French fashion house Louis Vuitton has grown its value by 15 percent in the last year to $53.4 billion, courtesy of its innovative, contemporary consumer engagement tactics.

According to the 2020 BrandZ Top 50 Most Valuable French Brands rankings, Louis Vuitton took the lead ahead of its peers Chanel and Hermès. Indicative of the power of French luxury, the nine luxury brands on the list accounted for about half of the top 50’s total $309.7 billion in brand value.

“France was one of the best countries for growth in 2019 and growth is outperforming GDP,” said Graham Staplehurst, global strategy director at BrandZ and Kantar, in the report.

“Growth is being led by the premium sector — luxury brands and premium personal care," he said. "In fact, luxury is so dominant in France’s growth story, without it, France would not have grown for 2020.”

Kantar’s BrandZ rankings include companies that are either public or that have public financial information.

Luxury in the lead

Louis Vuitton stands out for its efforts to court consumers in an immersive fashion. For instance, this past year, the brand debuted a new YouTube vertical, LVTV, which blends formats including documentary and reality television (see story).

Speaking to the next generation of consumers, Louis Vuitton has launched branded video games and has aligned with diverse spokesmodels from the entertainment industry. The label has also embraced technology, creating smartwatches and most recently launching wireless earbuds.

Coming in second, Chanel is said to be worth $43 billion, while third place Hermès has a value of $34.6 billion.

Rounding out the luxury presence in the top 10 is Lancôme.

The luxury brands that made the top 50 list saw some of the strongest growth this past year. Alcohol brand Martell achieved the steepest growth, but Dior, Saint Laurent, Louis Vuitton, Lancôme, Givenchy, Celine and Hermès all made the top 10 with double-digit year-over-year growth.

What has helped to drive French luxury forward is a combination of catering to wealthy clientele through exclusive experiences and courting new generations with casual styles and diversity.

Also having an impact for brands is establishing a sense of purpose, as companies convey environmental and social responsibility to consumers.

For instance, Dior’s 20 percent lift in brand value this past year is in part due to women’s wear artistic director Maria Grazia Chiuri’s feminist messaging. Menswear creative director Kim Jones has also made a splash with artistic collaborations, such as a commissioned Hajime Sorayama sculpture for a show.

Dior's spring/summer 2018 campaign. Image credit: Dior

Meanwhile, Sephora has risen to 21st place from 26th last year, which Kantar attributes to the retailer’s Clean certification. Sephora has also made inclusion a pillar of its values, whether casting diverse faces in campaigns or using its platform to help transgender individuals express themselves through beauty.

Value-centric pushes are also being made in gender diversity within business. For instance, 34th place Veuve Clicquot launched a report on women in business, while 12th place Cartier hosts its annual Women’s Initiative Awards.

In environmental sustainability, Chanel has invested in Sulapac, a biodegradable packaging firm.

“Purpose is essential for French brands now," Mr. Staplehurst said. "However, with communication/positioning and purpose converging towards more CSR, we see a slowdown of CSR commitment in creating brand value growth.

“Luxury and premium sector brands still fall behind the average for corporate reputation, environmental responsibility and social responsibility," he said.

Kantar found that the top 30 French brands have more of an international presence than the leaders in Germany and Italy, with these top brands having an average 76 percent exposure rating based on revenue, volumes sold and profitability outside of France. The report calls luxury and premium brands “France’s greatest exports.”

This globalization has also helped French luxury companies cope with the political turmoil at home. The ongoing "Yellow Vest" protests have now continued for more than a year, weighing on luxury sales in France.

Modernity and heritage

The top luxury brands are venturing into new markets, whether targeting a younger demographic or digitally reaching global customers.

For instance, Louis Vuitton has been using a new form of influencer relationship to cater to a younger generation, as experiential leanings become more important to brands.

Model Karlie Kloss was the special guest at Louis Vuitton’s runway show during Paris Fashion Week, alongside 17-year old YouTube influencer Emma Chamberlain. The label extended its relationships with the influencers through a series of content following the show, in the hopes of catering to millennials as well as Gen Z consumers (see story).

