- About

- Subscribe Now

- New York,

September 28, 2011

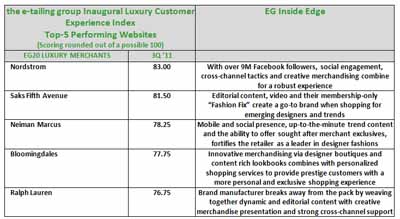

Luxury retailers such as Nordstrom, Saks Fifth Avenue, Bloomingdale’s and Neiman Marcus blew independent luxury brands out of the water in digital presence, customer service and accessibility in the Inaugural Luxury Mystery Shopping study by the e-tailing group.

The findings comprised the mystery shopping study as well as the Luxury Customer Experience Index, which compiled quantitative analyses based on Web sites, presence and execution of vital merchandising tactics, customer service execution and accessibility. Four of the five top sellers were retailers, with one manufacturer coming in fifth.

“While retailers realize the requirements for a comprehensive on-site selling experience and continue to elevate it, brand manufacturers currently face a steeper learning and selling curve, focusing their energies more on the brand experience,” said Lauren Freedman, president of the e-tailing group, Chicago.

“[However], given their emphasis on creating a branded experience, it was surprising that brand manufacturers gave customers more limited access to customer service agents for service and product support, a likely frustration for shoppers spending at this level,” she said.

E-tailing group studied the ecommerce strategies of brands Burberry, Coach, David Yurman, Gucci, Jimmy Choo, Jonathan Adler, Louis Vuitton, Prada, Ralph Lauren, Tory Burch, Tumi and Waterford.

Retailers analyzed were Barneys, Bergdorf Goodman, Bloomingdale’s, Neiman Marcus, Net-A-Porter, Nordstrom, Saks Fifth Avenue and Tiffany & Co.

Top performers

Deportment store

The luxury consumer experience was benchmarked in the third quarter and compared brand manufacturers going direct-to-consumer and the department store counterparts that have long been commerce-enabled.

The participants were rated on a 100-point scale, with Nordstrom coming in first with 83 points.

“Nordstrom artfully supports a very active social community on Facebook and also encourages engagement on their site with a blog and many sharing options,” Ms. Freedman said. “This is leveraged to not only lure online shoppers, but to drive foot traffic to their bricks-and-mortar locations.”

Nordstrom's Facebook page

Nordstrom was also lauded for its cross-channel efforts that are enhanced with a store locator and shoppable catalogs.

The merchandises up-to-the-minute trends and designers, uses relevant search options to help shoppers find them and enhances product pages to sell them, per Ms. Freedman.

Retailers Saks, Bloomingdale’s, Neiman Marcus and brand Ralph Lauren followed behind in that order.

Grouped together, retailers had a combined score of 74.84 while brands had a combined score of 61.17.

The main reasons that the retailers overpowered the individual brands is that the department stores were more apt to engage with consumers. They were also centered on selling rather than aesthetics, and focused on excelling in customer service.

E-tailing group declined divulging which brands scored the lowest in the ratings, but those that did had a combination of limitations on branding efforts, insufficient on-site experiences including on-site search and general merchandising efforts, and slow-responsive customer service, per Ms. Freedman.

High five

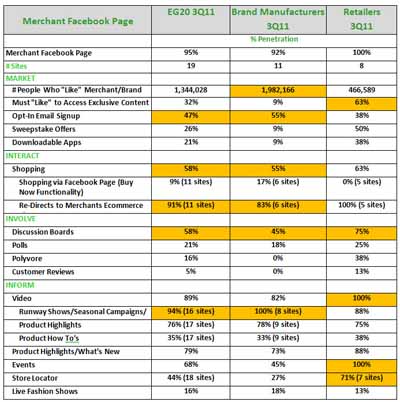

Much of the retailers’ success – or lack thereof – came from their digital presence on different social and branded pages, as well as how effective they were at reaching consumers through these vehicles.

The companies were rated based on branded hubs such as Web sites, social engagement, Facebook presence and style, mobile connectivity and cross-channel initiatives.

Italian apparel and accessories designer Gucci integrated video content on its feature-rich hub and also included news, events, ad campaigns, company historical timeline, philanthropic efforts, new product highlights and drop-down navigation, proving quite efficient in the branded hub section.

In the social engagement category, apparel and accessories designer Tory Burch displayed impressive Facebook, YouTube and Twittter icons throughout the site.

The brand also enabled consumers to “like” it on Facebook, highlighted Tweets from consumers and tied in other branding opportunities such as Tory’s blog, product guides and video.

All forms of social engagement is important, but Facebook is in a league of its own.

The study highlighted department stores Bloomingdale’s and Barneys for their customer acquisition skills and involvement in upcoming events, showcasing trends and cross-channel engagement on their Facebook pages.

E-tail Facebook chart

In a world where many luxury brands are still hesitant to promote branded mobile tactics, the few that stand out were lauded for their mobile initiatives.

For instance, Burberry’s consistency cross-channel and Nordstrom’s promotional messaging and customer service moved them to the front of the pack in this section.

Finally, brands and retailers were rated on cross-channel promotion. The main reason that brands have social media, mobile and digital presences are to get consumers to actually buy their products in-store or online.

Fifth-place lifestyle brand Ralph Lauren presents a retail locator that is engaging and enhanced with imagery that accurately reflects the brand’s personality, individual store pages and an email sign-up interface.

“With the sophistication of many of their mainstream online shopping experiences, customers expect that luxury merchants will put forth strong branded and social experiences,” Ms. Freedman said. “Research shows that the number of affluent shoppers who have in the past few months shopped online or conducted product research is quite high.

“Additionally, the growing global economy is primed to take advantage of first-class selling that inspires consumers to browse and buy online and via their mobile devices,” she said. “A selection of features coupled with exemplary service is a prerequisite for participation.”

Final Take

Rachel Lamb, associate reporter on Luxury Daily, New York

Share your thoughts. Click here