With all six of its indexed brands netting top 10 rankings in L2's latest report, Starwood Hotels and Resorts demonstrates that portfolios can evenly employ digital innovations across brands.

The report depicts the increasingly complex digital landscape that hotel brands must navigate and argues that digital proficiency is a major differentiating factor. As travel firms, search engines and marketplaces pursue larger shares of the travel market, hotels will be pressed to keep guests from defecting.

"Brands are experiencing pressure from many different angles," said Ashley Tolbert, lead researcher of the report, New York. "Online travel agencies, metasearch and new players like AirBnB and Hotel Tonight. In efforts to keep guests on their site, brands have increasingly integrated reviews directly within the property pages and have ramped up use of inspirational destination content.

"However, brands still struggle to manage their 'frenemy' relationship with OTAs," she said. "No brand within the index was able to achieve an average top five rank in search results on Expedia, Booking.com or Orbitz.

"Similarly, OTAs are giving brands a run for their money on metasearch sites. On average, 94 percent of first page booking listings on Kayak are from OTAs. Given the influence of search on travel planning, Google Carousel shows a light of hope as, on average, 59 percent of brands show up in the top eight Carousel results with room to grow in optimization of Hotel Price Ads."

The "Digital IQ Index: Prestige Hotels" report assesses the digital competence of 66 Luxury, Upper Upscale and Upscale hotel. L2 ranks brands according to the following criteria: 30 percent Web site and ecommerce, 30 percent digital marketing, 10 percent social media and 30 percent mobile.

Improving Web sites

Consumers spend less time on indexed brand Web sites than on channels such as Booking.com, Expedia and Priceline, which, along with Google, are siphoning serious booking revenue. Another major disruptor, AirBnB, holds consumers on its Web site for nearly three times as long as the average brand site.

Listings on AirBnB

Hotel sites also have higher bounce rates. Brands do have the upper hand in some areas, though. For instance, a report by Google found that 77 percent of consumers turn to brand Web sites for travel planning, compared to 52 percent that turn to online travel agencies.

Consumers also maintain engagement with hotel sites more regularly throughout the travel research process than they do with metasearch engines and OTAs, according to a report by comScore and Expedia Media Solutions.

From Four Seasons' "Extraordinary Experiences Collection"

To further capitalize on this travel planning tendency, a third of the studied brands launched new Web sites since last year's report that improve the experiential nature of visits.

Most of these Web sites include editorial content, lush images and localized information.

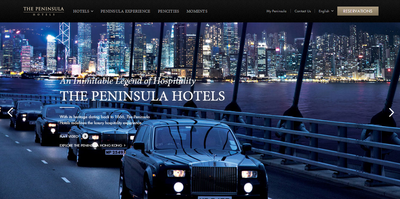

For instance, The Peninsula Hotels revamped its Web site with a cleaner look that consolidates information and emphasizes visual content. The new site espouses the popular trends of an airy feel, fewer pages and plenty of images (see story).

Peninsula's redesigned Web site

More brand sites overall have adopted local information, links to attractions, concierge tips and contact info and curated itineraries.

While consumers may find the enhanced content enjoyable and informative, search functions, which can lead to bookings, generally fail to meet consumer preferences.

Consumers cite price, proximity to key attractions and online reviews as the top influencing factors when booking a room. However, 41 percent of brands allow consumers to filter by price, 36 percent by destination and 2 percent by rating.

Brands are working to increase transactions through a variety of streamlining tactics. Eighty-six percent of studied brands provide personal information auto-fill, 68 percent offer mid-booking date modification and 65 percent offer reliable customer service.

Ninety percent of consumers say that guest reviews are important to their travel decisions and 61 percent of brand Web sites now feature consumer reviews, up from 24 percent in 2013.

Inflate or deflate

Starwood's W Hotel received the top ranking in this year's report because of its highly functional app, search visibility across traditional search and metasearch and incorporation of user-generated content on its Web sites.

St. Regis earned the fourth best score mainly because of its "best-in-class mobile site experience." The Luxury Collection came in ninth because of localized, influencer-driven content and a brand Web site experience in nine languages.

Four Seasons rounded out the top 10 on the strength of its social media presence.

