The latest study installment of The Shullman Luxury and Affluence Monthly Pulse probes consumer habits to get a better sense of Amazon's impact on luxury.

Seventy-two percent of ultra-affluent said that they buy based on quality and less on price, and 64 percent said that they seek out superior service when shopping. This study builds upon the Shullman Research Center's last study by providing a closer look at Amazon from the consumer's perspective.

"I’m of the opinion that a lot of luxury brands are unaware of what Amazon has done," said Bob Shullman, founder/CEO of the Shullman Research Center, New York.

"Big picture, Amazon has an incredibly large amount of product selection," he said. "The study is trying to bring it all together to show people a view from 10,000 feet of how Amazon is positioned."

The Shullman Luxury and Affluence Monthly Pulse Fall 2013 Preview Wave was conducted online Aug. 20-27 among Unites States adults ages 18 or older.

A total of 1,013 completed interviews were obtained from five sample groups divided among four income brackets: $75,000 to $149,999, $150,000 to $249,999, $250,000 to $499,999 and $500,000 or more.

Consumer perspective

The study found that eight percent of ultra-affluent respondents are swayed to make decisions by celebrity endorsements. Twenty percent of all adults said that these endorsements influence their purchasing decisions.

Thirty-one percent of ultra-affluent respondents said that they look for services and products that are exclusive.

Amazon My Habit

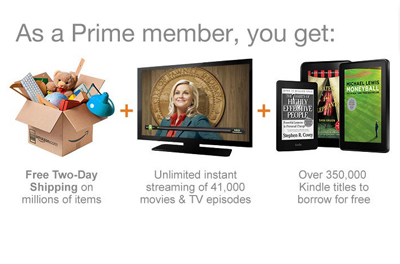

The Amazon Prime service has been embraced by 29 percent of ultra-affluent respondents, versus a total average of 17 percent. When looking at those who bought from Amazon in the past 12 months, the average number for Prime enrollments jumped to 29 percent and 45 percent for the highest consumer bracket.

Amazon Prime

Seventeen percent of ultra-affluent respondents reported buying products on Amazon once or more every week.

The backstory

Fifty-nine percent of adults in the United States have made a purchase on Amazon in the past year, according to a new survey by the Shullman Research center.

The “Shullman Luxury and Affluence Monthly Pulse” survey suggests that the consumer shift toward Amazon is powered by the engines of competitive pricing and convenience. Although Amazon’s ascent, capabilities and penetration of the luxury market are nothing new, determining the size of jeopardized market share will help luxury brands find a common ground with the online retailer (see story).

A supplementary study examines the consumer propensities of respondents.

Forty-eight percent of women with a household income of more than $500,000 plan to take a luxury vacation in the next 12 months, while 41 percent of men with the same credentials plan to take a luxury vacation, according to the report.

The “Luxury and Affluence Monthly Pulse Fall 2013″ report teases out buying-pattern disparities among men and women in many areas such as premium cosmetics and designer clothing or accessories. The report also confirms previous findings that buying patterns across generations vary, notably in the categories of luxury vacation and premium beer and ales (see story).

"Amazon is going to change how goods are marketed and how people buy," Mr. Shullman said. "You need to be providing your customers with real tangible benefits that out-Amazon Amazon."

