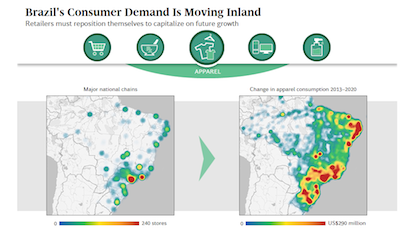

While most brands concentrate their efforts on Brazil’s coastal cities, consumers residing in the country’s interior are projected to contribute more than 45 percent of the growth through 2020, according to a new report by Boston Consulting Group.

“Capturing Retail Growth in Brazil’s Rising Interior” explains that Brazilian consumers in general are tightening their spending compared with the past 15 years, but inland consumers go against the trend, and are anticipated to account for $60 billion in new purchases over the next five years. While sporadic demand within the population may not justify a wide retail presence, brands can use other strategies to reach these consumers.

“Because inland populations are less dense, consumer demand is more fragmented,” said Olavo Cunha, a BCG partner and an author of the report. “As a result, companies have a more difficult time reaching the minimum thresholds needed to warrant the modern retail presence of branded stores seen in urban coastal areas.”

Interior intuition

As its economy plateaus, Brazil has decreased its spending on luxury goods, trading for necessities, according to research from Boston Consulting Group.

Brazil was once considered one of the prime emerging markets for luxury brands to focus on, with a decade of economic stability that resulted in more consumer purchasing. These changing consumer spending habits call for a retooled strategy for luxury brands (see story).

Part of the changing strategy can be to look beyond the most populous cities. However, many retailers are not poised to take advantage of the opportunities present due to their current focus on only a few metropolitan areas.

Fendi boutique in São Paulo

Brazil’s interior comes with its own set of challenges, and it can be difficult to enter the region in a cost-effective manner.

Distribution is more expensive and due to a fragmented customer base, bricks-and-mortar stores may not reach the sales quota required to be built. There may also be difficulties finding talent with the right skills and education to work as store personnel, and brands might have a learning curve in understanding interior consumer behavior, since it differs from that of the coastal population.

To combat the lack of demand density, BCG suggests mapping out clusters of cities near to each other, since consumers are more willing to travel to shop, for some goods up to 20 miles. Also, cities such as Ribeirão Preto act as commercial center for neighboring towns, so placing a store there can reach more consumers than just the cities’ residents.

Retailers can also assess what the competition is within a cluster to help them decide if needs are already being met.

BCG map of Brazil

To convince consumers to travel, a retailer can make their store more of a destination with food courts or play areas.

Brands can tailor their store size to the potential market, creating smaller spaces accordingly or set up a space in an existing store with an established presence in the market.

If a traditional store cannot be supported, brands may fare better with a pop-up or virtual point of sale, but consumers who have little experience in online shopping may be more familiar with physical outlets.

While shopping may not take place online at this time, the Internet is used to conduct research prior to making a purchase, making a multichannel approach effective. Retailers can use online channels to drive consumers in-store with loyalty programs, discounts and content.

Brazil ranks fifth globally in number of Internet users, with more than half of the population connected. Mobile phone Internet usage is growing, with 3G and 4G networks outnumbering 2G connections.

To save on logistics, a retailer can partner with an existing third-party who has operations already in the region. Other solutions are to create more space for stock, allowing for less frequent deliveries, or supplementing in-store options with online merchandise.

Guerlain built a strategic partnership with Sephora to distribute in Brazil

Brazil ranks 14th in availability of individuals qualified for jobs such as managers and engineers.

One option is to establish franchise owners, who will have a stake in the company’s success. Others develop extensive training programs or send skilled employees in one area of the country to another where there is a talent drought.

Retailers can also team with a university to solve the lack of skilled individuals.

Talent pool

Luxury brands struggle to find and recruit the top talent for positions across their companies, according to another study from Boston Consulting Group.

Having the right employees can have a measured impact on a brand’s profits and economic growth, especially in executive and leading creative roles. Because of this luxury brands may need to rethink their existing recruiting strategy to locate the personnel necessary (see story).