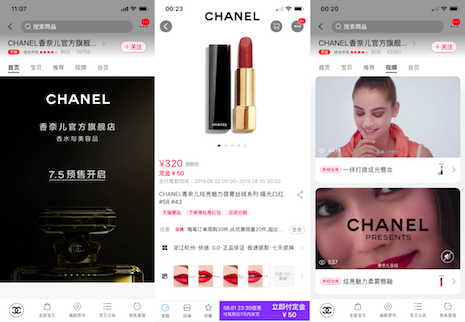

In its own digital move, Chanel is making its beauty and fragrance offerings more accessible to Chinese consumers with the launch of a store on Alibaba’s Tmall Luxury Pavilion.

Chanel's store on Tmall. Image credit: Alibaba

The store officially launched in August, but a pre-sale period that began July 5 attracted thousands of followers for the brand on the platform. While Chanel has been slower to adopt ecommerce than some of its luxury peers, it has embraced a digital approach towards selling its beauty products, which now extends to Tmall (see story).

“France’s place on the global stage has never been in doubt, reinforced by luxury fashion brands that are synonymous with style and prestige the world over," said David Roth, CEO of The Store WPP EMEA and Asia and chairman of BrandZ. "This year’s ranking cements that reputation with the visible proof that, far from relying on their heritage, French brands are executing innovative maneuvers that will ensure they are also brands of tomorrow.”