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York

{"ct":"gpf4RvBTFTdaLGlsA3SkkTI60UdeOe52VOPJ0pbW8yE2PQHIBNVDjGcsSEkP4IVF6wLf1UKv2Vg0b0qLHupnWf+a6qGQV6uk6bdZ3IQknZNdxBZoMQt9f1NtHdqW6QQXbT7\/5rlVZlNyZyhm5QlafNmXbJSEb48HRe82nJBmbJ\/MmIir9iUDi662MMaArN1meWC9RNO83OlIE1CikTb0ob5KwpWQH6WpU5RfD9uS\/xvVhUvzwtnTghMknG17rdsHDzzV2AZ6b1Mmt2p+MxKzMV\/uzhQogy2WvOCtzk\/+eR3m4BbvY8\/Al\/4YpsCL5pODYeeV9OhSVhixMpzcsV6XOHs7ZJRktsCE5XyOg9Ju8x6rmfyZ0vsc1f4RFrfJZqldXQa2s4ixxpOgIOh8\/Vt+6wClvs1MIyFr6RGkknqAgvxU7JZoz55\/l+NivKorYv4umlawNZbBjyUNH+DbzYTvllvmutcmCojq\/oR77qA1JkGJvC0r5Wj70zH2cFPI6oGjEFL\/WsKvW2UXXCpuHdPmioK0Y4pOtqQxfWM5TeNnmSgQhGhJjc43wA5cpki0r04zRzMAFadjbYFUxQ0PjVfbFfngsDBaXOW0odFuQzpTs7b256pcsF2jryMRi6mQOJGJi6b\/pg6u9Z43ARIIK28pO2G\/PaxqULerbqcPgEkZ+IPnCRtCJDP2rhvz1xVbp0Olo6GFFE+MS3CJ\/htVuLiuitj8bArvJLvyzybPHsY+o2aUHrTOzhbgjjIMhe+s5xOZn5U9b1YbDcMZ8W8UE2zws4LRvwuV0MrGyr7l8iirYURehgFIeNqQ\/+2cinZ+QItOimHZZCo8N38qRD9IQlJBknkGHdg\/9OGs86tA\/IloEXTBAGiJaA4l2TIYwGq0AwgrbB9KY7zqKC+dz55ZiqmavAxuJ6nkYvBBHX\/8\/HzHGYKHW5IEDtJv6ODQ2m4Fn9JHyf45uDQicAN0frm41Mx9lpA3HE14\/+gRyJ2DGLI1WwNJhvIbp7GcNcwewEL79vKhRSo3PmcP9vCyv+noOYDcwDa\/5c6H82Dkcw8o9FKLrfN5lwi\/3gmekkALjp43MSI3PFjbD5ZbKVFhIToC0dJNfMD6tdPv99XDxvnWr+Hjjr0xrSzJy22R4G7j\/GwIadGaeaCxLe+9Le9H7CjKVsapj\/puV+xDoZRDHHXstO5v1y\/3WAZAPm3+l9Yd4MmJomI4Ixoas7D26gWz8HUkdTCArPZ9+Zh9Vqo8HwpsWTDZ+bDFabSyEuT6vjAd22A2YQtvH6yERJlXtQhZSJWuDGHt0WcCpxmCUPZGamb+xJI8zJnbIQlUl2v\/YXS75cY1kHPVkg58Qw4NtUraa54\/1+UGnQT0l5oY8MktRA7n6oG0t+sd11xSWAKLOuP5SzCY\/CCtQepqrpVT5EepL9BmDLgG2Ue43g8jZ\/zxkPDj\/cRWhHYjmTuqRIF9VInXKwkfrZXQXcT59petmdvXiKFWnI2+Me+mp2OWy678Dr5jBn+caEPrChinUfXXmkazonLNzSrIY9eZ0RcBOCvrNNf+KTKJ7yVrWpV7\/VwFzPXlWBx+Pb5BmrR0e5zYMblY9m4yFUe\/HjNwzboauxTIkU3rJFV1JqVBZX0pVmr7xRFzvQ9Ic3PTnGMA0qBMxlPQVcN8cxR59iUTQgv1XLfOS4IWRWxAcB+CqsyMYCLqk0Tf2vTmh4IcaWwmhOYf1ZIBZET1CuHhg59MQRauMknsGMye\/44v5VSxebkDUJl3\/O9hKnS3aTH2djoRP7zaPftOvh9zwEVu5y+dknLvJNvW3eIytdgrQVB\/5Ux\/g1Y+ZiTrhe8GYb8WPAK8UpXpRKnOXopCN5GfZ25a\/Lyl\/rer5NyF2+ni2AuE4mVAXrYy+mL1Lw3m2gk3gUIagdiFUUHZGq5Y6xAuGNlHHcmBgUqbr3n5jyHmVF0GTgoD99JtrYF\/qwQLJN0sj3tNJoEYyMQQ0AGGjCSMazxFW\/QSukgb\/Nr7cWtkE1HPRHl6\/8JWnpDJ2dFkaTyxnmIsakc+EknagrSN+sGDZsTc4yw5oXM\/H0N2ICHF6E2tV+SHhd9Hjxi8h3D8kvju4KCMDJutcjjk9WQwB4LkjbvBIO0nDwG08aA2qm487iV68xvvW3ymudABtZZc4zb74lMX0CDDpI8iUqQfzmCGfq77nPZx+pSFXY4cxTAWUTMIhOuA4l2OSaxbw46Z6SiyaS\/ViA+3Peb56Y67jhuhpefmMAmDPrPX4+ycmnqbp\/SKuyZArETFRaITwIAm8LTkCyUhFNyOkqudLZfLb8uA7BSpfo25XGSCCWvo7xwl4KXd+ibI2tfFpSaU9VxZF5wz7YDa18Gg93QTDAuzhNn063ZiPEV3s9P\/DxoAiQb7cC06jXdXaCBoa+RkM8STrK7ILjKYJf8tWlx3SKCvSJUnfp\/JtjUqFjW+Ot2ViyJI0K1vVQpzlSehlL7XxdwqA1sL022V6aTeSpK7lWrg1f+tES5+oN5K2RcQ9l2tiapetLSimI8+XzCH2J3d7c635cIHLY5hsxYSi61VOhEJWqhPNXnMCyVUFyfIUn++vtWbZax\/KH3Pq+KX8LHacwU\/XzHNcYOb6ub2mAXlOawKfuNGCCGvslEIgscC20WBM5\/j5ujdEijZHlpP7sYpVVZMDCNnE3aLFn9F4nrM49Dv0thJlTla9ZgiRY0ld6GIILsaMg703Qva8Ubz+XXVgMNcGVpz0Sa3FsNJIJIUXkv29\/mq7fQESf8HQrV1ALX\/YHVwRcc6XPBXo2zRt3b0DVqHoFoYvq3hI5I96C57aUaBlpPTB6k4mqps+qMq\/w8GtRvWCYbsv2CqR47YDG7X3\/teLLtNaau2m9EekBG2b46KtwSNmT1NTXMtTP5ypFMobNG6cIwTbkrsKBCOqr0zCnsLmLZu9aIX\/3\/txIXXiVhU+u4BXx2JWYWgRaNnupFDfGJFAqwtsLPRMI2laeqtVlScPOrd44JS5T2Yhsiy6ABeUqj0IR322\/qsF4sCgMSQk+hKfK4fERzyuAGVhlJ5E6YKythTyC4SEtvzzvQjbK7bwBoUa\/wikRFmP\/tV+72ufmxImoj9aItEMO1J2uI\/THFIZEAWp\/9+vyHL2sveU1g+LYIRDb9qLYA\/4oSogF+eDwE9UK6o39vz0XTRbH+ut2N\/\/fOgI3RERgnGvE8wqA\/hL49VLneaaouVdHyakXtVgGTKQCFc\/R6yrsv2d8OcVgq18vkvSQdPgAadmXBngDmDOjdUFy0Svb5yQqUhv81UUUM6OClGpfbuAtCLmWviBS14M7EpUVgi6kyUerjwPXQiUoZGjQI\/tfC6BKVe+xpBqtEt7+55NH7IhJa3jsxuPJ7dnNU9EVN69ckhbzM4\/oEVka0\/6BnVz8K5SDb9P6DH2RKjk+fDcnvKd\/Ybwt\/jN9xNbLJDmqHklrq8lLlFeR18qVncHPbqRAFwfYrZiov\/yxXFQm+lB3sXTktby05HFMuZWkT89FK+Dt5x3Uev6g9VAITq9CsVfuzq6TcWJ78u+H3+skVM0GyoiaDtTX8VgJCCtau+pfhxI0++3QntGusiosSOEcjJ2DxaERBVcF3VjRrmJZWmzo+4mwJ0fvFp69wo3xQxhWl4N7NU3DhtIuB0wKsuCjQBRWthkbEU\/gfkV4aUjCbqHfpnH2+AX3iRKQL0wZ3HTM0GhLKjZ9ZgNZF3cEhzG\/U8i1fBdxiZyLirTWRrh2d8SHaKk3XMx37DmRQyjzBYSaE3d5GO2ZkgU5+0yyWRzf0jJtSir7iz0FD9cAhU6SAW7\/k9HQ8bk79SL7bB115jtlPTRGXueyO2a2WvzS+yq\/QQ2BL\/jVRjQr3+ThPrEPXRCB5SSTXo4edqdpipZjjUzoVWImpzBnfg4s+xdLgbr9kVesCZogqSXPUB8oZLymvjZcl2Lw6Mz5stiuvtg8V\/kISg3FKtLi0chKjBsO4XG7DZcq19ZvyHB4udn48\/RHIUuRdBvVOsAXDva97mcviWoUgU3u2oIkQb9yMAbahvjMM7BpQ21qX6nZow8JWLWbV\/v8IWy2WghyFs+p4V3TWm7qu1GH\/MwgJF7mVpvBCnuJg3GLh7NOJUL2x473xbbDNSNbC5qNmEDm\/go2rA9IjyzKmoDNDjXW9mz0BKVZ9EKh5pLFpuy4BVZe66NE3DxHmV3Zgxa427pOF27eyeRx9SJ\/qHClTzQ\/9GysL0DLlnej9gz6Kaq1aJE5Fp9yx+T1dsJzsnepal8OUBwOBjofVGhTD9wRjEnw\/CT9p92ZdS43hiATHGDGGL38m6ImTfrSZ2O1hwqbCsrkr8A9aoHEcUeugoRl++fr0I9MrJjHiUhVMyX\/Qg4RtnnaYosh\/\/tdQmjH\/Jfzv0dJIGQ1ILceOZV9NUYcw\/LPiFcMTkZALqYKsCKrWGKXq+JlpOmg9tHjHwYtqnkY6WemQeZc12G2zLji95EId17peATUJYQNphNvORir5jyocGUYSFZmYbVf0+\/AwwEEPU6d+LKaTZN5irFp\/e77quzMqSYDHoJCsTYEQF9mlgn8Mpz6RQkd8zNdWlm7R3sCLQAeSFUGEKzHjqF3FYWb\/p+m6jbeexnVLsrxlQ9tXXD\/mTPRxA6Ek+hTcoFJK+McH5nFV05EkGNfe6ToAzwtEOLeH7kh+bwNqPhZPSxQzGPvukoi6pa4rVuGSBvV6gCJeaI\/T2QN2U0yUVVZIQuyIBkMGyJ8TU3rfKr3t8GKkd6yB49SiTBxXXbOKSuVGZNw337aZDr6sFVRRcOX91R68Nd6yHHixkYFTBPYe\/7DfEKWRTsbkwl9NY0sOPTr72oGVSLBR9e2bA+RJg2qWdukcyIbbUDkKbyDBDmJZ+pCRdKkvgQZ62mCzXMJ+Pxv7s\/rLQGS3iC76Y6bvm+l2U9lNWjT8imXzlwjJplD+rlChMuPhpUpO7L47TZViWoxTqdwBQx8Gv0UYQ986B7R4MvXHHiiETF5VUXsRVaXr\/BTi3