Dorchester Collection rose 51 percent into average territory from the year-ago period, while Mandarin Oriental dropped 41 percent to average during the same period.

"Mobile has emerged as an opportunity for brands to differentiate themselves and drive direct sales," Ms. Tolbert said. "Since last year, brands have ramped up their mobile strategies, and today, almost 90 percent of brands offer a site.

"What is surprising here, however, is the lag in customization for non-English markets is not accelerating at the same pace," she said. "For example, only 57 percent of brands that have a Chinese desktop site have a mobile equivalent.

"Fairmont has done a great job here. Starwood brands have leveraged their scale to set a high bar in this regard. Their mobile sites are offered in all nine languages offered via desktop and have enabled impressive functionality across the portfolio."

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York

{"ct":"i9l+2hoPDI0D1km3\/JHclqoYncXAk9l5Uizsbt2I0MrKQf2rudXLS3ptsRzgc8ejxstiUspQXBCmNWXMnPa3Fs1Uzsjx1Dx0HyNDA+UF9lJ161jEvNRgDCXroYDIvmo+LSn6vWsnSPARi00t3LbynA\/WB5qdpYUqZQPpqqxxi6Tvp2PZP5Zmq61uwb+fQOCS9f1b4xkcBv1L5DJAItb4XebogKW\/S1SL9yXVw6yQTZkw3Z9hJP51KiNSmHJgVhVk24UxPiyD3yE10PwsJfAWZrpUieDZ3HfODhsLTxpT1Lt38vl+DLoeEAyx58IvB5C\/RRvUTM17FQo3gRCVPcCW0+Sis6Gt6ACmVO9ZbOpsr93lvrPzL0gF28eGptxmZtIXuvXiWJig1p2zuyM8ngwUNzGV80xodQgxdR9vCGxORPJhT+TZ4GCE5sOt9cOjR19ANPl2Lv9kbGSWsN1nJd0Rak5ZCwRXdWtq5PxDqNLvJLUh5o19ARMUfc6lEBzL3Vqw6GGiaL+7poyHjE9BEy7hJw6+jE+9AlZbAIufTF\/Wj52eqQaqukyL418oxA9KEPTbNw2K8Fv2lhwkSUXZkKK8y5k0ZggqOYim6zX0Qdskb0JtJrvTsaXZXONwWRfpuiqnfnQ04OJdnnL393BAWe+dO5ycpSAKTzFuglG0XBogHvR4cZN0UEsyM0OKna5t7zpfCsOQzWcMQUbNHjrb\/caw8uZ9IwHR5UOEyX\/RDuTtnlJLUWR9lq+Dq6T6YiUHr71WFbnacLzu+WoRVjlkZ\/dlMr2bCoCFqceEkkiQWpmczMTOpa2o4LlftPhwBPPw0mCfOkUOVmqOtaQrAr27rhK4di0dObfnPYURIIRF1e90C3p38H2RGtJNE5L0tZNACJDMoojoEshg52EdJqaGLG1k4MaXwbXphRrrcPO+KTkupTCLr9HLA18xgfNPQSVIJki5bvdAbEVbahXvGVoF8p0XB+wiXYNnFN5oMX8BuxHY\/Vh\/qN3SNzNeJ2a10u2RWUCMN7FwLi3QNJv5LrRxNO3JLMpDVbv\/EYZxaTPzccGLXXLzbvKzG5LohYbAEo769SIjneWAOGIJU86fOoipn1Heby6az5TrtLK3cOYtfB6y+3r4zCioopxeZWUARZxFZIOEThY48KMsGXDNXJstmfbnd65xiI0bVI3UXfXJLp0D1yohI7N16EHCfaUrSfNkp7k0O5WXHsgLYAnOof9JH6z+hN0nnVoG6UPw5ZmxpOtBPMVLosRDTZGI7ZQHgNyqyNO3dhByeabE+WE0OBXSIEGSWE69q279C3UQQUTUEstosX+xDyLp+tcSaM2ABIcFUFo\/BcUnNh+LSuNV9JS4GsEbLyap\/vIWHV7bnc1z9G4YXQi+9l2b1kV4a4+VedtMcFh+Xi4ENV+mL4+c4H70Pm+7qKK7X+m6ucgJ2zjL0NCQSkGBsRxVmHSbQyFTuJDlMdcIr0UtAuV\/pCeVRGTE6MANbql4iwc6vRYYH0BI+W8pa\/WRH8FTshoU6AQ635DQvKrvW6hKyc91+IPtxmjVM00VmiL31+zr6xdF0KXMBWkcx\/gczc+l8GQf89kr86QSVopryYvfPgXQhnEt9K1EdZRPHK5ZAa4JWUgRlAmeU5KeD8BVL4tanz+h3NJJRRlSr4vfcR1wlXhsF9Sniacdwu+x8QrS0E2Eh6FICmwuV0G54qmnzERZVYEJn2lvDw4aRO6rVZDam\/XViLxgB6LYHq+NSj6vgFOCTkHAiPBqszP5caFrnOKWUAF5oXNcDtlajd5Lmg2cBGv+r1edvQnyKCZQAtsBU2sQfuGxI+B4hbsP0ZisHbeq8jq4xHHJDBkuBdroTbHVfcWcqYlccNPFg5CvsXifyp4Nfw83iD2XXUxBJ3xvHMUlXEKC4nemSLsPjWgJASeqoc50Wokg28AUdmsLvz3Gn+m2CBNyKvBc9+tRjVyXPgpT3O1kH3aLWS710c2cqdBpoxXvf+ldjBr+gThofZH1A69a9hRLda8UORGWLHBW8OPlPOa2xhBABRBaEN2\/VbqHpE4RhMZ0yCTeXbmEix25nTvkShWlCtQkMX\/Y9dhxoa2a2j6a3DydsbZR7Hi2\/ZOys\/PZYaIgV9V9fQ9G9s\/iriznjq\/PP4L9qF8YWUJy2Ssy6U4XvJCObftkTi1QtSNDYzhDpBsRWmHdGEZIuxQpNAzKRhFRLVYbf9zMBjnFME4KWd\/7q33C0zwZCK8+5pNk+931mMRbORNAK8m71ir2yBv5lWf\/Ulp3QfF\/Vnxv2zdgOL0ShyaAVCO5lFTi7\/lqXYVi\/e+ITcCPJewYdSAfek8aMB8iGHmbT7FX9vlKJcLTAW\/NLnQbwhzc1L46KRx2jcSXX0yFq\/B2RhRmyXN8YKGGU0ZRmIiHAa2chvqZEILKJAReJtaoCeqjmVF3oJuOSgF9K2KywzC+q110iLrvcVDbtKkWq3KwCqEk61jgnNIDUP585\/n11z0Ec8Ya1W2cMoZ5fSetKTRjFZpqX2HtAm91bPrN+fwKcImPj0C1JV\/Ua+gc+6pRej1L3E7aXpQ7dqum\/h+bVcOVDWONTxpjBM8++4zVyi4SlUEN66YkxM\/XIE1NDkq+SaDnihVhcuFfcc98v+\/e\/uBeOjwNyG0wFY\/XDgmV9cHYJXDVGldYierJCLzKxYsg9H1sv0e3A79wDD+pPEkM41z3ip+yWQyfQs3GZWK+Sg2aVCSZsAlKfa3pzRdVj94+mUP1XEWp0OOo8vm0VJtODMsWCyiXCTR9chKVQuL4GB+Vzv4F5naG4exDR1517ufWcMRiwlbX3CEXCP7\/oOrPndRfKVVVYg7OXaikE\/5JR8cyejWu8HffvzLni16+L7FwOHliWbklZOOMVd34MF03\/4PXNwfaiC6mxVx4Od1W5U0Dpc2l3l8D1J9nS3bDOY0N6mkxyj+gU3PbaMMDu9KVOw2XIW65VtZCQR0CsNObzilbMe7WdGHT3BIPGdCeDGTdbssT3bGT6eMusM5HsqsayYnesNLJtlg1e9U0KTaQrOCuklkQKMYFl+mqo2AdDmt\/YupYUZIOmY\/tP+KT1t+3gYzYcr1NYc4RuMZzD1DrDSn3rXDVG5JrzOvsi0fhGCh497L0fZHTr9Feuan2\/7XX3YB\/TdLDmBy1WdGVQdpKZgCGDoxUTDTbQ+eiA6t2BqWuW7Yw9u2WxPrI0aTpH87k+iduB4CJUgndcxMZonP+m66y\/pqO+OxFjENlFRsd1I7OP9lL5pnej8cU7tS0amGeQ9hmMwvKrijU2l9Obo+vulT6VumAH6ACESiS5MtpSDtj0Ku+NumqlOC\/J+Pg0fexe+Ea\/UKm4mDy8OVsDklsLJb2FtsQs76IDCMzIfDotE6RmDmynUIOGzgVMKmAebrOUCFjyjyUsN8KfEL7HqtnvwfuZ15KAhzIaDetcX+9Zb7maiSXX5nng3U0\/r+mLj6RA2gGQpLPFE4BhFozRUYX9Gz+rzJsIFITuymnsuHCcDL4Z8EA+ujRXJjHkPQA4SAVWF9Fs2oPKhtcKRsZ9spTIaYI1h49ekXKLF3qkEYnLRJ1mC\/2UcJZOIzEil4+XvUrRUMOqXeKmbwR8zu5D+7qGo0vrVZupw8m7atbD9t+Rj9R4MJSJjFs25KX6BHIxAeeUBfx5r36aXnaX\/heKZlKKF9j8FQ0hcyg\/M8BilX1\/MxnS6eL62FrEOezggW3xilXVSLa2SMHM\/K7XvrA3ufxK7nP1\/n7\/0U+03ww6PPlpKiVfVwIVlszlkDcDW9KVe4VclzsxfiFhnqIwAho6cf+U\/zM4sMmtROuX4Ulou9ZLkoCGkvZuwTJ7ZFzRDTXuvKZMScjVaJWv7c1QPB4cmNt7r+XfdemTJQZ0NcjhUj5BpUa6nnb3wMlpZ3b9kYMF1y1vrKGTZ4\/CF9Z1qm08H13K4nBmKPFYml0UpLRHlb3Q2PJA8xfj7FlUHpAP0ukWpGJbfa8xJHcPG5tnYp1VJZ2\/Una58vg2Kw23jyUu0\/yXtm9w\/U3YRW08iQTpXzDCL9xM7W\/z9xmD1yhZdfcr64p4029oW6MbF0YL0xdFykHCdj9B0u7gGdnBs1ggz8q+SA4JpYSuLB3OJ1D\/SgxRzvBpS6Va+vfqpP31VyU57NTjkp1ZJbJ62f981go\/dfy\/eq21vU4dov8qFH+ycd\/PQkjJVzQOylkPnPuGy4ERj6VwDJLGLSxvqLO7pfuKdgx7J3mvwi9d7qsxx3e0mOxHMCoFB1mzvaUJUggppY7qncd2XlVx3UTSvYRpoPa8ELthe9Zeit3Nh3Q8uQ7T1RYV+Dl7t\/52M1iUIa8o7kP0ory6LcdwzJ+0rIz1hauhb6jWOBJNynMGykVAZ562Hk1575yjQkTKAE4rMUp2c+IRqXdYEpOXAsk\/2rgtkpE5Su4L0+7EuKI\/\/\/z2A2g5KLizpn9226YcgTaVyZVHrd7QaZn4s5LxcHQW8Cd50b2HyXNdBZWwRbuGAu7VaS3Zgdjnfm4grPyYruIw39BuN9O5\/Es4tc1VtIDFcxWkThuDTKdWLsBiKli3IHcnuubISZdQxXjF1AOlCrWNHit5OU1Sc+po4HK5gdStAvaOaIXq5GVfZrpI3bfiIyQILa+fejkw+1wN2pT7ju2NpCg41B3BMv5NfoWAr1X4dxUCHjg5fktGgapraGqXdl3bvKKiKPS\/Yuvc693axsdzsjCPG\/ugByiGtAw2hQD8DeDQqZ8mK6WKfMRBon+1Tki1ja3jOA0quJ0a4kqRfbXPKqZAu\/mCWiU97MietXjNFZTEJyZ5KaYtNyHApdkybm0gFPnkS4YLCqmatbHUKFOmxw35TWCmezzbUJYma3fGyZRsv2G5sEurH+DLVGwRz1Ij1LiVzBy1+HFSL4CNqTr\/8JES4r+DVD9fvC\/A\/zPe8lmK5gUhNI+NmwTDUWmGKW06OJ2naGIohZMBGnKJzILQArRa7uX2V6OlOmUGhKOXvcyzFUavUTABanZaauJunU2vyXUnqgf5zahqSMdvo0wIlKm6CdZQvuyWfZscPgN1m574tOOIl9CsvrGwQuCmG4t3kOJLUum\/IY\/lan5G9Brdwlmb3Sh5VW8i+xIo+j32XhWRSulKp3uJ+zJgZfoXk7xPDp157Ar\/E\/TS4HAcgm9HVvlQINMc3mTTQCt9nOxBpJVYfrsNS3pSInleYRMXCJC2+b+jQAkvGIZE\/Sa2G4lvmTelCjgb0f1QxhFWalG7sEoqUsfhwBCO4M8lxJRvlqhm5fkTPGQIBC9gM0k8hHCjQKhPWjbgdp\/koh7JH3pilYjBSsNQBopz2er7\/d7mmG7KUvI99m9\/9UlXPzRXk+Bshdf\/JJcDC3OhdTiYV\/mJ9C3NWplrw4kSLVe9H2\/6Ng9RVt+6xjgttBUCVjoH5RxdaFlNdkhNH\/7Vjp5X9BPaWske6lD1aGfUj+5jS0j66F\/GdauU1\/uulRXA7hCSkqjP7X4nAJv9zlWtuIpOE0KR+8cesvLUco1aaN6FtYSRZeNOz5dBvOUIw\/amEflLZxYUIffp7\/niPByIPnREsQQ3Tq5UvsXwmm5PWFaVX6YhWtLYZlZ1PeE0K4CEL1Z2xafFYr7DOlYamO8qWD9JsSv4dbczMLWpmS2yDAsmBmfd4\/qz6o0TcHJ8Dz4Ioa1SpXV\/XBoFBlYPVGFJxx7ZHYoJxI3BDuxWIAAtkDQwHDbHgYDUNaNadtt8nq0W\/i6Po+GG7i3CtkLR21LHoYDyyKh+K+fc7q8nFcvf2I9iHOELwHvHVl\/Z5BfmXhBsn7e3MFbOBamxDiw5ZBESy0M1oYQKYbH5AJmo7q5HZD6fwQklpHAohgOxKT7lE9+TKOnxm7O8hFvLmqIsDhF\/tDMCAr2VfxcsT9PM8euwBAQRXLWKPo2xDcsnrvpXf\/316CK7pQSfnC16n2JAJD7\/Z62moNOmSop1Z6HztaxUOnj1ZK2\/8cGgMgzsrLUQHSD4+Ke4qyn+3LSxUVfUwA5CrQ9Nc97szD3v2FuQV6p7ePknbjdxE6ro205ZpPK4bXAbw9vwdzgOeibOE4su5Gytmn6I1ZhdTDrALs4lyiLtRt5ix5wm5hcqaQ6x0MDFBBRB\/\/979JUNGmMzOWJtmnqYR3C+WMtdS2QBr7ZlRaw8yPa7JZ\/doxkFwbcF5gcbv0HB+o4yKe0Z+ndWf4CVoap9LM+COkhzSNyBE9yQq8Fyz1fzWNbOFsZU\/d9RwvQdKqtODSj+XzX6\/YvAAEU4Pc+kxUvWkk283VIgq4DoQz244S47xcysY5iw7vD6n7vNi30cSv87Ui4ihgDGnbFAGfo1xawU4JvkSq+h44hmrPKzcJXfcWtf50tj9rxT3xjsinc\/+BufxR49yRmdlFXv4oRuBMLfIyzDkSRTVRe7JemGzEt1vFclvp5TrP8EMK4k9B14hJfpPeBdeIdpQ6Y8wmcCZLndzYs6TDd5iSfdn8S1oOF0TPfp5QeDBoY2jJLBQB5D7Y1\/cwcqzvTwkVKed\/Hv6tUhKHIiWEfmclR\/\/tFKfoUq7h57DRzlpG3REvMaXUdFBlCEihyUHA8YtRkiAyC5ZHvM74UogyD1e0lfYRJMRxrGtK0xCQgK8g6\/2sbSbwmSZCdIg3c17NrMFHfp9AWskJ41UXRgqLJUMmjOoAENwmXOWv5TnDxpgxdtp2rHqileWZC68iWIjxGbjLulLgk8zgi16gIGvVthD3sCp+c6o4mKodfRHrOCNsxgGYcjJzw7Vp2tXprPoA6q2M96gsSsbWOjZvKe330s4mfdgSWATP1qZqLRY31w45Uexqn4jJrSaIpQdeuw0KiTcWvnsrc9hPXpzKNYZvD4GprIlSXVTeJbCXTZEVPUMBsb39V8rZsEV+dGvVQblXveumT7FMU5FS15cCSxeEglXMlmOv6oMGUyiXSLuVC6BKdE4HOHLspJEpSeSjdKDLpEls9i1j3aLabWN3VBBagYwE4rhTcZ1xnW7Wy7d05FT4S8\/cpYExJBcHOcTUjp8zrJ5XUYdShPOUtaT4Dzxv4+78G0\/pI6IQbKJL\/\/33YVqol8pFhKWG4sN8CUDiyYr8rCJe5i86TnZOf6WLbN4ieXLpvI8MyEWGUaH3gGnPF3XM9x\/UAjMutLnDkzcYqNch5dECZvp8PrAMB\/N68paIZxrqAVRGvVUfukkveq6W+n2AGPyoW1qzlxQE\/WkLbV42Xi9jyN5BJGvxH12EMmyugr3Gv1W+sxG5\/st8CeFEwcCc0jkbyHKkKplZghzRfBVOErp\/37dCzuYQMTbOui7imgKj2szcOHUfAEWgVGlOF0FrkI8NvX\/0bowZILGcQcjCZfOCCLQHAknRIPZgWHKn3ZnwyDezVxxcSpegj9c\/tVpWcnzThVMSWdLmsX9CgCo8kpIFPP3L8Vw3wZVBDKk43LtgrmIeKz3ljUj\/BpjoL\/JGgAqIh046mVUUI+pFg84DfJ4\/nbid2NXIlrfzmwcR0nOVsRpA7ZSz0SI7EkkmNK0o6b4krPDJaOTAjaGehY0p\/gfB+LACLbxFxZPcDwmGSs+Bl7j48SSeJ\/5JgGUIEJ13oLfijj0sc3roQIVhQd3tCr1sHz7H7rUVmv4GO1PWVUfgvEDyI6EGaU2s0maWV3mYLLwmrFbV78zpoBS5YBZHnRXJ3tHnTH5sXEV+ovYIpf36xSkmpKrOBaStBRoRIdVTwrmE28kKKNuDQG34VTbAKSc9BdMIcF6vKeHg8CXj8ZbDncw9nyQUMaLAkkcVhibz22RQmmnpIWsRh5GA\/g1C8aCzM85NzfKM8rNuszJOwm+ZkoWEz+F\/UT2roPXjCUQeES\/6xcYizE8m+kcqJ2UX8Uf8Gi+vLe\/12axozX\/Ve3CMOVyMDNXLf8bQzmPVq1plE2FcAGtz5vwZ7qGE36i2YwQrDiZ\/gaGbiiizlgKuX191d5hcgF5ZLsUOMht\/HTJnmsl7fbKP2ZpZM2kiva2Ni1GZwfOKmIXKCMtdsC7YFL8LCo41XxqN2b3+PquXQTDaDUcuSoKpJn3El+Q43ZROA5XjTvDW2zuhBIE3\/zhit9DlupdbiVQNYMiTdBrw+FUZRngqTYYv9+RVqWcDgGQas\/gfS+2FHYCYlNdgjiEBqAeS14Adn7zIl\/5iRqamojLdkSMf5dtvfo3OZ20moVv7aqMIi+YCOu1vqzs+SqWM6GkMyShmNZ3fH4XpXIGr3l2dP8VmEOggapRmmiiSWb1rD1BzzPUMZMWRVNUtL6PQr4f9uR+J2pjVDXveTyq7XOxJJzUwEe+ojfsH4QwU29sUMb6o941ss3uJV8ProYu234XcEWiIbXvnp3KTOhEoClwwkv7+xKlTDfogxsN7851XLVzUS3FUIEMcEYhcp5FDfUVC99Sjq7w3WIg2IDaaB5vRD3mZO97g0qG79Nkvtc06x10ArwEw0Q+JXEraI2rb8u8eXMYTlRLp+lwAdVMLsJiaYkbRC++WdLBHQqx7PYjfr67AuO5qiAsycmf+XYerWX\/n1O4EWwQGQLT0Mi+VgQm\/ek1EhH5fbNU9Rpom1oZhNvWoWjNEYQ082MaHaPX3seSYa6JsQ1f3LSTEK1sMaM8CeWB2ZjYaP5Z2nziWxizkW0Jm6tms\/wkg9Ad59dL+ya1fiTVpPCpuWveT8zcZoYmJpLjerMKlmZxMfxYn8fBVgalYsuYzv44Xz\/\/aFTXN0ZbYrvDqtNzBHPe7yFgvdRS4vqhMqx1A3\/uDFpTqWnC8jW7BI5rRGwjh6B73a94AZCxL1+rkXdEc+SkgjsQy2Y7vu22ih65kCNu\/ma13x+SzJ7DZQhyUqVyqpEjvFlPFQtkAhVVj2VJNMyLgYkSUHE+dROCLvOoZIVS+Y5hUZExun\/MjV6XHoptEQnfMAZyV2MpmmI4hrm7AZ4tkbTcwpR+4otML3LefZSOdsuHqbYwQ+noCL1JKuD87oMGBTzCSoeHdR8lnCJNpU41xwUq73zYbDj2FcKlG3hatU\/rVJNJMhOt\/RNz7ZyTtmglyPhQBrzW1zG6sH2TozVNsyGj01i0d\/Vuu4xIW2ukr96FGsdjKLHlsCojzmnanqM2j\/Dym7l82NdoyJuo7DoHvJFqqSUpx6qbGzor2BgIo4ZS6FiFzu1GOi5QWNrktTtQM9b+5C61TuW2RohWRuq8lpSMiQpu87vHOmJWXfOl5ZuycFPMLOH7foesDcJhJEjMBe8ix4Cw+KMa1cTtDyUGEQhWogzTt9qxacg9MXei\/o5n6R8xA5BiswFyQRacDcgcRbGvCGbXzZ2GsLA0fpDSOGHwFI97xzVcuf7wsAAg3oRbzyYtWcFkqSQ5FuPDvIdIqesKRXia1yWEIQP2KSpjz4a5vVPwHBLDBUFnvEtSMwKB8mMnNiTUKo4M2OFoLGII26UBhn8rbuffref1p8QyVSH\/9B7oaKXPOjVMjnlOBf8JReIAhDnMsumaz\/YscxAOPlFI4UAruSHAxraBg3iByfRs6QY1bW0sIozW5Ak51xOO58tYfkBpSOTCZx6yW13tWV\/lwcCxgmAwFFNeW3pESQb5e0mvXfNbp2B5IzunueFinqVclTb1fOzc+h1lqN1uhfnDydMwrHFvfQSOupugZOqEf9I+1PGSJLmTR3XbNriIHujkI0aYxKKiOngYDTJ\/PwLO3JCHlLkizFff8g5ZGbG2TX1o3RxA819\/rlfkeCdIMaj6kcvbOP6r2XTHsivViAsPf7XF0Keoa2+h2K8eDWqwyZV3V9zj5VRKviG+h6oLRmrj6EfjOWdxIkl81ja1AKmbvDtWTrFaMBJrnfNkkeQTvVCSv5FdEJLtIcSqW5+zXlMzfhq+KvjxqdeEOZmAx3c+n81HnY3EBf\/i2lOChDrkvk84XMvwBgGJnywtFi2oqv3cEo3o+beZlWuASQZo1cCm7Tb\/wZ3dFehq9htfsC6UzKEalfUzxIcfauDxDdMKoA5AsvTB\/RlZ8dqiCm5KO56ITjIBllWHRURmm++DItRTI2mP4+evkmAH6\/U1pnXYSs4uc=","iv":"8fa4379ab778d85cc2212eb52afd97ad","s":"7744dae46f7e7841"}