“Although most major retailers have yet to target Brazil’s interior cities, other companies are already winning market share and customer loyalty—companies like Havan and Eletrozema," said Rim Abida, a BCG principal and an author of the report. "These five strategies can help companies make the leap to Brazil’s interior—and do so profitably."

Final Take

Sarah Jones, staff reporter on Luxury Daily, New York

{"ct":"5jnZRkPjLnxkaapSKAlEETFMysm2RuYNGdTH8rLg0ohFQ8vkotlDa6r+YVhHS4\/xBVOa+nh5qyp9G308ZQeVubwREB6QKi8oycvwAHN5EdbLO\/7EtNnfpqVxS3LqLw\/4XpMy3BSnmLmculz94cQEGE3sxmZpedGDlCHc2+XZsioT9MhAOaeM660hZ0ZszwKgAysPKTvMtQxz9KXIIPFwIbDIJlCees6FQorrYSk38F2Q7JYPsayhCjweOopFwv7K7O67zizJ36A\/ZkPPI\/25ERcO6thxN+1MU3Iez1Ns4btbZ6m71sYidfpl5jG0A4pdeAuVC+XpZfmH91QTDhiLbXq\/TNFt27M\/RpAV+Jh3sB1OKUJOwV9IGqf4+hs3HFFo7L9ouF57C3Q3RRjbX7biRR6WkzEok025BV\/du1z22Gdp5dYUsNMlcYs+1whpe72Nz5B6Wg\/nHIm1SH7outYJZmcfX1M8jKKz+H5BbYy+SbtgVFU0Kp4KOl2W7sAfZcGcKojxxFsSAno2SNclM+sv0IY8+lSndnpTGkUGX6UW4AdeSB5WhMSk58lLEWtuVjKxXm6t2WHp5oe+khA1RRywL0dDuh3YovyHFgiIVR5hT4Hg3r4K3U\/j14JzWbaHSFdvQR41gEU1TF7eNrxPGiIrjEna9MoU1X\/Ena0S7Ckot2D\/WMrCN20cfromGh7gn3NXf8ljLG8CNj0YiAbFBclj57qhpsIrHnEp7hUqAmxiPtNxT7afMi5Rp0bJhCugKmU5UrvyJ5JFchzb2PqK+7zvcwcCZIzwCnObhkpNVDqatTUOlMoom4EuiSJNzisAboOtChkfDM9pNpILW1Ca+Q535b8gMNsp\/RKJ4NLokHGrLA8VQJ5dodoI5rkncz7nhmB2G3qSJwVuyr+u+Ak2VGERarJLZuy3U2UKFmnZP3zR2v3S2Yguz+Z\/mgo+0T8+H3FnUjxAEnFtUbyouQJbSs4\/+LhyJ8WvT0DDWPvzRUICZiuRgPF3\/RvpCWSqNyyqX\/lY3b8afrLf2rxG0EiAFvjD3IXIM0Vtp7Dwslw+IApdFcNG4B71wv+8pBQGsTljfcryW2Q+6iKx0Ddz68Ylu0TVQ\/Wz9u6B8OwbRFcbpBxrla2W75MBOwZlQqZJYpRvgSPbwHKrJUADeEzjcX6\/rXYZQTvzo49kJUEoF1qwSaRMALqAiwEETe+oZDU6ZttREMNJWrV07MtxqHESK2bx\/9ECEZPq8im\/DV2otvZMep99LqNkm8yOQ\/MTWi1TFeFgpJ1VSYLJ6QBNEn7ZSSSKsiQSDItSxCqzFDqMV5nd9eMVh3umFJUSP07mwkbZIkZaeRzVxw2xCvwI0l3FtYY5\/9fGoX6qs87ae2ogCxU5bYMlae7gwpSRpF2h55FlfD6GlHfTe1vhVTC5OdqCdGa8ejnpZgu6HNszKxqNFqiafyTeH\/WpTjcHdlKe480ZgdKsZijc1UzRXvCvVdN\/G+vBiT4LwohTq2Pt0HnHHv2CYP\/7XZJjuafONeiC9HQIFyZBEdh8qqS9zgNauvm8yXZ7PqwvP6d2pzZ7nkcHwckAunbalDXTnZlrTVEdFWtHXaHRw0YRDtlDoMIi\/3Yu0kyHskWNoCnC3KU3MY3JFNeuB4+6Rjvoo3LlqKWcXJ5vWd5GOE0T8ZbQuu+o0sD2evtyN4i9kg+5P6OIgagEY8l8nGrehIeQrAtW5t8jWbgDS6k1HuNrAM5YZXrngr6SOZz9YJ15B1QmsfkS0XuHSbrSjtMShxnzkCjGjk3jK4rJ6lvh1gupPaOJbEPtkxzFhOZP8dbG7iEczwy9lgRKcrog9SqyaBQFGmH5ekobWDf7lA4GNsvBCpJvgVvpPdUnVeBzGgJ3X92DBlwFCnelApQNZ2\/cXpTvSoD2\/gFHwl3zRTLC0IgxztbzmIf+\/YGXGCH+\/o\/vNGw7WV0PurwsT2euIrG4T7BWJkSecWJsTQe771nNuBkjWxk5cC\/cRTbsyU6qCsSS853ud8myKciq1DWaAZyUo8yIa1CPDGB2FflLbITRl2ltFpz1\/BvAMPlxaNtbmX+iD0T7O0gioZbNqs6Rufh7Y1ev85dS6Q9\/CgY6zL3CFwzAHr8SJUdxMx2UmCxQHBbuHIQBltcgJHfCJKZDxCKYhKjhzJBGjaKseQbW3+aBOF50HWlGg+\/oYwbcoeZtPIFYZTiFm++g599xQAhc+2T9qhA+Y9yTWMIlkJMJ9O85cG7bOT9C7xxValQ0IMCccuJK4kMx\/NYsbKS865yyisC6Mb+OZXteHUHyqA1jkJvrBpWYQ4Bg5QT\/\/gGIKCx8XIr2VSCrgk2aCftKV8BqvHKA+yATmJQtMgFtfF59gWHoUyYR6KY4cciPNIR1n3Jx6bXPJExrXdxotPaQOpB23nBhzloRIfiY2tSV0XTy3cCM7fQVPRtW4JkeqeLcAd1402\/HKL3uxML03SEX56Mb4sBExdzxJZqyx7UxB2\/jgapb1z7e4cXTxarSFYpDMtQKgygSx1zc4um4\/TM2ZGsf7A0I5Y3uxMIRstpeP1dK9f44Pn0TFhei33azAam6Uy5fjg5AAijRtJSIrWxUPvw3PXh5\/Y+BHOu88wIy+DlBczltjiuDP1M02stb1rb\/5WQw3D1QQE8m3S5\/ifsFL3tsPOrWT3Xyx0SXpV61ZZcuVIYewcZlvcVD+0InKCkbdWwU7BPmf7JNqldSo6Ku69iSaMV1f+nc0RvGyJj\/3ZJGYvz8\/bE0b2hiHi8cZ446ZnDoyeKKMfkzMd8tJxkqKCIaiH8FjKzOIQuTlbOHqFIk9spvAZ12lVT5LZEsaVkMbEYjKe3nBi4l3EVv+FV1QG68sBnnPWun3f3yoCKC+LL48Qx7i0kaa9sbekGbZWmEINopryjZ+j9vu5VdNGjuYIsQ1fxs6EDLevBatF0TdDT\/ug7LsMm2AUTT0HwqgAVxbFOwVnOBZizEiNaVcdY5QIqGtDI2J7sH1ZvdoHdAi\/gouBcoABWZFs8MX1C3OYnMTb7oxRsN2oSC8NMQLVcQsFUmEP0A0FYGXNyOvA9\/21EURQ5zxxmPQD394z5+wD0ltaBH477LObwqpjwyGeMqFyD2qg6Ps7W+Vj6fCxnorN4zcsFlxqk0QPGR6OOVKfsTk0nnxvLFksaIRHEMV09u6wfvgkrZwMHBeJTv7BCQgfO7Q87t7pZZuyAbSWkXz0OUHMzj\/H4uSHMXuDNuxxNjoue2WYKzZIhN4K6Nfj0pVr92LbYpJGSxYqMt0Uke\/12fxbaSkiMLzxdIXcf1Knff5ox3Gjg64PHlhsBxMdwO0L64v+ZSgiCjns87+d0UskOvvjZPJ3FkSJVKXmzk1SLiNj3FAoLd\/yJp2eWN0mlqcMGViQC08V\/CYbuk\/ZnGJHQvvyhSBGBUR7H13uO86OXSwcEXOBaE8FCPDYvjTnVbgD1dEw72Xt0+nIwAwqndhyd\/DFqD4w5VvpERRzBJcwtvegBWmGUS\/FAItmKxlBfF\/6NsUEBIOqVb+jkY3fV9Y9DI2pl2B0tU4Kb78Sh3fgdomH77NEzXFN2D4PX8hNzJ6HHm9A+2M24NLUPx7x++B61DLBUXQr\/wbImoe47g43YlDW\/V0R1Ry5skbr95IYUe59A5mGCJCsmgAsene+FgpOui4z288GFRxX96jDUW6wYm+yH\/uPop9Wr6+o0sNXAam50jNk76OIAcq37wlkGHcml2pt3M3rksQAHkMciK1lfl0WVet6MEK6He9oU0urnPxFrwbF+CbB\/V6zJctK2+hF9rmQdr1Hb9k\/NKWDw4AqTuil3\/mj0TissIqlULWaU7sr8iDIC2Vn2vZC7vxExv0N1bm0XMnefnwFsEoghoVB\/BA7abuUpAFc256pXwAOy8siYwmY2cw9ryGuGiNYS4v5\/rkyu3oKya5Sz8Znyv1BzdRKKKA3iaTfpBeA2K5Vc2pssQAX+eJN+LndW5swMhGNpB5Xzh04lL4OOCaNd9gDpJsbPdc\/g723EY7HI8qXCIyCqdrGyiJHWCdteuDTHxpC1XVu4sOD6l8149mSHJGGlP3ac9s9MOYn90eQaSrkCsVa3R8kiR7vkREStvLohJHxCAiMBsV1LM\/YMPYLJbzgNjJ9LvyveXIu4qcRtw+nJrdOftIJlzb7eKPFlADwJO4ugKdnB6\/1Xac\/X7pXY1t3Aj9NYsTJAa3UXdMxbBjChU2clVeZZVK6+vpKv+SHmcOWwaM2ADRYxvAdL9PTnoV71vHCYt7HY+ruduzlIKJXbOW\/aRFSTogkJdCoERPCz0WEre3T+mNwoNeu3dXuXb5tXnAf5OPWHc6yr0mZyj29pxoLtkfwL5W9z9XLOUrNLVanTvOlOwYWSTrVyxqH1oB4\/bQp9ACMGkxzPMMNLVECzBUGxhcZvRhAipnVUO+HLHxXo4xNgNv9aPPyd1RsmcIcmesa\/YsD2p42dy6MJKfdfV6PAXWyrgYwLXaDh2\/lQOKCokzizaMvwPpSZTtgtEYWp9ACOuVdzlKVeXnG7EGLo9OtMq21RTTznAJAVrenaNgRWjK\/kqpEQNKLRG565ocMfIaNnjAofsPQ1ugg7adGFkJYd3so48ex1s99v4xJOf40DdqUVIaLSsslCE\/hvbTME0ef9JltKG6j5DGD2EEL7AiYFe8BtyAw7ZK0cpANuIBTjjImoVwxUOD1Co4ukx\/60SQHwejK3CHzRCtLhDzhESkI3QMZhOin4QioaykMKPeKW7KfRqdwuHDjr5EHTh1powP4KY7RFPp5notghKkuePFmr8LC77Zbm\/KP46i8+SxhrTJaln071dUVNWi2hHmMPUGxduITBia5CcMXR8IXsZ5I6rBUgnBcIowENZnUtDK7GZczro9u+TpfMhQ93ZAsAF2PHvV86+\/1MUGWsOjMbUjEFyA\/gzPyInDhumovcctWTO4cwIxhdN8u5SGFCqA9CspmkFjK41ACBglfvsRH9rR7r3bHS0HuLGqZcjgUfwNOAFt4UFgddY67cyGXQ+o\/uneaFSkw+fiWTKgbg5NZt6zD8Y5JE8DwPoeUtXoGEKTP0SM0HpYHU+OR6qMltMdgUAgLbz2Pdvjj+mxgewl4OpJPe28l91VIKJMnURWScIzvAZPVZ\/JrUnyidqATl5XLygbUgQKE7PfUoAqoH3WOx2Z++8IwJt1fnZIuu5Ti0D1Ni+64zVIFD+xHOFgBP7KuFijoS3z7ejbxbtuEreZuyAzPlV+PxhA5Hd7Cyu2+pUPPA8KV\/nz1NVlye8yqL+xGkf5j\/Wh408NH6OeJezeYUO4kUYD+zMCooCUTFmJfAk7KMw1etune8ZUU84KQE3TxNQ9WeWN30IFCKDKdo5XS1APat1CQqfBKKPCuJ+pqAcWQFBc5PDPt4OqckCHb5ORe+peS32RdUlbEJ+NLa+sho8JvtnaTX+1XpIV+8PQN53z\/T75mD\/zAQGfS3QeN0GdYOEGEyZdyVLrTz+7WrIjj7Zovsr8nWSstneBTUy4oAWLUiQxMBWL8rQ53rj\/XjHSgVLLX2q6HbxVvUFKIxUcHBGzn9TOV3vEY7R5B5wrgD0tEB\/cQe+9HW+OcGwyG6r18OguFiVHAkFRkVXVtLtqGTO0hyNBvOQbosrQt7hNOEAg9KdnXRnoBTps3vPK1i6NuwcZWOTIuy6QbrmvSoZoY7TccByxxGBK+1zd4KcDeMNVyZ5AGE4XAYKlAPcjU5+79WHgSXa\/FTj4Css6xKvKkA5a7QGJMOQ4JBTyasRyTdb55iK5hA56aPcTcgi06xJxYVxEb92LRUhPQbH5ZJZ34xbOX3pVDdSeHx7FmEPvln6N3E+1pEPU3tHsoKnY0XdTvHiou+IcDXibg\/V1wulBiQXEFrxxJFIxL40rym6tGlRcrpTwPvDoP5JtKx\/1Y09FWJ073Xb3Te7udPDzXvaMyfrb7kMc7sPUlBLRzVk71SMSODpcBuBKhbUMwVq06p\/Y1JFow69Ed2MQiDscgSJGax7\/xCRVE7My1ucdFk1fovLpbDyWmMLElAFtUuovueH6XpulUj79kWdv5JlGvYa\/v2oQh+QPvtJizL+wjnrjZxMXTmxIK\/xmfGNlvb3TR+tRmiHT\/1rcek7o+bAAJ8CZnBE+V1G1IVkrUlk30apaWUlvXLroymz3PLh6g+ueajxu3hnHTY+1lbT6rhawwo3JEANBOAxiWofg2aFKGhnIwhHQDpV\/Od\/7U+eBJzxHuo1TDBwLIN1DDJx7BZt5YtYnqXu\/DJsj9HyHjafDiM61s6ldpMRnm\/72CCIF73+WEVnEcTPFXhIPK3aDyDdX7q4FAZyumnYR8LNgmBCNIFhnYZSCZF8jI7WPRVBlIb30pQ4\/aGJW0CGf5ZzKn5B4OEsBm+JCh55SyONlQfuq6vP6J5IsdSkXej9x7BRqZdm\/zAyNjduojEDFHfxpqpgXP3Kl0PjAzO+0d4kdX\/\/CP5iPfVUX+Q4qJxV6oT0LNKyD8D1ABWuR318yYXA45KbszMQg+VAsj78f308fS7ZMAd\/migRJd0B4Ux0KAeY3gQvenoi9NLUVGPQJHwPDtmC9q17JG0vsiJCEOuA0TptCisGKOD6IjQzvDt5+6lTbmluQ\/PnAsGpVGjgV+CTx\/FovWxo4v4Zk\/5VmVKZdzNXd3WtLU\/SfHgG3o2p1mLesDGcPFWg0HynRQRWIxePur+fiieMPWGEoSc5+y1fDbdoteapdiXiGmiNc1wD+pe+3MvSyZi7CvAKV1TdiKSvvhthsaubwUr99qLjG0A1RVahgDCHG\/ZrbmgubbynXQXmvEvcE2WIkt7wjX6SbMOzgfTFrg7hSEwHsqH2WpN3dppe9Zu84B0eMv7RxihInT17z3uY3IVAHEsYLgaI2FsboJrimL5POOk2C4Vu9oo1RMWk7E3+ntYuBqU4n1NOottvRKIH1BT9yk4xnFVhENavhKNtzqwS2lUEcrlcJJ4Fu613354hWGMHvUMh24tHsQhqEU1lgmXqz\/P1nTdd32U5zxmvfNEPajKbn1tgu8Qz7C\/6pAAos\/R9lpua4hAozSyFCe2oWeD37Hu4LvDx0Ba\/BJicqutGHLj1u0X4XUkcn9QJ5K\/GNud8TO2Ux7zabpiZnRoJV4pPIbSCUFMgVjXPq2GagE\/n6nJ1udw3iwZszzL7c\/NExBtagcSCYlrJkMDnbf0nWXCV1B4tnOug3h5MFbttFOaCvj8WshrbvxTR1NmhCvcKSktHnl80EZHC1RVCoVlyNpGwY3HR7zTKrSV+s9Z0g964fCnj1dYwHYpeSl5vkJCjfrAbN2WFizJXOoO+8SG7ZPtk+Vz1EVqTSYFzHDQplfvQr52poGjeJLQsHNbHX9va9yPmXb8HFKCY5rFVwipsirQfl7rsqso4ImyVs8eEOkqtQWd\/oys04fVuw\/X35Q0dZuMkcQYejLQ0YK2FrblohNqmWNgqvbWGwFWrcZc1Cm3CxC3xvqmbZsXk70wmYUhMWdqIOJx1xKY7SXcv2XqmPUwVDbl+x+GuL6lmont+\/+x57WsrY67ySBRY01ziic84A4zwgpn14H1Ue4q\/MfbeUbz63outIc5Jfel15OedkcXVMiEZI+KBUYB\/YeIdNchwW5nlu2IzmmtJsbFZIUy10F\/HUEWDL9Bj3+jwkS4aSPH\/fxEbsW9Kp6rYyeZ3B557BtNARUFQFWAFKuvtXyNxcCYW7yyd9yn465Dhfx+iQWQLiEdPi6gV1Iw9ir\/x8iJSNIRCyrGKfMzfKeNmJR0BHI1WaelOHCb2jV2idz4k3C2EsmEF8ijpmB440sqbyTAMgThtlUy14nrU1wsr+wkau5JzRScyq6y6addeJxoe0Jw2EbibeVuk1dV6MnqjpB6UxtEK2o8dX5ZPJtyf\/vH6dABMk7eZY\/175+EPL7fsL5bvEVwuJlstRl6lpC2QKzRtRUyKgaFBpVNhEyBPX+Ol8N1k\/SHWDoYqB2pmdbDYMEKD9Sqo1WGY2TTZmnbQs4IhkhqM6xZFq3M1RIV+tKaWru0mIIiQFU+Fr75b8GFBY\/DShaVQLpNl2R3DFRNAsPuhdTHipIgk2CMLqGTibyMzWSaeT8h0f8LZ6OhYElvZhfAefG42X8aJrm0pOdYvsjKhomdMx+5eVo\/2Mhv4PcM\/l3kkRZ8TP8g+dT7CGWN02rsWeus2GL0\/MeboqzNP0RnNYJymAUrfN71LKVZaUEHWEI\/ItXgW3J4LnxMd129wmobRYulxo3ef7VfULwEX1tClA4KQW2fcpIE1\/nRgg+3wvjsKOYVhODop9XmcOynT72qHw6FT2NWKN0YHehQ1y7cU7qN6\/DXd+b1sOwE88YzQMlxV6WNOc0ZMnlSWQ6H\/Hl5+mMQuTCrp+S6UIQiWUix4hLA2+Ms8O2nM8uI+pFhKxeBQDNfHELV096EjgAoBQ3GiGKnaTdMF4Gq2XO4JEaE2VXUnstWnefdOdDul59MC7f8g2UPgkbWoA6pLIzS3nWxux1wvw7mTDeAi3hXqaNcOnDlR+Pzm2wvLN7GtkiZT5xuHsTBVvHLvotfU8nX5UMKaEloA3FKuiE\/HOT4ZvYfrum+d9g9C6NkkdwivynJlWBLrDUgVQISmW6BPQwqlX3P1zG9NyQtty0AE1IIpZGLVzH2RFZ8ttZQfWWt6W3XfTuWDsVEpe1ryQPzxXdvnkKU4IOZJV46V0Z8yQpeziKi8aeD38uo+7TeBkTsOa4f3gEWw8BVjWMYhTT+VRzwC5IdLGna1y0NaJYyFwyr2liAyjPiQNKHxwHiiklsgj0rffhaXkE55z1aYDYseU1g0a\/FYht9f5tsaay99cyLC8mMXO2B0R7sFiD7K275vkiVHwFWtmiIHvbtXwGQf+lFNBrofCIcnMyMYc7GqWbpcoF9faH8\/ZogooInyB\/rmiaxaWYuBhNlh+DO6GNHeaJFGfR+zuWhuiQCJjt9j8lWIcW\/WzP7v4hZlBM63KvzTv3TB0fS9m03IHEzO1nJgQqoKnY66RyVsLnl2Y1XFqvoGhCtGpBbMPbVCavG6DHk5xpYucOedXukZR2BFcs+pd+Pqm84PencoL7NYdibPZv+EOL3BGBBeIEWQbacEBg\/YHY9WoypPTwXZmI59fli5c3Bl4nsmiH\/NJS90Rahvwllx0je55+w9DAN6wr5wygjezKnpJfLsi5rdLvsmz4gjjUdpenxoBgv1e67ST3usEKkGxkjUNHF90mx0h66LMO32IeIYq1EEffe2a1DEgwYc9d7Ie7vHk8ksbMuZKa+TWDtY2cOQNZEcEZ0akKXS0ZXnw15Ls3E3CgFa1313\/zgKdNNoDuuG7K+eiNTipyR2\/bcT3vCy4TtlCt\/\/doi27RMzuYX+sCawjkBWUVVdQogKcq3w+83mc5KlYL\/UqW8u+paPU6GTelLkxm4cwGy2IjpWMyZKTsIkwjYuTObkceA247q5K1gGKjfonhKRwX1Fl1AYS7bU6biqaEBM9bzybom0pjy1ad1OVWPaEhxK7RE5JiA1V+0O76E2G42p5\/KtJIJ2sAmZ1eAzOd69x9KxaC1haEf5fs45ki55tzgX7kG0PwU=","iv":"ffb12a55a3e924e9ea5138ca1f7f742a","s":"1ced1ea91eb7f5fa"}

Ralph Lauren's Sāo Paulo flagship

Ralph Lauren's Sāo Paulo flagship