ADkXY\/2NgNmCh9\/3L9zF\/O5SEr3FdY3Y5K9eaFOmoIVu2tdfe2wnq+gchgilAr2G+8jHyDr4fE6u+fiVI+NCiunR9oMLHYz6xhbhqas2ePjzyakXVZprx58BPsZKTrHvyDy\/7uovMso+UtwWzGI4tER0gX\/XUEh6Irx5PHR9bf6gNEemq5V2wSIK6f1Qu2t0pGTaNaRtNDF2kNEQPSI5i6QJb61T3FMdMgwEh1p34JTF1n+bXzjfdXDNr9tBO8r6BeUqcdr\/B8NXWvbLfEHIti\/iTSbivSAZfwKWB7eTU8vecDUc3P1gQjQZhKUWQefaG5EuhK5SFzDfGzJT+EMoO4Vg\/Ea+mMvQxi16j\/CF55EuPwI06VrHCBht4qhBHFFun9jg6PExU7JxRHtDECRuhN+qiTZ1g73MNw5FFefOHc\/hzDaD9BxHGpgzC9p2aJuttm9k5fJZ2a1SiVi83hQP4yNG6LUCCq3NthR6F4Gi2uJM4gcPAOrf4vFbX5ioJs55KejSJB14D\/FZwGOnJ12AcUBo\/E6Lbv4Vt5FGx\/O8UbNfkyt8iI6eTcxdEaxTNen3mQS8y4Lk7UGJZFnymqTtP7wn6EHpkMLBhEb6jZJQrAjU+3EAbGUdTTekx+0+mM+v4w\/GIPb5SvrA4iLPlbbKLwlsBUSjW0T\/cx15UnCDVmpMjHe8VfOMHixq54TZU3DRK+Qri8kh3\/G7rs9J+BFlzEBM+pzOS\/thNDQDwymAoaw6TbTM1R+HCgIu49Y\/clDZrcyBeC\/G6avJyRQP4YeC85wwl\/RT+leY4U9qlEkw9qEXxE31YpIhv26KQoPBUK\/PwI81M7CGiS1A8J85A2wUDnGE4omzoqvwGip\/p2Re9t3n7mYOnTvrLCD\/xq699ph19S+Ta\/HQn+pJeZKnyRZrGvyExK2qXdRXq32VbTWWlssSTe\/tAVQgohE4gXsUqtKTTewFk8JG+bFhC3M\/JEg1c0Oy4u45dZz0MGnhCqoAjQPYb5jgOwlCwbni6WI9VnxVQoZN8XK7AkmQjr5np8smNO1IsLuey71zO3jXboeGmlcMzNEak9IYsNFwSryQW1tEMdxP3DPKJxUtR4JnnjgsL9er9KS0Kuc6ePkVYsiCfmk1N0PSnqEfV4dxVvioBG1lFFCEy9tELutG5NGmNJCrhlzEJoeB8UC8WUnGw1NnXpuGfyo+b\/yRZYuRuo\/k6Px56V\/8WGg1Nt6YoIyaXmsz6Jxs6nhMc6EOGqL39zUAq2crnU4ShpAC9dDUxx9L\/uN66ZG4JnoUYH3MilwP2bFt\/FSfcVPf38ICqQQY\/vbCbB76Xp5I6MID2cB2jwQbaJQ0YoaoA6ZK1qbNnC28N3fk2rfPLEIq\/bH1Ni8By\/+j\/PF5zX7qba2jmQb7f3z1xxuLPvJRy2xxVD\/ZGhRsVmecAh\/V6d8inE0BNtyXmCDPuYTUBZLzA\/i6MCx7+XnyVwKB0yNvU\/wO7r5OT7sy15nnjRmFx0iM6hrMx7VAsSH\/BVtzBUJ0kspKSOoETQqv2kmOrKAWEK3HXwI909hy6ohtWlbm1dEkmu0rAxDUBkbPgWtUWJAxD3hqVgMWfS\/MZRXr5JpAmMaSkbdRcw==","iv":"25ef97c248cb6d08686425193023be5f","s":"c44de73fcb6d3217"}