{"ct":"ChESrDayUyR7DtFDOjHUtSNAiipfpFd7YFOVI2veimxNpaZqKRS9rHthFj5W1sBeK+AV\/OKYukXqboAHLYGDpq+sypPEhOupSlPS54uXGeSsQJ8kZd0yw\/iXlxtZoP3HBRiObY3zYsv8Wj1rpQM0txf3\/qywHTcXPIO9RTeauaY3NUmIth6kUTWXyvnZhA6vfDI+6jm3uSvCfBH64wGLxLrM8DhFQ2Tte0tHmpUqvUpRJrm5dGxcWRkh+B4C+ySS9zaF5G4XdwyMoPhxV0FHESfsMUWQWM70MZVMU7Vl7mCX+joJw9aq5d6GtED+OHjQkcDB\/B+Ero8OPg5a6iYmiXyM0orfoUD30PLVa+wR2mt1VOqZxNNrETz74EfhBcKXRA1KAkDnbkpXeVE2DNC+9zgUe8u20B4w0cVCKB8UimDh7OW6dKXrxc+BvIh7SOv3Tx1Q6UH\/4cNY7hVGavysutlJmLbIX+OxCONzyIxQVXVxAC0xYIpEvoHrT76V795kNpndisq6tN6h8hB6Dn+m6KM\/D3T2+QAaqQ2Tk+BS2tx0fGOXLWmo1N7DbQim8buc3ZgrvzAZO3Dgqld0cFf6n0w1g2JFnhRa0fN70kmAyDgD4G93B5BP4qk6N8HzKLeMgoc5Gfn7\/C6yr7UfHVyQDdbBgaO4Cgt5P55lgZnPel1kk7YOQNqZ4zqe7WmW00ZMKiS3uOBCOD428MIZBLDY1qWaq9eu6YTFV+DjC8\/w5iJbqnlLWBq40DwjvVhIVE+LN2DLzS7T3UN0WGz5Ki++aybvyFQqEfnz1yz4XArjsXA1pxqWibkpgYL1v+Zr6dYBIlbSsvZdHJ7eoOj8MiKE5hk4wyIhdl9znOmfGPnrtkP+0RsEM1utuHm42IUsdQbVutO2\/wwY2EuprdXR2yLVCfhX1\/glxQuxxv\/zrj4WUCPu4Ok2e1LFOp6yCoj7932us3geb17kKkWVdZ6SDDZcr1y5GjXZnq1VdjXhFg97fIpssF\/ZeWDWr8VmVSHAULc1WdlybPnm+PzqxXW69jvl7YChvuyDexB5zjNK6wQs1a2zXJY49ftVH\/T\/\/b2S\/T9zu1\/PVnUpafIgiBIUyK8K7jKXSehPHTdZ9yAvQbOeisLYRwCbKihN0verdfP9jT3GunUHOHP7E8IytynP0baJ6csdIbKM3uIGrFVjz+yHJ+R\/qrtEsCLaHS4DMA5dWNaKLpDxLzraSg5ff1abeDY0dA4vifdTRMMWIA7ClqzjPddr4MMxWMa+a4iVOdKYeMSmhZgur\/jZcu3cw48JfscwwGNRYiI96QVNO1ZCgeu86v0c1j6j2IYBf1fUkxO5FpBkujO7+sUEuwMl6fQaQbzucgAZ\/vA5IAf9Add7eh7RQohzuOXlBpfWwCqsc7EpAgzaAJrWqJjrvkS4VVab9ZYtl3PCszr\/ZCcpnShlCVy6QEMM4hifxJFcW8w7xcHdC2b\/ZzsWwejHr80zGyOG6YEZVj6HhUjBh\/3u3TdBH\/8mEGFnMpczJhc9sUiZEkeD6y7thCg4\/P80vvIEh+3zo41LVIQzhWIhnkGHn30LH4K336pnGOW4hJq1EyIUoECbtguvgdLgbOcw2eO3la\/dyLvxE7IHp0TgaUuM\/h+CAMyXVDco5GdrsPJjARXaJTJdAv73O4LfoToc23Sxh+WFZqcwbhoPXexbMfEh3QYj8aG17X8X8VGQ0juijF+2PxtfMaEUp\/mb1u5i7Dafycf2La+xDX0Y\/gIFWTVSRZzuJCkmSV7SAIPq70b5moXh7hAuhU+N74O8mP1p73ZYTPWbvsduimlqX59woyV8k+K0BTV3QXIoX9vlN6OAQ0hbZWszhhZy3PmHnrqiizerLepO4Qgz72PBs63q+1eZYhAClgtERifnsfWR54KkrHptnzDyMlJK5y0fZQfU3r1Jd6zFH1kXT93ujYt6n2AkLpxfGrYsLDxq\/MBiR0swQ5wced6xADLLaKHjn9qqeiFf+GSZGYjV5lOyOj9vsbhLzfhXPlc4n0fLJWT3ngnAFj+8Cf+5VLwoOlPuPS58HJT9qYngx1e+pUCqYG