd+yuLKHk9lmHpiZKTT+XCww64N8d3aqU5l87YhoQLZr\/txm8d\/uSY5IY4ErVlPtXAPrCs9akmlDGumlJ5wOKRpLaZGJJlz+194ht5\/rx7y5PkzCDEZ\/Y7LqjXp9SfFWwsG2Vpdc1O+fOGItOT7peegd17NZCmblTCNS8ni2Xfzg5m6PNc7A2fNx9McJ2OBnrHW5UPYZbZpUsVeF39t0SqzwRLb3bEZ7IOZDysThxYVio3jLh8ouaj3FRKNOStI6SHECpWuChe7\/N93lmnr+bd6FlgfwLtpswuuYFp\/IyJZVFCfABI8LuXSMD6SeHPv0uriO4OpmKNTTNTgXpB0HuUx98Lha2z9urx0Cd4v9nOjIPDYA0Z9ny4FtDtyT2I+shThtKAx6tw6Gg\/yod1qsvZLsRM2SvqJG5IM5PT5u6RTyksb66wJSSSM4XtVD5P2l5b+\/d1jS60aELL+Kw9fNhGrQg2lUT\/sAkOW6uuO2DpJUInwcgkvtCLS5Q4\/70vHAcPH5eojDlCeMBUqHAc1HXapc9SVrW64iG4fBdn3sd4Z09z6rAW0Er9VSzpYjQ3plju6o9g0b\/vOJCs3CdYdMYUFqkXrvv7U0TtaAxevXTeHppYSxI8qFlQkKKeDEwd67xAiOQivjEb+sA95jA2KRQ4Q4MgGjWbnjwuRxL3ozraBanpoPrujslpZpfTV2e2\/0PLKuRsLsS7F32O+c5aJME85LXVeXpictvNDdW6XVkhRbDv6RJC1PYN+nlOo4ujad\/bB9B\/xorJGuVKeeumZ9SYyP9qwlNTMe7hb6iEIFLYKyBviNlQ+wCCc303wVh49voY9MdCGd0OFomoS9HRvlZ3tT8RiYKOeO8Qc46q0csCFW30W0jFPji1kxG\/9XoBZrj+VhiC0oQWxmGuq6btzSJGWGlXd0Yo8w9Ifi87+A52Q4FdORHXhBbVfAL5qK8aoL1MDa7DrVoOeALpwxpKBoKF0vwjSm16WE24i2RYs4+Ez2YSYPQhVuMH9SsKEvoTFlcTZOwUVFsm8lOCGrtEzlq2hGWRQdoVf\/y70+3GfuchmKRX3E19YRoZtFBI\/hjCnmbTQGskPWg9Re0iYRAseb1OJoTlJ1pWxtQ3vmTOoJn3Cx2mv6Fcj5UqRT+BoOYkPVewswDeDbk3Plht5xy1gL1dklf4OrkQu6Mvu4sjFIPRqGEb6Gr3ZNcYwSu7IyJCixfeUCY\/dzqaj0E4pPHWpgOLQB0AETIB+6B6qcurf6cRbOzfUtHcP5iNvuQiOQKUDMVZdmP6qLBNJQMte94aFojZ3yL9jUvWa48B+W4bWr0eLRombiBARppAZpF\/mi6qoJlAeFPaQDUOy9jtLVcO3zY\/tACe\/gzGKCLjFu92MpgqDh0D05qoYkqgZXmvA9IRl\/BAPE6desQQGRuljiVlPo+8PGyE771OQnBhIzSjD8Qz\/UD7XAS6RFZIyDZ0lU6U30\/AP0QUqb7psQD7\/z1S0zBZ2Im+DA7hFM+zs20py\/FI9qopUXmAA6lZOjj1nBEXz71ZrZaJc7tH6QURVmzIcx8euXNDO62PwkA0nqmWCdi\/e5ElQZvMtuxJRauaH7tze1ZzlQVn07B8qIqvJHD9Lbe6Go4lZEv6gm4\/n6C89OTwklHCn4hklwC1GjkWuDKSJllQTsxOUyHJ+E\/ulkcxiRELJ5KilGUlBxghsLoJ2PZLuEpu1i0F4jJL+R7QtdNuoy8YwTxJq56bGHrm10TNVSgYM4PDPUmo4TecC6Uu1ukEuMyVZkB9tO6wjoJM7bW6GMRN6XajFP0W9YOud9XhlTqPEBVSgk1P+P4ggkc+NCR2epjhzf2Xd9PQDtd2LV89MHUMr\/KHZwFn5oV3NcKTw6HcneHIDW8bmnVXqLoCen9HnG1bTMrcUkfzCcNdb49\/myKRJZlZCHwMENvxzLxo0i1t9AvZlJXWfB\/B1wgqKihWbTc1Qw2fXEheqMhPBD5eMCtjC4ZG7rVykw7J+Oh98e7yQ7PnpDCcus8gaATfT8J3lG1Ei\/k7l8+X\/kKVOZTmDSLUpJhRC8a57A1uPM5wRSdu1MSep\/FGui+u+JyDxRyJ2CrL1eWcJzi8KreyOVeVWmoV2eL9JpCVhD79ypo3z7J0hoBBgB8NCxWkhA\/NBpzQLn4Ttd1DQ\/xkbEtBGbaMHH79Up\/ztyE2Iar3rDBWwx\/XsfF58tgUpQpZg9LZN7XiITE0fMBj4yb1+l2RetjWjAmX68ijKSKm+18qSCvWp41+dx1XTYediWr3dnaIm0kdSg2ptfzCemTXuF\/QOJsxEIUtxo+tmMoIEhg=","iv":"cc613455790e7cc6f45e09f2258e8741","s":"210f6c3c7862d901"}

Percentage of consumers iwho have bought gold in the past 12 months by income band. Image credit: World Gold Council

Percentage of consumers iwho have bought gold in the past 12 months by income band. Image credit: World Gold Council