- About

- Subscribe Now

- New York,

November 7, 2013

The number of ultra-high-net-worth individuals is continuing to grow with 2,170 global billionaires holding a combined $6.5 trillion net worth in 2013, according to a new census report by Wealth-X and UBS.

Although these billionaires account for only one percent of the ultra-high-net-worth global population, their combined net worth reflects one quarter of all ultra-wealthy individuals and constitutes a higher GDP than every country except the United States and China. Examining the net worth, lifestyles and interests of global billionaires will benefit brands that appeal to and target this demographic.

"If you factor in all of the connections of all the billionaires combined social graph, the first degree of separation of all their net worths amount to $33 trillion," said David Friedman, president of wealth intelligence firm Wealth-X, New York.

"In the day and age of social media, this is an angle that the banks don’t address," he said.

"In some sense, birds of a feather flock together because referrals are the primary driver of high-wealth products and client acquisitions from fashion, jets and ivy league referrals are most critical."

The inaugural “Wealth-X and UBS Billionaire Census 2013” measured the wealth of 2,170 global billionaires with an average net worth of $3 billion dollars between July 2012 and June 2013. These ultra-high-net-worth individuals, on average, have 18 percent liquid assets amounting to $545 million in cash and similar assets.

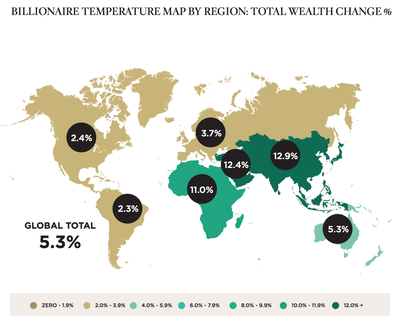

Wealth-X and UBS’s census shows that in the last twelve months the global billionaire population grew 0.5 percent with wealth increase of 5.3 percent. The census looked at billionaires living in North America, Latin America, Europe, Africa, the Middle East, Asia and Oceania.

Welcome to the neighborhood

The census report shows that since the 2009 global financial crisis, 810 new billionaires have been created. The addition of these individuals has caused the global population of global billionaires to rise 60 percent.

In addition to the increase in population, their net worth has also significantly increased. Since the financial crisis, the total wealth of global billionaires has doubled from $3.1 trillion to $6.5 trillion. In the last year alone, the billionaire population grew 0.5 percent, resulting in a 5.3 percent wealth increase.

Wealth-X's billionaire temperature map graphic

The Asian region continues to drive the rise of wealth with 508 billionaires, an increase of 18 percent from the year-ago period.The total wealth of Asian billionaires amounts to $1,188 billion, compared to $1,052 billion in 2012.

In contrast, Europe was the only region to see a decline in its billionaire population. Over the course of the year, Europe’s billionaire population decreased by 29 individuals from 795 in 2012 to 766 in 2013.

The region with the slowest growth of billionaires was Latin America, whose billionaires have a total wealth of $496 billion. Although the region saw a 2.3 percent increase in total wealth, the number of individuals only grew by 3 from 108 in 2012 to 111 in 2013.

Breaking it down

Wealth-X and UBS’ census also discovered that of the 2,170 global billionaires, 111 have a net worth greater than $10 billion dollars. This group of billionaires has a combined net worth of $2 trillion, a figure greater than Canada’s GDP.

Wealth-X's wealth tier graphic

In terms of gender, the census revealed that 87 percent of the world’s billionaires are male while 13 percent are female.

Interestingly, the average wealth of billionaire females is higher than their male counterparts, with a ten percent net worth difference. The average female billionaire has a net worth of $3.2 billion compared to $3 billion for men.

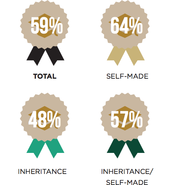

The source of wealth is also distinguished by gender with 60 percent of men being self-made billionaires, while only 17 percent of females can say the same.

Where its spent

The census also shows that over the last three years, the world’s billionaires, mainly from the U.S., China, Britain, Russia and Canada, have donated an estimated $69 billion in philanthropy, a number that works out to $32 million per billionaire.

Many global luxury brands have strong relationships with various charities. By helping others and urging target consumers to do the same, a brand is able to show its core values.

For example, Swiss jeweler Chopard is working together with the Happy Hearts Fund to help rebuild schools and aid children that have been affected by natural disasters with an exclusive bracelet designed specifically for the cause.

The Happy Hearts Fund was created by model Petra Nemcova in 2005 after she was injured in Thailand during the 2004 tsunami that devastated the region. Chopard’s involvement with Ms. Nemcova’s charity is likely to attract affluent philanthropists interested in giving back to their global community in time for the holiday season (see story).

In addition to philanthropy, the world’s billionaires spend most of their funds on art, private jets and real estate. In the latter sector, billionaires, on average, own four homes priced at $20 million or above, and own $78 million dollars worth of property.

According to the latest Coldwell Banker Previews International Luxury Market Report, Aspen, CO, was the only non-coastal region among the top 20 United States ZIP codes with the most luxury real estate sales from June 2012 to June 2013.

The Luxury Market Report found that Beverly Hills, CA, ranked as the most concentrated ZIP code with 18 sales of $10 million and up, while New York scored four ZIP codes in the top ten including the Upper West Side and the Upper East Side of Manhattan. For the highest volume of sales $10 million and up in a city, New York has a resounding first place with 95 compared to second place Los Angeles’ 23 (see story).

Although a tremendous amount of wealth is funneled toward charities, art collecting is the top passion interest of the world's billionaires.

"Philanthropy has been the new black with the emergence of well-branded and highly-effective nonprofits that are incredible at marketing, transparency and branding in ways that other charities have never been," Mr. Friedman said.

"But if you look at all the passion investment areas, art is the number one category that has been helped and assisted by ultra-high-net-worth individuals seeing it as a new investment class," he said.

"Although this is not the only driver for the investment because to purchase art as an investment you first need to like and appreciate it."

Final take

Jen King, editorial assistant on Luxury Daily, New York

Share your thoughts. Click here