7PhXtIEoBR9q0tR0peE8buZPtDrL9T7STLyEVgZJBGFV0xbtCObgWNvFakaT\/bzH4y4\/4gTrDzhN6F7ZaPkMxIa15mQ8Hzo6uNifJvYv7zMtYdIGTKVvfio40tqAZWPxurKVtv4L9Lhja6bFEnusrP2fr0rZqNmQVNE9MKIZ2K3yfI53uC3k8q6bON5bA0D5Bhh89zLg6ohL8M6tvlN8SRA5Pde6dm0nskGyen5+mce6i9zkYVv0aF4BcE4aEvkmkw4eIJlzSbz2ZhSPykhOabBTamUy3EykEmvAS9dBihRxPC1qrSFVMyeGLhG8fnunJmgwmPYBv3TEGtkORx8dK\/rJG0KBKByKNXlr08MBmoC1bvEsyFNbxwDk+v+ReaPpEi73TOGjSoD6J9BKtUt5sqZP+Zn8DxVm\/IwlftVxUQdRQ85lp98IG0T0IdXtxkCNbIRGfE+j6VuGBfUszwo8JFFSO15K5glehVk8D2QACeTx\/a3WiouxdKv\/qhBUOejowTiUy8oWPM3OyVkMcW1ijL0pjAPsiVPg8bhM\/fPNwEhPiTvgGoKhyCNjArBfTZSl2McrbZuBxww8i+3nhvyWFXgMoOIjANwJ4RziuICh+14JvjBXo51z\/ILg\/EGRREF6RTWnkB8tiXV7mnvQwOfvjTY37X99g3xxRckHJSUsF0eEsqMj9eqnllwrUpuwwTCKKrZrK15Yg0sYS2QtiFm3Ia36lMZRPlQrAq17Vc+9jBEUqETuHMOEigi707xrA\/OBNu7w3P7kGzAlY1sLYvp7mL6dkFUVL70vc2ue49of\/4\/eXuOpg80SzLA0b0f402pgnjSJZs+QsCqI5LS9OLXnLuoliTfWGSQCPo5SwZoqyGa7tkINXZKVsPmToIw532M7jNJC12votCfTePyFGSx1mYwjRH4qjrZWHaFrXVIEDbyOl0WoNPTF+YEMR86CHPGpVBbpHdxmITPFae12ALItwfQgXQ\/zJB6SKcN9spZLajU0\/4HxJN1yoHI\/eaDtyApQHqOv\/4HXfMscw3jT\/JylsbhaF\/d\/gEKL+xR8y5c6ET\/rITWcWaKVd6wL3fI\/onRP2IazsmQRDlXvkekjdiAI0D5otXIJ16gBxUlcoaoTftBjI\/4wmhOKkl+POwWBjh1oTWvea7aBB4Tuqk1Z3\/CqiqlJNWt4rQYn\/jopMPXJlLQenK6Z+07AXWhCWtrMn6JTI4DNPq5he\/ggbpaHOcpmvvLyTyjRTfpultK3yGBmMScG4zIS7EAAoR7yI3Oiiqnca6uvFF6ZaIMn\/a5Uef4XLS8\/XfKtiWLbsMAijf1L4kt7H6Z8ueoVmgeOTYi5\/GfnmiEV1cAhbekt2QDaYgE4JsZgY\/H1RwW4R0qq\/RrUL6erA3aSlyJIn1kc5s6zrKp9OjxaqeMqtfO2PCdcus6Taoa8Gu155vSgBxYdAGZKHwuLoBeyTEarG3\/2E0K58rKS187ETqdDQKWBvldzbbZ7CvgGk8lqCrVGbarguy9n9ROAxcxzkjYJzQ\/32pfdnvRgQYkR3cQk46pmb3uafFlW9AWSkzEUg73aL\/6oLlt85YSSFoUnyf60m7LMTPpA7B1JB2xyDbqF2ymfQho+Vm\/cU3u9mROxI3CTw7YbK2bGcYvVIaDE3+bSH7\/\/2jGeClnQyZ7m9iT9OYy9QytXLMJCfHFMnNZj7YfJQbq2QII8ZWx9owGuK6ftkrxAvcmXigWHOG1zS4Mz+JvgjnZSet8s7x7ccUlKfd48jKper0g5Tty50hXl2Y+Fk591MDJ\/i31kZHxSK1k9wwLRs9DeuIVt76IxvJY0XeFGB+mOnDu513OTSMuFtNC0h5FAI44I9WfhXeipQOsSGa1ZCbpfhN\/7+LQJ0Um9Ec4CGv3O1x6xt6BZUZu5CbZLjzBqBo1+\/cr6NGbn4reSCdq9SybroTvBWEtI8gRB9UN1W4v9HeH1xDVEpntZpeTY5nr25IYQeOOOzKVrpRrxt0u3iRGjcyYPM26F2mlP5SV0OzNhsK5DtMs7+hoJbUS4ZhTdw2janUCmN2JxrvoJL5oCqEOZj1BNG3qpb8c1W8+sppZ3\/zQAKPJY7Kj04zjxPt06gFLj1e27C0yYMDOL4E+imgBKoCC\/dOIPbwHKw8alZ0u4J0fxTM0n1SfraRjVn\/Cv5Pb+WyjXz3wD73sNVLNvNcB7wIUYuTaxNAg5QTuT1lQA+7naNrIfHZKzAsiHuUlsa2KDG6X\/miRg5dKPn9a0Ul8sFXdpqGby0Vsj\/g29pfMPQGsNpRbZLao9ek+YqDMbpppnDAxOTCY9fcNdIBjOPdQu2u7LpTfs0MNym3QhvOnL9+6ML3\/d1c0U4fZKdR1cXOSY0T3p1qShkzUOSMSnjVzejVGQXc+q7IMWYdFh8IkZFWT9LthyTApivL6F7yFTgr\/UV5ZvVoat+j8KSL67zW2xIZREbC0fowRH0MzyTIOPHAoBl0FDxEABI4wEbuHJUDSWFCR6kDBgkakA3Ywt865J9kqZjE8lpx\/A2N\/F4jLoceLtq7vzBZUDPyorLVzk1Z1w3\/EjnkJNXBhiTlPIenkEHNx4KgMV3wQI1TdwJ\/ka1Si58KGcgx1\/RyOw7uVxz62XcoSx4KGNpWiuNOX\/u4rXeEwAjmhXDwZkiqanqzNnf5b9WNdvn4tR7JCujFg3N3nHFeN2HtqPUnN4uqNY1WKt\/812qWluQxXjw1xK1FxZ3IEP0VwRnO9SrmJ4HqtCR9Z\/jFFufrp4lcLZfWzyC7poMzLsZZ5X\/eZVxW56ZW+Kf2nScVVcA6MZcM+lqXvdtyhQ7i0RkRIeGqBibXJlBnOeZ8gPl+fSLkRsmj+ecH4bJr9cGuF9bWOdm\/1V+se0UjevFXNsrSyDw6m8ScD32cTw7oCWrhSjf2acSBPGcE0lD88hZ1QMGXQck+GyATuki5HnTCS+Xl7F9YXKibNwLdv4fAI\/xcp+AchCoWkC+TGfpCLWzBwL7HkriX2keaCeKJkY2P5oDe8sNaNEi0voTpf9FxG79uS0zWGRtHMTjiEPHk5yfaoVuhNuP73sP6SKq9X68Oe1DSpiYnsI2RmgCcZAHT7kJFaHeC07qtoR+X9oBHq9ARlaP0RkLL9T5cD+ctpJf4Sc0B2XrJAZrvTSeV9j8\/zYbTcT2vaWoWJk2hP0QNPFn5V93pfetSWu+XNWFUHIXNqEj4auy02U0Il4vKtGjAL7ivAx+epDonzZVEc3uIBjX2zl7BIU0+4yoOMrplzXMC6tl515Wk+nJ6lvQKIlERphEoBlXjGVhTarJwoE83\/+lQIAiLzJexFcenQs+QDY4EIulmC1ODrUjwbBuD3YZI\/WyOBETnJhBPsB+kFKFS2c9ZQxTAro+Iu+IjaXLUsROQJhf580\/PfQm16RXI+FBuqje97X7IlJ64ZhY2XKZbQP4EQpp0dYWQJA1MxRL\/yik9sT46nIFL+RgcSkXk+uXHaPKEVBkw7j+jbrGyZl6TCC4Jy08MMYmimBNfLBQUVFH81iu2Q3RFfVoGpGkz5ekE2sTxwdzG6L+HY2R9JQhixzp2mr\/tjwxNQcizhKBQPJjVd7GYdgDs15RJG096YW8PlXOUH3HeEmm2pwryob8XJ0PoMTYsDB2nySM\/JP4lnE5OMREKl6kKHz9uILUbfmCxaPTyyZWovZv4n\/WdHOsUCVG7sMhEhObMXtygIVy94mXUk\/02HRvXYLTdQIjxeHzVTygC9akLT+2RsfN5Znz6cCFjXPSApC1XEsVq5b31He26N15gOaGP3t18SusjbgamqDhY5diZImORKhb97dBYd7qWrRCMbH8qsAMOVJNDeGt4aGftummf1G+Rn0HxVAkzjgBvIILudDwz6u8R3R0RK\/knMH5IuHqmZDEHfs+gGGVQzVzrAWSr9pbWlX0gAorxK1qil0pbzlZ6mWIf7wxc+HcyVnlE9xXPaVMalxVJDR88OjlLbYVNS7PX9tCbC68ar3rDpOZFuzRlJaxUQDHyir\/FdiVO5WJStPQbRDO+SJZwiQI+BxaDcSc2J382oLaIfl3Zoidyg6h9TGxKxenuJ\/OoWOz8qN2FETIDcJ4Z9+XQNOEPNYZIbEvIWjbtlpYijI+ZYzjEkFF4BgnYKDa\/qnXLdd+1\/Ix147lzSw2amVr8V6awbqYjH3ZOi8YoqZer0g2bEG2uaCnHyIoY3imY3\/pJCok1iLzjh8diRoltIidey+0zdJBj1lLpoYajU9iLac4p3+KqNXfEQPJ69oNEKpzlwED7Guxjx4rUVK4yl9TgMWXgspJ0MwaJC3gDE1ZlyvBTvoaLzfJnKjkidJrGcPOlyi86op9+rPJUWr93ficjIXoSyVNy7XcQAQ9JpD8ZYboCcZvaFMNcnvcSwvagjRc90mY17VJd9\/XEUZGSJO2ZMBSHI43Cr8bBWAZJNIU4cvgQF2bveb\/YtZe5xweZO1pZi\/ouQHIhYB7Sj2PMZubiCrBaujx98ZD4+hvxE+ZWam\/eYifsPdZ5jxw9ESR8XMZI1jZI663GaWN4yBVFB+FQzQJcsSyenunn6ktQagRQbw9oeL3DDfADf8AP+OkMWhwlowWQJZaoy4B2ZlAZ2e9\/2uabvbOvo1zNA2pM+ujLXofQF\/0Sbkrd8ZiZz\/kzvY63iMkocuP0KZSjz2vxikOqwL7v4QfGkwOd16pswKfBYghQJN5dfCFuv90NPDi5EYqKO7Wnkac7JdxBkweNVPSvG2OT9dip6S9mM1q0OzmZ92iFP0g\/IHZcjE\/47sylq1RbFOzFTk\/zEKQCiFoGwdT7UA9tVLos6IZ0Tc3+jPE+VjOTceiti6wz5pCvbqhSQDQI4518IX199wyqM\/2gE4V0ZpjCXbD15G7\/4FvgsOsMS2hctcWpbTxueTtXSE8i5WOkKJLdZqmVILBbYIn3xKKgqtoinrchj1282yribkKr9kVBmmRwSgJZQHLnCJ87jZwYdq67rT2F2WhPHj56w8n8EOqxaAnT9Y2+Ay+VyHAwp39qHS4Cfef929J7y0Q1ND0jIRkUY5ckbp+1KqjrRVb5lJWu7vUrWyw+qTlUxWZUV\/J+EVZIr0YIAEAcP6IOgUXDei8Z6htgKzCUgCx+0AzCBYkzpsvBtfmJo\/62RakP3WAeUB4UqZE2bhbAVJ4RAN5n8IAucGVFMma8e7zRjbJCAugkQW\/eqN2Ea6n0T7m7IBGe\/GJZmYV8z4VElw+dlTeeErLaXpT0iBNDTKWVPAYWNc1\/Hm7sSxg7P+QpvVslA+hcw8+1qkMQ357bzmsJuMEXeBGMzvr3O9UmwkgDZMU5IEj297\/FiKN0SslSLC0mKCDV7o2ssF+HCrMtlpGpT6Dna7UqEMRmRIVf\/k8K9Yw8ANdoLTessFOrH1HVh6gxkadZbrs1SFg\/AJyg8MAr8zmmzFgZTV64jijGy\/TKvA6sqnK9gTgWHYEkXcK7kIMg5Bu3+QgOJ+ZlFqjd6aGYEl7C9Cd5GGEK+NcWFr9Hamu46j42JRZQ50UyfXaDnxsgaVKB2X8T3RK5N3fhwWOeXcaxC1VKZCC58Pxek21tt0a3obx8MRngE2d3I7NIxciiQg44\/jJAfoXGHIQ4sGbM8UT6YtKkgC6pJUF9tWnYSaQ\/FynQUcvXZdW6EjLVdPgmTI3yElN5KtpzmBeYIHinUyxaObm7QjujFCH5C\/ywpcp2msahwTKFaOhYzwrEugDt8hTZ1xanfxEAr7KmuAlKWnZjuLQBCcQVVcPbL93x\/pg0iE0docgZpB439WoU3LTbBacDo5YHy0Bzc5qIK\/d+9FyJbwwdh8M\/1n4NvoEjuiPN2fFqEMaDCYipk9S\/BHrcopHRxXpsyZEbW3He+ZlYr8ruYJL9LW\/00Noe8gE633qN8uYJhQzSs49MQ9Webv6q\/cCXvVAnjaEhrZBs\/y9r9qXodeeQcX5sgyIEP\/dXl8LBEdmotFC25SxkektWyMBUWuyMoh4oW29zyqTQs3FUPGkvGkFitnJvlfPJQKtvkMZX3wDEKhC8nOM5zrCpgNm4cGZV6M3wn0SETE60iSmk+o8FyNd9HwwNipqB2tRNkFrlAaTTi3vaKPmwfffrXqf7aK6i7dq4XZPr3Vdf3qu2OcqYcDSTNPMOg+bLu6ybhit4GB3g0lNSPO67tuYUWAAInpfv5mB3AFmEK32PFSS4SyIA5TCY66UzfGYJsv7e+FEZGZMLqyAyfoQv9zRg3RnJ4iax00Ccz5Px2\/Mqaa+dFKposYg5XA4qALGsRaC6Uv+\/3IHsNXbDJ3oz6M43BV6wHMna16OTftVJmjX1ncoW9HmyWSFGjfIJJQpeaK0Fz+sxsKCfFhEAHDvLpBfIClVAkAdAJAf\/8m9OjnBwJdWyNeJgHRtyb\/wHByqOPkSnu1rjFCN5EmWRFkHuXXZ19KreZa3kySMAEKIB08DQVlNSvqtBQHR\/ZtbxwKj+buJE2JDJqx8k8ASSFwaWmU13sAu0Xht3E6uG7VOuzO7owRQjxRbkAPIY5Om9pTlKixXc45vKh5MxshK+Rru6FfVCAIEYzxrRyB+jLbnDjdUjiQaU0SmwuPkxCMepqQqaP1BB9J8vnkRkY0yFU3Pten9nslfCkBimVhktbYRa1p9oPo5l9QOR+2aUF8kJzVfBfV4e50d3PG4caPHZkRwZislipjJT0xqANH0+QdL7PyBbDXg\/o9oizslEoygBqP+GC+fz8e9htaFxTTtBCEL4Evz7OVYqi+fAkrVeSHXYow+cgnVM50kgbZnyQUvModuybTUu++LFcYlbyH9I1elkqMNd9thxyiUgGE3fR7i\/fJVhUm13flgctJ\/+vAaA7mdaDwAm+f1MXHqrk+IUmwDK30rmtGw4ik+l9OuOwHiq+NeCb60C4XC9c6JNStoHDum5\/OXZMA+nI+UIY2hQcf3Wdi3MRI0pZ0jT8NM\/7v6wIkLNb2ez0\/jOWbVtHCGaYXy8UIPbaidYkvlfyyXhQ+RiIfUpLAIpNzToJ8oa4f3m7f5zCwEZqOCPewD5j7D7bxcyr7fQNMN0WX5pihcnn4GKhz+Z+TE4s7Q9p9lz+YwikN6N9XUBsQsUpmmwtvkFTgYSvEN2yBLDmeABZdjGBK8eqfAsl5jB9NBd6zXPB4T8SdMN378PBHb6bA6DWZoOod8RUaDgvroQ4FqvcH087IPtL3PkITx7BdCbdgDNI5M0MSlwl0En2Gjpe1hP3Bo\/VeyCYl4YBmZ4e7oez2lNYmseBjgwWcgzCOMqDayyP8h67VcL1OtfFu918\/S+b6Ml+C6YsznxKsgaOCvqV5RcOqj1MpmCTdofbZi\/NY8DfxnXy6+iAVq\/eQ7Kai6CINrMwosYAluIjit9nD\/b5vY8wXs8aq\/blUopr7\/MF5EyffD3AuhwME\/zTyjGYGYzGV1WQCBmbHkn+PoWySuZ9+tim4s9MWC563YYeJTbNb96UwiGkzKuJU4D\/4LQXck5Z8sIIAuejv7LB8PBiDOy\/ngu9gx7A8AWWxU7tZcNsK5JBNoQ+aQCVgQsiDIjdrfbOx4EB1vdqbzpGNKSUWalUybgqizQ85X3XFqIe\/3qWO+\/DT0WVhh1zzV1o6bQj7Ei7Hy43Q\/5xm0QU8QZC5KA53d8g1JwBoVGvTsdP9\/uL2cQ+nU8ZrdHqCr8CjDmfAt1SFGBFoZqNJ\/51YDcvpe3xbe7n2jnDoImdcVGTpAUVL+ZTRUhEgcBIY8rQap0EpwlAcS+Vk3C4kB4YYZoJBTrfc5dlnkctvQDfG7jMSt6CCTXikPLEcTcG+LdIUBGvRTIoJrt6qLwAOE4qVkNxwhL4MuswzA9qwQIz4sT2rdra06mioq0UXN4\/pgIPJCUTbz3u44aWp8XBMAtE8oRSSKBDcY6vccqmRhfG\/wJar4MbB1C6UlWbw206SbhfUMDEvD3oGXnIGH9UePcbEngM54Oh9hCticLbJ1ORXHEE4RsLz5zayCvWJGTzEU\/elTt64tzMIkECDxKlRutC\/0CMbH0SA3MGwKsp1iKulPbuRDk8KOzxnCyGwwhuUDlOqTelwyNAcK6GNQOiAH+UBG94au3zGoKsWtrXG+IMb4=","iv":"839f5850510aeb155d3b39fe8d410ef5","s":"88073772f29956df"}

Louis Vuitton spring/summer 2020 menswear campaign. Image credit: Louis Vuitton

Louis Vuitton spring/summer 2020 menswear campaign. Image credit: Louis Vuitton